Академический Документы

Профессиональный Документы

Культура Документы

PPP & Irp Session 6 Ifm

Загружено:

Jim MathilakathuОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

PPP & Irp Session 6 Ifm

Загружено:

Jim MathilakathuАвторское право:

Доступные форматы

International Parity Conditions

2

Introduction

Managers of multinational firms, international

investors, importers and exporters, and government

officials must deal with these fundamental issues:

Are changes in exchange rates predictable?

How are exchange rates related to interest rates?

What, at least theoretically, is the proper

exchange rate?

To answer these questions we need to first understand

the economic fundamentals of international finance,

known as parity conditions.

3

Parity Conditions

Parity Conditions provide an intuitive explanation of the

movement of prices and interest rates in different

markets in relation to exchange rates.

The derivation of these conditions requires the

assumption of Perfect Capital Markets (PCM).

no transaction costs

no taxes

complete certainty

NOTE Parity Conditions are expected to hold in the

long-run, but not always in the short term.

4

Purchasing Power Parity (PPP)

PPP is based on the notion of arbitrage across

goods markets and the basic building block of

PPP is the Law of One Price (LOP).

LOP states that the price of an identical good

should be the same in all markets (assuming no

transactions costs).

Otherwise, one could make profits by buying the

good in the cheap market and reselling it in the

expensive market.

5

The Law of One Price

LOP states that a products price may be stated in

different currency terms, but the price of the product

should remain the same.

Comparison of prices would only require conversion from

one currency to the other:

Conversely, the exchange rate could be deduced from the

relative local product prices:

$

/ $

P

P

S =

$ $

P S P =

6

LOP Example

P

wheat, Aust

= $4/bushel and P

wheat, UK

= 2.5/bushel

Spot rate (A$/) = 1.70

A$ equivalent price of wheat in UK is A$1.70/ *2.5

= $4.25/bushel

Implication: The demand for Australian wheat will

increase forcing up its price. The price of UK wheat will

drop.

wheat

UK

wheat

Aust

P S P =

/ $

7

The Big Mac Index

The most famous test is The Economist magazines

Big Mac Hamburger standard.

First launched in 1986, updated ever since.

For example, see:

http://www.oanda.com/products/bigmac/bigmac.shtml

8

9

Research on the Big Mac Index

Pakko and Pollard (1996) conclude that Big Mac PPP

holds in the long-run, but currencies can deviate from it

for lengthy periods. They note several reasons why the

Big Mac index may be flawed:

It assumes that there are NO barriers to trade.

Prices are distorted by taxes.

Profit margins may vary according to competition.

Prices of non-traded goods (real estate, utilities, labor)

are also inputs that affect production costs.

10

Working for a Big Mac

Big Mac

Price (US $)

Net Hourly

Wage (US $)

Minutes of work

to buy a Big Mac

Big Mac

Price (US $)

Net Hourly

Wage (US $)

Minutes of work

to buy a Big Mac

Argentina 1.42 1.70 50 Mexico 2.18 2.00 65

Australia 1.86 7.80 14 New Zealand 2.22 6.80 20

Brazil 1.48 2.05 43 Peru 2.28 2.20 62

Britain 3.14 12.30 15 Philippines 2.24 1.20 112

Canada 2.21 9.35 14 Poland 1.62 2.20 44

Chile 1.96 2.80 42 Russia 1.32 2.60 30

China 1.20 2.40 30 Singapore 1.85 5.40 21

Colombia 2.13 1.90 67 South Africa 1.85 3.90 28

Czech Republic 1.96 2.40 49 South Korea 2.70 5.90 27

Denmark 4.09 14.40 17 Sweden 3.60 10.90 20

Euro area 2.98 9.59 19 Switzerland 4.60 17.80 16

Hong Kong 1.47 7.00 13 Taiwan 2.01 6.90 17

Hungary 2.19 3.00 44 Thailand 1.38 1.70 49

Indonesia 1.84 1.50 74 Turkey 2.34 3.20 44

Japan 2.18 13.60 10 United States 2.71 14.30 11

Malaysia 1.33 3.10 26 Venezuela 2.32 2.10 66

11

A New Index Starbucks Index

12

Absolute PPP

A less extreme form of the Law of One Price is

ABSOLUTE PPP which says that the price of a basket

of goods should be the same in each market.

The PPP exchange rate between the two countries

should then be:

Absolute PPP:

t F

t D F D

t

PI

PI

S

,

, /

=

PI

D,t

(PI

F,t

) is the domestic (foreign) price index (e.g., consumer

price index) at time t.

13

Relative Purchasing Power Parity

Relative PPP claims that exchange rate movements

should exactly offset any inflation differential between

two countries:

Relative PPP:

F

D

t

t

+

+

=

+

1

1

S

S

D/F

t

D/F

1 t

We can also write:

F

D

t

t

+

+

=

+

1

1

S S

D/F

t

PPP

1 t

Percentage

change in

domestic prices

F

F D

t

t t

+

+

1 S

S S

D/F

t

D/F

t

D/F

1 t

14

Relative PPP

Relative PPP implies that the change in the exchange rate

will offset the difference between the relative inflation of

two countries.

The previous formula can be approximated as:

where,

D

and

F

refers to the percentage change in

domestic and foreign price levels respectively and As to

the percentage change in the exchange rate.

If domestic inflation > (<) foreign inflation, PPP predicts

the domestic currency should depreciate (appreciate).

F D

s t t = A

15

Relative PPP Example

Given inflation rates of 5% and 10% in Australia and the UK

respectively, what is the prediction of PPP with regards to $A/GBP

exchange rate?

= (0.05 0.10)/(1 + 0.10) = - 0.045 = - 4.5%

The general implication of relative PPP is that countries with

high rates of inflation will see their currencies depreciate

against those with low rates of inflation.

F

F D

t

t t

S

S S

t

t t

+

1

1

1

Relative PPP

16

How well does PPP work?

We have seen that the strictest version of PPP that all

goods and financial assets obey the law of one price is

demonstrably false.

However, there is clearly a relationship between relative

inflation rates and changes in exchange rates.

Currencies that have had the largest relative decline

(gain) in purchasing power see the sharpest erosion

(appreciation) in their foreign exchange values.

17

Relative Purchasing Power Parity

Applications of Relative PPP:

1. Forecasting future spot exchange rates.

2. Calculating appreciation in real exchange rates.

This will provide a measure of how expensive a

countrys goods have become (relative to another

countrys).

18

Forecasting Future Spot Rates

Suppose the spot exchange rate and expected inflation

rates are:

What is the expected /$ exchange rate if relative PPP

holds?

2% 5%; $; / 90 S

. . t0 /$,

= = =

Japan S U

t t

( ) $ / 43 . 87

05 . 1

02 . 1

$ / 90

1

1

$

0 , / 1 $, /

=

|

.

|

\

|

=

|

|

.

|

\

|

+

+

=

t

t

t S

PPP

t

S S

19

Real Exchange Rate

By definition, the real exchange rate measures

deviations from PPP.

That is, changes in the spot exchange rate that do not

reflect differences in inflation rates between the two

currencies in question.

Real Exchange Rate:

PPP

1 t

1 t

S

S

E

+

+

=

20

Real Exchange Rate

Appreciation/depreciation in the real exchange rate

measures deviations from PPP.

When E = 1, the denominator currency is valued correctly.

The competitiveness of this country is unaltered.

When E < 1, the denominator currency is undervalued.

Products from the other country seem expensive relative to

the base year. That is, the competitiveness of the

denominator country improves.

When E > 1, the denominator currency is overvalued.

Products from the other country seem cheap relative to the

base year. That is, the competitiveness of the denominator

country deteriorates.

21

The Fisher Effect

The international Fisher relation is inspired by the

domestic relation postulated by Irving Fisher (1930).

The Fisher effect (also called Fisher-closed) states:

This relation is often presented as a linear

approximation stating that the nominal interest rate is

equal to a real interest rate plus expected inflation:

( ) ( )( ) t t t r r i r i + + = + + = + 1 1 1

t + ~r i

22

The Fisher Effect

Applied to two different countries, like Australia and

Japan, The Fisher Effect would be stated as:

It should be noted that this requires a forecast of the

future rate of inflation, not what inflation has been in

the past.

$ $ $

i r t ~ +

t + ~ r i

23

The International Fisher Effect

The International Fisher Effect (also called Fisher-open)

states that the spot exchange rate should change to

adjust for differences in interest rates between two

countries:

F

D

F D

t

F D

t

i

i

S

S

+

+

=

+

1

1

/

/

1

24

The International Fisher Effect

The Fisher effect applied to two different countries like

Australia and Japan would be:

(1) (1+i

$

) = (1+r

$

)(1+t

$

)

(2) (1+i

) = (1+r

)(1+t

)

Dividing (1) by (2), we get:

(3)

|

|

.

|

\

|

t +

t +

|

|

.

|

\

|

+

+

=

+

+

$

1

1

r 1

r 1

i 1

i 1

= 1

25

The International Fisher Effect

If real interest rates are equalized across countries, then

for equation (3) we get r

$

= r

:

(4)

$

1

1

i 1

i 1

t +

t +

=

+

+

(5)

$

1 1 t

t t

+

=

+

i

i i

Remember this?

F

F D

t

t t

S

S S

t

t t

+

+

1

1

F

F D

t

t t

i

i i

S

S S

+

+

1

1

International Fisher:

E(S

t+1

)

26

Tests of the International Fisher Effect

Empirical tests lend some support to the relationship

postulated by the international Fisher effect (currencies

with high interest rates tend to depreciate and currencies

with low interest rates tend to appreciate), although

considerable short-run deviations occur.

27

Interest Rate Parity

Interest rate parity (IRP) is an arbitrage condition that

provides the linkage between the foreign exchange

markets and the international money markets.

f

d

t

t t

i

i

S

F

+

+

=

+

1

1

1 ,

where, F

t

and S

t

are the forward and spot rates and i

d

and i

f

are domestic and foreign interest rates

respectively.

Interest Rate Parity (IRP)

28

Interest Rate Parity

The approximate form of IRP says that the % forward

premium equals the difference in interest rates.

f d

t

t t

i i

S

F

~

+

1

1 ,

In general, the currency trading at a forward premium

(discount) is the one from the country with the lower

(higher) interest rate.

Approximation of IRP

f d

t

t t t

i i

S

S F

~

+1 ,

29

Interest Rate Parity An Example

Basic idea: Two alternative ways to invest funds over

same time period should earn the same return.

Suppose the 3-month money market rate is 8% p.a. (2%

for 3-months) in the U.S. and 4% p.a. (1% for 3-

months) in Switzerland, and the spot exchange rate is

SFr1.48/$.

The 3-month forward rate must be SFr1.4655/$ to

prevent arbitrage opportunities (i.e., interest rate parity

must hold).

30

The Example Continued

90 days

S = SF 1.4800/$

SF 1,480,000

Dollar money market

$1,000,000 $1,020,000 1.02

Start End

i

$

= 8.00 % per annum

(2.00 % per 90 days)

Swiss franc money market

SF 1,494,800 1.01

i

SF

= 4.00 % per annum

(1.00 % per 90 days)

F

90

= SF 1.4655/$

$1,019,993

*

* Rounding error.

31

Interest Rate Parity: Why It Holds

This must hold by arbitrage. Otherwise riskless profits

could be made. This is known as covered interest

arbitrage (CIA) and occurs whenever IRP does not

hold. CIA can involve the following steps:

Borrow the domestic currency;

Exchange the domestic currency for the

foreign currency in the spot market;

Invest the foreign currency in an interest-

bearing instrument; and then

Sign a forward contract to lock in a future exchange rate

at which to convert the foreign currency proceeds back to

the domestic currency.

Вам также может понравиться

- HCMДокумент17 страницHCMJim MathilakathuОценок пока нет

- Scheme & Syllabus For PHD Entrance Test in ManagementДокумент8 страницScheme & Syllabus For PHD Entrance Test in ManagementDar UbeasОценок пока нет

- O M 2 .2production Planning and ControlДокумент26 страницO M 2 .2production Planning and ControlJim MathilakathuОценок пока нет

- OM2.1plant Location and LytДокумент66 страницOM2.1plant Location and LytJim MathilakathuОценок пока нет

- Functions of The Handling SystemДокумент51 страницаFunctions of The Handling SystemJim MathilakathuОценок пока нет

- Finanacial Restructuring 2Документ48 страницFinanacial Restructuring 2Jim Mathilakathu100% (2)

- OM 2. 4inventorycontroДокумент26 страницOM 2. 4inventorycontroJim MathilakathuОценок пока нет

- Business Ethics 2333Документ15 страницBusiness Ethics 2333Jim MathilakathuОценок пока нет

- Dividends and Dividend PolicyДокумент24 страницыDividends and Dividend Policyfalak_praveen4928Оценок пока нет

- Aggregate Production PlanningДокумент27 страницAggregate Production PlanningJim MathilakathuОценок пока нет

- Supply Chain ManagementДокумент76 страницSupply Chain Managementsreejith_eimt13Оценок пока нет

- Operations ResearchДокумент1 страницаOperations ResearchJim MathilakathuОценок пока нет

- SHR PlanningДокумент21 страницаSHR PlanningJim MathilakathuОценок пока нет

- Exchange Rate RegimeДокумент5 страницExchange Rate RegimeNaman DugarОценок пока нет

- Economis and GovernmentДокумент63 страницыEconomis and GovernmentJim MathilakathuОценок пока нет

- Aggregate Production Planning - Lecture NotesДокумент16 страницAggregate Production Planning - Lecture NotesJim Mathilakathu100% (1)

- Financial Accounting RWДокумент592 страницыFinancial Accounting RWJim MathilakathuОценок пока нет

- Consumer Protection Act GahlotДокумент21 страницаConsumer Protection Act GahlotSwati KamtheОценок пока нет

- Tender Pricing StrategyДокумент35 страницTender Pricing StrategyWan Hakim Wan Yaacob0% (1)

- 3 Impact of Reforms in Capital Market On Indian Capital MarketДокумент29 страниц3 Impact of Reforms in Capital Market On Indian Capital MarketJim MathilakathuОценок пока нет

- Caion-Demaestri Freedberg OverpopulationpresentationДокумент21 страницаCaion-Demaestri Freedberg OverpopulationpresentationJim MathilakathuОценок пока нет

- Time StudyДокумент40 страницTime StudySazid Rahman100% (1)

- Einstein 10 LessonsДокумент26 страницEinstein 10 LessonsKrishnamurthy Prabhakar100% (1)

- 42 AmalgamationДокумент10 страниц42 AmalgamationRoopa RoyОценок пока нет

- ERV English Bible 20 ProverbsДокумент21 страницаERV English Bible 20 ProverbsJim MathilakathuОценок пока нет

- Public FinnceДокумент57 страницPublic FinnceJim MathilakathuОценок пока нет

- And Budget Management (FRBM) Bill in December 2000. in This Bill Numerical Targets ForДокумент11 страницAnd Budget Management (FRBM) Bill in December 2000. in This Bill Numerical Targets ForJim MathilakathuОценок пока нет

- GFHДокумент1 страницаGFHJim MathilakathuОценок пока нет

- Monetary PolicyДокумент24 страницыMonetary PolicySwati AgarwalОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Tulip Mania ScriptДокумент7 страницTulip Mania ScriptafzalkhanОценок пока нет

- Valuation of SAIF POWERTEC Limited: Analysis of Financial Investment Course Code: F-307Документ23 страницыValuation of SAIF POWERTEC Limited: Analysis of Financial Investment Course Code: F-307Farzana Fariha LimaОценок пока нет

- Exercise 1 WaccДокумент1 страницаExercise 1 WaccGazelle CalmaОценок пока нет

- Unit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToДокумент56 страницUnit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToAudit MarathonОценок пока нет

- Arbor Final ReportДокумент17 страницArbor Final Reportapi-583299179Оценок пока нет

- Investor's Perception Towards The Reliance Mutual FundsДокумент83 страницыInvestor's Perception Towards The Reliance Mutual FundsmanuОценок пока нет

- Chapter 13Документ11 страницChapter 13MekeniMekeniОценок пока нет

- Mutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToДокумент43 страницыMutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToNidhi Kaushik100% (1)

- Sources of Financing A ProjectДокумент8 страницSources of Financing A ProjectAbhijith PaiОценок пока нет

- Share Structure QuestionsДокумент18 страницShare Structure QuestionsmikiОценок пока нет

- 06 - Raising Equity CapitalДокумент46 страниц06 - Raising Equity CapitalAnurag PattekarОценок пока нет

- Adeel BMДокумент27 страницAdeel BMttsopalОценок пока нет

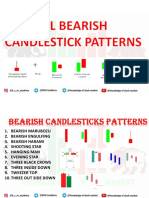

- All Bearish Candle Stick PatternsДокумент18 страницAll Bearish Candle Stick PatternsxhghdghОценок пока нет

- John Robert Maniego (CV)Документ2 страницыJohn Robert Maniego (CV)Youcan B StreetsmartОценок пока нет

- Uncertainty and Consumer BehaviorДокумент118 страницUncertainty and Consumer BehaviorPhuong TaОценок пока нет

- 358763050Документ15 страниц358763050kristelle0marisseОценок пока нет

- The Magic of Pension Accounting, Part IIIДокумент160 страницThe Magic of Pension Accounting, Part IIIMUNAWAR ALIОценок пока нет

- List of Valuation ReportsДокумент18 страницList of Valuation ReportsBhavin SagarОценок пока нет

- Acturial AnalysisДокумент14 страницActurial AnalysisRISHAB NANGIAОценок пока нет

- Chapter1 - Return CalculationsДокумент37 страницChapter1 - Return CalculationsChris CheungОценок пока нет

- Laporan Keuangan Nasi LiwetДокумент116 страницLaporan Keuangan Nasi Liwetnirmaya esthiОценок пока нет

- 0205 ReposedДокумент45 страниц0205 ReposedLameuneОценок пока нет

- Risk ManagementДокумент21 страницаRisk ManagementAndreeaEne100% (2)

- Ev Standard AnalyticsДокумент7 страницEv Standard AnalyticsDavid ShapiroОценок пока нет

- Goldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldДокумент109 страницGoldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldPol BernardinoОценок пока нет

- Introduction To Security MarketДокумент41 страницаIntroduction To Security MarketdeeptiОценок пока нет

- David Hillier (2019)Документ12 страницDavid Hillier (2019)eriwirandanaОценок пока нет

- HW 1, FIN 604, Sadhana JoshiДокумент40 страницHW 1, FIN 604, Sadhana JoshiSadhana JoshiОценок пока нет

- Free Mock For Jaiib & CaiibДокумент6 страницFree Mock For Jaiib & CaiibsandeepОценок пока нет

- Business Incubation CenterДокумент40 страницBusiness Incubation CenterFati ma100% (1)