Академический Документы

Профессиональный Документы

Культура Документы

B.Satyanarayana Rao: PPT ON Agricultural Income in Indian Income Tax Act 1961

Загружено:

EricKenОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

B.Satyanarayana Rao: PPT ON Agricultural Income in Indian Income Tax Act 1961

Загружено:

EricKenАвторское право:

Доступные форматы

B.

SATYANARAYANA RAO

ASSO.PROF IN COMMERCE

ST.JOSEPHS DEGREE & P.G COLLEGE

PPT

ON

AGRICULTURAL INCOME

IN INDIAN INCOME TAX ACT 1961

MEANING: The Income which received

from Agriculture source is called

Agricultural Income.

Definition U/S 2(IA)

Agricultural Income Is Fully Exempted as per

Income Tax Act 1961 U/S 10(1)

Agricultural Income includes the following

(a).Any Rent or Revenue derived from

Agricultural Land situated in India

(b) Any Income From

(i) Cultivation of Agricultural Land

(ii) a process carried on to make the

produce or rent in kind marketable.

(iii) From sale of Agricultural produce

(c) Income From Agricultural House

Property

TYPES OF AGRICULTURAL INCOME

1. RENT OR REVENUE

2. CULTIVATION OF LAND

3. INCOME FROM A PROCESS

4. INCOME FROM SALE OF PRODUCE

5. INCOME FROM LET OUT

AGRICULTURAL H OUSE PROPERTY

TESTS TO DETERMINE AGRI INCOME

INCOME IS DERIVED FROM LAND

LAND MUST BE USED FOR

AGRICULTUR PURPOSE

LAND MUST BE SITUATED IN INDIA

Agricultural Incomes

(a) Income from sale of replanted trees.

(b) Rent received for agricultural land.

(c) Income from growing flowers and creepers.

(d) Share of profit of a partner from a firm

engaged in agricultural operations.

(e) Interest on capital received by a partner from

a firm engaged in agricultural operations.

(f) Income derived from sale of seeds.

Non Agricultural Incomes

(a) Income from poultry farming.

(b) Income from bee hiving.

(c) Income from sale of spontaneously

grown trees.

(d) Income from dairy farming.

(e) Purchase of standing crop.

(f) Dividend paid by a company out of its

agriculture income.

(g) Income of salt produced by flooding

The land with sea water.

(h) Royalty income from mines.

(i) Income from butter and cheese

making.

(j) Receipts from TV serial shooting in

farm house is not agriculture income.

Integration of Agricultural Income

Meaning: Clubbing of Agricultural

Income with Non Agricultural

Income for the Computation of Tax

Liability is known as Integration

of Agricultural income.

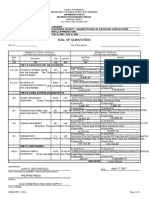

When to Integrate

If Agricultural Income exceeds Rs.5000

in the relevant Previous year

If Non Agricultural Income Exceeds

Basic Exemption Limits of

Rs.2,00,000/2,50,000/5,00,000 in the

relevant Previous year

How to Integrate

Step 1 : Add A.I with N.A.I

Step 2 : Calculate Tax on the (Step

1) total as per the current Tax Rates

Step 3 : Add A.I with Basic

exempted limit

Step 4 : Calculate Tax on the (Step 3)

total as per the current Tax Rates

Step 5 : Tax calculated at step 4 is

deducted from tax calculated at step 2

Step 6 : Add Education Cess 3%

Step 7 : Total is tax payable.

THANK YOU

Вам также может понравиться

- Work Plan and Monitoring TemplateДокумент8 страницWork Plan and Monitoring TemplateromeeОценок пока нет

- 8 Top Questions You Should Prepare For Bank InterviewsДокумент10 страниц8 Top Questions You Should Prepare For Bank InterviewsAbdulgafoor NellogiОценок пока нет

- Briefing Note: "2011 - 2014 Budget and Taxpayer Savings"Документ6 страницBriefing Note: "2011 - 2014 Budget and Taxpayer Savings"Jonathan Goldsbie100% (1)

- Private Equity Real Estate FirmsДокумент13 страницPrivate Equity Real Estate FirmsgokoliОценок пока нет

- Network PlanningДокумент59 страницNetwork PlanningVignesh ManickamОценок пока нет

- Tesda Perpetual and Periodic Inventory SystemsДокумент6 страницTesda Perpetual and Periodic Inventory Systemsnelia d. onteОценок пока нет

- Motor Vehicle Act 2019Документ2 страницыMotor Vehicle Act 2019dmc ivcОценок пока нет

- Shaking Tables Around The WorldДокумент15 страницShaking Tables Around The Worlddjani_ip100% (1)

- Agriculturl Income: Section Section 2 (1A)Документ95 страницAgriculturl Income: Section Section 2 (1A)leela naga janaki rajitha attiliОценок пока нет

- Income Tax Computation for Business ProfitsДокумент20 страницIncome Tax Computation for Business ProfitsSapna KawatОценок пока нет

- PetitionerДокумент21 страницаPetitionermohan kumarОценок пока нет

- Income Tax Treatment of Agricultural IncomeДокумент9 страницIncome Tax Treatment of Agricultural Incomeprabs2007Оценок пока нет

- Regulation of CombinationsДокумент11 страницRegulation of CombinationsDivyansha GoswamiОценок пока нет

- N. B A - C.I.T. JT 2003 (1) SC 363: Agavathy Mmal VДокумент6 страницN. B A - C.I.T. JT 2003 (1) SC 363: Agavathy Mmal VarmsarivuОценок пока нет

- Verschures Creameries, LTD v. Hull and Netherlands Steamship Company, LTDДокумент5 страницVerschures Creameries, LTD v. Hull and Netherlands Steamship Company, LTDVaidehi kolhe100% (1)

- Chanderprabhu Jain College of Higher Studies School of Law: E-NotesДокумент6 страницChanderprabhu Jain College of Higher Studies School of Law: E-NotesSatwik SenguptaОценок пока нет

- IBC Notes PDFДокумент46 страницIBC Notes PDFbhioОценок пока нет

- An Assignment On: Environmental Auditing & Eco - MarkДокумент11 страницAn Assignment On: Environmental Auditing & Eco - MarkDeonandan kumarОценок пока нет

- 10 Main Features of Indian Tax StructureДокумент16 страниц10 Main Features of Indian Tax Structurerahul chauhanОценок пока нет

- Set Off and Carry Forward Losses ExplainedДокумент3 страницыSet Off and Carry Forward Losses ExplainedAnu KОценок пока нет

- The Reformatory Schools Act, 1897Документ7 страницThe Reformatory Schools Act, 1897kashifrazamangi0% (1)

- Muhammedan Law - Reports CompilationДокумент55 страницMuhammedan Law - Reports CompilationAshwanth M.SОценок пока нет

- Taxs Law ExamДокумент15 страницTaxs Law ExamSaif AliОценок пока нет

- DEEMED INCOME UNDER SECTIONS 68-69DДокумент18 страницDEEMED INCOME UNDER SECTIONS 68-69DVicky DОценок пока нет

- Chapter 4Документ123 страницыChapter 4Satyam singhОценок пока нет

- Voluntary Disclosure Scheme of 1997Документ11 страницVoluntary Disclosure Scheme of 1997Shivam GuptaОценок пока нет

- Real Estate Sale Agreement Confirming Party DraftДокумент10 страницReal Estate Sale Agreement Confirming Party DraftSravya0% (1)

- Chhattisgarh Rent Control Act, 2011Документ10 страницChhattisgarh Rent Control Act, 2011pankaj dhillonОценок пока нет

- Income Tax Residential Status PDFДокумент16 страницIncome Tax Residential Status PDFNagesha CSОценок пока нет

- AbinashДокумент32 страницыAbinashNazia Zabin MemonОценок пока нет

- S. Azeez Basha and Anr Vs Union of IndiaДокумент7 страницS. Azeez Basha and Anr Vs Union of IndiaJatin ChauhanОценок пока нет

- Veer PetitionerДокумент19 страницVeer Petitionerpriyanka100% (1)

- List of AbbreviationsДокумент2 страницыList of AbbreviationsRonak PatidarОценок пока нет

- Residential Status Problems 2021-2022-1Документ5 страницResidential Status Problems 2021-2022-120-UCO-517 AJAY KELVIN AОценок пока нет

- High Court Jurisdiction Over Animal Preservation ActДокумент17 страницHigh Court Jurisdiction Over Animal Preservation ActswatiОценок пока нет

- PGBP Complete TheoryДокумент21 страницаPGBP Complete TheoryNirbheek Doyal100% (4)

- 03 - Bombay - Foreign - Liquor - Rules - 1953 - 1 - 1 - 1 - Police ImportantДокумент72 страницы03 - Bombay - Foreign - Liquor - Rules - 1953 - 1 - 1 - 1 - Police ImportantMohit VarshneyОценок пока нет

- Income From Capital GainДокумент19 страницIncome From Capital GainAniket ShivganОценок пока нет

- Subsidiary and Holding CompanyДокумент27 страницSubsidiary and Holding CompanyDhriti SharmaОценок пока нет

- ICFAI LAW SCHOOL MOOT PROBLEM ON DATA PRIVACYДокумент4 страницыICFAI LAW SCHOOL MOOT PROBLEM ON DATA PRIVACYHena KhanОценок пока нет

- Bacha F. Guzdar v. CIT (1955) 27 ITR 1(SC) - Is dividend income agricultural incomeДокумент11 страницBacha F. Guzdar v. CIT (1955) 27 ITR 1(SC) - Is dividend income agricultural incomeDivija PiduguОценок пока нет

- Basis of Charge and Scope of TotalДокумент24 страницыBasis of Charge and Scope of TotalSujithОценок пока нет

- U.P Land Law Test: Board of Revenue PowersДокумент10 страницU.P Land Law Test: Board of Revenue PowersSadhvi SinghОценок пока нет

- Advance Ruling Under GSTДокумент33 страницыAdvance Ruling Under GSTShivam MishraОценок пока нет

- R 634Документ26 страницR 634Rachna Yadav100% (1)

- Books and Resources for Law ExamsДокумент4 страницыBooks and Resources for Law ExamsKapil TomerОценок пока нет

- Anatomy of Administrative Function - Aparajita MamДокумент26 страницAnatomy of Administrative Function - Aparajita MamNitish Kumar NaveenОценок пока нет

- Amendment in Jammu and Kashmir Excise Act Samvat 1958 PDFДокумент13 страницAmendment in Jammu and Kashmir Excise Act Samvat 1958 PDFLatest Laws TeamОценок пока нет

- India Is Largest Producer and Consumer in The World: Moot Proposition 3Документ2 страницыIndia Is Largest Producer and Consumer in The World: Moot Proposition 3rishabh0% (1)

- Spring Board Doctrine - A Critical Study of Trade Secret ProtectionДокумент5 страницSpring Board Doctrine - A Critical Study of Trade Secret Protectionmanish88raiОценок пока нет

- User Manual Noc NazulДокумент16 страницUser Manual Noc NazulSamyak JainОценок пока нет

- A Report On The Study of Gram Kachahari in BiharДокумент31 страницаA Report On The Study of Gram Kachahari in BiharSubodhksrm100% (2)

- Various Tax Authorities Under The Income TaxДокумент18 страницVarious Tax Authorities Under The Income TaxHardik SabbarwalОценок пока нет

- House PropertyДокумент22 страницыHouse PropertyAmrit TejaniОценок пока нет

- Judgement0210427 204948 1 10Документ10 страницJudgement0210427 204948 1 10Niraj PandeyОценок пока нет

- A Textbook of The Indian Penal Code by K D GaurДокумент6 страницA Textbook of The Indian Penal Code by K D GaurJosepj0% (3)

- Advanced Rank File For Munsiff Magistrate (Kerala Judicial Service) Examination by M.a.rashidДокумент1 страницаAdvanced Rank File For Munsiff Magistrate (Kerala Judicial Service) Examination by M.a.rashidruks7890% (1)

- Hit & Run Cases - Criminal Law Project ReportДокумент14 страницHit & Run Cases - Criminal Law Project ReportNimisha SajekarОценок пока нет

- Mafatlal Industries LTD Introduction. EditedДокумент7 страницMafatlal Industries LTD Introduction. EditedVishal KapurОценок пока нет

- Residential Status Scope of Total IncomeДокумент4 страницыResidential Status Scope of Total IncomedeepakadhanaОценок пока нет

- ULTIMATE BOOK OF ACCOUNTANCY CLASS 12Документ14 страницULTIMATE BOOK OF ACCOUNTANCY CLASS 12TrostingОценок пока нет

- Food Laws in India - A Comparative StudyДокумент39 страницFood Laws in India - A Comparative StudyUvais MohammedОценок пока нет

- Team B AppellantДокумент26 страницTeam B Appellantharidas venkateshОценок пока нет

- Agricultural IncomeДокумент18 страницAgricultural IncomeroopamОценок пока нет

- Agricultural Income Tax Exemption & Computation RulesДокумент3 страницыAgricultural Income Tax Exemption & Computation RulesVikram VermaОценок пока нет

- Agricultural Income in Indian Income Tax ACT 1961Документ28 страницAgricultural Income in Indian Income Tax ACT 1961Khushika KhokharОценок пока нет

- Unit 1 Agricultural IncomeДокумент25 страницUnit 1 Agricultural IncomeSresth VermaОценок пока нет

- Service TaxДокумент115 страницService TaxEricKenОценок пока нет

- Applied Indirect TaxationДокумент349 страницApplied Indirect TaxationVijetha K Murthy100% (1)

- 01 Introduction To ComputersДокумент23 страницы01 Introduction To Computersmkjhacal5292Оценок пока нет

- 28 04 Data Storage Retreival DbmsДокумент28 страниц28 04 Data Storage Retreival Dbmsjayan_SikarwarОценок пока нет

- IT Computer Networks and Network SecurityДокумент39 страницIT Computer Networks and Network SecurityVaibhav SharmaОценок пока нет

- Revision Kit GroupIIДокумент127 страницRevision Kit GroupIIEricKenОценок пока нет

- 14 06 Internet Emerging TechnologiesДокумент25 страниц14 06 Internet Emerging TechnologiesEricKenОценок пока нет

- How to Make Flowcharts in Word, Excel & PowerPointДокумент10 страницHow to Make Flowcharts in Word, Excel & PowerPointArunsounder VenkatramanОценок пока нет

- TdsДокумент25 страницTdsEricKenОценок пока нет

- THEME2 PresentationДокумент24 страницыTHEME2 PresentationChirag DaveОценок пока нет

- Taxing Agriculture 1195369749254447 4Документ11 страницTaxing Agriculture 1195369749254447 4EricKenОценок пока нет

- How to Make Flowcharts in Word, Excel & PowerPointДокумент10 страницHow to Make Flowcharts in Word, Excel & PowerPointArunsounder VenkatramanОценок пока нет

- Webcastjul6ipccp7b SMДокумент28 страницWebcastjul6ipccp7b SMEricKenОценок пока нет

- Organic Chicken Business RisksДокумент13 страницOrganic Chicken Business RisksUsman KhanОценок пока нет

- Title:-Home Service at A Click: Presented byДокумент14 страницTitle:-Home Service at A Click: Presented byPooja PujariОценок пока нет

- File 9222Документ4 страницыFile 9222lexxusmransomОценок пока нет

- International Market SegmentationДокумент9 страницInternational Market SegmentationYashodara Ranawaka ArachchigeОценок пока нет

- Finance Manager Reporting Planning in Los Angeles, CA ResumeДокумент2 страницыFinance Manager Reporting Planning in Los Angeles, CA ResumeRCTBLPOОценок пока нет

- 17FG0045 BoqДокумент2 страницы17FG0045 BoqrrpenolioОценок пока нет

- Dragonpay Payment InstructionДокумент1 страницаDragonpay Payment Instructionkenneth molinaОценок пока нет

- John Ashton Arizona Speech 2013Документ6 страницJohn Ashton Arizona Speech 2013climatehomescribdОценок пока нет

- Nluj Deal Mediation Competition 3.0: March 4 - 6, 2022Документ4 страницыNluj Deal Mediation Competition 3.0: March 4 - 6, 2022Sidhant KampaniОценок пока нет

- Example Accounting Ledgers ACC406Документ5 страницExample Accounting Ledgers ACC406AinaAteerahОценок пока нет

- Quan Tri TCQTДокумент44 страницыQuan Tri TCQTHồ NgânОценок пока нет

- Impact of Annales School On Ottoman StudiesДокумент16 страницImpact of Annales School On Ottoman StudiesAlperBalcıОценок пока нет

- Microeconomia: Preferenze Lessicografiche (Dimostrazioni Delle Proprietà)Документ3 страницыMicroeconomia: Preferenze Lessicografiche (Dimostrazioni Delle Proprietà)maslsl daimondОценок пока нет

- The Utopian Realism of Errico MalatestaДокумент8 страницThe Utopian Realism of Errico MalatestaSilvana RAОценок пока нет

- June 2010 (v1) QP - Paper 1 CIE Economics IGCSEДокумент12 страницJune 2010 (v1) QP - Paper 1 CIE Economics IGCSEjoseph oukoОценок пока нет

- Chairing A Meeting British English TeacherДокумент7 страницChairing A Meeting British English TeacherJimena AbdoОценок пока нет

- Spring Homes Subdivision Co Inc, Sps. Pedro Lumbres and Roaring Vs Sps TabladaДокумент1 страницаSpring Homes Subdivision Co Inc, Sps. Pedro Lumbres and Roaring Vs Sps TabladaSaji JimenoОценок пока нет

- Secretary of Finance vs. Lazatin GR No. 210588Документ14 страницSecretary of Finance vs. Lazatin GR No. 210588Gwen Alistaer CanaleОценок пока нет

- Income Statement Template For WebsiteДокумент5 страницIncome Statement Template For WebsiteKelly CantuОценок пока нет

- 2010 Tax Matrix - Individual AliensДокумент2 страницы2010 Tax Matrix - Individual Alienscmv mendozaОценок пока нет

- Robot Book of KukaДокумент28 страницRobot Book of KukaSumit MahajanОценок пока нет

- LKP Jalan Reko Pedestrian Hand Railing Sight Distance Issue ReportДокумент29 страницLKP Jalan Reko Pedestrian Hand Railing Sight Distance Issue ReportLokman Hakim Abdul AzizОценок пока нет

- Weekly business quiz roundup from 2011Документ8 страницWeekly business quiz roundup from 2011Muthu KumarОценок пока нет