Академический Документы

Профессиональный Документы

Культура Документы

CH 10

Загружено:

sumihosaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH 10

Загружено:

sumihosaАвторское право:

Доступные форматы

The Valuation of Common Stocks

Chapter 10 Charles P. Jones, Investments: Analysis and Management, Tenth Edition, John Wiley & Sons Prepared by G.D. Koppenhaver, Iowa State University

10-1

Fundamental Analysis

Present value approach

Capitalization of expected income Intrinsic value based on the discounted value of the expected stream of cash flows

Valuation relative to a financial performance measure Justified P/E ratio

Multiple of earnings approach

10-2

Present Value Approach

Intrinsic value of a security is

Value of security

n Cash

Flows

t 1

( 1 k)t

Estimated intrinsic value compared to the current market price

What if market price is different than estimated intrinsic value?

10-3

Required Inputs

Discount rate

Required rate of return: minimum expected rate to induce purchase The opportunity cost of dollars used for investment

Stream of dividends or other cash payouts over the life of the investment

Expected cash flows

10-4

Required Inputs

Expected cash flows

Dividends paid out of earnings

Earnings important in valuing stocks

Retained earnings enhance future earnings and ultimately dividends

Retained earnings imply growth and future dividends Produces similar results as current dividends in valuation of common shares

10-5

Dividend Discount Model

Current value of a share of stock is the discounted value of all future dividends

Pcs

D1 ( 1 kcs )

1

D2 ( 1 kcs )

t 1 2

...

D ( 1 kcs )

Dt ( 1 kcs )

t

10-6

Dividend Discount Model

Problems:

Need infinite stream of dividends Dividend stream is uncertain

Must estimate future dividends

Dividends may be expected to grow over time

Must model expected growth rate of dividends and need not be constant

10-7

Dividend Discount Model

Assume no growth in dividends

Fixed dollar amount of dividends reduces the security to a perpetuity

D0 P0 kcs

Similar to preferred stock because dividend remains unchanged

10-8

Dividend Discount Model

Assume a constant growth in dividends

Dividends expected to grow at a constant rate, g, over time

D1 is the expected dividend at end of the first period D1 =D0 (1+g)

D1 P0 k g

10-9

Dividend Discount Model

Implications of constant growth

Stock prices grow at the same rate as the dividends Stock total returns grow at the required rate of return

Growth rate in price plus growth rate in dividends equals k, the required rate of return

A lower required return or a higher expected growth in dividends raises prices

10-10

Dividend Discount Model

Multiple growth rates: two or more expected growth rates in dividends

Ultimately, growth rate must equal that of the economy as a whole Assume growth at a rapid rate for n periods followed by steady growth

n

P0

D0( 1 g1 ) ( 1 k)

t

t 1

Dn( 1 gc ) 1 n k-g ( 1 k)

10-11

Dividend Discount Model

Multiple growth rates

First present value covers the period of super-normal (or sub-normal) growth Second present value covers the period of stable growth

Expected price uses constant-growth model as of the end of super- (sub-) normal period Value at n must be discounted to time period zero

10-12

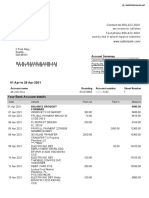

Example: Valuing equity with growth of 30% for 3 years, then a long-run constant growth of 6%

k=16%

1

5.20

2

g = 30%

3

g = 6%

4

9.315

g = 30% g = 30%

D0 = 4.00 4.48 5.02 5.63 59.68 74.81 = P0

6.76

8.788

P3 = 9.315 .10

What About Capital Gains?

Is the dividend discount model only capable of handling dividends?

Capital gains are also important

Price received in future reflects expectations of dividends from that point forward

Discounting dividends or a combination of dividends and price produces same results

10-14

Other Discounted Cash Flows

Free Cash Flow to Equity (FCFE): What could shareholders be paid?

FCFE = Net Inc. + Depreciation Change in Noncash Working Capital Capital Expend. Debt Repayments + Debt Issuance

Free Cash Flow to the Firm (FCFF): What cash is available before any financing considerations?

FCFF = EBIT (1-tax rate) + Depreciation Change in Noncash Working Capital Capital Expend.

Use per share measures instead of dividends

10-15

Intrinsic Value

Fair value based on the capitalization of income process

The objective of fundamental analysis

If intrinsic value >(<) current market price, hold or purchase (avoid or sell) because the asset is undervalued (overvalued)

Decision will always involve estimates

10-16

P/E Ratio or Earnings Multiplier Approach

Alternative approach often used by security analysts P/E ratio is the strength with which investors value earnings as expressed in stock price

Divide the current market price of the stock by the latest 12-month earnings Price paid for each $1 of earnings

10-17

P/E Ratio Approach

To estimate share value

Po estimated earnings

P/E ratio can be derived from

justified P/E rati o E1 Po /E1

D1 D1/E1 Po or Po /E1 k-g k-g

Indicates the factors that affect the estimated P/E ratio

10-18

P/E Ratio Approach

The higher the payout ratio, the higher the justified P/E

Payout ratio is the proportion of earnings that are paid out as dividends

The higher the expected growth rate, g, the higher the justified P/E The higher the required rate of return, k, the lower the justified P/E

10-19

Understanding the P/E Ratio

Can firms increase payout ratio to increase market price?

Will future growth prospects be affected?

Does rapid growth affect the riskiness of earnings?

Will the required return be affected? Are some growth factors more desirable than others?

P/E ratios reflect expected growth and risk

10-20

P/E Ratios and Interest Rates

A P/E ratio reflects investor optimism and pessimism

Related to the required rate of return

As interest rates increase, required rates of return on all securities generally increase P/E ratios and interest rates are indirectly related

10-21

Which Approach Is Best?

Best estimate is probably the present value of the (estimated) dividends

Can future dividends be estimated with accuracy? Investors like to focus on capital gains not dividends

P/E multiplier remains popular for its ease in use and the objections to the dividend discount model

10-22

Which Approach Is Best?

Complementary approaches?

P/E ratio can be derived from the constantgrowth version of the dividend discount model Dividends are paid out of earnings Using both increases the likelihood of obtaining reasonable results

Dealing with uncertain future is always subject to error

10-23

Other Multiples

Price-to-book value ratio

Ratio of share price to stockholder equity as measured on the balance sheet Price paid for each $1 of equity

Ratio of a companys total market value (price times number of shares) divided by sales Market valuation of a firms revenues

10-24

Price-to-sales ratio

Copyright 2006 John Wiley & Sons, Inc. All rights reserved. Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United states Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information contained herein.

10-25

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Sutton Bank StatementДокумент2 страницыSutton Bank StatementNadiia AvetisianОценок пока нет

- CH 20Документ22 страницыCH 20sumihosaОценок пока нет

- CH 16Документ20 страницCH 16sumihosaОценок пока нет

- CH 21Документ20 страницCH 21sumihosaОценок пока нет

- CH 22Документ19 страницCH 22sumihosaОценок пока нет

- CH 19Документ23 страницыCH 19sumihosaОценок пока нет

- CH 15Документ24 страницыCH 15sumihosaОценок пока нет

- CH 12Документ23 страницыCH 12sumihosaОценок пока нет

- CH 14Документ20 страницCH 14sumihosaОценок пока нет

- Selecting and Optimal PortfolioДокумент16 страницSelecting and Optimal PortfoliosumihosaОценок пока нет

- CH 09Документ29 страницCH 09sumihosaОценок пока нет

- What To Know About Trading SecuritiesДокумент16 страницWhat To Know About Trading SecuritiessumihosaОценок пока нет

- What To Know About Trading SecuritiesДокумент16 страницWhat To Know About Trading SecuritiessumihosaОценок пока нет

- Diversification and Portfolio TheoryДокумент20 страницDiversification and Portfolio TheorysumihosaОценок пока нет

- Financial Assets Available To InvestorsДокумент22 страницыFinancial Assets Available To InvestorssumihosaОценок пока нет

- Investing in Mutual Funds and EtfsДокумент16 страницInvesting in Mutual Funds and EtfssumihosaОценок пока нет

- Investing in Mutual Funds and EtfsДокумент16 страницInvesting in Mutual Funds and EtfssumihosaОценок пока нет

- Financial Assets Available To InvestorsДокумент22 страницыFinancial Assets Available To InvestorssumihosaОценок пока нет

- Artifact5 Position PaperДокумент2 страницыArtifact5 Position Paperapi-377169218Оценок пока нет

- A Real Driver of US CHINA Trade ConflictДокумент8 страницA Real Driver of US CHINA Trade ConflictSabbir Hasan EmonОценок пока нет

- The Economist-Why Indonesia MattersДокумент3 страницыThe Economist-Why Indonesia Mattersdimas hasantriОценок пока нет

- What Are The Difference Between Governme PDFДокумент2 страницыWhat Are The Difference Between Governme PDFIndira IndiraОценок пока нет

- Infosys Case StudyДокумент2 страницыInfosys Case StudySumit Chopra100% (1)

- "Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselДокумент101 страница"Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselRasel89% (9)

- Algorithmic Market Making StrategiesДокумент34 страницыAlgorithmic Market Making Strategiessahand100% (1)

- Bank Interview QuestionsДокумент8 страницBank Interview Questionsfyod100% (1)

- India Timber Supply and Demand 2010-2030Документ64 страницыIndia Timber Supply and Demand 2010-2030Divyansh Rodney100% (1)

- Case Study 3 NirmaДокумент9 страницCase Study 3 NirmaPravin DhobleОценок пока нет

- Howe India Company ProfileДокумент62 страницыHowe India Company ProfileowngauravОценок пока нет

- Oceanic Wireless Vs CirДокумент6 страницOceanic Wireless Vs CirnazhОценок пока нет

- 9 Ekonomi Kesehatan MateriДокумент51 страница9 Ekonomi Kesehatan MaterialyunusОценок пока нет

- Core Complexities Bharat SyntheticsДокумент4 страницыCore Complexities Bharat SyntheticsRohit SharmaОценок пока нет

- Econometrics Assignment Summary and TableДокумент4 страницыEconometrics Assignment Summary and TableG Murtaza DarsОценок пока нет

- A Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Документ98 страницA Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Md MubashirОценок пока нет

- HR PoliciesДокумент129 страницHR PoliciesAjeet ThounaojamОценок пока нет

- Advanced Rohn Building Your Network Marketing1Документ31 страницаAdvanced Rohn Building Your Network Marketing1sk8ermarga267% (6)

- Tanzania Mortgage Market Update 2014Документ7 страницTanzania Mortgage Market Update 2014Anonymous FnM14a0Оценок пока нет

- Project Profile ON Roasted Rice FlakesДокумент7 страницProject Profile ON Roasted Rice FlakesPrafulla ChandraОценок пока нет

- The Role of Philanthropy or The Social ResponsibilityДокумент8 страницThe Role of Philanthropy or The Social ResponsibilityShikha Trehan100% (1)

- Neelam ReportДокумент86 страницNeelam Reportrjjain07100% (2)

- Voyage Accounting ExampleДокумент4 страницыVoyage Accounting Exampledharmawan100% (1)

- Contingent Liabilities For Philippines, by Tarun DasДокумент62 страницыContingent Liabilities For Philippines, by Tarun DasProfessor Tarun DasОценок пока нет

- Aid For TradeДокумент6 страницAid For TradeRajasekhar AllamОценок пока нет

- 2023 - Forecast George FriedmanДокумент17 страниц2023 - Forecast George FriedmanGeorge BestОценок пока нет

- Rivalry in The Eastern Mediterranean: The Turkish DimensionДокумент6 страницRivalry in The Eastern Mediterranean: The Turkish DimensionGerman Marshall Fund of the United StatesОценок пока нет

- Court of Tax Appeals First Division: Republic of The Philippines Quezon CityДокумент2 страницыCourt of Tax Appeals First Division: Republic of The Philippines Quezon CityPaulОценок пока нет

- MphasisДокумент2 страницыMphasisMohamed IbrahimОценок пока нет