Академический Документы

Профессиональный Документы

Культура Документы

Levy of Penalties, Heads of Income & Aggregation of Income Under Income Tax Act

Загружено:

Jitendra VernekarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Levy of Penalties, Heads of Income & Aggregation of Income Under Income Tax Act

Загружено:

Jitendra VernekarАвторское право:

Доступные форматы

slide 3.

4

Levy of Penalties,Heads of

Income & Aggregation of

Income under Income Tax Act

slide 3.4

INTRODUCTION

Increase in tax payers call for more reliance on

voluntary compliance of tax laws by assessees

Appropriate penal provisions needed to impel

compliance by imposing additional tax burden in

case of non compliance

Penalties to be within reasonable limits to be more

effective

Object should be to bend and not to break the tax

payer

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

140A

(3)

Failure to pay

whole or any part

of income-tax or

interest or both in

accordance with

the provisions of

section 140A(1)

Slide 3.2

Such amount

as the

Assessing

Officer may

impose [Sec.

221(1)]

Tax in arrears

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

221(1) Default in making

payment of tax

within prescribed

time

Slide 3.2

Such amount

as the

Assessing

Officer may

impose

Tax in arrears

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271(1)

(b)

Failure to comply

with a notice

under section

142(1) or 143(2)

or with a direction

issued under

section 142(2A)

Slide 3.2

Rs. 10,000

(Rs. 1,000

up to May

31, 2001) for

each failure

Rs. 10,000

(25,000 up to

May 31,

2001) for

each failure

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271(1)

(c)

Concealment of

the particulars of

income or

furnishing

inaccurate

particulars of

income

100% of tax

sought to be

evaded

300% of tax

sought to be

evaded

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271(4) Distribution of profit

by registered firm

otherwise than in

accordance with

partnership deed and as

a result of which

partner has returned

income below the real

income

Up to 150%

of difference

between tax

on partners

income

assessed and

tax on

returned

income

----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271A Failure to keep or

maintain books of

account, documents,

etc., as required under

section 44AA

Rs. 25,000

(Rs. 2,000 up

to May 31,

2001)

Rs. 25,000

(Rs.

1,00,000

up to May

31, 2001)

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271AA Failure to keep and

maintain information

and documents in

respect of international

transaction (applicable

from the assessment

year 2002-03)

2% of value

of each

international

transaction

---

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271B Failure to get accounts

audited under section

44AB or furnish such

report as is required

under section 44AB

2

% of the

total sales,

turnover, or

gross receipts

Rs.100000

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271BA Failure to submit report

under section 92E

(applicable from the

assessment year 2002-

03)

Rs. 1,00,000 -----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

271C Failure to deduct the whole

or any part of tax as required

under sections 192 to 195 or

(with effect from June 1,

1997) failure to pay the

whole or any part of tax as

required under section

115-O(2) or second proviso

to section 194B

Amount

of tax

such

person

has failed

to deduct

or pay

-----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximum

penalty

271D Taking or accepting any

loan or deposit in

contravention of the

provisions of section 269SS

Amount

of loan/

deposit so

taken or

accepted

-----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

271E Repaying any deposit or

(with effect from June 1,

2003) loan referred to in

section 269T otherwise than

in accordance with the

provisions of section 269T

Amount

of deposit

so repaid

-----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

271F Failure to furnish return of

income as required by

section 139(1) before the

end of relevant assessment

year

Rs. 5,000

(Rs. 1,000

up to May

31, 2001)

-----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

271F Failure to furnish return of

income as required by

proviso to section 139 (1) on

or before the due date

Rs. 5,000

(Rs. 1,000

up to May

31, 2001)

-----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

271G Failure to furnish

information or documents

under section 92D applicable

from the assessment year

2002-03

2% of

value of

the

internatio

nal

transactio

n for each

failure

-----

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

272A(1

)(a)

Failure to answer any

question put to a person

(who is legally bound to

state the truth of any matter

touching the subject to his

assessment) by an income-

tax authority

Rs.

10,000

(Rs. 500

up to May

31, 2001)

for each

default

Rs.

10,000

for each

default

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

272A(1

)(b)

Failure to sign any statement

made by a person in course

of income-tax proceeding

Rs.

10,000

(Rs. 500

up to May

31, 2001)

for each

default

Rs.

10,000

for each

default

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

272A(1

)(c)

Failure to comply with

summons issued under

section 131(1) to attend

office to give evidence and

produce books of account or

other documents

Rs.

10,000

(Rs. 500

up to May

31, 2001)

for each

default

Rs.

10,000

for each

default

slide 3.4

Penalties in brief

Section Nature of default Minimum

penalty

Maximu

m penalty

272A(1

)(d)

Failure to comply with the

provisions of section 139A

(upto 31.5.2002)

Rs.

10,000

(Rs. 500

up to May

31, 2001)

for each

default

Rs.

10,000

for each

default

slide 3.4

Penalties in brief

Sec Nature of default Min penalty Max penalty

272A

(2)

Failure

to comply with a

notice issued under

section 94 ;

to give notice of

discontinuance of

business/profession

under section 176(3);

Rs. 100 for

every day

during

which

default

continues

Rs. 100 for every

day during which

default continues

slide 3.4

Penalties in brief

Sec Nature of default Min

penalty

Max penalty

272A

(2)

Failure

to furnish

returns/statement

mentioned in section 133,

206, 206C or 285B ;

to allow inspection of

register referred in section

134 (or of any entry in

such register or to allow

copies of such register to

be taken) ;

Rs. 100

for every

day

during

which

default

continues

Rs. 100 for every

day during which

default continues

(the amount of

penalty under

sections 206 and

206C shall not

exceed the

amount of tax

deductible or

collectible)

slide 3.4

Penalties in brief

Sec Nature of default Min

penalty

Max penalty

272A

(2)

Failure

to furnish return of

income under section

139(4A) [or section 139

(4C) from April 1, 2003] or

to deliver in due time a

declaration mentioned in

section 197A ;

Rs. 100

for every

day

during

which

default

continues

Rs. 100 for every

day during which

default continues

(the amount of

penalty in relation

to declaration

under section

197Ashall not

exceed the

amount of tax

deductible or

collectible)

slide 3.4

Penalties in brief

Sec Nature of default Min

penalty

Max penalty

272A

(2)

Failure

to furnish a

certificate as required

in section 203 or

206C ;

to deduct and pay tax

under section 226;

(from April 1, 2002)

to furnish a statement

as required by section

192(2C)

Rs. 100

for every

day

during

which

default

continues

Rs. 100 for every day

during which default

continues (the amount

of penalty in relation

to certificate in Form

No. 16/16A as required

under section 203 and

the amount of penalty

under section 206C

shall not exceed the

amount of tax

deductible or

collectible)

slide 3.4

Penalties in brief

Sec Nature of default Min penalty Max penalty

272AA Failure to comply

with the provision of

section 133B

Any amount

up to Rs.

1,000

Rs. 1,000

272B Failure to comply

with the provisions of

section 139A (ap-

plicable from June 1,

2002)

Rs. 10,000 -----

slide 3.4

Penalties in brief

Sec Nature of default Min penalty Max penalty

272BB Failure to comply

with the provisions

of section 203A

Up to Rs.

10,000 (Rs.

5,000 up to

May 31, 2001)

Rs. 10,000

(Rs. 5,000 up

to May 31,

2001)

272BB

B

Failure to comply

with the provisions

of section 206CA

(applicable from

June 1, 2002)

Rs. 10,000 -----

slide 3.4

WHEN PENALTY IS NOT

LEVIABLE

Penalty is not leviable under section 271(1)(b),

271A, 271AA

, 271B, 271BA

, 271BB, 271C,

271D, 271E, 271F, 271G

, 272A(1)(c)/(d),

272A(2), 272AA(1), 272B

, 272BB(1) or

272BBB(1)

or 273(1), (2)(b)/(c), if the assessee

proves that there was reasonable cause for failure

slide 3.4

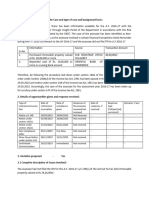

Time limit for completion of penalty

proceedings

Time limit for making an order imposing a penalty is :

a. within the financial year in which penalty

proceedings are started ; or

b. within 6 months from the end of month in which

action for imposition of penalty is initiated or within 6

months from the end of month in which order of

appeal of Commissioner (Appeals) under section 246

or 246A or Tribunal under section 253 is received by

Commissioner,

whichever is later.

slide 3.4

Time limit for completion of penalty

proceedings

However, in case the relevant assessment or other

order is the subject-matter of revision under

section 263 (or with effect from June 1, 2003,

section 264), then the time-limit for imposing

penalty is six months from the end of the month in

which such order for revision is passed

slide 3.4

Heads of income (Section 14)

1. Salaries

2. Income from house property

3. Profits and gains of business or profession

4. Capital gains

5. Income from other sources.

slide 3.4

Heads of income (Section 14)

The several heads into which income is divided

under the Act do not make different kinds of taxes.

Tax is always one; but it may arise under different

heads to which the different rules of computation

have to be applied. These heads are in a sense

exclusive to one another and income which falls

within one head cannot be assigned to or taxed

under another headKaranpura Development Co.

Ltd. v. CIT [1962] 44 ITR 362 (SC).

slide 3.4

Heads of income (Section 14)

Income has to be brought under one of the

heads under section 14 and can be charged to

tax only if it is chargeable under the computing

section corresponding to that head

Nalinikant Ambalal Mody v. CIT (supra).

n The method of book-keeping followed by

an assessee cannot decide under which head

a particular income should goNalinikant

Ambalal Mody v. CIT (supra

slide 3.4

Section 68 [I.T. Act, 1961]

Cash Credits.

Where any sum is found credited in the books of

an assessee maintained for any previous year, and

assessee offers no explanation about the nature and

source thereof or the explanation offered by him is

not, in the opinion of the Assessing officer,

satisfactory, the sum so credited may be charged to

income-tax as the income of the assessee of that

previous year.

slide 3.4

Section 68 [I.T. Act, 1961]

Cash Credits.

Section 68 enacts deeming provisions : - Section

essentially contains a deeming provision, which

applies when the assessees explanation about a

cash credit found in his books is rejected. There is

no distinction to be drawn between income

resulting from application of section 68 and

income accruing from any other of the heads

indicated in section 14. [CIT v Ganpatrai

Gajanand, (1977) 108 ITR 403] (Orissa

slide 3.4

Section 68 [I.T. Act, 1961]

Cash Credits.

Section 68 hits also entries in own capital account: -

Although the marginal note to section 68 refers to Cash

credits, the provisions of section 68 can be invoked in

relation to an entry in assessees capital account. In fact,

an entry on the credit side of the capital account shows

that the credit entries in that account are larger than the

debit entries. The fact some of these credits relate to costs

of assets can make no difference. [Dharmavat Provision

Stores v CIT (1983) 139 ITR 700 (Bom)]

slide 3.4

Section 69 [I.T. Act, 1961]

Unexplained Investments

Under section 69 the value of investments made

by the assessee in a financial year immediately

preceding the assessment year may be deemed to

be the income of the assessee of such financial

year if

i. Such investments are not recorded in the books

of account, if any, maintained by him for any

source of income; and

slide 3.4

Section 69 [I.T. Act, 1961]

Unexplained Investments

ii. (a) the assessee offers no explanation about the nature

and source of the investments, or

(b) the explanation offered by him is, in the opinion of

the assessing officer not satisfactory

In cases where the assessee is able to satisfy the assessing

officer about the nature and source of only a part of the

investment, the other unexplained portion may be added

as his income (Jatindra Nath Sarmah v ITO (1978) 113

ITR 898 (Guahati).

slide 3.4

Section 69A [I.T. Act, 1961]

Unexplained Money, Etc

Where in any financial year the assessee is found to be the

owner of any money, bullion, jewellery or other valuable

article and such money, bullion, jewellery or valuable

article is not recorded in the books of account, if any,

maintained by him for any source of income, and the

assessee offers no explanation about the nature and source

of acquisition of the money, bullion, jewellery or other

valuable article, or the explanation offered by him is not,

in the opinion of the Assessing Officer satisfactory, the

money and the value of the bullion, jewellery or other

valuable article may be deemed to be the income of the

assessee of such financial year.

slide 3.4

Section 69B [I.T. Act, 1961]

Amount Of Investments, Etc., Not Fully

Disclosed In Books Of Account.

Where in any financial year the assessee has made investments

or is found to be the owner of any bullion, jewellery, or other

valuable article, and the Assessing Officer finds that the

amount expended on making such investments or in acquiring

such bullion, jewellery or other valuable article exceeds the

amount recorded in this behalf in the books of account

maintained by the assessee for any source of income, and the

assessee offers no explanation about such excess amount or the

explanation offered by him is not, in the opinion of the

Assessing Officer, satisfactory, the excess amount may be

deemed to be the income of the assessee for such financial

year.

slide 3.4

Section 69C [I.T. Act, 1961]

Unexplained Expenditure, Etc .

Where in any financial year an assessee has incurred any

expenditure and he offers no explanation about the source of

such expenditure or part thereof, or the explanation, if any,

offered by him is not, in the opinion of the Assessing Officer,

satisfactory, the amount covered by such expenditure or part

thereof, as the case may be, may be deemed to be the income

of the assessee for such financial year;

Provided that, notwithstanding anything contained in any other

provision of this Act, such unexplained expenditure which is

deemed to be the income of the assessee shall not be allowed

as a deduction under any head of income.

slide 3.4

Section 69C [I.T. Act, 1961]

Unexplained Expenditure, Etc .

The provisions of section 69C are merely

clarificatory and embody a rule of evidence, which

is otherwise quite clear. This is so because even

otherwise an addition could be made in respect of

the amount of expenditure, which the assessee is

found to have actually incurred but not

satisfactorily explained (Yadu Hari Dalmia v CIT

(1980) 126 ITR 48 (Delhi).

slide 3.4

Section 69C [I.T. Act, 1961]

Unexplained Expenditure, Etc .

marriage expenses

It is necessary to establish whether the assessee

himself has incurred the expenditure wholly

Custom in India for maternal and paternal relations

of the bride and bridegroom to contribute for

marriage expenses

Only unexplained of expenditure incurred by

assessee to be brought to tax

slide 3.4

Section 69D [I.T. Act, 1961]

Amount Borrowed Or Repaid On

Hundi.

Where any amount is borrowed on a hundi from,

or any amount due thereon is repaid to, any person

otherwise than through an account payee cheque

drawn on a bank, the amount so borrowed or

repaid shall be deemed to be the income of the

person borrowing or repaying the amount aforesaid

for the previous year in which the amount was

borrowed or repaid, as the case may be :

slide 3.4

Section 69D [I.T. Act, 1961]

Amount Borrowed Or Repaid On Hundi.

Provided that, if in any case amount borrowed on

hundi has been deemed under the provisions of this

section to be the income of any person, such

person shall not be liable to be assessed again in

respect of such amount under the provisions of this

section on repayment of such amount.

Вам также может понравиться

- Income Tax Penalty BriefДокумент33 страницыIncome Tax Penalty BriefAshok HirparaОценок пока нет

- Consequences of Tds FailureДокумент2 страницыConsequences of Tds FailureMahaveer DhelariyaОценок пока нет

- HTML File ProcessДокумент10 страницHTML File ProcessSuresh SharmaОценок пока нет

- CBDT Issued New Guidelines For Compounding of Income Tax Offences - Taxguru - inДокумент22 страницыCBDT Issued New Guidelines For Compounding of Income Tax Offences - Taxguru - inveer_bcaОценок пока нет

- Offences and Prosecution Under Income Tax ActДокумент8 страницOffences and Prosecution Under Income Tax Actnahar_sv1366Оценок пока нет

- Penal Provisions in Income TaxДокумент24 страницыPenal Provisions in Income Taxdiksha singhОценок пока нет

- CA Final DT Amendments For May 2022 Exam - Part 2Документ23 страницыCA Final DT Amendments For May 2022 Exam - Part 2Bhuvanesh RavichandranОценок пока нет

- Income Tax ProjectДокумент22 страницыIncome Tax ProjectGargi UpadhyayaОценок пока нет

- Offences N ProsecutionsДокумент12 страницOffences N ProsecutionsIndu Shekhar PoddarОценок пока нет

- IT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideДокумент26 страницIT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideKriben Rao100% (1)

- Income Tax (Deduction For Expenses in Relation To Secretarial Fee and Tax Filing Fee) Rules 2014 (P.U. (A) 336-2014)Документ1 страницаIncome Tax (Deduction For Expenses in Relation To Secretarial Fee and Tax Filing Fee) Rules 2014 (P.U. (A) 336-2014)Teh Chu LeongОценок пока нет

- Rajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617Документ6 страницRajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617sssadangiОценок пока нет

- Rules For NonATPДокумент4 страницыRules For NonATPsmyns.bwОценок пока нет

- US Internal Revenue Service: 20032601fДокумент9 страницUS Internal Revenue Service: 20032601fIRSОценок пока нет

- IT Circular1 - 2015 PDFДокумент59 страницIT Circular1 - 2015 PDFSellanAnithaОценок пока нет

- Analysis of Changes Introduced in The Lok Sabha-Approved Finance Bill 2023Документ20 страницAnalysis of Changes Introduced in The Lok Sabha-Approved Finance Bill 2023BuntyОценок пока нет

- Income Tax 2017 Edazdb1013Документ50 страницIncome Tax 2017 Edazdb1013Pradeep PatilОценок пока нет

- GSTNTF55Документ7 страницGSTNTF55JGVОценок пока нет

- 5254__Tax regime_2024_240408_212256Документ3 страницы5254__Tax regime_2024_240408_212256sunil78Оценок пока нет

- FORM 10E RELIEFДокумент4 страницыFORM 10E RELIEFJa M EsОценок пока нет

- Direct Tax Assessment ProceduresДокумент16 страницDirect Tax Assessment ProceduresManohar LalОценок пока нет

- Penalty U/s Nature of Default Amount of Penalty Power To Levy NoteДокумент3 страницыPenalty U/s Nature of Default Amount of Penalty Power To Levy NoterajeshutkurОценок пока нет

- Proper Officer Circularno-31-Under CGSTДокумент4 страницыProper Officer Circularno-31-Under CGSTGroupA PreventiveОценок пока нет

- Aasb1018 06-02Документ40 страницAasb1018 06-02Oshan SachinthaОценок пока нет

- VT & PT - Latest Revenue IssuancesДокумент19 страницVT & PT - Latest Revenue Issuancesapplemae.mostalesОценок пока нет

- Major Changes of Finance ActДокумент5 страницMajor Changes of Finance ActJulia RobertОценок пока нет

- 34 - Appeal To CitДокумент11 страниц34 - Appeal To CitHanuman MeenaОценок пока нет

- Service TaxДокумент27 страницService TaxJapojh GiptrdОценок пока нет

- Section 137 To 146aДокумент11 страницSection 137 To 146aSher DilОценок пока нет

- Penalty and ProsecutionsДокумент50 страницPenalty and ProsecutionsSatish BhadaniОценок пока нет

- PENALTIES AND PROSECUTION UNDER INCOME TAX ACTДокумент6 страницPENALTIES AND PROSECUTION UNDER INCOME TAX ACTFathima SulaimanОценок пока нет

- RR 13-2001 As Amended by RR 4-2012Документ7 страницRR 13-2001 As Amended by RR 4-2012Quinciano MorilloОценок пока нет

- IT FormДокумент8 страницIT Formapi-3829020Оценок пока нет

- Form2FandInstructions 06062006Документ11 страницForm2FandInstructions 06062006Mnaoj PatelОценок пока нет

- New rules for income tax formsДокумент4 страницыNew rules for income tax formsBibhuChhotrayОценок пока нет

- Notificaiton 5Документ3 страницыNotificaiton 5Parmeet NainОценок пока нет

- ProsecutionДокумент12 страницProsecutionKomal JaiswalОценок пока нет

- ProsecutionДокумент12 страницProsecutionParth UpadhyayОценок пока нет

- Compounding Guidelines Dated 16.09.2022Документ29 страницCompounding Guidelines Dated 16.09.2022Mane TVОценок пока нет

- Undetaking For Remittance For NRДокумент5 страницUndetaking For Remittance For NRhds1979Оценок пока нет

- It Computation As Per Sec 115bacДокумент2 страницыIt Computation As Per Sec 115bacDivyaОценок пока нет

- Taxation Law, Full NotesДокумент26 страницTaxation Law, Full NotesPavan GuptaОценок пока нет

- Itr-7 FaqДокумент14 страницItr-7 FaqAshwin KumarОценок пока нет

- US Internal Revenue Service: rp-04-57Документ4 страницыUS Internal Revenue Service: rp-04-57IRSОценок пока нет

- Book Num 3 CAF DT Regular Batch November 2021Документ358 страницBook Num 3 CAF DT Regular Batch November 2021funny todaysОценок пока нет

- Sec 149Документ2 страницыSec 149Vedaprakash ManavalanОценок пока нет

- DT PROVISIONS ENACTED FINANCE ACT 2022 PankajДокумент21 страницаDT PROVISIONS ENACTED FINANCE ACT 2022 Pankajnilanjan_kar_2Оценок пока нет

- Shashi BekalДокумент6 страницShashi BekalAdvocateNitinsharmaОценок пока нет

- Unit 5 GSTДокумент3 страницыUnit 5 GSTNishu KatiyarОценок пока нет

- 07 EngДокумент1 страница07 EngYours YoursОценок пока нет

- Irc XiДокумент301 страницаIrc XihenrydpsinagaОценок пока нет

- Form No 10eДокумент3 страницыForm No 10eIncome Tax Department JindОценок пока нет

- Penalities and ProsecutionДокумент37 страницPenalities and ProsecutionDharshini AravamudhanОценок пока нет

- Cir 185 17 2022 CGSTДокумент5 страницCir 185 17 2022 CGSTAmritesh RaiОценок пока нет

- ILDP Prashant Bhimrao KapseДокумент3 страницыILDP Prashant Bhimrao Kapseanil deswalОценок пока нет

- IT Act With Master Guide To Income Tax ActДокумент22 страницыIT Act With Master Guide To Income Tax ActManoj RaghavОценок пока нет

- Environmental Protection and Enhancement (Miscellaneous) RegulationДокумент11 страницEnvironmental Protection and Enhancement (Miscellaneous) RegulationRyan LiОценок пока нет

- FIDIC RED BOOK 1999 TIME LIMITSДокумент1 страницаFIDIC RED BOOK 1999 TIME LIMITSmarx0506Оценок пока нет

- Trinidad and Tobago Emolument Income Tax 2012Документ5 страницTrinidad and Tobago Emolument Income Tax 2012Anand RockerОценок пока нет

- Companies Act 2013 Ready Referencer 13 Aug 2014Документ150 страницCompanies Act 2013 Ready Referencer 13 Aug 2014AvaniJainОценок пока нет

- Companies Act 2013 in Brief Section WiseДокумент21 страницаCompanies Act 2013 in Brief Section WiseJitendra VernekarОценок пока нет

- DictionaryДокумент625 страницDictionaryJitendra Vernekar0% (1)

- Major Events BreakdownДокумент16 страницMajor Events Breakdownnajeebcr9100% (1)

- Planetary WarДокумент7 страницPlanetary WarJitendra VernekarОценок пока нет

- The Beginner's GameДокумент212 страницThe Beginner's GameMthunzi DlaminiОценок пока нет

- GFR2005Документ167 страницGFR2005Jitendra VernekarОценок пока нет

- Highlights - ICAIДокумент20 страницHighlights - ICAIvishalchitlangyaОценок пока нет

- NakshatraДокумент18 страницNakshatraJitendra Vernekar100% (1)

- Dress Bolero SetДокумент8 страницDress Bolero SettinitzazОценок пока нет

- C Programming FaqДокумент432 страницыC Programming FaqharshabalamОценок пока нет

- Hanuman Chalisa With Meaning in EnglishДокумент11 страницHanuman Chalisa With Meaning in Englishamitpratapsingh007Оценок пока нет

- 20957handbk Auditing Pro VolII2010Документ610 страниц20957handbk Auditing Pro VolII2010Jitendra Vernekar100% (1)

- Notes On Quantum MechanicsДокумент397 страницNotes On Quantum MechanicsBruno Skiba100% (3)

- Autonomous Bodies ManualДокумент116 страницAutonomous Bodies ManualJitendra Vernekar0% (1)

- Annual Report 13-14 EngДокумент30 страницAnnual Report 13-14 EngJitendra VernekarОценок пока нет

- ICAI Accounting StandardsДокумент347 страницICAI Accounting Standardsarinroy100% (1)

- Accounting Standard IcaiДокумент867 страницAccounting Standard IcaiKrishna Kanojia100% (2)

- Notes To Capital Work-In-progressДокумент3 страницыNotes To Capital Work-In-progressJitendra VernekarОценок пока нет

- Audit of Autonomous Bodies 551Документ35 страницAudit of Autonomous Bodies 551Jitendra VernekarОценок пока нет

- Chess Teaching ManualДокумент303 страницыChess Teaching Manuallavallee2883Оценок пока нет

- Roads & BridgesДокумент66 страницRoads & BridgesvivekranjanjamОценок пока нет

- Hanuman Chalisa With Meaning in EnglishДокумент11 страницHanuman Chalisa With Meaning in Englishamitpratapsingh007Оценок пока нет

- Audit of ContractsДокумент26 страницAudit of ContractsSarvesh Khatnani100% (1)

- The Beginner's GameДокумент212 страницThe Beginner's GameMthunzi DlaminiОценок пока нет

- Government ReceiptsДокумент164 страницыGovernment Receiptsbharanivldv9Оценок пока нет

- House Division - ControversyДокумент3 страницыHouse Division - ControversyJitendra VernekarОценок пока нет

- Is There Something Made by Man That Approaches The Beauty of Nature? Perhaps Music!Документ44 страницыIs There Something Made by Man That Approaches The Beauty of Nature? Perhaps Music!Grizzly GroundswellОценок пока нет

- Air (Prevention and Control of Pollution) Act, 1981 PDFДокумент35 страницAir (Prevention and Control of Pollution) Act, 1981 PDFJay KothariОценок пока нет

- Audit of ContractsДокумент26 страницAudit of ContractsSarvesh Khatnani100% (1)

- Types of Technical Writing For BusinessДокумент7 страницTypes of Technical Writing For BusinessJane Ericka Joy MayoОценок пока нет

- Audit and Assurance Final ProjectДокумент15 страницAudit and Assurance Final Projectnimranaseer037100% (1)

- GMP Audit ChecklistДокумент10 страницGMP Audit Checklistmrshojaee100% (5)

- Ar Vja 2017 - Eng - Up 2206Документ79 страницAr Vja 2017 - Eng - Up 2206Evgeny KirovОценок пока нет

- International Transfer Pricing Advance ArrangementsДокумент30 страницInternational Transfer Pricing Advance ArrangementsSen JanОценок пока нет

- Drill Chapter 1: Notre Dame of Midsayap CollegeДокумент5 страницDrill Chapter 1: Notre Dame of Midsayap CollegeMarites AmorsoloОценок пока нет

- Management AuditДокумент14 страницManagement AuditManic TafilОценок пока нет

- Auditing and Reporting Social Performance 1Документ12 страницAuditing and Reporting Social Performance 1ROMAR A. PIGAОценок пока нет

- FAR101A-Financial Accounting and Reporting AДокумент153 страницыFAR101A-Financial Accounting and Reporting AMark Juliah NaveraОценок пока нет

- RR No. 34-2020 v2Документ3 страницыRR No. 34-2020 v2Boss NikОценок пока нет

- IATF 16949 Lead Auditor CourseДокумент1 страницаIATF 16949 Lead Auditor Coursemhaseeb359081Оценок пока нет

- Mas First Preboard Examination Batch 95Документ11 страницMas First Preboard Examination Batch 95Lhairyz Francine RamirezОценок пока нет

- The Institute of Chartered Accountants of India - Admit CardДокумент10 страницThe Institute of Chartered Accountants of India - Admit CardMayur samdariyaОценок пока нет

- Audit in Sap EnvrДокумент7 страницAudit in Sap Envrjramesh111Оценок пока нет

- Action Item - 7 Pillar Audit Mar 06Документ8 страницAction Item - 7 Pillar Audit Mar 06Saravanan RasayaОценок пока нет

- Internal Audit FrameworkДокумент11 страницInternal Audit FrameworkJoe MashinyaОценок пока нет

- Chapter 5Документ56 страницChapter 5lyj1017100% (1)

- Thompson Et Al.2022Документ20 страницThompson Et Al.2022hanieyraОценок пока нет

- Accounting Information System Chapter 5: The Expenditure Cycle - Purchases and Cash Disbursements ProceduresДокумент58 страницAccounting Information System Chapter 5: The Expenditure Cycle - Purchases and Cash Disbursements Procedureshasan jabrОценок пока нет

- Check Disbursement Journal InstructionsДокумент1 страницаCheck Disbursement Journal Instructionsabbey89Оценок пока нет

- Arthur Andersen's Fall From Grace Is A Sad Tale of Greed and Miscues - WSJДокумент7 страницArthur Andersen's Fall From Grace Is A Sad Tale of Greed and Miscues - WSJasda asdaОценок пока нет

- AT08 Audit Sampling (PSA 530)Документ6 страницAT08 Audit Sampling (PSA 530)John Paul SiodacalОценок пока нет

- Essar Steel India Limited Board and Annual ReportДокумент188 страницEssar Steel India Limited Board and Annual ReportoguОценок пока нет

- MOCKBOARD With AnswersДокумент12 страницMOCKBOARD With AnswersAnonymous IFu8Wi1gHIОценок пока нет

- Configuration Steps Third PartyДокумент3 страницыConfiguration Steps Third Partyrakesh_sapОценок пока нет

- Audit Evidence and Audit Documentation Nature and Types Audit EvidenceДокумент4 страницыAudit Evidence and Audit Documentation Nature and Types Audit EvidenceCattleyaОценок пока нет

- 2018 Compensation DisclosureДокумент114 страниц2018 Compensation DisclosureElishaDacey50% (2)

- Management School of ThoughtДокумент36 страницManagement School of ThoughtAckah OwusuОценок пока нет

- Client Acceptance: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 5Документ20 страницClient Acceptance: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 5Tenesha ReynoldsОценок пока нет

- AIS - Chapter 2 Overview of The Business ProcessesДокумент24 страницыAIS - Chapter 2 Overview of The Business ProcessesErmias GuragawОценок пока нет