Академический Документы

Профессиональный Документы

Культура Документы

FIN509 Session2

Загружено:

Michael OdiemboОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FIN509 Session2

Загружено:

Michael OdiemboАвторское право:

Доступные форматы

Fixed Income Markets - Part 2

Duration and convexity

FIN 509: Foundations of Asset Valuation

Class session 2

Professor Jonathan M. Karpoff

FIN 509 Class session 2 2

Sleeping Beauty bond case - Central points

Bond prices are sensitive to changes in interest rates

This sensitivity tends to be greater for longer term bonds

But duration is a better measure of term than maturity

Duration for 100-year bond = 14.24

Duration for 30-year zero = 30

Duration for 30-year coupon = 12.64

Sleeping beauty bond has longer maturity but less sensitivity to interest rates

than the 30-year zero bond

30-year coupon and zero bonds have the same maturity but 30-year zero is

more sensitive than the 30-year coupon bond

FIN 509 Class session 2 3

Duration and convexity: Outline

I. Macaulay duration

II. Modified duration

III. Examples

IV. The uses and limits of duration

V. Duration intuition

VI. Convexity

VII. Examples with both duration and convexity

VIII. Takeaways

FIN 509 Class session 2 4

I. (Macauly) duration

Weighted average term to maturity

Measure of average maturity of the bonds promised cash flows

Duration formula:

where:

t is measured in years

P

) 1 /(

) ( PV

) ( PV

t

t t

t

y CF

Bond

CF

w

+

= =

D

m

= t w

t

( )

t =1

T

w

t

=1

t =1

q

FIN 509 Class session 2 5

Duration - The expanded equation

Duration is shorter than maturity for all bonds except zero

coupon bonds

Duration of a zero-coupon bond is equal to its maturity

D

m

= t w

t

t =1

T

= t

PV(C

t

)

PV(Bond)

(

(

t =1

T

=

1

C

1

(1 + y)

1

(

(

+ 2

C

2

(1+ y)

2

(

(

+ . .. + N

C

N

(1+ y)

N

(

(

C

1

(1+ y)

1

+

C

2

(1 + y)

2

+. .. +

C

N

(1+ y)

N

FIN 509 Class session 2 6

II. Modified duration (D*

m

)

Direct measure of price sensitivity to interest rate changes

Can be used to estimate percentage price volatility of a bond

y

D

D

m

m

+

=

1

*

AP

P

= D

m

*

Ay

FIN 509 Class session 2 7

Derivation of modified duration

So D*

m

measures the sensitivity of the % change in bond price

to changes in yield

y

D

D

m

m

+

=

1

*

P =

C

t

(1+ y)

t

t =1

N

cP

cy

=

1

1 + y

t

C

t

(1 + y)

t

|

\

|

.

t =1

N

cP

cy

=

D

m

1 + y

P = D

m

*

P

1

P

cP

cy

= D

m

*

FIN 509 Class session 2 8

III. An example

Compare the price sensitivities of:

Two-year 8% coupon bond with duration of 1.8853 years

Zero-coupon bond with maturity AND duration of 1.8853 years

Semiannual yield = 5%

Suppose yield increases by 1 basis point to 5.01%

Upshot: Equal duration assets are equally sensitive to interest rate

movements

Original Price New Price % Change

Coupon bond 964.54 964.19 -.0189

Zero bond 831.96 831.61 -.0189

FIN 509 Class session 2 9

Another example

Consider a 3-year 10% coupon bond selling at $107.87 to yield 7%.

Coupon payments are made annually.

87 . 107 79 . 89 73 . 8 35 . 9 bond of Price

79 . 89

) 07 . 1 (

110

) (

73 . 8

) 07 . 1 (

10

) (

35 . 9

) 07 . 1 (

10

) (

3

3

2

2

1

= + + =

= =

= =

= =

CF PV

CF PV

CF PV

Duration (D

m

) = 1*

9.35

107.87

|

\

|

.

+ 2 *

8.73

107.87

|

\

|

.

+ 3 *

89.79

107.87

|

\

|

.

= 2.7458

FIN 509 Class session 2 10

Another example page 2

Modified duration of this bond:

If yields increase to 7.10%, how does the bond price change?

The percentage price change of this bond is given by:

= 2.5661 .0010 100

= .2566

5661 . 2

07 . 1

7458 . 2

*

= =

m

D

AP

P

100 = D

m

*

Ay 100

FIN 509 Class session 2 11

Another example page 3

What is the predicted change in dollar terms?

New predicted price: $107.87 .2768 = $107.5932

Actual dollar price (using PV equation): $107.5966

AP =

.2566

100

P

=

.2566

100

$107.87

= $.2768

Good

approximation!

FIN 509 Class session 2 12

Summary: Steps for finding the predicted

price change

Step 1: Find Macaulay duration of bond.

Step 2: Find modified duration of bond.

Step 3: Recall that when interest rates change, the change in a bonds

price can be related to the change in yield according to the rule:

Find percentage price change of bond

Find predicted dollar price change in bond

Add predicted dollar price change to original price of bond

Predicted new price of bond

AP

P

100 = D

m

*

Ay 100

FIN 509 Class session 2 13

IV. Why is duration a big deal?

Simple summary statistic of effective average maturity

Measures sensitivity of bond price to interest rate changes

Measure of bond price volatility

Measure of interest-rate risk

Useful in the management of risk

You can match the duration of assets and liabilities

Or hedge the interest rate sensitivity of an investment

FIN 509 Class session 2 14

Qualifiers

First-order approximation

Accurate for small changes in yield

Limitation: Depends on parallel shifts in a flat yield curve

Multifactor duration models try to address this

Strictly applicable only to option-free (e.g., non-convertible)

bonds

FIN 509 Class session 2 15

An aside: Corporate bonds and default risk

Most corporate bonds are either callable or convertible

Callable bonds give the firm the right to repurchase these bonds at a pre-

specified price on or after a pre-specified date

Convertible bonds give their holders the right to convert the bonds they

hold into common stock of the firm

Bond Rating: An indicator or assessment of the issuers ability to meet its

interest and principal payments

Moodys: Aaa; Aa; A; Baa; Ba; Caa; Ca; C (1-3)

S&P: AAA; AA; A; BBB; BB; B; CC; C; CI; D (+/-)

FIN 509 Class session 2 16

V. Check your intuition

How does each of these changes affect duration?

1. Having no coupon payments.

2. Decreasing the coupon rate.

3. Increasing the time to maturity.

4. Decreasing the yield-to-maturity.

FIN 509 Class session 2 17

Pictorial look at duration

*

Cash flows of a seven year 12% bond discounted at 12%.

Shaded area of each box is PV of cash flow

Distance (x-axis) is a measure of time

FIN 509 Class session 2 18

Effects of the coupon

Duration is similar to the distance to the fulcrum (5.1 years)

Duration

High C, Lower Duration

Low C, Higher Duration

FIN 509 Class session 2 19

Example of the coupon effect

Consider the durations of a 5-year and 20-year bond with

varying coupon rates (semi-annual coupon payments):

5 year bond 20 year bond

Zero coupon 5 20

6% coupon 4.39 11.90

9% coupon 4.19 10.98

FIN 509 Class session 2 20

Effect of maturity and yield on duration

Duration increases with increased maturity

Effect of yield

| yield, weight on earlier payments |, fulcrum shifts left

+ yield, weight on earlier payments +, fulcrum shifts right

FIN 509 Class session 2 21

VI. A complication

Notice the convex shape of price-yield relationship

Bond 1 is more convex than Bond 2

Price falls at a slower rate as yield increases

A

B

5% 10%

Bond 1

Bond 2

Price

Yield

FIN 509 Class session 2 22

Convexity

Measures how much a bonds price-yield curve deviates from a

straight line

Second derivative of price with respect to yield divided by bond price

Allows us to improve the duration approximation for bond price

changes

c

2

P

c

2

y

=

1

(1 + y)

2

CF

t

(1+ y)

t

(t

2

+ t)

(

(

t =1

N

Convexity =

1

P

c

2

P

c

2

y

FIN 509 Class session 2 23

Predicted percentage price change

Recall approximation using only duration:

The predicted percentage price change accounting for

convexity is:

AP

P

100 = D

m

*

Ay 100

AP

P

100 = D

m

*

Ay 100

( )

+

1

2

Convexity (Ay)

2

100

|

\

|

.

FIN 509 Class session 2 24

VII. Numerical example with convexity

Consider a 20-year 9% coupon bond selling at $134.6722

to yield 6%. Coupon payments are made semiannually.

D

m

= 10.98

The convexity of the bond is 164.106.

66 . 10

) 2 / 06 . 0 ( 1

98 . 10

*

=

+

=

m

D

FIN 509 Class session 2 25

Numerical example - page 2

If yields increase instantaneously from 6% to 8%, the percentage

price change of this bond is given by:

First approximation (Duration):

10.66 .02 100 = 21.32

Second approximation (Convexity)

0.5 164.106 (.02)

2

100 = +3.28

Total predicted % price change: 21.32 + 3.28 = 18.04%

(Actual price change = 18.40%.)

FIN 509 Class session 2 26

Numerical example - page 3

What if yields fall by 2%?

If yields decrease instantaneously from 6% to 4%, the percentage

price change of this bond is given by:

First approximation (Duration):

10.66 .02 100 = 21.32

Second approximation (Convexity)

0.5 164.106 (.02)

2

100 = +3.28

Total predicted price change: 21.32 + 3.28 = 24.60%

Note that predicted change is NOT SYMMETRIC.

FIN 509 Class session 2 27

VIII. Takeaways: Duration and convexity

Price approximation using only duration:

New Bond Price ($) = P + [AP (Duration)]

Price approximation using both duration and convexity:

New Bond Price ($) = P + [AP (Duration)] + [AP (Convexity)]

= P+ P D

m

*

Ay

| |

= P+ P D

m

*

Ay

| |

+ .5 P Convexity (Ay)

2

| |

Вам также может понравиться

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Duration - and - ConvexityДокумент22 страницыDuration - and - ConvexityJackNgОценок пока нет

- Interest Rate RiskДокумент25 страницInterest Rate Riskmailinh1991Оценок пока нет

- Bond RiskДокумент31 страницаBond RiskSophia ChouОценок пока нет

- Duration Convexity Bond Portfolio ManagementДокумент49 страницDuration Convexity Bond Portfolio ManagementParijatVikramSingh100% (1)

- 14 Fixed Income Portfolio ManagementДокумент60 страниц14 Fixed Income Portfolio ManagementPawan ChoudharyОценок пока нет

- Valuation of Fixed Income SecuritiesДокумент29 страницValuation of Fixed Income SecuritiesTanmay MehtaОценок пока нет

- Immunization StrategiesДокумент20 страницImmunization StrategiesnehasoninsОценок пока нет

- Gabaritorendafixa1 PDFДокумент7 страницGabaritorendafixa1 PDFhmvungeОценок пока нет

- Chapter 5 NEW Slides Interest Rate Markets2Документ28 страницChapter 5 NEW Slides Interest Rate Markets2Joe HanSik HaОценок пока нет

- Bonds Exam Cheat SheetДокумент2 страницыBonds Exam Cheat SheetSergi Iglesias CostaОценок пока нет

- Applying Duration: A Bond Hedging ExampleДокумент8 страницApplying Duration: A Bond Hedging ExampleSunil VermaОценок пока нет

- Chap010 StuДокумент24 страницыChap010 StuBingbong Magluyan MonfielОценок пока нет

- Bond Return Valuatio DurationДокумент63 страницыBond Return Valuatio DurationSambi Reddy Gari NeelimaОценок пока нет

- E136l7 Bond PricingДокумент21 страницаE136l7 Bond PricingRahul PatelОценок пока нет

- Chapter 12 Bond Portfolio MGMTДокумент41 страницаChapter 12 Bond Portfolio MGMTsharktale2828Оценок пока нет

- 435x Lecture 3 Duration-Based Strategies VfinalДокумент42 страницы435x Lecture 3 Duration-Based Strategies Vfinalarjunbusiness7012Оценок пока нет

- Ciia Final Exam 2 March 2009 - SolutionsДокумент13 страницCiia Final Exam 2 March 2009 - SolutionsDavid OparindeОценок пока нет

- Problem Set IV (9 Marks) : YTM/2) (n2)Документ5 страницProblem Set IV (9 Marks) : YTM/2) (n2)steve bobОценок пока нет

- KOCH6Документ63 страницыKOCH6Swati SoniОценок пока нет

- Bond Prices and Yields: Mcgraw-Hill/IrwinДокумент24 страницыBond Prices and Yields: Mcgraw-Hill/IrwinAshutosh KalraОценок пока нет

- 19DM511, Fixed Income SecuritiesДокумент4 страницы19DM511, Fixed Income SecuritiesSIDDHARTHA VERMA 20DM210Оценок пока нет

- Interest Rate Risk - Duration ModelДокумент28 страницInterest Rate Risk - Duration ModelRoger RogerОценок пока нет

- Fabozzi CH 04 HW AnswersДокумент6 страницFabozzi CH 04 HW AnswersKaRan KatariaОценок пока нет

- Bonds DurationДокумент31 страницаBonds DurationAashima GroverОценок пока нет

- The Analysis and Valuation of Bonds: Answers To QuestionsДокумент4 страницыThe Analysis and Valuation of Bonds: Answers To QuestionsIsmat Jerin ChetonaОценок пока нет

- The Duration MeasureДокумент38 страницThe Duration MeasureKatrina Vianca DecapiaОценок пока нет

- Risk Management Chap 9 Interest Risk II MODДокумент52 страницыRisk Management Chap 9 Interest Risk II MODYasser MishalОценок пока нет

- Chap 9 Interest Rate Risk IIДокумент123 страницыChap 9 Interest Rate Risk IIAfnan100% (3)

- CFA Level1 - Fixed Income - SS15 v2021Документ85 страницCFA Level1 - Fixed Income - SS15 v2021Carl Anthony FabicОценок пока нет

- Chapter 4 NotesДокумент3 страницыChapter 4 NotesMatt CourchaineОценок пока нет

- Fixed Income Portfolio MGMT - Butterfly SpreadsДокумент111 страницFixed Income Portfolio MGMT - Butterfly Spreadssawilson1Оценок пока нет

- Convexity and DurationДокумент20 страницConvexity and DurationNikka CasyaoОценок пока нет

- Chap 009Документ39 страницChap 009Shahrukh Mushtaq0% (1)

- Bond ValuationДокумент35 страницBond ValuationVijay SinghОценок пока нет

- Bond Duration: Derivation of Macaulay's Duration FactorДокумент9 страницBond Duration: Derivation of Macaulay's Duration Factorrohitbareja111Оценок пока нет

- 15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritiesДокумент29 страниц15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritieswelcometoankitОценок пока нет

- Chapter 06 RДокумент38 страницChapter 06 RMonalisa RevillaОценок пока нет

- Lecture 2 - Determining The Term Structure of Interest Rate Through BootstrappingДокумент3 страницыLecture 2 - Determining The Term Structure of Interest Rate Through BootstrappingPeter WuОценок пока нет

- DurationДокумент36 страницDurationnguyenlt22Оценок пока нет

- CFA Exercise With Solution - Chap 16Документ3 страницыCFA Exercise With Solution - Chap 16Fagbola Oluwatobi OmolajaОценок пока нет

- Chapter 16: Fixed Income Portfolio ManagementДокумент20 страницChapter 16: Fixed Income Portfolio ManagementSilviu TrebuianОценок пока нет

- ch9 Solutions PDFДокумент38 страницch9 Solutions PDFHussnain NaneОценок пока нет

- Fins 2624 Problem Set 3 SolutionДокумент11 страницFins 2624 Problem Set 3 SolutionUnswlegend100% (2)

- You Have To Answer Each Section Separately, Handwritten Submission Shall Be PenalisedДокумент6 страницYou Have To Answer Each Section Separately, Handwritten Submission Shall Be PenalisedDavid ViksarОценок пока нет

- 10 InclassДокумент50 страниц10 InclassTОценок пока нет

- TOPIC 1 Accounting For Financial LiabilitiesДокумент45 страницTOPIC 1 Accounting For Financial LiabilitiesZe KhaiОценок пока нет

- Topic 2 Bonds Price YieldДокумент52 страницыTopic 2 Bonds Price Yieldjason leeОценок пока нет

- IM6. Fixed IncomeДокумент42 страницыIM6. Fixed IncomeZoon KiatОценок пока нет

- CH 4Документ43 страницыCH 4Mick MalickОценок пока нет

- Chapter 3 - Interest Rates and Security ValuationДокумент26 страницChapter 3 - Interest Rates and Security ValuationNazmul Hasan Bhuyan100% (2)

- BFC5935 - Tutorial 7 SolutionsДокумент4 страницыBFC5935 - Tutorial 7 SolutionsXue XuОценок пока нет

- SFM-Ans - Unit 2 Fixed Income Securities EduДокумент14 страницSFM-Ans - Unit 2 Fixed Income Securities EduJenneey D RajaniОценок пока нет

- HW 06 CorrectionДокумент3 страницыHW 06 Correctiondhruvg14Оценок пока нет

- Matlab Bond Pricing Examples PDFДокумент5 страницMatlab Bond Pricing Examples PDFromanticos2014Оценок пока нет

- Bond Portfolio ManagementДокумент90 страницBond Portfolio ManagementAbhishek DuaОценок пока нет

- FIN221 Chapter 3 - (Q&A)Документ15 страницFIN221 Chapter 3 - (Q&A)jojojoОценок пока нет

- Valuation of Bonds and SharesДокумент45 страницValuation of Bonds and SharessmsmbaОценок пока нет

- Business Failures, Macroeconomic Risk and The E Ect ofДокумент24 страницыBusiness Failures, Macroeconomic Risk and The E Ect ofMichael OdiemboОценок пока нет

- ROIC ExplanationAndExamplesДокумент4 страницыROIC ExplanationAndExamplesMichael OdiemboОценок пока нет

- Effect of Macroeconomic Variables OnДокумент16 страницEffect of Macroeconomic Variables OnMichael OdiemboОценок пока нет

- Isitions. What Changed During The COVID-19 pandemicEmeraldInsight - Citations - 20231204123859Документ1 страницаIsitions. What Changed During The COVID-19 pandemicEmeraldInsight - Citations - 20231204123859Michael OdiemboОценок пока нет

- One Spa Excel WorksheetДокумент2 страницыOne Spa Excel WorksheetMichael OdiemboОценок пока нет

- WSP Cash Conversion Cycle - VFДокумент8 страницWSP Cash Conversion Cycle - VFMichael OdiemboОценок пока нет

- How Do You Align Your Business Operations Metrics With Your Strategic Goals and VisionДокумент6 страницHow Do You Align Your Business Operations Metrics With Your Strategic Goals and VisionMichael OdiemboОценок пока нет

- Biofuel - Rice Husk Briquette Machine - United Nations Industrial Development OrganizationДокумент7 страницBiofuel - Rice Husk Briquette Machine - United Nations Industrial Development OrganizationMichael OdiemboОценок пока нет

- Advanced Mortgage Amortization v2.0Документ20 страницAdvanced Mortgage Amortization v2.0Michael OdiemboОценок пока нет

- Break-Even Ratio Example by ZilculatorДокумент2 страницыBreak-Even Ratio Example by ZilculatorMichael OdiemboОценок пока нет

- Pages From Credit Suise-806230540Документ8 страницPages From Credit Suise-806230540Michael OdiemboОценок пока нет

- Invested Capital Formula Excel TemplateДокумент24 страницыInvested Capital Formula Excel TemplateMichael OdiemboОценок пока нет

- Break-Even Ratio Example by ZilculatorДокумент2 страницыBreak-Even Ratio Example by ZilculatorMichael OdiemboОценок пока нет

- After Tax Analysis Model v1.12Документ8 страницAfter Tax Analysis Model v1.12Michael OdiemboОценок пока нет

- County Emergency Management Form Renal Network 11 Dialysis Facility Disaster Plan ChecklistДокумент5 страницCounty Emergency Management Form Renal Network 11 Dialysis Facility Disaster Plan ChecklistMichael OdiemboОценок пока нет

- A Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation PurposesДокумент21 страницаA Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation Purposesjulita rachmadewiОценок пока нет

- 2 Business Budget Template TipsographicДокумент7 страниц2 Business Budget Template TipsographicMichael OdiemboОценок пока нет

- Advanced Mortgage Amortization v2.0Документ20 страницAdvanced Mortgage Amortization v2.0Michael OdiemboОценок пока нет

- After Tax Analysis Model v1.12Документ8 страницAfter Tax Analysis Model v1.12Michael OdiemboОценок пока нет

- 1 Simple Budget Template With Dashboard TipsographicДокумент7 страниц1 Simple Budget Template With Dashboard TipsographicMichael OdiemboОценок пока нет

- Chart Template-Kpi - Ru.enДокумент45 страницChart Template-Kpi - Ru.enMichael OdiemboОценок пока нет

- Artikel WACC Misconception and ErrorsДокумент27 страницArtikel WACC Misconception and ErrorsFerry SihalohoОценок пока нет

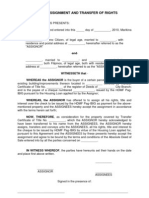

- Deed of Assignment and Transfer of RightsДокумент2 страницыDeed of Assignment and Transfer of Rightsabbeyllanes89% (76)

- Chart Template-Kpi - Ru.enДокумент45 страницChart Template-Kpi - Ru.enMichael OdiemboОценок пока нет

- LuoДокумент1 страницаLuoMichael OdiemboОценок пока нет

- Goods Food and DrinkДокумент7 страницGoods Food and DrinkMichael OdiemboОценок пока нет

- Lease Agreement Capital City001Документ4 страницыLease Agreement Capital City001Michael OdiemboОценок пока нет

- Merton Model DefinitionДокумент7 страницMerton Model DefinitionMichael OdiemboОценок пока нет

- Global Food Beverage Market Summer 2017Документ38 страницGlobal Food Beverage Market Summer 2017Titan KОценок пока нет

- Holy RosaryДокумент19 страницHoly RosaryMichael OdiemboОценок пока нет