Академический Документы

Профессиональный Документы

Культура Документы

CH 7 Time Value of Money - Advanced

Загружено:

Muhammad Arslan UsmanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH 7 Time Value of Money - Advanced

Загружено:

Muhammad Arslan UsmanАвторское право:

Доступные форматы

Chapter 7

Time Value of Money: Advanced

Learning Objectives

Use a financial calculator to solve TVM problems

involving multiple periods and multiple cash flows

General case

Perpetuity

Annuity

Find the rate of return in multi-period (multi-CF) time-

value-of-money problems

The frequency of compounding

Prepare an amortization schedule

A Special Case: Perpetuity

C C

C

|------------|-----------|--------- -----|----- --------> time

0 1 2 t

Cash flows are fixed (same) in each period

N (number of periods) is infinity

What would be the PV of a stream of equal cash flows that occur at the end

of each period and go on forever?

PV = C / r

3

Perpetuity Examples

An asset that generates $1,000 per year forever, in other

words, a perpetuity of $1,000. If the discount rate is 8%, the

present value of this perpetuity will be

PV=1,000/0.08=$12,500.

4

A Special Case: Annuity

C C

C

|------------|-----------|--------- -----|----- ------------> time

0 1 2 t

Cash flows are fixed (same) in each period

N (number of periods) is fixed

What would be the PV of a stream of equal cash flows that occur at the end

of each period and go on for N periods?

PV = C / r * [ 1 - 1/(1+r)^N ]

5

Annuity Examples

What is the PV of a three-year annuity of $700 per year? The

discount rate is 8% p.a.

PV=(700/0.08)*(1-(1/(1+0.08))^3)=$1803.97

6

Time Value Calculations with a

Financial Calculator

Texas Instruments BAII PLUS

Basic Setting

Press 2nd and [Format]. The screen will display the number of decimal

places that the calculator will display. If it is not eight, press 8 and then

press Enter

Press 2nd and then press [P/Y]. If the display does not show one, press

1 and then Enter

Press 2nd and [BGN]. If the display is not END, that is, if it says BGN,

press 2nd and then [SET], the display will read END

Special keys used for TVM problems

N: Number of years (periods)

I/Y: Discount rate per period

PV: Present value

PMT: The periodic fixed cash flow in an annuity

FV: Future value

CPT: Compute

8

Practice Example One

How much do you need to deposit today so that you can have $6,000 six years

from now when the discount rate is 14%.

6 and then N

14 and then I/Y

0 and then PMT

6,000 and then FV

Finally, press CPT and then PV

The number -2,733.519286 will be in the display

Why negative?

9

Practice Example Two

Suppose you deposit $150 in an account today and the interest rate is 6 percent p.a..

How much will you have in the account at the end of 33 years?

33 then N

6 then I/Y

150 then +/- and then PV

0 then PMT

CPT then FV

The number 1,026.09 will be in the display

10

Practice Example Three

You deposited $15,000 in an account 22 years ago and now the account has

$50,000 in it. What was the annual rate of return that you received on this

investment?

N = 22, PV = - 15,000, PMT = 0, FV = 50,000,

I/Y = ?

I/Y=5.625%

11

Practice Example Four

You currently have $38,000 in an account that has been paying 5.75

percent p.a.. You remember that you had opened this account quite

some years ago with an initial deposit of $19,000.You forget when the

initial deposit was made. How many years (in fractions) ago did you

make the initial deposit?

PV = - 19000, PMT = 0, FV = 38000, I/Y = 5.75,

N = ?

N=12.398

12

Practice Example Five

Suppose an investment promises to yield annual cash flows of

$13,000 per year for eleven years. If your required rate of return is

13%, what is the maximum price that you would be willing to pay?

N=11, I/Y=13, PMT=13,000, FV=0, PV=?

PV=$73,930.23

Practice Example Six

An asset promises the following stream of cash flows. It will pay you

$80 per year for twenty years and , in addition, at the end of the

twentieth year, you will be paid $1,000. If your required rate of return

is 9%, what is the maximum price that you would pay for this asset?

N=20, I/Y=9,PMT=80,FV=1,000,PV=?

PV=-908.71

Practice Example-Retirement Problem

You plan to retire in 30 years. After that, you need $200,000 per year for 10 years

(first withdraw at t=31). At the end of these 10 years, you will enter a retirement

home where you will stay for the rest of your life. As soon as you enter the

retirement home, you will need to make a single payment of 1 million. You want to

start saving in an account that pays you 9% interest p.a. Therefore, beginning from

the end of the first year (t=1), you will make equal yearly deposits into this account

for 30 years. You expect to receive $500,000 at t=30 from a cash value insurance

policy that you own and you will deposit this money to your retirement account.

What should be the yearly deposits?

Answer: Two annuities.

At t=30: N=10, I/Y=9, PMT=-200,000,FV=-1,000,000, PV(30)=1705942.347

1705942.347-500,000=1205942.347

At t=0: N=30, I/Y=9,PV=0, FV=1205942.347

PMT=-8847.22

Special topics in Time Value

Compounding period is less than one year

Loan amortization

16

Compounding period is less than One year

Suppose that your bank states that the interest on your account

is 8% p.a.. However, interest is paid semi annually, that is every

six months or twice a year. The 8% is called the stated interest

rate. (also called the nominal interest rate) But, the bank will

pay you 4% interest every 6 months.

In other words, the compounding frequency is two.

17

Compounding Frequency example

Suppose you deposit $100 into the account today.

If the interest had been paid once a year,

100 x1.08=108

If the interest had been paid twice a year,

Account balance at end of 6 months:

100 x 1.04 = 104

Account balance at end of 1 year:

104 x 1.04 =108.16

Effective Interest Rate = (108.16 100)/100 = 8.16%

Compounding Frequency example

Suppose the interest had been paid quarterly, you would have

receive 8/4=2 % interest every quarter.

In this case:

Account balance at end of 1 year:

100 x (1.02)^4 =108.2432

Effective Interest Rate = (108.2432 -100)/100=8.2432%

Compounding period is less than One year

1 1 rate interest Effective

1

1

|

.

|

\

|

+ =

|

.

|

\

|

+ =

|

.

|

\

|

+

=

m

n m

n m

m

r

m

r

PV FV

m

r

FV

PV

20

n = number of years

m = frequency of

compounding per year

r = stated interest

rate

Example

Suppose you deposit $100 today in your bank account that

states the interest is 8% p.a.. However, the interest is paid

quarterly. Compute your account balance at the end of five years

with quarterly compounding.

Account balance at end of 5 year:

100 x (1.02)^20 =148.59

N =5 x4=20

I/Y=2, PV=-100,PMT=0, CPT FV=148.59

Loan Amortization

Amortization is the process of separating a payment into two

parts:

The interest payment

The repayment of principal

Note:

Interest payment decreases over time

Principal repayment increases over time

Example of Loan Amortization

You have borrowed $8,000 from a bank and have promised to

return it in five equal years payments. The first payment is at the

end of the first year. The interest rate is 10 percent. Draw up the

amortization schedule for this loan.

Amortization schedule is just a table that shows how each

payment is split into principal repayment and interest payment.

23

Example of Loan Amortization

Step 1: Compute periodic payment.

PV=8000, N=5, I/Y=10, FV=0, PMT=?

Verify that PMT = 2,110.38

Step 2: Amortization for first year

Interest payment = 8000 x 0.1 = 800

Principal repayment

= 2,110.38 800 = 1310.38

Immediately after first payment, the principal balance is

= 8000 1310.38 = 6,689.62

24

Example of Loan Amortization

Step 3: Amortization for second year

Interest payment = 6689.62 x 0.1 = 668.96

(using the new balance!)

Principal repayment

= 2,110.38 668.96 = 1441.42

Immediately after second payment, the principal balance is = 6,689.62

1441.42 = 5,248.20

Verify that the entire schedule (on following slide)

25

Example of Loan Amortization

Year

Beg.

Balance Payment Interest Principal

End.

Balance

0 8,000.00

1 8,000.00 2,110.38 800.00 1,310.38 6,689.62

2 6689.62 2,110.38 668.96 1,441.42 5,248.20

3 5248.20 2,110.38 524.82 1,585.56 3,662.64

4 3662.64 2,110.38 366.26 1,744.12 1,918.53

5 1918.53 2,110.38 191.85 1,918.53 0.00

Summary

TVM problems with multiple periods and multiple cash flows

Solving TVM problems using financial calculator and time

lines

Special Topics

Compounding period < One Year

Loan amortization

Practice! Practice! Practice!

27

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Practical Accounting of Cash Flow From Operating ActivitiesДокумент13 страницPractical Accounting of Cash Flow From Operating ActivitiesDJ Nicart63% (8)

- 142 Mcqs Good - Financial ManagementДокумент26 страниц142 Mcqs Good - Financial ManagementMuhammad Arslan Usman71% (7)

- Chapter 11&12 QuestionsДокумент8 страницChapter 11&12 QuestionsMya B. Walker100% (1)

- Another Solution and QuestionДокумент28 страницAnother Solution and QuestionradislamyОценок пока нет

- A Study of Collateral Options For Microfinance Loans in PakistanДокумент52 страницыA Study of Collateral Options For Microfinance Loans in PakistanMuhammad Arslan UsmanОценок пока нет

- English Composite 1-7-11Документ22 страницыEnglish Composite 1-7-11Muhammad Arslan UsmanОценок пока нет

- 5 Ways To Solve - Insufficient Storage Available - On AndroidДокумент18 страниц5 Ways To Solve - Insufficient Storage Available - On AndroidMuhammad Arslan UsmanОценок пока нет

- 502C - Cost AccountingДокумент38 страниц502C - Cost AccountingMuhammad Arslan Usman100% (1)

- 102A - Principles of AccountingДокумент38 страниц102A - Principles of AccountingMuhammad Arslan Usman0% (1)

- Arbitrage Pricing Theory (APT) Definition & Example - Investing AnswersДокумент2 страницыArbitrage Pricing Theory (APT) Definition & Example - Investing AnswersMuhammad Arslan UsmanОценок пока нет

- MCQS For Subject Specialist (Islamic Studies) Khyber Pakhtunkhwa Service Commission Through NTSДокумент6 страницMCQS For Subject Specialist (Islamic Studies) Khyber Pakhtunkhwa Service Commission Through NTSMuhammad Arslan UsmanОценок пока нет

- Commercial Bank: Kangwon Rachael Caroline XiaoyiДокумент22 страницыCommercial Bank: Kangwon Rachael Caroline XiaoyiMuhammad Arslan UsmanОценок пока нет

- Full CV 1 1Документ2 страницыFull CV 1 1Muhammad Arslan UsmanОценок пока нет

- Role of Commercial Banks in IndiaДокумент31 страницаRole of Commercial Banks in IndiaMuhammad Arslan UsmanОценок пока нет

- Merit List - 1 - Economics: Campus: Bahawalpur, Program: BS Economics (BWP - Morning) Date: 27-10-14Документ2 страницыMerit List - 1 - Economics: Campus: Bahawalpur, Program: BS Economics (BWP - Morning) Date: 27-10-14Muhammad Arslan UsmanОценок пока нет

- 1414403144Документ2 страницы1414403144Muhammad Arslan UsmanОценок пока нет

- Merit List - 1 - Commerce: Campus: Bahawalpur, Program: BS Commerce (Open - Morning) Date: 27-10-14Документ2 страницыMerit List - 1 - Commerce: Campus: Bahawalpur, Program: BS Commerce (Open - Morning) Date: 27-10-14Muhammad Arslan UsmanОценок пока нет

- Tom Holden: Curriculum VitaeДокумент2 страницыTom Holden: Curriculum VitaeMuhammad Arslan UsmanОценок пока нет

- HBP Case Analysis WorksheetДокумент1 страницаHBP Case Analysis WorksheetMuhammad Arslan UsmanОценок пока нет

- P I D E I: Admission 2014 2 Merit List of PHD Economics, Fall 2014Документ1 страницаP I D E I: Admission 2014 2 Merit List of PHD Economics, Fall 2014Muhammad Arslan UsmanОценок пока нет

- Thermo Fisher Annual ReportДокумент104 страницыThermo Fisher Annual ReportAlessandro PolledroОценок пока нет

- Ch12 Intangible AssetsДокумент28 страницCh12 Intangible AssetsBabi Dimaano Navarez0% (1)

- MPPA (Financial Statement Analysis)Документ36 страницMPPA (Financial Statement Analysis)Sufian TanОценок пока нет

- Partner Communications: Company and Financial OverviewДокумент27 страницPartner Communications: Company and Financial OverviewMunniОценок пока нет

- Are Present Obligation of An Entity: As A Result of Past EventsДокумент14 страницAre Present Obligation of An Entity: As A Result of Past EventsMARY ACOSTAОценок пока нет

- Lease or Buy DecesionДокумент7 страницLease or Buy DecesionRashid HussainОценок пока нет

- Accounting For LeasesДокумент25 страницAccounting For LeasesAnna Lin100% (1)

- EW00467 Annual Report 2018Документ148 страницEW00467 Annual Report 2018rehan7777Оценок пока нет

- Chapter 32 - Multiple ChoiceДокумент2 страницыChapter 32 - Multiple ChoiceLorraineMartinОценок пока нет

- Practice Set 8 Liabilities Part 1Документ8 страницPractice Set 8 Liabilities Part 1Hemabhimanyu MaddineniОценок пока нет

- TRILLION DOLLAR FEDERAL LAWSUIT FOR MORTGAGE FRAUD AND A CRIME ALL HOMEOWNERS SUFFER UNKNOWINGLY - MURRAY V CHASE Et Al THIRD CIRCUITДокумент67 страницTRILLION DOLLAR FEDERAL LAWSUIT FOR MORTGAGE FRAUD AND A CRIME ALL HOMEOWNERS SUFFER UNKNOWINGLY - MURRAY V CHASE Et Al THIRD CIRCUITT Patrick Murray100% (3)

- 10 Amortization GenmathДокумент41 страница10 Amortization GenmathMac FerdsОценок пока нет

- Sol. Man. - Chapter 7 Leases Part 1Документ12 страницSol. Man. - Chapter 7 Leases Part 1Miguel Amihan100% (1)

- AnnuitiesДокумент8 страницAnnuitiesNasserОценок пока нет

- AmortizationДокумент2 страницыAmortizationVishal GajjarОценок пока нет

- ABanca Cuentas Consolidadas 1s 2019 enДокумент75 страницABanca Cuentas Consolidadas 1s 2019 enMiguel RamosОценок пока нет

- Tutor FM Week 10Документ3 страницыTutor FM Week 10Tiffany SasmitoОценок пока нет

- 12 Handout 1 Pas 38, Pas 40, and Pfrs 1Документ10 страниц12 Handout 1 Pas 38, Pas 40, and Pfrs 12DMitchОценок пока нет

- Special Commercial Law: New Central Bank ActДокумент34 страницыSpecial Commercial Law: New Central Bank ActMasterboleroОценок пока нет

- Amortization vs. Depreciation - What's The Difference - InvestopediaДокумент4 страницыAmortization vs. Depreciation - What's The Difference - InvestopediaBob KaneОценок пока нет

- JMJ Marist Brothers Notre Dame of Dadiangas University Accountancy ProgramДокумент5 страницJMJ Marist Brothers Notre Dame of Dadiangas University Accountancy ProgramAvox EverdeenОценок пока нет

- Banking GlossaryДокумент178 страницBanking GlossaryasadullahqureshiОценок пока нет

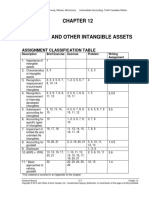

- Assignment Classification Table: Description Brief Exercise Exercise Problem Writing AssignmentДокумент104 страницыAssignment Classification Table: Description Brief Exercise Exercise Problem Writing AssignmentAbdifatah AbdilahiОценок пока нет

- Consumer Mathematics: Borrowing: Loans and Loan RepaymentДокумент22 страницыConsumer Mathematics: Borrowing: Loans and Loan RepaymentAlthea Noelfei QuisaganОценок пока нет

- 8SOLCH04Документ102 страницы8SOLCH04Ricard MatahariОценок пока нет

- Eastland Center - Loan Prop DetailДокумент10 страницEastland Center - Loan Prop DetailClickon DetroitОценок пока нет

- Toa Cpa ReviewДокумент10 страницToa Cpa ReviewKim ZamoraОценок пока нет