Академический Документы

Профессиональный Документы

Культура Документы

Balance of Payments

Загружено:

Jagannath PadhiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balance of Payments

Загружено:

Jagannath PadhiАвторское право:

Доступные форматы

Presented By:

Pooja Mohan Ajinkya Keni Girish patil

The balance of payment is defined as a systematic record of all economic transactions between the residents of a country and residents of a foreign countries It is presented in the form of double-entry bookkeeping.

BOP

Current Account

Capital Account

Reserves Gold Reserves Forex Reserves IMF Loans

Trade Transfer / factor Payments Invisibles

FDI/FIIs Portfolio Investments NRE/NRI A/cs

Capital Account:That part of balance of payments that reflects net change in national ownership of assets. Capital Account = Foreign direct investment +Portfolio investment +Other investment

INDIA'S OVERALL BALANCE OF PAYMENTS

Item/Year 1 Credit 2 256159 190488 124636 15793 14246 1945 535 92117 53100 24050 2010-11 Debit 3 383481 111218 80555 11026 13880 1400 820 53430 2194 27694 2011-12 Debit 6 499533 107625 78227 13762 16382 1497 780 45806 1256 26788 (US $ million) 2012-13 Debit Net 9 10 502237 -195656 116551 107493 80763 64915 11823 14806 1409 813 51912 2363 30349 6176 2528 818 -239 55632 63504 -1902

Net 4 -127322 79269 44081 4768 366 545 -285 38687 50905 -3644

Credit 5 309774 219229 142325 18462 18241 2632 478 102513 62212 25910

Net 7 -189759 111604 64098 4699 1859 1134 -302 56707 60957 -878

Credit 8 306581 224044 145678 17999 17334 2227 574 107544 65867 28447

A. Current Account

1. Merchandise 2. Invisibles (a+b+c) a) Services i) Travel ii)Transportation iii) Insurance iv) G.n.i.e. v) Miscellaneous of which : Software services Business services

Financial services

Communication services b) Transfers i) Official ii) Private c) Income i) Investment income

6508

1562 56265 647 55618 9587 8471

7483

1152 3125 631 2494 27538 25546

-975

410 53140 16 53125 -17952 -17075

5967

1600 66761 632 66129 10144 7676

7984

1557 3267 607 2660 26131 24141

-2018

43 63494 25 63469 -15988 -16465

4949

1686 68090 463 67627 10276 7202

4633

741 4057 772 3285 31731 29572

316

945 64034 -309 64342 -21455 -22370

ii) Compensation of employees

1116

446647

1992

494700

-876

-48053

2468

529003

1991

607158

477

-78155

3074

530625

2159

618788

914

-8816

Total Current account (1+2)

The BOP provides an extremely useful data for the economic analysis of the countrys weakness and strength as a partner in international trade. BOP also reveals the changes in the composition and magnitude of foreign trade. BOP also provides indications, future repercussions of countries past trade performances.

Total receipts and total payments inequality shows disequilibrium of balance of payments account

B=RP Where, B stands for balance of payments, R denotes receipts from foreigners, P stands for payments made to foreigners A country whose balance of payments is positive is called as surplus country (R>P) A country whose balance of payments is negative is called as deficit country (P>R)

Cyclical disequilibrium: It occurs on account of trade

cycles. Cyclical fluctuations in demand are caused by changes in Income, employment, output & price.

Structural disequilibrium: It is caused because of

fluctuation in the demand based on changes in tastes, fashions, habits, income, economic progress etc.

Short run disequilibrium: When a country borrows

or lends internationally, it will have short run disequilibrium, as these are usually for short period.

Long run disequilibrium: It occurs because of

accumulation of deficits or surpluses over a long period.

Causes for Indias BOP deficit

Huge development & investment programs : Due to huge development and investment programs , Import goes on increasing , requirement of capital for rapid industrialization, while exports may not be boosted up to that extent. Thus, there will be structural changes in the balance of payments and structural equilibrium will result.

Population growth: High population growth in poor countries has adverse impact on their balance of payments. Increase in the population increases the needs of these countries for imports and decreases the capacity of export. Huge external borrowing: A country will have adverse balance of payments when it borrows heavily from another country Inflation: Rapid economic development, increase in the income & price will adversely affect BOP position of a developing country like India.

THANK YOU

Вам также может понравиться

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismОт EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismОценок пока нет

- 11 Finance and DevelopmentДокумент6 страниц11 Finance and DevelopmentM IshaqОценок пока нет

- Amity University Kolkata IfmДокумент8 страницAmity University Kolkata IfmPinki AgarwalОценок пока нет

- Chapter 2-Flow of FundsДокумент78 страницChapter 2-Flow of Fundsธชพร พรหมสีดาОценок пока нет

- MFM-103 Balance of Payment-Current ScenarioДокумент8 страницMFM-103 Balance of Payment-Current ScenarioAhel Patrick VitsuОценок пока нет

- BOP India BullsДокумент19 страницBOP India Bullsthexplorer008Оценок пока нет

- Balance of Payments & International Investment Position: For The Quarter Ended September 2012Документ6 страницBalance of Payments & International Investment Position: For The Quarter Ended September 2012BermudanewsОценок пока нет

- BOP RevДокумент70 страницBOP RevJulian ChackoОценок пока нет

- Alance OF Ayments: Presented By: Vikas Roll No.: 31Документ54 страницыAlance OF Ayments: Presented By: Vikas Roll No.: 31saratkarvivekОценок пока нет

- Balanceofpayment 190415122143Документ22 страницыBalanceofpayment 190415122143Unique OfficialsОценок пока нет

- Balance of PaymentsДокумент7 страницBalance of PaymentsthokachiОценок пока нет

- Analysis On Balance of Payments in India For Last 5 YearsДокумент15 страницAnalysis On Balance of Payments in India For Last 5 YearsRoopavathy Mani100% (2)

- Brac University: Assignment TopicДокумент12 страницBrac University: Assignment TopicMarshal Richard57% (7)

- Union Budget SimplifiedДокумент5 страницUnion Budget SimplifiedParin ChawdaОценок пока нет

- Report On India's Balance of Payments Crisis and It's ImpactsДокумент31 страницаReport On India's Balance of Payments Crisis and It's ImpactsRavi RockОценок пока нет

- Balance of PaymentsДокумент12 страницBalance of PaymentsAlgine EscolОценок пока нет

- Balance of Payments INDIA 2006-12: Course - Organizational Behaviour PGDM - PTДокумент19 страницBalance of Payments INDIA 2006-12: Course - Organizational Behaviour PGDM - PTVarun GandhiОценок пока нет

- Balance of PaymentДокумент34 страницыBalance of PaymentBilawal ShabbirОценок пока нет

- BOP FairДокумент23 страницыBOP FairAnonymous tClys7qPyeОценок пока нет

- 4.1 Balance of Payments & Its Components: Balance of Payments (Bop) StatisticsДокумент12 страниц4.1 Balance of Payments & Its Components: Balance of Payments (Bop) StatisticsABHISHEK TYAGIОценок пока нет

- Therefore GDP C+ G+ I + N ExДокумент10 страницTherefore GDP C+ G+ I + N Exyashasheth17Оценок пока нет

- Ndia S Rade Olicy: Foreign Trade Balance of Payments Trade Policies Foreign Trade Policy (FTP)Документ20 страницNdia S Rade Olicy: Foreign Trade Balance of Payments Trade Policies Foreign Trade Policy (FTP)Murtaza BharthooОценок пока нет

- Kiit School of Management Kiit University BHUBANESWAR - 751024Документ14 страницKiit School of Management Kiit University BHUBANESWAR - 751024ss_shekhar007Оценок пока нет

- Balance of PaymentsДокумент6 страницBalance of PaymentsFayshal MiazyОценок пока нет

- The Balance of Trade Is A Narrow Term It Takes Into Account Only The Transactions Arising Out of The Export and Import of Visible ItemsДокумент25 страницThe Balance of Trade Is A Narrow Term It Takes Into Account Only The Transactions Arising Out of The Export and Import of Visible ItemspranalisalunkheОценок пока нет

- Bop in IndiaДокумент37 страницBop in IndiaKrishna TiwariОценок пока нет

- B. A .Programme Economics VI Semester Paper: Economic Development and Policy India-IIДокумент8 страницB. A .Programme Economics VI Semester Paper: Economic Development and Policy India-IIShubham SinghОценок пока нет

- Capital AccountДокумент38 страницCapital AccountSheetal IyerОценок пока нет

- Lecture 20 - Open Economy - Introduction and The Savings InequalityДокумент21 страницаLecture 20 - Open Economy - Introduction and The Savings InequalityParth BhatiaОценок пока нет

- C C C C CДокумент5 страницC C C C Cmrinmoy_nsuОценок пока нет

- Balance of Payments: Presented By: AnuradhaДокумент13 страницBalance of Payments: Presented By: AnuradhaSalman AghaОценок пока нет

- Welcome: Welcome To Welcome ToДокумент34 страницыWelcome: Welcome To Welcome ToKrish PatilОценок пока нет

- Balance of Payments: Chapter Learning ObjectivesДокумент74 страницыBalance of Payments: Chapter Learning ObjectivesShuvro RahmanОценок пока нет

- Chapter-14 en FDIДокумент22 страницыChapter-14 en FDIS. M. Hasan ZidnyОценок пока нет

- Unit. 18 India'S Balance Payments: 18.0 ObjectivesДокумент16 страницUnit. 18 India'S Balance Payments: 18.0 ObjectivesRobert SkidelskyОценок пока нет

- Budget 2015-16Документ100 страницBudget 2015-16bazitОценок пока нет

- Module 6 - Lect 5 - BOPДокумент16 страницModule 6 - Lect 5 - BOPBHAVYA GOPAL 18103096Оценок пока нет

- Balance of PaymentДокумент42 страницыBalance of PaymentGaurav PareekОценок пока нет

- Chapter-3: Balance of PaymentsДокумент34 страницыChapter-3: Balance of Paymentschanchal22Оценок пока нет

- Types of Bop, Disequilibrium in Bop, Measures of Disequilibrium BopДокумент7 страницTypes of Bop, Disequilibrium in Bop, Measures of Disequilibrium Boparuproy.aaОценок пока нет

- Balance of Payments: Systematic Records OF All Economic TransactionsДокумент50 страницBalance of Payments: Systematic Records OF All Economic TransactionsnishantkastureОценок пока нет

- Balance of Payment (Int. Eco)Документ6 страницBalance of Payment (Int. Eco)Phalguni MuthaОценок пока нет

- Balance of PaymentsДокумент16 страницBalance of PaymentsShipra SinghОценок пока нет

- BOPДокумент15 страницBOPmrunОценок пока нет

- Assignment Bop AnalysisДокумент9 страницAssignment Bop AnalysisJustin SunnyОценок пока нет

- International Economics: Topic 7Документ16 страницInternational Economics: Topic 7Ngọc Minh NguyễnОценок пока нет

- Macroeconomic AnalysisДокумент6 страницMacroeconomic AnalysisMeghna B RajОценок пока нет

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiДокумент38 страницDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89Оценок пока нет

- Balance of Payments: UNIT-2Документ9 страницBalance of Payments: UNIT-2naveenОценок пока нет

- Balance of Payments AccountsДокумент9 страницBalance of Payments AccountsRitu GoelОценок пока нет

- SEBI Grade A 2020 Economics Balance of PaymentsДокумент11 страницSEBI Grade A 2020 Economics Balance of PaymentsThabarak ShaikhОценок пока нет

- Balance of PaymentsДокумент12 страницBalance of Paymentspuneet8817Оценок пока нет

- MF Review: Budget 2009-10: Nothing To Rejoice On FM's SilenceДокумент5 страницMF Review: Budget 2009-10: Nothing To Rejoice On FM's SilencePartha Pratim MitraОценок пока нет

- Ratings On Egypt Raised To 'B-/B' On Donor Support Outlook StableДокумент7 страницRatings On Egypt Raised To 'B-/B' On Donor Support Outlook Stableapi-228714775Оценок пока нет

- Unit 14 India'S Balance of Payments: ObjectivesДокумент18 страницUnit 14 India'S Balance of Payments: ObjectivesHemant SharmaОценок пока нет

- Earnings Update (Company Update)Документ59 страницEarnings Update (Company Update)Shyam SunderОценок пока нет

- Online Coaching For IAS (Pre.) G.S. Paper - 1: Printed Study Material For IAS, CSAT Civil Services ExamsДокумент11 страницOnline Coaching For IAS (Pre.) G.S. Paper - 1: Printed Study Material For IAS, CSAT Civil Services Examskrishan palОценок пока нет

- FDI in IndiaДокумент4 страницыFDI in IndiaPratik RambhiaОценок пока нет

- Encl.: As AboveДокумент7 страницEncl.: As AboveJagannath PadhiОценок пока нет

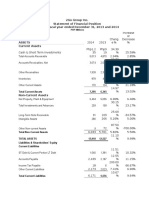

- Profitability Ratios: Liquidity and Solvency RatiosДокумент2 страницыProfitability Ratios: Liquidity and Solvency RatiosJagannath PadhiОценок пока нет

- Robin SharmaДокумент8 страницRobin SharmaJagannath Padhi0% (3)

- Linear Programming Problems - FormulationДокумент55 страницLinear Programming Problems - FormulationJagannath Padhi100% (1)

- Fiscal Policy: Presented byДокумент40 страницFiscal Policy: Presented byJagannath PadhiОценок пока нет

- Market Structure in BangladeshДокумент15 страницMarket Structure in BangladeshTalukder Riman80% (5)

- Executive SummaryДокумент22 страницыExecutive SummaryHabibur RahmanОценок пока нет

- Tybms Sem Vi - International Finance Paper SolutionДокумент11 страницTybms Sem Vi - International Finance Paper SolutionQuestTutorials Bms100% (4)

- Spin Off & Corporate Restructuring in BriefДокумент11 страницSpin Off & Corporate Restructuring in BriefTushar Kadam100% (1)

- JPM Private BankДокумент31 страницаJPM Private BankZerohedge100% (2)

- MS1-Final Exams For StudentsДокумент6 страницMS1-Final Exams For StudentsNikki Estores GonzalesОценок пока нет

- Real Estate Appraisal FormulasДокумент4 страницыReal Estate Appraisal FormulasMichelleOgatis83% (6)

- 8657948Документ4 страницы8657948Pulkit MahajanОценок пока нет

- Investor Presentation (Company Update)Документ47 страницInvestor Presentation (Company Update)Shyam SunderОценок пока нет

- NakedPutsOptionsInvesting PDFДокумент177 страницNakedPutsOptionsInvesting PDFRamy Taraboulsi100% (1)

- Michael Guichon Sohn Conference PresentationДокумент49 страницMichael Guichon Sohn Conference PresentationValueWalkОценок пока нет

- Revenue Per EmployeeДокумент5 страницRevenue Per EmployeeAmit SharmaОценок пока нет

- Dustin Mathews Business Credit ManifestoДокумент31 страницаDustin Mathews Business Credit Manifestojim_fleck100% (22)

- Study Material Inventory-1Документ9 страницStudy Material Inventory-1lipak chinaraОценок пока нет

- Assesing Vietnam's Key Regions and Economic Zones in 2017Документ12 страницAssesing Vietnam's Key Regions and Economic Zones in 2017Tan Tien NguyenОценок пока нет

- Acounting PrinciplesДокумент1 страницаAcounting PrinciplesLubeth CabatuОценок пока нет

- Bank of America Merrill LynchДокумент27 страницBank of America Merrill LynchMaheshwar MallahОценок пока нет

- The Oilcoin White Paper: Oilcoin: A U.S. Based, Regulatory Compliant, Digital Reserve CurrencyДокумент27 страницThe Oilcoin White Paper: Oilcoin: A U.S. Based, Regulatory Compliant, Digital Reserve CurrencySlobodan MomakОценок пока нет

- CFA CaseДокумент8 страницCFA CaseAnonymous yBhSg7vdОценок пока нет

- Survival StakesДокумент12 страницSurvival StakesShonit MittalОценок пока нет

- Assessing A New Venture's Financial Strength and ViabilityДокумент6 страницAssessing A New Venture's Financial Strength and ViabilityAsif KureishiОценок пока нет

- Case Study Make My Trip Vivek Aggarwal 29 05Документ17 страницCase Study Make My Trip Vivek Aggarwal 29 05Homework Ping100% (1)

- Chapter 18 SolutionДокумент5 страницChapter 18 SolutionSilver BulletОценок пока нет

- Investment Notes (Lecture 2)Документ35 страницInvestment Notes (Lecture 2)JoelОценок пока нет

- AC213 Ch04 ExerciseSolutionsДокумент28 страницAC213 Ch04 ExerciseSolutionsRezzan Joy Camara MejiaОценок пока нет

- 2go Group IncДокумент7 страниц2go Group IncSheenah FerolinoОценок пока нет

- Tax - 001Документ3 страницыTax - 001HURLY BALANCAR0% (1)

- Board Member ToolkitДокумент112 страницBoard Member Toolkitthpvxhfi100% (1)

- Statement of Management'S Responsibility For Financial StatementsДокумент12 страницStatement of Management'S Responsibility For Financial StatementsRonald Allan QuicayОценок пока нет

- Guna Fibres Case Analysis EssayДокумент4 страницыGuna Fibres Case Analysis EssayVeneranda Atria0% (2)