Академический Документы

Профессиональный Документы

Культура Документы

Capital Budgeting With Illustration and Theory

Загружено:

mmuneebsdaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Capital Budgeting With Illustration and Theory

Загружено:

mmuneebsdaАвторское право:

Доступные форматы

CAPITAL BUDGETING

1

Capital Budgeting

Capital budgeting decisions are related to the allocation of

funds to different long assets.

Broadly speaking, the capital budgeting decisions a

decisions situation where the lump sum funds are

invested in the initial stages of projects and the returns

are expected over a long period.

2

Significance of capital budgeting

Decisions

Long-term Effects.

Substantial commitments.

Irreversible decisions.

Affect the capacity and strength to compete

3

Types of Capital Budgeting Decisions

Every capital budgeting decisions is a specific

decisions in the given situation, for a given firm and with

given parameters and therefore, an almost infinite number

of types or forms of capital budgeting decisions may occur.

Even if the same decision being considered by the

same firm at two different points of time, the decisions

consideration may changes as a result of changes in any of

the variable.

4

Types of Capital Budgeting Decisions

However, the different types of capital budgeting decision

undertaken from time to time by different firm can be classified

on a number of dimension. In general, the projects can be

categorized as follows:

From the point of view of firms existence:

New firm.

Existing firm :

Replacement and modernization.

Expansion.

Diversification.

Contingent decisions.

Mutually exclusive investment.

Independent investment.

5

Types of Capital Budgeting Decisions

However, the different types of capital budgeting decision

undertaken from time to time by different firm can be classified on a

number of dimension. In general, the projects can be categorized as

follows:

From the point of view of firms existence:

New firm.

Existing firm :

Replacement and modernization.

Expansion.

Diversification.

Contingent decisions.

From the point view of decision situation:

Mutually exclusive investment.

Independent investment.

6

Evaluation Criteria

Non-discounted Cash Flow Criteria

Payback Period (PB)

Discounted payback period (DPB)

Accounting Rate of Return (ARR)

Discounted Cash Flow (DCF) Criteria

Net Present Value (NPV)

Internal Rate of Return (IRR)

Profitability Index (PI)

7

PAYBACK

Payback is the number of years required to recover the

original cash outlay invested in a project.

If the project generates constant annual cash inflows, the

payback period can be computed by dividing cash outlay

by the annual cash inflow. That is:

8

Example

Assume that a project requires an outlay of Rs 50,000

and yields annual cash inflow of Rs 12,500 for 7 years.

The payback period for the project is:

9

PAYBACK

Unequal cash flows : In case of unequal cash inflows, the

payback period can be found out by adding up the cash

inflows until the total is equal to the initial cash outlay.

Suppose that a project requires a cash outlay of Rs

20,000, and generates cash inflows of Rs 8,000; Rs

7,000; Rs 4,000; and Rs 3,000 during the next 4 years.

What is the projects payback?

3 years + 12 (1,000/3,000) months

3 years + 4 months

10

Acceptance Rule

The project would be accepted if its payback period is

less than the maximum or standard payback period set by

management.

As a ranking method, it gives highest ranking to the

project, which has the shortest payback period and lowest

ranking to the project with highest payback period.

11

DISCOUNTED PAYBACK PERIOD

The discounted payback period is the number of periods

taken in recovering the investment outlay on the present

value basis.

The discounted payback period still fails to consider the

cash flows occurring after the payback period.

12

Evaluation of Payback

Certain virtues:

Simplicity

Cost effective

Short-term effects

Risk shield

Liquidity

Serious limitations:

Cash flows after payback

Cash flows ignored

Cash flow patterns

Administrative difficulties

Inconsistent with shareholder value

13

Evaluation of Payback

Cash flows after pay back :

Cash flows (Rs)

Project C0 C1 C2 C3 Payback NPV

X -4,000 0 4000 2000 2 years 806

Y -4000 2000 2000 0 2 years -530

14

Evaluation of Payback

Cash flows ignored :

Cash flows (Rs.)

Project C0 C1 C2 C3 Payback NPV

C -4,000 0 4000 2000 2 years 806

D -4000 2000 2000 0 2 years -530

15

Evaluation of Payback

Cash flows patterns:

Cash flows (Rs.)

Project C0 C1 C2 C3 Payback NPV

P -5,000 3000 2000 2000 2 years 881

X -5000 2000 3000 2000 2 years 798

16

Accounting Rate of Return (ARR)

The accounting rate of return is also known as return on

investment or return on capital employed.

Method employing the normal accounting technique to

measure the increase in profit expected to result from an

investment by expressing the net accounting profit arising

from the investment as a percentage of that capital

investment.

Accounting rate of return= Average annual profit after tax

average or initial investment

Average investment = Initial investment +salvage value

2

100

17

ACCOUNTING RATE OF RETURN

METHOD

The accounting rate of return is the ratio of the average

after-tax profit divided by the average investment. The

average investment would be equal to half of the original

investment if it were depreciated constantly.

Or

A variation of the ARR method is to divide average

earnings after taxes by the original cost of the project

instead of the average cost.

18

Example

A project will cost Rs 40,000. Its stream of earnings before

depreciation, interest and taxes (EBDIT) during first year

through five years is expected to be Rs 10,000, Rs

12,000, Rs 14,000, Rs 16,000 and Rs 20,000. Assume a

50 per cent tax rate and depreciation on straight-line

basis.

19

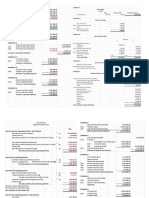

Cacualtion of Accounting Rate of Return

Period 1 2 3 4 5 Average (RS)

Earning Before Depreciation, Interest and Taxes ( EBDIT) 10,000 Rs. 12,000 Rs. 14,000 Rs. 16,000 Rs. 20,000 Rs. 14,400 Rs.

Depreciation 8,000 Rs. 8,000 Rs. 8,000 Rs. 8,000 Rs. 8,000 Rs. 8,000 Rs.

Earning before , Interest and Taxes ( EBIT) 2,000 Rs. 4,000 Rs. 6,000 Rs. 8,000 Rs. 12,000 Rs. 6,400 Rs.

Taxes at 50% 1,000 Rs. 2,000 Rs. 3,000 Rs. 4,000 Rs. 6,000 Rs. 3,200 Rs.

Earning before interest and after taxes [EBIT(1-T)] 1,000 Rs. 2,000 Rs. 3,000 Rs. 4,000 Rs. 6,000 Rs. 3,200 Rs.

Book value of investment

Begning

Ending

Average

40,000 Rs.

32,000 Rs.

36,000 Rs.

32,000 Rs.

24,000 Rs.

28,000 Rs.

24,000 Rs.

16,000 Rs.

20,000 Rs.

16,000 Rs.

8,000 Rs.

12,000 Rs.

8,000 Rs.

Nil

4,000 Rs.

20,000 Rs.

20

Calculation of Accounting Rate of Return

21

Calculation of Accounting Rate of Return

Consider the following investment opportunity:

A machine is available for purchase at a cost of Rs.80,000.

We expect it to have a life of five years and to have a Scarp value of Rs.10,000 at the end of

the five years period. We have estimated that it will generate additional profits over its life as

follows:

These estimate are of profit before depreciation.

Your required to calculate the return on capital employed

Year 1 2 3 4 5

Amount (RS) 20,000 40,000 30,000 15,000 5,000

22

Solution

Total profit before depreciation over the life of the machine = Rs1,10,000

Avergare profit p.a = Rs. 1,10,000/5 years = Rs.22,000

Total depricaition over the life of the machine (Rs. 80,000 - Rs. 10,000 =RS.70,000

Average depreciation p.a = Rs.70,000/5 years = Rs.14,000

Average annual profit after depreciation = Rs. 22,000 - Rs. 14,000 =Rs.8,000

Original investment required = Rs.80,000

Accounting rate of return = ( Rs.8000/Rs.80,000)X 100 = 10%

Average investment = (Rs.80,000 + Rs.10,000)/2 = Rs. 45,000

Accounting rate of return = ( Rs.8,000/Rs.45000)X100 = 17.78%

23

Calculation of Accounting Rate of Return

X Ltd considering the purchase of a machine. Two machines are

available E and F. the cost of each machine is Rs.60,000. Each

machine has an expected life of years. Net profit before tax and

after depreciation during the expected life of the machine are given

below.

Following the method of average return on average investment

ascertain the which of the alternative will be more profitable. The

average rate of tax may be taken at 50%.

24

year

1

2

3

4

5

Total

Machine E

15, 000

20, 000

25, 000

15, 000

10, 000

85, 000

Machine F

5, 000

15, 000

20, 000

30, 000

20, 000

90, 000

Calculation of Accounting Rate of Return

25

Solution :

Year Machine E Machine F

1

2

3

4

5

Total

PBT(Rs)

15000

20000

25000

15000

10000

85000

Tax @ 50%(RS)

7500

10000

12500

7500

5000

42500

PAT(Rs)

7500

10000

12500

7500

5000

42500

PBT(Rs)

5000

10000

20000

30000

20000

90000

Tax @50% (Rs)

2500

5000

10000

15000

10000

45000

PAT(Rs)

2500

5000

10000

15000

10000

45000

Statement of Profitablity

42500x1/5=Rs.85,000 45000x1/5 = Rs.9,000

Machine E Machine F

Avergae Profit After Tax:

8500/30,000x100 = 28.33%

Avergae Investment :

Average return on Average investment:

60,000x1/2 = Rs.30,000 60,000x1/2 = Rs.30,000

9000/30,000x100=30%

Thus, Machine "F" is more profitable

Acceptance Rule

This method will accept all those projects whose ARR is

higher than the minimum rate established by the

management and reject those projects which have ARR

less than the minimum rate.

This method would rank a project as number one if it has

highest ARR and lowest rank would be assigned to the

project with lowest ARR.

26

Evaluation of ARR Method

The ARR method may claim some merits

Simplicity

Accounting data

Accounting profitability

Serious shortcomings

Cash flows ignored

Time value ignored

Arbitrary cut-off

27

Discounted cash flows (DCF)/Time

Adjusted (TA) Techniques

The distinguishing character of the DCF capital budgeting

techniques is that they take into consideration the time

value of money while evaluating the cost and benefit of a

project.

28

Net Present Value Method

Cash flows of the investment project should be forecasted

based on realistic assumptions.

Appropriate discount rate should be identified to discount

the forecasted cash flows.

Present value of cash flows should be calculated using

the opportunity cost of capital as the discount rate.

Net present value should be found out by subtracting

present value of cash outflows from present value of cash

inflows. The project should be accepted if NPV is positive

(i.e., NPV > 0).

29

Net Present Value Method

The formula for the net present value can be written as

follows:

30

=

+

=

+

+ +

+

+

+

+

+

=

n

t

t

t

n

n

C

k

C

C

k

C

k

C

k

C

k

C

1

0

0

3

3

2

2 1

) 1 (

NPV

) 1 ( ) 1 ( ) 1 ( ) 1 (

NPV

Calculating Net Present Value

Assume that Project X costs Rs 2,500 now and is

expected to generate year-end cash inflows of Rs.900,

Rs.800, Rs.700, Rs.600 and Rs.500 in years 1 through 5.

The opportunity cost of the capital may be assumed to be

10 per cent.

31

Calculating Net Present Value

32

Years

0

1

2

3

4

5

Cash Inflows(Rs)

2500

900

800

700

600

500

Discount factor 10%

1

0.909

0.826

0.751

0.683

0.62

Present value

-2500

818

661

526

410

310

Project NPV=225

Why is NPV Important?

Positive net present value of an investment represents

the maximum amount a firm would be ready to pay for

purchasing the opportunity of making investment, or the

amount at which the firm would be willing to sell the right

to invest without being financially worse-off.

The net present value can also be interpreted to

represent the amount the firm could raise at the required

rate of return, in addition to the initial cash outlay, to

distribute immediately to its shareholders and by the end

of the projects life, to have paid off all the capital raised

and return on it.

33

Acceptance Rule

34

Acceptance Rule

35

NPV is most acceptable investment rule for the

following reasons:

Time value

Measure of true profitability

Value-additivity

Shareholder value

Limitations:

Involved cash flow estimation

Discount rate difficult to determine

Mutually exclusive projects

Ranking of projects

Present value of .1

36

37

Internal Rate Return

38

Internal rate of return ( IRR) is a percentage discount rate used in

capital investment appraisals which brings the cost of a project and its

future cash inflows into equality.

This technique also known as YIELD ON INVESTMENT, marginal

efficiency of capital, MARGINAL PRODUCTIVITY OF CAPITAL RATE

OF RETURN, TIME ADJUSTED RATE OF RETURN and so on.

It is the rate of return which equates the present value of anticipated

net cash flows with the initial outlay.

The IRR is also defined as the rate at which the present value is zero.

The rate for computing IRR depends on bank lending rate or

opportunity cost of funds to invest in which is often called as personal

discounting rate or accounting rate.

The test of profitability of a project is the relationship between the IRR

(%) of the project and the minimum acceptable rate of return (%).

Calculation of Internal Rate Return

39

When future cash flows are equal:

In case the proposal has only one outflows in the beginning and

stream of equal cash flow in future, the calculation of IRR is rather

simple.

This can be explained with help of example.

Calculation of Internal Rate Return

A firm is evaluating a proposal

costing . 1,00,000 and having

annual inflows of .25,000

occurring at the end of each of

next six years. There is no

salvage value. The IRR of the

proposal may be calculated as

follows:

Step 1:

Make an approximate of the IRR on

the basis of cash flows data.

A rough approximation may be

made with reference to the pay

back period.

The payback period in the given

case is 4 years.

Now, search for a value nearest to

4 in the 6 years row of the PVAF

table.

The closet figure are given in rate

12%(4.111) and the rate 13%

(3.998).

This mean that the IRR of the

proposal is expected to lie between

12% and 13%

40

Calculation of Internal Rate Return

A firm is evaluating a proposal

costing . 1,00,000 and having

annual inflows of .25,000

occurring at the end of each of

next six years. There is no

salvage value.

Step 2:

In order to make a precise

estimate of the IR, find out the

NPV of the project for both

these rates as follows:

At 12%, NPV =

(25,000PVAF12%6) -

.100,000

=(.250004.111)-

100,000

= . 2,775.

At 13%, NPV =

(25,000PVAF13%6) -.100,000

=(.250003.998)-

100,000

= . -50.

41

Calculation of Internal Rate Return

A firm is evaluating a proposal

costing . 1,00,000 and having

annual inflows of .25,000

occurring at the end of each of

next six years. There is no

salvage value.

Step 3.

find out the exact IRR by

interpolating between 12% and

13%.

It may be noted that IRR is the rate

of discount at which the NPV is

zero.

At 12%, the NPV is .2,775 and at

13% .-50.

Therefore , the rate at which the

NPV is zero will be higher than 12%

but less then 13%.

This rate, at which NPV is Zero may

be found with the help of

interpolation technique.

42

Calculation of Internal Rate Return

A firm is evaluating a proposal

costing . 1,00,000 and having

annual inflows of .25,000

occurring at the end of each of

next six years. There is no

salvage value.

.Step 3.

The formula using the interpolation

method is as follows:

IRR = L

()

Where ,L =Lower discount rate, at which NPV is

positive.

H = Higher discount rate, at which NPV is

negative.

A = NPV at lower discount rate, L.

B = NPV at higher discount rate, H.

43

Calculation of Internal Rate Return

A firm is evaluating a proposal

costing . 1,00,000 and having

annual inflows of .25,000

occurring at the end of each of

next six years. There is no

salvage value.

.Step 3.

By interpolating difference of 1% i.e.,

( 13%-12%), over NPV difference of

.2,825 i.e., [.2,775- (-50)],

IRR = 12%

.2,775

(2,755(.50)

13%12%

IRR = 12.98%

So, the IRR of the project is 12.98%.

44

Calculation of Internal Rate Return

When future cash flows are not equal:

In this case when the project is expected to generate uneven

stream of cash flows, the calculation of the IRR is complicated.

In order to minimize the number of calculation one can start by

guessing the IRR in either of the two ways.

a) If the cash inflows apparent in a broader sense, an annuity,

then the technique explained as above can be applied.

b) If there is no apparent pattern of annuity in the cash inflows

then weighted average cash inflows can be used as follows :

45

Calculation of Internal Rate Return

Suppose a firm is evaluating a

proposal costing .1,60,000 and

expected to generate cash

inflows of .40,000, .60,000

.50,000, .50,000 and

.40,000 at the end next five

years respectively. There is no

salvage value thereafter .

In this case, there is an uneven

stream of cash inflows and the

IRR can be approximated as

follows:

Step1: find out the weighted average

of cash inflows :

Note that the weights used are stated n

the reverse order in order to give

maximum weights to earliest cash flows.

It may be noted that simple

(arithmetic)Average can also be used in

placed of weighted average.

46

Year

1

2

3

4

5

Cash inflows

40,000

60,000

50,000

50,000

40,000

Weigh

5

4

3

2

1

CF x W

2,00,000

2,40,000

1,50,000

1,00,000

40,000

Total 15 7,30,000

Weighted average = 7,30,000/15=Rs.48,667

Calculation of Internal Rate Return

Suppose a firm is evaluating a

proposal costing .1,60,000 and

expected to generate cash

inflows of .40,000, .60,000

.50,000, .50,000 and

.40,000 at the end next five

years respectively. There is no

salvage value thereafter .

Step2:

Consider the weighted ( Or simple)

average as the annuity of cash

inflows and find out the payback

period. For the above case, the

payback period is

.1,60,000/48,667=3.288.

47

Calculation of Internal Rate Return

Suppose a firm is evaluating a

proposal costing .1,60,000 and

expected to generate cash

inflows of .40,000, .60,000

.50,000, .50,000 and

.40,000 at the end next five

years respectively. There is no

salvage value thereafter .

Step3:

Now, search for a value nearest a

value 3.288in 5 years row of PVAF

table.

The closest figures given in the

table are at 15% ( 3.352) and at

16% (3.274).

This means that the IRR of the

proposal is expected to lie between

15% and 16%.

48

Calculation of Internal Rate Return

Suppose a firm is evaluating a

proposal costing .1,60,000 and

expected to generate cash

inflows of .40,000, .60,000

.50,000, .50,000 and

.40,000 at the end next five

years respectively. There is no

salvage value thereafter .

Step4:

Find out the NPV of the proposal for

both of these approximate rates as

follows:

49

Year

1

2

3

4

5

Cash inflows

40,000

60,000

50,000

50,000

40,000

PVF(16%)

0.862

0.743

0.641

0.552

0.497

PV

34,480

44,580

32,050

27,600

19,040

PVF(15%)

0.87

0.756

0.658

0.572

0.497

PV

34,800

45,360

32,900

28,600

19,880

Total 1,57,750 1,61,540

Calculation of Internal Rate

Return

Suppose a firm is evaluating a

proposal costing .1,60,000 and

expected to generate cash

inflows of .40,000, .60,000

.50,000, .50,000 and

.40,000 at the end next five

years respectively. There is no

salvage value thereafter .

AT16% NPV = .1,57,750- .1,60,000

= .-2,250

AT 15% NPV = .161,540,- .1,60,000

= .1540.

50

Calculation of Internal Rate

Return

Suppose a firm is evaluating a

proposal costing .1,60,000 and

expected to generate cash inflows

of .40,000, .60,000 .50,000,

.50,000 and .40,000 at the end

next five years respectively.

There is no salvage value

thereafter .

Step 5: find out exact IRR by interpolating

between 15% and 16%.

At 15% NPV is .1,540 and at 16% the

NPV is . -2,250.

Therefore . The rate at which NPV is zero

will be more than 15% but less than 16%.

By interpolating the difference of 1% (i.e.,

16%-15%) over the NPV difference of .

3,790 [i.e., . 2,250-(-1,540)].

IRR = L+

()

(H-L)

IRR =15%+

1,540

1,540(2,250)

(16-15)

=15.40%

So, The IRR of the project is 15.40%.

51

EVALUATION OF IRR

Disadvantages

It involves tedious calculation

It produces multiple rates which can

be confusing.

In evaluating mutually exclusive

proposals, the project with the

highest IRR would be picked up to

the exclusion of all others. However,

in practice, it may not turn out to be

one that is the most profitable and

consider with objective of the firm

i.e., maximization of the wealth of

shareholders.

52

Advantage :

It possess the advantage, which

offered by the NPV criterion such as

it consider time value of money,

takes into account the total cash

and outflows.

IRR is easier to understand.

Business executive and non-

technical people understand the

concept of IRR much more readily

that they understand the concepts

of NPV.

It does not use the concept of the

required cost of return ( or the cost

of capital). It self provides a rate of

return which is indicative of the

profitability of the proposal. The cost

of capital enters the calculation later

on.

Profitability Index

Yet another time adjusted capital budgeting technique is profitability

index (PI) or Benefit-cost ratio (B/C).

It is similar to the NPV approach.

The profitability index approach measure the present value of returns

per rupee invested, while the NPV is based on the difference between

the present value of future cash inflows and the present value of cash

outlays.

A major shortcoming of the NPV method is that, being an absolute

measures, it is reliable method to evaluate projects requiring different

initial investment.

The PI method provides a solution to this kind of problem.

It is, in other words, a relative measure.

It may be defined as the ratio which is obtained diving the present

value of future cash inflows by the present value of cash outlays.

53

Profitability Index

It may be defined as the ratio which is obtained diving the present

value of future cash inflows by the present value of cash outlays.

Symbolically :

PI =

This method also known as the B/C ratio because the numerator

measure benefits and the denominator cost.

A more appropriate descriptions would be present value index.

54

PI DECISION RULE

Under PI technique, the decision rule is:

Accept the project if its PI is more then 1 and reject the project

proposal if the PI is less than 1.

However, if the PI is equal to 1, then the firm my be indifferent

because the present value of inflows is expected to just equal to the

outflows.

In case of ranking of mutually exclusive proposals, the proposal with

highest positive PI will be given top priority.

The proposal having PI of less than 1 are likely to be out rightly

rejected.

55

Critical Evaluation

The PI technique, as already noted is an extension of the NPV

technique.

In the NPV technique, the difference between the present value of

inflows and the present value of outflows was yardstick.

Therefore, the PI as a technique of evaluation of capital budgeting

proposal has the same merits and shortcoming which the NPV has.

56

Calculation PI

The initial cash outlay of a project is .100,000 and it can generate cash

inflow of .40,000, .30,000, .50,000 and 20,000 in year 1 through 4.

Assume a 10 %of discount. The PV of cash inflows at 10% discount rate is:

57

Calculation PI

58

year

0

1

2

3

4

Cash flows

.-100000

.40000

.30000

.50000

.20,000

PVF 10%

1

0.909

0.826

0.751

0.683

NPV

.-100000

.36,360

.24,780

.37,550

.13,660

NPV =

.12,350

PI =

1,12,350

100,000

= 1.1235

Calculation of PI

The following mutually exclusively

projects can be consider:

Calculate PI and suggest which

project is be to accept and which

project has to reject.

Analysis:

Project A:

PI =

.20,000

.15,000

PI =1.33

Project A PI is 1.33

59

Paritcular

P.V of cash inflows

Intial outlay

Project A

.20,000

.15,000

Project B

.8,000

.5,000

Calculation of PI

The following mutually exclusively

projects can be consider:

Calculate PI and suggest which

project is be to accept and which

project has to reject.

Analysis:

Project B:

PI =

.8,000

.5,000

PI =1.60

Project B PI is 1.60

Project B would be

accepted.

60

Paritcular

P.V of cash inflows

Intial outlay

Project A

.20,000

.15,000

Project B

.8,000

.5,000

NPV v. PI A comparison

As far as, the accept reject decisions is concerned, the

both the NPV and the PI will give the same decision.

The reasons for this are obvious.

The PI will be greater than 1 only for that projects which

has a positive NPV, the project will be acceptable under

both techniques.

On the other hand, if the PI is equal to 1 then the NPV

would also be 0.

Similarly, a proposal having PI of less than 1 will also

have the negative NPV.

However, a conflict between the NPV and the PI may

arise in case of evaluation of mutually exclusive

proposals.

61

Terminal value

In the NPV technique, the future cash flows are

discounted to make them comparable.

In the TV technique, the future cash flows are first

compounded at the expected rate of interest for the period

from their occurrence till the end of the economic life of

the project.

The compounded values are then discounted at an

appropriate discount rate to find out the present value.

This presents value is compared with the initial outflows

to find out the suitability of the proposal.

62

Terminal value

Investopedia explains 'Terminal Value - TV'

The terminal value of an asset is its anticipated value on a certain date in

the future.

It is used in multi-stage discounted cash flow analysis and the study of

cash flow projections for a several-year period.

The perpetuity growth model is used to identify on-going free cash flows.

The exit or terminal multiple approach assumes the asset will be sold at

the end of a specified time period, helping investors evaluate risk/reward

scenarios for the asset. A commonly used value is enterprise

value/EBITDA (earnings before interest, tax, depreciation and

amortization) or EV/EBITDA.

An asset's terminal value is a projection that is useful in budget planning,

and also in evaluating the potential gain of an investment over a specified

time period.

63

Decision Rule of T.V

The decisions rule in the TV technique is that:

Accept the proposal if the present value of the total

compounded value of all the cash inflows is greater than

the present value of the cash outflows. Otherwise, reject

the proposal.

In case ranking of mutually exclusive proposals, the

proposal with the highest net present value is assigned

top priority and the proposal with the lowest net present

value is assigned the lowest priority.

However, the project with negative net present value is

likely to rejected.

64

Calculation of TV

A firm has an investment

proposal costing .1,20,000

with useful economic life of 4

years over which it is

expected to generate cash

inflows .40,000 at end of

each of the next 4 years.

Given the rate of return as

10% and that the firm can

reinvest the cash inflows for

the remaining period at the

rate of 8%. Calculate TV.

Solution :

65

year

1

2

3

4

cash flows

.40,000

.40,000

.40,000

.40,000

Remaining Years

3

2

1

0

CVF(8%,n)

1.26

1.17

1.08

1.00

C.Values

50,400

46,640

43,200

40,000

Total compunded value = 1,80,240

Compound value of an annuity Re.1

66

Calculation of TV

A firm has an investment

proposal costing .1,20,000

with useful economic life of 4

years over which it is

expected to generate cash

inflows .40,000 at end of

each of the next 4 years.

Given the rate of return as

10% and that the firm can

reinvest the cash inflows for

the remaining period at the

rate of 8%. Calculate TV.

The amount .1,80,240 is to be

discounted at 10% (i.e., rate of

discount) for 4 years to find out its

present values.

The PVF(10%, 4 y) is .683.

So, the present value of .1,80,240

is .1,80,240x.683 = .1,23,104.

This present value can now be

compared with the initial investment

of .1,20,000 to find out the net

present value of .1,23,104.

So, the project has a net present

value of .3,104. as per the TV

technique.

67

Capital Rationing

You know the meaning of Capital !

You dont know the meaning of Rationing !

A fixed portion.

In economics, rationing is an artificial restriction of

demand.

68

Capital Rationing

The process of selecting the more desirable projects

among many profitable investment is called capital

rationing.

Or

The capital rationing situation refers to the choice of

investment proposal under financial constrain in term of

given of capital expenditure budget.

Or

Capital rationing refers to the selection of the investment

proposal in situation of constraint on availability of capital

funds, maximize the wealth of the company by selecting

those projects which will maximize overall NPV of the

concern.

69

Capital Rationing

Capital rationing refers to situation where a company

cannot undertake all positive NPV projects it has identified

because of shortage of capital.

Under this situation, a decision maker is compelled to

rejects some of the viable projects having positive net

present value because of shortage of funds.

It is known as situation involving capital rationing.

70

Capital Rationing

Investopedia explains 'Capital Rationing :

Companies may want to implement capital rationing in

situations where past returns of investment were lower than

expected. For example, suppose ABC Corp. has a cost of

capital of 10% but that the company has undertaken too many

projects, many of which are incomplete.

This causes the company's actual return on investment to drop

well below the 10% level.

As a result, management decides to place a cap on the number

of new projects by raising the cost of capital for these new

projects to 15%.

Starting fewer new projects would give the company more time

and resources to complete existing projects.

71

Capital Rationing

Capital rationing exists if there is a limit on the amount of funds available for

investment.

There are two forms of capital rationing: soft rationing and hard rationing.

Soft Rationing.

Hard Rationing.

Soft Rationing exists if businesses themselves, or their senior managers,

place limits on the size of the capital budget. Soft rationing limits can be

relaxed if added NPV investments are available; financing is provided easily

by financial markets.

Hard Rationing Hard rationing or limits on the capital budget are set by

financial markets (investors).With funding constraints, positive NPV projects

are forgone. With hard rationing, the firm must choose projects, to the limit

of its financing ability, from among a list of projects with positive NPVs.

72

Capital Rationing

Classification of projects:

Divisible projects:

Indivisible projects:

73

(i.e. Unable to be divided or

separated)

( i.e. capable of being divided)

Capital Rationing

Classification of projects:

Divisible projects:

There are certain projects which can either be taken in full

or can be taken in parts.

For example, a building( have 5 floors) can be contrasted

at a cost of 5 corers. How ever, if the funds are not

sufficiently available then only a part of building, say only

2 floors, can be constructed for the time being. But all the

proposal may not be divided.

74

Capital Rationing

Classification of projects:

Indivisible projects:

There are certain projects proposal which are indivisible.

These proposal have a feature that either the proposal, as

a whole, be taken in its totality or not taken at all.

For example, A proposal to buy a helicopter cannot be

taken in parts.

Similarly, a multi stage plant can only be installed fully but

not in parts.

There can be many instances of indivisible projects.

75

Capital Rationing

Another important aspects of capital rationing is that a firm

may face capital rationing for one particular period only i.e.,

single period capital rationing or may face capital rationing

for several periods i.e., multiple periods capital rationing

76

Capital Rationing

Single period capital rationing:

This is simple type of capital rationing and occurs when a

firm faces shortage of funds in particular year only.

Impliedly, these limited capital funds can finance fewer

than otherwise available feasible proposal.

77

Capital Rationing

Multi-Period capital rationing:

When a firm faces limitation of funds in more than one

period then above technique may not be of much help.

In such case, the firm may have to resort to some sort of

mathematical programming in order to identify the

optimum selection of proposals.

78

Calculation of Capital Rationing

(divisible)

A company has 7 core available for investment. It has

evaluated its options and has found that only 4 investment

projects given below have positive NPV. All these

investment are divisible. Advise the management which

investment(s) projects it selects.

79

Projects Intial Invesments(crore)

x 3

y 2

z 2.5

w 6

NPV(crore)

0.6

0.5

1.5

1.8

PI

1.2

1.25

1.6

1.3

Calculation of Capital Rationing

Solution :

Accept the project Z in full and W in part (4,50,000) as it

will maximize the NPV.

80

Ranking of the Projects in Descending Order of Profitabilty Index

Project and (Rank) Investment outlay (crore) Profitability Index

1.50

1.80

0.50

0.60

NPV (crore)

1.60

1.30

1.25

1.20

2.50

6.00

2.00

3.00

Z(1)

W(2)

Y(3)

x(4)

Calculation of Capital Rationing

Indivisible projects:

Example:

A company working against a self-imposed capital rationing constraint of .

70 corer is trying to decide which of the following investment proposal

should be undertaken by it. All these investment proposal are invisible

as well as independent. The list of investment along with the

investment required and the NPV of the projected cash flows are

given below :

which investment should u be acquired by the company?

81

Project Initial Investment (. Crore) NPV(. Crore)

A

B

C

D

E

10

24

32

22

18

6

18

20

30

20

Calculation of Capital Rationing

Solution:

NPV from investment D,E B

.68 crore with utilised

leaving .6 crore to be

invested in some other

investment outlet.

No other package would

yield an NPV higher than this

amount.

The company is an integral

part of selecting optimal

investment package /set in

capital rationing situation.

82

Indivisible projects:

Example:

A company working against a self-imposed

capital rationing constraint of . 70 corer

is trying to decide which of the following

investment proposal should be

undertaken by it. All these investment

proposal are invisible as well as

independent. The list of investment

along with the investment required and

the NPV of the projected cash flows are

given below :

which investment should u be acquired

by the company?

Calculation of Capital Rationing

Example:

Total funds available is .3,00,000. Determine the optimal

combination of projects assuming that the projects are

divisible.

83

Project

Required intial investment NPV at the appropriate cost of capital

A

B

C

D

E

20,000

35,000

16,000

25,000

30,000

1,00,000

3,00,000

50,000

2,00,000

1,00,000

Calculation of Capital Rationing

Solution:

continue.

84

Project Required NPV at the

Intial outlay Appoprite

(.)

Cost of the capital ().

Profitability

Index

[(3)/(2)]

Rank

[1] [2] [3] [4] [5]

A

B

C

D

E

1,00,000

3,00,000

50,000

2,00,000

1,00,000

0.2

0.117

0.32

0.125

0.3

20,000

35,000

16,000

25,000

30,000

3

5

1

4

2

Calculation of Capital Rationing

*(2,00,000X1/4)

Therefore, the optimal combination of projects is C,E,A and 1/4

th

portion of D.

85

Rank of Investment Project

Required Initial (.)

1

2

3

4

C

E

A

1/4th of D

50,000

1,00,000

1,00,000

50,000

Total 3,00,000

Abandonment Evaluation Of Capital

Budgeting

Meaning of Abandon:

To leave thing or place.

Meaning of abandonment :

The act of giving something up.

86

Abandonment Evaluation Of Capital

Budgeting

It quite possible in practice, that though a proposal has

been evaluated and implemented after a careful analysis

of all types of risk associated with it, yet at later stage, it

may be found that the project is no longer economically

viable even if its economic life is not yet over.

The firm may be faced with a situation when it is take a

decision whether to abandon project which has failed

before the end of its estimated economic life.

87

Abandonment Evaluation Of Capital

Budgeting

Example :

The projected cash flows and the expected net abandonment values for a

project are given below.

a) Should a project be abandoned ?if so, when ?

Assume that the minimum rate of return expected from the project is 10%.

b) Will you recommendation be different, id the project, is voluntary in

nature ? Support your answer.

88

Year

0

1

2

3

4

Cash I nflows( .)

1, 00, 000

35, 000

30, 000

25, 000

20, 000

Abandonment value( . . )

NI L

65, 000

45, 000

25, 000

NI L

Abandonment Evaluation Of Capital

Budgeting

Solution :

89

Computation of expected NPV over 4 years of economic life for the project

Year Cash flows

Abdoment value (.)

P.V factor @ 10 % P.V of Cash flow (.) P.V of Abandonment value (.)

0

1

2

3

4

-1,00,000

35,000

30,000

25,000

20,000

0

65,000

45,000

20,000

0

1

0.909

0.826

0.751

0.683

-1,00,000

31,815

24,780

18,775

13,660

0

59,085

37,170

15,020

0

Total NPV= (10,970)

Abandonment Evaluation Of Capital

Budgeting

Cont

90

Statement Showing Computation of total NPV of the Project at the end of each year

P.v and Total at the end of

year Praticular 1year 2year 2year

0 cash flows -1,00,000 -1,00,000 -1,00,000

1 cash flows 31,815 31815 31,815

abandonment value 59,085 0 0

2 cash flows 0 24,780 24,780

abandonment value 37,170 0

3 cash flows 0 18,775

abandonment value 15,020

TOTAL -9,100 -6,235 -9,610

Abandonment Evaluation Of Capital

Budgeting

91

Recommendation :

In the view of above comparative statement it may be

observed that the project should be abandoned since

there is no positive NPV at the end of any year.

It should be abandoned at the end of 2 years, where the

losses are the minimal- the total NPV at the end of 2

years being the highest, viz, (.6,235), where the

negative value is the least.

Impact of inflation in capital budgeting

92

What is inflation ?

Impact of inflation in capital budgeting

93

Inflation refers to a continuous rise in general price level

which reduces the value of money or purchasing power

over a period of time.

Impact of inflation in capital budgeting

94

Inflation is the rate of sustained increase in the prices of

goods and services, measured as a percentage increase

over an annual period.

When there is an increase in inflation rates it means that

for each Rupee that you spend you will be able to buy a

smaller amount of a particular product or service.

Inflation means that the value of a Rupee (in terms of

what it can buy) is not constant.

This is referred to as the purchasing power of the

Rupee. When rates of inflation rise there is a

corresponding reduction in purchasing power as the

money is able to buy less tangible goods.

Impact of inflation in capital budgeting

95

EXAMPLE: Assume that the inflation rate of a particular

economy is 2% per year. This means that a product that

currently costs 2 will cost 2.04 at the same time next

year. Inflation increases the price and you cant buy the

same goods with a Rupee as you previously could.

Impact of inflation in capital budgeting

96

General inflation, i.e., the changes in price of the various

factor which may increase the project cost e.g., wage

rates, sales prices, material costs , energy costs,

transportation charges and so on.

Every attempt should be made to estimate specific

inflation for each element of the project in a detailed

manner as feasible.

The overall estimate based on the RPI are likely to be

inaccurate and misleading.

Impact of inflation in capital budgeting

97

Types of inflation in capital budgeting:

1. Differential inflation

2. Synchronized inflation

Impact of inflation in capital budgeting

Differential inflation :

differential is where

costs and revenue

change at differing

rates of inflation or

where the various

items of cost and

revenue move at

different rates.

Synchronized inflation:

Synchronized inflation

where the cost and

revenue rise at the

same rate.

98

Impact of inflation in capital budgeting

99

Types of cash flows :

Money cash flows.

Real cash flow.

Impact of inflation in capital budgeting

Money cash flows:

The money cash flows are

those which are expressed in

money terms.

These are the actual amount

expected to arise in future.

These cash flows include the

effect of inflation.

The money cash flows are

known as the nominal cash

flows.

The money cash flows will

occur in terms of the

purchasing power of that

period in which they occur.

Real Cash Flows:

The real cash flows are those

cash flows which have been

expressed in terms of real

values i.e., these are

expressed in term of constant

prices.

So these cash flows exclude

the effect of inflation.

It May be noted that the real

cash flows are not necessarily

equal to the present values

of money cash flows.

100

Impact of inflation in capital budgeting

101

The money cash flows and the real cash flows differ only

because of existence on inflation.

Is there is no inflation then the money cash flows are just

equal to the real cash flows.

If there is inflation, the real cash flows can be derived by

discounting the future money cash flows at the inflation rate.

Impact of inflation in capital budgeting

102

The relationship between nominal and real discount rate can

be expressed as:

Nominal Discount Rate = (1+Real discount Rate) (1+inflation rate) -1

Real discount Rate =

1+

(1+ )

1

Impact of inflation in capital budgeting

A corporate firms

management policy is to

earn a real rate of return

(r) of 10% on new projects.

It is expected that the

inflation rate (i) during the

proposed projects life is

6% per year.

Determine the nominal

discount rate (n) which

should be used by the firm

to determine the present

value of the project.

Solution:

Nominal rate (n) = (1+r)(1+i)-1

=(1+0.10)(1+0.06)-1

=(1.1)(1.06)-1

= 1.166-1

= 0.166

= 16.6%

103

Impact of inflation in capital budgeting

Sagar industries employ 15% as

nominal required rate of return

to evaluate its new investment

projects.

In the recent meeting of its

board of directors, it has been

decided to protect the interest

of shareholder against

purchasing power loss due to

inflation.

The expected inflation rate in

the economy is 6%.

Determine the real discount

rate to be employed now by

Sagar industries

Solution:

Real rate(r) =

1+

(1+)

1

=

1+.015

(1+0.06)

1

=

(1.15)

(1.06)

1

=1.0849 1

=.0849

=8.49%

104

Impact of inflation in capital budgeting

A new machine is expected the

following set of incremental CFAT

during its 5 years economic useful

life.

The rate of inflation during the

period is expected to be 8% and the

projects cost of capital in real terms

would be 10%.

Should the machine be purchased if

it cost .25 lakh?

Solution: Step 1.

105

Year CFAT()

1

2

3

4

5

10,00,000

12,00,000

15,00,000

8,00,000

5,00,000

Determination of Real CFAT

Year CFAT() Inflation factor at 8% Real CFAT()

1

2

3

4

5

10,00,000

12,00,000

15,00,000

8,00,000

1/(1.08)=0.926

1/(1.08)2=0.857

1/(1.08)3=0.794

1/(1.08)4=0.735

1/(1.08)5=0.681

9,26,000

10,28,400

11,91,000

5,88,000

3,40,500

Impact of inflation in capital budgeting

A new machine is expected the

following set of incremental CFAT

during its 5 years economic useful life.

The rate of inflation during the period

is expected to be 8% and the projects

cost of capital in real terms would be

10%.

Should the machine be purchased if it

cost .25 lakh?

Solution: Step 2.

Recommendation : The machine should

be purchased as the NPV is positive.

106

Year CFAT()

1

2

3

4

5

10,00,000

12,00,000

15,00,000

8,00,000

5,00,000

Determination of NPV using real Rate of Discount

1

Year

2

3

4

5

Real CFAT()

9,26,000

10,28,400

11,91,000

5,88,000

3,40,500

Discount factor at 10%

0.909

0.826

0.751

0.683

0.621

Total PV()

8,41,734

8,49,458

8,94,441

4,01,604

2,11,450

Total present value ()3198687

Less : Cash outflows ()25,00,000

Net present value ()6,98,687

A company is considering a cost saving project. This

involves purchasing a machine costing .7,000. which will

result in annual saving on wage costs .1,000 and on

material cost of .400.the following forecast are made of

the rates of inflation each year for the next 5 years:

Wages costs10%,

Material costs 5%

General prices 6%

The cost of capital of the company, in monetary terms, is

15%.Evaluate the projects, assume that the machine has

life of 5 years and no scrap value.

107

Impact of inflation in capital budgeting

d

Solution :

Analysis : Since present value of cost of project exceeds the cost of savings from it and

hence it is not suggested to purchase the machine.

108

Year

1

2

3

4

5

Labour cost saving( )

Material Cost Saving( ) Total saving( ) Total saving( ) DCF @15% DCF @15% Present Value ( )

100(1.1)

2

= 1,210

100(1.1)

3

= 1,331

100(1.1)=1,100

100(1.1)

4

= 1,464

100(1.1)

5

= 1,610

400(1.05)=420

400(1.05)

2

= 441

400(1.05)

3

= 463

400(1.05)

4

= 486

400(1.05)

5

= 510

1,520

1,651

1,794

1,950

2,120

0.87

0.756

0.658

0.572

0.497

1,322

1,255

1,184

1,112

1,060

Present value of total saving 5,933

Less: initial cash outflows 7,000

Net present value ( negative) -1,067

Calculation of NET Present Value

Impact of inflation in capital budgeting

Risk Evaluation in Capital Budgeting

Probability Analysis .

Certainty Equivalent Method.

Sensitivity Technique .

Standard Deviation Method

Co-efficient Of Variation Method

Decision Tree Analysis

109

Risk Evaluation in Capital Budgeting

Probability Analysis :

A probability technique is the relative frequency with which

an event may occur in the future.

When future estimates of cash inflows have different

probabilities the expected monetary values may be

computed by multiplying cash inflows with the probability

assigned.

The monetary values of the inflows may further be

discounted to find out the present values.

The projects that gives higher net present value may be

accepted.

110

Risk Evaluation in Capital Budgeting

Example :

Two mutually exclusive investment proposals are being

considered. The following information is available.

Assuming cost of capital at 10%, advise the selection of the

project.

111

Project X() Project Y()

Cost ()6,000 ()6,000

Cash Inflows

Year () Probability () Probability

1

2

3

4,000

8000

12,000

0.2

0.6

0.2

8,000

9,000

9,000

0.2

0.6

0.2

Risk Evaluation in Capital Budgeting

Solution : Project X

112

Calutation of Net Present Value of the Two Projects

Year P.V.F @10% C.I () Probability Monetary value P.V()

1

2

3

0.909

0.826

0.751

4,000

8,000

12,000

0.20

0.60

0.20

800

4,800

2,400

727

3,965

1,802

Total Present Value 6,494

Less: Cost of Investment 6,000

Net Present Value 494

Risk Evaluation in Capital Budgeting

Solution : Project Y

113

Calutation of Net Present Value of the Two Projects

Year P.V.F @10% C.I () Probability Monetary value P.V()

1

2

3

0.909

0.826

0.751

0.20

0.60

0.20

7,000

8,000

9,000

1,400

4,800

1,800

1,273

3,965

1,352

Total Present Value 6,590

Less: Cost of Investment 6,000

Net Present Value 590

Risk Evaluation in Capital Budgeting

Solution : Project Y

114

Calutation of Net Present Value of the Two Projects

Year P.V.F @10% C.I () Probability Monetary value P.V()

1

2

3

0.909

0.826

0.751

0.20

0.60

0.20

7,000

8,000

9,000

1,400

4,800

1,800

1,273

3,965

1,352

Total Present Value 6,590

Less: Cost of Investment 6,000

Net Present Value 590

Risk Evaluation in Capital Budgeting

DECISION TREE ANALYSIS :

Quit often a firm may have to take a sequential decision i.e., the

present decision is affected by the decisions taken in the past or

it affects the future decision of the same firm

In the capital budgeting the evaluation of a project frequently

requires a sequential decision making process where the accept

or reject decision made in several stages.

Instead of making decision once for all, it is broken up into

several parts and stages.

At each stage there may be more then one option available and

the firm may have to decide every time that which option is to be

taken for.

115

Risk Evaluation in Capital Budgeting

In modern business there are complex investment

decisions which involve a sequence of decisions over time.

Such sequential decisions can be handled by plotting

decisions tree.

A decision tree is graphic representation of the relationship

between a present decision and future event, future

decision and their consequence,

The sequence of events is mapped out over time in format

resembling branches of a tree and hence the analysis is

known as decision tree analysis .

116

Risk Evaluation in Capital Budgeting

Mr. wise is considering an investment proposal of . 20,000. the expected

returns during the life of the investment are as under.

Using 10% as the cost capital, advise about the acceptability of the project.

117

Year 1

Event

1

2

3

Cash flows ()

8,000

12,000

10,000

Probability

0.3

0.5

0.2

Year 2

Cash flows in year 1 are

.8,000 .12,000 .10,000

Event

1

2

3

C.I ()

15,000

20,000

25,000

Prob

0.2

0.6

0.2

C.I ()

20,000

30,000

40,000

Prob

0.1

0.8

0.1

C.I

25,000

40,000

60,000

Prob

0.2

0.5

0.3

118

Calculation of Net Present Value of Cash Inflows

Alternatives

Cash inflows Discount factor

Year I () Year II ()

Discount factor 10% Present Values

Year I Year II

10% Present Values

Year I () Year II ()

Total ()

Net Present

Value ()

a) (i) 8,000 15,000 0.909 0.826 7,272 12,390 19,662 -338

(ii) 8,000 20,000 0.909 0.826 7,272 16,520 23,792 3,792

(iii)

b)(i)

(ii)

(iii)

c) (i)

(ii)

(iii)

8,000 25,000 0.909 0.826 7,272 20,650 27,922 7,922

12,000 20,000 0.909 0.826 10,908 16,520 24,428 7,428

12,000 30,000 0.909 0.826 10,908 24,780 35,688 15,688

12,000 40,000 0.909 0.826 10,908 33,040 43,948

23,948

10,000 25,000

0.909

0.909

0.909

0.826

0.826

0.826

9,090

9,090

9,090 20,650

33,040

49,560

29,740

42,130

58,650

9,740

22,130

38,650

10,000

10,000

40,000

60,000

119

Decision Tree Analysis

Cash

outflow

.20,000

.8,000

.12,000

.10,000

1

Year 0

2

YearI Prob earII Prob

C.I ()

Year II Prob

C.I ()

3 4

N.P.V

of inflow()

5

Joint

Probability

6 = 4x5

Expected

N.P.V ()

15,000

20,000

25,000

20,000

30,000

40,000

25,000

40,000

60,000

-338

3,792

7,922

7,428

15,688

23,948

9,740

22,130

38,650

0.06

0.18

0.06

0.05

0.4

0.05

0.04

0.1

0.06

-20.28

682.56

475.32

371.4

6,275.20

1,197.40

389.60

221.30

2,319.00

Total : 1 11,911.50

.3

.5

.2

.2

.6

.2

.1

.8

.1

.2

.5

.3

RISK ADJUSTED DISCOUNT RATE

The simplest method of accounting for risk in capital

budgeting is to increase the cut-off rate or discount factor

by certain percentage on account of risk.

The project which are more risky and which have greater

variability in expected returns should be discounted at

higher rate as compared to the projects which are less

risky and expected to have lesser variability in returns.

120

RISK ADJUSTED DISCOUNT RATE

Beta company Ltd. Is considering the purchase a new investment .

Two alternative investment are available (A & B ) each costing

. 1,00,000.Cash inflows are expected to be as follows :

The company has a great return on capital of 10%. Risk premium

rates are 2% and 8% respectively for investment A & B.

Which investment should be preferred?

121

Cash flows

Year

1

2

3

4

I nvestment A (. . )

40, 000

35, 000

25, 000

20, 000

I nvestment B ( . . )

50, 000

40, 000

30, 000

30, 000

RISK ADJUSTED DISCOUNT RATE

Solution :

The profitability of the investment can be compared on the basis of net

present values cash inflows adjusted for risk premium rates as follows:

122

Years

1

2

3

4

Discount factor @

10%+2%=12%

0.893

0.797

0.712

0.635

Cash

Inflows ()

40,000

35,000

25,000

20,000

Present

Value ()

35,720

27,895

17,800

12,700

Total : 94,115

Investment A

Net Present Value .94,115-1,00,000 = (5,885)

RISK ADJUSTED DISCOUNT RATE

As at even higher discount rate B gives a higher net present value,

investment B should be preferred.

123

Years

1

2

3

4

Cash

Inflows ()

Present

Value ()

Discount factor @

10%+8%= 18%

0.847

0.718

0.609

0.516

50,000

40,000

30,000

30,000

Total : 1,04,820

42,350

28,720

18,270

15,480

Investment B

Net Present Value .1,04,820-1,00,000 = 4,820

SENSITIVITY TECHNIQUE

SENSITIVITY TECHNIQUE :

Where cash inflows are very sensitive under different

circumstance, more than one forecast of the future cash inflows

may be made.

These inflows may be regarded as Optimistic, Most likely and

Pessimistic.

further cash inflows may be discounted to find out the net

present values under these three different situations.

If the net present values under the three situation differ widely it

implies that there three different situations.

If the net present values under the three situation differ widely it

implies that there is a great risk in the project and the investors

decisions to accept or reject a project will depends upon his risk

bearing abilities.

124

SENSITIVITY TECHNIQUE

Example : Mr. risky is considering two mutually exclusive projects A and B.

You are required to advise him about the acceptability of the projects from

the following information.

125

Project A Project B

Cost of the investment 50,000 50,000

forcast Cash Inflows per annum for 5 years

Optimistic

Most Likely

Pessimistic

30,000

20,000

15,000

50,000

40,000

20,000

(The cu-off rate may be assumed to be 15%)

SENSITIVITY TECHNIQUE

The net present value as calculated above indicate that Project B is more

risky as compared to Project A. But at the same time during favorable

conditions, it is more profitable also. The acceptability of the project will

depend upon Mr. Riskys attitude towards risk.

If he could afford to take higher risk, project b may be more profitable.

126

Calucation of Net present value of Cash Inflows at a Discount

Rate of 15% ( annuity of Re. 1 for 5 years)

Annual Discount P.V N.P.V

cash flows . factor 15% . .

Project A Project B

Optimistic

Most likely

Pessimistic

Annual Discount P.V N.P.V

cash flows . factor 15% . .

30,000

20,000

15,000

3.3522

3.3522

3.3522

1,00,566

67,014

50,283

50,566

17,044

283

40,000

20,000

5,000

3.3522

3.3522

3.3522

1,34,088

67,044

16,761

84,088

17,044

-33,239

Conflict between NPV & IRR results

In case of mutually exclusive investment proposals, which

compete with one another in such a manner that acceptance

of one automatically excludes the acceptance of the other.

The NPV method and IRR method may give contradictory

result.

The NPV may suggest acceptance of one proposal where

as, the internal rate of return may favor another proposal.

127

Conflict between NPV & IRR results

Such conflict in ranking may be caused by any one or more

of the following problems:

I. Significant difference in the size ( amount ) of cash outlays

of the various proposal under consideration.

II. Problem of difference in the cash flows patterns or timings

of the various proposals.

III. Difference in service life or unequal expected lives of the

projects.

In such case, while choosing among mutually exclusive

projects, one should always select the project giving the

largest positive net present value using appropriate cost of

capital or predetermined cut off rate.

128

Conflict between NPV & IRR results

The reason for the same lies in the fact that the objective of

an firm is to maximize shareholders wealth and the project

with the largest NPV has the most beneficial effect on shares

prices and shareholders wealth.

Thus, the NPV method is more reliable as compared to the

IRR method in ranking the mutually exclusive projects.

In fact, NPV is the best operational criterion for ranking

mutually exclusive investment proposals.

129

Conflict between NPV & IRR results

A firm whose cost of capital is 10% is considering two

mutually exclusive projects A and B, the cash flows of which

are as below:

Suggest which project should be taken up using

I. Net Present Value Method, and

II. The Internal Rate of return Method.

130

Year Project A Project B

. .

0 -50,000 -80,000

1 62,500 96,170

Conflict between NPV & IRR results

Solution :

131

(I) Calucation of Net PresentValue (NPV)

Project A Project B

YEAR P.V. factor Cash flows (.) P.V () Cash flows (.) P.V ()

0

1

1

0.909

-50,000

62,500

-50,000

56,812

-80,000

96,170

-80,000

87,418

Net Present Value (NPV) 6812 7418

(II)Calculation of Internal Rate of Return

Project A Project B

Conflict between NPV & IRR results

Suggestion :

According to the NPV Method, investment in project B is

better because of its Higher positive NPV; but according to

the IRR method project A is better investment because of

higher internal rate of Return.

Thus, there is a conflict in ranking of the two mutually

exclusive proposal according to the two methods.

Under these circumstances, we would suggest to take up

Project B which give a higher Net present Value because in

doing so the firm will be able to maximize the wealth of the

shareholders.

132

Spontaneous sources :

The spontaneous sources are those sources which occur

and result from the normal business activities.

In the usual course of business operations, a firm might be

getting goods and services for which payments are to be

made at a later stage. i.e., with a time gap.

To extent, payment is delayed, the funds are available to

firm.

These sources are generally unsecured and vary in line with

the change in sales level.

There are also known as trade liabilities or simply as current

liabilities. cont

133

Two important spontaneous sources of short term financing

are:

i. Trade credit.

ii. Accrued expenses .

134

Trade credit :

When firm buys goods from another, it may bot be required

to pay for these goods immediately.

During this period, before the payment become due, the

purchaser has a debt outstanding to the supplier.

This debt is recorded in the buyers balance sheet as

creditors; and the corresponding account for the supplier is

that of debtors.

The trade credit may be define as the credit available in

connection with goods and services purchased for resale.

135

Its the resale which distinguish trade credit from other

sources.

For example :

A fixed asset may be purchased on credit, but since these

are to be used in the production process rather then for

resale, such credit purchase of fixed asset is not called the

trade credit. The credit extended in connection with the

goods purchased for resale by a retailer or a wholesaler of

raw material used by manufacturer in producing its products

is called the trade credit.

136

Accrued expenses :

oThe accrued expenses refer to the services availed by the

firm, but the payment for which has not yet been made.

oIt is built in and an automatic source of finance as most of

the service i.e., labor etc. are paid only at the end of a

period.

137

Credit terms:

The credit term refer to the set of conditions on which a seller

sells goods and services to the buyer and in particular, on

which the buyer has to make the payment to the seller. These

include

The size of the cash discount, if any from the net invoice

price which is given for making cash payment within a

specified period.

The period within which payment must be made if the cash

discount Is to be availed.

The maximum period that can elapse before payment of net

invoice price should be made if the discount is not taken.

138

Credit terms:

For example:

A credit term may be expressed as 2/10 net 30.

It means that a cash discount of 2% is allowed if the invoice

amount is paid within 10days otherwise full payment must be

paid within 30 days.

In simple terms :

2 is percentage of discount.

10 is number days to avail discount.

30 is number days allowed by supplier .

139

140

Firm buys .100

goods

Cash discount

period ends

Credit period

ends

Cost of additional 20 days . 2

Credit period

begins

Pay

.100

June 10

June1

OR

June 30

Pay

.98

Cost of trade credit or Annual Interest Rate :

Cost of Trade Credit =

1

365

100

Where :

d = % Cash discount

n = Net period in days

p = Discount period in days

141

What is the annual percentage interest cost associated with

the following credit terms?

I. 2/10 net 50

II. 2/15 net 40

III. 1/15 net 30

IV. 1/10 net 30

Assume that the firm does not avail of the cash discount but

pay on the last day of net period. Assume 360 days to a year.

142

Question :

I. 2/20 net 50

II. 2/15 net 40

III. 1 /15 net 30

Solution:

I. cost =

0.02

10.02

360

5020

= 24.5%

II. cost =

0.02

10.02

360

4015

= 29.4%

III. cost =

0.01

10.01

360

3015

= 24.2%

143

Question :

iv) 1/10 net 30

Solution:

iv) cost =

0.01

10.01

360

3010

= 18.2%

144

145

Вам также может понравиться

- Capital Budgeting TechniquesДокумент48 страницCapital Budgeting TechniquesMuslimОценок пока нет

- A. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueДокумент30 страницA. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueAfroz AlamОценок пока нет

- The Cost of CapitalДокумент18 страницThe Cost of CapitalzewdieОценок пока нет

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsДокумент90 страниц35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- PP05Документ73 страницыPP05aahsaaanОценок пока нет

- ICMA Questions Dec 2012Документ55 страницICMA Questions Dec 2012Asadul HoqueОценок пока нет

- 9 Risk Analysis in Capital BudgetingДокумент20 страниц9 Risk Analysis in Capital BudgetingSwati Singh75% (4)

- Problems Solved Pay Back PeriodДокумент7 страницProblems Solved Pay Back PeriodAfthab MuhammedОценок пока нет

- Leverage PPTДокумент13 страницLeverage PPTamdОценок пока нет

- Financial Management 2: UCP-001BДокумент3 страницыFinancial Management 2: UCP-001BRobert RamirezОценок пока нет

- QP March2012 p1Документ20 страницQP March2012 p1Dhanushka Rajapaksha100% (1)

- Financial Management - PPT - 2011Документ134 страницыFinancial Management - PPT - 2011Bhanu Prakash100% (1)

- Unit 2 Capital StructureДокумент27 страницUnit 2 Capital StructureNeha RastogiОценок пока нет

- 2 - Time Value of MoneyДокумент68 страниц2 - Time Value of MoneyDharmesh GoyalОценок пока нет

- 06 Financial Estimates and ProjectionsДокумент19 страниц06 Financial Estimates and ProjectionsSri RanjaniОценок пока нет

- BCG ApproachДокумент2 страницыBCG ApproachAdhityaОценок пока нет

- Problems On Cash Management Baumol ModelsДокумент1 страницаProblems On Cash Management Baumol ModelsDeepak100% (1)

- ValuationДокумент23 страницыValuationishaОценок пока нет

- CH 12Документ31 страницаCH 12Mochammad RidwanОценок пока нет

- Approaches in Portfolio ConstructionДокумент2 страницыApproaches in Portfolio Constructionnayakrajesh89Оценок пока нет

- Working CapitalДокумент66 страницWorking CapitalAamit KumarОценок пока нет

- FinancialManagement MB013 QuestionДокумент31 страницаFinancialManagement MB013 QuestionAiDLo50% (2)

- Capital Structure TheoriesДокумент47 страницCapital Structure Theoriesamol_more37Оценок пока нет

- SAPM Portfolio EvaluationДокумент6 страницSAPM Portfolio EvaluationsarahrahulОценок пока нет

- Sickness in Small EnterprisesДокумент15 страницSickness in Small EnterprisesRajesh KumarОценок пока нет

- C.A IPCC Capital BudgetingДокумент51 страницаC.A IPCC Capital BudgetingAkash Gupta100% (4)

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsДокумент63 страницыChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Chapter 5 Time Value of MoneyДокумент5 страницChapter 5 Time Value of MoneyMariya ErinahОценок пока нет

- Financial Management: Unit 3Документ47 страницFinancial Management: Unit 3muralikarthik31Оценок пока нет

- MGT705 - Advanced Cost and Management Accounting Midterm 2013Документ1 страницаMGT705 - Advanced Cost and Management Accounting Midterm 2013sweet haniaОценок пока нет

- Slides On Functions of State Bank of PakistanДокумент19 страницSlides On Functions of State Bank of PakistanMuhammad Talha Khan100% (1)