Академический Документы

Профессиональный Документы

Культура Документы

Accounting For and Presentation of Owners' Equity

Загружено:

danterozaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounting For and Presentation of Owners' Equity

Загружено:

danterozaАвторское право:

Доступные форматы

8-1

CHAPTER 8

Accounting for and Presentation of Owners Equity

McGraw-Hill/Irwin

2008 The McGraw-Hill Companies, Inc., All Rights Reserved.

8-2

What Should You Learn in Chapter 8?

1. The characteristics of common stock and how common stock is presented in the balance sheet. 2. What preferred stock is, what its advantages and disadvantages to the corporation are, and how it is presented in the balance sheet. 3. The accounting for a cash dividend and the dates involved in dividend transactions. 4. What stock dividends and stock splits are and why each is used.

8-3

What Should You Learn in Chapter 8?

5. What the components of accumulated other comprehensive income (loss) are and why these items appear in owners equity. 6. What treasury stock is, why it is acquired, and how treasury stock transactions affect owners equity.

8-4

Nature of Owners Equity

Less

Total Owners Equity Paid-in Capital Retained Earnings Common Stock

Par or Stated Value Additional Paid-In Capital

Treasury Stock Preferred Stock

Par or Stated Value

Additional Paid-In Capital

8-5

LO1

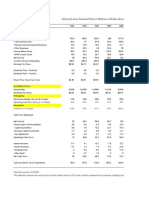

Owners Equity Section

Owners' Equity Paid-in capital Common stock $1 par, 100,000 shares issued and 95,000 outstanding Additional paid-in capital Total paid-in capital Retained earnings Total paid-in capital and retained earnings Less: cost of treasury stock (5,000 shares) Total owners' equity

100,000 2,800,000 2,900,000 1,400,000 4,300,000 (150,000) $ 4,150,000

8-6

LO1

Paid-in Capital

Common Stock

On January 01, 2008, Matrix, Inc. issued 100,000 of its $3 par value common stock for $14 per share. The following entry is recorded:

GENERAL JOURNAL Date Account Titles and Explanation 2008 Jan. 1 Cash Common stock Additional-paid-in-capital Debit 1,400,000 300,000 1,100,000 Credit

This transaction has the following effect on the financial statements of Matrix:

Balance Sheet Assets Cash +1,400,000 = Liabilities + Owners' Equity Common Stock +300,000 Additional Paid-in Capital +1,100,000 Net income = Income Statement Revenues Expenses

8-7

LO1

Common Stock

Issued shares that have been reacquired. Treasury

Unissued

Issued shares include outstanding and treasury shares.

Authorized Shares

Outstanding Issued shares that are owned by shareholders.

8-8

LO2

Preferred Stock

Normally no voting rights, but dividend payment has preference over common stock. Has a par or stated value with dividend expressed as a percent of par.

If callable, may be retired. If convertible, may be exchanged for common shares.

8-9

LO2

Preferred Stock

Normally, preferred stock is cumulative meaning that all dividends must be paid before any dividends can be paid to common shareholders.

Preferred may be noncumulative. If dividends are not paid, the company is not required to make-up the missed dividends.

Matrix, Inc. has 50,000, $100 par value, 6%, cumulative preferred stock outstanding. Calculate the annual dividend on the stock. 50,000 $100 = $5,000,000 total par 6% = $300,000 dividend

8-10

LO2

Preferred Stock Versus Bonds

Comparison of Preferred Stock and Bonds Payable Similarities Preferred Stock Bonds Payable Dividend is usually fixed Interest is fixed claim to claim to income income Redemption value is fixed Maturity value is a fixed claim claim to assets to assets Is usually callable and may be Is usually callable and may be convertible convertible Differences Dividend may be skipped, Interest must be paid or firm even if it must be caught up faces bankruptcy before payments to common Principal must be paid at No maturity date maturity Dividends are not an Interest is a tax deductible expense and are not tax expense deductible

8-11

LO1+2

Additional Paid-in Capital

Represents the excess of the amount received from the sale of preferred or common stock over par (or stated) value

8-12

LO1+2

Retained Earnings

Represents the cumulative earnings of a corporation less the cumulative dividends paid since the business started operations.

Retained earnings is NOT cash.

8-13

LO3

Cash Dividends

The company must have sufficient cash and retained earnings to pay the dividend.

Dividends must be declared by the board of directors before they can be legally paid.

The company is not legally required to pay dividends, but once declared a legal liability is created

8-14

LO3

Cash Dividend

On January 5, 2008, the Board of Directors of Matrix, Inc. declares a cash dividend of $1 per share on the 500,000 shares of common stock outstanding. The dividend is payable to stockholders of record on February 5, and will be paid on March 5.

Date of declaration Jan. 5

GENERAL JOURNAL Date Account Titles and Explanation 2008 Jan. 5 Retained earnings Dividends payable Debit 500,000 500,000 Credit

Balance Sheet Assets = Liabilities Dividends payable +500,000 + Owners' Equity Retained earnings 500,000 Net income =

Income Statement Revenues Expenses

8-15

LO3

Cash Dividend

On January 5, 2008, the Board of Directors of Matrix, Inc. declares a cash dividend of $1 per share on the 500,000 shares of common stock outstanding. The dividend is payable to stockholders of record on February 5, and will be paid on March 5.

Date of record Feb. 5

8-16

LO3

Cash Dividend

On January 5, the Board of Directors of Matrix, Inc. declares a cash dividend of $1 per share on the 500,000 shares of common stock outstanding. The dividend is payable to stockholders of record on February 5, and will be paid on March 5.

Date of payment Mar. 5

GENERAL JOURNAL Date Account Titles and Explanation 2008 Mar. 5 Dividends payable Cash Debit 500,000 500,000 Credit

Balance Sheet Assets Cash 500,000 = Liabilities Dividends payable 500,000 + Owners' Equity Net income =

Income Statement Revenues Expenses

8-17

LO4

Stock Dividends

Distribution of additional shares of stock to stockholders.

No change in par value of stock or in total stockholders equity.

Stockholders retain percentage ownership in the company (preemptive right)

Reasons for stock dividends: Preserve cash. Decrease market price of stock. Reduce retained earnings.

8-18

LO4

Stock Dividend

Large Stock Dividend

Stock dividend more than 25% of the outstanding shares.

Small Stock Dividend

Stock dividend less than 25% of outstanding shares.

Record at current market value of stock.

Record at par or stated value of stock.

8-19

LO4

Stock Dividend

On May 10, 2008, Matrix, Inc. declares and distributes a 2% stock dividend on its 500,000 common shares outstanding. Par value is $1.00 per share and the current market value is $17 per share.

GENERAL JOURNAL Date Account Titles and Explanation 2008 May 10 Retained earnings Common stock Additional paid-in-capital Debit 170,000 10,000 160,000 Credit

Common shares outstanding 500,000 Dividend rate 2% New shares issued 10,000 Market price per share $ 17 Value of dividend $ 170,000

8-20

LO4

Stock Dividend

On May 10, 2008, Matrix, Inc. declares and distributes a 2% stock dividend on its 500,000 common shares outstanding. Par value is $1.00 per share and the current market value is $17 per share.

GENERAL JOURNAL Date Account Titles and Explanation 2008 May 10 Retained earnings Common stock Additional paid-in-capital Debit 170,000 10,000 160,000 Credit

Balance Sheet Assets = Liabilities + Owners' Equity Retained earnings 170,000 Common stock +10,000 Additional paid-in capital +160,000 Net income =

Income Statement Revenues Expenses

8-21

LO4

Stock Split

Increase the number of shares outstanding. Decrease the par value per share.

No change to total stockholders equity.

No journal entry required.

8-22

LO4

Stock Split

Matrix, Inc. has 300,000 shares of $1 par value common stock outstanding before a 2for1 stock split.

Before Split After Split 300,000 2 600,000 $ 1.00 2 $ 0.50 $ 300,000 $ 300,000

Common Shares Par Value per Share Total Par Value

8-23

LO5

Other Comprehensive Income

A new category in owners equity called accumulated other comprehensive income (loss) includes the following unrealized changes to owners equity:

1. Cumulative foreign currency translation adjustments, 2. Unrealized gains or losses on available-for-sale investments, net of related income taxes, 3. Additional minimum pension liability adjustments, net of related income taxes.

8-24

LO6

Treasury Stock

On July 25, 2008, Matrix, Inc. repurchases 5,000 of its common shares in the open market for $30 per share.

GENERAL JOURNAL Date Account Titles and Explanation 2008 July 25 Treasury stock Cash Debit 150,000 150,000 Credit

Balance Sheet Assets Cash 150,000 = Liabilities + Owners' Equity Treasury stock 150,000 Net income =

Income Statement Revenues Expenses

Contra owners equity account

8-25

LO6

Treasury Stock

On Aug. 30, 2008, Matrix, Inc. resells 2,000 of its treasury stock in the open market for $35 per share.

GENERAL JOURNAL Date Account Titles and Explanation 2008 Aug. 30 Cash Treasury stock Aditional paid-in capital Debit 70,000 60,000 10,000 Credit

2,000 $30 cost per share

Balance Sheet Assets Cash +70,000 = Liabilities + Owners' Equity Treasury stock +60,000 Additional paid-in capital +10,000 Net income = Income Statement Revenues Expenses

8-26

End of Chapter 8

Вам также может понравиться

- Financial Statements and Accounting Concepts/PrinciplesДокумент30 страницFinancial Statements and Accounting Concepts/PrinciplesdanterozaОценок пока нет

- What We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingДокумент39 страницWhat We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingSunil Kumar SahooОценок пока нет

- Chap 13Документ33 страницыChap 13Boo LeОценок пока нет

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsОт EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Chap 002Документ16 страницChap 002species09Оценок пока нет

- Retained Earnings, Treasury Stock, and The Income StatementДокумент43 страницыRetained Earnings, Treasury Stock, and The Income Statementshiawsyan_chanОценок пока нет

- Elliott Homework Week1Документ8 страницElliott Homework Week1Juli ElliottОценок пока нет

- Chap 012Документ39 страницChap 012lunara_sОценок пока нет

- ACC1002X Optional Questions - SOLUTIONS CHP 10Документ5 страницACC1002X Optional Questions - SOLUTIONS CHP 10edisonctrОценок пока нет

- The Corporate Form of OrganizationДокумент7 страницThe Corporate Form of OrganizationRabie HarounОценок пока нет

- Taller Cuatro Acco 112Документ35 страницTaller Cuatro Acco 112api-274120622Оценок пока нет

- Chapter 16 Day 1 EPS - ComplexДокумент5 страницChapter 16 Day 1 EPS - Complexgilli1trОценок пока нет

- AS20Документ10 страницAS20Selvi balanОценок пока нет

- Principles of Accounting Chapter 12Документ40 страницPrinciples of Accounting Chapter 12myrentistoodamnhigh100% (2)

- Chapter 13Документ11 страницChapter 13Maya HamdyОценок пока нет

- Stock Splits, Stock Dividends and Treasury Stock: in DepthДокумент44 страницыStock Splits, Stock Dividends and Treasury Stock: in DepthDaniella PhillipОценок пока нет

- Chapter 8Документ6 страницChapter 8Nor AzuraОценок пока нет

- Stock Splits, Stock Dividends and Treasury Stock: in DepthДокумент44 страницыStock Splits, Stock Dividends and Treasury Stock: in DepthAkash BafnaОценок пока нет

- Lehman Brothers Private Equity Partners Investor Presentation13Mar2009Документ40 страницLehman Brothers Private Equity Partners Investor Presentation13Mar2009SiddhantОценок пока нет

- Equity: Intermediate Accounting IFRS Edition Kieso, Weygandt, and WarfieldДокумент70 страницEquity: Intermediate Accounting IFRS Edition Kieso, Weygandt, and WarfieldagustadivОценок пока нет

- Self-Study Exercise 1Документ3 страницыSelf-Study Exercise 1chanОценок пока нет

- Chapter Five: The Financial Statements of Banks and Their Principal CompetitorsДокумент30 страницChapter Five: The Financial Statements of Banks and Their Principal CompetitorsMaria ZakirОценок пока нет

- Corporations: Organization, Capital Stock Transactions, and DividendsДокумент37 страницCorporations: Organization, Capital Stock Transactions, and DividendsTanhoster AgustinОценок пока нет

- Financial Statements and Accounting Concepts/PrinciplesДокумент27 страницFinancial Statements and Accounting Concepts/PrinciplesdanterozaОценок пока нет

- 2013 CFA LVL 1 FSA 4 Understanding IsДокумент25 страниц2013 CFA LVL 1 FSA 4 Understanding IsInge AngeliaОценок пока нет

- Additional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionДокумент36 страницAdditional Issues in Accounting For Corporations: Accounting Principles, Eighth EditionAiiny Nurul 'sinepot'Оценок пока нет

- CH 11 Exam PracticeДокумент20 страницCH 11 Exam PracticeSvetlanaОценок пока нет

- Chapter 15 EquityДокумент67 страницChapter 15 EquityRiska Novitasari100% (1)

- Accounting Concepts and Financial StatementsДокумент27 страницAccounting Concepts and Financial StatementsvenkatsssОценок пока нет

- CH 18: Dividend PolicyДокумент55 страницCH 18: Dividend PolicySaba MalikОценок пока нет

- Chapter 7Документ24 страницыChapter 7ClaraОценок пока нет

- FIN924 Workshop Topic 2 QuestionsДокумент4 страницыFIN924 Workshop Topic 2 QuestionsYugiii YugeshОценок пока нет

- Financial Management 2 - BirminghamДокумент21 страницаFinancial Management 2 - BirminghamsimuragejayanОценок пока нет

- Week 9Документ76 страницWeek 9BookAddict721Оценок пока нет

- RECORDING Shares 1 Issue & DividendsДокумент4 страницыRECORDING Shares 1 Issue & DividendsDonald SОценок пока нет

- The Balance Sheet and Financial DisclosuresДокумент20 страницThe Balance Sheet and Financial DisclosuresMadchestervillainОценок пока нет

- Topic 5 - Sukokokopplemental Tasks and Exercises (Week 17)Документ2 страницыTopic 5 - Sukokokopplemental Tasks and Exercises (Week 17)Taylor Kongitti PraditОценок пока нет

- Lecture Financial AnalysisДокумент27 страницLecture Financial Analysisrizcst9759Оценок пока нет

- Chap 2Документ10 страницChap 2Houn Pisey100% (1)

- Chapter1A - Financial Accounting, Fourth Canadian EditionДокумент14 страницChapter1A - Financial Accounting, Fourth Canadian EditionMuktar Ibrahim BockОценок пока нет

- Ekuitas SahamДокумент54 страницыEkuitas SahamLukman GunawanОценок пока нет

- Sec: B Financial AnalysisДокумент8 страницSec: B Financial AnalysisSaifiОценок пока нет

- 8Документ25 страниц8JDОценок пока нет

- Shareholders EquityДокумент51 страницаShareholders EquityIsmail Hossain100% (2)

- Purpose of Financial StatementДокумент22 страницыPurpose of Financial StatementMonkey2111Оценок пока нет

- Chapter 7 Stockholers Equity FinalДокумент77 страницChapter 7 Stockholers Equity FinalSampanna ShresthaОценок пока нет

- The Accounting Cycle:: Capturing Economic EventsДокумент44 страницыThe Accounting Cycle:: Capturing Economic EventsSumitasОценок пока нет

- Accounting Cycle (I) - : Recording Economic TransactionsДокумент49 страницAccounting Cycle (I) - : Recording Economic TransactionsDevang BharaniaОценок пока нет

- Topic 3 Financial Statement and Financial Ratios AnalysisДокумент23 страницыTopic 3 Financial Statement and Financial Ratios AnalysisMardi Umar100% (1)

- Reporting and Analyzing Owner FinancingДокумент38 страницReporting and Analyzing Owner FinancingNing WangОценок пока нет

- Strat ReportДокумент23 страницыStrat ReportApril Jochebed MadriagaОценок пока нет

- Accounting Capital+Stock+TransactionsДокумент17 страницAccounting Capital+Stock+TransactionsOckouri BarnesОценок пока нет

- To Financial Statement AnalysisДокумент93 страницыTo Financial Statement AnalysisRizalMawardiОценок пока нет

- Question 1 (40marks - 48 Minutes)Документ8 страницQuestion 1 (40marks - 48 Minutes)dianimОценок пока нет

- Ch10 Financial Statements of A Limited CompanyДокумент21 страницаCh10 Financial Statements of A Limited Companyne002Оценок пока нет

- Shares and Taxation: A Practical Guide to Saving Tax on Your SharesОт EverandShares and Taxation: A Practical Guide to Saving Tax on Your SharesОценок пока нет

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideОт EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideОценок пока нет

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОт EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОценок пока нет

- The Income Statement and The Statement of Cash FlowsДокумент31 страницаThe Income Statement and The Statement of Cash FlowsdanterozaОценок пока нет

- Accounting For and Presentation of Current AssetsДокумент54 страницыAccounting For and Presentation of Current AssetsdanterozaОценок пока нет

- Explanatory Notes and Other Disclosures: Mcgraw-Hill/Irwin © 2008 The Mcgraw-Hill Companies, Inc., All Rights ReservedДокумент18 страницExplanatory Notes and Other Disclosures: Mcgraw-Hill/Irwin © 2008 The Mcgraw-Hill Companies, Inc., All Rights ReserveddanterozaОценок пока нет

- Fundamental Financial AccountingДокумент29 страницFundamental Financial AccountingdanterozaОценок пока нет

- The Bookkeeping Process and Transaction AnalysisДокумент54 страницыThe Bookkeeping Process and Transaction AnalysisdanterozaОценок пока нет

- Fundamental Financial Accounting Key Terms and Concepts Chapter 8 - Accounting For and Presentation of Owners' EquityДокумент2 страницыFundamental Financial Accounting Key Terms and Concepts Chapter 8 - Accounting For and Presentation of Owners' EquitydanterozaОценок пока нет

- Fundamental Financial Accounting Key Terms and Concepts Chapter 10 - Corporate Governance, Explanatory Notes, and Other DisclosuresДокумент2 страницыFundamental Financial Accounting Key Terms and Concepts Chapter 10 - Corporate Governance, Explanatory Notes, and Other DisclosuresdanterozaОценок пока нет

- Fundamental Financial Accounting Key Terms and Concepts Chapter 6 - Accounting For and Presentation of Property, PlantДокумент2 страницыFundamental Financial Accounting Key Terms and Concepts Chapter 6 - Accounting For and Presentation of Property, PlantdanterozaОценок пока нет

- Fundamental Financial Accounting Key Terms and Concepts Chapter 7 - Accounting For and Presentation of LiabilitiesДокумент2 страницыFundamental Financial Accounting Key Terms and Concepts Chapter 7 - Accounting For and Presentation of LiabilitiesdanterozaОценок пока нет

- Key Terms and Concepts - CH 09Документ2 страницыKey Terms and Concepts - CH 09danterozaОценок пока нет

- Key Terms and Concepts - CH 04Документ1 страницаKey Terms and Concepts - CH 04danterozaОценок пока нет

- Fundamental Financial Accounting Key Terms and Concepts Chapter 5 - Accounting For and Presentation of Current AssetsДокумент3 страницыFundamental Financial Accounting Key Terms and Concepts Chapter 5 - Accounting For and Presentation of Current AssetsdanterozaОценок пока нет

- Financial Statements and Accounting Concepts/PrinciplesДокумент27 страницFinancial Statements and Accounting Concepts/PrinciplesdanterozaОценок пока нет

- ASE SyllabusДокумент3 страницыASE SyllabusdanterozaОценок пока нет

- Key Terms and Concepts - CH 01Документ2 страницыKey Terms and Concepts - CH 01danterozaОценок пока нет

- Homeworks 1 and 2Документ4 страницыHomeworks 1 and 2danterozaОценок пока нет

- Financial Statements and Accounting Concepts/PrinciplesДокумент18 страницFinancial Statements and Accounting Concepts/PrinciplesdanterozaОценок пока нет

- Accounting For and Presentation of Property, Plant, and Equipment, and Other Noncurrent AssetsДокумент54 страницыAccounting For and Presentation of Property, Plant, and Equipment, and Other Noncurrent AssetsdanterozaОценок пока нет

- Financial Accounting-I Assignment 2: InstructionsДокумент3 страницыFinancial Accounting-I Assignment 2: InstructionsMemes CreatorОценок пока нет

- Kenneth Andrade & Sunil Singhania Buy Cheap Blue-Chip MNC StockДокумент9 страницKenneth Andrade & Sunil Singhania Buy Cheap Blue-Chip MNC StockSam vermОценок пока нет

- Abba Hussain Ibrahim PharmacyДокумент64 страницыAbba Hussain Ibrahim PharmacySLYОценок пока нет

- Introduction To Management Accounting and Financial Statement AnalysisДокумент24 страницыIntroduction To Management Accounting and Financial Statement Analysis24.7upskill Lakshmi V100% (1)

- Chapter - Dissolution of Partnership PDFДокумент5 страницChapter - Dissolution of Partnership PDFBHUMIKA JAINОценок пока нет

- Consolidated Balance Sheet: As at 31St March, 2017Документ7 страницConsolidated Balance Sheet: As at 31St March, 2017Yatin BhardwajОценок пока нет

- DMBA 202 Financial ManagementДокумент427 страницDMBA 202 Financial ManagementParas ThakanОценок пока нет

- Lecture 2 Notes: (A) Fixed Capital Requirements: in Order To Start Business, Funds Are Required To Purchase FixedДокумент5 страницLecture 2 Notes: (A) Fixed Capital Requirements: in Order To Start Business, Funds Are Required To Purchase FixedAmrit KaurОценок пока нет

- Far15 Long Term Liability 1Документ9 страницFar15 Long Term Liability 1Joana TatacОценок пока нет

- Parrino 2e PowerPoint Review Ch13Документ55 страницParrino 2e PowerPoint Review Ch13Khadija AlkebsiОценок пока нет

- Credit and Collection ReportДокумент14 страницCredit and Collection ReportCarlos John Talania 1923Оценок пока нет

- Introduction To Investment BankingДокумент45 страницIntroduction To Investment BankingHuế ThùyОценок пока нет

- BUS328 TM 2015 Tutorial QuestionsДокумент16 страницBUS328 TM 2015 Tutorial Questionsjacklee19180% (1)

- 5.1. Debt Market Instrument CharacteristicsДокумент15 страниц5.1. Debt Market Instrument CharacteristicsMavis LunaОценок пока нет

- Re CumberДокумент21 страницаRe CumberAshok NagpalОценок пока нет

- Corporate Reporting November 2018Документ28 страницCorporate Reporting November 2018swarna dasОценок пока нет

- On January 1 2013 Stamford Reacquires 8 000 of The OutstandingДокумент1 страницаOn January 1 2013 Stamford Reacquires 8 000 of The OutstandingMiroslav GegoskiОценок пока нет

- Financial Management - SmuДокумент0 страницFinancial Management - SmusirajrОценок пока нет

- Financial Accounting Fundamentals: John J. Wild 2009 EditionДокумент39 страницFinancial Accounting Fundamentals: John J. Wild 2009 EditionKhvichaKopinadze100% (1)

- Lembar Kerja Pt. Aldenio Jurnal KhususДокумент73 страницыLembar Kerja Pt. Aldenio Jurnal KhususSalsabila Syifa AriesfiaОценок пока нет

- Leveraged Buyout Model Calculator V 1.2Документ3 страницыLeveraged Buyout Model Calculator V 1.2john hirshОценок пока нет

- 2000 5000 Full Company Update 20230222Документ241 страница2000 5000 Full Company Update 20230222Contra Value BetsОценок пока нет

- 345Документ2 страницы345TarkimОценок пока нет

- Cambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtДокумент4 страницыCambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtShannen LyeОценок пока нет

- ICQДокумент12 страницICQAndrew LamОценок пока нет

- Sap Fi Ecc 6.0 Bootcamp - Day 1Документ144 страницыSap Fi Ecc 6.0 Bootcamp - Day 1totoОценок пока нет

- Working Sheet Rahima Food CorporationДокумент8 страницWorking Sheet Rahima Food CorporationMirza Tasnim NomanОценок пока нет

- Linear Tech Dividend PolicyДокумент25 страницLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Chapter 19 Financing and ValuationДокумент8 страницChapter 19 Financing and ValuationLovely MendozaОценок пока нет