Академический Документы

Профессиональный Документы

Культура Документы

Excise Duty

Загружено:

Glen NazarethАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Excise Duty

Загружено:

Glen NazarethАвторское право:

Доступные форматы

Made for DBIT By Satish T Sawnani B.

Com; FCA;ACS;CMA;CAIIB;CTM;DISA & IFRS (ICAI)

1)Central Excise Act,1944(CEA) : The basic Act which providing for charging of duty, valuation , powers of officers, provisions of arrests, penalty , etc. 2)Central Excise Tariff Act,1985 (CETA): This classifies the goods under 96 chapters with specific codes assigned. 3)Central Excise Rules,2002: The procedural aspects are laid herein. Implemented after issue of notification. 4)Central Excise Valuation(Determination of Price of Excisable Goods) Rules,2000: The provisions regarding the valuation of excisable goods are laid down in this rule. 5) Cenvat Credit Rules,2004: The provisions relating to Cenvat Credit available and its utilisation is mentioned.

For DBIT - Mar 2013

The duty of Central Excise is levied if the following conditions are satisfied : (1) The duty is on goods. (2) The goods must be excisable. (3) The goods must be manufactured or produced (4) Such manufacture or production must be in India. Note: All Conditions must be satisfied Ownership of raw material is not relevant for duty liability

For DBIT - Mar 2013 3

Note : Goods manufactured or produced in SEZ are excluded excisable goods. Goods should be Moveable Goods should be marketable Machinery /Petrol Pump permanently embedded to Earth is NOT GOODS

For DBIT - Mar 2013

Defn: Goods specified in the Schedule to Central Excise Tariff Act, 1985 as being subject to a duty of excise and includes salt Explanation to section 2(d),: goods includes any article, material or substance which is capable of being bought and sold for a consideration and such goods shall be deemed to be marketable. Thus, unless the item is specified in the Central Excise Tariff Act as subject to duty, no duty is leviable.

For DBIT - Mar 2013 5

. Manufacture includes any process :(i) incidental or ancillary to the completion of a manufactured product; and (ii) which is specified in relation to any goods in the Section or Chapter Notes of the Schedule to the Central Excise Tariff Act, 1985, as amounting to manufacture or, (iii) which, in relation to the goods specified in the Third Schedule, involves packing or repacking of such goods in a unit container or labeling or re-labelling of containers including the declaration or alteration of retail sale price on it or adoption of any other treatment on the goods to render the product marketable to the consumer.

For DBIT - Mar 2013

Manufacture implies a change, but every change is not manufacture and yet every change of an article is the result of treatment, labour and manipulations. But something more is necessary and there must be transformation; a new and different article must emerge having a distinctive name and character or use.

For DBIT - Mar 2013

The word produced is broader than manufacture and covers articles produced naturally, live products, waste, scrap etc. Manufacture means to make, to inset, to fabricate, or to produce an article by hand, by machinery or by other agency. To manufacture is to produce something new, out of existing materials.

For DBIT - Mar 2013

Is Assembling Manufacture ???? SC says Yes if it brings into existence of a new commercially known different product, however minor the consequent change be, it would amount to manufacture.

For DBIT - Mar 2013

(a) CETA specifies some processes as amounting to manufacture. If any of these processes are carried out, goods will be said to be manufactured, even if as per Court decisions, the process may not amount to manufacture, [Section 2(f)(ii)]. (b) In respect of goods specified in Third Schedule to Central Excise Act, repacking, relabelling, putting or altering retail sale price etc. will be manufacture. Eg: Goods on which excise duty is payable u/s 4A on basis of MRP printed on the package. [Section 2(f)(iii) w.e.f. 14-5-2003].

For DBIT - Mar 2013

10

Basic Excise Duty Education Cess @ 2% of excise duty Secondary and Higher Education Cess (S&H Education Cess) @ 1% of the Excise duty National Calamity Contingent Duty imposed on some products. NCCD of 1% has been imposed on mobile phones

In addition, cesses and duties have been imposed on some specified products.

For DBIT - Mar 2013

11

(i) A person, who produces or manufactures any excisable goods, (ii) A person, who stores excisable goods in a warehouse, (iii) In case of molasses, the person who procures such molasses, (iv) In case goods are produced or manufactured on job work, (a) the person on whose account goods are produced or manufactured by the job work, or (b) the job worker, where such person authorizes the job worker to pay the duty leviable on such goods.

For DBIT - Mar 2013 12

Excise duty is leviable on all excisable goods, which are produced or manufactured in India. Thus, manufacture or production in India of an excisable goods is a taxable event . It becomes immaterial that duty is levied and collected at a later stage i.e. at the time of removal of goods. Therefore, removal from factory is not the taxable event. Captive consumpeiton? Should we pay Ans Yes

For DBIT - Mar 2013 13

A) Physical removal procedure Cigarrettes Clearance takes place under supervision of Excise officers B) Self Removal procedure: The assesee himself determines the duty liability on the goods and clears the goods( On all other goods applicable)

For DBIT - Mar 2013

14

((a) Natural activity, e.g. drying yarn in sun; (b) Processing of duty paid goods; (c) Purchasing various item and putting into a container and selling them; (d) Obtaining of natural products; (e) Testing/quality control of items mfgby others; (f) Cutting /polishing of diamond; (g) Upgradation of computer system; (h) Printing on glass bottles; (i) Affixing brand name; (j) Crushing of boulders into smaller stones.

For DBIT - Mar 2013

15

(a) Person manufacturing for own consumption, (b) Person hiring labour or employees for manufacturing, (c) A job-order worker, (d) A contractor

(a) `Where an activity is not a manufacture; (b) Brand Owners, if their relation with the manufaturer is Principal to Principal basis. (c) Labour Contractors, who supply labor; (d) Loan licensee. (e) Raw material supplier is not manufacturer

Manufacturer as per Statute

Not a Manufacturer

For DBIT - Mar 2013 16

Detailed & Comprehensive Based on Harmonised system of Nomencleture- GATT Grouping of goods of same class Clarification notes-for each section/chapter All the section notes, chapter notes and rules for interpretation are legal notes - serve as statutory guidelines in classification of goods. All goods relating to industry in 1 chapter

For DBIT - Mar 2013

17

1.Duty based on production capacity : On products prone to duty evasion (pan Masala, rolled steel products) 2.Specific duty basis ( on specified unit like

weight, length, volume, thickness etc

3.Tariff value / Notional value fixed by govt

4Duty based on basis of M.R.P. printed on carton after allowing certain deductions 5.Ad valorem (as per assessable value) 6.Compunded levy scheme

For DBIT - Mar 2013 18

(a) The goods are sold at the time of removal from the factory or warehouse. (b) The transaction is between unrelated parties, (c) Price is the sole consideration for the sale (i) The goods are sold by an assessee for delivery at the time of place of removal

For DBIT - Mar 2013

19

Transaction value would include any amount which is paid or payable by the buyer to or on behalf of the assessee, on account of the factum of sale of goods. Transaction Value includes receipts/ recoveries or charges incurred or expenses provided for in connection with the manufacturing, marketing, selling of the excisable goods to be part of the price payable for the goods sold.

For DBIT - Mar 2013

20

(i) Packing charges : ii) Design and Engineering charges (iii) Consultancy charges relating to manufacturing/ production (iv) Loading and handling charges in the factory (v) Royalty charged in franchise agreement Price increase, variation, escalation after removal of goods from the factory is not relevant, IFthe price is

final at the time of removal.

Free After Sales Service/Warranty charges Advertisement and sales promotion expenses incurred by the buyer After-sales service and pre delivery inspection (PDI) charges provided free

For DBIT - Mar 2013 21

(i) Taxes and duties (ii) Erection, installation and commissioning charges (iii) Freight( Expenses after place of removal/ factory gate are not considered) (iv)Advertising/Publicity expenditure by brand name/copyright owner as not done by manufacturer assessee. v) Notional interest on security deposit/ advances

For DBIT - Mar 2013 22

(vi) Interest on Receivables Trade Discounts Deemed export incentives earned on goods supplied: Price of accessories and optional bought out ) Subsidy/rebate obtained by assessee

For DBIT - Mar 2013

23

(a) Should be under provisions of Standards of Weights and Measures Act or Rules (b) Notification by Central Govt in Official Gazette specifying the commodities to which the provision is applicable and the abatements (Deductions)permissible. ( (d) The retail sale price should be the maximum price at which goods in packaged forms are sold to ultimate consumer. It includes all taxes, freight, transport charges, commission payable to dealers and all charges towards advertisement, delivery, packing, forwarding charges etc. If under certain law, MRP is required to be without taxes and duties, that price can be the retail sale price. If more than 1 retail price then consider higher one

For DBIT - Mar 2013 24

(i) Value nearest to time of removal if goods not sold ( say free samples ) Cost of prodn +10% if other modes of calculation not there (ii) Goods sold at different place . (- transport cost ) iii) Valuation when the price is not the sole consideration Where the price is not the sole consideration for sale, the value of such goods shall be deemed to be the aggregate of (a) such transaction value, and (b) the amount of money value of any additional consideration flowing directly or indirectly from the buyer to the assessee.

For DBIT - Mar 2013

25

) Sale at depot/consignment agent Section 4(3)(c)(iii) provides that in case of sale at depot/consignment agent, the depot/place of consignment agent will be the place of removal time of removal shall be deemed to be the time at which the goods are cleared from factory. So price @ date when cleared from factory

For DBIT - Mar 2013

26

(v) Captive consumption : E.D is payable valuation shall be done on basis of cost of production plus 10% Inter connected undertakings: Buyer and seller are related if they are inter-connected undertakings, as defined in S.2(g) of (MRTP). The essence of the definition under MRTP is that the inter-connection could be through ownership, control or management. Just 25% of total controlling power in both undertakings is enough to establish inter-connection.

For DBIT - Mar 2013

27

(As per section 4(3)(b) of Central Excise Act, persons shall be deemed to be related if (a) They are inter-connected undertakings (b) They are relatives Buyer is a relative and a distributor of assessee, or a sub-distributor of such distributor or (d) They are so associated that they interest, directly or indirectly, in the business of each other. Note: It is not enough if only buyer has interest in seller or seller has interest in buyer. Both must have interest

For DBIT - Mar 2013 28

(As per section 4(3)(b) of Central Excise Act, persons shall be deemed to be related if (a) They are inter-connected undertakings (b) They are relatives Buyer is a relative and a distributor of assessee, or a sub-distributor of such distributor or (d) They are so associated that they interest, directly or indirectly, in the business of each other. Note: It is not enough if only buyer has interest in seller or seller has interest in buyer. Both must have interest

For DBIT - Mar 2013 29

(If assessment is not possible under any of the earlier rules, assessment will be done by best judgement. If the value of any excisable goods cannot be determined under the foregoing rules, the value shall be determined using reasonable means consistent with the principles and general provisions of these rules

For DBIT - Mar 2013

30

Job-worker means a person engaged in the manufacture or production of goods on behalf of a principal manufacturer, from any inputs or goods supplied by the said principal manufacturer or by any other person authorised by him. The price at which principal manufacturer sells is T.Value. From factory gate of job worker

For DBIT - Mar 2013

31

Assembly at site is not manufacture, if immovable product emerges Article can be goods if marketable before erection or becoming immovable Betel Nut to supari powder is not manufacture Upgradation of computer system is not manufacture Same product partly sold in retail and partly in wholesale (adopt different rules of valuation) Valuation of free samples based on similar goods Valuation in case of stock transfer @date of clearance from factory Part sale and part consumption then of price at

which goods are sold to other independent buyers

For DBIT - Mar 2013

32

(i) Rebate of duty on export goods and material used in manufacture of such goods (ii) Export of goods without payment of excise duty under Bond Rule 19 (iii) Cenvat credit of input excise duty provided drawback for the same is not taken (iv) Setting up of units in FTZ/EPZ/ETP and Jewellery Complexes and 100% EOU/SEZ ( No Customs duty on capex & inputs,can sell within FTZ, amongst EOU (v) Drawback of Customs and Central Excise Duties in respect of inputs, both indigenous and imported :

For DBIT - Mar 2013

33

(vi) Drawback of 98% customs duty (including anti-dumping duty). (vii) Duty free Replenishment Scheme (Post export replenishment possible of duty free imports with certain additions as per norms) (viii) DEEC Scheme - Duty Entitlement

Export Certificate - Not trf but duty free imports possible for value stipulated (ix) DEPB Scheme : Duty entitlement pass book scheme

For DBIT - Mar 2013 34

Exporters are granted duty credits, on the basis of pre-notified entitlement rates, which will allow them to import inputs duty free. The exporter can export any product under the DEPB Scheme provided the same is covered by the Standard Input-Output Norms. The importer has the option to forego exemption from C.V.D. and pay the C.V.D. in cash so that he or the customer can claim Cenvat credit. Goods in the Negative List of EXIM Policy cannot be exported.

For DBIT - Mar 2013

35

(x) Imports for repair, jobbing, etc. free of duties (both basic and additional) : (xi) Import of capital goods at 5% concessional rate under EPCG Scheme ( All sectors, No limit, Service sectors opened too) (xii) Duty Free Entitlement Credit Certificate to Status holders (xiii) Duty Free Entitlement Credit Certificate to Service Providers xiv) Special Economic Zones (Treat as outside India the zones)

For DBIT - Mar 2013 36

Pay Duty by 5th of following month except March when pay on 31 March Buyers claim credit ASAP after manufacturers have cleared goods from factory E-payment compulsory for assessees paying 50 lakhs or more . Optional for others.

For DBIT - Mar 2013

37

Producer/ manufacturer should get registered Maintain Daily Stock A/c goods mfg,cleared & in Stock Goods clrd by Owner or rep. under invoice Pay duty on monthly basis File Mthly return-10th of month.SSI units qtrly File Annual info Reportby 30 nov if taxes > 1 crore Specified assessees file Info relating to Principal Inputs every year by 30th April in form ER-5, to Superintendent of Central Excise and monthly consumption records

For DBIT - Mar 2013 38

Inform change in boundary of premises, address, name of authorised person, change in name of partners, directors or Managing Director in form A-1. List in duplicate of records kept for receipt, purchase, sales or delivery of goods including inputs and capital goods, input services and financial records and statements including trial balance Specified assessees file Info relating to Principal Inputs every year by 30th April in form ER-5, to Superintendent of Central Excise and monthly consumption records

For DBIT - Mar 2013

39

Remission of duty can be granted in following cases (a) Goods have been lost or destroyed by natural causes (b) Goods have been lost or destroyed by unavoidable accident (c) Goods are claimed by manufacturer as unfit for consumption or for marketing.

For DBIT - Mar 2013

40

A system of granting credit of duty paid on inputs and input services. A manufacturer or service provider has to pay excise duty and service tax as per normal procedure on the basis of Assessable Value (which is mainly based on selling price). However, he gets credit of duty paid on inputs and service tax paid on input services. Thus, he actually pays amount equal to duty/ service tax as shown in invoice less the Cenvat credit available to him

For DBIT - Mar 2013

41

Capital goods (machinery, plant, spare parts of machinery, tools, dies, etc.) as defined in rule 2(a), used for manufacture of final product and/or used for providing taxable output service will be available. Capital goods should be used in the factory. 50% credit is available in current year and balance in subsequent financial year/(s) . Assessee should not claim depreciation on duty portion on which he has availed Cenvat credit. A service provider can take out capital goods from his premises, provided that he brings them back within 180 days. (Extendable)

For DBIT - Mar 2013

42

Credit on basis of specified documents( B/L, Invoice, BoE, supplemental invoice) Credit available instantly in case of inputs Cenvat to manufacturer available only if there is manufacture (ELSE NOT)

One-to-one correlation not required for credits and debits etc.

No input credit if final product/output service exempt from duty/ service tax

For DBIT - Mar 2013

43

(a) Maintain separate inventory and accounts of receipt and use of inputs and input services used for exempted goods/exempted output services Rule 6(2) of Cenvat Credit Rules. (b) Pay amount equal to 5% of value of exempted goods (if he is manufacturer) and/or 6% of value of exempted services (if he is service provider) if he does not maintain separate inventory and records, (c) Pay an amount equal to proportionate Cenvat credit attributable to exempted final product/ exempted output services Rule 6(3)(ii) w.e.f. 1-42008.

For DBIT - Mar 2013

44

For DBIT - Mar 2013

45

For DBIT - Mar 2013

46

For DBIT - Mar 2013

47

For DBIT - Mar 2013

48

For DBIT - Mar 2013

49

For DBIT - Mar 2013

50

For DBIT - Mar 2013

51

Вам также может понравиться

- Consumption, Saving, and InvestmentДокумент50 страницConsumption, Saving, and InvestmentMinerva EducationОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Project Profile-ReadymixConcrete PlantДокумент5 страницProject Profile-ReadymixConcrete PlantAshish MajumderОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Law On Chattel MortgageДокумент17 страницLaw On Chattel MortgageRojohn ValenzuelaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Topic 10 - Practice ProblemsДокумент2 страницыTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanОценок пока нет

- How To Become A Certified Finance Planner (CFP) in India - QuoraДокумент11 страницHow To Become A Certified Finance Planner (CFP) in India - QuorarkОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Finc 610 QPДокумент15 страницFinc 610 QPSam Sep A SixtyoneОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- RRJ EnterprisesДокумент1 страницаRRJ EnterprisesOFC accountОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- 5-Non-Banking Financial InstitutionsДокумент19 страниц5-Non-Banking Financial InstitutionsSharleen Joy TuguinayОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Site Visit. Promoting Frankincense Processing in Puntland State of SomaliaДокумент10 страницSite Visit. Promoting Frankincense Processing in Puntland State of SomaliaGanacsi KaabОценок пока нет

- Andhra Bank Po RuleДокумент208 страницAndhra Bank Po Ruleharshdh1Оценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Theories of Exchange RateДокумент47 страницTheories of Exchange RateRajesh SwainОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Simple InterestДокумент24 страницыSimple InterestAgatha JenellaОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Duxbury Clipper 2010-30-06Документ40 страницDuxbury Clipper 2010-30-06Duxbury ClipperОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Hola Kola Case StudyДокумент8 страницHola Kola Case StudyAbhinandan Singh100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- CMA 2017-1 January Marking ScreamДокумент12 страницCMA 2017-1 January Marking Screamchit myo100% (1)

- Module 3 Cost Volume Profit Analysis NA PDFДокумент4 страницыModule 3 Cost Volume Profit Analysis NA PDFMadielyn Santarin Miranda50% (2)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Valuation VariantДокумент4 страницыValuation Variantsrinivas50895Оценок пока нет

- Chapter 6 ACCA F3Документ12 страницChapter 6 ACCA F3siksha100% (1)

- Mariner QuestionnaireДокумент2 страницыMariner QuestionnaireMonique Van Kan-WierstraОценок пока нет

- Summer Internship Programme 2018-19: National Aluminum Company Limited NalcoДокумент59 страницSummer Internship Programme 2018-19: National Aluminum Company Limited Nalcoanon_849519161Оценок пока нет

- Spes Form 5 - Placement Report Cum Gsis - Dec2016Документ1 страницаSpes Form 5 - Placement Report Cum Gsis - Dec2016Joel AndalesОценок пока нет

- McKinsey Profile Up1 1201Документ94 страницыMcKinsey Profile Up1 1201007003sОценок пока нет

- Course Title: Financial Markets Course Code: Course DescriptionДокумент6 страницCourse Title: Financial Markets Course Code: Course Descriptionharon franciscoОценок пока нет

- Security Valuation G3 730AMДокумент3 страницыSecurity Valuation G3 730AMKearn CercadoОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Horngrens Accounting Australia 8Th Edition Nobles Test Bank Full Chapter PDFДокумент45 страницHorngrens Accounting Australia 8Th Edition Nobles Test Bank Full Chapter PDFsaturnagamivphdh100% (9)

- United States Court of Appeals, Fourth CircuitДокумент4 страницыUnited States Court of Appeals, Fourth CircuitScribd Government DocsОценок пока нет

- 4 - Notes Receivable Problems With Solutions: ListaДокумент21 страница4 - Notes Receivable Problems With Solutions: Listabusiness docОценок пока нет

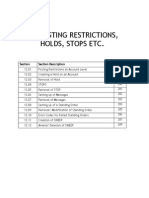

- 01.12 Posting RestrictionsДокумент14 страниц01.12 Posting Restrictionsmevrick_guyОценок пока нет

- UnpaidDividend 2009 2010Документ49 страницUnpaidDividend 2009 2010harsh bangurОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Course Information BookletДокумент212 страницCourse Information BookletTang Szu ChingОценок пока нет