Академический Документы

Профессиональный Документы

Культура Документы

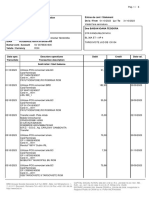

Credit Information Bureaue (India) LTD

Загружено:

Mayank JainОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Credit Information Bureaue (India) LTD

Загружено:

Mayank JainАвторское право:

Доступные форматы

CREDIT

INFORMATION

BUREAUE(INDIA

) Ltd. - CIBIL

WHAT IS CIBIL???

Credit Information Bureau (India) Limited (CIBIL) is Indias first Credit

Information Company (CIC) founded in August 2000. CIBIL collects

and maintains records of an individuals payments pertaining to

credit facilities (like loans, credit cards, Non-fund lines)

NEED and OBJECTIVES

A drastic rise in the level of spending.

Higher purchasing power as result of rapidly rising salaries.

Rapid rise in lending by the banks in order to utilize the above

mentioned opportunities.

All these factors lead to increase in the importance of maintaining

proper records of credit transactions. In order to achieve this, CIBIL was

created with following objectives:

To keep a tab on all the credit lent

To identify defaulters and refrain from re-lending to them to avoid

bad debt

To facilitate good borrowers with easy and timely credit facility.

SHAREHOLDING PATTERN AND

MEMBERS(as on March 31

st

2014)

All the Credit Grantors; Banks, Financial

Institutions, State Financial Corporations,

Non-Banking Financial Companies,

Housing Finance Companies and Credit

Card Companies are the Members of

CIBIL. These members only provide the

information about the individuals credit

history which can later be used by the

other institution while taking decisions to

lend money to that individual or not

TYPES OF BANK CREDIT ACTIVITIES

BANK

CREDIT

ACTIVITIES

RETAIL

BANKING

WHOLESALE

BANKING

RETAIL

BANKING

CIBIL TRANSUNION SCORE &

INFORMATION REPORT

The CIBIL TransUnion Score is a 3 digit numeric summary of your

credit history which indicates your financial & credit health. The

Score is derived from your credit history as detailed in the Credit

Information Report [CIR] and ranges from 300 to 900 points. Your

credit score tells the lender how likely you are to pay back loan or

credit card dues based on your past repayment behavior

A Credit Information Report (CIR) is a factual record of an

individuals (borrowers) credit payment history compiled from

information received from different credit grantors which are the

CIBIL members. It contains all the information about a borrowers

transaction in the past..

FACTORS AFFECTING CIBIL TRANSUNION

SCORE.

AVERAGE CREDIT SCORES w.r.t.

AGE GROUP

Recently officials from around 4 major public and private banks including SBI, AXIS Bank

etc. conducted a study on the credit activities of different age-groups. The study

revealed the following results:

18-24 years old; Average credit score: 638

25-34 years old; Average credit score: 652

35-44 years old; Average credit score: 659

45-54 years old; Average credit score: 685

55+ years old; Average credit score: 724

Conclusion: The study concluded that people in the 18-39 age group had the

greatest number of late payments during the previous 12 months; that the 40-59 age

group held the greatest amount of debt; and the 60+ age group had the lowest

average credit utilization (used the least amount of credit that was available to

them).

WHOLESALE

BANKING

WHOLESALE BANKING

CIBIL also maintains the credit information of entities as submitted to

them by its member banks and financial institutions. The credit

products included are cash credit, overdraft facilities, loans of all

maturities, bank guarantees, letters of credit, deferred payment

obligations, forward contracts and any other debt exposure

companies incur. This information is used to create a Company

Credit Report (CCR)- a month-on-month record of a companys

debt related exposure and payments.

Benefits of using a CCR

While applying for a loan: CCR is used to evaluate companys

creditworthiness whenever you apply for a loan or additional credit lines.

Accessing CCR helps the company to ensure its accuracy and a better

understanding of financial standing.

While building reputational collateral with business partners: Partners and

vendors see a demonstrated ability to regularly service loan obligations as

an indicator of your financial strength.

While re-evaluating existing trade credit practices: Ask your business

partners to build reputational collateral by sharing their CCR with you, which

will give you an understanding of their creditworthiness and help you to

periodically re-evaluate the credit terms you provide.

HOW TO IMPROVE YOUR CREDIT

SCORE or COMPANY's CCR

Pay off debt

Pay on time

Limit new accounts

Don't close old accounts

Keep tabs on your credit

Mayank Jain | Summer Intern

Mobile: +91 8860540128

mnkjain14@gmail.com

506, Antriksh Bhavan,

Connaught Place, New Delhi -

110001

Вам также может понравиться

- NPA & Income RecognitionДокумент56 страницNPA & Income RecognitionDrashti Raichura100% (1)

- IbcДокумент62 страницыIbcpankaj vermaОценок пока нет

- IRAC Norms & NPA ManagementДокумент29 страницIRAC Norms & NPA ManagementSarvar PathanОценок пока нет

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- NPA Provisioning: Asset Classification Provision Required: Advances Rs. in LacsДокумент3 страницыNPA Provisioning: Asset Classification Provision Required: Advances Rs. in LacsAikya GandhiОценок пока нет

- HR Policy For PACS-Report PDFДокумент145 страницHR Policy For PACS-Report PDFRahul Sodani100% (1)

- Retail Banking Indusind BankДокумент54 страницыRetail Banking Indusind BankNithin NitОценок пока нет

- Chapter 5 CGTMSEДокумент17 страницChapter 5 CGTMSEMikeОценок пока нет

- 01.01 IntroductionДокумент16 страниц01.01 Introductionmevrick_guyОценок пока нет

- What Is An Account Aggregator?Документ7 страницWhat Is An Account Aggregator?Francis NeyyanОценок пока нет

- Function of Commercial BankДокумент7 страницFunction of Commercial BankEmranul Islam ShovonОценок пока нет

- Pfms User Manual-EatДокумент50 страницPfms User Manual-EatAnkit Kumar JainОценок пока нет

- Cash Credit Proposal For Bank FinanceДокумент15 страницCash Credit Proposal For Bank Financeajaya thakurОценок пока нет

- Npa Management SbiДокумент104 страницыNpa Management Sbiparth jani100% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementОт EverandRegional Rural Banks of India: Evolution, Performance and ManagementОценок пока нет

- Procedural Guidelines1Документ69 страницProcedural Guidelines1sburugulaОценок пока нет

- Notes On NBFCДокумент9 страницNotes On NBFCgspkishore7953Оценок пока нет

- NachДокумент8 страницNachS GanesanОценок пока нет

- Study On Implementation of KCC Scheme - WBДокумент92 страницыStudy On Implementation of KCC Scheme - WBR K ThanviОценок пока нет

- KCC CompleteДокумент94 страницыKCC CompleteRonit HrishikeshОценок пока нет

- Public Issue 4Документ50 страницPublic Issue 4Shammi KhaihraОценок пока нет

- MargdarshniДокумент185 страницMargdarshniRahul Singh100% (1)

- Non Banking Financial Services: (NBFCS)Документ20 страницNon Banking Financial Services: (NBFCS)rashmymorayОценок пока нет

- Banking Regulations Basel Norms1590249674403 PDFДокумент10 страницBanking Regulations Basel Norms1590249674403 PDFAadeesh JainОценок пока нет

- Non-Banking Finance Companies (NBFCS) : Vivek Sharma Instructor Indian Financial SystemДокумент24 страницыNon-Banking Finance Companies (NBFCS) : Vivek Sharma Instructor Indian Financial Systemviveksharma51Оценок пока нет

- The Importance of Compliance in Banking Bank Quest Oct-Dec - 2019 - Rakesh - KaushikДокумент8 страницThe Importance of Compliance in Banking Bank Quest Oct-Dec - 2019 - Rakesh - KaushikRakesh KaushikОценок пока нет

- Fintech ScopeДокумент5 страницFintech Scopearpit85Оценок пока нет

- NBFC Mba FinanceДокумент7 страницNBFC Mba FinanceAmita BissaОценок пока нет

- Lending Policies of Indian BanksДокумент47 страницLending Policies of Indian BanksProf Dr Chowdari Prasad80% (5)

- Different Types of BorrowersДокумент15 страницDifferent Types of Borrowersmevrick_guyОценок пока нет

- STFC NCD ProspectusOCT 13 NCDДокумент47 страницSTFC NCD ProspectusOCT 13 NCDPrakash JoshiОценок пока нет

- NAFSCOB Annual Report 2017-18Документ226 страницNAFSCOB Annual Report 2017-18K Srinivasa MurthyОценок пока нет

- Non Trading OrganizationДокумент2 страницыNon Trading OrganizationPBGYB60% (5)

- Some Information On Export Some Information On Export Financing FinancingДокумент23 страницыSome Information On Export Some Information On Export Financing FinancingRoshani JoshiОценок пока нет

- Functions of A Central BankДокумент29 страницFunctions of A Central BankHopper ScopsОценок пока нет

- Cbs HandoutДокумент126 страницCbs HandoutsudhaaОценок пока нет

- Research Paper On The Topic Microfinance in AgricultureДокумент12 страницResearch Paper On The Topic Microfinance in AgricultureSukhmander SinghОценок пока нет

- Banking, Financial & General Awareness 2015 For Upcoming ExamsДокумент166 страницBanking, Financial & General Awareness 2015 For Upcoming Examsshubh9190100% (1)

- POs Pre Joining Study Material PDFДокумент152 страницыPOs Pre Joining Study Material PDFKushagra Pratap SinghОценок пока нет

- NPA & Categories Provisioning NormsДокумент26 страницNPA & Categories Provisioning NormsSarabjit KaurОценок пока нет

- Radhika Growth of Banking SectorДокумент36 страницRadhika Growth of Banking SectorPranav ViraОценок пока нет

- Capsule On BankingДокумент127 страницCapsule On BankingpavanОценок пока нет

- Retail Loan User Manual-393Документ41 страницаRetail Loan User Manual-393Arindam MukherjeeОценок пока нет

- SBI - Credit AppraisalДокумент31 страницаSBI - Credit AppraisalSuvra Ghosh25% (4)

- Financial Analysis PNBДокумент32 страницыFinancial Analysis PNBTarandeepОценок пока нет

- Dena Bank Working Capital and Ratio Analysis VinayДокумент106 страницDena Bank Working Capital and Ratio Analysis Vinayविनय गुप्ता75% (4)

- Banking Interview Questions: Important Personal Questions That Are Mostly Asked in InterviewsДокумент8 страницBanking Interview Questions: Important Personal Questions That Are Mostly Asked in InterviewsJithin RajanОценок пока нет

- NBFC1Документ82 страницыNBFC1Tushar PawarОценок пока нет

- UPI GuidelinesДокумент31 страницаUPI Guidelinespradyumna sisodiaОценок пока нет

- JAIIB Principles of Banking Module C NewДокумент16 страницJAIIB Principles of Banking Module C News1508198767% (3)

- NPA MGMTДокумент60 страницNPA MGMTRajib Ranjan SamalОценок пока нет

- SAP FICO Syllabus PDFДокумент11 страницSAP FICO Syllabus PDFÅndraju DineshОценок пока нет

- Industry Analysis Research Paper On Evolution of Banking Industry in IndiaДокумент4 страницыIndustry Analysis Research Paper On Evolution of Banking Industry in IndiaInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Takeover - Credit ReportДокумент8 страницTakeover - Credit ReportShantanuMogalОценок пока нет

- Principles and Practices of BankingДокумент57 страницPrinciples and Practices of BankingYogesh Devmore100% (1)

- Saket Bahuguna - Chief Legal Officer - IndiabullsДокумент1 страницаSaket Bahuguna - Chief Legal Officer - IndiabullsMayank JainОценок пока нет

- Affordable HousingДокумент11 страницAffordable HousingMayank JainОценок пока нет

- Nobal Reschedulement in PSPДокумент1 страницаNobal Reschedulement in PSPMayank JainОценок пока нет

- Sector 10 - Noida Ext - Financial SnapshotДокумент2 страницыSector 10 - Noida Ext - Financial SnapshotMayank JainОценок пока нет

- 67 A Affordable-ModelДокумент1 страница67 A Affordable-ModelMayank JainОценок пока нет

- Silicon City LayoutДокумент1 страницаSilicon City LayoutMayank JainОценок пока нет

- Plotted Commercial - Excluding GMUCДокумент1 страницаPlotted Commercial - Excluding GMUCMayank JainОценок пока нет

- Affordable Housing India-1Документ20 страницAffordable Housing India-1Venkat RamanОценок пока нет

- Plotted Commercial - Inclduing GMUCДокумент1 страницаPlotted Commercial - Inclduing GMUCMayank JainОценок пока нет

- Deen Dayal Jan Awas YojanaДокумент4 страницыDeen Dayal Jan Awas YojanaMayank JainОценок пока нет

- EDC Relief PolicyДокумент2 страницыEDC Relief PolicyMayank JainОценок пока нет

- Ezycolour Beautiful Homes GuideДокумент40 страницEzycolour Beautiful Homes GuideMayank JainОценок пока нет

- Area Norms For Licence in Low and Medium-9.2.2016Документ2 страницыArea Norms For Licence in Low and Medium-9.2.2016Mayank JainОценок пока нет

- Architecture Technical Module Web Booklet Chapter6Документ17 страницArchitecture Technical Module Web Booklet Chapter6Bhanu Shankar SinghОценок пока нет

- Presentations PapersДокумент20 страницPresentations PapersMayank JainОценок пока нет

- Affordable Housing Project Wise DetailsДокумент8 страницAffordable Housing Project Wise DetailsMayank JainОценок пока нет

- Architecture Technical Module Web Booklet Chapter6Документ17 страницArchitecture Technical Module Web Booklet Chapter6Bhanu Shankar SinghОценок пока нет

- ICRA Report 2 WheelersДокумент6 страницICRA Report 2 WheelersMayank JainОценок пока нет

- TVS 2013Документ101 страницаTVS 2013Mayank Jain100% (1)

- CDRДокумент17 страницCDRMayank JainОценок пока нет

- Role of Media in Indian DemocracyДокумент8 страницRole of Media in Indian DemocracyMayank JainОценок пока нет

- Auto CompaniesДокумент6 страницAuto CompaniesMayank JainОценок пока нет

- 06 MPBF PDFДокумент3 страницы06 MPBF PDFMayank JainОценок пока нет

- 8 - Modes of LendingДокумент21 страница8 - Modes of LendingMayank JainОценок пока нет

- Content For MeДокумент1 страницаContent For MeMayank JainОценок пока нет

- Ranjana Project Report On Inventory ManagementДокумент93 страницыRanjana Project Report On Inventory Managementranjanachoubey90% (10)

- Rbi Monetary PolicyДокумент2 страницыRbi Monetary PolicyMayank JainОценок пока нет

- Cold CallingДокумент1 страницаCold CallingMayank JainОценок пока нет

- The St. Olaf College Fieldhouse Project - PaperДокумент16 страницThe St. Olaf College Fieldhouse Project - PaperMayank JainОценок пока нет

- Maths Worksheet - LoansДокумент3 страницыMaths Worksheet - LoansCape Town After-School TutorialsОценок пока нет

- Example of Term Loan RepaymentДокумент2 страницыExample of Term Loan RepaymentDrakon BgОценок пока нет

- 9.1 Banking Law - ProfessionalДокумент394 страницы9.1 Banking Law - ProfessionalMaryam KhalidОценок пока нет

- Respuestas de Los Agentes de Microfinanzas (Desde 1998)Документ154 страницыRespuestas de Los Agentes de Microfinanzas (Desde 1998)Microcredit Summit CampaignОценок пока нет

- Opening PageДокумент10 страницOpening PageHd SecretariatОценок пока нет

- Relationship Between Banker and CustomerДокумент3 страницыRelationship Between Banker and CustomerEditor IJTSRDОценок пока нет

- Wa0097 PDFДокумент57 страницWa0097 PDFPooja PhadatareОценок пока нет

- LivingOffYourPaycheck 66WaysToSaveMoney Handout 1Документ8 страницLivingOffYourPaycheck 66WaysToSaveMoney Handout 1Brenda L.Оценок пока нет

- Bank StatementДокумент5 страницBank StatementAshwani KumarОценок пока нет

- Mortgage Securitization ExplainedДокумент10 страницMortgage Securitization ExplainedMartin AndelmanОценок пока нет

- Business Account Statement: Account Summary For This PeriodДокумент2 страницыBusiness Account Statement: Account Summary For This PeriodBrian TalentoОценок пока нет

- NRI BankingДокумент33 страницыNRI BankingKrinal Shah0% (1)

- DEPOSIT V MutuumДокумент3 страницыDEPOSIT V MutuumNichole LanuzaОценок пока нет

- InvestmentДокумент6 страницInvestmentSaurav soniОценок пока нет

- Basel II.5, Basel III, and Other Post-Crisis ChangesДокумент18 страницBasel II.5, Basel III, and Other Post-Crisis Changessubba raoОценок пока нет

- Timing FedwireДокумент16 страницTiming FedwireOscar SanabriaОценок пока нет

- Abhishek Sarkar SipДокумент3 страницыAbhishek Sarkar SipAbhishek SarkarОценок пока нет

- Interest Formulas AND Their ApplicationsДокумент27 страницInterest Formulas AND Their ApplicationsShahzaib Anwar OffОценок пока нет

- Shambel Tegie 0902707 Kasahun Teshome ..0902574 Lijaddis Mosye ... 0902595 Mamene Atalay .0902605 Yaregal Kassahun ... 0902792Документ45 страницShambel Tegie 0902707 Kasahun Teshome ..0902574 Lijaddis Mosye ... 0902595 Mamene Atalay .0902605 Yaregal Kassahun ... 0902792Fiteh KОценок пока нет

- TXN Date Value Date Description Branch Debit Credit Balance No. CodeДокумент3 страницыTXN Date Value Date Description Branch Debit Credit Balance No. CodeMaaz AliОценок пока нет

- SV39786361600 2023 10Документ6 страницSV39786361600 2023 10ioanateodorabaisanОценок пока нет

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Документ5 страницApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnОценок пока нет

- Motion Court 10 10 2019Документ5 страницMotion Court 10 10 2019denis blackОценок пока нет

- Payment NotificationДокумент1 страницаPayment Notificationosas RichardОценок пока нет

- Mercial BanksДокумент24 страницыMercial BanksBharat ChoudharyОценок пока нет

- Notes IA1 PirntДокумент18 страницNotes IA1 PirntBack upОценок пока нет

- Reverse Mortgage Primer - BOFA 2006Документ24 страницыReverse Mortgage Primer - BOFA 2006ab3rdОценок пока нет

- Confidential General Customer Information Form: U U U U U U UДокумент9 страницConfidential General Customer Information Form: U U U U U U USara AriffОценок пока нет

- Emilio Final Updated - Docx 1Документ33 страницыEmilio Final Updated - Docx 1Joel C. BaccayОценок пока нет

- Amendments and Additions To Ifsca Banking Handbook and Other Issues12112021075247Документ5 страницAmendments and Additions To Ifsca Banking Handbook and Other Issues12112021075247Rishab GoelОценок пока нет