Академический Документы

Профессиональный Документы

Культура Документы

Chap 016

Загружено:

Bobby MarionИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chap 016

Загружено:

Bobby MarionАвторское право:

Доступные форматы

Chapter 16 - Technology and Other Operational Risks

Chapter Sixteen Technology and Other Operational Risks

Chapter Outline Introduction What Are the Sources of Operational Risk? Technological Innovation and Profitability The Impact of Technology on Wholesale and Retail Financial Service Production Wholesale Financial Services Retail Financial Services The Effect of Technology on Revenues and Costs Technology and Revenues Technology and Costs Testing for Economies of Scale and Economics of Scope The Production Approach The Intermediation Approach Empirical Findings on Cost Economies of Scale and Scope and Implications for Technology Expenditures Economies of Scale and Scope and X-Inefficiencies Technology and the Evolution of the Payments System Risks That Arise in an Electronic Transfer Payment System Other Operational Risks Regulatory Issues and Technology and Operational Risks Summary

16-1

Chapter 16 - Technology and Other Operational Risks

Solutions for End-of-Chapter Questions and Problems 1. Explain how technological improvements can increase an FIs interest and noninterest income and reduce interest and noninterest expenses. Use some specific examples.

Technological improvements in the services provided by financial intermediaries help increase income and reduce costs in several ways: (a) (b) (c) Interest income: By making it easier to draw down on loans directly via computers, as well as by processing loan applications faster. Interest expense: By enabling banks to access lower cost funds that are available directly from brokers and dealers through computers and screen-based trading. Noninterest income: By making more nonloan products available to customers through computers to customers such as letters of credit, commercial paper and derivatives.

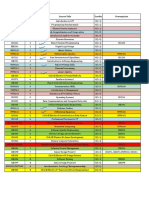

(d) Noninterest expense: By reducing processing and settlement fees, an area that has changed drastically for most FIs, especially in trading activities and in the use of automated teller machines (ATMs). 2. Table 16-1 shows data on earnings, expenses, and assets for all insured banks. Calculate the annual growth rates in the various income, expense, earnings, and asset categories from 1991 to 2008. If part of the growth rates in assets, earnings, and expenses can be attributed to technological change, in what areas of operating performance has technological change appeared to have the greatest impact? What growth rates are more likely to be caused by economy-wide economic activity? Growth rates through the end of 2008: Category Interest income Interest expense Net interest income Provision for Loan Loss Noninterest income Noninterest expenses Net earnings Total assets Eighteen-Year Growth Rate 3.43% 1.29% 5.51% 8.63% 6.76% 5.57% -0.67% 7.36%

The high growth rate in noninterest income reflects in part, the additional fees for technology oriented products such as ATMs and other services. The growth in noninterest expense reflects a lower growth in personnel expenses that further supports the transition toward more technology. The relatively small growth rates in interest income and interest expense reflect the low interest rate environment of the economy that was prevalent during the 2000s. The negative growth rate

16-2

Chapter 16 - Technology and Other Operational Risks

in net earnings is partially fueled by loan losses experienced during the financial crisis. 3. Compare the effects of technology on an FIs wholesale operations with the effects of technology on an FIs retail operations. Give some specific examples. Generally, the wholesale efforts have centered on the FIs ability to improve the management of float for the FI and for large corporate customers. These efforts include services dealing with lockboxes, funds concentrations, treasury management software, etc. The effect on retail services primarily has been to make it easier for individuals to obtain banking services as exemplified by ATMs and home banking products. 4. What are some of the risks inherent in being the first to introduce a financial innovation?

One risk is that the innovation may not be successful, because of either lack of acceptance by the customers of the FI or problems with the design and delivery of the product. If the product is successful, competitors may be able to quickly duplicate the product without incurring similar development cost of the original innovator. Another risk involves agency issues in which an employee recommends and/or pushes for new products or expansion which may not be in the best interests of the shareholders. 5. The operations department of a major FI is planning to reorganize several of its back-office functions. Its current operating expense is $1.5 million, of which $1 million is for staff expenses. The FI uses a 12 percent cost of capital to evaluate cost-saving projects. a. One way of reorganizing is to outsource overseas a portion of its data entry functions. This will require an initial investment of approximately $500,000 after taxes. The FI expects to save $150,000 in annual operating expenses after taxes for the next seven years. Should it undertake this project? This is a traditional capital budgeting problem. Investments = $500,000, and annual cost savings = $150,000. NPV = CF x PVAk=12%, n=7 Investment, where k = FIs cost of capital and CF = cash flows or cost savings. NPV = $150,000 x PVAk=12%, n=7 -500,000 = $684,563.48 - $500,000 = $184,563.48. Yes, the FI should undertake this project. b. Another option is to automate the entire process by installing new state-of-the-art computers and software. The FI expects to realize more than $500,000 per year in aftertax savings, but the initial investment will be approximately $3 million. In addition, the life of this project is limited to seven years, at which time new computers and software will need to be installed. Using this seven-year planning horizon, should the FI invest in this project? What level of after-tax savings would be necessary to make this plan comparable in value creation to the plan in part (a)? NPV = $500,000 x PVAk=12%, n=7 - $3,000,000 = -$718,121.73. No, the FI should not undertake the project under these terms. The level of after-tax savings necessary to make the plan comparable to part (a) is NPV = Savings x PVAk=12%, n=7 - $3,000,000 = $184,563.48, Annual savings = $697,794.34 over the seven-year period.

16-3

Chapter 16 - Technology and Other Operational Risks

6.

City Bank upgrades its computer equipment every five years to keep up with changes in technology. Its next upgrade is two years from today and is budgeted to cost $1 million. Management is considering moving up the date by two years to install some new computers with breakthrough software that could generate significant cost savings. The cost for this new equipment also is $1 million. What should be the savings per year to justify moving up the planned update by two years? Assume a cost of capital of 15 percent

The equivalent annual cost for the planned 5 years is $1,000,000/PVAk=15%, n=5 = $298,315.55. Since the cost of the planned improvement is the same as the original investment, the savings generated should be the present value of $298,315.55 in years 1 and 2, or a total of $484,974.24. 7. Identify and discuss three benefits of technology in generating revenue for FIs?

Technology (1) allows for more efficient cross-marketing of new and old products; (2) encourages an increase in the rate of innovation of new products; and (3) supports improvements in service quality and convenience. Many FIs use high-tech efforts to determine how they can reach more customers with more products. As marketing lines are identified and defined, new product ideas emerge that further the usefulness of FI products to customers. 8. Distinguish between economies of scale and economies of scope.

Economies of scale refer to the average cost of production falling as output of a firm increases, and thus reflect the benefits of a single product firm getting larger. Economies of scope refer to the average cost of production falling through the use of joint inputs to produce multiple products, and thus reflect the benefits of a single-product firm becoming a multi-product firm. 9. What information on the operating costs of FIs does the measurement of economies of scale provide? If economies of scale exist, what implications do they have for regulators?

Economies of scale provide a measure of the average costs of producing a unit of output and usually are measured as total costs over total assets, total loans, or total deposits. If average costs decline as the size of the firm increases, large FIs will be able to offer more competitive rates than their smaller counterparts and possibly drive them out of business. This is easier today because the costs of incorporating new technology can be very expensive to small FIs. Regulators have to be concerned about economies of scale, because, if it is true that larger firms have lower operating costs, policies on restricting mergers, especially vertical mergers, may be counterproductive, since social benefits may outweigh the social costs of mergers. 10. What are diseconomies of scale? What are the risks of large-scale technological investments, especially to large FIs? Why are small FIs willing to outsource production to large FIs against which they are competing? Why are large FIs willing to accept outsourced production from smaller FI competition?

16-4

Chapter 16 - Technology and Other Operational Risks

Diseconomies of scale occur when the average cost of production increases as the amount of production increases. The risks of large-scale technological investments have to do with whether the uncertain future cash flows will be sufficient to cover the fixed costs of development and installation of the systems. The costs of excess capacity and cost overruns due to integration problems can easily absorb the expected benefits from the expansions. As a result, large FIs will accept production from smaller competitor FIs if such acceptance will assure that the desired cost benefits are obtained. At the same time, small FIs are willing to outsource production in an attempt to gain the benefits of lower production expenses that may be unattainable through their own technology upgrades. 11. What information on the operating costs of FIs is provided by the measurement of economies of scope? What implications do economies of scope have for regulators?

Economies of scope measure the synergistic cost savings to FIs that offer multiple products or services. For example, if an FI offers both banking and insurance services and offers them at lower costs than a bank and an insurance company offering them separately, economies of scope are said to exist. For regulators, this would mean being less restrictive on horizontal mergers where FIs are able to offer multiple services. 12. Buy Bank had $130 million in assets and $20 million in expenses before the acquisition of Sell Bank, which had assets of $50 million and expenses of $10 million. After the merger, the bank had $180 million in assets and $35 million in costs. Did this acquisition generate either economies of scale or economies of scope for Buy Bank?

Neither. The costs as a percentage of assets have increased from 15.38 percent to 19.44 percent for the bank. This represents diseconomies of scale. 13. A commercial bank, with assets of $2 billion and costs of $200 million has acquired an investment banking firm subsidiary with assets of $40 million and expenses of $15 million. After the acquisition, the costs of the bank are $180 million and the costs of the subsidiary are $20 million. Does the resulting merger reflect economies of scale or economies of scope?

This situation would represent economies of scope since different but joint operations are involved. The average cost of the separate firms was $215 million/$2.04 billion or 10.54 percent. After the merger, the average costs are $200 million/$2.04 billion or 9.8 percent. 14. What are diseconomies of scope? How could diseconomies of scope occur?

Diseconomies of scope occur when the average cost of production is higher from the joint production of services than the average costs from the previous independent production of the services. This situation can occur if the technology used in the production of a portion of the services is not sufficiently efficient for the production of the remaining services.

16-5

Chapter 16 - Technology and Other Operational Risks

15.

A survey of a local market has provided the following average cost data: Mortgage Bank A (MBA) has assets of $3 million and an average cost of 20 percent. Life Insurance Company B (LICB) has assets of $4 million and an average cost of 30 percent. Corporate Pension Fund C (CPFC) has assets of $4 million and an average cost of 25 percent. For each firm, average costs are measured as a proportion of assets. MBA is planning to acquire LICB and CPFC with the expectation of reducing overall average costs by eliminating the duplication of services. a. What should be the average cost after acquisition for the bank to justify this merger? Average cost: Bank A = 0.20 x $3,000,000 Insurance Company B = 0.30 x $4,000,000 Pension Fund C = 0.25 x $4,000,000 Total costs = $ 600,000 = 1,200,000 = 1,000,000 = $2,800,000

The average cost after merger should be no more than 25.45 percent (= 2,800,000/11,000,000). If Bank A can lower its average costs to less than 25.45 percent, it should go ahead with the merger. b. If MBA plans to reduce operating costs by $500,000 after the merger, what will be the average cost of the new firm? If Bank A lowers its operating costs by $500,000, the average cost of the new firm will be $2,300,000/$11,000,000 = 20.91 percent. 16. What is the difference between the production approach and the intermediation approach to estimating costs functions of FIs?

The production approach assumes FIs use labor and capital to produce two outputs: deposits and loans. The intermediation approach assumes the function of FIs is to intermediate between borrowers and lenders. As a result, the inputs consist of capital, labor, and deposits. 17. What are some of the conclusions of empirical studies on economies of scale and scope? How important is the impact of cost reductions on total average costs? What are Xinefficiencies? What role do these factors play in explaining cost differences among FIs?

Earlier studies have shown very little economies of scale except for small banks. More recent studies have shown economies of scale to exist for banks up to the $10 billion to $25 billion sector. Unfortunately, tests for these studies are very sensitive and can be influenced by the models used. Recent studies also suggest that cost-inefficiencies or costs associated with managerial performance and other hard-to-quantify factors (X-inefficiencies) may account for cost variations among FIs. Similarly, economies of scope studies are not very conclusive. Most

16-6

Chapter 16 - Technology and Other Operational Risks

find no evidence of benefits to offering multiple services. Finally, it is possible that some of the cost inefficiencies could be overshadowed by efficiencies in revenue generation. 18. Why does the United States lag behind most other industrialized countries in the proportion of annual electronic noncash transactions per capita? What factors probably will be important in causing the gap to decrease?

A specific reason for the U.S. lagging behind other countries is difficult to identify. However, the United States has a much higher ratio of banks per bank customer, and these banks have been slow to provide technological products that allow and encourage electronic transaction. Many experts believe the gap between the United States and other countries will narrow as the effects of nationwide interstate branching and consolidation of the financial services industry continue to be realized and as electronic transaction products become more available. 19. What are the differences between the Fedwire and CHIPS payment systems?

Fedwire and CHIPS both are electronic payments systems that transfer various transactions between banks. Fedwire is comprised of domestic FIs linked with the Federal Reserve System, and CHIPS is a private consortium of the largest domestic and international FIs. When FIs engage in overdrafts while using the Fedwire system, the counterparty is safe even if the FI fails because the Federal Reserve guarantees any payments made over the wire. However, in the case of CHIPS, the transactions are only tentative and are confirmed only at the end of the day. In the event of an FI failure, the receipts and payments from all banks dealing with the failed FI are tabulated again and new debits and credits are posted. Consequently, there is a danger that a systemic default can be triggered in the event of a single failure. 20. What is a daylight overdraft? How do an FIs overdraft risks incurred during the day differ for each of the two competing electronic payment systems, Fedwire and CHIPS? What provision has been taken by the members of CHIPS to introduce an element of insurance against the settlement risk problem?

A daylight overdraft occurs at the Federal Reserve Bank when a bank, in the continuing process of transferring in money and transferring out money from its account, has transferred out more money than is currently in the account. This is similar to the retail transaction of depositing a check and withdrawing cash before the funds from the initial check have cleared into the account. Under the Fedwire system, the Federal Reserve System guarantees all wire transfer messages, while the private CHIPS system will unwind transactions in the event that funds are not sufficient to cover the wire messages. To reduce the potential of a serious system-wide financial crisis, the members of CHIPS have created an escrow fund to cover message commitments of a failed bank. 21. How does Regulation F of the 1991 FDICIA reduce the problem of daylight overdraft risk?

Regulation F requires banks, thrifts, and foreign institutions to implement procedures to reduce their daylight overdraft exposures. As of December 1992, banks are limited from keeping

16-7

Chapter 16 - Technology and Other Operational Risks

overdraft positions with a correspondent bank to no more than 25 percent of the correspondent banks capital. If a bank is adequately capitalized, then it can have exposures of up to 50 percent of the correspondent banks capital. For well-capitalized banks, there is no limit. 22. Why do FIs in the United States face a higher degree of international technology risk than do the FIs in other countries, especially some European countries?

The implementation of high technology systems by United States banks in Sweden and Singapore tends to be slow because of the cost of accessing telephone transmission lines. In contrast, foreign FIs in the U.S. have direct access to U.S. technology-based products at a low cost. 23. What has been the impact of rapid technological improvements in the electronic payment systems on crime and fraud risk?

The massive increase in the use of electronic payment mechanisms has greatly increased the level of sophistication required to commit unauthorized transfers by accessing computers illegally. However, knowledge of specialized technical information has created a new type of white-collared crime and thus security problems. 24. What are usury ceilings? How does technology create regulatory risk?

Usury ceilings are state government imposed limits that FIs may charge on certain types of lending activities, such as consumer loans and credit cards. Because many product transactions rely heavily on electronic technology, financial products often can be marketed from locations without severe regulatory constraints. This activity in effect circumvents the regulatory effects desired in the constrained environments. 25. How has technology altered the competition risk of FIs?

Competition in the financial services industry has increased because of the entrance of nontraditional financial service providers through the use of technology. Thus, the franchise values of traditional service providers, such as banks, savings institutions, etc., are under increasing pressures from the new, technology-based, nontraditional providers. 26. What actions has the BIS taken to protect depository institutions from insolvency due to operational risk? In 1999 the Basle Committee (of the BIS) on Banking Supervision said that operational risks are sufficiently important for banks to devote necessary resources to quantify the level of such risks and to incorporate them (along with market and credit risk) into their assessment of their overall capital adequacy. In its follow up consultative document released in January 2001, the Basle Committee proposed three specific methods by which depository institutions (DIs) would hold capital to protect against operational risk.

16-8

Вам также может понравиться

- Financial Institutions ManagementДокумент8 страницFinancial Institutions ManagementJesmon RajОценок пока нет

- Chap 008Документ12 страницChap 008Fawzi FawazОценок пока нет

- Solutions Chap007Документ13 страницSolutions Chap007Said Ur RahmanОценок пока нет

- Chap 008Документ6 страницChap 008Haris JavedОценок пока нет

- CH 9Документ13 страницCH 9Cary Lee17% (6)

- Capital Asset Pricing Theory and Arbitrage Pricing TheoryДокумент19 страницCapital Asset Pricing Theory and Arbitrage Pricing TheoryMohammed ShafiОценок пока нет

- Chapter 10 - MarketДокумент13 страницChapter 10 - MarketTammie Henderson100% (1)

- Chap 009Документ39 страницChap 009Shahrukh Mushtaq0% (1)

- Exam Questions Fina4810Документ9 страницExam Questions Fina4810Bartholomew Szold75% (4)

- CH 6 Making Capital Investment DecisionsДокумент3 страницыCH 6 Making Capital Investment DecisionsMuhammad abdul azizОценок пока нет

- Fixed Income QuestionsДокумент1 страницаFixed Income QuestionsAbhishek Garg0% (2)

- CH 11Документ12 страницCH 11Cary Lee33% (3)

- Exchange Rate Risk Assessment and Internal Techniques ofДокумент19 страницExchange Rate Risk Assessment and Internal Techniques ofSoumendra RoyОценок пока нет

- Solutions For End-of-Chapter Questions and Problems: Chapter TenДокумент27 страницSolutions For End-of-Chapter Questions and Problems: Chapter TenSam MОценок пока нет

- Risk Management Solution Chapters Seven-EightДокумент9 страницRisk Management Solution Chapters Seven-EightBombitaОценок пока нет

- Refinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenДокумент6 страницRefinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenJeffОценок пока нет

- EOC08 UpdatedДокумент25 страницEOC08 Updatedtaha elbakkushОценок пока нет

- ENG 111 Final SolutionsДокумент12 страницENG 111 Final SolutionsDerek EstrellaОценок пока нет

- Risk Management For MBA StudentsДокумент28 страницRisk Management For MBA StudentsMuneeb Sada50% (2)

- Session 5 - Valuing Bonds and StocksДокумент51 страницаSession 5 - Valuing Bonds and Stocksmaud balesОценок пока нет

- Assignment 1Документ29 страницAssignment 1ALLAHISGREAT100Оценок пока нет

- Interest Rates and Security ValuationДокумент60 страницInterest Rates and Security Valuationlinda zyongweОценок пока нет

- Solutions BD3 SM24 GEДокумент4 страницыSolutions BD3 SM24 GEAgnes ChewОценок пока нет

- Fixed Income Securities: Bond Basics: CRICOS Code 00025BДокумент43 страницыFixed Income Securities: Bond Basics: CRICOS Code 00025BNurhastuty WardhanyОценок пока нет

- Chapter 008 SolutionsДокумент6 страницChapter 008 SolutionsAnton VelkovОценок пока нет

- III.B.6 Credit Risk Capital CalculationДокумент28 страницIII.B.6 Credit Risk Capital CalculationvladimirpopovicОценок пока нет

- Hillier Model 3Документ19 страницHillier Model 3kavyaambekarОценок пока нет

- Var, CaR, CAR, Basel 1 and 2Документ7 страницVar, CaR, CAR, Basel 1 and 2ChartSniperОценок пока нет

- Making Investment Decisions With The Net Present Value RuleДокумент60 страницMaking Investment Decisions With The Net Present Value Rulecynthiaaa sОценок пока нет

- Preguntas 5 y 6Документ4 страницыPreguntas 5 y 6juan planas rivarolaОценок пока нет

- Ch20 SolutionsДокумент19 страницCh20 SolutionsAlexir Thatayaone NdovieОценок пока нет

- Saunders CH04 AccessibleДокумент29 страницSaunders CH04 AccessibleindriawardhaniОценок пока нет

- Return and Risk:: Portfolio Theory AND Capital Asset Pricing Model (Capm)Документ52 страницыReturn and Risk:: Portfolio Theory AND Capital Asset Pricing Model (Capm)anna_alwanОценок пока нет

- Capital Budgeting AnswerДокумент18 страницCapital Budgeting AnswerPiyush ChughОценок пока нет

- Market Risk MeasurementДокумент19 страницMarket Risk MeasurementRohit SinghОценок пока нет

- AccДокумент4 страницыAccrenoОценок пока нет

- IMChap 020Документ29 страницIMChap 020Roger TanОценок пока нет

- Dynamic ALMДокумент5 страницDynamic ALMleonodisОценок пока нет

- StudentДокумент26 страницStudentKevin CheОценок пока нет

- CDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsДокумент26 страницCDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsSimran AroraОценок пока нет

- JP Morgan CreditMetricsДокумент16 страницJP Morgan CreditMetricsKSОценок пока нет

- BTP Italy Features and Workings - Unicredit 15 Sep 15Документ8 страницBTP Italy Features and Workings - Unicredit 15 Sep 15pavleinОценок пока нет

- Financial Risk Management Assignment: Submitted By: Name: Tanveer Ahmad Registered No: 0920228Документ13 страницFinancial Risk Management Assignment: Submitted By: Name: Tanveer Ahmad Registered No: 0920228Tanveer AhmadОценок пока нет

- Act7 2Документ4 страницыAct7 2Helen B. EvansОценок пока нет

- Asset Quality Management in BankДокумент13 страницAsset Quality Management in Bankswendadsilva100% (4)

- Banking Industry: Structure and CompetitionДокумент34 страницыBanking Industry: Structure and CompetitionA_StudentsОценок пока нет

- Fabozzi BMAS8 CH03 IM GE VersionДокумент29 страницFabozzi BMAS8 CH03 IM GE VersionsophiaОценок пока нет

- Foreign Exchange Risks ExplainedДокумент24 страницыForeign Exchange Risks ExplainedWisDomRaazОценок пока нет

- BKM Chapter14Документ5 страницBKM Chapter14Vishakha DarbariОценок пока нет

- Credit Derivatives: An Overview: David MengleДокумент24 страницыCredit Derivatives: An Overview: David MengleMonica HoffmanОценок пока нет

- Capital Structure: Theory and PolicyДокумент31 страницаCapital Structure: Theory and PolicySuraj ShelarОценок пока нет

- 6 & 7Документ13 страниц6 & 7Awais ChОценок пока нет

- Part Seven: THE Management of Financial InstitutionsДокумент40 страницPart Seven: THE Management of Financial InstitutionsIrakli SaliaОценок пока нет

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsОт EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsОценок пока нет

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskОт EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskРейтинг: 3.5 из 5 звезд3.5/5 (1)

- Financial Soundness Indicators for Financial Sector Stability in Viet NamОт EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamОценок пока нет

- Structured Financial Product A Complete Guide - 2020 EditionОт EverandStructured Financial Product A Complete Guide - 2020 EditionОценок пока нет

- Internet Access Via Cable TV NetworkДокумент15 страницInternet Access Via Cable TV Networkankur_desai100% (1)

- UntitledДокумент9 страницUntitledyzlОценок пока нет

- Evs 3643 Summary ProductДокумент43 страницыEvs 3643 Summary ProductishaqnfОценок пока нет

- Instalación Opera en Win7Документ12 страницInstalación Opera en Win7pedro_orozco_80Оценок пока нет

- Cukurova: CJ1100PM CJ400PNДокумент6 страницCukurova: CJ1100PM CJ400PNSaqib IqbalОценок пока нет

- IBM Tivoli Storage Manager Version 6.4 Problem Determination GuideДокумент294 страницыIBM Tivoli Storage Manager Version 6.4 Problem Determination GuideBogdanОценок пока нет

- E500 Series: E F C PДокумент44 страницыE500 Series: E F C Pnghienhugo100% (1)

- Holtek E-Link For 8-Bit MCU OCDS User S Guide enДокумент17 страницHoltek E-Link For 8-Bit MCU OCDS User S Guide enHardware HbeonlabsОценок пока нет

- Häfele Appliance MRP ListДокумент10 страницHäfele Appliance MRP Listpriyanjit910Оценок пока нет

- Modelling of Interference Caused by Uplink Signal For Low Earth Orbiting Satellite Ground StationsДокумент5 страницModelling of Interference Caused by Uplink Signal For Low Earth Orbiting Satellite Ground StationsMurthyОценок пока нет

- CESGA DTN User Guide: Release 1.0.1Документ25 страницCESGA DTN User Guide: Release 1.0.1Pop ExpangeaОценок пока нет

- Spec Sheet Potato Peeler Pi 20Документ2 страницыSpec Sheet Potato Peeler Pi 20voldemort.bilalОценок пока нет

- Management Information Systems PDFДокумент96 страницManagement Information Systems PDFPuneet GajendragadОценок пока нет

- Botnet SetupДокумент18 страницBotnet Setupjajaj moneseОценок пока нет

- Mobile Telephone History PhilippinesДокумент29 страницMobile Telephone History PhilippinesKyou Chan100% (1)

- Experiment No. 1 - To Study PLC Trainer Kit PDFДокумент8 страницExperiment No. 1 - To Study PLC Trainer Kit PDFShashikant PrasadОценок пока нет

- Makalah Bahasa InggrisДокумент6 страницMakalah Bahasa InggrisIRFANОценок пока нет

- Mobile Money Note 2019Документ8 страницMobile Money Note 2019Hunter killersОценок пока нет

- KBA Commander Printing PressДокумент28 страницKBA Commander Printing PressuthramОценок пока нет

- Computer Science 2210 Class 9 Revised Syllabus Break Up2020-21-23Документ5 страницComputer Science 2210 Class 9 Revised Syllabus Break Up2020-21-23MohammadОценок пока нет

- Chapter 8 - Network Security and Network ManagementДокумент34 страницыChapter 8 - Network Security and Network ManagementMuhammad NazmiОценок пока нет

- Dissertation Adoption of Enterprise Resource Planning Erp in VietnamДокумент30 страницDissertation Adoption of Enterprise Resource Planning Erp in VietnamAr Puneet AroraОценок пока нет

- Automotive EngineeringДокумент4 страницыAutomotive EngineeringIrinaОценок пока нет

- Mitsubishi f700 Series ManualДокумент0 страницMitsubishi f700 Series ManualraeljОценок пока нет

- 0417 - N18 - Instructions For Conducting The IGCSE ICT Practical TestsДокумент6 страниц0417 - N18 - Instructions For Conducting The IGCSE ICT Practical TestsRichie HarvyОценок пока нет

- Open Source Whitebox Router PDFДокумент13 страницOpen Source Whitebox Router PDFtobecaОценок пока нет

- ISO IEC 17025 2017 Transition TemplateДокумент8 страницISO IEC 17025 2017 Transition TemplateaasОценок пока нет

- DH7 OsДокумент2 страницыDH7 OsSampalau AnglerОценок пока нет

- Proxy Exams Being Cert-1Документ4 страницыProxy Exams Being Cert-1Bryan GoetzОценок пока нет

- BSE SoSДокумент2 страницыBSE SoSALI AHMADОценок пока нет