Академический Документы

Профессиональный Документы

Культура Документы

Costs Terms, Concepts and Classifications: Chapter Two

Загружено:

William Masterson ShahИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Costs Terms, Concepts and Classifications: Chapter Two

Загружено:

William Masterson ShahАвторское право:

Доступные форматы

Costs Terms, Concepts and Classifications

Chapter Two

2-2

Learning Objective

Identify and give examples of each of the three basic manufacturing cost categories.

2-3

Classification of COST

Manufacturing Cost

1. Direct Labor 2. Direct Material 3. Mfg. OH

Non Manufacturing Cost

Selling Administrative

2-4

Cost Classification according to Purpose

Financial Statement

Product Cost Period Cost Variable Cost Fixed Cost Direct Cost Indirect Cost Differential Cost Sunk Cost Opportunity Cost

Predicting Cost Behavior

Assigning Cost to cost object

Making Decision

2-5

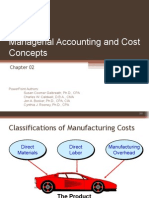

Manufacturing Costs

Direct Materials

Direct Labor

Manufacturing Overhead

The Product

2-6

Direct Materials

Raw materials that become an integral part of the product and that can be conveniently traced directly to it.

Example: Engine installed in an automobile

2-7

Direct Labor

Those labor costs that can be easily traced to individual units of product.

Example: Wages paid to automobile assembly workers

2-8

Manufacturing Overhead

Manufacturing costs that cannot be traced directly to specific units produced.

Examples: Indirect labor and indirect materials

Wages paid to employees who are not directly involved in production work.

Examples: maintenance workers, janitors and security guards.

Materials used to support the production process.

Examples: lubricants and cleaning supplies used in the automobile assembly plant.

2-9

Classifications of Costs

Manufacturing costs are often classified as follows:

Direct Material Direct Labor Manufacturing Overhead

Prime Cost

Conversion Cost

2-10

Comparing Merchandising and Manufacturing Activities

Manufacturers . . .

Buy raw materials. Produce and sell finished goods. Buy finished goods. Sell finished goods.

Merchandisers . . .

MegaLoMart

2-11

Balance Sheet Merchandiser

Current assets

Cash Receivables Prepaid Expenses Merchandise

Manufacturer

Current Assets

Cash

Receivables Prepaid Expenses Inventories Raw Materials Work in Process Finished Goods

Inventory

2-12

Balance Sheet Merchandiser

Current assets

Cash Receivables Prepaid Expenses

Manufacturer

Current Assets

Cash

Receivables Materials waiting to be processed. Prepaid Expenses Inventories Raw Materials Work in Process Finished Goods

Partially complete Merchandise products Inventory some material, labor, or overhead has been added.

Completed products awaiting sale.

2-13

Non-manufacturing Costs

Selling Costs

Administrative Costs

Costs necessary to get the order and deliver the product.

All executive, organizational, and clerical costs.

2-14

Learning Objective

Distinguish between product costs and period costs and give examples of each.

2-15

Product Costs Versus Period Costs

Product costs include direct materials, direct labor, and manufacturing overhead.

Inventory Sale

Cost of Good Sold

Period costs include all selling costs and administrative costs.

Expense

Balance Sheet

Income Statement

Income Statement

2-16

Quick Check

Which of the following costs would be considered a period rather than a product cost in a manufacturing company? A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. D. Electrical costs to light the production facility. E. Sales commissions.

2-17

Quick Check

Which of the following costs would be considered a period rather than a product cost in a manufacturing company? A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. D. Electrical costs to light the production facility. E. Sales commissions.

2-18

Learning Objective

Understand the differences between variable costs and fixed costs.

2-19

Cost Classifications for Predicting Cost Behavior

How a cost will react to changes in the level of activity within the relevant range.

Total variable costs change when activity changes. Total fixed costs remain unchanged when activity changes.

2-20

Variable Cost

Your total long distance telephone bill is based on how many minutes you talk.

Total Long Distance Telephone Bill Minutes Talked

2-21

Variable Cost Per Unit

The cost per long distance minute talked is constant. For example, 10 cents per minute.

Per Minute Telephone Charge Minutes Talked

2-22

Fixed Cost

Your monthly basic telephone bill probably does not change when you make more local calls.

Monthly Basic Telephone Bill Number of Local Calls

2-23

Fixed Cost Per Unit

The average fixed cost per local call decreases as more local calls are made.

Monthly Basic Telephone Bill per Local Call

Number of Local Calls

2-24

Cost Classifications for Predicting Cost Behavior

Behavior of Cost (within the relevant range)

Cost Variable In Total Total variable cost changes as activity level changes. Total fixed cost remains the same even when the activity level changes. Per Unit Variable cost per unit remains the same over wide ranges of activity. Average fixed cost per unit goes down as activity level goes up.

Fixed

2-25

Learning Objective

Understand the differences between direct and indirect costs.

2-26

Assigning Costs to Cost Objects

Direct costs

Costs that can be easily and conveniently traced to a unit of product or other cost object. Examples: direct material and direct labor

Indirect costs

Costs that cannot be easily and conveniently traced to a unit of product or other cost object. Example: manufacturing overhead

2-27

Learning Objective

Define and give examples of cost classifications used in making decisions: differential costs, opportunity costs, and sunk costs.

2-28

Differential Cost and Revenue

Costs and revenues that differ among alternatives.

Example: You have a job paying $1,500 per month in your hometown. You have a job offer in a neighboring city that pays $2,000 per month. The commuting cost to the city is $300 per month.

Differential revenue is: $2,000 $1,500 = $500 Differential cost is: $300

2-29

Opportunity Cost

The potential benefit that is given up when one alternative is selected over another.

Example: If you were not attending college, you could be earning $15,000 per year. Your opportunity cost of attending college for one year is $15,000.

2-30

Sunk Costs

Sunk costs have already been incurred and cannot be changed now or in the future. They should be ignored when making decisions.

Example: i) Cost of getting license of a business. iii) Suppose you bought a technology by $ 20,000 which is obsolete now.

2-31

Quick Check

Suppose you are trying to decide whether to drive or take the train to Portland to attend a concert. You have ample cash to do either, but you dont want to waste money needlessly. Is the cost of the train ticket relevant in this decision? In other words, should the cost of the train ticket affect the decision of whether you drive or take the train to Portland? A. Yes, the cost of the train ticket is relevant. B. No, the cost of the train ticket is not relevant.

2-32

Quick Check

Suppose you are trying to decide whether to drive or take the train to Portland to attend a concert. You have ample cash to do either, but you dont want to waste money needlessly. Is the cost of the train ticket relevant in this decision? In other words, should the cost of the train ticket affect the decision of whether you drive or take the train to Portland? A. Yes, the cost of the train ticket is relevant. B. No, the cost of the train ticket is not relevant.

2-33

Quick Check

Suppose you are trying to decide whether to drive or take the train to Portland to attend a concert. You have ample cash to do either, but you dont want to waste money needlessly. Is the annual cost of licensing your car relevant in this decision? A. Yes, the licensing cost is relevant. B. No, the licensing cost is not relevant.

2-34

Quick Check

Suppose you are trying to decide whether to drive or take the train to Portland to attend a concert. You have ample cash to do either, but you dont want to waste money needlessly. Is the annual cost of licensing your car relevant in this decision? A. Yes, the licensing cost is relevant. B. No, the licensing cost is not relevant.

Further Classification of Labor Costs

Appendix 2A

2-36

Learning Objective

(Appendix 2A)

Properly account for labor costs associated with idle time, overtime, and fringe benefits.

2-37

Idle Time

Machine Breakdowns Power Failures Material Shortages

The labor costs incurred during idle time are ordinarily treated as manufacturing overhead.

2-38

Overtime

The overtime premiums for all factory workers are usually considered to be part of manufacturing overhead.

2-39

Labor Fringe Benefits Fringe benefits include employer paid costs for insurance programs, retirement plans, supplemental unemployment programs, Social Security, Medicare, workers compensation and unemployment taxes.

Some companies include all of these costs in manufacturing overhead. Other companies treat fringe benefit expenses of direct laborers as additional direct labor costs.

2-40

THANK YOU ALL

Вам также может понравиться

- Landman Training ManualДокумент34 страницыLandman Training Manualflashanon100% (2)

- CH - 02 - Cost Terms, Concepts and Classifications With Mixed Cost AnalysisДокумент84 страницыCH - 02 - Cost Terms, Concepts and Classifications With Mixed Cost AnalysisankonmahmudОценок пока нет

- Chapter 2 Management Accounting Hansen Mowen PDFДокумент28 страницChapter 2 Management Accounting Hansen Mowen PDFidka100% (1)

- 2-Doctrine of Arbitrariness and Legislative Action-A Misconceived ApplicationДокумент14 страниц2-Doctrine of Arbitrariness and Legislative Action-A Misconceived ApplicationShivendu PandeyОценок пока нет

- Chief Affidavit of Petitioner M.v.O.P.222 of 2013Документ4 страницыChief Affidavit of Petitioner M.v.O.P.222 of 2013Vemula Venkata PavankumarОценок пока нет

- Costs Terms, Concepts and Classifications: Chapter TwoДокумент40 страницCosts Terms, Concepts and Classifications: Chapter TwokorpseeОценок пока нет

- Cost Accounting Concepts ExplainedДокумент53 страницыCost Accounting Concepts ExplainedHassham YousufОценок пока нет

- Chap002 Cost TermsДокумент41 страницаChap002 Cost TermsNgái Ngủ100% (1)

- Chap 002 Garrision PresДокумент18 страницChap 002 Garrision Presee1993Оценок пока нет

- Basic Cost Management Concepts: Mcgraw-Hill/IrwinДокумент52 страницыBasic Cost Management Concepts: Mcgraw-Hill/IrwinDaMin ZhouОценок пока нет

- Chapter 1 ACOB3Документ5 страницChapter 1 ACOB3shirardadivisoОценок пока нет

- Cost Terms, Concepts, and ClassificationsДокумент33 страницыCost Terms, Concepts, and ClassificationsKlub Matematika SMAОценок пока нет

- Cost ConceptsДокумент43 страницыCost ConceptsProfessorAsim Kumar MishraОценок пока нет

- Chapter 2 Cost Concepts and Design EconomicsДокумент25 страницChapter 2 Cost Concepts and Design Economicsgar fieldОценок пока нет

- Lecture 03EEДокумент37 страницLecture 03EEMuhammad SalmanОценок пока нет

- Chapter Two ActivitiesДокумент27 страницChapter Two ActivitiesaishaОценок пока нет

- Fundamental Cost Concepts: (Part 1)Документ29 страницFundamental Cost Concepts: (Part 1)zahirahsaffriОценок пока нет

- Cost Concepts: Managerial AccountingДокумент72 страницыCost Concepts: Managerial AccountingCianne AlcantaraОценок пока нет

- Engineering - Economics 2020Документ18 страницEngineering - Economics 2020Arshad MahmoodОценок пока нет

- Topic 2Документ6 страницTopic 2Dave Jhaeson AlivioОценок пока нет

- Costacctg13 SM ch02Документ26 страницCostacctg13 SM ch02Yenny TorroОценок пока нет

- Product Costing SessionДокумент63 страницыProduct Costing SessionAnkitShettyОценок пока нет

- Solution Manual For Fundamentals of Cost Accounting 4Th Edition by Lanen Anderson Maher Isdn 0078025524 9780078025525 Full Chapter PDFДокумент36 страницSolution Manual For Fundamentals of Cost Accounting 4Th Edition by Lanen Anderson Maher Isdn 0078025524 9780078025525 Full Chapter PDFnancy.rodriguez985100% (12)

- Cost Terms, Concepts, and ClassificationsДокумент45 страницCost Terms, Concepts, and ClassificationsMountaha0% (1)

- Cost Management Concepts and Accounting for Mass Customization OperationsДокумент4 страницыCost Management Concepts and Accounting for Mass Customization OperationsNalynCasОценок пока нет

- Blocher - 9e - SM - Ch03-Final - StudentДокумент25 страницBlocher - 9e - SM - Ch03-Final - Studentadamagha703Оценок пока нет

- Basic Management Accounting ConceptsДокумент33 страницыBasic Management Accounting ConceptsNur Ravita HanunОценок пока нет

- Unit 2Документ34 страницыUnit 2Abdii DhufeeraОценок пока нет

- Ch02, MGMT Acct, HansenДокумент28 страницCh02, MGMT Acct, HansenIlham DoankОценок пока нет

- Hilton Chapter 2 Assigned Homework Exercises 10thДокумент9 страницHilton Chapter 2 Assigned Homework Exercises 10thWynona Gaile PagdonsolanОценок пока нет

- An Introduction To Cost Terms and Purposes 2-1Документ33 страницыAn Introduction To Cost Terms and Purposes 2-1Moayad TeimatОценок пока нет

- Lecture 3 - Chapter 2Документ21 страницаLecture 3 - Chapter 2Ali AlluwaimiОценок пока нет

- Assigmment of Managerial Accounting Sem 6thДокумент10 страницAssigmment of Managerial Accounting Sem 6thFarrukhAminRajputОценок пока нет

- Chapter 2 UpdatedДокумент58 страницChapter 2 Updatedbing bongОценок пока нет

- Eco BreakevenДокумент32 страницыEco Breakevenkhen026Оценок пока нет

- Engineering Cost Week4AДокумент34 страницыEngineering Cost Week4Aihsanullah91Оценок пока нет

- PDFenДокумент68 страницPDFenKawaii SevennОценок пока нет

- Cost Concepts and Engineering Economics ChapterДокумент55 страницCost Concepts and Engineering Economics Chapterimran_chaudhryОценок пока нет

- Prepared by Debby Bloom-Hill Cma, CFMДокумент55 страницPrepared by Debby Bloom-Hill Cma, CFMAlondra SerranoОценок пока нет

- CostДокумент11 страницCostBD EntertainmentОценок пока нет

- Cost Accounting: Direct, Variable, FixedДокумент7 страницCost Accounting: Direct, Variable, FixedMahnoor ChathaОценок пока нет

- Cost TermsДокумент98 страницCost TermsVinay GoyalОценок пока нет

- COST CLASSIFICATIONS & CONCEPTSДокумент23 страницыCOST CLASSIFICATIONS & CONCEPTSPrincess Jay NacorОценок пока нет

- Kinney 8e - CH 02Документ16 страницKinney 8e - CH 02Ashik Uz ZamanОценок пока нет

- Basic Management Accounting ConceptsДокумент28 страницBasic Management Accounting Conceptslita2703Оценок пока нет

- GE Hca15 PPT ch02Документ35 страницGE Hca15 PPT ch02kkОценок пока нет

- Notes On Cost AccountingДокумент86 страницNotes On Cost AccountingZeUs100% (2)

- Khanda Habeeb RaheemДокумент12 страницKhanda Habeeb RaheemHarith EmaadОценок пока нет

- Managerial Accounting Chap 001Документ40 страницManagerial Accounting Chap 001JennyRicaldeKonОценок пока нет

- GE301 Lecture 01Документ25 страницGE301 Lecture 01Nathan AsinasОценок пока нет

- CHAPTER 2 Question SolutionsДокумент3 страницыCHAPTER 2 Question Solutionscamd1290100% (1)

- L2 - Cost ClassificationДокумент50 страницL2 - Cost ClassificationDhawal RajОценок пока нет

- Understanding Direct, Indirect, Fixed and Variable CostsДокумент5 страницUnderstanding Direct, Indirect, Fixed and Variable CostsJoe DomarsОценок пока нет

- Full Download Test Bank For Connect With Smartbook Online Access For Managerial Accounting 11th Edition PDF Full ChapterДокумент36 страницFull Download Test Bank For Connect With Smartbook Online Access For Managerial Accounting 11th Edition PDF Full Chapterreaffirmkalendarl4ye8m100% (17)

- Cost AccountingДокумент28 страницCost Accountingrenjithrkn12Оценок пока нет

- Chapter 2-Cost ConceptДокумент54 страницыChapter 2-Cost ConceptCik MinnОценок пока нет

- CHAPTER 2 Cost Terms and PurposeДокумент31 страницаCHAPTER 2 Cost Terms and PurposeRose McMahonОценок пока нет

- CH-4 Chapter ManufДокумент14 страницCH-4 Chapter Manufጌታ እኮ ነውОценок пока нет

- CH 02Документ40 страницCH 02lyonanh289Оценок пока нет

- Blocher8e EOC SM Ch03 FinalДокумент27 страницBlocher8e EOC SM Ch03 FinalDiah ArmelizaОценок пока нет

- Managerial Accounting and Cost ConceptsДокумент44 страницыManagerial Accounting and Cost ConceptsQUANG NGUYỄN VINHОценок пока нет

- Psalms 117 in BengaliДокумент1 страницаPsalms 117 in BengaliWilliam Masterson ShahОценок пока нет

- Definitions Definitions Definitions: Financial Engineering Financial Engineering Financial EngineeringДокумент1 страницаDefinitions Definitions Definitions: Financial Engineering Financial Engineering Financial EngineeringWilliam Masterson ShahОценок пока нет

- Leadership Term PaperДокумент27 страницLeadership Term PaperWilliam Masterson ShahОценок пока нет

- Product and Service DesignДокумент40 страницProduct and Service DesignSapari VelОценок пока нет

- Sample of Social Media Marketing PresentationДокумент14 страницSample of Social Media Marketing PresentationWilliam Masterson ShahОценок пока нет

- CH 04Документ38 страницCH 04varunjajooОценок пока нет

- Human Resource Management CH12Документ46 страницHuman Resource Management CH12William Masterson ShahОценок пока нет

- Financial EngineeringДокумент11 страницFinancial EngineeringWilliam Masterson ShahОценок пока нет

- Drawing Near To GodДокумент5 страницDrawing Near To GodWilliam Masterson ShahОценок пока нет

- ERP SystemДокумент28 страницERP SystemWilliam Masterson ShahОценок пока нет

- 5 Nature of Stra MGT Ev 10 22 Oct 15Документ16 страниц5 Nature of Stra MGT Ev 10 22 Oct 15William Masterson ShahОценок пока нет

- Management Functions of Robi Axiata LimitedДокумент30 страницManagement Functions of Robi Axiata LimitedWilliam Masterson Shah0% (1)

- CH 04Документ38 страницCH 04varunjajooОценок пока нет

- BRM 3 - Ethical Issues in Business ResearchДокумент7 страницBRM 3 - Ethical Issues in Business ResearchWilliam Masterson ShahОценок пока нет

- Chapter 10 1Документ40 страницChapter 10 1William Masterson Shah0% (1)

- Principles of Managerial EconomicsДокумент155 страницPrinciples of Managerial EconomicsBL@CK DR@GON100% (1)

- Job Description Writing - A Step by Step GuideДокумент21 страницаJob Description Writing - A Step by Step GuideWilliam Masterson ShahОценок пока нет

- Chapter Eighteen: Consumer Loans, Credit Cards, and Real Estate LendingДокумент40 страницChapter Eighteen: Consumer Loans, Credit Cards, and Real Estate LendingWilliam Masterson ShahОценок пока нет

- Bangladesh Crisis ReportДокумент21 страницаBangladesh Crisis ReportWilliam Masterson ShahОценок пока нет

- Presesentation On State FarmДокумент27 страницPresesentation On State FarmWilliam Masterson ShahОценок пока нет

- Hse Lecture III (May 23, 2011) Basel I and Basel IIДокумент49 страницHse Lecture III (May 23, 2011) Basel I and Basel IIAsad MuhammadОценок пока нет

- Chapter 15Документ29 страницChapter 15William Masterson ShahОценок пока нет

- An Assignment On Agent Banking: Prepared ForДокумент1 страницаAn Assignment On Agent Banking: Prepared ForWilliam Masterson ShahОценок пока нет

- Chapter 11Документ50 страницChapter 11William Masterson ShahОценок пока нет

- Green Banking DetailsДокумент24 страницыGreen Banking DetailsWilliam Masterson ShahОценок пока нет

- 04 Software ArchitectureДокумент13 страниц04 Software ArchitectureWilliam Masterson ShahОценок пока нет

- Bitcoin Manifesto - Satoshi NakamotoДокумент9 страницBitcoin Manifesto - Satoshi NakamotoJessica Vu100% (1)

- Presesentation On State FarmДокумент27 страницPresesentation On State FarmWilliam Masterson ShahОценок пока нет

- Case of ICICI and Bank of Madura MergerДокумент6 страницCase of ICICI and Bank of Madura MergerWilliam Masterson Shah100% (3)

- Inquiring Mind WantДокумент5 страницInquiring Mind WantWilliam Masterson ShahОценок пока нет

- Thomas More EssayДокумент6 страницThomas More EssayJackОценок пока нет

- Will NEET PG 2023 Be Postponed Students ApproachДокумент1 страницаWill NEET PG 2023 Be Postponed Students ApproachBhat MujeebОценок пока нет

- FIT EdoraДокумент8 страницFIT EdoraKaung MyatToeОценок пока нет

- Sentencing Practice PDFДокумент14 страницSentencing Practice PDFamclansОценок пока нет

- Imam Al-Qurtubi's Tafsir of The Ayah: He Then Established Himself Over The Throne'Документ3 страницыImam Al-Qurtubi's Tafsir of The Ayah: He Then Established Himself Over The Throne'takwaniaОценок пока нет

- Cleaner/ Conditioner PurgelДокумент2 страницыCleaner/ Conditioner PurgelbehzadОценок пока нет

- Liabilities Are Classified Into Current and Non-Current.: SUBJECT Fundamental of AccountingДокумент12 страницLiabilities Are Classified Into Current and Non-Current.: SUBJECT Fundamental of Accounting1214 - MILLAN, CARLO, LОценок пока нет

- A Project Report ON Practice SchoolДокумент31 страницаA Project Report ON Practice SchoolSiddharth DevnaniОценок пока нет

- Guingona v. Gonzales G.R. No. 106971 March 1, 1993Документ1 страницаGuingona v. Gonzales G.R. No. 106971 March 1, 1993Bernadette SandovalОценок пока нет

- Rolex Watch U.S.A. v. Leland Stanford Hoffman Trademark ComplaintДокумент15 страницRolex Watch U.S.A. v. Leland Stanford Hoffman Trademark ComplaintKenan FarrellОценок пока нет

- Memorial moot court competitionДокумент29 страницMemorial moot court competitionAadarsh Vivek MitraОценок пока нет

- Latur District JUdge-1 - 37-2015Документ32 страницыLatur District JUdge-1 - 37-2015mahendra KambleОценок пока нет

- Psbank Auto Loan With Prime Rebate Application Form 2019Документ2 страницыPsbank Auto Loan With Prime Rebate Application Form 2019jim poblete0% (1)

- COMPLETING YOUR IRC FORM C TAX RETURNДокумент31 страницаCOMPLETING YOUR IRC FORM C TAX RETURNDanielОценок пока нет

- Memorandum of AgreementДокумент4 страницыMemorandum of AgreementCavite PrintingОценок пока нет

- No. 49 "Jehovah Will Treat His Loyal One in A Special Way"Документ5 страницNo. 49 "Jehovah Will Treat His Loyal One in A Special Way"api-517901424Оценок пока нет

- Childe Harolds Pilgrimage 432743Документ4 страницыChilde Harolds Pilgrimage 432743Parthiva SinhaОценок пока нет

- Mana Angel de Amor BassДокумент4 страницыMana Angel de Amor BassToreto SantanaОценок пока нет

- Sagar Kailas Salunke Primary Account Holder Name: Your A/C StatusДокумент3 страницыSagar Kailas Salunke Primary Account Holder Name: Your A/C Statussagar_salunkeОценок пока нет

- Titan MUX User Manual 1 5Документ158 страницTitan MUX User Manual 1 5ak1828Оценок пока нет

- 2011 Veterans' Hall of Fame Award RecipientsДокумент46 страниц2011 Veterans' Hall of Fame Award RecipientsNew York SenateОценок пока нет

- Mindanao Island 5.1 (PPT 1) Group 2Документ40 страницMindanao Island 5.1 (PPT 1) Group 2Aldrin Gabriel BahitОценок пока нет

- The Three Principles of The CovenantsДокумент3 страницыThe Three Principles of The CovenantsMarcos C. Thaler100% (1)

- Bridal ContractДокумент5 страницBridal ContractStacey MarieОценок пока нет

- Audit Vault Admin PDFДокумент296 страницAudit Vault Admin PDFNguyenОценок пока нет

- CHAPTER 2 FINANCIAL ANALYSIS AND PLANNINGДокумент85 страницCHAPTER 2 FINANCIAL ANALYSIS AND PLANNINGTarekegn DemiseОценок пока нет

- AsfsadfasdДокумент22 страницыAsfsadfasdJonathan BautistaОценок пока нет