Академический Документы

Профессиональный Документы

Культура Документы

Kieso 10

Загружено:

noortiaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Kieso 10

Загружено:

noortiaАвторское право:

Доступные форматы

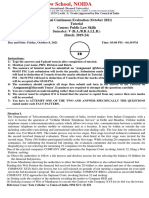

Chapter

10-1

Acquisition and Disposition of

Property, Plant, and Equipment

Chapter

10

Intermediate Accounting

12th Edition

Kieso, Weygandt, and Warfield

Prepared by Coby Harmon, University of California, Santa Barbara

Chapter

10-2

1. Describe property, plant, and equipment.

2. Identify the costs to include in initial valuation of property,

plant, and equipment.

3. Describe the accounting problems associated with self-

constructed assets.

4. Describe the accounting problems associated with interest

capitalization.

5. Understand accounting issues related to acquiring and valuing

plant assets.

6. Describe the accounting treatment for costs subsequent to

acquisition.

7. Describe the accounting treatment for the disposal of property,

plant, and equipment.

Learning Objectives

Chapter

10-3

Acquisition and Disposition of

Property, Plant, and Equipment

Acquisition

Acquisition costs:

Land, buildings,

equipment

Self-constructed

assets

Interest costs

Observations

Valuation

Cost

Subsequent to

Acquisition

Dispositions

Cash discounts

Deferred

contracts

Lump-sum

purchases

Stock issuance

Nonmonetary

exchanges

Contributions

Other valuation

methods

Sale

Involuntary

conversion

Miscellaneous

problems

Additions

Improvements

and

replacements

Rearrangement

and reinstallation

Repairs

Summary

Chapter

10-4

Used in operations and not for resale.

Long-term in nature and usually depreciated.

Possess physical substance.

Property, plant, and equipment includes land, buildings,

and equipment (machinery, furniture, tools).

Major characteristics include:

Property, Plant, and Equipment

LO 1 Describe property, plant, and equipment.

Chapter

10-5

At acquisition, cost reflects fair value.

Historical cost is reliable.

Companies should not anticipate gains and losses but

should recognize gains and losses only when the asset

is sold.

Valued at Historical Cost, reasons include:

Acquisition and Valuation of PP&E

LO 2 Identify the costs to include in initial valuation

of property, plant, and equipment.

APB Opinion No. 6 states,

property, plant, and equipment

should not be written up to

reflect appraisal, market, or

current values which are above

cost.

Chapter

10-6

Includes all costs to acquire land and ready it for use.

Costs typically include:

Cost of Land

Acquisition and Valuation of PP&E

LO 2 Identify the costs to include in initial valuation

of property, plant, and equipment.

(1) the purchase price;

(2) closing costs, such as title to the land, attorneys

fees, and recording fees;

(3) costs of grading, filling, draining, and clearing;

(4) assumption of any liens, mortgages, or encumbrances

on the property; and

(5) Additional land improvements that have an indefinite

life.

Chapter

10-7

Includes all costs related directly to acquisition or

construction.

Costs typically include:

Cost of Buildings

Acquisition and Valuation of PP&E

LO 2 Identify the costs to include in initial valuation

of property, plant, and equipment.

(1) materials, labor, and overhead costs incurred during

construction and

(2) professional fees and building permits.

Chapter

10-8

Include all costs incurred in acquiring the equipment

and preparing it for use.

Costs typically include:

Cost of Equipment

Acquisition and Valuation of PP&E

LO 2 Identify the costs to include in initial valuation

of property, plant, and equipment.

(1) purchase price,

(2) freight and handling charges

(3) insurance on the equipment while in transit,

(4) cost of special foundations if required,

(5) assembling and installation costs, and

(6) costs of conducting trial runs.

Chapter

10-9

E10-1 (Acquisition Costs of Realty) The following expenditures

and receipts are related to land, land improvements, and buildings

acquired for use in a business enterprise. Determine how the

following should be classified:

Acquisition and Valuation of PP&E

(a) Money borrowed to pay building contractor

(b) Payment for construction from note proceeds

(c) Cost of land fill and clearing

(d) Delinquent real estate taxes on property

assumed

(e) Premium on insurance policy during

construction

(f) Refund of 1-month insurance premium because

construction completed early

Classification

Notes Payable

Building

Land

Land

Building

(Building)

LO 2 Identify the costs to include in initial valuation

of property, plant, and equipment.

Chapter

10-10

E10-1 (Acquisition Costs of Realty) The following expenditures

and receipts are related to land, land improvements, and buildings

acquired for use in a business enterprise. Determine how the

following should be classified:

Acquisition and Valuation of PP&E

(g) Architects fee on building

(h) Cost of real estate purchased as a plant site

(land $200,000 and building $50,000)

(i) Commission fee paid to real estate agency

(j) Installation of fences around property

(k) Cost of razing and removing building

(l) Proceeds from salvage of demolished building

(m) Cost of parking lots and driveways

(n) Cost of trees and shrubbery (permanent)

Costs of:

Building

LO 2 Identify the costs to include in initial valuation

of property, plant, and equipment.

Land

Land

Land Improvements

Land

(Land)

Land Improvements

Land

Chapter

10-11

Self-Constructed Assets

Acquisition and Valuation of PP&E

Costs typically include:

(1) Materials and direct labor

(2) Overhead can be handled in two ways:

1. Assign no fixed overhead

2. Assign a portion of all overhead to the

construction process.

Companies use the second method extensively.

LO 3 Describe the accounting problems associated with self-constructed assets.

Chapter

10-12

Three approaches have been suggested to account for the

interest incurred in financing the construction.

Interest Costs During Construction

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Capitalize no

interest

during

construction

Capitalize actual

costs incurred

during construction

(with modification)

Capitalize

all costs of

funds

GAAP

$ 0 $ ?

Increase to Cost of Asset

Illustration 10-1

Chapter

10-13

GAAP requires capitalizing actual interest (with

modification).

Consistent with historical cost all costs incurred to

bring the asset to the condition for its intended use.

Capitalization considers three items:

1. Qualifying assets.

2. Capitalization period.

3. Amount to capitalize.

Interest Costs During Construction

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Chapter

10-14

Require a period of time to get them ready for their

intended use.

Two types of assets:

Assets under construction for a companys own use.

Assets intended for sale or lease that are

constructed or produced as discrete projects.

Qualifying Assets

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Chapter

10-15

Capitalization Period

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Begins when:

1. Expenditures for the asset have been made.

2. Activities for readying the asset are in progress .

3. Interest costs are being incurred.

Ends when:

The asset is substantially complete and ready for use.

Chapter

10-16

Amount to Capitalize

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Capitalize the lesser of:

1. Actual interest costs

2. Avoidable interest - the amount of interest

that could have been avoided if expenditures

for the asset had not been made.

Chapter

10-17

Interest Capitalization Illustration: Delmar Corporation

borrowed $200,000 at 12% interest from State Bank on Jan. 1,

2005, for specific purposes of constructing special-purpose

equipment to be used in its operations. Construction on the

equipment began on Jan. 1, 2005, and the following expenditures

were made prior to the projects completion on Dec. 31, 2005:

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Actual Expenditures:

January 1, 2005 $100,000

April 30, 2005 150,000

November 1, 2005 300,000

December 31, 2005 100,000

Total expenditures $650,000

Other general debt existing

on Jan. 1, 2005:

$500,000, 14%, 10-year

bonds payable

$300,000, 10%, 5-year

note payable

Chapter

10-18

Step 1 - Determine which assets qualify for

capitalization of interest.

Special purpose equipment qualifies because it

requires a period of time to get ready and it will be

used in the companys operations.

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Step 2 - Determine the capitalization period.

The capitalization period is from Jan. 1, 2005

through Dec. 31, 2005, because expenditures are

being made and interest costs are being incurred

during this period while construction is taking place.

Chapter

10-19

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Weighted

Average

Actual Capitalization Accumulated

Date Expenditures Period Expenditures

Jan. 1 100,000 $ 12/12 100,000 $

Apr. 30 150,000 8/12 100,000

Nov. 1 300,000 2/12 50,000

Dec. 31 100,000 0/12 -

650,000 $ 250,000 $

Step 3 - Compute weighted-average accumulated

expenditures.

A company weights the construction expenditures by the amount of time

(fraction of a year or accounting period) that it can incur interest cost on

the expenditure.

Chapter

10-20

Chapter

10-21

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Step 4 - Compute the Actual and Avoidable Interest.

Selecting Appropriate Interest Rate:

1. For the portion of weighted-average accumulated

expenditures that is less than or equal to any amounts

borrowed specifically to finance construction of the

assets, use the interest rate incurred on the specific

borrowings.

2. For the portion of weighted-average accumulated

expenditures that is greater than any debt incurred

specifically to finance construction of the assets, use a

weighted average of interest rates incurred on all other

outstanding debt during the period.

Chapter

10-22

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Accumulated Interest Avoidable

Expenditures Rate Interest

200,000 $ 12% 24,000 $

50,000 12.5% 6,250

250,000 $ 30,250 $

Step 4 - Compute the Actual and Avoidable Interest.

Avoidable Interest

Interest Actual

Debt Rate Interest

Specific Debt 200,000 $ 12% 24,000 $

General Debt 500,000 14% 70,000

300,000 10% 30,000

1,000,000 $ 124,000 $

Weighted-average

interest rate on

general debt

Actual Interest

$100,000

$800,000

= 12.5%

Chapter

10-23

Step 5 Capitalize the lesser of Avoidable

interest or Actual interest.

Acquisition and Valuation of PP&E

LO 4 Describe the accounting problems associated with interest capitalization.

Avoidable interest 30,250 $

Actual interest 124,000

Journal entry to Capitalize Interest:

Equipment 30,250

Interest expense 30,250

Chapter

10-24

Companies should record property, plant, and

equipment:

at the fair value of what they give up or

at the fair value of the asset received,

whichever is more clearly evident.

Generally

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Chapter

10-25

Cash Discounts whether taken or not generally

considered a reduction in the cost of the asset.

Deferred-Payment Contracts Assets, purchased

through long term credit, are recorded at the present value

of the consideration exchanged.

Lump-Sum Purchases Allocate the total cost among

the various assets on the basis of their fair market values.

Issuance of Stock The market value of the stock

issued is a fair indication of the cost of the property

acquired.

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Chapter

10-26

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Ordinarily accounted for on the basis of:

the fair value of the asset given up or

the fair value of the asset received,

whichever is clearly more evident.

Exchanges of Nonmonetary Assets

Companies should recognize immediately any gains or losses

on the exchange when the transaction has commercial

substance (future cash flows change as a result of the

transaction).

Chapter

10-27

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Accounting for Exchanges

* If cash is 25% or more of the fair value of the exchange,

recognize entire gain because earnings process is complete.

Illustration 10-10

Chapter

10-28

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Companies recognize a loss immediately whether the

exchange has commercial substance or not.

Rationale: Companies should not value assets at more

than their cash equivalent price; if the loss were

deferred, assets would be overstated.

Exchanges - Loss Situation

Chapter

10-29

Exchange Gain Situation Illustration: Carlos Arruza

Company exchanged equipment used in its manufacturing

operations plus $3,000 in cash for similar equipment used in the

operations of Tony LoBianco Company. The following information

pertains to the exchange.

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Arruza LoBianco

Equipment (cost) $28,000 $28,000

Accumulated Depreciation 19,000 10,000

Fair value of equipment 15,500 12,500

Cash given up 3,000

Instructions: Prepare the journal entries to record the exchange

on the books of both companies.

Chapter

10-30

Calculation of Gain or Loss

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Arruza LoBianco

Fair value of equipment received $12,500 $15,500

Cash received / paid 3,000 (3,000)

Less: Bookvalue of equipment

($28,000-19,000) (9,000)

($28,000-10,000) (18,000)

Gain or (Loss) on Exchange $6,500 ($5,500)

When a company receives cash (sometimes referred to as boot)

in an exchange that lacks commercial substance, it may

immediately recognize a portion of the gain.

Chapter

10-31

Has Commercial Substance

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Arruza:

Equipment 12,500

Cash 3,000

Accumulated depreciation 19,000

Equipment 28,000

Gain on exchange 6,500

LoBianco:

Equipment 15,500

Accumulated depreciation 10,000

Equipment 28,000

Cash 3,000

Loss on exchange 5,500

Chapter

10-32

Lacks Commercial Substance

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Arruza:

Equipment (12,500 5,242) 7,258

Cash 3,000

Accumulated depreciation 19,000

Equipment 28,000

Gain on exchange 1,258

Cash Received

Cash Received + FMV of Assets Received

x

Total

Gain

=

Recognized

Gain

$3,000

$3,000 + $12,500

x $6,500 = $1,258

Deferred gain = $6,500 1,258 = $5,242

Chapter

10-33

Lacks Commercial Substance

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

LoBianco (no change):

Equipment 15,500

Accumulated depreciation 10,000

Equipment 28,000

Cash 3,000

Loss on exchange 5,500

Companies recognize a loss immediately whether the

exchange has commercial substance or not.

Chapter

10-34

Summary of Gain and Loss Recognition on Exchanges

of Nonmonetary Assets Lacks Commercial Substance

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Illustration 10-20

Chapter

10-35

Valuation

LO 5 Understand accounting issues related to acquiring and valuing plant assets.

Companies should use:

the fair value of the asset to establish its value on

the books and

should recognize contributions received as

revenues in the period received.

Accounting for Contributions

Chapter

10-36

Costs Subsequent to Acquisition

LO 6 Describe the accounting treatment for costs subsequent to acquisition.

In general, costs incurred to achieve greater future

benefits should be capitalized, whereas expenditures

that simply maintain a given level of services should be

expensed.

To capitalize costs, one of three conditions must be

present:

Useful life of the asset must be increased.

Quantity of units produced from asset must be increased.

Quality of units produced must be enhanced.

Chapter

10-37

Costs Subsequent to Acquisition

LO 6 Describe the accounting treatment for costs subsequent to acquisition.

Additions

Improvements and Replacements

Rearrangement and Reinstallation

Repairs

Major Types of Expenditures

See Illustration 10-21, in the text, for summary of

normal accounting treatment for these expenditures.

Chapter

10-38

Disposition of Plant Assets

LO 7 Describe the accounting treatment for the

disposal of property, plant, and equipment.

Sale of Plant Assets

BE10-14 Sim City Corporation owns machinery that cost

$20,000 when purchased on January 1, 2004. Depreciation

has been recorded at a rate of $3,000 per year, resulting in

a balance in accumulated depreciation of $9,000 at

December 31, 2006. The machinery is sold on September 1,

2007, for $10,500. Prepare journal entries to (a) update

depreciation for 2007 and (b) record the sale.

Chapter

10-39

(a) update depreciation for 2007

Depreciation expense ($3,000 x 8/12) 2,000

Accumulated depreciation 2,000

LO 7 Describe the accounting treatment for the

disposal of property, plant, and equipment.

(b) record the sale

Cash 10,500

Accumulated depreciation 11,000

Machinery 20,000

Gain on sale 1,500

Disposition of Plant Assets

Chapter

10-40

Sometimes an assets service is terminated through some

type of involuntary conversion such as fire, flood, theft, or

condemnation.

Companies report the difference between the amount

recovered (e.g., from a condemnation award or insurance

recovery), if any, and the assets book value as a gain or

loss.

They treat these gains or losses like any other type of

disposition.

Involuntary Conversion

LO 7 Describe the accounting treatment for the

disposal of property, plant, and equipment.

Disposition of Plant Assets

Chapter

10-41

If a company scraps or abandons an asset without any cash

recovery, it recognizes a loss equal to the assets book

value.

If scrap value exists, the gain or loss that occurs is the

difference between the assets scrap value and its book

value.

If an asset still can be used even though it is fully

depreciated, it may be kept on the books at historical cost

less depreciation.

Miscellaneous Problems

LO 7 Describe the accounting treatment for the

disposal of property, plant, and equipment.

Disposition of Plant Assets

Chapter

10-42

Copyright 2006 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

in Section 117 of the 1976 United States Copyright Act without

the express written permission of the copyright owner is

unlawful. Request for further information should be addressed

to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.

Copyright

Вам также может понравиться

- Clinical Skills Resource HandbookДокумент89 страницClinical Skills Resource Handbookanggita budi wahyono100% (1)

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryОт EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryОценок пока нет

- Pinochle Rules GuideДокумент2 страницыPinochle Rules GuidepatrickОценок пока нет

- Folk Tales of Nepal - Karunakar Vaidya - Compressed PDFДокумент97 страницFolk Tales of Nepal - Karunakar Vaidya - Compressed PDFSanyukta ShresthaОценок пока нет

- Property and EquipmentДокумент101 страницаProperty and EquipmentJulianna TonogbanuaОценок пока нет

- Valuation of Inventories A Cost-Basis ApproachДокумент46 страницValuation of Inventories A Cost-Basis ApproachIrwan JanuarОценок пока нет

- OCFINALEXAM2019Документ6 страницOCFINALEXAM2019DA FT100% (1)

- Safety Guidelines For Direct DrivesДокумент9 страницSafety Guidelines For Direct DrivesJOseОценок пока нет

- FCC TechДокумент13 страницFCC TechNguyen Thanh XuanОценок пока нет

- Anti Viral DrugsДокумент6 страницAnti Viral DrugskakuОценок пока нет

- CH 10Документ60 страницCH 10Desing Bima Airlangga100% (1)

- Kieso 6Документ54 страницыKieso 6noortiaОценок пока нет

- CES Wrong Answer SummaryДокумент4 страницыCES Wrong Answer SummaryZorg UAОценок пока нет

- The NEC4 Engineering and Construction Contract: A CommentaryОт EverandThe NEC4 Engineering and Construction Contract: A CommentaryОценок пока нет

- Test Initial Engleza A 8a Cu Matrice Si BaremДокумент4 страницыTest Initial Engleza A 8a Cu Matrice Si BaremTatiana BeileșenОценок пока нет

- 7 22 13+Slides+Chapter+10+for+Students+Документ88 страниц7 22 13+Slides+Chapter+10+for+Students+etafeyОценок пока нет

- Acquisition and Disposition of Property, Plant and EquipmentДокумент63 страницыAcquisition and Disposition of Property, Plant and EquipmentKashif Raheem100% (1)

- Wiley - Chapter 10: Acquisition and Disposition of Property, Plant, and EquipmentДокумент27 страницWiley - Chapter 10: Acquisition and Disposition of Property, Plant, and EquipmentIvan Bliminse100% (3)

- Kieso CH 10 Aset Tetap Versi IFRS LilikДокумент44 страницыKieso CH 10 Aset Tetap Versi IFRS LilikSri Apriyanti Husain100% (1)

- Chapter 9 Acquisition and Disposition of Property, Plant, and EquipmentДокумент57 страницChapter 9 Acquisition and Disposition of Property, Plant, and EquipmentGrace Debora100% (1)

- Kieso - Inter - ch10 - Ifrs Psak Ppe RevДокумент59 страницKieso - Inter - ch10 - Ifrs Psak Ppe RevJhoОценок пока нет

- 10 PpeДокумент53 страницы10 PpeSalsa Byla100% (1)

- Acquisition of PP&E Acquisition of PP&EДокумент20 страницAcquisition of PP&E Acquisition of PP&EbereniceОценок пока нет

- CH 10Документ65 страницCH 10Helmi NurОценок пока нет

- CH 10Документ61 страницаCH 10Ashraful Islam ShowrovОценок пока нет

- Acquisition and Valuation of Property AssetsДокумент69 страницAcquisition and Valuation of Property AssetsSunny SunnyОценок пока нет

- Ch8 HKAS16Документ29 страницCh8 HKAS16jaberalislamОценок пока нет

- ch10Документ33 страницыch10errahahahaОценок пока нет

- Intermediate AccountingДокумент66 страницIntermediate AccountingTiến NguyễnОценок пока нет

- 1, Aset TetapДокумент45 страниц1, Aset TetapM Syukrihady IrsyadОценок пока нет

- PPEДокумент15 страницPPEShara Mae SameloОценок пока нет

- CH 10Документ56 страницCH 10Tifany Natasia100% (1)

- Acquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1Документ58 страницAcquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1amjad asfourОценок пока нет

- CH 10Документ30 страницCH 10Johnny Wong100% (1)

- Chapter 10 - ACQUISITION AND DISPOSITION OF PROPERTY, PLANT, AND EQUIPMENTДокумент34 страницыChapter 10 - ACQUISITION AND DISPOSITION OF PROPERTY, PLANT, AND EQUIPMENTheryadi100% (2)

- CH 10Документ67 страницCH 10potato chipsОценок пока нет

- CH 10Документ60 страницCH 10YovitaFebriyantiОценок пока нет

- CH 10Документ60 страницCH 10Shafira Putri IndikaОценок пока нет

- Learn Key Concepts of Property, Plant & EquipmentДокумент15 страницLearn Key Concepts of Property, Plant & EquipmentThea Danica BrazaОценок пока нет

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldДокумент34 страницыIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaОценок пока нет

- CH 10Документ40 страницCH 10huu nguyenОценок пока нет

- Philippine Accounting Standard No. 16: Property, Plant and EquipmentДокумент101 страницаPhilippine Accounting Standard No. 16: Property, Plant and EquipmentCoco MartinОценок пока нет

- FA II Chapter OneДокумент80 страницFA II Chapter OneGirma NegashОценок пока нет

- Module 5 Property Plant EquipmentДокумент16 страницModule 5 Property Plant EquipmentTrine De LeonОценок пока нет

- P-6 Aset TetapДокумент65 страницP-6 Aset TetapRaehan RaesaОценок пока нет

- Topic 1 PPE Part 1Документ58 страницTopic 1 PPE Part 1Xiao XuanОценок пока нет

- PP&E Chapter SummaryДокумент15 страницPP&E Chapter SummarySuleyman TesfayeОценок пока нет

- Chapter 10Документ50 страницChapter 10duy blaОценок пока нет

- AKM1 Minggu 8 - 9Документ36 страницAKM1 Minggu 8 - 9GilbertStevanusОценок пока нет

- Depreciation Notes - Advanced AccountingДокумент16 страницDepreciation Notes - Advanced AccountingSam ChinthaОценок пока нет

- IFA Chapter 5Документ68 страницIFA Chapter 5kqk07829Оценок пока нет

- CH - 10 - Acquisition and Disposition of Property, Plant, and EquipmentДокумент62 страницыCH - 10 - Acquisition and Disposition of Property, Plant, and EquipmentSamiHadadОценок пока нет

- Chapter 10 - SlidesДокумент38 страницChapter 10 - Slidesernest gyapongОценок пока нет

- Chapter 5 IFA NEWДокумент17 страницChapter 5 IFA NEWabdum1928Оценок пока нет

- Chapter Three PPE Copy 2Документ15 страницChapter Three PPE Copy 2nachmarket30Оценок пока нет

- Chapter 1 PPEДокумент22 страницыChapter 1 PPEGirma NegashОценок пока нет

- Ch-2. PPEДокумент159 страницCh-2. PPETsigereda Mulugeta100% (1)

- 1271683293-IAS16 Preparation For StudySession PDFДокумент13 страниц1271683293-IAS16 Preparation For StudySession PDFmohedОценок пока нет

- Student Notes Chap 10Документ8 страницStudent Notes Chap 10TINAIDAОценок пока нет

- Chapter 9 PowerPointДокумент101 страницаChapter 9 PowerPointcheuleee100% (2)

- Topic 4 PP&EДокумент62 страницыTopic 4 PP&Efastidious_5100% (1)

- Capex - Pankaj Goel - Foundation Chapter - 4 NotesДокумент19 страницCapex - Pankaj Goel - Foundation Chapter - 4 NotesAmit KumarОценок пока нет

- Land, Building and MachineryДокумент26 страницLand, Building and MachineryJirah DigalОценок пока нет

- CMA Data PRESENTATION-FOR-30-OCTOBER 2015-NewДокумент52 страницыCMA Data PRESENTATION-FOR-30-OCTOBER 2015-NewvikkiОценок пока нет

- Acfn 2082 Ch01-Part IДокумент96 страницAcfn 2082 Ch01-Part IbikilahussenОценок пока нет

- ACCO ch10Документ80 страницACCO ch10Samar BarakehОценок пока нет

- PA2C2-PA & Dep-Non ACFNДокумент33 страницыPA2C2-PA & Dep-Non ACFNSelamОценок пока нет

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Solutions Manual 1Документ36 страницCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Solutions Manual 1aliciahollandygimjrqotk100% (20)

- CH 10Документ81 страницаCH 10Putu DenyОценок пока нет

- CH 10Документ55 страницCH 10KHANH Du NgocОценок пока нет

- MAHM6e Ch10.Ab - AzДокумент57 страницMAHM6e Ch10.Ab - AznoortiaОценок пока нет

- 4-Capital Budgeting TechniquesДокумент20 страниц4-Capital Budgeting TechniquesnoortiaОценок пока нет

- MAHM6e Ch09.Ab - AzДокумент42 страницыMAHM6e Ch09.Ab - AznoortiaОценок пока нет

- Statement of Cash Flows Statement of Cash FlowsДокумент45 страницStatement of Cash Flows Statement of Cash Flowslow profileОценок пока нет

- CH 24Документ22 страницыCH 24meea_nur9451Оценок пока нет

- 4-Capital Budgeting TechniquesДокумент20 страниц4-Capital Budgeting TechniquesnoortiaОценок пока нет

- Kieso 10Документ42 страницыKieso 10noortiaОценок пока нет

- CH 21Документ53 страницыCH 21noortiaОценок пока нет

- SOALДокумент1 страницаSOALnoortiaОценок пока нет

- CH 09Документ37 страницCH 09noortiaОценок пока нет

- Statement of Cash Flows Statement of Cash FlowsДокумент45 страницStatement of Cash Flows Statement of Cash Flowslow profileОценок пока нет

- Income Statement and Related InformationДокумент50 страницIncome Statement and Related InformationIrwan JanuarОценок пока нет

- Accounting For Pensions and Postretirement BenefitsДокумент49 страницAccounting For Pensions and Postretirement BenefitsIrwan JanuarОценок пока нет

- Kieso 7Документ61 страницаKieso 7noortiaОценок пока нет

- Kieso 10Документ42 страницыKieso 10noortiaОценок пока нет

- Exploring Financial and Sustainability Reporting PbfeamДокумент22 страницыExploring Financial and Sustainability Reporting PbfeamnoortiaОценок пока нет

- Exploring Financial and Sustainability Reporting PbfeamДокумент22 страницыExploring Financial and Sustainability Reporting PbfeamnoortiaОценок пока нет

- Eksplorasi Kualitas Profesional SiaДокумент14 страницEksplorasi Kualitas Profesional SianoortiaОценок пока нет

- TestДокумент2 страницыTestnoortiaОценок пока нет

- Financial Reports, Depreciation and Cash Flow AnalysisДокумент6 страницFinancial Reports, Depreciation and Cash Flow AnalysisnoortiaОценок пока нет

- Yoto Tire Company Budgets for 2011 Sales, Production, Materials, Labor, Overhead, Cost of GoodsДокумент2 страницыYoto Tire Company Budgets for 2011 Sales, Production, Materials, Labor, Overhead, Cost of GoodsnoortiaОценок пока нет

- CH 11Документ38 страницCH 11noortiaОценок пока нет

- CH 09Документ37 страницCH 09noortiaОценок пока нет

- Financial Accounting and Accounting StandardsДокумент31 страницаFinancial Accounting and Accounting StandardsIrwan JanuarОценок пока нет

- Jiptummpp GDL Jou 2009 Sasongkobu 17097 The+prac eДокумент21 страницаJiptummpp GDL Jou 2009 Sasongkobu 17097 The+prac eer4sallОценок пока нет

- Nomer 8 Ujian MKДокумент5 страницNomer 8 Ujian MKnoortiaОценок пока нет

- Prilaku BiayaДокумент31 страницаPrilaku BiayanoortiaОценок пока нет

- An Equivalent SDOF System Model For Estimating The Earthquake Response of R/C Buildings With Hysteretic DampersДокумент8 страницAn Equivalent SDOF System Model For Estimating The Earthquake Response of R/C Buildings With Hysteretic DampersAlex MolinaОценок пока нет

- Solving Problems Involving Simple Interest: Lesson 2Документ27 страницSolving Problems Involving Simple Interest: Lesson 2Paolo MaquidatoОценок пока нет

- Joey Cena 2Документ1 страницаJoey Cena 2api-635313033Оценок пока нет

- Value Creation-How-Can-The-Semiconductor-Industry-Keep-Outperforming-FinalДокумент7 страницValue Creation-How-Can-The-Semiconductor-Industry-Keep-Outperforming-FinalJoão Vitor RibeiroОценок пока нет

- Multiple Choice Questions Class Viii: GeometryДокумент29 страницMultiple Choice Questions Class Viii: GeometrySoumitraBagОценок пока нет

- Sach Bai Tap Tieng Anh8 - Mai Lan HuongДокумент157 страницSach Bai Tap Tieng Anh8 - Mai Lan Huongvothithao19750% (1)

- Volleyball ReflectionДокумент1 страницаVolleyball ReflectionJake Santos100% (1)

- Rashi - Effusion CytДокумент56 страницRashi - Effusion CytShruthi N.RОценок пока нет

- NUC BIOS Update Readme PDFДокумент3 страницыNUC BIOS Update Readme PDFSuny Zany Anzha MayaОценок пока нет

- Ce QuizДокумент2 страницыCe QuizCidro Jake TyronОценок пока нет

- Symbiosis Law School ICE QuestionsДокумент2 страницыSymbiosis Law School ICE QuestionsRidhima PurwarОценок пока нет

- Aerospace Propulsion Course Outcomes and Syllabus OverviewДокумент48 страницAerospace Propulsion Course Outcomes and Syllabus OverviewRukmani Devi100% (2)

- Labor DoctrinesДокумент22 страницыLabor DoctrinesAngemeir Chloe FranciscoОценок пока нет

- VET PREVENTIVE MEDICINE EXAMДокумент8 страницVET PREVENTIVE MEDICINE EXAMashish kumarОценок пока нет

- Biological Control in Brazil An OverviewДокумент10 страницBiological Control in Brazil An OverviewGustavo Ferreira MoraisОценок пока нет

- The Sociopath's MantraДокумент2 страницыThe Sociopath's MantraStrategic ThinkerОценок пока нет

- MICROHARDNESS TESTER HMV-2 - SeriesДокумент9 страницMICROHARDNESS TESTER HMV-2 - SeriesRicoОценок пока нет

- Independent University, BangladeshДокумент14 страницIndependent University, BangladeshMD. JULFIKER HASANОценок пока нет

- All India Ticket Restaurant Meal Vouchers DirectoryДокумент1 389 страницAll India Ticket Restaurant Meal Vouchers DirectoryShauvik HaldarОценок пока нет

- Chemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryДокумент53 страницыChemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryMarthaAlbaGuevaraОценок пока нет

- PPT ch01Документ45 страницPPT ch01Junel VeriОценок пока нет