Академический Документы

Профессиональный Документы

Культура Документы

Sample Qualified Written Request

Загружено:

James Adams-JohnsonИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sample Qualified Written Request

Загружено:

James Adams-JohnsonАвторское право:

Доступные форматы

Date: 5/31/2012

To: Wells Fargo/Select Portfolio Servicing 3815 South West Temple Salt Lake City, UT 84115

RE: Loan #: 0152038428 Property Address: 301 New York Road, Browns Mills, NJ 08015 Owner Mailing Address: 325 E. Jimmie Leeds Road, Ste. 199, Galloway, NJ 08205 1) 2) 3) RESPA Qualified Written Request and Complaint FDCPA Dispute of Debt & Validation of Debt Letter Request That You Cease Contact with Anyone Other than Us about this Mortgage and Note

Requests:

Dear Sir/Madam, We are in receipt of a communication dated 5/18/2012 which can be interpreted to directly violate the FDCPA and several consumer protection provisions found under RESPA. A QWR and a specific request to cease contact with the original borrower, who has been discharged from this debt, was sent and validated on 2/7/12 by Bank of America, the previous company claiming to be the servicer on the rd account and also to SPS in 4/2012. A 3 request was also sent to SPS on 4/30/12. Your letter would seem to ignore each of those direct requests. Due to the recent mortgage market meltdown and your involvement in this market, and as we are the current owners of the deed to the above referenced property, we are concerned over the legitimacy of this loan, and/or that this previous loan was not properly credited, amortized, calculated, and serviced properly. We are also concerned with the ownership, legitimacy, and continuing existence of the promissory note; to whom an actual obligation may or may not be owed; who was the actual lender; and the authority of any entity of non-financial interest to demand/collect payments and/or negotiate the purchase/repurchase of a promissory note from the actual lender. We are writing to complain about the validity of a certain title lien, and/or multiple inconsistencies with the servicing of the mortgage identified by the lien and our need for understanding and clarification of various securitization legalities, charges, credits, debits, transactions, action, payments analysis and records related to the servicing of this loan from its inception to the present date. As such, please treat this letter as a "Qualified Written Request" under the Real Estate Settlement Procedures Act (RESPA), codified as Section 2605(e) of Title 12 of the United States Code. We are the sole owners of the above referenced property. We are very concerned that you have violated the Fair Debt Collection Practices Act by ignoring our cease and desist requests, for attempting to collect payments that you are not entitled to collect or to which, through your PSA can be shown that you have already been paid for, as well as violations of the contractual agreement set forth in the promissory note and mortgage or deed of trust and/or PSA identified by the now disputed lien or cloud on our title. As we are sure you are aware, mortgage servicing fraud is rampant. We are exploring various options to protect our property. A house is a very important and valuable asset that we desire to protect. Please don't infer any negative connotation by this letter, but the industry-wide practices employed in recent years are troubling and it is imperative for us to guard our new asset against future problems, including but not limited to the reporting of negative information to the credit reporting bureaus, or unsubstantiated collection activity and harassment. We have contracted with a firm to audit the initial origination, any true sales, apparent robo-signing evident in recorded documentation, and the PSA securitization linked to the mortgage loan that you service as we explore various recoupment, sale, refinancing, loan, business, and financial options. In order to conduct this examination and audit, we need to have full and immediate disclosure including copies of all pertinent information related to this loan. As such please send (to at the address below) copies of the following documents and answers to these servicing-related questions below within a 60 day time frame.

I DOCUMENTS NEEDED TO CONDUCT AUDIT 1) All "master" transaction registers/ledgers of the loan of question in your servicing files or backup files with you or any sub-service, or ASSIGN, including but not limited to the fidelity mortgage servicing system, FiServ or any mortgage servicing system you use. Please provide all information residing in any data field in the system or any component that supports the system that deals with any of the questions listed below. (no screen or partial dumps or spreadsheets please). 2) Also, please provide and include all description and legends of all Codes used in your mortgage servicing and accounting system so that the examiners, auditor and experts I have retained to audit and review my mortgage account may properly conduct their work. 3) A certified copy of the front and back portion of the current mortgage or deed of trust as it exists today along with all assignments whether recorded or not. 4) A certified copy of the front and back portion of the current wet-signed promissory note as it exists today along with all endorsements, affixed or un-affixed allonges, and assignments whether recorded or not.

5) Proof of possession, by notary, of the original wet-signed promissory note, mortgage and deed of trust from the inception of the loan in question, along with all endorsements, affixed or un-affixed allonges, and assignments whether recorded or not.

6) Cancelled checks, wire transmittals or other evidence of payment for each assignment of the promissory note.

7) All executed, recordable and "non-recordable" assignments associated with the loan including, but not limited to assignments, transfers, allonges, or other documents evidencing a transfer, sale or assignment of the mortgage, deed of trust, promissory note or other document that secures payment to an obligation in this account from the inception of the loan to the present date.

8) All records, electronic or otherwise, of assignments of the mortgage, deed of trust, promissory note, or servicing rights to the mortgage or deed of trust.

9) All escrow analyses conducted on the account from the inception of the loan until the date of this letter.

II SERVICING RELATED QUESTIONS After the recent problems in the mortgage market, we have many servicing-related questions in addition to the questions enumerated above. Please answer the following questions: 1) What is your actual servicing relationship with the loan in question? Are you the servicer, master servicer, interim servicer, private label servicer, default servicer, sub-servicer, and/or special servicer of the loan?

2) Has the promissory note ever been securitized? If so kindly inform us of the following information: a. All trusts, SPVs, QSPEs, REMICS, and other entities that the note has been assigned to from its inception to the current date. b. The current trust, SPV, QSPE, SPE, REMIC or entity that owns the note. 3) Is there any Fannie Mae, Freddie Mac, Ginnie Mae, FHA, HUD, VA or private guarantee related to the loan? If yes, who has provided this guarantee and what portion of the payment goes to this guarantee and have gone to this guarantee in the past? 4) Who is the document custodian that safeguards and holds the "original" promissory note that was signed in ink and at what address may that person be found? 5) Does the original promissory note currently have any "blank endorsements" on it? [Yes/No]. a. If yes, can you kindly explain why? b. If yes, can you kindly tell us as of the date written above: i. Who owns the note and is the actual current "lender" and not servicer of the note? ii. Who claims to be the holder of the note? iii. Has the United States government ever owned the note? 6) Does the original promissory note properly reflect the chain of title from one interest to another? [Yes/No] a. If yes, can you kindly send certified document showing this chain of title and recordation? 7) Are there any missing assignments? [Yes/No] a. If yes, can you kindly explain why? 8) Has any due diligence and/or quality control services conducted by you or any other entity on this loan identified any red flags, frauds, misrepresentations, misstatements, errors, or problems? a. If yes, can you kindly detail such problems to us? 9) Has the loan ever been classified as a "scratch and dent" loan? 10) When will we receive the original (signed in ink) promissory note stamped "Cancelled, Voided, Released or Paid in Full"? 11) Have any BPOs, property inspections, and/or appraisals by you or any investor been conducted on the property since the inception of the loan? [Yes/No] a. If yes, have you charged or assessed any fee to the above account for any BPOs, property inspections or appraisals after the inception of the loan? [Yes/No] b. If yes, kindly tell us that date of such BPO, property inspections or appraisal, the amount paid and provide us with copies of all documents related to each BPO, property inspections or appraisal conducted on the property including, but not limited to reports, orders, invoices and cancelled checks for payments. 12) Who may we contact to negotiate the purchase, refinance, and/or novation of any promissory note? 13) What is the name and date of the pooling and servicing agreement that governs your servicing of the loan? Where can we secure a copy of this agreement? 14) Is there any power of attorney ("POA") filed in the property's county or any other county that governs your relationship with the loan? If yes, kindly identify for us the county where the POA is filed and the filing (instrument) number, name, and date of the POA.

15) At any time during the term of this loan, did the servicer, master servicer, interim servicer, private label servicer, default servicer, sub-servicer, and/or special servicer of the loan change? If the answer is yes, please identify how the original mortgagor was notified of the change of the servicer, master servicer, interim servicer, private label servicer, default servicer, sub-servicer, and/or special servicer of the loan? Please provide copies of all written notification of any change of the servicer, master servicer, interim servicer, private label servicer, default servicer, sub-servicer, and/or special servicer of the loan? 16) At any time during the term of the loan, did the mailing address for making payments change? If yes, identify how was the original mortgagor notified of the change of the mailing address for making payments. If such notification occurred in writing, please provide a copy of such notifications. 17) If during the term of the loan the mailing address for making payments changed, what provision was made to insure that payments made to the previous address were forwarded to the new mailing address, timely and properly posted to the account? 18) Were any fees for late payments charged to the account? If yes, we these fees charged and applied secondary to the mortgage payment each month? Were any late payments caused by said late fees being carried over month after month, and if so, which months? 19) Do you have a direct financial interest in the property (i.e.- purchase or refinance money lent) or is your role solely that of servicer and collector of payments?

III SUSPENSE/UNAPPLIED ACCOUNT QUESTIONS For the purpose of this section, please treat the terms "suspense account" and unapplied account" as one in the same. 1) When will the balance of the escrow account for taxes and insurance with an accounting of such funds be returned? 2) What is the current status of the tax escrow account? How did the current figure get calculated and have taxes been paid when due? If yes, please provide evidence of payment dues dates and dates paid.

3) Has there been any suspense or unapplied account transaction on the account from inception of the loan until present date? a. If yes, why? If no, please skip these questions in this section dealing with suspense and unapplied accounts. b. In a spreadsheet or in a letter form in a columnar format, please detail for each and every suspense or unapplied transaction, both debits and credits that have occurred on the account from the inception of the loan until present date. c. What is the current suspense account balance? d. Why was the money placed into suspense and how will it be allocated to the loan?

IV LATE FEE QUESTIONS 1) Has there been any late fee transaction on the account from the inception of the loan until the present date? a. If yes, why? If no, please skip the question in this section dealing with late fees. b. In a spreadsheet or in letter form in a columnar format, please detail each and every late fee transaction, both debits and credits that have occurred on the account from the inception of the loan until present date? c. What is the current late fee balance?

2) Have you reported the collection of late fees on the account as interest in any statement to the original mortgagor or the Internal Revenue Service? [Yes/No] 3) Do you consider the payment of late fees as liquidated damages to you for not receiving payments on time? [Yes/No] 4) Are late fees considered interest? [Yes/No] 5) Please detail in writing what expenses and damages you incurred for any allegedly late payment? 6) Were any of these expenses or damages charged or assessed to the account in any other way? [Yes/No] If yes, please describe what expenses or charges were charged or assessed to the account? 7) Please describe in writing what expenses you or others undertook due to any payment which you allege were made late. 8) Please identify for in writing the provision, paragraph, section or sentence of any note, mortgage, deed of trust or any agreement signed authorizing the assessment of collection late fees.

Thank you in advance for addressing the question and issues above. Upon receipt of the documents and answers, an exam and audit will be conducted that may lead to further document requests and questions to answer under an additional QWR letter or filing. It is our hope that all the information told to us on multiple occasions by your debt collectors and customer service agents, statements, etc, will be 100% accurate and that you will not need to correct and adjust any errors or abuses identified. We also may request the return of the original wet signed note which is an entitlement under recoupment or we may want to negotiate a purchase price for the original wetsigned note from the actual lender. We do not want a face-to-face meeting to discuss loss mitigation opportunities at this time, but reserve the right to do so in the future. Last, we are specifically requesting that you not contact the original mortgagor and property owner, any of their friends, relatives, neighbors or anyone else, and you must not contact us in any manner except by email and U.S. mail. Telephone conversations cannot be documented unless agreed to recording. The last exception, which is a face-to-face meeting, which we do want currently and feel is unnecessary at this time; however, we reserve the right to ask for such a meeting in the future. We anxiously await your prompt response to this request. With regards,

Mr. James Adams-Johnson AdamsJohnson, LLC 325 East Jimmie Leeds Road Ste 199 Galloway, New Jersey 08205 Fax: (609) 939-0301

Вам также может понравиться

- CH 14Документ71 страницаCH 14Febriana Nurul HidayahОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Counter AffidavitДокумент23 страницыCounter AffidavitDivya SinghОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- All Products Payout Structure Dec'23 13Документ8 страницAll Products Payout Structure Dec'23 13Albert PeterОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Presentation ON Internship at Nabil Bank: Chhitiz Shrestha Bba-Bi 7 Semester Ace Institute of ManagementДокумент26 страницPresentation ON Internship at Nabil Bank: Chhitiz Shrestha Bba-Bi 7 Semester Ace Institute of ManagementChhitiz ShresthaОценок пока нет

- 20220606125603-Banking Sector - Q1-22 enДокумент9 страниц20220606125603-Banking Sector - Q1-22 enHadeel NoorОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Commercial Banks: Investopedia)Документ3 страницыCommercial Banks: Investopedia)Minmin WaganОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Unit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovДокумент5 страницUnit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovMarcusОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Anama, Mary Grace-ComboДокумент7 страницAnama, Mary Grace-ComboFrederick SimbolОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Pay in SlipДокумент2 страницыPay in SlipRahul ManwatkarОценок пока нет

- Nego Reviewer FinalДокумент159 страницNego Reviewer FinalI.G. Mingo MulaОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- BofA - LLC Corporate ResolutionsДокумент2 страницыBofA - LLC Corporate ResolutionsDebra Anderson67% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Raju Chinthapatla: Oracle Applications 11i Order To Cash (O2C) Implementation StepsДокумент12 страницRaju Chinthapatla: Oracle Applications 11i Order To Cash (O2C) Implementation Stepssuj pОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Study On Online Payment ApplicationsДокумент38 страницStudy On Online Payment ApplicationsPrathamesh DafaleОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Govan Mbeki Municipality: General Valuation Roll (Sectional Title)Документ72 страницыGovan Mbeki Municipality: General Valuation Roll (Sectional Title)WikusОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Deposit SlipДокумент1 страницаDeposit SlipSrinivasreddy ChallaОценок пока нет

- Problems Ledger Account 1 5 UnsolvedДокумент11 страницProblems Ledger Account 1 5 UnsolvedNeeraj Gugle0% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Citigroup CB Internship ProgramДокумент1 страницаCitigroup CB Internship ProgramSandra DeeОценок пока нет

- BOP Credit Card Sales Training Tool Kit (7 Files Merged)Документ115 страницBOP Credit Card Sales Training Tool Kit (7 Files Merged)Shivam KumarОценок пока нет

- SWIFT Formats For Money TransfersДокумент3 страницыSWIFT Formats For Money TransfersBhairab Pd. PandeyОценок пока нет

- Axxess DSL (Pty) LTD ProFormaInvoiceДокумент1 страницаAxxess DSL (Pty) LTD ProFormaInvoiceThreshing Flow100% (1)

- ' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPДокумент2 страницы' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPvinothmcakmdОценок пока нет

- SBB 29 02Документ5 страницSBB 29 02Afework AtnafsegedОценок пока нет

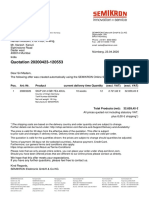

- Quotation 20200423-120553: Pos. Art.-Nr. Product Current Delivery Time Quantity Unit Price (Excl. VAT) Total (Excl. VAT)Документ1 страницаQuotation 20200423-120553: Pos. Art.-Nr. Product Current Delivery Time Quantity Unit Price (Excl. VAT) Total (Excl. VAT)kanrinareshОценок пока нет

- Ready For Growth Well Provisioned To Manage Asset Quality RiskДокумент11 страницReady For Growth Well Provisioned To Manage Asset Quality RiskMazid KhanОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Ufce FormatДокумент2 страницыUfce FormatPankaj GuptaОценок пока нет

- Kurikulum S1 Finance & Banking Peminatan BankingДокумент6 страницKurikulum S1 Finance & Banking Peminatan BankingIka Yunsita PratiwiОценок пока нет

- Regal Cars Has Been Manufacturing Exotic Automobiles For More ThanДокумент1 страницаRegal Cars Has Been Manufacturing Exotic Automobiles For More ThanTaimour HassanОценок пока нет

- EssayДокумент2 страницыEssayDevil faОценок пока нет

- Exercises (Time Value Money) 2022Документ2 страницыExercises (Time Value Money) 2022wstОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Project Report OnДокумент86 страницA Project Report OnDevangi PatelОценок пока нет