Академический Документы

Профессиональный Документы

Культура Документы

Mutual Fund ppt04

Загружено:

Raj GuptaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mutual Fund ppt04

Загружено:

Raj GuptaАвторское право:

Доступные форматы

PART 2

By:-Brijesh lakho

MONEY MARKET MUTUAL FUNDS (MMMF)

the Reserve Bank of India (RBI) permitted the establishment of the Money Market Mutual Funds (MMMF) in the year 1992. The basic idea is the deployment of mutual funds' surplus funds in the money market. MMMF ensures high liquidity, adequate surety and high returns.

RBI GUIDELINES (23.11.1995)

MMMFs can be launched by banks, public financial institutions and private sector MFs. Units of MMMF can be issued to individuals only. No minimum return can be assured by the MMMF Minimum lock-in period is 15 days

RBI GUIDELINES (23.11.1995)

MMMF can be set up with the approval of the RBI only while private sector ones with the approval of the SEBI. Shares and units issued by the MMMF are subject to stamp duty. Funds received by the MMMF can be invested only in Treasury Bills, Government of India securities dated with an unexpired maturity up to one year, call loans to banks, CDs and CPs.

RBI GUIDELINES (23.11.1995)

MMMF should have a minimum investment of 25 per cent in the Treasury Bills and dated government securities minimum investment in call loans 30%, commercial bills 20% and CPS 15% (maximum exposure to a single company cannot be more than 3 per cent). RBI announced on 22-10-1997 that they can invest in rated corporate bonds and debentures, with residual maturity of up to one year.

UTI'S MONEY MARKET MUTUAL FUND (23.4.1997)

The Unit Trust of India (UTI) launched its Maiden Money Market Mutual fund (MMMF) on 23.4.1997. The minimum subscription amount has been pegged at Rs.10,000. The fund comes without a sale and redemption load with a nominal fee of Rs.20 charged for redemption transactions according to the RBI guidelines.

UTI'S MONEY MARKET MUTUAL FUND (23.4.1997)

MMMF can invest in money market instruments, but it has to have a lock-in period of 30 days. This is done to prevent competition to bank deposits.

COLLECTIVE INVESTMENT SCHEMES (CIS)

Under the SEBI Act and Regulations, no person can carry on any CIS unless he obtains a certificate of registration from SEBI. All existing collective investment schemes were required to apply for registration by December 14,1999. An existing scheme which does not obtain registration from SEBI shall have to wind-up and repay the money to the investors.

Salient features of collective investment schemes: CIS includes any schemes or arrangement with respect to property of any description, which enables investors to participate in the scheme by way of subscriptions and to receive profits or income or produce arising from the management of such property. Schemes structured for investment in shares/bonds and other marketable securities would not be treated as CIS.

LIST OF MUTUAL FUND COMPANIES IN INDIA

Public companies:UTI (1964 State Bank of India (SBI) (1987) Reliance Mutual Funds Bank of Baroda Canara Bank

Private companies:Kotak Mahindra ING saving MF Escort India MF CEAT MF Indus Ind MF

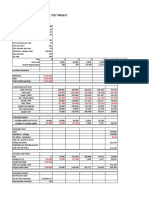

RETURN FROM MUTUAL FUNDS

Dividends Capital Gains Increase or Decrease in NAV MUTUAL FUND HOLDER'S ACCOUNT

Regular Account Accumulation Account Withdrawal Account Setting up Mutual Funds

FREQUENTLY USED TERMS

Net Asset Value (NAV) Sale Price Repurchase Price Valuation of Unit

Total market value of assets, or securities in the portfolio, of the fund Liabilities

NAV=

Number of funds units (shares) outstanding

(Market value of assets Liabilities excluding contingent liabilities, initial share capital, reserves & unit capital)+ (brokerage charges, commission .tax, stamp duties, other management & administrative expenses)

Sale Price =

Number of units outstanding

BUYING MUTUAL FUNDS

Contacting the Asset Management Company directly Agents/Brokers Financial planners Insurance agents Banks Online Trading Account

Вам также может понравиться

- Profit CentersДокумент22 страницыProfit CentersRaj GuptaОценок пока нет

- Fullservices Marketing 101121121554 Phpapp01Документ132 страницыFullservices Marketing 101121121554 Phpapp01Raj GuptaОценок пока нет

- MCS Wilson ND BinoyДокумент20 страницMCS Wilson ND BinoyRaj GuptaОценок пока нет

- P S T R: AT South Eastern Coalfields Limited (C.G.)Документ16 страницP S T R: AT South Eastern Coalfields Limited (C.G.)Raj Gupta100% (1)

- Simple Perovskites Have An ABX3 StoichiometryДокумент5 страницSimple Perovskites Have An ABX3 StoichiometryRaj GuptaОценок пока нет

- Summer Training Report On: (Evaluation of Capital Using Capital Budgeting Techniques)Документ1 страницаSummer Training Report On: (Evaluation of Capital Using Capital Budgeting Techniques)Raj GuptaОценок пока нет

- PotentialДокумент40 страницPotentialRaj GuptaОценок пока нет

- "Advertising Appeal Is An Attempt atДокумент64 страницы"Advertising Appeal Is An Attempt atRaj GuptaОценок пока нет

- Manual 26Документ6 страницManual 26Raj GuptaОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- DILG BNEO PresentationДокумент119 страницDILG BNEO PresentationNlNl Palmes Bermeo0% (1)

- Accounting CycleДокумент15 страницAccounting Cyclearubera2010Оценок пока нет

- 1 The Importance of Business ProcessesДокумент17 страниц1 The Importance of Business ProcessesFanny- Fan.nyОценок пока нет

- Mengelola Keuangan Kegiatan MiceДокумент7 страницMengelola Keuangan Kegiatan MiceGabriella Eldiva NoorОценок пока нет

- Investing in MusicДокумент32 страницыInvesting in MusicBMX Entertainment CorporationОценок пока нет

- Customer Profitability Analysis: F.M.KapepisoДокумент9 страницCustomer Profitability Analysis: F.M.Kapepisotobias jОценок пока нет

- Indirect TaxesДокумент4 страницыIndirect TaxesArwa Makharia ChharchhodaОценок пока нет

- An Assignment ON Wealth Management Organisation: Submitted by S. Ramnath (098004100038) Ii Mba-BimДокумент5 страницAn Assignment ON Wealth Management Organisation: Submitted by S. Ramnath (098004100038) Ii Mba-Bimanon_552306714Оценок пока нет

- Sbi-Sme-Mudra Application FormsДокумент8 страницSbi-Sme-Mudra Application FormsGaurav PawarОценок пока нет

- L6 P2 Fed Tapering v3Документ34 страницыL6 P2 Fed Tapering v3Ajay SinghОценок пока нет

- Cash Flow TheoryДокумент50 страницCash Flow TheoryJovelyn ManlucobОценок пока нет

- Capital Budgeting Example ExcelДокумент1 страницаCapital Budgeting Example ExcelNgoc Hong DuongОценок пока нет

- FinanceДокумент3 страницыFinanceAbrarОценок пока нет

- CG European Capital Growth Fund: StrategyДокумент2 страницыCG European Capital Growth Fund: Strategyapi-25889552Оценок пока нет

- IDBI Bank Result UpdatedДокумент13 страницIDBI Bank Result UpdatedAngel BrokingОценок пока нет

- Centrum Broking Limited: Institutional EquitiesДокумент53 страницыCentrum Broking Limited: Institutional EquitiesgirishrajsОценок пока нет

- Management Brief - Difference Between Carbon Tax & Cap and Trade ModelsДокумент3 страницыManagement Brief - Difference Between Carbon Tax & Cap and Trade Modelsapi-283791078Оценок пока нет

- Theresa Wulff ResumeДокумент3 страницыTheresa Wulff ResumemomnpopОценок пока нет

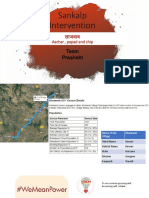

- Sankalp Intervention: Team PrashaktДокумент39 страницSankalp Intervention: Team PrashaktSanjanaОценок пока нет

- Choiseul Top100 2019Документ64 страницыChoiseul Top100 2019JM KoffiОценок пока нет

- Cross Border Transactions HandbookДокумент232 страницыCross Border Transactions Handbookralphhvillanueva100% (2)

- Chennai CDP ReviewДокумент11 страницChennai CDP Reviewbadshah3Оценок пока нет

- What Are SMEДокумент13 страницWhat Are SMEsandsoni2002Оценок пока нет

- As Samra Project Expansion (From CC)Документ4 страницыAs Samra Project Expansion (From CC)Jason McCoyОценок пока нет

- Annual Report KAEFДокумент384 страницыAnnual Report KAEFNatasya EdyantoОценок пока нет

- Working Capital Management at BEMLДокумент20 страницWorking Capital Management at BEMLadharav malikОценок пока нет

- IFCIДокумент14 страницIFCIabhijeet0905Оценок пока нет

- Difference Between EVA and ROIДокумент6 страницDifference Between EVA and ROINik PatelОценок пока нет

- Acct 2301 Spring 2010 TestДокумент6 страницAcct 2301 Spring 2010 Testamittutorials1985Оценок пока нет

- HPSEBL Shimla ContactsДокумент52 страницыHPSEBL Shimla ContactsManoj ManhasОценок пока нет