Академический Документы

Профессиональный Документы

Культура Документы

Managerial Accounting

Загружено:

Deepak KumarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Managerial Accounting

Загружено:

Deepak KumarАвторское право:

Доступные форматы

The total costing is under the purview of head office in kolkata. Emami produces 500-1000 units on an average.

. Batch Costing Each batch is termed as bomb and has a batch & identity Code

Cost Budget

They take into consideration WIP costs which includes overhead costs(labour cost, maintainence cost upto 8%), packaging costs, costs including ingredients etc.

Batch costing is used when articles are produced in definite batches & kept in stock. When Certain characteristics of goods are uniform. Applicability of Batch Costing The capacity of units is less than the number of units produced.

Costs

Setting up costs

Carrying Costs

Where, A= Total quantity demand in a specific period. C1= Holding Cost per unit period. C2= Set up cost of each batch.

Where, D= Annual Demand of the product. S= Setting up cost per batch. I= Annual rate of interest. C= Unit cost of production.

Identification

Budget

Production Planning

Operational Efficiency

Expensive

Clerical errors

General Policy : provisions of the Companies Act, 1956 and the Accounting Standards notified in Companies (Accounting Standards) Rules 2006, to the extent applicable. Fixed Assets : They are stated at cost less Depreciation. Interest and other financial charges on loans borrowed specifically for acquisition of capital assets are capitalised till the start of commercial production. all pre-operative and trial run expenditure (net of realisation, if any) are capitalised. Intangible Assets : The intangible assets are carried at cost less accumulated amortisation and accumulated impairment losses. Depreciation and Amortisation Tangible Assets : straight line method, except for the assets of Vapi, Dongari and Masat units for which depreciation is provided on written down value method, at the rates and in the manner prescribed under Schedule XIV of the Companies Act, 1956

Investments: Long Term Investments are stated at cost. Current Investments are stated at cost or fair value whichever is lower. Diminution in value of long term investments other than temporary in nature is charged to Statement of Profit & Loss. Inventories : The inventories are valued at cost or net realisable value whichever is lower except for work in progress and advertising material which are valued at cost Voluntary Retirement Scheme Expenditure : incurred on voluntary retirement scheme is charged to profit in the year in which it is incurred. Sales : It includes duty drawback, license premium on exports, Sales Tax and are recorded net of Trade discounts and other rebates. Excise duty: payable on products is accounted for at the time of despatch of goods from the factories and is included in stocks held at the year end.

Вам также может понравиться

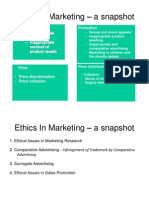

- Ethical Issues in MarketingДокумент30 страницEthical Issues in MarketingDeepak KumarОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Mobile Banking in IndiaДокумент14 страницMobile Banking in IndiaDeepak KumarОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Friendly IcecreamДокумент27 страницFriendly IcecreamDeepak KumarОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Distribution Channel - Tyre Industry: Tyre Sourcing Units Tubes/flaps SourcingДокумент1 страницаDistribution Channel - Tyre Industry: Tyre Sourcing Units Tubes/flaps SourcingDeepak KumarОценок пока нет

- Depreciation and Fixed AssetsДокумент10 страницDepreciation and Fixed AssetsDeepak KumarОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Output or Unit Costing (Cost Sheet)Документ8 страницOutput or Unit Costing (Cost Sheet)Deepak KumarОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Case Study TopicsДокумент3 страницыCase Study TopicsDeepak KumarОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Semantic Web: (An Introduction)Документ39 страницSemantic Web: (An Introduction)Deepak KumarОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Mount Vernon City School District AuditДокумент47 страницMount Vernon City School District AuditSamuel L. RiversОценок пока нет

- Accounting, Budgeting and Control Systems in Their Organizational Context: Theoretical and Empirical PerspectivesДокумент1 страницаAccounting, Budgeting and Control Systems in Their Organizational Context: Theoretical and Empirical Perspectivesrhynos loversОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- ACT 5060 MidtermДокумент20 страницACT 5060 MidtermAarti JОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Financing Health Systems in 21st Century - SchieberДокумент18 страницFinancing Health Systems in 21st Century - SchieberGauri GavaliОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Annual Investment Program-2018Документ3 страницыAnnual Investment Program-2018Shy Pantinople100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Goal Setting WorkshopДокумент8 страницGoal Setting WorkshopRod HyattОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Project Management ApproachДокумент34 страницыProject Management ApproachMbavhalelo100% (1)

- SITXFIN004 Assessment Task 1Документ17 страницSITXFIN004 Assessment Task 1Ishaak DinОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The BSP Seal LatestДокумент5 страницThe BSP Seal LatestJess Francis LicayanОценок пока нет

- Exercise Chapter 6Документ3 страницыExercise Chapter 6Siti AishahОценок пока нет

- MGT 209 - CH 12 NotesДокумент5 страницMGT 209 - CH 12 NotesAmiel Christian MendozaОценок пока нет

- Question and AnswerДокумент2 страницыQuestion and AnswerAbdelnasir HaiderОценок пока нет

- Public Tourism Promotion ROI: Cutting The Promotional Budget Is Tempting Is It Worth It?Документ12 страницPublic Tourism Promotion ROI: Cutting The Promotional Budget Is Tempting Is It Worth It?Ken McGillОценок пока нет

- Book 2Документ4 страницыBook 2maurОценок пока нет

- Sangguniang Kabataan Annual Budget: Annex AДокумент1 страницаSangguniang Kabataan Annual Budget: Annex AJONA MAPALOОценок пока нет

- February 14, 2011 IssueДокумент12 страницFebruary 14, 2011 IssueThe Brown Daily HeraldОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- GFR and Advances: Made ObjectiveДокумент48 страницGFR and Advances: Made ObjectiveSurendra Sharma78% (27)

- 10 - 2 - Judicial Review and Money BillsДокумент36 страниц10 - 2 - Judicial Review and Money BillsSharjeel AhmadОценок пока нет

- Market-Based Transfer Prices 2. Cost-Based Transfer Prices 3. Negotiated Transfer PricesДокумент10 страницMarket-Based Transfer Prices 2. Cost-Based Transfer Prices 3. Negotiated Transfer PricesvmktptОценок пока нет

- Public Finance 3 Performance Based BudgetingДокумент22 страницыPublic Finance 3 Performance Based BudgetingAnshu Kumar SrivastavaОценок пока нет

- 2015 SURE Program - BillДокумент8 страниц2015 SURE Program - Billmateto_2014Оценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- CostДокумент126 страницCostAbbie PuraОценок пока нет

- Budget TechniquesДокумент15 страницBudget TechniquesrachitcreativeОценок пока нет

- Budget and Budgetary ControlДокумент13 страницBudget and Budgetary ControlMaheshKumarChinniОценок пока нет

- Maharashtra Act No. Xliv of 1975Документ13 страницMaharashtra Act No. Xliv of 1975anaamikaaОценок пока нет

- Appropriation Ordinance For The Supplemental BudgetДокумент2 страницыAppropriation Ordinance For The Supplemental BudgetJohn Iver BasaОценок пока нет

- Paper - 4: Cost Accounting and Financial Management QuestionДокумент27 страницPaper - 4: Cost Accounting and Financial Management QuestionJerry HuffmanОценок пока нет

- 2009-09-06 125024 MmmmekaДокумент24 страницы2009-09-06 125024 MmmmekathenikkitrОценок пока нет

- Management Accounting II 0405Документ29 страницManagement Accounting II 0405api-26541915Оценок пока нет

- Project Planning, Appraisal and Control - 1 PDFДокумент117 страницProject Planning, Appraisal and Control - 1 PDFArchna RaiОценок пока нет