Академический Документы

Профессиональный Документы

Культура Документы

Internet Banking

Загружено:

engenier7860 оценок0% нашли этот документ полезным (0 голосов)

42 просмотров23 страницыBanks and financial institutions in Pakistan are turning towards Internet Banking. At least 28 commercial banks and 3 another financial institutions are now offering financial transactions over the Internet. E-commerce is the application of information technology to facilitate the buying and selling of products, services and information over public standards based net works.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBanks and financial institutions in Pakistan are turning towards Internet Banking. At least 28 commercial banks and 3 another financial institutions are now offering financial transactions over the Internet. E-commerce is the application of information technology to facilitate the buying and selling of products, services and information over public standards based net works.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

42 просмотров23 страницыInternet Banking

Загружено:

engenier786Banks and financial institutions in Pakistan are turning towards Internet Banking. At least 28 commercial banks and 3 another financial institutions are now offering financial transactions over the Internet. E-commerce is the application of information technology to facilitate the buying and selling of products, services and information over public standards based net works.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 23

Why banks and financial

institutions in Pakistan are

turning towards internet

banking? E-Banking

Sajjad Nazir

NFC Institute of Engineering & Fertilizer

Research, Faisalabad

OUTLINE

INTRODUCTION

OBJECTIVE

LITERATURE REVIEW

METHODOLOGY

DATA ANALYSIS AND FINDINGS

CONCLUSION

INTRODUCTION

Internet has flooded all types of commercial transaction in our

modern world.

Banking services via the Internet is popular among developed

countries.

Institutions strategic initiatives and at the same time

empower customers, by enabling them to monitor their

accounts 24-hours-a-day, 7-days-a-week, through the

borderless environment.

most of the financial institutions in Pakistan are employing e-

commerce technologies .

All of the financial institutions also have built their own

websites.

combination of Automated Banking/Teller

Machine (ABM/ATM) facilities, automatic funds

transfer, electronic bill payment and call centre

services, and with telephone banking being the

latest e-commerce trend.

At least 28 commercial banks and 3 another

financial institutions are now offering financial

transactions over the Internet.

1990 breakdown in Pakistan financial system

chiefly within the Banking sectors.

1996, few of the local banks had collapsed.

Rumors for further closure of some of the financial

institutions, causing customers to lose their

confidence in our own home-based banks.

Total 46 banks have operations in Pakistan.

30 are the local banks & 16 are the foreign banks

After 1999 most of foreign financial institutions

started investment in banking sector.

OBJECTIVE

The objective of the research paper is two folded

The first aim is to investigate the feasibility of

adopting Internet Banking within the Pakistan

Financial Services Sector.

The second objective is to demonstrate how

Internet Banking may serve as a dual solution in

restoring the viability of the Pakistan financial

institutions and restoring investor confidence.

E-COMMERCE: The Concept of Internet Banking.

Electronic Commerce [E-Commerce] is the

application of information technology to

facilitate the buying and selling of products,

services and information over public standards

based net works [Price Waterhouse Coopers (PWC),

1999].

Networks can be a combination of telephone systems,

Broadband, Cable TV, leased lines, or wireless.

In 1979, Hosemann predicted that by the year 2000,

electronic delivery of banking services would be as

common place as the paper cheque was in that period

Network Connection between Clients and

Financial Institutions [Bauer, 1999; p. 72]

Existing of Internet Banking seems so

attractive, there are concern that demand

for cash may fall drastically. (Henry 2000)

On the matter of security (Baker 2000)

points out that there remains fear in many

places around the world

Financial Sectors plays a critical role in

Pakistan economy, accounting for

approximately 50% GDP and providing

employment. (PCOP 2010)

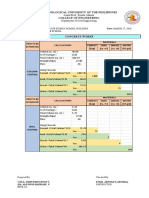

Electronic Means of Product/Service

Delivery by the Financial Institutions

Electronic Medium Commercial Banks

Total 46

Other Categorical

Financial

Institutions

Internet Banking 28 3

Telephone/ mobile

banking

15 3

ATM Debit / Credit

and

Business Card

Facility

35 2

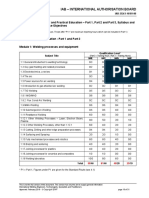

The Financial Institutions' Available Technological

Infrastructures, Employee Awareness and

Customers' Interest in Internet Banking

Questions asked of the Financial Institutions

[Commercial Banks & Other Categorical Institutions

Yes

% NO %

Are there technological infrastructures available? 37 80 9 20

Have employees been informed about the potential

Internet Banking Venture?

19 40 27 60

Has a customer/client survey been done to ask for

customers personal views on Internet Banking

31 66.66 15 33.33

Benefits of Internet Banking to the Financial Institutions

Increased relationship with customers, giving rise to greater loyalty and share of

wallet

More cost-effective mechanism for communicating with customers

Improved banking services

Less staff (e.g. tellers and customer service officers] and less office space

Able to reach a wider cross-section of customers. Reach more offshore

customers as they would be able to view account information from anywhere in

the world.

Provides revenue and increases profitability

Provides real-time banking information to customers

Reduces the need for branch expansion, more reach and availability without an

investment in property

Decreases downtime if access workstation is affected

Benefits of Internet Banking to Customers

Convenience

Single access point for all financial products and services.

Banking at customers' own convenience.

Ensures better monitoring.

Portability.

Accessibility [Easy Access]

Global access to accounts; clients can access account

information anywhere and at anytime [24-hours-a-day; 7-days-

a-week].

Higher availability of bank data.

Increase Competition

Give local merchants a chance to compete on international

markets.

Increase Profitability and Savings

Merchants/corporate clients get funds of varying

currencies. deposited to their local accounts.

Ordinary citizens can reap similar benefits.

Saves Time

Less time required for bank business.

Quick delivery of products and services.

Reduces commute.

More Choices

Can select from many financial institutions and from

more products and Services.

Possibility of Cost-saving

Using cheaper" delivery channels.

Benefits of Internet Banking to Pakistan

International Reach

Providing a new way for local entities to do business overseas and

fulfilling cross-border banking needs.

Potential for more investments locally by citizens living outside of

Pakistan.

Sophistication of Basic Infrastructure.

Increased technology exposure for citizens generally adds to the

sophistication of basic infrastructure of the country thereby

increasing its appeal to the investment community.

Better image for Pakistan, particularly as a technology destination

with superior financial services.

Increased Competition

Gives local merchants a chance to compete on international markets

as well as provide a more competitive industry to global clients.

Additional area for Resource Development

Generation of new jobs/employment, new job skills, and livelihoods.

Increased Productivity and Reduced Pollution

More production time as less people will need to

leave work to go to the bank.

Less commuting would reduce the pollution from

the motor vehicles, as there will be less traffic on

the road.

E-commerce Growth

Enabling/paving the way for further development

of e-commerce and merchant commerce [m-

commerce] activity.

Convenience and Possibility of Cost Savings

Provide another [less expensive] alternative for

consumers and business to conduct their business.

Obstacles to Internet Banking in Pakistan

Culture

Pakistanis [especially the older generation] prefer to conduct their

financial transactions in the conventional manner.

People in general do not want to be a part of an experiment; hence at

first they might not be willing to utilize the Internet Banking facility. For

example, when ATM/ABM machines and cards were first introduced in

Pakistan, customers were not willing to use them. However, these

facilities are now like second nature.

Security

Need to overcome societal distrust of electronic commerce, there is

perceived tendency for fraud in Pakistan.

Generally, the possibility exists those transactions done over the Internet

can be intercepted by unauthorized individuals [hackers].

Resistance to Technology

Getting customers to set up and use the system may cause a challenge as

most people are resistant to change, especially the older customers.

Banks staff members may express anger to the technology and the new

method of banking

Cost and Initial Expenses

Providing this service at the beginning is very expensive for the bank. It may

be difficult to rationalize the purchasing of the system, as the profits may not

be seen in the short-term.

Internet access can be costly for the customer, especially with regard to dial-

up and use-per-minute rates.

Legislation

Lack of proper legislation [absence of local laws on Internet policies] to

govern Internet Banking in Pakistan.

Lack of Public Education

Need to improve computer literacy rate, as there is lack of knowledge

about computers and the Internet.

Online Population

Limited number of persons with Internet Access, lack of depth of

Internet penetration in the society. Online population needs to be

increase to 15% or 20% by 2011 for e-commerce to be effective.

Low telecommunication facilities in rural area of Pakistan

Relatively small number of home computers vs. the population

OBSTACLE POSSIBLE SOLUTIONS

Culture

Phased implementation of Internet Banking service. This will help to

improve uncertainty. For example, ATM/ABMs are now fully utilized,

even though customers were initially unconvinced about them.

Security

Launch of tight security systems such as firewalls and passwords, and

development of encryption and authentication methods.

Resistance to Technology

Installation of booths in the financial institutions so that customers

can get familiar with the service.

Cost and Initial Expenses

Government subsidies on computer technologies and Internet

access.

Legislation [Lack therefore]

Implementation of Internet Laws; Financial Institutions can

push government to enact e-commerce legislation.

Lack of Public Education

Conduct training seminars and public education programmes

[through Pakistan Promotions Corporation & Society etc];

Display more computer- and internet-related advertisements

Online Population

Increased Internet Service Providers.

Increased Internet access points [e.g. public libraries, schools,

cyber cafes, community centers].

The number of home PC will increase with time as personal

computers are already exempted from tax and import duty.

CONCLUSION

Internet banking is a very marginal activity in

Pakistan, as some of the financial institutions

have not yet experienced the full potential of this

form of e-commerce.

Only 28 commercial banks and 3 other

categorical financial institutions have already

embarked on the internet banking venture.

Furthermore, this type of service is currently

being offered mainly to merchants and corporate

clients.

Internet banking as a possible e-commerce

solution will create possibilities for local

financial institutions by marketing their products

and services, thereby attracting new clients and

customers.

Whilst internet banking is not without its

drawbacks and challenges, this research

recommends that the Pakistani Financial Sector

should move closely towards as e-commerce

solutions by conducting its transactional banking

services through the internet.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Core Task 2 - Ayushi BoliaДокумент3 страницыCore Task 2 - Ayushi BoliaAyushi BoliaОценок пока нет

- EnCase Forensics Edition Primer - Getting StartedДокумент37 страницEnCase Forensics Edition Primer - Getting StartedJason KeysОценок пока нет

- 6260 p0408 S enДокумент3 страницы6260 p0408 S enDavid BarrosОценок пока нет

- Reva Parikshak Online Examination SystemДокумент30 страницReva Parikshak Online Examination SystemSandesh SvОценок пока нет

- Fault Tree AnalysisДокумент36 страницFault Tree AnalysisAMOL RASTOGI 19BCM0012Оценок пока нет

- Express Specialization RequirementsДокумент8 страницExpress Specialization RequirementsZeus TitanОценок пока нет

- Advanced Product Quality Planning (APQP)Документ15 страницAdvanced Product Quality Planning (APQP)José AlcocerОценок пока нет

- BMCG 2513 - Teaching Plan Sem - 2 2016 2017 - BasriДокумент11 страницBMCG 2513 - Teaching Plan Sem - 2 2016 2017 - BasriW Mohd Zailimi AbdullahОценок пока нет

- 2 Concrete Works CompuДокумент14 страниц2 Concrete Works CompuALFONSO RAPHAEL SIAОценок пока нет

- LexionAir Flyer UKДокумент2 страницыLexionAir Flyer UKficom123Оценок пока нет

- LC320W01 Sla1Документ33 страницыLC320W01 Sla1Robert TocaОценок пока нет

- CV-Agus Nugraha (11.01.2021)Документ11 страницCV-Agus Nugraha (11.01.2021)Agus NugrahaОценок пока нет

- Eaton 9PX Brochure (SEA)Документ4 страницыEaton 9PX Brochure (SEA)Anonymous 6N7hofVОценок пока нет

- HydacДокумент4 страницыHydacmarkoОценок пока нет

- KeyboardДокумент8 страницKeyboardaltawanmudzharОценок пока нет

- Wireless Headphones Bluedio T2 Plus Turbine - 75Mm Driver, Bluetooth 4.1, 220mah Battery, Built-In Mic, FM Mode, SD Card, 110DbДокумент7 страницWireless Headphones Bluedio T2 Plus Turbine - 75Mm Driver, Bluetooth 4.1, 220mah Battery, Built-In Mic, FM Mode, SD Card, 110DbLinas BielskisОценок пока нет

- Another Smart BookДокумент22 страницыAnother Smart BookKeshav PОценок пока нет

- The A - Z Guide of PythonДокумент11 страницThe A - Z Guide of PythonSakshi JainОценок пока нет

- Lenovo Yoga 710-14ISK LA-D471P r2.0Документ53 страницыLenovo Yoga 710-14ISK LA-D471P r2.0Julio MinaОценок пока нет

- CyberAces Module1-Windows 6 PoliciesAndCredStorageДокумент18 страницCyberAces Module1-Windows 6 PoliciesAndCredStorageAbiodun AmusatОценок пока нет

- Planning Guide PMP450i CambiumДокумент237 страницPlanning Guide PMP450i CambiumPedro MarroquinОценок пока нет

- HeroLab ManualДокумент55 страницHeroLab ManualColin BraddockОценок пока нет

- IWE SyllabusДокумент4 страницыIWE Syllabusmdasifkhan2013Оценок пока нет

- Muhammed Abrar - Salesforce DeveloperДокумент1 страницаMuhammed Abrar - Salesforce DeveloperKarthik KingОценок пока нет

- Banks Betting Big On Big Data and Real-Time Customer InsightДокумент5 страницBanks Betting Big On Big Data and Real-Time Customer InsightShahid_ONОценок пока нет

- Geotechnical Big Fish Career StoriesДокумент53 страницыGeotechnical Big Fish Career Storieskrainaoz2011Оценок пока нет

- Installing USBasp in Atmel Studio Ver 7Документ4 страницыInstalling USBasp in Atmel Studio Ver 7J Uriel CorderoОценок пока нет

- Company ProfileДокумент15 страницCompany ProfilerishdugarОценок пока нет

- DRFM Basic PaperДокумент7 страницDRFM Basic PaperAjinkya Kale100% (1)