Академический Документы

Профессиональный Документы

Культура Документы

Brief Introduction On Balance Sheet, Income Statement and Cash Flow Statement

Загружено:

SanzuDhakal0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров14 страницMA

Оригинальное название

Managerial Accounting

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документMA

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров14 страницBrief Introduction On Balance Sheet, Income Statement and Cash Flow Statement

Загружено:

SanzuDhakalMA

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 14

Brief Introduction on

Balance Sheet, Income Statement

and Cash flow Statement

INFORMATION

Gather

Analyze

DECIDE!!

Information

Accounting

Quantitative: eg. Revenue,

Profit, Expenses

Non-Accounting

Qualitative: eg.

Management

Quantitative: Employee

turnover, Market Share

B/S.Balance Sheet

LIABILITY

Financing Side

Paid Up: $1,000/person

Total Paid Up: $1,000 *

8 = $8,000

ASSET

Investing Side

Bank: $8,000

Liability + Owners Equity = Asset

Company XYZ

B/SAfter Loan

LIABILITY

Financing Side

Paid Up: $1,000/person

Total Paid Up: $1,000 *

8 = $8,000

Loan: $12,000

ASSET

Investing Side

Bank: $8,000 $20,000

Liability + Owners Equity = Asset

Company XYZ

B/S..After Investment

LIABILITY

Financing Side

Paid Up: $1,000/person

Total Paid Up: $1,000 *

8 = $8,000 (Equity Capital)

Loan: $12,000 (Debt Capital)

ASSET

Investing Side

Bank: $20,000 $2000

Land: $18,000

Liability + Owners Equity = Asset

Company XYZ

Keep in mind!!!!

Profit & retained profit belongs to share

holders

Receivables is assumption of collectability

Sale is transfer of product and not receipt of

cash

Equity=Paid-Up Capital + Retained Profit

Total Capital = Equity Capital + Debt Capital

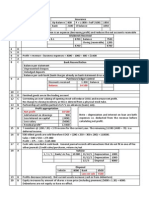

I/S.Income Statement

Cost = $18,000 Sales =$25,000

What happens when only 60% of sales

amount is received and 40% is pending?

B/S.After receiving 60% payment

LIABILITY

Financing Side

Paid Up: $1,000/person

Total Paid Up: $1,000 *

8 = $8,000 (Equity Capital)

Retained

Profit:$7000(Equity Capital)

Loan: $12,000 (Debt Capital)

ASSET

Investing Side

Bank: $2,000 $17,000

Land: $18,000 $0

Receivable: $10,000

Liability + Owners Equity = Asset

Company XYZ

$15000 from sales and

previous $2000

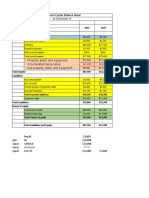

At The End We Have

Loan + Owners Equity = Asset

$12000

$15,000

$27,000

C/SCash Flow Statement

Cash From Financing +$20,000

Cash For Investment -$18,000

Cash From Operation -$15,000

Net Cash Flow: -$3,000

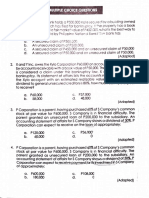

ROE (Return on Equity)

Total Capital ($20,000)= Debt Capital ($12,000) + Equity Capital ($8,000)

ROE = Profit/Equity

= 7000/8000

= 87.5%

However, if expenses are considered, profit will be

decreased accordingly. Eg, interest on loan of

14%.

ROE = 5,320/8,000

= 66.5%

Profit after interest of

14% on $12000, $1,680

ROE (Return on Equity)

Total Capital ($20,000)= Debt Capital ($8,000) + Equity Capital ($12,000)

ROE = Profit/Equity

= 7,000/12,000

= 58.3%

However, if expenses are considered, profit will be

decreased accordingly. Eg, interest on loan of

14%.

ROE = 5,880/12,000

= 49%

Profit after interest of 14%

on $8000, $1,120

Conclusion: ROE depends on operations and financing.

Thank you!!

ANY QUESTIONS??

Вам также может понравиться

- Full Name: Mai Thị Loan Class: 12KT201: Accounting ExercisesДокумент9 страницFull Name: Mai Thị Loan Class: 12KT201: Accounting Exercisesthanhyu13Оценок пока нет

- Lecture 1 & 2 - Accounting & Financial Statements - MD Sazzad HossainДокумент26 страницLecture 1 & 2 - Accounting & Financial Statements - MD Sazzad HossainMd. Sazzad HossainОценок пока нет

- Exercise 3. Cash Flows Statements and WorkingДокумент8 страницExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnОценок пока нет

- Some Solved Problems and Statement From Tabular AnalysisДокумент9 страницSome Solved Problems and Statement From Tabular AnalysisSubrata RoyОценок пока нет

- Patricia Petsch - Maria HernandezДокумент10 страницPatricia Petsch - Maria Hernandez075765ppОценок пока нет

- Statement of Cash Flows: Like An Income StatementДокумент27 страницStatement of Cash Flows: Like An Income StatementbecalmОценок пока нет

- Acct 100 Chapter 5 S22Документ23 страницыAcct 100 Chapter 5 S22Cyntia ArellanoОценок пока нет

- Cash Flow StatementДокумент10 страницCash Flow StatementSheilaMarieAnnMagcalasОценок пока нет

- Statement of Cash FolwДокумент57 страницStatement of Cash FolwmibshОценок пока нет

- ISEM 530 ManagementДокумент6 страницISEM 530 ManagementNaren ReddyОценок пока нет

- Week 1 - Critical Thinking - Chip Shot Driving RangeДокумент4 страницыWeek 1 - Critical Thinking - Chip Shot Driving RangePriya PrasadОценок пока нет

- Financial Accounting CH2Документ38 страницFinancial Accounting CH2SaudksnОценок пока нет

- Seminar in Management AccountingДокумент6 страницSeminar in Management AccountinglolaОценок пока нет

- Accounting equation transactionsДокумент3 страницыAccounting equation transactionsRudsan TurquezaОценок пока нет

- Analysing Management Buyout Using Statement of Cash FlowsДокумент9 страницAnalysing Management Buyout Using Statement of Cash FlowsJaisyur Rahman SetyadharmaatmajaОценок пока нет

- Financial Reporting & AnalysisДокумент9 страницFinancial Reporting & AnalysisNuman Rox0% (1)

- Practice Final Acct 1Документ12 страницPractice Final Acct 1hannahkellum08Оценок пока нет

- Handsout 06 Chap 03 Part 02Документ4 страницыHandsout 06 Chap 03 Part 02Shane VeiraОценок пока нет

- Accounting Equation: Fundamentals of ABM 1Документ97 страницAccounting Equation: Fundamentals of ABM 1ediwowОценок пока нет

- Ôn Tập FA1 RecoveredДокумент16 страницÔn Tập FA1 RecoveredHiếu Hoàng MinhОценок пока нет

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsДокумент12 страницSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranОценок пока нет

- Preparing a Cash Flow StatementДокумент7 страницPreparing a Cash Flow StatementMiconОценок пока нет

- Solution and AnswerДокумент4 страницыSolution and AnswerMicaela EncinasОценок пока нет

- Insurance: Balance 14 100Документ2 страницыInsurance: Balance 14 100zahid_mahmood3811Оценок пока нет

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Документ5 страницMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1Оценок пока нет

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentДокумент6 страницProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilОценок пока нет

- Calculating return on assets and equity before and after investmentДокумент2 страницыCalculating return on assets and equity before and after investmentsafarashОценок пока нет

- Partnership: A Partnership Is An Association of Two or More Persons Who Own and Manage A Business For ProfitДокумент34 страницыPartnership: A Partnership Is An Association of Two or More Persons Who Own and Manage A Business For ProfitRuthLimbongОценок пока нет

- Chapter 15 SolutionsДокумент6 страницChapter 15 SolutionshappysparkyОценок пока нет

- Accounting Cycle CompletedДокумент29 страницAccounting Cycle CompletedMUHAMMAD HARIS PERVAIZОценок пока нет

- Online Ass Advance Acc NEWДокумент6 страницOnline Ass Advance Acc NEWRara Rarara30Оценок пока нет

- Bab 12Документ5 страницBab 12ScribdTranslationsОценок пока нет

- Double Entry Accounting Assessment QuestionsДокумент7 страницDouble Entry Accounting Assessment QuestionsLhaiela AmanollahОценок пока нет

- The Statement of Cash FlowsДокумент19 страницThe Statement of Cash FlowsZuldi Ghazaly BatubaraОценок пока нет

- Real Estate Investment MathДокумент3 страницыReal Estate Investment MathbillhayerОценок пока нет

- Return On InvestmentДокумент3 страницыReturn On InvestmentTirupal Puli0% (1)

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Документ10 страницSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroОценок пока нет

- Cash FLOW ProjectionДокумент3 страницыCash FLOW ProjectionCarolОценок пока нет

- Balance Sheet and Transactions Analysis for Charles CompanyДокумент14 страницBalance Sheet and Transactions Analysis for Charles CompanyArunesh SN100% (1)

- Calculating Total Equity for Def CompanyДокумент2 страницыCalculating Total Equity for Def Companygabriel berwuloОценок пока нет

- Chap 15Документ66 страницChap 15jamn1979Оценок пока нет

- FM AssignmentДокумент7 страницFM Assignmentkartika tamara maharaniОценок пока нет

- Activity 3 CAMINGAWAN BSMA 2B PDFДокумент7 страницActivity 3 CAMINGAWAN BSMA 2B PDFMiconОценок пока нет

- An Introduction To Accounting Module F1Документ30 страницAn Introduction To Accounting Module F1Jason Fry100% (1)

- Finance Report2Документ8 страницFinance Report2Sadman Sharar 1931037030Оценок пока нет

- Problem1 - The Following Data Are From The Giant Oreo Division at Keebler CookiesДокумент29 страницProblem1 - The Following Data Are From The Giant Oreo Division at Keebler CookiesFerl ElardoОценок пока нет

- M M HypothesisДокумент37 страницM M HypothesisJim MathilakathuОценок пока нет

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsДокумент9 страницFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMОценок пока нет

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFДокумент38 страницFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (9)

- Chapter+2 3Документ14 страницChapter+2 3kanasanОценок пока нет

- Chapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ67 страницChapter 12 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais AzeemiОценок пока нет

- CF MathДокумент5 страницCF MathArafat HossainОценок пока нет

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsДокумент16 страницSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamОценок пока нет

- Single EntryДокумент26 страницSingle EntryMac b IBANEZОценок пока нет

- Pages From GA701-Invested by Danielle TownДокумент6 страницPages From GA701-Invested by Danielle TownLestariОценок пока нет

- Asset Conversion CycleДокумент12 страницAsset Conversion Cyclessimi137Оценок пока нет

- Accounting Project - EMBA Cohort 43 Group33 - FinalSubmissionДокумент4 страницыAccounting Project - EMBA Cohort 43 Group33 - FinalSubmissionodlivingstonОценок пока нет

- Financial Forecasting SamarakoonДокумент33 страницыFinancial Forecasting SamarakoonEyael ShimleasОценок пока нет

- 317 Midterm 1 Practice Exam SolutionsДокумент9 страниц317 Midterm 1 Practice Exam Solutionskinyuadavid000Оценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- Loan Approval For Ntsopa S. MaponyaneДокумент3 страницыLoan Approval For Ntsopa S. Maponyanegudeme0000% (1)

- Interest Rate Swap DiagramДокумент1 страницаInterest Rate Swap DiagramTheGreatDealerОценок пока нет

- Senior High School: Asia Academic School, IncДокумент5 страницSenior High School: Asia Academic School, IncAbdel-Nasser AbdurayaОценок пока нет

- Chap 009Документ20 страницChap 009Ela PelariОценок пока нет

- Dy, Angelica Joyce B. - 5170138 - PALE MidtermДокумент17 страницDy, Angelica Joyce B. - 5170138 - PALE MidtermAngelica Joyce DyОценок пока нет

- Information On Flexible Loan Product and JPY Lending Rates - 27 Jan 2023Документ14 страницInformation On Flexible Loan Product and JPY Lending Rates - 27 Jan 2023atca0102Оценок пока нет

- Sales Finance Loan Application Form: Personal DetailsДокумент5 страницSales Finance Loan Application Form: Personal DetailsAshmith KumarОценок пока нет

- Hamilton Financial IndexДокумент52 страницыHamilton Financial IndexThe Partnership for a Secure Financial FutureОценок пока нет

- Finance Lease ConceptsДокумент19 страницFinance Lease ConceptsPallavi KokateОценок пока нет

- Capital Structure Analysis of Tata Steel FinalДокумент21 страницаCapital Structure Analysis of Tata Steel FinalSaket Sane100% (2)

- CorpLid Dayag ProblemsДокумент11 страницCorpLid Dayag ProblemsMark Jesus Aristo0% (1)

- CH 06 Interest Rate FuturesДокумент28 страницCH 06 Interest Rate FuturesSyed Usama RashidОценок пока нет

- Comparative Study of Interest Rate of Different BanksДокумент8 страницComparative Study of Interest Rate of Different Banksshanti k mОценок пока нет

- Mgt325 m4 Solutions Ch8Документ25 страницMgt325 m4 Solutions Ch8Matt DavisОценок пока нет

- Getting Started with Bankscope DatasetДокумент43 страницыGetting Started with Bankscope DatasetAliОценок пока нет

- The International Debt Crisis in Historical PerspectiveДокумент5 страницThe International Debt Crisis in Historical PerspectivejamesihnoОценок пока нет

- Bpi Vs Alfred BerwinДокумент2 страницыBpi Vs Alfred Berwinksulaw2018Оценок пока нет

- Money Management: PhilosophiesДокумент13 страницMoney Management: PhilosophiesAnne Cherisse AmonОценок пока нет

- Larsen & Toubro Limited: Case StudyДокумент36 страницLarsen & Toubro Limited: Case Studyarvind2431Оценок пока нет

- Bridge Loan - InvestopediaДокумент3 страницыBridge Loan - InvestopediaBob KaneОценок пока нет

- Case 3Документ13 страницCase 3Prezi Toli100% (1)

- 10-1 - Developing An Effective Business PlanДокумент21 страница10-1 - Developing An Effective Business PlanZameer AbbasiОценок пока нет

- General Debt Advice - Sample Letters To CreditorsДокумент9 страницGeneral Debt Advice - Sample Letters To CreditorswtflopОценок пока нет

- 63 Profit LossДокумент26 страниц63 Profit LossBharath RamaiahОценок пока нет

- Dallas County, TX V MERS and Bank of AmericaДокумент63 страницыDallas County, TX V MERS and Bank of AmericajohngaultОценок пока нет

- Chapter 16 ProblemsДокумент4 страницыChapter 16 ProblemsDaood AbdullahОценок пока нет

- Fixed Income - Reading 52Документ47 страницFixed Income - Reading 52Kira100% (1)

- Kodak SWOT Analysis and Financial RatiosДокумент31 страницаKodak SWOT Analysis and Financial RatiosZineb Elouataoui100% (1)

- Certified Project Finance Analyst (CPFA)Документ9 страницCertified Project Finance Analyst (CPFA)Oroma David FabianoОценок пока нет

- Lecture 1. Ratio Analysis Financial AppraisalДокумент11 страницLecture 1. Ratio Analysis Financial AppraisaltiiworksОценок пока нет