Академический Документы

Профессиональный Документы

Культура Документы

CH-12 ABC Costing

Загружено:

Sweetu NancyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CH-12 ABC Costing

Загружено:

Sweetu NancyАвторское право:

Доступные форматы

Traditional Costing Systems

Product Costs

Direct labor

Direct materials

Factory Overhead

Period Costs

Administrative expense

Sales expense

Appear on the income

statement when

goods are sold, prior

to that time they are

stored on the balance

sheet as inventory.

Appear on the income

statement in the

period incurred.

Traditional Costing Systems

Product Costs

Direct labor

Direct materials

Factory Overhead

Period Costs

Administrative expense

Sales expense

Direct labor and direct

materials are easy to

trace to products.

The problem comes

with factory

overhead.

Traditional Costing Systems

Typically used one rate to allocate overhead to

products.

This rate was often based on direct labor

dollars or direct labor hours.

This made sense, as direct labor was a major

cost driver in early manufacturing plants.

Problems with Traditional Costing

Systems

Manufacturing processes and the products

they produce are now more complex.

This results in over-costing or under-costing.

Complex products are not allocated an adequate

amount of overhead costs.

Simple products get too much.

Todays Manufacturing Plants

Are more complex

Are often automated

Often make more than one product

Use proportionately smaller amount of direct

labor

making direct labor a poor allocation base for

factory overhead.

When the manufacturing process is

more complex:

Then multiple allocation bases should be

used to allocate overhead expense.

In such situations, managers need to

consider using activity based costing

(ABC).

ACTIVITY BASED COSTING

Activity Based costing is recent development in Cost

Accounting which attempts to absorb overheads into

product cost on more realistic basis.

ABC focusses on activities as fundamental cost

objects.

ACTIVITIES

COST

DRIVERS

COST OF ACTIVITIES

___________________

COST POOLS

COST

ALLOCATED TO

COST OBJECTS

An activity is a process or procedure that causes

work. In relation to ABC, we only mean activities of

support or service departments, such as material

handling, quality testing, inspection etc. Activities

consume resources.

ABC differ from traditional system only in respect of

allocation of overheads or indirect cost.

DIRECT COST

INDIRECT COST

COST

ASCERTAINMENT

COST OF PRODUCT

OR SERVICE

COST TRACING

COST ALLOCATION

TRADITIONAL COSTING

ACTIVITY BASED COSTING

Volume based allocation bases e.g

Labour-hours, machine hours

Cost Divers are used as

allocation bases e.g, Set-up

hours for set-up cost;

inspection hours for

allocating inspection cost;

testing hours for allocating

quality cost and so on..

Cost is allocated based on drivers .Cost drivers are factors

or transaction that are significant determinants of costs.

For e.g, purchasing departments cost depends on number of

purchase order placed, costs of warehousing depends upon

number of items in stock, machine set-up cost depends on

number of set-up per periods etc.

ACTIVITY COST DRIVERS

Machine set-up Number of production runs

Purchasing material Number of orders placed

Warehousing Items in stock

Material handling Number of parts

Inspection Inspection per item

packing Number of packing order

In ABC, a cause and effect relationship is established.

Cost are allocated based on demands on resources.

RESOURCES

COST/EXPENSES

ACTIVITIES

Create

Drive

Measurement of

Consumption of resources

ABC focusses on activities for cost management.

Traditional system focusses on cost the effect rather

than on the cause the activity

ABC Steps

Overhead cost drivers are determined.

Activity cost pools are created.

A activity cost pool is a pool of individual costs

that all have the same cost driver.

All overhead costs are then allocated to one of

the activity cost pools.

ABC Steps:

An overhead rate is then calculated for each

cost pool using the following formula:

Costs in activity cost pool/base

The base is, of course, the cost driver

Overhead costs are then allocated to each

product according to how much of each base

the product uses.

Lets work an example . . .

Assume that a company makes widgets

Management decides to install an ABC system

Overhead Cost Drivers are Determined:

Management decides that all overhead costs

only have three cost driverssometimes

called activities (obviously a simplification of

the real world)

Direct labor hours

Machine hours

Number of purchase orders

All overhead costs are then allocated to one of the

activity cost pools.

Direct Labor

Machine Hours

# of Purchase Orders

General Ledger

Payroll taxes $1,000

Machine maintenance $500

Purchasing Dept. labor $4,000

Fringe benefits $2,000

Purchasing Dept. Supplies $250

Equipment depreciation $750

Electricity $1,250

Unemployment insurance $1,500

Which overhead costs do you

think are driven by direct labor

hours?

All overhead costs are then allocated to one of the

activity cost pools.

Direct Labor

Machine Hours

# of Purchase Orders

General Ledger

Payroll taxes $1,000

Machine maintenance $500

Purchasing Dept. labor $4,000

Fringe benefits $2,000

Purchasing Dept. Supplies $250

Equipment depreciation $750

Electricity $1,250

Unemployment insurance $1,500

$1,000

2,000

1,500

$4,500

Overhead driver by direct labor

hours

All overhead costs are then allocated to one of the

activity cost pools.

Direct Labor

Machine Hours

# of Purchase Orders

General Ledger

Payroll taxes $1,000

Machine maintenance $500

Purchasing Dept. labor $4,000

Fringe benefits $2,000

Purchasing Dept. Supplies $250

Equipment depreciation $750

Electricity $1,250

Unemployment insurance $1,500

$1,000

2,000

1,500

$4,500

Which overhead costs are

driven by machine hours?

$ 500

750

1,250

$2,500

All overhead costs are then allocated to one of the

activity cost pools.

Direct Labor

Machine Hours

# of Purchase Orders

General Ledger

Payroll taxes $1,000

Machine maintenance $500

Purchasing Dept. labor $4,000

Fringe benefits $2,000

Purchasing Dept. Supplies $250

Equipment depreciation $750

Electricity $1,250

Unemployment insurance $1,500

$1,000

2,000

1,500

$4,500

And finally, which overhead

costs are driven by # of

purchase orders?

$ 500

750

1,250

$2,500

$4,000

250

$4,250

An overhead rate is then calculated for each cost

pool:

Direct Labor

Machine Hours

# of Purchase Orders

$1,000

2,000

1,500

$4,500

$ 500

750

1,250

$2,500

$4,000

250

$4,250

Again the formulas is:

Costs in Activity Cost Pool/Base = rate

Assume the following bases:

Direct labor hours = 1,000

Machine hours = 250

Purchase orders = 100

$4,500/1,000 = $4.50 per direct labor hour

$2,500/250 = $10 per machine hour

$4,250/100 = $42.50 per purchase order

The ABC rates are:

Overhead costs are then allocated to each

product according to how much of each base the

product uses.

$4,500/1,000 = $4.50 per direct labor hour

$2,500/250 = $10 per machine hour

$4,250/100 = $42.50 per purchase order

The ABC rates are:

Lets assume the company makes two products, Widget A and Widget B:

Lets also assume that each product uses the following quantity

of overhead cost drivers:

Base Widget A Widget B Total

Direct labor hours 400 600 1,000

Machine hours 100 150 250

Purchase orders 50 50 100

Notice that

all base units

are

accounted

for.

Now lets allocate overhead to Widget

A:

Base A Rate Allocated

Direct labor hours 400 $ 4.50 $ 1,800.00

Just like we learned in Accounting ,we multiply

the base used by the rate.

In this case, 400 hours used to make Widget A is

multiplied by the rate of $4.50. This gives total overhead

applied for this activity cost pool of $1,800 to

Widget A.

Continuing the calculation:

Widget A Base Rate Allocated

Direct labor hours 400 $ 4.50 $ 1,800.00

Machine hours 100 $ 10.00 $ 1,000.00

Purchase orders 50 $ 42.50 $ 2,125.00

Total $ 4,925.00

Lets do the same thing for the other two rates, to get the total amount

of overhead applied to Widget A:

Now lets allocate overhead to Widget

B:

Lets do the same thing for the other two rates, to get the total amount

of overhead applied.

Widget B Base Rate Allocated

Direct labor hours 600 $ 4.50 $ 2,700.00

Machine hours 150 $ 10.00 $ 1,500.00

Purchase orders 50 $ 42.50 $ 2,125.00

Total $ 6,325.00

The original overhead to be applied was $4,500 of direct labor

driven overhead + $2,500 of machine hour driven overhead + $4,250 of

purchase order driven overhead = $11,250 total overhead to apply.

The actual overhead allocated was $4,925 for Widget A + $6,350 =

$11,250 overhead applied.

Same Problems Traditional Method

Okay, so what if we had allocated the

overhead in this company using traditional

cost accounting allocation.

Lets assume the base is direct labor hours.

What would be the amount allocated to each

product?

Calculation

General Ledger

Payroll taxes $1,000

Machine maintenance $500

Purchasing Dept. labor $4,000

Fringe benefits $2,000

Purchasing Dept. Supplies $250

Equipment depreciation $750

Electricity $1,250

Unemployment insurance $1,500

This the total

overhead we were

given, the total

amount is $11,250

as explained on

the previous slide.

Base Widget A Widget B Total

Direct labor hours 400 600 1,000

Machine hours 100 150 250

Purchase orders 40 60 100

Total direct labor

hours are 1,000, also

given earlier.

Calculation

The rate would be:

OH Rate = Overhead/Direct Labor Hours

$11,250/1,000 = $11.25 per hour.

Applying overhead using this rate:

Widget A: 400 hours x $11.25 = $4,500

Widget B: 600 hours x $11.25 = $6,750

Total overhead applied = $11,250

Comparison

Widget A Widget B Total

Traditional Method $4,500 $6,750 $11,250

Activity Based

Costing

$4,925 $6,325 $11,250

Difference -$425 $425 -0-

Which is more accurate?

ABC Costing!

Note these are total costs. To get per-unit costs we would divide by the

number of units produced.

When do we use ABC costing?

When one or more of the following conditions are

present:

Product lines differ in volume and manufacturing

complexity.

Product lines are numerous and diverse, and they

require different degrees of support services.

Overhead costs constitute a significant portion of total

costs.

The manufacturing process or number of products has

changed significantlyfor example, from labor

intensive to capital intensive automation.

ADVANTAGES OF ABC

ABC system focus attention on activities rather than

products . Because activities of various department may be

combined and cost of similar activities ascertained, e.g

quality control, inspection, handling of material. If detailed

cost are kept by activities, the total company cost of each

activity can be obtained, analyzed, planned and controlled.

Because cost are identified with activities and then

allocated to product or services, based on appropriate cost

drivers, more accurate product/service cost results.

Managers manage activities and not products. Changes

in activities leads to changes in cost. Therefore, if activities

are managed well, costs will fall and resulting products

will be more competitive

Allocating overheads cost to production based on single

cost drivers can result in an unrealistic product cost( as in

traditional costing). To manage activities better and to

make wiser economic decision, managers need to identify

the relationship of cause( activities) and effect( cost) . ABC

focusses on this aspect.

ABC highlight problem area that deserve managements

attention and more detailed analysis.

DISADVANTAGES OF ABC COSTING:

ABC fails to encourage manager think about changing

work processes to make business more Competitive.

ABC does not confirm to GAAP in some areas. For,

example ABC encourages allocation of non-product cost

as research and development to product cost . While

committed cost such as factory depreciation are not

allocated to product.

Using ABC, for short-run decisions may sometimes

prove costly in long run. For ex, decision of lowering sales

order handling cost by reducing small order that generate

lower margin.

ABC does not encourage the identification and removal

of constraints creating delay and excesses.

Additional Uses of ABC

Activity Based Management (ABM)

Extends the use of ABC from product costing to a

comprehensive management tool that focuses on

reducing costs and improving processes and

decision making.

ABM

ABM classifies all activities as value-added or

non-value-added.

Value-added activities increase the worth of a

product or service to the customer.

Example: Addition of a sun roof to an automobile.

Non-value added activities dont.

Example: The cost of moving or storing the product

prior to sale.

The Objective of ABM . . .

To reduce or eliminate non-value related

activities (and therefore costs).

Attention to ABM is a part of continuous

improvement of operations and activities.

The End!

Вам также может понравиться

- 12 Physics Usp SP by AneeshДокумент4 страницы12 Physics Usp SP by AneeshSweetu NancyОценок пока нет

- Atom N NucleiДокумент1 страницаAtom N NucleiSweetu NancyОценок пока нет

- CH-12 Target CostingДокумент4 страницыCH-12 Target CostingSweetu NancyОценок пока нет

- Question Paper 2 Code 1Документ42 страницыQuestion Paper 2 Code 1Sweetu NancyОценок пока нет

- Em ThriftДокумент30 страницEm ThriftSweetu NancyОценок пока нет

- Ch-4 Material CostingДокумент38 страницCh-4 Material CostingNeelesh MishraОценок пока нет

- Atom N NucleiДокумент1 страницаAtom N NucleiSweetu NancyОценок пока нет

- CH-12 Costing Methods-Direct, AbsorptionДокумент26 страницCH-12 Costing Methods-Direct, AbsorptionSweetu NancyОценок пока нет

- CH 12 Standard CostingДокумент25 страницCH 12 Standard CostingSweetu NancyОценок пока нет

- 1 Production ControlДокумент25 страниц1 Production ControlSweetu NancyОценок пока нет

- CH 12 ABC Costing ExampleДокумент33 страницыCH 12 ABC Costing ExampleSweetu Nancy100% (1)

- 3 Capacity PlanningДокумент11 страниц3 Capacity PlanningSweetu NancyОценок пока нет

- CH 12 Standard CostingДокумент25 страницCH 12 Standard CostingSweetu NancyОценок пока нет

- Session 2c - Quality Specification & TolerancesДокумент28 страницSession 2c - Quality Specification & TolerancesSweetu NancyОценок пока нет

- Laser FadingДокумент34 страницыLaser FadingSweetu NancyОценок пока нет

- 1 Production ControlДокумент25 страниц1 Production ControlSweetu NancyОценок пока нет

- Productivity: Ratio of Output and Per Unit Input (Material, Money, Manpower Etc.)Документ16 страницProductivity: Ratio of Output and Per Unit Input (Material, Money, Manpower Etc.)Umar MohammadОценок пока нет

- 10 Construction DefectsДокумент13 страниц10 Construction DefectsSweetu NancyОценок пока нет

- Details For A Trouser Manufacturing Unit: BY: Manisha Uttam Shweta Yadav Sonakshi Kochhar Piyush PushkarДокумент16 страницDetails For A Trouser Manufacturing Unit: BY: Manisha Uttam Shweta Yadav Sonakshi Kochhar Piyush PushkarSweetu NancyОценок пока нет

- Session 2B - Quality Standard & GradeДокумент36 страницSession 2B - Quality Standard & GradeSweetu NancyОценок пока нет

- FGFДокумент19 страницFGFSweetu NancyОценок пока нет

- Application of Industrial Engineering in Garments Sewing FloorДокумент79 страницApplication of Industrial Engineering in Garments Sewing FloorAsif Newton100% (5)

- FGF PresentationДокумент19 страницFGF PresentationSweetu NancyОценок пока нет

- Laser FadingДокумент34 страницыLaser FadingSweetu NancyОценок пока нет

- Denim WashingДокумент22 страницыDenim WashingSweetu Nancy100% (1)

- 1 Spreading-and-CuttingДокумент21 страница1 Spreading-and-CuttingSweetu NancyОценок пока нет

- FGFДокумент45 страницFGFSweetu NancyОценок пока нет

- FGFДокумент19 страницFGFSweetu NancyОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Macasadia, Kier - Bsba-3b - Part 2 Channel of DistributionДокумент2 страницыMacasadia, Kier - Bsba-3b - Part 2 Channel of DistributionMary Joy AlbandiaОценок пока нет

- BPM FinallДокумент29 страницBPM FinallChristhea De Leon100% (1)

- Marketing BasicsДокумент34 страницыMarketing BasicsSurya TejaОценок пока нет

- Annual Report - 2021 (Part2)Документ309 страницAnnual Report - 2021 (Part2)john morawoОценок пока нет

- GoogleДокумент8 страницGoogleinfo.bharatfabsОценок пока нет

- Steps in Manpower PlanningДокумент2 страницыSteps in Manpower PlanningSakib Ahmed SiamОценок пока нет

- Chapter 2 - Strategy and Human Resources PlanningДокумент44 страницыChapter 2 - Strategy and Human Resources PlanningJessah Mae E. Reyes0% (1)

- Depreciation 28-10-23Документ8 страницDepreciation 28-10-23RONAK THE LEGENDОценок пока нет

- Sales & Distribution ManagementДокумент36 страницSales & Distribution Managementmba betaОценок пока нет

- Satisfying Customer NeedsДокумент19 страницSatisfying Customer NeedsHariton FloreaОценок пока нет

- Risk Management PlanДокумент9 страницRisk Management Planapi-491293300Оценок пока нет

- Formulation, Implementation, and Control of Competitive StrategyДокумент11 страницFormulation, Implementation, and Control of Competitive StrategyWam OwnОценок пока нет

- Chaper 1 - Version1Документ39 страницChaper 1 - Version1raxhelammОценок пока нет

- Supervision and Contract Evaluation Manual For Road Works: October, 2012Документ136 страницSupervision and Contract Evaluation Manual For Road Works: October, 2012graceОценок пока нет

- Enterprise Resource Planning 3rd Edition Monk Test BankДокумент22 страницыEnterprise Resource Planning 3rd Edition Monk Test Bankkieranthang03m100% (24)

- Staffing ActivitiesДокумент20 страницStaffing ActivitiesJaneth MercadoОценок пока нет

- Chapter 1 Introduction To Sales & Distribution Management 1Документ49 страницChapter 1 Introduction To Sales & Distribution Management 1aditya singhОценок пока нет

- 15 KRM Om10 Tif ch12Документ35 страниц15 KRM Om10 Tif ch12Dingyuan OngОценок пока нет

- Boehm 1991Документ10 страницBoehm 1991Cesar de la LuzОценок пока нет

- Brosure WTW Masterclass Sept ClassДокумент6 страницBrosure WTW Masterclass Sept ClassAnggatra Herucakra AjiОценок пока нет

- Cost Accounting and ControlДокумент5 страницCost Accounting and ControlRodelle Lyn C. Delos SantosОценок пока нет

- Maximizing The Impact and Effectiveness of HR Analytics To Drive Business Outcomes PDFДокумент8 страницMaximizing The Impact and Effectiveness of HR Analytics To Drive Business Outcomes PDFSagar BansalОценок пока нет

- Englishtec 1st Partial - Melvin González - 2183612Документ5 страницEnglishtec 1st Partial - Melvin González - 2183612Melvin GonzalezОценок пока нет

- Feasibility PaperДокумент6 страницFeasibility PaperRosas Ereguiro ClenistaОценок пока нет

- ERP Intro 2Документ52 страницыERP Intro 2Sentthil KumarОценок пока нет

- E-Commerce Business in Nepal - Registration and MoreДокумент5 страницE-Commerce Business in Nepal - Registration and MoreManish Modi100% (1)

- Consulting Talk - 20200802 - v5Документ27 страницConsulting Talk - 20200802 - v5Divya TyagiОценок пока нет

- Test Bank For Foundations of Financial Management 10th Canadian Edition by Block PDFДокумент18 страницTest Bank For Foundations of Financial Management 10th Canadian Edition by Block PDFAhmed E EsmailОценок пока нет

- Hiring and Onboarding: Process Overview: Onboard Prep Screen Post Select Interview Key PhasesДокумент2 страницыHiring and Onboarding: Process Overview: Onboard Prep Screen Post Select Interview Key PhasesFahrika ErwanaОценок пока нет

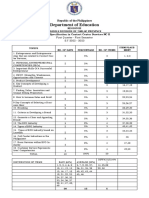

- Department of Education: Republic of The PhilippinesДокумент2 страницыDepartment of Education: Republic of The PhilippinesDandref ReyesОценок пока нет