Академический Документы

Профессиональный Документы

Культура Документы

Benevolence Policy

Загружено:

Mitchael McDonaldИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Benevolence Policy

Загружено:

Mitchael McDonaldАвторское право:

Доступные форматы

Crossroads Church Benevolence Policy & Guidelines

Purpose of this Document Establish and outline an objective, unbiased process for the evaluation of requests for assistance from the Benevolence Fund. Provide written eligibility requirements and criteria for receiving assistance from the Benevolence Fund. Describe the request, approval and disbursement process. Biblical Basis Let us not lose heart in doing good, for in due time we will reap if we do not grow weary. So then, while we have opportunity, let us do good to all people, and especially to those who are of the household of the faith. (Galatians 6:9-10) Pure and undefiled religion in the sight of our God and Father is this: to visit orphans and widows in their distress, and to keep oneself unstained by the world. (James 1:27) The Staff of Crossroads Church affirm these principles and, by God's grace and for His glory, commit to be guided by them as we exercise faithful stewardship of the money entrusted to us for the purpose of providing benevolence to individuals or families in need of ministering and assistance. Oversight & Accountability The Community Life Pastor, under the oversight of the Associate Pastor, shall

have responsibility for overseeing the administration of the Benevolence Fund and the Biblical stewardship of the money held therein. The Community Life Pastor shall give a regular accounting to the Associate Pastor of all contributions to and disbursements from the Benevolence Fund. Source of Funding The Benevolence Fund shall receive income from two sources: Through the receipt of special contributions by individuals and/or families wishing to make a donation to the Fund (members of the church are not encouraged to contribute to the Benevolence Fund in lieu of regular giving to the General Fund of the church); and Through the allocation or transfer of funds from the General Fund when deemed necessary and appropriate by the Community Life Pastor upon approval of the Associate Pastor. Contributions to the Benevolence Fund in the form of a check should be made payable to "Crossroads Church", with a notation that the funds are to be placed in the Crossroads Church Benevolence Fund. The leadership of Crossroads Church exhorts members to minister directly to other members of the congregation as they become aware of specific needs. However, gifts made by a member to a needy individual or family are not tax-deductible under IRS regulations.

In order to comply with IRS regulations concerning charitable contributions, all gifts to the Benevolence Fund must be unconditional

and without personal benefit to the donor. Contributions to the Benevolence Fund may not be earmarked or otherwise designated for particular purposes or recipients. The leadership of Crossroads Church may choose, at its discretion, to decline certain contributions that are designated or earmarked. Donors making contributions to the Benevolence Fund subject to these Church Fund. Recipients of Assistance In order of priority, recipients of assistance from the Benevolence Fund shall be: Members of Crossroads Church Regular attendees of Crossroads Church Members of the community The stated purpose of the Benevolence Fund is to minister to individuals or families during a time of hardship or crisis by temporarily their basic needs. Depending on the circumstances, include financial counseling, training in household family avoid potential hardships or crises in the future. from the Benevolence Fund is intended to cover an assisting them with assistance may also help the individual or Generally, assistance conditions may be able to deduct their contributions if they itemize on the federal income tax return. The leadership of Crossroads the appropriate tax treatment of contributions they make to the recommends that donors consult their individual tax advisor or CPA deductions concerning

budgeting and/or debt management, or other financial education that would

individual's or family's basic Fund is to be used to meet basic

needs. The Crossroads Church Benevolence needs of families and individuals. We tangible way to those in our from the fund is only to be during a time of crisis.

want to show the love of Christ in a

congregation and in the community at large. Help given for temporary needs or for a one-time need

Needs that may not be met by the Benevolence Fund include: Business investments, business debts or anything that brings financial profit to the individual or family Paying off credit cards. Exceptions can be made when an individual has had to use a credit card in a crisis or emergency (e.g., hospitalization, death, etc.) Needs of individuals who are wanted by the law or for paying fines as a result of breaking the law Housing for unmarried couples Legal fees arising from criminal behavior Gambling debts Penalties relating to late payments or irresponsible actions School tuition or fees

This list s not intended to be exhaustive; instead, it is intended to provide general guidelines in determining the type of expenses not covered by benevolent assistance.

The stated purpose of the Benevolence Fund is to meet peoples basic needs, Food such as:

Clothing Medical Treatment Lodging Utilities Funeral Expenses Guidelines for Disbursement The Benevolence Fund is intended as a source of last resort, to be used other when the individual or family requesting assistance has explored all possibilities of assistance from appropriate sources (i.e., family,

savings, investments, etc). It is intended to be a means of assistance during the time of a crisis or other hardship. Disbursements from the Benevolence Fund may not be made in the form of a loan. Under no circumstance is assistance from the Benevolence in labor. other appropriate Biblical counseling. Crossroads Church will not anyone who, in their estimation, will have negative or grant Crossroads Church permission to provided to them. Crossroads Church will Fund to be considered a loan. No gift may be repaid, either in part or in full, in money or family, or Those requesting assistance must be willing to receive financial, provide help to

irresponsible behavior reinforced by the financial assistance. Those requesting help must be willing to follow up on any of the information be sensitive to confidentiality issues. To the extent possible, and at the discretion of the Community Life Pastor and Associate Pastor, all disbursements from the Benevolence Fund shall be made directly to the party or entity to whom payment is due and not

in the form

of cash given directly to the individual or family requesting directly to the individual or family's landlord or

assistance (e.g., if assistance with rent or a mortgage payment is needed, payment shall be made mortgage holder). Application and Approval Process Individuals or families seeking assistance from the Benevolence Fund shall follow the steps below: (along with all supporting documentation). Complete interview(s) and/or appropriate counseling with the Community Life Pastor. Provide all additional documents and information requested by the Community Life Astor or Associate Pastor. Review and approval of the application, as well as communication of the amount and form of assistance, shall be done by the Community Life Pastor at the earliest practicable date. All applications will be reviewed be given on Thursdays. Should an application be and responses will Obtain and submit an Application for Assistance from Crossroads Church

received on Thursday, it will be reviewed the following Thursday.

Revised 4.5.2012

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Supplementary Code on Insolvency Resolution and BankruptcyДокумент33 страницыSupplementary Code on Insolvency Resolution and BankruptcyVikky VasvaniОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Equitable Pci V FernandezДокумент10 страницEquitable Pci V Fernandezrgtan3Оценок пока нет

- REY DANIEL S. ACEDILLO Midterm Exam Credit TransactionsДокумент4 страницыREY DANIEL S. ACEDILLO Midterm Exam Credit TransactionsÝel ÄcedilloОценок пока нет

- AGREEMENT FOR PAWNING A LOT PROPERTY BlankДокумент1 страницаAGREEMENT FOR PAWNING A LOT PROPERTY BlankMary Anne Manangan Baltazar83% (12)

- Composition of Fund Clusters: Codes Description Fund Cluster Existing Uacs Funding SourceДокумент15 страницComposition of Fund Clusters: Codes Description Fund Cluster Existing Uacs Funding SourcejanineОценок пока нет

- Home - Universal CreditДокумент3 страницыHome - Universal CreditPaul MolyОценок пока нет

- Cpa Review School of The Philippines ManilaДокумент3 страницыCpa Review School of The Philippines ManilaAljur SalamedaОценок пока нет

- Multi-Purpose Loan (MPL) Application FormДокумент16 страницMulti-Purpose Loan (MPL) Application FormPablito BeringОценок пока нет

- Guidelines For Registration of ChargesДокумент4 страницыGuidelines For Registration of ChargesSuhaina HamidОценок пока нет

- Ayala V. CAДокумент1 страницаAyala V. CAMichelle Vale CruzОценок пока нет

- B5 PsafДокумент926 страницB5 PsafIRIBHOGBE OSAJIEОценок пока нет

- Loan LetterДокумент4 страницыLoan Lettermohd.hadi36Оценок пока нет

- Financial Management PGDM Study MaterialДокумент152 страницыFinancial Management PGDM Study MaterialSimranОценок пока нет

- Citibank Investment DisputeДокумент120 страницCitibank Investment Disputegeorge_erandioОценок пока нет

- A+ Answers To Multiple Choice QuestionsДокумент51 страницаA+ Answers To Multiple Choice QuestionsjupiterukОценок пока нет

- Chapter 5 - BudgetingДокумент16 страницChapter 5 - BudgetingMary Anne BillonesОценок пока нет

- Central Bank of The Philippines vs. Court of AppealsДокумент4 страницыCentral Bank of The Philippines vs. Court of AppealsphiaОценок пока нет

- AL Americana's 2015 consolidated financial statements componentsДокумент4 страницыAL Americana's 2015 consolidated financial statements componentsFarrukhsgОценок пока нет

- GE 3 2nd Topic (Consumer Math)Документ5 страницGE 3 2nd Topic (Consumer Math)Ivanne GomezОценок пока нет

- TIA 2/FM Seminar A.1 ProblemsДокумент23 страницыTIA 2/FM Seminar A.1 ProblemsPrisco SayОценок пока нет

- PGINVIT - Q3 FY24 Earnings CallДокумент17 страницPGINVIT - Q3 FY24 Earnings CallBuvanesh BalajiОценок пока нет

- Instructions For Form 8949: Future DevelopmentsДокумент12 страницInstructions For Form 8949: Future DevelopmentsJacen Bonds0% (1)

- Limitation Case Law - Semester3Документ58 страницLimitation Case Law - Semester3NARINDERОценок пока нет

- Lesson 8 - Short Term FinancingДокумент16 страницLesson 8 - Short Term FinancingTomoyo AdachiОценок пока нет

- Banking LawsДокумент18 страницBanking LawsLance Cedric Egay DadorОценок пока нет

- Department Accounts - SolutionДокумент17 страницDepartment Accounts - Solution203 596 Reuben RoyОценок пока нет

- What Do Interest Rates Mean and What Is Their Role in Valuation?Документ3 страницыWhat Do Interest Rates Mean and What Is Their Role in Valuation?Alessandra PilatОценок пока нет

- FIN300 Homework 4Документ4 страницыFIN300 Homework 4John0% (2)

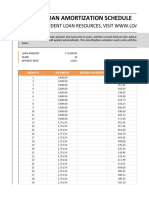

- Calculate student loan paymentsДокумент18 страницCalculate student loan paymentsIsmail UsmanОценок пока нет

- Education and Street VendorsДокумент10 страницEducation and Street VendorsMauie PandsОценок пока нет