Академический Документы

Профессиональный Документы

Культура Документы

Guidelines & Policies For The Monitoring of Service Fees of Professionals

Загружено:

PriMa Ricel Arthur0 оценок0% нашли этот документ полезным (0 голосов)

46 просмотров15 страницA presentation on the new BIR requirement to submit affidavit and appointment book

Оригинальное название

RR 4-2014 Professionals

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документA presentation on the new BIR requirement to submit affidavit and appointment book

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

46 просмотров15 страницGuidelines & Policies For The Monitoring of Service Fees of Professionals

Загружено:

PriMa Ricel ArthurA presentation on the new BIR requirement to submit affidavit and appointment book

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 15

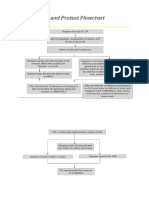

Guidelines & Policies

for the Monitoring of Service fees

of Professionals

(Revenue Regulations 4-2014)

Basic Taxpayer Obligations

"The ultimate inspiration is the

deadline"

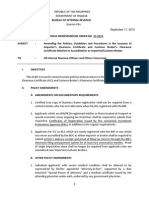

Revenue Memorandum Circular No. 32-2014-Extension

of time to comply with RR 4-2014 from May 6 to May 31,

2014

REGISTRATION

New Requirements on

REGISTRATION (RR 4-2014)

All self-employed professionals shall submit

an AFFIDAVIT indicating the ff:

1.) rates;

2.) manner of billings;

3.) and the factors they may consider in

determining their fees.

Examples of affidavit

Source: PICPA website

When to submit?

Due date

Upon registration and every year

thereafter on or before Jan. 31

Transitory provision

Affidavit to be submitted within 30 days

from effectivity of this Regulation

May 31, 2014 per RMC 32-2014

INVOICING

New Requirements on

INVOICING (RR 4-2014)

In cases when no professional

fees are charged by the professional

and paid by client, a BIR registered

receipt, duly acknowledged by the latter,

shall be issued showing a discount of

100% as substantiation of the pro-

bono service.

BOOKKEEPING

***PATIENTS LOG BOOK (A SUBSIDIARY

BOOK)

Daily list of clients w/ the corresponding fees including

those free of charge, per branch

Name and address

Date

Official receipt no.

Amount charge

Must be registered with the BIR

New Requirements on

BOOKKEEPING (RR 4-2014)

OFFICIAL APPOINTMENT BOOKS

(RR 4-2014)

Shall contain only the names of the client

and the date/time of the meeting

Due date

May 31, 2014

RECAP

1. Submit affidavit on or before May 31,

2014 and every year thereafter;

2. Register appointment book on May 31,

2014;

3. Issue receipt for "pro bono" transactions

Penalty Clause

SEC. 254. Attempt to Evade or Defeat Tax. - in addition to other

penalties provided by law, upon conviction thereof, be punished by a

fine not less than Thirty thousand (P30,000) but not more than One

hunderd thousand pesos (P100,000) and suffer imprisonment of not

less than two (2) years but not more than four (4) years: That the

conviction or acquittal obtained under this Section shall not be a bar

to the filing of a civil suit for the collection of taxes.

SEC. 275. Violation of Other Provisions of this Code or Rules

and Regulations in General. - Any person who violates any

provision of this Code or any rule or regulation promulgated by the

Department of Finance, for which no specific penalty is provided by

law, shall, upon conviction for each act or omission, be punished by

a fine of not more than One thousand pesos (P1,000) or suffer

imprisonment of not more than six (6) months, or both.

Вам также может понравиться

- Theoretical Aspects: Registration (Section 69 & Rule 4 of The Service Tax Rules, 1994)Документ54 страницыTheoretical Aspects: Registration (Section 69 & Rule 4 of The Service Tax Rules, 1994)Manish HarlalkaОценок пока нет

- BIR Guidelines for Changing Accounting PeriodsДокумент2 страницыBIR Guidelines for Changing Accounting PeriodsAemie JordanОценок пока нет

- Update On Taxpayers Rights Remedies VicMamalateoДокумент53 страницыUpdate On Taxpayers Rights Remedies VicMamalateoNimpa PichayОценок пока нет

- Tax Remedies For Bir Cases and Compliance TrainingДокумент29 страницTax Remedies For Bir Cases and Compliance TrainingCenon AquinoОценок пока нет

- TopicsДокумент40 страницTopicsDa Yani ChristeeneОценок пока нет

- Tax Agents and PractitionersДокумент5 страницTax Agents and PractitionerskawaiimiracleОценок пока нет

- ACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Документ31 страницаACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Quinciano MorilloОценок пока нет

- BIR Revenue Regulations 4-2014Документ2 страницыBIR Revenue Regulations 4-2014Tonyo CruzОценок пока нет

- TAX REMEDIES NotesДокумент66 страницTAX REMEDIES NotesJane BiancaОценок пока нет

- Tax+Remedies Nirc 2011 AteneoДокумент103 страницыTax+Remedies Nirc 2011 AteneoGracia Jimenez-CastilloОценок пока нет

- Summary of Tax RemediesДокумент15 страницSummary of Tax Remediesquinn ezekielОценок пока нет

- Accounting Periods and Methods of AccountingДокумент11 страницAccounting Periods and Methods of Accountingmhilet_chiОценок пока нет

- BIR Releases Rules On Appealing Disputed Tax AssessmentsДокумент13 страницBIR Releases Rules On Appealing Disputed Tax AssessmentsDana100% (1)

- Section 44AB of Income Tax ActДокумент6 страницSection 44AB of Income Tax ActKANNAPPAN NAGARAJANОценок пока нет

- UNIFEEDS TaxДокумент64 страницыUNIFEEDS TaxRheneir MoraОценок пока нет

- Powers of Audit, Search and Seizure Under GST: By: Pratha KhannaДокумент21 страницаPowers of Audit, Search and Seizure Under GST: By: Pratha KhannaLaiba FatimaОценок пока нет

- Coa 2012-001Документ51 страницаCoa 2012-001Earl Clarence InesОценок пока нет

- Audit Project TAX AUDITДокумент34 страницыAudit Project TAX AUDITkhairejoОценок пока нет

- Provisions of Audit Under Service Tax LawДокумент3 страницыProvisions of Audit Under Service Tax Lawanon_922292293Оценок пока нет

- Issues, Problems and Solutions in Tax Audit and Investigation (1-10-13)Документ184 страницыIssues, Problems and Solutions in Tax Audit and Investigation (1-10-13)marygrace_apaitan100% (2)

- 2000 Revenue Regulations - The Lawphil ProjectДокумент4 страницы2000 Revenue Regulations - The Lawphil ProjectCherry ursuaОценок пока нет

- Lesson 4. Tax Administration.Документ44 страницыLesson 4. Tax Administration.Si OneilОценок пока нет

- Sales Tax - 05Документ3 страницыSales Tax - 05Bilal ShaikhОценок пока нет

- Subject: of To ToДокумент2 страницыSubject: of To ToAnonymous DCfjLP50Оценок пока нет

- 2009 RMC 23-2009 LOA RevalidationДокумент2 страницы2009 RMC 23-2009 LOA Revalidationedong the greatОценок пока нет

- L13LLB183031Документ29 страницL13LLB183031Debasis MisraОценок пока нет

- Tax Remedies-Nirc-2011-AteneoДокумент103 страницыTax Remedies-Nirc-2011-AteneoschaffyОценок пока нет

- Protesting A Tax AssessmentДокумент3 страницыProtesting A Tax AssessmenterinemilyОценок пока нет

- TX102 Topic 1 Module 3Документ21 страницаTX102 Topic 1 Module 3Richard Rhamil Carganillo Garcia Jr.Оценок пока нет

- Transforming Tax Withholding Rules Under TRAIN LawДокумент108 страницTransforming Tax Withholding Rules Under TRAIN LawKenneth Cyrus Olivar100% (1)

- 503 Service Unavailable No Server Is Available To Handle This Request.Документ3 страницы503 Service Unavailable No Server Is Available To Handle This Request.NitinAggarwal100% (1)

- Required Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Документ6 страницRequired Before The BIR May Audit The Records of The Taxpayer? Letter of Authority (LOA)Jade CoritanaОценок пока нет

- Guidance On Tax Audit Procedure: National Tax Service Instructions No. 1661Документ8 страницGuidance On Tax Audit Procedure: National Tax Service Instructions No. 1661Arya FlyingboyОценок пока нет

- Tax Remedies 2011Документ103 страницыTax Remedies 2011Doni June AlmioОценок пока нет

- Court of Tax Appeals: en BaneДокумент14 страницCourt of Tax Appeals: en BaneAudrey DeguzmanОценок пока нет

- Audit Project TAX AUDIT PDFДокумент38 страницAudit Project TAX AUDIT PDFYogesh Sahani100% (3)

- Boi Bir RulingДокумент172 страницыBoi Bir RulingChristine Fe BobisОценок пока нет

- Handout PDFДокумент23 страницыHandout PDFElla CayОценок пока нет

- 09 BIR Stand On Cooperative CTEДокумент52 страницы09 BIR Stand On Cooperative CTEClaudio Jr OlaritaОценок пока нет

- Tax 01-Lesson 02 - Tax RemediesДокумент42 страницыTax 01-Lesson 02 - Tax RemediesShannise Dayne Chua0% (1)

- BIR Order Amending Rules For Importer and Customs Broker AccreditationДокумент5 страницBIR Order Amending Rules For Importer and Customs Broker AccreditationPortCallsОценок пока нет

- Change in Accounting PeriodДокумент4 страницыChange in Accounting PeriodCris Lloyd AlferezОценок пока нет

- CA Roopa NayakДокумент40 страницCA Roopa NayakAayushi AroraОценок пока нет

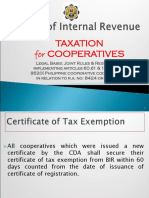

- Taxation For CooperativesДокумент27 страницTaxation For Cooperativesdecember231981Оценок пока нет

- Tips in Tax FilingДокумент30 страницTips in Tax FilingNIcey NiceyОценок пока нет

- Remedies of The TaxpayerДокумент4 страницыRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- GST Assessment, Audit and ComplianceДокумент33 страницыGST Assessment, Audit and ComplianceSuresh Kumar YathirajuОценок пока нет

- Audit Project TAX AUDITДокумент34 страницыAudit Project TAX AUDITkarthika kounder67% (9)

- 55026RR 14-2010 Accreditation PDFДокумент5 страниц55026RR 14-2010 Accreditation PDFlmin34Оценок пока нет

- General Audit Procedures and Documentation-BirДокумент3 страницыGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaОценок пока нет

- NIRC RemediesДокумент62 страницыNIRC Remediessei1david100% (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsОт EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsОценок пока нет

- Formula: Output Tax - 0% Input Tax XXX Refundable XXXДокумент2 страницыFormula: Output Tax - 0% Input Tax XXX Refundable XXXPriMa Ricel ArthurОценок пока нет

- Realubit Vs Jaso PartnershipДокумент2 страницыRealubit Vs Jaso PartnershipPriMa Ricel ArthurОценок пока нет

- SC rules local govt cannot prohibit lottoДокумент4 страницыSC rules local govt cannot prohibit lottoPriMa Ricel ArthurОценок пока нет

- These Are The Highlights of The Previously Concluded New BIR Forms Briefing Observations... Easier To Understand Than The Old FormДокумент3 страницыThese Are The Highlights of The Previously Concluded New BIR Forms Briefing Observations... Easier To Understand Than The Old FormPriMa Ricel ArthurОценок пока нет

- Suntay Vs Cojuanco SuntayДокумент4 страницыSuntay Vs Cojuanco SuntayPriMa Ricel ArthurОценок пока нет

- Sworn Statement of Assets, Liabilities and Net WorthДокумент2 страницыSworn Statement of Assets, Liabilities and Net WorthPriMa Ricel ArthurОценок пока нет

- Jose Garcia RonДокумент1 страницаJose Garcia RonPriMa Ricel ArthurОценок пока нет

- Tax, Tort, Trial & Transportation Laws Review NotesДокумент16 страницTax, Tort, Trial & Transportation Laws Review NotesPriMa Ricel Arthur100% (1)

- Guidelines & Policies For The Monitoring of Service Fees of ProfessionalsДокумент15 страницGuidelines & Policies For The Monitoring of Service Fees of ProfessionalsPriMa Ricel ArthurОценок пока нет

- Dispute Over Ownership of Property in Calbayog CityДокумент9 страницDispute Over Ownership of Property in Calbayog CityPriMa Ricel ArthurОценок пока нет

- Pascual Vs CA TrustДокумент5 страницPascual Vs CA TrustPriMa Ricel ArthurОценок пока нет

- Court ruling on partnership liabilityДокумент9 страницCourt ruling on partnership liabilityPriMa Ricel ArthurОценок пока нет

- R Civil NamesДокумент1 страницаR Civil NamesPriMa Ricel ArthurОценок пока нет

- Sancho Vs LizarragaДокумент1 страницаSancho Vs LizarragaPriMa Ricel ArthurОценок пока нет

- Heirs of Timoteo Moreno Vs Mactan Cebu International PortДокумент4 страницыHeirs of Timoteo Moreno Vs Mactan Cebu International PortPriMa Ricel ArthurОценок пока нет

- Salvador Comilang Vs Burcena TrustДокумент6 страницSalvador Comilang Vs Burcena TrustPriMa Ricel ArthurОценок пока нет

- Dispute Over Ownership of Property in Calbayog CityДокумент9 страницDispute Over Ownership of Property in Calbayog CityPriMa Ricel ArthurОценок пока нет

- Hernandez Nievera Vs Hernandez AgencyДокумент6 страницHernandez Nievera Vs Hernandez AgencyPriMa Ricel ArthurОценок пока нет

- Bonnevie Vs Hernandez Case Digest DissolutionДокумент4 страницыBonnevie Vs Hernandez Case Digest DissolutionPriMa Ricel ArthurОценок пока нет

- VAT calculation for canned goods sale between two VAT registered companiesДокумент1 страницаVAT calculation for canned goods sale between two VAT registered companiesPriMa Ricel ArthurОценок пока нет

- Suntay Vs Cojuanco SuntayДокумент4 страницыSuntay Vs Cojuanco SuntayPriMa Ricel ArthurОценок пока нет

- Sanchez Vs Medicard AgencyДокумент2 страницыSanchez Vs Medicard AgencyPriMa Ricel ArthurОценок пока нет

- Case Digests LaborДокумент6 страницCase Digests LaborPriMa Ricel ArthurОценок пока нет

- Opinion On ImpeachmentДокумент1 страницаOpinion On ImpeachmentPriMa Ricel ArthurОценок пока нет

- Tax, Tort, Trial & Transportation Laws Review NotesДокумент16 страницTax, Tort, Trial & Transportation Laws Review NotesPriMa Ricel Arthur100% (1)

- DOF CREDO & PANUNUMPA SA WATAWATДокумент7 страницDOF CREDO & PANUNUMPA SA WATAWATPriMa Ricel ArthurОценок пока нет

- Death Penalty PaperДокумент5 страницDeath Penalty PaperPriMa Ricel ArthurОценок пока нет

- Kaa MulanДокумент1 страницаKaa MulanPriMa Ricel ArthurОценок пока нет

- Tax Collector's PrayerДокумент1 страницаTax Collector's PrayerPriMa Ricel ArthurОценок пока нет

- Other Tax Updates 2012 MDArthurДокумент30 страницOther Tax Updates 2012 MDArthurPriMa Ricel ArthurОценок пока нет

- Ensuring Compliance To Regularity VFДокумент22 страницыEnsuring Compliance To Regularity VFBira myОценок пока нет

- Hiranandani Hospital CaseДокумент17 страницHiranandani Hospital CaseSimran BaggaОценок пока нет

- Global Financial Crisis and The Intellectual Capital Performance of UAE BanksДокумент18 страницGlobal Financial Crisis and The Intellectual Capital Performance of UAE BanksArchidHananAfifahОценок пока нет

- NCR - EmdДокумент7 страницNCR - EmdDhey LacanlaleОценок пока нет

- 30 RiskMgmt 101 2020Документ23 страницы30 RiskMgmt 101 2020Ramkumar GОценок пока нет

- (KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketДокумент27 страниц(KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketJay LeeОценок пока нет

- Telamon Corporation: Quality Management System Manual IATF TIS Dayton/Fresnillo/Skopje 21-DEC-18Документ53 страницыTelamon Corporation: Quality Management System Manual IATF TIS Dayton/Fresnillo/Skopje 21-DEC-18staneslauОценок пока нет

- Audit ProgramДокумент2 страницыAudit ProgramzenellebellaОценок пока нет

- Oxfam GROW Report On Farmers Cooperation - EngДокумент44 страницыOxfam GROW Report On Farmers Cooperation - EngOxfam in VietnamОценок пока нет

- Ac8050 2Документ3 страницыAc8050 2rory hudsonОценок пока нет

- EconomicandCommercial Laws PDFДокумент702 страницыEconomicandCommercial Laws PDFjeyasinghsp100% (1)

- Accounting Standards OverviewДокумент21 страницаAccounting Standards Overview119936232141Оценок пока нет

- Eaton's MTL product range and the ATEX directive explainedДокумент1 страницаEaton's MTL product range and the ATEX directive explainedscribdkhatnОценок пока нет

- Customs Officer PDFДокумент2 страницыCustoms Officer PDFHimanshu YadavОценок пока нет

- BS en Iso 10545-1-2014Документ20 страницBS en Iso 10545-1-2014ayman m.waleedОценок пока нет

- Present Status of Apartment Building Approval and ConstructionДокумент57 страницPresent Status of Apartment Building Approval and ConstructionBinay ShresthaОценок пока нет

- ADR Prudential Guarantee Assurance vs. Anscor Case DigestДокумент2 страницыADR Prudential Guarantee Assurance vs. Anscor Case DigestJessa MaeОценок пока нет

- Bài Tập Chương 2+3 Vi Mô - MentorA+ (English)Документ22 страницыBài Tập Chương 2+3 Vi Mô - MentorA+ (English)K60 Phạm Anh HiếuОценок пока нет

- Acct 3151 Notes 1Документ10 страницAcct 3151 Notes 1Donald YumОценок пока нет

- Lab Manual of Maintenance Engineering & ManagementДокумент65 страницLab Manual of Maintenance Engineering & Managementsamim100% (1)

- Model SIAC Response To Notice of Arbitration PDFДокумент8 страницModel SIAC Response To Notice of Arbitration PDFshopie shopieОценок пока нет

- Market Structure - Single TableДокумент24 страницыMarket Structure - Single TablegaurigopinathОценок пока нет

- Building and The Law - ContentsДокумент13 страницBuilding and The Law - ContentsDonal La0% (1)

- Guidelines - EASA - Issue2Документ12 страницGuidelines - EASA - Issue2Mahmoud KrayemОценок пока нет

- YM APAA Sports Group Entertainment v. Frank Mason IIIДокумент7 страницYM APAA Sports Group Entertainment v. Frank Mason IIIDarren Adam HeitnerОценок пока нет

- Template 1 Project Proposal TemplateДокумент8 страницTemplate 1 Project Proposal TemplateLaurence HabanОценок пока нет

- RFQ Bus TerminalДокумент84 страницыRFQ Bus TerminalsombansОценок пока нет

- Corporate Ethics in Tele CommutationДокумент13 страницCorporate Ethics in Tele CommutationMitaliPatilОценок пока нет

- Unit 3 - Forms of Business OwnershipДокумент10 страницUnit 3 - Forms of Business OwnershipshaunОценок пока нет

- Guidelines On Managing Interest Rate Risk in The Banking BookДокумент94 страницыGuidelines On Managing Interest Rate Risk in The Banking Booksh1minhОценок пока нет