Академический Документы

Профессиональный Документы

Культура Документы

7.0term Structure of Interest Rates

Загружено:

SanaFatimaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

7.0term Structure of Interest Rates

Загружено:

SanaFatimaАвторское право:

Доступные форматы

CHAPTER 15

The Term Structure of Interest

Rates

15-2

The yield curve is a graph that displays the

relationship between yield and maturity.

Information on expected future short term

rates can be implied from the yield curve.

Overview of Term Structure

15-3

Figure 15.1 Treasury Yield Curves

15-4

Bond Pricing

Yields on different maturity bonds are not all

equal.

We need to consider each bond cash flow

as a stand-alone zero-coupon bond.

Bond stripping and bond reconstitution

offer opportunities for arbitrage.

The value of the bond should be the sum

of the values of its parts.

15-5

Table 15.1 Prices and Yields to Maturities on

Zero-Coupon Bonds ($1,000 Face Value)

15-6

Example 15.1 Valuing Coupon Bonds

Value a 3 year, 10% coupon bond using

discount rates from Table 15.1:

Price = $1082.17 and YTM = 6.88%

6.88% is less than the 3-year rate of 7%.

3 2

07 . 1

1100 $

06 . 1

100 $

05 . 1

100 $

Price

15-7

Two Types of Yield Curves

Pure Yield Curve

The pure yield curve

uses stripped or zero

coupon Treasuries.

The pure yield curve

may differ significantly

from the on-the-run

yield curve.

On-the-run Yield Curve

The on-the-run yield

curve uses recently

issued coupon bonds

selling at or near par.

The financial press

typically publishes on-

the-run yield curves.

15-8

Yield Curve Under Certainty

Suppose you want to invest for 2 years.

Buy and hold a 2-year zero

-or-

Rollover a series of 1-year bonds

Equilibrium requires that both strategies

provide the same return.

15-9

Figure 15.2 Two 2-Year Investment Programs

15-10

Yield Curve Under Certainty

Buy and hold vs. rollover:

Next years 1-year rate (r

2

) is just enough

to make rolling over a series of 1-year

bonds equal to investing in the 2-year

bond.

2

2 1 2

1

2

2 1 2

(1 ) (1 ) (1 )

1 (1 ) (1 )

y r x r

y r x r

15-11

Spot Rates vs. Short Rates

Spot rate the rate that prevails today for a

given maturity

Short rate the rate for a given maturity (e.g.

one year) at different points in time.

A spot rate is the geometric average of its

component short rates.

15-12

Short Rates and

Yield Curve Slope

When next years short

rate, r

2

, is greater than

this years short rate, r

1

,

the yield curve slopes

up.

May indicate rates

are expected to rise.

When next years short

rate, r

2

, is less than this

years short rate, r

1

, the

yield curve slopes

down.

May indicate rates

are expected to fall.

15-13

Figure 15.3 Short Rates versus Spot Rates

15-14

1

1

) 1 (

) 1 (

) 1 (

n

n

n

n

n

y

y

f

f

n

= one-year forward rate for period n

y

n

= yield for a security with a maturity of n

) 1 ( ) 1 ( ) 1 (

1

1 n

n

n

n

n

f y y

Forward Rates from Observed Rates

15-15

Example 15.4 Forward Rates

The forward interest rate is a forecast of a

future short rate.

Rate for 4-year maturity = 8%, rate for 3-year

maturity = 7%.

1106 . 1

07 . 1

08 . 1

1

1

1

3

4

3

3

4

4

4

y

y

f

% . f 06 11

4

15-16

Interest Rate Uncertainty

Suppose that todays rate is 5% and the

expected short rate for the following year is

E(r

2

) = 6%. The value of a 2-year zero is:

The value of a 1-year zero is:

47 . 898 $

06 . 1 05 . 1

1000 $

38 . 952 $

05 . 1

1000 $

15-17

Interest Rate Uncertainty

The investor wants to invest for 1 year.

Buy the 2-year bond today and plan to sell

it at the end of the first year for $1000/1.06

=$943.40.

0r-

Buy the 1-year bond today and hold to

maturity.

15-18

Interest Rate Uncertainty

What if next years interest rate is more (or

less) than 6%?

The actual return on the 2-year bond is

uncertain!

15-19

Interest Rate Uncertainty

Investors require a risk premium to hold a

longer-term bond.

This liquidity premium compensates short-

term investors for the uncertainty about

future prices.

15-20

Expectations

Liquidity Preference

Upward bias over expectations

Theories of Term Structure

15-21

Expectations Theory

Observed long-term rate is a function of

todays short-term rate and expected

future short-term rates.

f

n

= E(r

n

) and liquidity premiums are zero.

15-22

Long-term bonds are more risky; therefore,

f

n

generally exceeds E(r

n

)

The excess of f

n

over E(r

n

) is the liquidity

premium.

The yield curve has an upward bias built

into the long-term rates because of the

liquidity premium.

Liquidity Premium Theory

15-23

Figure 15.4 Yield Curves

15-24

Figure 15.4 Yield Curves

15-25

Interpreting the Term Structure

The yield curve reflects expectations of future

interest rates.

The forecasts of future rates are clouded by

other factors, such as liquidity premiums.

An upward sloping curve could indicate:

Rates are expected to rise

And/or

Investors require large liquidity premiums to

hold long term bonds.

15-26

Interpreting the Term Structure

The yield curve is a good predictor of the

business cycle.

Long term rates tend to rise in anticipation of

economic expansion.

Inverted yield curve may indicate that interest

rates are expected to fall and signal a

recession.

15-27

Figure 15.6 Term Spread: Yields on 10-year vs.

90-day Treasury Securities

15-28

Forward Rates as Forward Contracts

In general, forward rates will not equal the

eventually realized short rate

Still an important consideration when

trying to make decisions :

Locking in loan rates

15-29

Figure 15.7 Engineering a Synthetic Forward

Loan

Вам также может понравиться

- Option StrategiesДокумент9 страницOption StrategiesSatya Kumar100% (1)

- BondsДокумент55 страницBondsfecaxeyivuОценок пока нет

- Spotting Trend Reversals With MACDДокумент3 страницыSpotting Trend Reversals With MACDnypb2000100% (3)

- Valuation of BondsДокумент49 страницValuation of BondsSanjit SinhaОценок пока нет

- Technical Graphical Analysis EbookДокумент66 страницTechnical Graphical Analysis EbookAngeli Pirvulescu100% (5)

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- 5.1foreign Exchange Rate Determination and ForecastingДокумент34 страницы5.1foreign Exchange Rate Determination and ForecastingSanaFatimaОценок пока нет

- Chapter 6 - Bond Valuation and Interest RatesДокумент36 страницChapter 6 - Bond Valuation and Interest RatesAmeer B. BalochОценок пока нет

- 9.1 Operating ExposureДокумент28 страниц9.1 Operating ExposureSanaFatimaОценок пока нет

- Bond Yields DurationДокумент18 страницBond Yields DurationKaranbir Singh RandhawaОценок пока нет

- Overview of Capital MarketsДокумент31 страницаOverview of Capital MarketsDiwakar BhargavaОценок пока нет

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- Chapter 12 Bond Portfolio MGMTДокумент41 страницаChapter 12 Bond Portfolio MGMTsharktale2828Оценок пока нет

- Yield Curve Analysis and Fixed-Income ArbitrageДокумент33 страницыYield Curve Analysis and Fixed-Income Arbitrageandrewfu1988Оценок пока нет

- Immunization StrategiesДокумент75 страницImmunization StrategiesSarang GuptaОценок пока нет

- Time Value of Money: Practical Application of Compounding & DiscountingДокумент32 страницыTime Value of Money: Practical Application of Compounding & DiscountingSaurabh RajputОценок пока нет

- Introduction To Capital MarketsДокумент46 страницIntroduction To Capital MarketsSushobhita Rath100% (4)

- Chap 014Документ79 страницChap 014hanguyenhihiОценок пока нет

- Securities TradingДокумент51 страницаSecurities TradingameetavoОценок пока нет

- Term Structure of Interest RatesДокумент21 страницаTerm Structure of Interest RatestoabhishekpalОценок пока нет

- Fixed Income - Toto - 7Документ44 страницыFixed Income - Toto - 7sagita fОценок пока нет

- Financial Management - Bonds 2014Документ34 страницыFinancial Management - Bonds 2014Joe ChungОценок пока нет

- Valuation of SecuritiesДокумент43 страницыValuation of SecuritiesVaidyanathan RavichandranОценок пока нет

- Lecture 3Документ29 страницLecture 3Nurfaiqah AmniОценок пока нет

- Business School: ACTL4303 AND ACTL5303 Asset Liability ManagementДокумент62 страницыBusiness School: ACTL4303 AND ACTL5303 Asset Liability ManagementBobОценок пока нет

- Interest Rate Models and Derivatives 2019Документ69 страницInterest Rate Models and Derivatives 2019Elisha MakoniОценок пока нет

- Debt - Investment Drivers & ApproachesДокумент26 страницDebt - Investment Drivers & ApproachesMisba KhanОценок пока нет

- Valuation of Securities: - Debentures (Bonds) - Preference Shares - Equity SharesДокумент42 страницыValuation of Securities: - Debentures (Bonds) - Preference Shares - Equity SharesVivek RoyОценок пока нет

- Lecture 6 - Interest Rates and Bond ValuationДокумент61 страницаLecture 6 - Interest Rates and Bond ValuationDaniel HakimОценок пока нет

- 0 20200519134342understanding of Loans and Bonds Part 2 PDFДокумент19 страниц0 20200519134342understanding of Loans and Bonds Part 2 PDFWalter WhiteОценок пока нет

- Chapter 8 Interest Risk IДокумент46 страницChapter 8 Interest Risk ISabrina Karim0% (1)

- Derivatives 5 MFIN SwapsДокумент59 страницDerivatives 5 MFIN SwapsNan XiangОценок пока нет

- Time Value of Money, Compounding and DiscountingДокумент6 страницTime Value of Money, Compounding and DiscountingAmenahОценок пока нет

- Corp FinДокумент45 страницCorp FinSoe Group 1Оценок пока нет

- Chapter 11 Bond Prices and YieldsДокумент36 страницChapter 11 Bond Prices and Yieldssharktale2828Оценок пока нет

- Chapter 2 - How To Calculate Present ValuesДокумент36 страницChapter 2 - How To Calculate Present ValuesDeok NguyenОценок пока нет

- Cost of CapitalДокумент19 страницCost of Capitalshraddha amatyaОценок пока нет

- Interest Rates and Bond Valuation: All Rights ReservedДокумент28 страницInterest Rates and Bond Valuation: All Rights ReservedFahad ChowdhuryОценок пока нет

- Time Value of Money (TVM)Документ5 страницTime Value of Money (TVM)Yesha Jade SaturiusОценок пока нет

- FM PPT 1Документ59 страницFM PPT 1nivethapraveenОценок пока нет

- YeahДокумент2 страницыYeahMoimen Dalinding UttoОценок пока нет

- Valuation of Bonds and SharesДокумент21 страницаValuation of Bonds and ShareszlnpjbcckbeqwnzgojОценок пока нет

- Term Structure and Risk StructureДокумент28 страницTerm Structure and Risk StructureAdina CasianaОценок пока нет

- Financial Management: by K Lubza NiharДокумент21 страницаFinancial Management: by K Lubza NiharAashutosh MishraОценок пока нет

- Finals HWK NotesДокумент24 страницыFinals HWK NotesbenОценок пока нет

- Interest Rates and Risk PremiumДокумент36 страницInterest Rates and Risk PremiumPrathiba PereraОценок пока нет

- WK13-14 Valuation and Rates of ReturnДокумент49 страницWK13-14 Valuation and Rates of ReturnJAEZAR PHILIP GRAGASINОценок пока нет

- Chapter 2 - Interest Rates - SДокумент117 страницChapter 2 - Interest Rates - STuong Vi Nguyen PhanОценок пока нет

- How To Calculate Present Values: Principles of Corporate FinanceДокумент41 страницаHow To Calculate Present Values: Principles of Corporate FinanceSalehEdelbiОценок пока нет

- Chapter 8 - The Term Structure of Interest RateДокумент28 страницChapter 8 - The Term Structure of Interest RateDuy MinhОценок пока нет

- Asset Liability ManagementДокумент32 страницыAsset Liability ManagementAshish ShahОценок пока нет

- Interest Rate Risk I (CH 8)Документ13 страницInterest Rate Risk I (CH 8)Mahbub TalukderОценок пока нет

- Providence College School of Business: FIN 417 Fixed Income Securities Fall 2021 Instructor: Matthew CallahanДокумент51 страницаProvidence College School of Business: FIN 417 Fixed Income Securities Fall 2021 Instructor: Matthew CallahanAlexander MaffeoОценок пока нет

- Discounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinДокумент48 страницDiscounted Cash Flow Valuation: Rights Reserved Mcgraw-Hill/IrwinEnna rajpootОценок пока нет

- AFM 204 - Class 7 Slides - Cost of EquityДокумент49 страницAFM 204 - Class 7 Slides - Cost of Equityasflkhaf2Оценок пока нет

- Bond ValuationДокумент46 страницBond ValuationNor Shakirah ShariffuddinОценок пока нет

- Week 2 Lecture Slides - Ch02Документ39 страницWeek 2 Lecture Slides - Ch02LuanОценок пока нет

- Bond Valuation 000000001Документ41 страницаBond Valuation 000000001Subrata BagОценок пока нет

- Session5 7Документ42 страницыSession5 7Abhishek KashyapОценок пока нет

- Chap 14Документ25 страницChap 14rana sarfaraxОценок пока нет

- Time Value of MoneyДокумент30 страницTime Value of MoneyMoshmi MazumdarОценок пока нет

- 05 Lecture - The Time Value of Money PDFДокумент26 страниц05 Lecture - The Time Value of Money PDFjgutierrez_castro7724Оценок пока нет

- Fundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DДокумент41 страницаFundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DKhánh Linh PhanОценок пока нет

- BVДокумент62 страницыBVKetan BhanushaliОценок пока нет

- The Structure of Interest RatesДокумент72 страницыThe Structure of Interest RatesMarwa HassanОценок пока нет

- Bonds and The Term Structure of Interest RatesДокумент29 страницBonds and The Term Structure of Interest RatesZUNERAKHALIDОценок пока нет

- 7 EFM Class 6 Financial NeedДокумент68 страниц7 EFM Class 6 Financial NeedSiu EricОценок пока нет

- Bond Evaluation - FinalДокумент14 страницBond Evaluation - FinalNishant PokleОценок пока нет

- Lancashire Business School: MD4003 - Management Theory and PracticeДокумент9 страницLancashire Business School: MD4003 - Management Theory and PracticeSanaFatimaОценок пока нет

- 7.0 Does Debt Policy MatterДокумент22 страницы7.0 Does Debt Policy MatterSanaFatimaОценок пока нет

- 6.0 Poyout PolicyДокумент28 страниц6.0 Poyout PolicySanaFatimaОценок пока нет

- 4.3 Q MiniCase Turkish Kriz (A)Документ6 страниц4.3 Q MiniCase Turkish Kriz (A)SanaFatimaОценок пока нет

- 2.2 FX MiniCase Venezuelan BolivarДокумент4 страницы2.2 FX MiniCase Venezuelan BolivarSanaFatimaОценок пока нет

- 5.2 Q JPMorgan Chase FXДокумент7 страниц5.2 Q JPMorgan Chase FXSanaFatimaОценок пока нет

- 3.1 International Parity ConditionsДокумент41 страница3.1 International Parity ConditionsSanaFatimaОценок пока нет

- Country RiskДокумент42 страницыCountry RiskmandarcoolОценок пока нет

- Blue Chip Stocks TipsДокумент16 страницBlue Chip Stocks TipsPinal MehtaОценок пока нет

- ID Analisis Rasio Keuangan Dan Metode EconoДокумент9 страницID Analisis Rasio Keuangan Dan Metode Econo1878 saiful 1927 bonek red devilОценок пока нет

- Reduction of Portfolio Through DiversificationДокумент28 страницReduction of Portfolio Through DiversificationDilshaad ShaikhОценок пока нет

- Questionnaire MДокумент4 страницыQuestionnaire MSubhasisChatterjeeОценок пока нет

- Rising Wedge Article PDFДокумент13 страницRising Wedge Article PDFKiran KrishnaОценок пока нет

- Forex 101Документ18 страницForex 101Geoffrey Castillon RamirezОценок пока нет

- S 26 eДокумент2 страницыS 26 eMichael WestОценок пока нет

- Balance of Payments: Chapter ThreeДокумент36 страницBalance of Payments: Chapter ThreeHu Jia QuenОценок пока нет

- Multibagger Stock Ideas2Документ16 страницMultibagger Stock Ideas2KannanОценок пока нет

- Qualifying Job Titles For FRM CertificationДокумент6 страницQualifying Job Titles For FRM CertificationAnoop TyagiОценок пока нет

- Chapter 1 - AFP313Документ34 страницыChapter 1 - AFP313Mah Chee SiongОценок пока нет

- K-10 Colgate Palmolive 1994-1992Документ96 страницK-10 Colgate Palmolive 1994-1992salwanahotmailcomОценок пока нет

- TCQTTTДокумент32 страницыTCQTTTdohongvinh40Оценок пока нет

- Mutual Fund ProjectДокумент35 страницMutual Fund ProjectKripal SinghОценок пока нет

- Za Test 8 KumarДокумент30 страницZa Test 8 KumarMia Omerika100% (1)

- The Profit and Loss Appropriation AccountДокумент4 страницыThe Profit and Loss Appropriation AccountSarthak GuptaОценок пока нет

- Cost-Volume-Profit Analysis: Slide 3-28Документ15 страницCost-Volume-Profit Analysis: Slide 3-28SambuttОценок пока нет

- Some ExercisesДокумент3 страницыSome ExercisesMinh Tâm NguyễnОценок пока нет

- Sanjeevani Forex Education RewДокумент34 страницыSanjeevani Forex Education RewfaiyazaslamОценок пока нет

- Coal TradersДокумент4 страницыCoal TradersDouglas SuarezОценок пока нет

- Forex Trading by Money Market, BNGДокумент69 страницForex Trading by Money Market, BNGsachinmehta1978Оценок пока нет

- UntitledДокумент15 страницUntitledkayal_vizhi_6Оценок пока нет

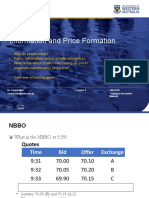

- Information and Price FormationДокумент36 страницInformation and Price FormationDylan AdrianОценок пока нет

- Foreign Currency TransactionsДокумент40 страницForeign Currency TransactionsJuliaMaiLeОценок пока нет