Академический Документы

Профессиональный Документы

Культура Документы

International Financial Institutions

Загружено:

Paavni SharmaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

International Financial Institutions

Загружено:

Paavni SharmaАвторское право:

Доступные форматы

International

Financial

Institutions

UIAMS,

Panjab University

Chandigarh

Definition

IFI refers to financial institutions

that have been established by more

than one country.

The most prominent IFIs are

creations of multiple nations,

although some are bilateral financial

institutions.

Introduction

The purpose of these international

financial institutions is maintain

orderly international financial

conditions and to provide capital and

advice for economic development,

particularly in those countries that

lack resources to do it themselves

Which are

international financial

organizations

1) The world bank group- international

bank for Reconstruction and

Development (IBRD) and its three

subsidiaries

a) International Development

Association

b) International Finance Corporation

c) Multilateral Investment Guarantee

Agency (MIGA)

2) International Monetary Fund (IMF)

Continue..

3) Bank of international Settlements (

BIS)

4) Asian Development Bank

5) African Development Bank

6) European Bank for Reconstruction

and Development

7) Inter- American Development Bank

Continue..

These international organization obtain

funds for the lending activities from

two basic sources:

1) The first is contribution of capital that

each nation makes when it becomes a

member

2) The second source is through

borrowings

The World Bank Group

The world Bank began in 1946 with

38 members.

Now the number of members has been

increased to 184

The world bank and International

Monetary Fund ( IMF) were conceived

as twin pillars of the post war

economic order at a conference of

Britain, America and their war-times

allies at Bretton Woods, in July 1944

Continue

The world bank is a publicly owned

financial intermediary ( FI)

For most part it borrows on commercial

terms to finance investments in

countries in need.

The IMF is not bank, but a club

Member countries pay a subscription

and agree to abide by a mutually

advantageous code of economic conduct

IBRD

The objective is to help raise

standards of living in developing

countries by channeling financial

resources from developed countries to

the developing world .

The article of agreement of IBRD

require it to promote private foreign

investments by means of guarantee or

participations in loan and other

investment made by private investors.

Continue..

In the development task, banks main

objectives are to stimulate, support and

provide from its own resources flow of

capital to worthwhile projects and

programmes in developing countries. In

addition the Bank group aims to improve

the quality of project planning and in

some case to improve the general

economic policies of recipient countries

Bank provides technical assistance

mainly in the form of project evaluation.

Continue

Beginning in 1980, the bank started to

shift towards policy based loans which

differ from standard project loans.

These loans are not targeted building

highway or housing complex but at

fostering far-reaching structural

reforms, such as end to import

restrictions or the establishment of

market prices of agricultural goods.

Objectives of IBRD

The original objective was to make

loans to develop the war shattered

economies of Europe in the Second

World War. To promote investment by

means of guarantee and participation

in loans and other investments made

by private investors To provide loans

to big projects To help the poor

countries by providing them loans

and information assistance.

Sources of credit

generation of IBRD

Quotas:

The membership of the world is the same

as that of IMF .Members make contribution

in relation to their IMF Quota.

Bonds:

The World Bank also sells Bonds in the

capital markets to raise funds

Income:

A very small proportion of the IBRD funds

come from the interest on loans advanced

by it.

Continue

These loans are of basic two types:

1) Structural Adjustment Loans

2) Sector Adjustment Loans

Human development plays a crucial role in

the Banks overall strategy to reduce

poverty. Bank focused on

a) Lending and non-lending services to

support population control, health

nutrition and education

b) Efforts to improve the quality of bank

services by working more closely with

clients, collaborating with partners and

establishing a human development

network to strengthen the banks ability to

provide quality services

International Development

Association (IDA)

The money lent under the IBRD label is

raised through bond sales in the market.

Borrowers pay interest rate on the basis

of market rate of interest

IDA loans, however, are much more

concessional. These resources are not

raised through borrowing, but through

subscriptions from rich member

countries.

IDA loans are offered only to poorest

countries.

IMF

Establishment:

It was the outcome of Wood Agreement

signed by 44 major countries of the world

in July 1944 in USA.

Organization: It is an autonomous body

and is affiliated to UNO. The

management of Fund is under control of

two bodies:

a)Board of governor,

b)Board of Executive directors

IMF (International

Monetary Fund)

a)Board of governor :

it formulates the general policies of the

Fund

b)Board of Executive directors :

it is responsible for the day to day

activities of the Fund .

Membership:

All those counties which agree to subscribe

to Funds Article of Agreement are eligible

to Funds Membership. The membership of

Fund has risen from 44 nations to183now

Continue..

Quotas:

Each member has to contribute a

quota to fund. The size of the quota

depends upon the national income

and share in international trade of

that country. The quota is made up of

75% in the country's currency and

25% in gold.

Functions of IMF

Maintaining exchange stability among the

members countries

Borrowing: The credit facility has been

raised up to 45% of ones quota over a three

years period.

Correcting Balance of Payment (A balance of

payments (BOP) sheet is an accounting

record of all monetary transactions between

a country and the rest of the world. These

transactions include payments for the

country s exports and imports of goods,

services)

Interest charges : It charges interest on the

credit provided to member countries

Continue..

Technical Assistance it helps the members

by providing the services of specialist and

experts in concerned fields.

Compensatory Finance Scheme : if a

member is facing difficulty in receipt of

export credit, the IMF can give loan to

member with few conditions.

The extended Fund Facility : For the

assistance of correcting the balance of

payments of the member countries,

introduced in 1974 by IMF8)

The Supplementary Financing Facility

:This scheme was introduced in 1979 in

order to give long term loans to less

developed counties

Continue..

Increasing international monetary co-

operation.

Promoting the growth of trade.

Promoting exchange rate stability.

Establishing a system of multilateral

payments member countries

Building reserve base

Funding facilities.

ADB

Established on December4,1966 with

an authorized capital of 58 billion

dollars. The purpose of its formation

was to lend funds, promote investment

and provide technical assistant to the

countries mainly in Asian region.

Asian Development

Bank

This was emerged as a result of the

Economic Commission For Asia and

Far East held in Manila in December

1963

It was decided that the capital

formation in the developing countries

is not possible through domestic

savings only and capital should be

made available to the low income

countries by establishing a bank

Functions

Provide loans to low income countries

Promote investments in private as well

as in public sector.

Help the member counties in foreign

trade

It provides technical assistance for

preparation, financing and execution

of development projects

It also helps the UNO in various

projects

IFC

IFC was set up with the objective of

providing capital for private enterprises

in order to encourage the development of

local capital markets and promote foreign

private investments in developing

countries.

IFC does not require a government

guarantee

Its functions are like that of investment

banks. It can participate in private

ventures , providing up to 25 % of the

capital

MIGA ( Multilateral

Investment Guarantee

Agency)

MIGA was created in 1988 by 42 world

bank member countries specifically to

encourage foreign private investments

MIGA insures investors in developing

countries against losses caused by the

outbreak of war or civil disturbance or

by acts of government, such as

expropriation or imposition of

restrictions on transfer of currency of

profits

Continue..

MIGA membership is divided into two

categories

1) Category 1 ( developed/ industrialized

countries)-19

2) Category 2 ( developing countries)-121

MIGA does not provide guarantee in

Category 1 member countries

A guarantee from MIGA is particularly

attractive for commercial banks in

countries such as France or Spain, as

these banks will not then need to make

special provisions for developing countries.

THANK U!

Вам также может понравиться

- Institutions International Financial: by Sachin N. ShettyДокумент33 страницыInstitutions International Financial: by Sachin N. ShettyPrasseedha Raghavan100% (1)

- Role of Financial Markets and InstitutionsДокумент30 страницRole of Financial Markets and InstitutionsĒsrar BalócОценок пока нет

- FINAL PPT On World BankДокумент20 страницFINAL PPT On World BankAravind JayanОценок пока нет

- Key Concepts of EthicsДокумент36 страницKey Concepts of EthicsJeff Ordinal100% (1)

- The Global EconomyДокумент15 страницThe Global EconomyJohn Patrick GarciaОценок пока нет

- Al-Baraka Islamic Bank Internship ReportДокумент69 страницAl-Baraka Islamic Bank Internship Reportbbaahmad89100% (8)

- International Financial InstitutionsДокумент15 страницInternational Financial InstitutionsNagunuri Srinivas100% (1)

- International Financial InstitutionsДокумент12 страницInternational Financial InstitutionsKashif ShakeelОценок пока нет

- Why It Is Importance For Us To Know How Global Financial System WorksДокумент4 страницыWhy It Is Importance For Us To Know How Global Financial System Workstalha55Оценок пока нет

- 324 - Foreign Exchange Market-ForEXДокумент74 страницы324 - Foreign Exchange Market-ForEXTamuna BibiluriОценок пока нет

- International Financial InstitutionsДокумент34 страницыInternational Financial InstitutionsMelvin Jan ReyesОценок пока нет

- Role of International Financial InstitutionsДокумент26 страницRole of International Financial InstitutionsSoumendra RoyОценок пока нет

- 04 WtoДокумент9 страниц04 WtoAfroz TamboliОценок пока нет

- International FinanceДокумент59 страницInternational Finance大雄100% (1)

- Balance of Payments: International Business AssignmentДокумент12 страницBalance of Payments: International Business AssignmentRashi MishraОценок пока нет

- Chapter 1 1Документ40 страницChapter 1 1ambitchous19Оценок пока нет

- Different Between International Trade and International BusinessДокумент2 страницыDifferent Between International Trade and International BusinessEunice OrtileОценок пока нет

- World Trade Organization (Wto)Документ43 страницыWorld Trade Organization (Wto)Ishpreet Singh BaggaОценок пока нет

- Domestic Vs International BusinessДокумент5 страницDomestic Vs International BusinessManu MalikОценок пока нет

- Regulations of Foreign Direct Investment (FDI) : PresentationДокумент15 страницRegulations of Foreign Direct Investment (FDI) : PresentationPatrick A. N. Aboku100% (1)

- The Challenges Facing ManagementДокумент8 страницThe Challenges Facing ManagementsubbaraoblueОценок пока нет

- Introduction of International Financial ManagementДокумент16 страницIntroduction of International Financial Managementgkgill92Оценок пока нет

- International FinanceДокумент27 страницInternational FinanceFouz19100% (1)

- Monetary Policy and Monetary Policy InstrumentsДокумент106 страницMonetary Policy and Monetary Policy Instrumentsjhsobrun100% (1)

- Investment Slide 1Документ17 страницInvestment Slide 1ashoggg0% (1)

- Multinational, International, Transnational CorporationsДокумент13 страницMultinational, International, Transnational CorporationsDeepa Suresh100% (1)

- Intro To Globalization 1Документ20 страницIntro To Globalization 1Kiesha Castañares100% (2)

- Role of Financial IntermediariesДокумент105 страницRole of Financial IntermediariesMaria AngelicaОценок пока нет

- Monetary PolicyДокумент11 страницMonetary PolicyWaqar100% (1)

- International Financial InstitutionsДокумент13 страницInternational Financial InstitutionsCraeven AranillaОценок пока нет

- Chapter 1 Monetary Policy IntroductionДокумент53 страницыChapter 1 Monetary Policy IntroductionBrian Ferndale Sanchez GarciaОценок пока нет

- Definition of Foreign Exchange MarketДокумент2 страницыDefinition of Foreign Exchange MarketSagar MehtaОценок пока нет

- International Financial Institutions: MMS (University of Mumbai)Документ28 страницInternational Financial Institutions: MMS (University of Mumbai)asadОценок пока нет

- Pension FundsДокумент24 страницыPension FundsRonica MahajanОценок пока нет

- Emerging Markets: International Business: The New RealitiesДокумент46 страницEmerging Markets: International Business: The New RealitiesSteffany AseretОценок пока нет

- The Meaning and Measurement of Economic DevelopmentДокумент19 страницThe Meaning and Measurement of Economic DevelopmentGaluh Eka PramithasariОценок пока нет

- Bangko Sentral NG Pilipinas (BSP)Документ27 страницBangko Sentral NG Pilipinas (BSP)Ms. Joy100% (2)

- The Global Economy (Naujas)Документ13 страницThe Global Economy (Naujas)Agnė VaičiulytėОценок пока нет

- Interest RatesДокумент11 страницInterest RatesPau GigantoneОценок пока нет

- International Bond MarketДокумент22 страницыInternational Bond MarketMayank RajОценок пока нет

- Monetary PolicyДокумент34 страницыMonetary PolicyYogesh Kende89% (9)

- International Trade BarriersДокумент19 страницInternational Trade BarriersYanix SeraficoОценок пока нет

- CIIB LECTURE 6 - Regional IntergrationДокумент25 страницCIIB LECTURE 6 - Regional IntergrationtapiwaОценок пока нет

- Defining GlobalizationДокумент24 страницыDefining GlobalizationdomermacanangОценок пока нет

- Financial MarketДокумент14 страницFinancial MarketDavid DavidОценок пока нет

- International Trade TheoryДокумент25 страницInternational Trade TheoryAnonymous Gh3QD7E5OzОценок пока нет

- International Financial InstitutionsДокумент5 страницInternational Financial Institutionsangelverma100% (1)

- Chapter - 2 (International Flow of Funds)Документ23 страницыChapter - 2 (International Flow of Funds)shohag30121991100% (1)

- Trade and Investment PoliciesДокумент24 страницыTrade and Investment PoliciesSarsal6067Оценок пока нет

- Module 2Документ41 страницаModule 2bhargaviОценок пока нет

- Balance of PaymentsДокумент36 страницBalance of PaymentsGourab Kundu50% (4)

- Evolution of Financial SystemДокумент12 страницEvolution of Financial SystemGautam JayasuryaОценок пока нет

- 1-International Economics - Nature & ScopeДокумент13 страниц1-International Economics - Nature & ScopeAvni Ranjan Singh100% (1)

- Financial System & BSPДокумент46 страницFinancial System & BSPZenedel De JesusОценок пока нет

- Economic IntegrationДокумент24 страницыEconomic IntegrationBikram Bisarad100% (1)

- What Is DevelopmentДокумент23 страницыWhat Is DevelopmentShah Raza Khan100% (1)

- Government Intervention in International Trade Activity 51Документ29 страницGovernment Intervention in International Trade Activity 51Valera MatviyenkoОценок пока нет

- International Monetary SystemДокумент18 страницInternational Monetary SystemUday NaiduОценок пока нет

- Devaluation of RupeeДокумент24 страницыDevaluation of Rupeesweetjiya2010Оценок пока нет

- If Is ButterflyДокумент29 страницIf Is Butterflyicha95bestОценок пока нет

- International Economic InstitutionsДокумент33 страницыInternational Economic InstitutionsRavinder YadavОценок пока нет

- WP Content Uploads 2014 03 Practice Question Set On Reasoning For Ibps Probationary Officer Exam 2012 Freshers AddaДокумент22 страницыWP Content Uploads 2014 03 Practice Question Set On Reasoning For Ibps Probationary Officer Exam 2012 Freshers AddaPaavni SharmaОценок пока нет

- Ibps Po Paper 32Документ44 страницыIbps Po Paper 32Paavni SharmaОценок пока нет

- Ibps Po Paper 32Документ44 страницыIbps Po Paper 32Paavni SharmaОценок пока нет

- Cbse Paper 3Документ14 страницCbse Paper 3Paavni SharmaОценок пока нет

- Joshi Classes Test (+2) : One Marks QuestionsДокумент15 страницJoshi Classes Test (+2) : One Marks QuestionsPaavni SharmaОценок пока нет

- IBPS RRB (Group A Officers) Exam 2012 Question Paper - Quantitative AptitudeДокумент41 страницаIBPS RRB (Group A Officers) Exam 2012 Question Paper - Quantitative AptitudePaavni SharmaОценок пока нет

- Cbse Paper 3Документ14 страницCbse Paper 3Paavni SharmaОценок пока нет

- Financial Service Mumbai Act of Parliament: IDBI Bank Limited Is An Indian Government-OwnedДокумент1 страницаFinancial Service Mumbai Act of Parliament: IDBI Bank Limited Is An Indian Government-OwnedPaavni SharmaОценок пока нет

- Australian Open French Open Wimbledon US Open: TennisДокумент1 страницаAustralian Open French Open Wimbledon US Open: TennisPaavni SharmaОценок пока нет

- The Blue Economy: 2014 Women's Hockey World CupДокумент9 страницThe Blue Economy: 2014 Women's Hockey World CupPaavni SharmaОценок пока нет

- The Blue Economy: 2014 Women's Hockey World CupДокумент9 страницThe Blue Economy: 2014 Women's Hockey World CupPaavni SharmaОценок пока нет

- Maha Navratna Psus: Maharatna StatusДокумент7 страницMaha Navratna Psus: Maharatna StatusPaavni SharmaОценок пока нет

- Sales and Finance Work Together in The Best-Run CompaniesДокумент2 страницыSales and Finance Work Together in The Best-Run CompaniesPaavni SharmaОценок пока нет

- SidbiДокумент3 страницыSidbiPaavni SharmaОценок пока нет

- Definition of 'Gross Margin'Документ1 страницаDefinition of 'Gross Margin'Paavni SharmaОценок пока нет

- Financial PlanДокумент3 страницыFinancial PlanPaavni SharmaОценок пока нет

- Finance Company ListДокумент7 страницFinance Company ListMohamed AbdullahОценок пока нет

- Assignment # 01: "Treasury and Funds Management"Документ5 страницAssignment # 01: "Treasury and Funds Management"Jahan Zeb KhanОценок пока нет

- KYC PresentationДокумент14 страницKYC Presentationgoswami.karan13464Оценок пока нет

- Fund ManagementДокумент12 страницFund ManagementstabrezhassanОценок пока нет

- The Role of National BankДокумент19 страницThe Role of National BankМурат Мусуралиев100% (2)

- Effect On Demonetization On Indian BanksДокумент26 страницEffect On Demonetization On Indian BanksDivyam DoshiОценок пока нет

- UL01ELLB51 Banking LawДокумент4 страницыUL01ELLB51 Banking LawManjitsinghОценок пока нет

- Making Suspense Payments: Consider The Following ExampleДокумент2 страницыMaking Suspense Payments: Consider The Following Exampleanoop kumarОценок пока нет

- R12 Model Bank TWS (EE) Deployment GuideДокумент8 страницR12 Model Bank TWS (EE) Deployment GuideAreefОценок пока нет

- BFC5916 - Topic 1 Tutorial SolutionsДокумент2 страницыBFC5916 - Topic 1 Tutorial SolutionsAlex YisnОценок пока нет

- Transaction History - 2024-01-26 - 63013852470Документ6 страницTransaction History - 2024-01-26 - 63013852470www.phumudzofrance99Оценок пока нет

- Internship Report On UBLДокумент75 страницInternship Report On UBLBashir Ahmad0% (2)

- Negotiable Instruments Course OutlineДокумент13 страницNegotiable Instruments Course OutlinePJDОценок пока нет

- Tarp PresentationДокумент18 страницTarp PresentationVivek_RОценок пока нет

- Refuse Payment Saying Goods Not To Satisfaction or (Ii) Cheat or (Iii) Become InsolventДокумент2 страницыRefuse Payment Saying Goods Not To Satisfaction or (Ii) Cheat or (Iii) Become Insolventcương trươngОценок пока нет

- Most Expensive Currency - Google SearchДокумент1 страницаMost Expensive Currency - Google SearchAbdulla JamalОценок пока нет

- Aml Kyc Mock Test PDFДокумент9 страницAml Kyc Mock Test PDFIlamparuthi JОценок пока нет

- American International University-Bangladesh (AIUB) Department of Computer Science Software Quality and Testing Fall 2021-2022Документ4 страницыAmerican International University-Bangladesh (AIUB) Department of Computer Science Software Quality and Testing Fall 2021-2022Juairah RahmanОценок пока нет

- A747 308 81 41 37195 - Rev 1Документ1 страницаA747 308 81 41 37195 - Rev 1Shaik AbdullaОценок пока нет

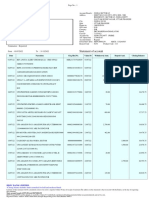

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент2 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceanupsharma2522_98756Оценок пока нет

- Statement of Account For The Period 01-Jan-2022 To 15-Ma - 2022Документ6 страницStatement of Account For The Period 01-Jan-2022 To 15-Ma - 2022Rohit raagОценок пока нет

- Cash Book RulesДокумент33 страницыCash Book RulesNarasimha Murthy InampudiОценок пока нет

- Balance Sheet PDFДокумент1 страницаBalance Sheet PDFMikhil Pranay SinghОценок пока нет

- Bank of BarodaДокумент14 страницBank of BarodaSimran MehrotraОценок пока нет

- Bank Definition: What Is A Bank?Документ5 страницBank Definition: What Is A Bank?Aliha FatimaОценок пока нет

- Globalization of Banking SectorДокумент9 страницGlobalization of Banking SectorDhananjay SharmaОценок пока нет

- Negotiable InstrumentДокумент9 страницNegotiable InstrumentVillafranca T. DandieОценок пока нет

- Payment ACH Best GuideДокумент66 страницPayment ACH Best Guidepandian0020% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент12 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVARIKUTI RAJASEKHARОценок пока нет