Академический Документы

Профессиональный Документы

Культура Документы

Uni. Ref Book - Page Nos - 123/136 (M3)

Загружено:

emmanuel Johny0 оценок0% нашли этот документ полезным (0 голосов)

50 просмотров9 страницIMF came to existence in December 1945 and started functioning in March 1947. Started with 30 countries and the current strength is more than 150. Resources of the IMF are subscribed by the members and subscription quota of each member is based on its national income.

Исходное описание:

Оригинальное название

economicsm2 IMF

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документIMF came to existence in December 1945 and started functioning in March 1947. Started with 30 countries and the current strength is more than 150. Resources of the IMF are subscribed by the members and subscription quota of each member is based on its national income.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

50 просмотров9 страницUni. Ref Book - Page Nos - 123/136 (M3)

Загружено:

emmanuel JohnyIMF came to existence in December 1945 and started functioning in March 1947. Started with 30 countries and the current strength is more than 150. Resources of the IMF are subscribed by the members and subscription quota of each member is based on its national income.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

Inter na ti onal

monetar y fund

(IMF)

Uni. Ref Book –Page nos –

123/136(M3)

IMF

International monetary institution

established by different countries after

World War II.

WW – prices. Profits, share prices,

production, employment, income of

leading countries fell very low.

affected the economies of the world.

World wide depression

Therefore, the monetary authorities of

the world felt the need for international

co-operation to establish international

monetary stability.

IMF

A conference of 44 major

countries was held at Bretton

Woods in July 1944 . The result

was the establishment of IMF and

International Bank for

Reconstruction and Development

(IBRD)

These two institutions are called

“Bretton Woods Twins”

IMF

Came to existence in December 1945

and started functioning in March 1947.

Autonomous institution affiliated to

UNO and functioning from Washington.

Started with 30 countries and the

current strength is more than 150.

The resources of the IMF are

subscribed by the members and

subscription quota of each member is

based on its national income

OBJ ECTI VES

To solve international monetary problems.

Balanced growth of international trade

Employment growth and income growth

Development of productive resources odf all

member countries

To promote exchange stability

To give confidence to members that

resources are available to them

Lesson the degree of disequilibrium in

International balance of payments.

FUN CTI ON S

It acts as a short term credit institution

Orderly adjustments of exchange rate

It is a reservoir of currencies of all

member nations, who can borrow the

currency of other nations

It grants loans only for financing

current transactions and not capital

transactions

Provides machinery for international

consultation

Org aniza tio n of I MF

Management of the fund is under

the control of two bodies.

(b) Board of Governors

(c) Board of Executive Directors

Org aniza tio n of I MF

The board of Governors has the responsibility

of formulating the general policies of the fund

Consists of one Governor and an alternate

Governor from each member country.

The board of executive directors controls the

day to day activities of the fund. It consists of

22 directors, 6 of these are appointed by the

members having the largest quotas, namely

US, UK, West Germany, France, Japan and

Saudi Arabia.

Achievements

Provision of credit – beneficial

for developing countries

Exchange stability

Expansion of world trade

Machinery for consultation

Вам также может понравиться

- Reforming the International Financial System for DevelopmentОт EverandReforming the International Financial System for DevelopmentОценок пока нет

- India’s Relations With The International Monetary Fund (IMF): 25 Years In Perspective 1991-2016От EverandIndia’s Relations With The International Monetary Fund (IMF): 25 Years In Perspective 1991-2016Оценок пока нет

- UoN International Finance InstitutionsДокумент22 страницыUoN International Finance InstitutionsFestus MuriukiОценок пока нет

- Imf Intro, Facts & History: The Main Objectives of IMF, As Noted in The Articles of Agreement, Are As FollowsДокумент4 страницыImf Intro, Facts & History: The Main Objectives of IMF, As Noted in The Articles of Agreement, Are As FollowsDevanshi RawatОценок пока нет

- S.K School of Business ManagementДокумент16 страницS.K School of Business ManagementchthakorОценок пока нет

- Imf Its Role and Functions: Presented by Afra Ba Economics VTH SemesterДокумент20 страницImf Its Role and Functions: Presented by Afra Ba Economics VTH SemesterShahinsha HcuОценок пока нет

- What Does International Monetary FundДокумент4 страницыWhat Does International Monetary FundSanthosh T KarthickОценок пока нет

- Internation Financial Institution G1 052202Документ31 страницаInternation Financial Institution G1 052202KaiОценок пока нет

- International OrganisationsДокумент18 страницInternational OrganisationsAnjaliPuniaОценок пока нет

- International Monetary FundДокумент16 страницInternational Monetary Fundtapan mistryОценок пока нет

- Module 5Документ2 страницыModule 5jagan22Оценок пока нет

- Imf 190911Документ4 страницыImf 190911Muhammad BilalОценок пока нет

- Bbi Institutional SupportДокумент13 страницBbi Institutional SupportChirag KotianОценок пока нет

- Formation of IMF: Organization With 190 Member Countries That Aims ToДокумент5 страницFormation of IMF: Organization With 190 Member Countries That Aims Tosuanshu15Оценок пока нет

- International Business Assignment (IMF)Документ13 страницInternational Business Assignment (IMF)Siddharth AgarwalОценок пока нет

- Part 1Документ16 страницPart 1Tanuja PuriОценок пока нет

- Agencies That Facilitate International FlowsДокумент10 страницAgencies That Facilitate International FlowsKamlesh Choudhary100% (1)

- International Financial Management - Unit 9 - IMF 2Документ26 страницInternational Financial Management - Unit 9 - IMF 2sonam agrawalОценок пока нет

- Supranational InstitutionДокумент9 страницSupranational InstitutionJoseph OkpaОценок пока нет

- ImfДокумент19 страницImfDeepesh Singh100% (1)

- International Monetary FundДокумент3 страницыInternational Monetary FundApoorva BhardwajОценок пока нет

- International Monetary FundДокумент6 страницInternational Monetary FundHarsh PanchalОценок пока нет

- Unit-2 - International Financial Institutions Markets - Lecture Note - ConsolidatedДокумент30 страницUnit-2 - International Financial Institutions Markets - Lecture Note - ConsolidatedNeerajОценок пока нет

- About IMFДокумент17 страницAbout IMFvinay sainiОценок пока нет

- Chapter 15 - Panugaling, Ramilyn AnnДокумент43 страницыChapter 15 - Panugaling, Ramilyn AnnAmbray LynjoyОценок пока нет

- Pol ScienceДокумент12 страницPol Sciencesanyagupta966Оценок пока нет

- Role of International Financial InstitutionsДокумент26 страницRole of International Financial InstitutionsSoumendra RoyОценок пока нет

- Role of International Financial Institutions on Indian EconomyДокумент26 страницRole of International Financial Institutions on Indian EconomySoumendra RoyОценок пока нет

- The Bretton Woods AgreementДокумент5 страницThe Bretton Woods AgreementKomal SinghОценок пока нет

- MS 509 - IFM - International Monetary Fund - GSKДокумент7 страницMS 509 - IFM - International Monetary Fund - GSKShaaz AdnanОценок пока нет

- International Monetary FundДокумент14 страницInternational Monetary FundArsaha FatimaОценок пока нет

- Bretton Woods ConferenceДокумент11 страницBretton Woods ConferenceAvni MoryaОценок пока нет

- Shubham Tiwari (IMF) .Документ13 страницShubham Tiwari (IMF) .Shubham TiwariОценок пока нет

- Imf Functions and Research DetailsДокумент11 страницImf Functions and Research DetailsJacob HilltonОценок пока нет

- International Monetary Fund: JatinДокумент18 страницInternational Monetary Fund: JatinADVENTURE ARASANОценок пока нет

- International Monetry FundДокумент21 страницаInternational Monetry FundRAGHAV GARGОценок пока нет

- ImfДокумент24 страницыImfKethavath Poolsing100% (2)

- International Monetary Fund.: What Does It Do?Документ7 страницInternational Monetary Fund.: What Does It Do?santhosh kumaranОценок пока нет

- International Monetary Fund (IMF) : ObjectiveДокумент8 страницInternational Monetary Fund (IMF) : ObjectiveSelvam RajОценок пока нет

- Chapter 3Документ3 страницыChapter 3Nguyễn Mai AnhОценок пока нет

- Imf ProjectДокумент17 страницImf ProjectkitkomalОценок пока нет

- International Organization 2019Документ31 страницаInternational Organization 2019rajiv sinhaОценок пока нет

- International Monitory Fund: Presentation OnДокумент25 страницInternational Monitory Fund: Presentation OnNishanth KsОценок пока нет

- L-32, International Monetary Fund (IMF)Документ17 страницL-32, International Monetary Fund (IMF)Surya BhardwajОценок пока нет

- International Monetary FundДокумент5 страницInternational Monetary FundDolphin sharkОценок пока нет

- Wk4 AE5 - INTL BUS&TRDДокумент23 страницыWk4 AE5 - INTL BUS&TRDArsenio N. RojoОценок пока нет

- Post WW II Economic OrderДокумент62 страницыPost WW II Economic OrderrahmadОценок пока нет

- Itl Unit IДокумент4 страницыItl Unit IShrabani KarОценок пока нет

- International Marketing: 1. World BankДокумент3 страницыInternational Marketing: 1. World BankPrince Daud xaxaОценок пока нет

- International Financial0201Документ23 страницыInternational Financial0201MD.MOKTARUL ISLAMОценок пока нет

- IMF SSSTДокумент7 страницIMF SSSTKriday SharmaОценок пока нет

- IMF Presentation on its Establishment, Objectives and Relationship with India (39Документ18 страницIMF Presentation on its Establishment, Objectives and Relationship with India (39dhruv hansОценок пока нет

- Imf and World BankДокумент3 страницыImf and World BankSHAMAPRASAD H P SDM College(Autonomous), UjireОценок пока нет

- EconomicsДокумент36 страницEconomicsNishaTambeОценок пока нет

- International Monetary Fund: HistoryДокумент2 страницыInternational Monetary Fund: HistoryGEEKОценок пока нет

- Presentation On International Monetary Fund: Presented byДокумент12 страницPresentation On International Monetary Fund: Presented bySourabh SharmaОценок пока нет

- Module 21 International Trade & OrganizationsДокумент33 страницыModule 21 International Trade & Organizationsg.prasanna saiОценок пока нет

- The OECD and the Challenges of Globalisation: The governor of the world economyОт EverandThe OECD and the Challenges of Globalisation: The governor of the world economyОценок пока нет

- The Financial Issues of the New International Economic Order: Pergamon Policy Studies on The New International Economic OrderОт EverandThe Financial Issues of the New International Economic Order: Pergamon Policy Studies on The New International Economic OrderОценок пока нет

- Bis-Electrical Code Is - sp.30.2011Документ411 страницBis-Electrical Code Is - sp.30.2011Seema SharmaОценок пока нет

- S ClassBrochure APR2013 PDFforWEBДокумент47 страницS ClassBrochure APR2013 PDFforWEBemmanuel JohnyОценок пока нет

- Companies Bill 2011 (121 of 2011)Документ397 страницCompanies Bill 2011 (121 of 2011)Nanty N. ShahОценок пока нет

- Highlight of Union Budget 2011-12Документ11 страницHighlight of Union Budget 2011-12emmanuel JohnyОценок пока нет

- Kerala Gov Budget Speech 2013-14Документ131 страницаKerala Gov Budget Speech 2013-14emmanuel JohnyОценок пока нет

- Canon Professional Digital camcorderXL2Документ12 страницCanon Professional Digital camcorderXL2emmanuel JohnyОценок пока нет

- Union Budget 2012-13: HighlightsДокумент15 страницUnion Budget 2012-13: HighlightsNDTVОценок пока нет

- Mahindra E2oДокумент16 страницMahindra E2oemmanuel Johny0% (1)

- Pepsi IPL 2013 ScheduleДокумент2 страницыPepsi IPL 2013 ScheduleArun PrabhudesaiОценок пока нет

- MACROECONOMIC AGGRREGATES of INDIA (At Current Prices) 1950 To 2011Документ10 страницMACROECONOMIC AGGRREGATES of INDIA (At Current Prices) 1950 To 2011emmanuel JohnyОценок пока нет

- Employement CertificateДокумент1 страницаEmployement Certificateemmanuel JohnyОценок пока нет

- Tax Compliance ChartДокумент20 страницTax Compliance Chartemmanuel JohnyОценок пока нет

- Canon Professional CamcordersXH A1 - XH G1Документ16 страницCanon Professional CamcordersXH A1 - XH G1emmanuel JohnyОценок пока нет

- PersonalityДокумент50 страницPersonalityemmanuel Johny0% (1)

- Great Expectations Begin HereДокумент24 страницыGreat Expectations Begin HeregiobruzzОценок пока нет

- Canon EOS 60DДокумент13 страницCanon EOS 60DSham Hardy100% (1)

- Canon 500d BrochureДокумент13 страницCanon 500d BrochurejaelunsОценок пока нет

- Made For You. Made For Your WorldДокумент24 страницыMade For You. Made For Your WorldLe Viet DungОценок пока нет

- Why Has Unemployment Not Risen More in The RecessionДокумент8 страницWhy Has Unemployment Not Risen More in The Recessionemmanuel JohnyОценок пока нет

- E-Commerce Emmanuel SeminarДокумент21 страницаE-Commerce Emmanuel Seminaremmanuel JohnyОценок пока нет

- Material of As 16Документ21 страницаMaterial of As 16emmanuel JohnyОценок пока нет

- Auditing of CompanyДокумент14 страницAuditing of Companyemmanuel JohnyОценок пока нет

- Raju and The Money TreeДокумент10 страницRaju and The Money TreeChandan MundhraОценок пока нет

- Material of As 28Документ48 страницMaterial of As 28emmanuel JohnyОценок пока нет

- Construction Contracts An AnalysisДокумент29 страницConstruction Contracts An Analysisemmanuel JohnyОценок пока нет

- Resources Transferred To States and U.T. Govt (Union Budget 2010-11 Tabular Presenation)Документ2 страницыResources Transferred To States and U.T. Govt (Union Budget 2010-11 Tabular Presenation)emmanuel JohnyОценок пока нет

- Material of As 22Документ4 страницыMaterial of As 22emmanuel JohnyОценок пока нет

- RBI MoneyKumar ComicДокумент24 страницыRBI MoneyKumar Comicbhoopathy100% (1)

- Overview of The Direct Tax Provisions in The Finance Bill 2010Документ33 страницыOverview of The Direct Tax Provisions in The Finance Bill 2010emmanuel JohnyОценок пока нет

- States and U.T. Plan Outlay by Ministries/Departments (Union Budget 2010-11 Tabular Presenation)Документ2 страницыStates and U.T. Plan Outlay by Ministries/Departments (Union Budget 2010-11 Tabular Presenation)emmanuel JohnyОценок пока нет

- Supply Chain-Case Study of DellДокумент3 страницыSupply Chain-Case Study of DellSafijo Alphons100% (1)

- PWC (2015) - 48 - State-Owned Enterprises - Catalysts For Public Value Creation (PEs SOEs) PDFДокумент48 страницPWC (2015) - 48 - State-Owned Enterprises - Catalysts For Public Value Creation (PEs SOEs) PDFAna Bandeira100% (1)

- Louis Vuitton in IndiaДокумент16 страницLouis Vuitton in IndiaFez Research LaboratoryОценок пока нет

- Water and Diamond ParadoxДокумент19 страницWater and Diamond ParadoxDevraj100% (1)

- The Investment Function in Banking and Financial-Services ManagementДокумент18 страницThe Investment Function in Banking and Financial-Services ManagementHaris FadžanОценок пока нет

- Chiffon Camisole and Tap Pants PDFДокумент34 страницыChiffon Camisole and Tap Pants PDFpiano lov100% (3)

- Quality Improvement With Statistical Process Control in The Automotive IndustryДокумент8 страницQuality Improvement With Statistical Process Control in The Automotive Industryonii96Оценок пока нет

- Idea Bridge - 100 Success Plan For Crisis Recovery & New CeoДокумент6 страницIdea Bridge - 100 Success Plan For Crisis Recovery & New CeoJairo H Pinzón CastroОценок пока нет

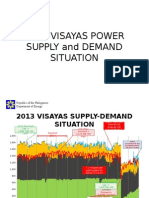

- 2013 Visayas Power Supply and Demand Situation: Republic of The Philippines Department of EnergyДокумент10 страниц2013 Visayas Power Supply and Demand Situation: Republic of The Philippines Department of EnergyJannet MalezaОценок пока нет

- Project EvaluationДокумент4 страницыProject EvaluationUkesh ShresthaОценок пока нет

- Presented By: Sainbu Dutt Gupta Mukul Mansharamani Nikhil BhatiaДокумент16 страницPresented By: Sainbu Dutt Gupta Mukul Mansharamani Nikhil BhatiaSirohi JatОценок пока нет

- Class 17 - Dabhol Case Study PDFДокумент28 страницClass 17 - Dabhol Case Study PDFBaljeetSinghKhoslaОценок пока нет

- Ravikumar S: Specialties: Pre-Opening, Procurement, Implementing Best Practices, Budgets, CostДокумент2 страницыRavikumar S: Specialties: Pre-Opening, Procurement, Implementing Best Practices, Budgets, CostMurthy BanagarОценок пока нет

- Cluster Profile of Pickle of ShikarpurДокумент7 страницCluster Profile of Pickle of ShikarpurZohaib Ali MemonОценок пока нет

- PWC NPL June18Документ64 страницыPWC NPL June18Murdoc Alphonce NicallsОценок пока нет

- Business PlanДокумент31 страницаBusiness PlanBabasab Patil (Karrisatte)100% (1)

- c19b - Cash Flow To Equity - ModelДокумент6 страницc19b - Cash Flow To Equity - ModelaluiscgОценок пока нет

- The Russian Oil Refining FactoriesДокумент17 страницThe Russian Oil Refining Factoriestomica06031969Оценок пока нет

- Master Key VIVA PPT UDAYДокумент11 страницMaster Key VIVA PPT UDAYUDayОценок пока нет

- Registration FormДокумент2 страницыRegistration Formapi-300796688Оценок пока нет

- Irfz 24 NДокумент9 страницIrfz 24 Njmbernal7487886Оценок пока нет

- Chapter 4 Transportation and Assignment ModelsДокумент88 страницChapter 4 Transportation and Assignment ModelsSyaz Amri100% (1)

- Main Theories of FDIДокумент22 страницыMain Theories of FDIThu TrangОценок пока нет

- India Is The Second Largest Employment Generator After AgricultureДокумент2 страницыIndia Is The Second Largest Employment Generator After AgriculturevikashprabhuОценок пока нет

- CompleteДокумент2 страницыCompleteappledeja7829Оценок пока нет

- Lecture7 - Equipment and Material HandlingДокумент52 страницыLecture7 - Equipment and Material HandlingAkimBiОценок пока нет

- Case of HyfluxДокумент6 страницCase of HyfluxMai NganОценок пока нет

- To Lease or Not To Lease?: Hotel ContractsДокумент10 страницTo Lease or Not To Lease?: Hotel ContractsDaryl ChengОценок пока нет

- E-Challan CCMT ChallanДокумент2 страницыE-Challan CCMT ChallanSingh KDОценок пока нет

- Keegan gm7 STPPT 01Документ20 страницKeegan gm7 STPPT 01Dirco JulioОценок пока нет