Академический Документы

Профессиональный Документы

Культура Документы

Telenor Underdog

Загружено:

Sandeep MishraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Telenor Underdog

Загружено:

Sandeep MishraАвторское право:

Доступные форматы

Telenor India:Underdogs Innovative pricing Strategy

Presented By Sandeep Mishra

Abstract

This case study helps in understanding the concepts of Price strategy and different degrees of Price Discrimination, in the Microeconomics course. The growth of the telecom industry in India backed by privatization since 1991, new players are emerging, making the telecom field a combat zone. The case study explains the pricing strategy of Uninor, a new entrant. It captures the growth of Uninor and the effectiveness of its "24X7 Badalta Discount Plan" launched in late 2009. The case revolves around the potency of Uninor's weapon over other giant players in both the short run and long run,

About - Indian Telecom Market

In Year 1851 is a start of Telegraph lines in India. In1882 telephone exchange was opened with 93 Subscribers. After 1947, the growth seems to be slow in Telephone sector.

Monopoly Of the Government in 1984.

In 1985 departments were separated though P&T and DoT created. MTNL established with motive 0f 2 reasons. In 1990 Government welcomed private companies by framing NTP. In October 1,2000, BSNL a new entity by DoT was created to mange operations for different parts of country. In 1997, a separate body TRAI was setup.

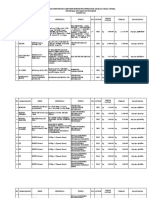

Exhibit 1

The Busy Lines Rise of industry

In mid- 2000s Indian telecom sector is on growth due to GoIs decisions. The no of subscribers increased from 33.7 million in march 2004 to 391.7 million in march 2009. Teledensity increased by 12.7% in march 2006 to 35.65% in Feb 2009. Urban teledensity increase seems to 11% in 2002 to 83.66% in 2009 while rural came to 13.81% in January 2009. By the end of 2010 in India became the 2nd largest Telecom Market.

By 2013 India was expected to become the largest mobile market in the World.

The growth Lure other foreign as well as domestic players to enter Indian Telecom sector.

Exhibit 2

Uninor The New Entrant ( Uniteach+Telenor)

Unitech was granted a 2G license for both national and international long distance for all 23 telecom circles in India. In 2008, Telenor was the worlds seventh largest telecom operator . In December 2009,Uninor launched its mobile services in seven Indian Telecom circles Uninor was the 14th operator to enter the competitive Indian cellular market and the 8th pan-India operator with a license in all 23 circles. Uninor rolled out its service in 13 of the 23 telecom sector. The government had allocated a 4.4 mega hertz(MHz) start-up GSM spectrum in these 13 circles. Uninor concluded tower sharing agreements with wireless TT Info Service Limited and Quippo telecom infrastructure limited (Quippo) Uninor outsourced infrastructure maintainance.

Exhibit 3

Uninor- Promotion

Launched its brand and logo in college streets and shopping malls . Launched TV ad campaign- Ab Mera Number Hai

Promotion in Kumbh Mela

Introduced Cell On Wheels Launch of Uninor Blue Brigade Launched 24x7 Badalta Discount plan

Exhibit 4

Scintillating tone: discount pricing

24x7 Badalta Discount Plan offered a discount- 5% and 60% on the 50 paisa chargeable per minute of call. Optimal utilization of BTS. 50% more traffic per BTS could be handled which will help to delay the congestion of network. A new concept of dynamic pricing', offering mobile call charges as low as 20 paise per minute. Company was confident of posting profit in the short term because they would not get into a price war that might bleed the business.

Exhibit 5

Uninor Dialing: Corrupt Signals

50% of the total Indian population and over 90% of the urban population subscribed to mobile services.

India was fast approaching saturation.

Indian telecom industry was saddled with problems like: Infrastructure problems Huge competition Declining ARPU Uninor also had specific issues of its own like it has invested heavily in a company that had not build any infrastructure ,had no subscribers and cash flows

Thank You

Here comes your footer Page 14

Вам также может понравиться

- Case StudyДокумент8 страницCase StudyRohit Rijhwani100% (1)

- Bajaj Lockout Case StudyДокумент4 страницыBajaj Lockout Case StudyJayesh RuchandaniОценок пока нет

- Projectonindianautomotiveindustry and Case Study of Tata MotorsДокумент26 страницProjectonindianautomotiveindustry and Case Study of Tata MotorsMukesh Manwani100% (1)

- Case StudyДокумент3 страницыCase Studyjohnleh1733% (3)

- Group 3 FM Project IT IndustryДокумент13 страницGroup 3 FM Project IT IndustryPS KannanОценок пока нет

- Group 13 AirtelДокумент53 страницыGroup 13 AirtelShilpa Ravindran100% (1)

- Zomato Annual Report 2022 1659701415938Документ5 страницZomato Annual Report 2022 1659701415938Mahak SarawagiОценок пока нет

- Case Study MobДокумент1 страницаCase Study MobRamamohan ReddyОценок пока нет

- HRM - Labour UnrestДокумент20 страницHRM - Labour Unrestvishal shivkar100% (2)

- Organisations Success BHARTI AIRTELДокумент6 страницOrganisations Success BHARTI AIRTELdukedhakaОценок пока нет

- GROUP 1 Project Report Strategy MGMTДокумент18 страницGROUP 1 Project Report Strategy MGMTDiksha LathОценок пока нет

- Reliance Jio - DiversificationДокумент1 страницаReliance Jio - DiversificationManas KapoorОценок пока нет

- Finlatics Research - Canara Bank Detailed ReportДокумент5 страницFinlatics Research - Canara Bank Detailed ReportAhana SarkarОценок пока нет

- BSNL SwotДокумент13 страницBSNL SwotAbhishek Chaudhary100% (1)

- IIM Ranchi - Group 2 - Workers' Compensation ReportДокумент16 страницIIM Ranchi - Group 2 - Workers' Compensation ReportMohit Kumar Sethy100% (1)

- Research Insights 2 Infosys LimitedДокумент6 страницResearch Insights 2 Infosys Limited2K20DMBA53 Jatin suriОценок пока нет

- Capital Structure Analysis of ITC LTDДокумент4 страницыCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- AirtelДокумент60 страницAirtelPankajОценок пока нет

- BCG and GE Analysis On Idea CellularДокумент14 страницBCG and GE Analysis On Idea CellularMaverick_raj83% (6)

- Kuria S Case Personal OrbitДокумент8 страницKuria S Case Personal OrbitArgha SenОценок пока нет

- Swot AnalysisДокумент3 страницыSwot AnalysisYashashvi RastogiОценок пока нет

- Times GroupДокумент7 страницTimes GroupRakesh SukumarОценок пока нет

- Hindalco Novelis CaseДокумент13 страницHindalco Novelis Casekushal90100% (1)

- Presented by - Abilash D Reddy Ravindar .R Sandarsh SureshДокумент15 страницPresented by - Abilash D Reddy Ravindar .R Sandarsh SureshSandarsh SureshОценок пока нет

- Porter Five Force ModelДокумент5 страницPorter Five Force ModelAbhishekОценок пока нет

- Final PPT of VodafoneДокумент44 страницыFinal PPT of VodafoneChinmay P Kalelkar100% (1)

- Human Resource Case StudyДокумент11 страницHuman Resource Case StudyArunesh PathakОценок пока нет

- General Management Project Retail Industry Industry AnalysisДокумент5 страницGeneral Management Project Retail Industry Industry AnalysisMaThew MarkoseОценок пока нет

- Tata Nano : ONE LakhДокумент24 страницыTata Nano : ONE Lakharunaghanghoria2803Оценок пока нет

- Competition Law in IndiaДокумент9 страницCompetition Law in IndiaAditi IndraniОценок пока нет

- Product - Mix of Tata MotorsДокумент1 страницаProduct - Mix of Tata Motorsapi-376995150% (2)

- "Tata Motors: Can The Turnaround Plan Improve Performance?" NameДокумент16 страниц"Tata Motors: Can The Turnaround Plan Improve Performance?" NameMehdi BelabyadОценок пока нет

- Group 4 - ITC - Live ProjectДокумент31 страницаGroup 4 - ITC - Live ProjectSyama kОценок пока нет

- MGT 407Документ7 страницMGT 407rizwan ali0% (1)

- Decision Sheet - MdbsДокумент3 страницыDecision Sheet - MdbsGayatri BommisettyОценок пока нет

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Документ9 страницTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaОценок пока нет

- Quiz Management Accounting - VIДокумент31 страницаQuiz Management Accounting - VILav SharmaОценок пока нет

- SM AssignesДокумент8 страницSM AssignesYugandhar MakarlaОценок пока нет

- Building An Agile Organization at ING Bank Netherlands From Tango To RIOДокумент1 страницаBuilding An Agile Organization at ING Bank Netherlands From Tango To RIOMohamad BachoОценок пока нет

- MARKETING MIX & 4P's OF RELIANCE JIOДокумент13 страницMARKETING MIX & 4P's OF RELIANCE JIOYash KarandeОценок пока нет

- Case Analysis Note - Vanraj TractorsДокумент4 страницыCase Analysis Note - Vanraj TractorsKeyur Sampat0% (1)

- JSW Steel Ratio AnalysisДокумент2 страницыJSW Steel Ratio AnalysisabhisekОценок пока нет

- Project Report - Macro Economics - Group 7 - MBA (IB) 2020-23 v1.1Документ28 страницProject Report - Macro Economics - Group 7 - MBA (IB) 2020-23 v1.1Alok KumarОценок пока нет

- Cost Sheet For The Month of January: TotalДокумент9 страницCost Sheet For The Month of January: TotalgauravpalgarimapalОценок пока нет

- # 722798 - Apple Internal AnalysisДокумент13 страниц# 722798 - Apple Internal AnalysisXueyingying JiangОценок пока нет

- Comparative Study of BSNL and AritelДокумент15 страницComparative Study of BSNL and AriteldiviprabhuОценок пока нет

- Role of Information Systems in Indian RailwaysДокумент21 страницаRole of Information Systems in Indian RailwaysAmrinder SinghОценок пока нет

- Jakson Evolution of A Brand - Section A - Group 10Документ4 страницыJakson Evolution of A Brand - Section A - Group 10RAVI RAJОценок пока нет

- HEC Project Report1Документ52 страницыHEC Project Report1r_bhushan62100% (1)

- Strategic Management, Jindal SteelДокумент12 страницStrategic Management, Jindal Steellino67% (3)

- Endeavour Twoplise LTDДокумент4 страницыEndeavour Twoplise LTDHafiz WaqasОценок пока нет

- Demand For CastingДокумент20 страницDemand For Castingchamanrai100% (1)

- Project Report On Vivels Fairness CreamДокумент47 страницProject Report On Vivels Fairness CreamDhirender Chauhan0% (1)

- Business Ethics - Jai Prakash SinghДокумент3 страницыBusiness Ethics - Jai Prakash SinghmitulОценок пока нет

- Otisline Case AnalysisДокумент2 страницыOtisline Case AnalysisSuhas AvgОценок пока нет

- Project Report On Airtel Product Launch and Sales and Distribution Channel ManagementДокумент62 страницыProject Report On Airtel Product Launch and Sales and Distribution Channel ManagementKranthiSanalaОценок пока нет

- Market Survey of AirtelДокумент77 страницMarket Survey of AirtelAnkit Singhvi0% (1)

- Comparative Study of AirtelДокумент36 страницComparative Study of AirtelAnkit AgrawalОценок пока нет

- Distribution MДокумент58 страницDistribution MNerella Srikanth100% (2)

- The Indian Internet Banking JourneyДокумент4 страницыThe Indian Internet Banking JourneySandeep MishraОценок пока нет

- SBI's Microfinance InitiativesДокумент3 страницыSBI's Microfinance InitiativesSandeep MishraОценок пока нет

- Mahindra CaseДокумент13 страницMahindra CaseSandeep Mishra100% (1)

- Making A Lending DecisionДокумент3 страницыMaking A Lending DecisionSandeep MishraОценок пока нет

- Retail Banking in Japan The New Strategic FocusДокумент2 страницыRetail Banking in Japan The New Strategic FocusSandeep MishraОценок пока нет

- A Loan Sanction Dilemma CaseДокумент2 страницыA Loan Sanction Dilemma CaseSandeep Mishra0% (1)

- Innovation in Indian Banking SectorДокумент3 страницыInnovation in Indian Banking SectorSandeep MishraОценок пока нет

- Cafe Industry PresentationДокумент10 страницCafe Industry PresentationSandeep MishraОценок пока нет

- Aventis Sales Promotion StartegyДокумент12 страницAventis Sales Promotion StartegySandeep Mishra100% (1)

- Deutsche Bank's Corporate and Investment Banking The Anshu Jain WayДокумент3 страницыDeutsche Bank's Corporate and Investment Banking The Anshu Jain WaySandeep MishraОценок пока нет

- Harley DavidsonДокумент12 страницHarley DavidsonSandeep Mishra100% (2)

- Fire InsuranceДокумент16 страницFire InsuranceSandeep Mishra100% (1)

- Asian Paints 4p'sДокумент25 страницAsian Paints 4p'sSandeep Mishra100% (1)

- Claim Letters: By-Sandeep Mishra IBS MumbaiДокумент6 страницClaim Letters: By-Sandeep Mishra IBS MumbaiSandeep MishraОценок пока нет

- Marketing Plan: By-Sandeep Mishra, IBS MumbaiДокумент26 страницMarketing Plan: By-Sandeep Mishra, IBS MumbaiSandeep MishraОценок пока нет

- Labor Unrest at HMSI.: Sandeep Mishra IBS MumbaiДокумент6 страницLabor Unrest at HMSI.: Sandeep Mishra IBS MumbaiSandeep MishraОценок пока нет

- D, Damas Research in PowaiДокумент21 страницаD, Damas Research in PowaiSandeep MishraОценок пока нет

- The Secret Book Best Take AwayДокумент12 страницThe Secret Book Best Take AwaySandeep MishraОценок пока нет

- Asian Paints 4p'sДокумент25 страницAsian Paints 4p'sSandeep Mishra100% (1)

- Catalogue of Archaeological Finds FromДокумент67 страницCatalogue of Archaeological Finds FromAdrinaОценок пока нет

- Case Study On Goodearth Financial Services LTDДокумент15 страницCase Study On Goodearth Financial Services LTDEkta Luciferisious Sharma0% (1)

- April 2021 BDA Case Study - GroupДокумент4 страницыApril 2021 BDA Case Study - GroupTinashe Chirume1Оценок пока нет

- Induction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesДокумент21 страницаInduction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesSpoiala DragosОценок пока нет

- Catalog Tu ZG3.2 Gian 35kV H'MunДокумент40 страницCatalog Tu ZG3.2 Gian 35kV H'MunHà Văn TiếnОценок пока нет

- Roland Fantom s88Документ51 страницаRoland Fantom s88harryoliff2672100% (1)

- Dept & Sem: Subject Name: Course Code: Unit: Prepared byДокумент75 страницDept & Sem: Subject Name: Course Code: Unit: Prepared by474 likithkumarreddy1Оценок пока нет

- Barista Skills Foundation Curriculum enДокумент4 страницыBarista Skills Foundation Curriculum enCezara CarteșОценок пока нет

- IPS PressVest Premium PDFДокумент62 страницыIPS PressVest Premium PDFLucian Catalin CalinОценок пока нет

- English 2nd Quarter Week 7 Connotation DenotationДокумент28 страницEnglish 2nd Quarter Week 7 Connotation DenotationEdward Estrella GuceОценок пока нет

- Mahatma Gandhi University: Priyadarshini Hills, Kottayam-686560Документ136 страницMahatma Gandhi University: Priyadarshini Hills, Kottayam-686560Rashmee DwivediОценок пока нет

- BluePrint & High Pressure Pascalization (HPP)Документ3 страницыBluePrint & High Pressure Pascalization (HPP)Prof C.S.PurushothamanОценок пока нет

- Friday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBДокумент3 страницыFriday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDONI ARTAОценок пока нет

- PronounsДокумент6 страницPronounsHải Dương LêОценок пока нет

- IbmautomtiveДокумент38 страницIbmautomtiveMeltz NjorogeОценок пока нет

- 2001 Ford F150 ManualДокумент296 страниц2001 Ford F150 Manualerjenkins1100% (2)

- Rab Sikda Optima 2016Документ20 страницRab Sikda Optima 2016Julius Chatry UniwalyОценок пока нет

- Allegro Delivery Shipping Company Employment Application FormДокумент3 страницыAllegro Delivery Shipping Company Employment Application FormshiveshОценок пока нет

- Strategic Audit of VodafoneДокумент35 страницStrategic Audit of VodafoneArun Guleria89% (9)

- Jurnal 1 Ieevee LPF PDFДокумент4 страницыJurnal 1 Ieevee LPF PDFNanda SalsabilaОценок пока нет

- Household: Ucsp11/12Hsoiii-20Документ2 страницыHousehold: Ucsp11/12Hsoiii-20Igorota SheanneОценок пока нет

- Angelo (Patrick) Complaint PDFДокумент2 страницыAngelo (Patrick) Complaint PDFPatLohmannОценок пока нет

- Risk Analysis and Assessment Methodologies in Work SitesДокумент49 страницRisk Analysis and Assessment Methodologies in Work SitesNhut NguyenОценок пока нет

- ProjectДокумент33 страницыProjectPiyush PatelОценок пока нет

- June 2014 (v3) QP - Paper 3 CIE Physics IGCSEДокумент20 страницJune 2014 (v3) QP - Paper 3 CIE Physics IGCSECole KhantОценок пока нет

- Digestive System Worksheet 2013 2Документ3 страницыDigestive System Worksheet 2013 2contessa padonОценок пока нет

- JBF Winter2010-CPFR IssueДокумент52 страницыJBF Winter2010-CPFR IssueakashkrsnaОценок пока нет

- ProbДокумент10 страницProbKashif JawaidОценок пока нет

- K MCQsДокумент6 страницK MCQsF ParikhОценок пока нет

- Navi-Planner User ManualДокумент331 страницаNavi-Planner User ManualRichard KershawОценок пока нет