Академический Документы

Профессиональный Документы

Культура Документы

Final PPT With Changes

Загружено:

VALLIAPPAN.PИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Final PPT With Changes

Загружено:

VALLIAPPAN.PАвторское право:

Доступные форматы

Analysis of Profit and Loss Account & Balance Sheet from Equity Research Point of View

Presentation by CA V Kandaswamy Partner J. Singh & Associates Chartered Accountants

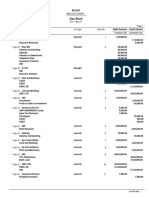

Profit & Loss Account

Key Issues

Sales Other Income Operating Margin (%) PAT before Exceptional Items EPS and PE ratios

Profit & Loss Account

Sales Variance Analysis Volume Price Mix

Profit & Loss Account

Other Income

Find sustainable other income Identify non recurring items

Profit & Loss Account

Operating Margins (%)

Due to increase in sales Due to reduction in costs Rise in prices Enrichment of Product Mix

Profit & Loss Account

PAT before Exceptional Items

Forex Impact Exceptional Items Tax Incidence Growth

Profit & Loss Account

EPS and PE ratios EPS should be based on normalised income Profits grow but EPS fall EPS grow despite fall in profits Sustainable growth in EPS can help PE to grow Winning Combination is a growth in EPS and PE ratio

EPS 12.0 14.4 18.7 26.2 39.3 327.6

Multiplier E ffec t E P S G rowth (% ) P E P E G rowth (% ) 4.0 25% 20% 5.0 20% 30% 6.0 17% 40% 7.0 14% 50% 8.0 200.0 G rowth % for the period

Market P rice 48.00 72.00 112.32 183.46 314.50 655.20

EPS 12.0 14.4 18.7 26.2 39.3 327.6

Multiplier E ffec t PE G rowth (% ) Market P rice E P S G rowth (% ) PE 4.0 48.00 20% 20% 4.8 69.12 30% 30% 6.2 116.81 40% 40% 8.7 228.95 50% 50% 13.1 515.14 327.6 1073.22 G rowth % for the period

Balance Sheet

Debt Equity Ratio Book Value Stock Turnover ratio Debtors Turnover ratio Trends in stocks and debtors

Balance Sheet

Debt Equity Ratio: Equity Share holders funds Equity Share Capital Preference Share Capital Reserves and Surplus Capital Reserves Revenue Reserves Revaluation Reserves Negative Reserves Networth excluding revaluation reserves

Balance Sheet

Debt Equity Ratio: Debt Long Term Debt Rupee loans Foreign Currency loans Quasi equity Short Term Debt Cash credit/over draft Long term debt Repayment due in 12 months Others

Balance Sheet

Book Value

No. of equity shares outstanding Average, Weighted Average, or year end equity? Networth excluding revaluation reserves Exclude preference capital if it is included in Networth Potential dilution of equity

ESOPS Convertible portion of quasi equity/debt Convertible Warrants

Balance Sheet

Turnover Ratios

Stock Turnover Ratio Debtors Turnover Ratio Trends in Stocks and Debtors

**They can be land mine that can topple equity appreciation, if not understood/analysed properly

Ratios

Liquidity Ratios Leverage Ratios Coverage Ratios Activity Ratios Profitability Ratios

Liquidity Ratios are based on only balance Sheet items

Current Ratio = Current Assets / Current Liabilities Quick / Acid Test Ratio = (Current Assets - Inventories)/Current Liabilities Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

Interval Measure = 365* (Current Assets - Inventories) /(COGS + SGA excluding depn)

Net Working Capital Ratio = Net Working Capital / Net Assets

Leverage Ratios are based on only balance sheet items

Debt Ratio = Total Debt /(Total Debt + Net worth) Debt Equity Ratio = Total Debt / Net worth

Capital Employed to Net Worth Ratio = Capital Employed / Net Worth

Capital Employed to Net Worth = 1 + Debt Equity Ratio Capital Employed = Net Assets = Net Worth + Total Debts

Coverage ratios involve items in Profit and loss account as well as Balance Sheet Debt Service Coverage Ratio = (Net profit + interest + lease rent + non cash expenses) / Instalments due + Lease Rentals

**Instalments due include principal and interest due for the period

Interest Coverage = Earnings before interest tax, depreciation and amortisation / Interest

Activity Ratios involve items in profit and loss as well as Balance Sheet

Inventory Turnover Ratio = Cost of goods sold / Average Inventory (or) Sales / Inventory

Days of Inventory holdings = 365 * inventory / sales

Debtors turnover ratio = Credit sales / average debtors (or) Sales / Debtors Average collection period = 365* Debtors / Sales

Assets Turnover ratio involve items in profit and loss as well as Balance Sheet

Net Assets Turnover Ratio = Sales / Net Assets Total Assets Turnover Ratio = Sales / Total Assets Fixed Assets Turnover ratio = Sales / Net Fixed Assets Current Assets Turnover Ratio = Sales / Current Assets

Working Capital Turnover Ratio = Sales / Net Current Assets

***Sales will be the Numerator in all turnover ratios

Profitability ratio generally involve only Profit and Loss account items

Gross Profit Margin = (Sales - Cost of Goods Sold ) / Sales Net Profit Margin = Profit after Tax / Sales Operating expenses ratio = Operating expenses / Sales Operating expenses = cost of goods sold + SGA

Return ratios involve both Profit and Loss account and Balance Sheet items

Return on Investment = Earnings before interest and tax / Total Assets Return on Investment = Earnings before interest and tax / Total Assets Return on capital employed = Earnings before interest and tax / Net Assets or Capital employed Return on Equity = Profit after tax / Net worth

Ratios of interest to investors and capital markets

Earnings per share = (Profit after tax - preference dividend) / No. of Equity Shares o/s Price - Earnings Ratio = Market Value Per Share / Earnings Per Share (or) Market Capitalisation / Net profit after preference dividend Dividend Per Share = Dividend to equity holders / No. of equity shares outstanding Dividend Pay out ratio = Equity dividend / Profit after tax

Dividend Yield = Dividend Per share / Market Value per share

Net worth = Equity Capital + Total Reserves and Surplus Exclude revaluation reserves in reserves and surplus Also reduce miscellaneous expenses not written off, if any Debit balance of Profit and loss account if negative reserve Book Value = Net Worth / No. of Equity Shares Market value to Book Value = Market Value per share / Book Value per share

Return On Capital Employed Operating Margin % = 100*((PBIDT - Other Income)/ Net Sales) Profit Margin = EBIT / Net Sales

Asset Turnover = Net Sales / Net Assets

Return on Net Assets (or) Return on Capital Employed = Profit Margin * Asset Turnover

Return on Net Assets= EBIT / Net Assets

Return On Net Worth

Leverage can accrue from income side as well as balance sheet side

Income side leverage = PAT / EBIT

Balance Sheet side leverage = Net assets / Net Worth

Financial leverage (or) Return on Capital Employed = Income side leverage * Balance Sheet side leverage = (PAT / EBIT) * (Net Assets / Net Worth)

Return on Net Worth = ROCE * Financial Leverage = (EBIT / Net Assets) * (PAT / EBIT) * (Net Assets / Networth) = PAT / Net Worth

P&L, Balance sheet and Ratios in real time analytics

Conclusion

There is no fool proof method to find multi baggers Understand the business, and USP of the company Value accretion can be sustainable only if growth is predictable Even one or two quarters of sub optimal performance can erode value Other things being constant, market will reward consistent performers

Thank You

Вам также может понравиться

- SBI ReasoningДокумент112 страницSBI ReasoningVALLIAPPAN.PОценок пока нет

- Multibagger Stock Ideas PDFДокумент16 страницMultibagger Stock Ideas PDFVALLIAPPAN.PОценок пока нет

- Inside Job - Movie Review (The Story of Global Recession 2008) PDFДокумент21 страницаInside Job - Movie Review (The Story of Global Recession 2008) PDFVALLIAPPAN.P100% (2)

- Iim A Case Studies Just A Click AwayДокумент3 страницыIim A Case Studies Just A Click AwayVALLIAPPAN.PОценок пока нет

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsДокумент15 страницDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PОценок пока нет

- Guidelines For Students Applying New PassportДокумент14 страницGuidelines For Students Applying New PassportVALLIAPPAN.P100% (2)

- IIMCorporate BrochurefinalДокумент60 страницIIMCorporate BrochurefinalVALLIAPPAN.PОценок пока нет

- Common MITC Sep10Документ6 страницCommon MITC Sep10VALLIAPPAN.PОценок пока нет

- Project Report On "Student & Alumni Management Information System in NIT - Warangal"Документ26 страницProject Report On "Student & Alumni Management Information System in NIT - Warangal"VALLIAPPAN.PОценок пока нет

- Beta Times Markets Edition11Документ4 страницыBeta Times Markets Edition11VALLIAPPAN.PОценок пока нет

- 5 Abstract UniversityДокумент1 страница5 Abstract UniversityVALLIAPPAN.PОценок пока нет

- Sulabh Case Studies IimДокумент21 страницаSulabh Case Studies IimAnand RajОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- SupermarketsДокумент20 страницSupermarketsVikram Sean RoseОценок пока нет

- Globalization Becomes Truly Global: Lessons Learned at LenovoДокумент9 страницGlobalization Becomes Truly Global: Lessons Learned at LenovormvffrankenbergОценок пока нет

- Pt. Shantui Indonesia: InvoiceДокумент5 страницPt. Shantui Indonesia: InvoiceTOBI RIANTOОценок пока нет

- Insurance Law Review 2015Документ43 страницыInsurance Law Review 2015peanut47Оценок пока нет

- About ATA CarnetДокумент4 страницыAbout ATA CarnetRohan NakasheОценок пока нет

- International Macroeconomics 3rd Edition by Feenstra Taylor Solution ManualДокумент6 страницInternational Macroeconomics 3rd Edition by Feenstra Taylor Solution Manualjuviles50% (2)

- Information Governance Analysis and StrategyДокумент44 страницыInformation Governance Analysis and StrategyJem MadriagaОценок пока нет

- United States Court of Appeals Second Circuit.: Nos. 256-258. Docket 27146-27148Документ16 страницUnited States Court of Appeals Second Circuit.: Nos. 256-258. Docket 27146-27148Scribd Government DocsОценок пока нет

- Cayetano vs. Monsod - G.R. No. 100113 September 3, 1991Документ21 страницаCayetano vs. Monsod - G.R. No. 100113 September 3, 1991Cyna Marie A. Franco100% (2)

- Workmen's Compensation Act 1923 (HR)Документ18 страницWorkmen's Compensation Act 1923 (HR)Rahul AcharyaОценок пока нет

- Lirag Vs SssДокумент2 страницыLirag Vs Sssyesubride100% (1)

- Neuromarketing and The Perception of Knowledge by Michael Butler PDFДокумент5 страницNeuromarketing and The Perception of Knowledge by Michael Butler PDFcarmldonadoaОценок пока нет

- G.O. 361-I&prДокумент3 страницыG.O. 361-I&prBalu Mahendra SusarlaОценок пока нет

- Advertisment and MediaДокумент21 страницаAdvertisment and MediaMohit YadavОценок пока нет

- Withholding Tax in MalaysiaДокумент4 страницыWithholding Tax in MalaysiaYana Zakaria100% (1)

- Jigs and Fixture Sem III FinalДокумент127 страницJigs and Fixture Sem III Finalnikhil sidОценок пока нет

- Blue Ribbon NovemberДокумент32 страницыBlue Ribbon NovemberDavid PenticuffОценок пока нет

- Responsibilities ChitfundsДокумент11 страницResponsibilities ChitfundsRanjith ARОценок пока нет

- The Effect of Management TrainingДокумент30 страницThe Effect of Management TrainingPulak09100% (1)

- Chapter 8/competitive Firms and MarketsДокумент19 страницChapter 8/competitive Firms and Marketsi.abdellah100% (1)

- Lady M Confections case discussion questions and valuation analysisДокумент11 страницLady M Confections case discussion questions and valuation analysisRahul Sinha40% (10)

- Business LetterДокумент6 страницBusiness LetterGlory Mae OraaОценок пока нет

- Day Book 2Документ2 страницыDay Book 2The ShiningОценок пока нет

- Archon Umipig Resume 2018 CVДокумент7 страницArchon Umipig Resume 2018 CVMaria Archon Dela Cruz UmipigОценок пока нет

- Andersen violated auditing standards in Enron auditДокумент2 страницыAndersen violated auditing standards in Enron auditJanelAlajasLeeОценок пока нет

- Organization & EthicsДокумент11 страницOrganization & EthicsAvijeet ChowdhuryОценок пока нет

- Bicolandia Drug Vs CirДокумент6 страницBicolandia Drug Vs CiritatchiОценок пока нет

- PR and The Party - The Truth About Media Relations in ChinaДокумент11 страницPR and The Party - The Truth About Media Relations in ChinaMSLОценок пока нет

- Quotation For Security Guards and Housekeeping Lpersons-340270102Документ11 страницQuotation For Security Guards and Housekeeping Lpersons-340270102ajaysharma.npcilОценок пока нет

- Newspapers Are Transforming Not Disappearing: iMAT Conference 2006Документ1 страницаNewspapers Are Transforming Not Disappearing: iMAT Conference 2006Justin ReedОценок пока нет