Академический Документы

Профессиональный Документы

Культура Документы

Amity Business School: Capital Structure

Загружено:

Aamir MalikОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Amity Business School: Capital Structure

Загружено:

Aamir MalikАвторское право:

Доступные форматы

Amity Business School

Amity Business School

MBA Class of 2014 , Semester II FINANCIAL MANAGEMENT MODULE III

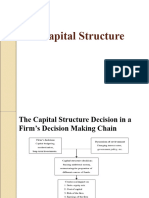

Capital Structure

1

Amity Business School

Introduction Financing decision is raising the necessary funds to meet our investment expenditures. Most of the investment is done through borrowed funds. So, while making an investment decision it is necessary to see whether adequate funds are available or not. Because without a financing decision investment decision is not possible and without investment decision financing decision has no purpose

Amity Business School

In financing decision company has to decide its capital structure. In this the debt & equity ratio is decided. It also termed as debt equity mix. The capital structure or financing decision indicates the left side (Liabilities) of the balance sheet whereas investment decision shows right side (Assets) of the balance sheet. The capital structure shows the proportionate relationship between debt & equity.

Amity Business School

That is how these two decisions are correlated. In financing decision, we not only have to look at availability of funds but also at its cost. We have to pay in future, that is why the cost of capital is very significant decision. It (cost of capital) has two dimensional impacts like it affects both the investment and financing decision

Capital structure does not effect the earnings of the firm but it can effect the share of Earning available for the equity share holders

Amity Business School

Illustration1. ABC company has currently an all equity capital structure consisting Of 15000 equity shares of Rs.100 each. The management is planning To raise another 25 lakhs to finance a major Programme of expansion And is considering three alternative method of financing: i. To issue 25000 equity shares of Rs.100 each. ii. To issue 25000, 8% debenture of Rs.100 each iii. To issue 25000, 8% preference share of Rs.100 each. The companys expected earnings before interest and taxes will be Rs.8 Lakhs. Corporate tax rate is 50%. Analysis the options and suggest the Best alternative with reasons.

Amity Business School

Optimum Capital Structure A capital structure decision can influence the value of the firm through the cost of capital and trading on equity. The optimum capital structure may be define as that capital structure or combination of debt and equity that leads to the maximum value of the firm.

Amity Business School

Simplicity Flexibility Minimum Cost of Capital Adequate Liquidity Minimum Risk Legal Requirements Control Floatation Cost

Вам также может понравиться

- Capital StructureДокумент28 страницCapital StructureSimmi KhuranaОценок пока нет

- Finance Decisions: Unit IvДокумент70 страницFinance Decisions: Unit IvFara HameedОценок пока нет

- Capital StructureДокумент9 страницCapital StructureRavi TejaОценок пока нет

- Theory of Capital StructureДокумент3 страницыTheory of Capital StructureAlamin Rahman JuwelОценок пока нет

- Capital Structure TheoriesДокумент38 страницCapital Structure TheoriesNeha SoodОценок пока нет

- Capital StructureДокумент44 страницыCapital Structureeliasjade2Оценок пока нет

- Capital Structure FinalДокумент27 страницCapital Structure FinalAkhil SardaОценок пока нет

- FM Unit 3Документ22 страницыFM Unit 3Krishnapriya S MeenuОценок пока нет

- Overview of Financial ManagementДокумент26 страницOverview of Financial ManagementAnthony DyОценок пока нет

- Unit 3rd Financial Management BBA 4thДокумент18 страницUnit 3rd Financial Management BBA 4thYashfeen FalakОценок пока нет

- FM-Cap. Structure COCДокумент24 страницыFM-Cap. Structure COCshagun.2224mba1003Оценок пока нет

- Capital Structure Unit 2Документ14 страницCapital Structure Unit 2Jia MakhijaОценок пока нет

- Hypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDДокумент25 страницHypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDlovels_agrawal6313Оценок пока нет

- CH 5Документ10 страницCH 5malo baОценок пока нет

- Capital StructureДокумент23 страницыCapital StructureDrishti BhushanОценок пока нет

- ActivityДокумент4 страницыActivityRain Vicente100% (1)

- Capital Structure DecisionДокумент18 страницCapital Structure DecisionFALAK OBERAIОценок пока нет

- Problems On Capital StructureДокумент5 страницProblems On Capital StructureBharath Gowda VОценок пока нет

- Project Appraisal: Department of Economics Email: Tel. 0832-2580207 (O) 08879506995 (M)Документ32 страницыProject Appraisal: Department of Economics Email: Tel. 0832-2580207 (O) 08879506995 (M)rajpd28Оценок пока нет

- Unit 7 Capital StructureДокумент12 страницUnit 7 Capital StructurepnkgoudОценок пока нет

- Review of FS Preparation Analysis and Interpretation 6Документ17 страницReview of FS Preparation Analysis and Interpretation 6Christian Jasper M. LigsonОценок пока нет

- Leverage: - Compiled by - Sapna Bhupendra Jain 98112-55704Документ7 страницLeverage: - Compiled by - Sapna Bhupendra Jain 98112-55704casapnaОценок пока нет

- Capital StructureДокумент8 страницCapital StructureVarun MudaliarОценок пока нет

- mb0045 FinancialManagementДокумент9 страницmb0045 FinancialManagementSaravanan VelayuthamОценок пока нет

- IGNOU MBA MS - 04 Solved Assignment 2011Документ12 страницIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcОценок пока нет

- FM Sheet 4 (JUHI RAJWANI)Документ8 страницFM Sheet 4 (JUHI RAJWANI)Mukesh SinghОценок пока нет

- Financial Management - Session 2Документ25 страницFinancial Management - Session 2amishi.22019Оценок пока нет

- Capital Structure DecisionДокумент12 страницCapital Structure Decisionchaterji_aОценок пока нет

- Capital Structure DecisionДокумент12 страницCapital Structure Decisionchaterji_aОценок пока нет

- What Is Corporate Finance4.9Документ6 страницWhat Is Corporate Finance4.9Alejo valenzuelaОценок пока нет

- Unit II, Chapter 4Документ33 страницыUnit II, Chapter 4abhikini93Оценок пока нет

- Submitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Документ18 страницSubmitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Ramesh BabuОценок пока нет

- Chapter-9, Capital StructureДокумент21 страницаChapter-9, Capital StructurePooja SheoranОценок пока нет

- FM S5 Capitalstructure TheoriesДокумент36 страницFM S5 Capitalstructure TheoriesSunny RajoraОценок пока нет

- Capital StructureДокумент15 страницCapital StructurePriyanka SharmaОценок пока нет

- IGNOU MBA MS - 04 Solved Assignment 2011Документ16 страницIGNOU MBA MS - 04 Solved Assignment 2011Kiran PattnaikОценок пока нет

- Mba-608 (CF)Документ14 страницMba-608 (CF)Saumya jaiswalОценок пока нет

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmДокумент11 страницCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairОценок пока нет

- Capital StructureДокумент4 страницыCapital StructureNaveen GurnaniОценок пока нет

- Ebit Eps AnalysisДокумент6 страницEbit Eps AnalysisNabhan JafferОценок пока нет

- HARSHIT VIJAY 138 Corporate Finance2Документ7 страницHARSHIT VIJAY 138 Corporate Finance2harshitvj24Оценок пока нет

- Factors Affecting Capital Structure DecisionsДокумент6 страницFactors Affecting Capital Structure DecisionsAminul Haque RusselОценок пока нет

- Capital Structure, Cost of Capital and ValueДокумент33 страницыCapital Structure, Cost of Capital and Valuemanish9890Оценок пока нет

- Financial Management: 1st Theory of Capital StructureДокумент7 страницFinancial Management: 1st Theory of Capital StructureYash AgarwalОценок пока нет

- SLM Unit 07 Mbf201Документ17 страницSLM Unit 07 Mbf201Pankaj Kumar100% (1)

- UNIT - 3:financial Decision: Prepared &presented Associate Professor, Dept. of Commerce&BS, CUSBДокумент71 страницаUNIT - 3:financial Decision: Prepared &presented Associate Professor, Dept. of Commerce&BS, CUSBswethaОценок пока нет

- FM Capital Structure TheoryДокумент6 страницFM Capital Structure Theoryjabeenbegum916Оценок пока нет

- Unit IVДокумент48 страницUnit IVGhar AjaОценок пока нет

- Presentation of Capital BudgetingДокумент45 страницPresentation of Capital BudgetingIsmail UmerОценок пока нет

- Capital Structure, The Determinants and FeaturesДокумент5 страницCapital Structure, The Determinants and FeaturesRianto StgОценок пока нет

- FM Leverage SailДокумент19 страницFM Leverage SailMohammad Yusuf NabeelОценок пока нет

- Capital Structure - Sep 2021Документ52 страницыCapital Structure - Sep 2021BHAVYA KANDPAL 13BCE0206Оценок пока нет

- Capital Structure and Firm ValueДокумент39 страницCapital Structure and Firm ValueIndrajeet KoleОценок пока нет

- Unit 5 Capital Structure - TheoriesДокумент39 страницUnit 5 Capital Structure - Theoriesvishal kumarОценок пока нет

- Bezu Aster Kema HW - 3Документ8 страницBezu Aster Kema HW - 3Michael SeyiОценок пока нет

- Unit Iv: Financing DecisionsДокумент11 страницUnit Iv: Financing DecisionsAR Ananth Rohith BhatОценок пока нет

- Chapter 6 Capital Structure PDFДокумент20 страницChapter 6 Capital Structure PDFmuluken walelgnОценок пока нет

- Abmpowerpoint 141113054150 Conversion Gate01Документ26 страницAbmpowerpoint 141113054150 Conversion Gate01Mclin Jhon Marave MabalotОценок пока нет

- Financial Management - AssignmentДокумент10 страницFinancial Management - Assignmentarjunviswan96Оценок пока нет

- Aasan Ihndi Tjurma: Haif J NJ R AhmdДокумент0 страницAasan Ihndi Tjurma: Haif J NJ R AhmdShahid Manzoor100% (1)

- Abstract - Summer InternshipДокумент1 страницаAbstract - Summer InternshipAamir MalikОценок пока нет

- Gaming:: Observation in Nehru Place MarketДокумент4 страницыGaming:: Observation in Nehru Place MarketAamir MalikОценок пока нет

- Objectives and Functions: Statutory Body Government of India Ministry of Micro, Small and Medium Enterprises KhadiДокумент2 страницыObjectives and Functions: Statutory Body Government of India Ministry of Micro, Small and Medium Enterprises KhadiAamir MalikОценок пока нет

- 5ca58ICICI Securities JCP Planning Session RegistrationДокумент5 страниц5ca58ICICI Securities JCP Planning Session RegistrationAamir MalikОценок пока нет

- GSCMДокумент7 страницGSCMAamir MalikОценок пока нет

- Amity Business SchoolДокумент2 страницыAmity Business SchoolAnuj HandaОценок пока нет

- Case Study PlagДокумент8 страницCase Study PlagAamir MalikОценок пока нет

- 6d26fsummer Internship MEX ExhibitsДокумент3 страницы6d26fsummer Internship MEX ExhibitsAamir MalikОценок пока нет

- 5f20asummer Internship Saint-Gobain Weber BriefingДокумент2 страницы5f20asummer Internship Saint-Gobain Weber BriefingAamir MalikОценок пока нет

- Journal Student Chapter DetailsДокумент1 страницаJournal Student Chapter DetailsAamir MalikОценок пока нет

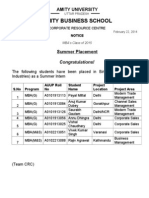

- 7eba1summer Placement Notice - Ingersoll RandgrererefrefrefДокумент3 страницы7eba1summer Placement Notice - Ingersoll RandgrererefrefrefAamir MalikОценок пока нет

- RM Mineral Water ReportДокумент29 страницRM Mineral Water ReportAamir MalikОценок пока нет

- 0 B 0 F 9 NoticeklnДокумент1 страница0 B 0 F 9 NoticeklnAamir MalikОценок пока нет

- The Product Launch of Tenso-1Документ24 страницыThe Product Launch of Tenso-1Aamir MalikОценок пока нет

- 04c0eindemnity Bond by ParentsДокумент1 страница04c0eindemnity Bond by Parentsgoody12foodsОценок пока нет

- Amity Business School: MBA, Semester 2 Legal Aspects of Business Ms. Shinu VigДокумент20 страницAmity Business School: MBA, Semester 2 Legal Aspects of Business Ms. Shinu VigAamir MalikОценок пока нет

- Amity Business School: MBA Legal Aspects of Business Ms. Shinu VigДокумент20 страницAmity Business School: MBA Legal Aspects of Business Ms. Shinu VigAamir MalikОценок пока нет

- Amity Business School: MBA M&S/ RM/E&L, Semester 2 Legal Aspects of Business Ms. Shinu VigДокумент39 страницAmity Business School: MBA M&S/ RM/E&L, Semester 2 Legal Aspects of Business Ms. Shinu Vigrohitk225Оценок пока нет

- Aaker Brand Equity ModelДокумент3 страницыAaker Brand Equity ModelAamir MalikОценок пока нет

- Difference in 1G, 2G, 3G, 4GДокумент5 страницDifference in 1G, 2G, 3G, 4GAamir MalikОценок пока нет

- Aaker Brand Equity ModelДокумент3 страницыAaker Brand Equity ModelAamir MalikОценок пока нет

- Border Security Using Wireless Integrated Network Sensor Seminar PresentationДокумент22 страницыBorder Security Using Wireless Integrated Network Sensor Seminar PresentationAamir MalikОценок пока нет

- Chapter 9 &10 - Gene ExpressionДокумент4 страницыChapter 9 &10 - Gene ExpressionMahmOod GhОценок пока нет

- On Evil - Terry EagletonДокумент44 страницыOn Evil - Terry EagletonconelcaballocansadoОценок пока нет

- ConjunctionДокумент15 страницConjunctionAlfian MilitanОценок пока нет

- Global Supply Chain Top 25 Report 2021Документ19 страницGlobal Supply Chain Top 25 Report 2021ImportclickОценок пока нет

- Net 2020Документ48 страницNet 2020Krishan pandeyОценок пока нет

- The Municipality of Santa BarbaraДокумент10 страницThe Municipality of Santa BarbaraEmel Grace Majaducon TevesОценок пока нет

- SJK (T) Ladang Renchong, PagohДокумент2 страницыSJK (T) Ladang Renchong, PagohAinHazwanОценок пока нет

- Performance Appraisal System-Jelly BellyДокумент13 страницPerformance Appraisal System-Jelly BellyRaisul Pradhan100% (2)

- Hop Movie WorksheetДокумент3 страницыHop Movie WorksheetMARIA RIERA PRATSОценок пока нет

- The Nervous System 1ae60 62e99ab3Документ1 страницаThe Nervous System 1ae60 62e99ab3shamshadОценок пока нет

- Affin Bank V Zulkifli - 2006Документ15 страницAffin Bank V Zulkifli - 2006sheika_11Оценок пока нет

- Apforest Act 1967Документ28 страницApforest Act 1967Dgk RajuОценок пока нет

- Flores Vs Drilon G R No 104732 June 22Документ1 страницаFlores Vs Drilon G R No 104732 June 22Henrick YsonОценок пока нет

- Brochure of El Cimarron by HenzeДокумент2 страницыBrochure of El Cimarron by HenzeLuigi AttademoОценок пока нет

- GiftsДокумент189 страницGiftsÜJessa Villaflor100% (2)

- TestertДокумент10 страницTestertjaiОценок пока нет

- Recollections From Pine Gulch QuestionsДокумент2 страницыRecollections From Pine Gulch Questionsoliver abramsОценок пока нет

- Reading 7.1, "Measuring and Managing For Team Performance: Emerging Principles From Complex Environments"Документ2 страницыReading 7.1, "Measuring and Managing For Team Performance: Emerging Principles From Complex Environments"Sunny AroraОценок пока нет

- 00000000Документ4 страницы00000000GagoОценок пока нет

- Soft Skills PresentationДокумент11 страницSoft Skills PresentationRishabh JainОценок пока нет

- Creole LanguagesДокумент2 страницыCreole LanguagesClaire AlexisОценок пока нет

- A Virtue-Ethical Approach To Education (By Pieter Vos)Документ9 страницA Virtue-Ethical Approach To Education (By Pieter Vos)Reformed AcademicОценок пока нет

- Gprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaДокумент34 страницыGprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaSajid HussainОценок пока нет

- Job Description: Jette Parker Young Artists ProgrammeДокумент2 страницыJob Description: Jette Parker Young Artists ProgrammeMayela LouОценок пока нет

- TM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Документ1 страницаTM201 - Session 1-2 Paper - Introduction To The Field of Technology Management - AFVeneracion - 201910816Nicky Galang IIОценок пока нет

- A History of The Church Part 1 (1) Coverage of Midterm ExamДокумент117 страницA History of The Church Part 1 (1) Coverage of Midterm ExamMary CecileОценок пока нет

- Multigrade Lesson Plan MathДокумент7 страницMultigrade Lesson Plan MathArmie Yanga HernandezОценок пока нет

- Robber Bridegroom Script 1 PDFДокумент110 страницRobber Bridegroom Script 1 PDFRicardo GarciaОценок пока нет

- Project Management Pro: Powerpoint SlidesДокумент350 страницProject Management Pro: Powerpoint SlidesJosephОценок пока нет

- Verb TensesДокумент3 страницыVerb TensesVeronicaGelfgren92% (12)