Академический Документы

Профессиональный Документы

Культура Документы

Kazi Wasim-Uz-Zaman Mirza Farhat Anjum Towsif Ur Rahid Makin Rishalat Jitu

Загружено:

Farhat9870 оценок0% нашли этот документ полезным (0 голосов)

71 просмотров24 страницыHRM of Al Arafah Islami Bank Ltd

Оригинальное название

HRM

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документHRM of Al Arafah Islami Bank Ltd

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

71 просмотров24 страницыKazi Wasim-Uz-Zaman Mirza Farhat Anjum Towsif Ur Rahid Makin Rishalat Jitu

Загружено:

Farhat987HRM of Al Arafah Islami Bank Ltd

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 24

Kazi Wasim-uz-zaman

Mirza Farhat Anjum

Towsif Ur Rahid

Makin Rishalat Jitu

State Bank of Pakistan

renamed as Bangladesh

Bank

Permitted foreign banks

to continue operation

Nationalizing local banks

License for private banks

Aggressive investments of Local

companies

Growth in GDP

Number of private banks went up

4 state owned banks, 5 specialized

banks, 31 local private commercial

banks and 7 Islamic Commercial

Banks and 9 foreign commercial banks

operating now

Popularity

rising around

the world

Extraordinary growth

and expansion

Islamic Banking

Services from

Conventional banks

Establishment of a

group comprising

representatives of

central Bank, Islamic

Banks and also the

Central Sharia Board

for Islamic Banks of

Bangladesh

Islami Bank

Shahjalal Islami Bank

Exim Bank

First Security Islami Bank

Al-Arafah Islami Bank

ICB Islamic Bank

Social Islami Bank

Established as a private limited

company on 1995

Follows the Islamic Sharia law

strictly

Sharia based profit/loss system to

get rid of the usury

Inauguration took place on 27

September 1995

AIBLs authorized capital is

BDT5000 million and its paid up

capital is 4677.28 million as of 2010

Number of employees: 2500-3000

Short-term deposits: One months MTDR (Mudaraba Term Deposit), three

months MTDR, Six months MTDR, one year to three years MTDR

Mudaraba Monthly Saving Scheme, consists of different amounts with different

time periods

Mudaraba Hajj scheme for hajjis

Murabaha

Bai-Muazzal

Brokerage house, Green Banking

Chairman

Managing

Director

Board of

Directors

Additional

Managing

Director

Deputy

Managing

Director

Executive

Vice

President

Senior

Assistant

Vice

President

Assistant

Vice

President

Assistant

Officer

Junior

Officer

Management

Trainee

Officer

Executive

Officer

Trainee Officer

External Recruitment

Corporate Web-site

Newspaper

Job Web-site

Interns (Less frequently used)

Internal Recruitment

Promotions & Transfers

Job Posting

Employee Referrals

Objectives

Enhancing the capacity

of the employee

Building an effective,

accountable

committed employee

Equipping Human

Resources with

requisite skills and

techniques

Trainees

Management

Trainee Officers

Executive Officers

Branch Managers

Officers of different

grades

Training institutions

AL-Arafah Islami Bank

Training & Research

Academy (AIBTRA)

Bangladesh Institute of

Bank Management (BIBM)

Bangladesh Bank Training

Academy

Programs

Training courses

Workshops

Executive workshops

Executive Development

Program (EDP)

Outreach workshops

IT training (ICT lab)

Total Training programs during 2013 : 79

Total Trainees: 2861

Annual

Performance

Appraisal

Very strict

Promotion

and salary

decisions

Key

considerations

Annual

Performance

Report (APR)

Educational

qualification

Training

received

Figure: Annual Performance

Report

Compensation

Basic salary

Allowances

Housing (50% of Basic )

Medical, transportation

Bonuses

2 festival bonuses

Incentive bonuses

Based on profit

8 people last year

Salary increment

For everyone

Exception : negative APR

Leave

Casual leave (15 days)

Earned leave (33 days)

Mandatory leave with one basic

(15 days )

6 months of maternity leave with

pay

Recruitment from 2009

Equal opportunity for

women

To maintain decency and discipline Female dress code

To provide comfortable environment

Minimum of two female

employees at a branch

To remove monotony

Full implementation of

the mandatory leave

No personal relationships and references bias No employee bias

Open door

policy

Mandatory

transfer of

employees

every three

years (success

rate 60%)

Employment for

the family

members of a

deceased

employee

6 months

maternity leave

(with full pay)

Exit interview

Only people

from Islamic

background

are recruited

Female dress

code

No single

women can

be appointed

in one

branch

Mandatory leave

Very strict annual performance appraisal

Training and skills development

Ease of access

Employee retention

Transfer of employees

At AIBL its mandatory to transfer

employees after every 3 years. This

policy has 60% success rate. it creates

a big problem as for the branch

managers and employees.

Year Turnover rate

2007 4.1

2008 2.1

2009 1.09

2010 0.95

2011 0.48

2012 0.09

2013 0.04

Recruitment

through BIBM

Employee

turnover rate

Employment

support after

death

Budget planning

Diversification of

HR department

form Head

Office

Recruitment and

selection team

Al Arafah Islami Bank Limited (AIBL) follows some unique

recruitment and HRM policies. The analysis of AIBL under

HRD revealed that people are most valuable resources for the

progress of the organization. AIBL make use of its most

important resource by developing and satisfying every need

of the employees. And the effective use of the human

resource makes the organization to achieve up to its

expectations and desired goals.

Вам также может понравиться

- Advisory Channels Case Studies: Las Vegas Hotels & Royal Bank of Mid - Western CanadaОт EverandAdvisory Channels Case Studies: Las Vegas Hotels & Royal Bank of Mid - Western CanadaОценок пока нет

- The HR Structure in UBIДокумент17 страницThe HR Structure in UBIVishwanath BhimappaОценок пока нет

- Motivation PlanДокумент11 страницMotivation PlanAnkur Dubey100% (1)

- The Six Principles of Service Excellence: A Proven Strategy for Driving World-Class Employee Performance and Elevating the Customer Experience from Average to ExtraordinaryОт EverandThe Six Principles of Service Excellence: A Proven Strategy for Driving World-Class Employee Performance and Elevating the Customer Experience from Average to ExtraordinaryОценок пока нет

- HRM in Banking Sector: Section B, Group 2 Faculty - Dr. Mousumi SenguptaДокумент15 страницHRM in Banking Sector: Section B, Group 2 Faculty - Dr. Mousumi SenguptaManu BОценок пока нет

- Ubl (Recruitment & Selection) 2Документ18 страницUbl (Recruitment & Selection) 2Fahad Aliani50% (6)

- Introduction To Organization: Habib Bank Limited Commonly Referred To As "HBL" and Head-Quartered in HabibДокумент8 страницIntroduction To Organization: Habib Bank Limited Commonly Referred To As "HBL" and Head-Quartered in HabibfaizanusmanОценок пока нет

- HR Practices of ICICI and SBIДокумент6 страницHR Practices of ICICI and SBIAmit Kumar45% (11)

- Standard CharteredДокумент18 страницStandard CharteredZubair AnjumОценок пока нет

- AskariДокумент31 страницаAskariShoaib QuddusОценок пока нет

- Askari Commercial Bank and NBP Comparison of HR PoliciesДокумент52 страницыAskari Commercial Bank and NBP Comparison of HR PoliciesRabia100% (2)

- HRM Report Bank AlfalahДокумент31 страницаHRM Report Bank AlfalahMirza MunirОценок пока нет

- Press Me UpДокумент24 страницыPress Me UpVarun BharathОценок пока нет

- Icici Bank of IndiaДокумент24 страницыIcici Bank of IndiaVarun BharathОценок пока нет

- Compensation and BenifitsДокумент162 страницыCompensation and BenifitsAnonymous WnrRCpОценок пока нет

- DibДокумент22 страницыDibHasan ViqarОценок пока нет

- HR Policy UBI & Yes BankДокумент20 страницHR Policy UBI & Yes BankGaurav Kumar97% (34)

- Human Resource PlanningДокумент50 страницHuman Resource PlanningMotiur Rahman GeorgeОценок пока нет

- HRM Report: Bank AlfalahДокумент24 страницыHRM Report: Bank Alfalahsaleemzaffar84_42042Оценок пока нет

- HRM 502 PPT Exim BankДокумент26 страницHRM 502 PPT Exim BankTasnim MumuОценок пока нет

- Presentation (Old)Документ117 страницPresentation (Old)Md. Saiful IslamОценок пока нет

- Compensation and BenefitsДокумент161 страницаCompensation and BenefitskulsoomalamОценок пока нет

- Slides of Internship Report NBPДокумент51 страницаSlides of Internship Report NBPUmm E MaryamОценок пока нет

- A Short Report On UCB of HRMДокумент23 страницыA Short Report On UCB of HRMPeterson0% (1)

- MBA Final Consultancy ProjectДокумент47 страницMBA Final Consultancy ProjectatifcomputerzОценок пока нет

- BRACДокумент38 страницBRACMahmudur Rahman100% (3)

- Union BankДокумент7 страницUnion BankChoice MyОценок пока нет

- CBL HRДокумент17 страницCBL HROmor Sahariar PolashОценок пока нет

- Compensation and BenifitsДокумент155 страницCompensation and BenifitskulsoomalamОценок пока нет

- Al-Arafah Islami Bank Limited: An OverviewДокумент17 страницAl-Arafah Islami Bank Limited: An OverviewRubel50Оценок пока нет

- Premier Bank ReportДокумент10 страницPremier Bank ReportraktimbeastОценок пока нет

- SWOT AnalysisДокумент15 страницSWOT AnalysisTadesse DinkuОценок пока нет

- USM Final Internship ReoprtДокумент40 страницUSM Final Internship ReoprtShining Eyes100% (1)

- HRM-301 Term PaperДокумент18 страницHRM-301 Term PaperShaiful Islam HimelОценок пока нет

- NBL..Slidez 2Документ14 страницNBL..Slidez 2Andrew JordanОценок пока нет

- Group K - ICICI Bank - MCS ReportДокумент16 страницGroup K - ICICI Bank - MCS ReportAnkit SaxenaОценок пока нет

- Jamuna BankДокумент88 страницJamuna BankMasood PervezОценок пока нет

- Karim Javeri CVДокумент3 страницыKarim Javeri CVkareem.javeriОценок пока нет

- Bharat SharmaДокумент19 страницBharat SharmaG2BPLОценок пока нет

- MY REPORT MCB BankДокумент63 страницыMY REPORT MCB BankLoving SeeroОценок пока нет

- Jamuna ReportДокумент31 страницаJamuna Reporttafsir163Оценок пока нет

- Job Satisfaction of Shahjalal Islami Bank LimitedДокумент63 страницыJob Satisfaction of Shahjalal Islami Bank LimitedRedwan Ferdous50% (2)

- INTERNSHIP ACN - ShimuДокумент35 страницINTERNSHIP ACN - ShimuIftekharul Hasan SiamОценок пока нет

- Recruitment and Selection Process of Eastern Bank LTDДокумент14 страницRecruitment and Selection Process of Eastern Bank LTDnayontaniaОценок пока нет

- Sbi Po CareerДокумент3 страницыSbi Po Careereclonline.comОценок пока нет

- Recruitment and Selection Process For 1st Level Officer in Bank AlfalahДокумент28 страницRecruitment and Selection Process For 1st Level Officer in Bank AlfalahArslan Nawaz100% (1)

- NCC Bank SampleДокумент11 страницNCC Bank SampleFahim HossainОценок пока нет

- MCB ReportДокумент35 страницMCB Reportrabiya0% (1)

- PPT. Slides of Internship Report NBPДокумент51 страницаPPT. Slides of Internship Report NBPrabirabi86% (37)

- HR Process BEXIMCO PHARMACEUTICALS LTDДокумент22 страницыHR Process BEXIMCO PHARMACEUTICALS LTDSheikh Abdullah AnnoorОценок пока нет

- National Bank of PakistanДокумент26 страницNational Bank of PakistanToûƧȝȝfIqßalMûghÅlОценок пока нет

- Human Resource Management Process in The OrganizationДокумент19 страницHuman Resource Management Process in The OrganizationabubakarsahilОценок пока нет

- Accounting Practices of Al - Arafah Islami Bank Limited, Chawkbazar Branch BranchДокумент61 страницаAccounting Practices of Al - Arafah Islami Bank Limited, Chawkbazar Branch BranchBishal Islam100% (1)

- Chapter DkalДокумент27 страницChapter DkalSaif UzZolОценок пока нет

- Strategy Analyses of Banks, Problems and Plausible SolutionsДокумент41 страницаStrategy Analyses of Banks, Problems and Plausible Solutionsshakhawat hossainОценок пока нет

- HR Comparison Between HSBC and SCBДокумент16 страницHR Comparison Between HSBC and SCBAftab MohammedОценок пока нет

- Sample - Group 6 - Final Report - Recruitment and SelectionДокумент30 страницSample - Group 6 - Final Report - Recruitment and SelectionUROOJ -Оценок пока нет

- Assessment of Culture of Standard Chartered BankДокумент5 страницAssessment of Culture of Standard Chartered BankMahtab OsmaniОценок пока нет

- PO FinalДокумент18 страницPO FinalAthar MalikОценок пока нет

- Internship On Grameen PhoneДокумент88 страницInternship On Grameen PhoneFarhat987Оценок пока нет

- Final Report GrameenPhoneДокумент81 страницаFinal Report GrameenPhoneFarhat9870% (1)

- Analysis & Findings - GPДокумент79 страницAnalysis & Findings - GPFarhat987Оценок пока нет

- Report On Grameen PhoneДокумент43 страницыReport On Grameen PhoneFarhat987Оценок пока нет

- Company Overview - GPДокумент22 страницыCompany Overview - GPFarhat987Оценок пока нет

- Chapter One: Page 1 of 47Документ47 страницChapter One: Page 1 of 47Farhat987Оценок пока нет

- Southeast Bank Limited: Auditors' Report To The Shareholders ofДокумент2 страницыSoutheast Bank Limited: Auditors' Report To The Shareholders ofFarhat987Оценок пока нет

- The Foundation of Our Strength: Our Vision, Missions and Commitments To ClientsДокумент69 страницThe Foundation of Our Strength: Our Vision, Missions and Commitments To ClientsFarhat987Оценок пока нет

- Annual Report 2011Документ207 страницAnnual Report 2011Farhat987Оценок пока нет

- Annual Report 2006Документ65 страницAnnual Report 2006Farhat987Оценок пока нет

- Annual Report 2007Документ101 страницаAnnual Report 2007Farhat987Оценок пока нет

- DBBL ProjectДокумент42 страницыDBBL ProjectFarhat987Оценок пока нет

- Annual Report 2005Документ39 страницAnnual Report 2005Farhat987Оценок пока нет

- First Security BankДокумент5 страницFirst Security BankFarhat987Оценок пока нет

- Understanding Specific Needs in Health and Social CareДокумент18 страницUnderstanding Specific Needs in Health and Social CareFarhat987Оценок пока нет

- My LifeДокумент9 страницMy LifeFarhat987Оценок пока нет

- First Security BankДокумент13 страницFirst Security BankFarhat987Оценок пока нет

- First Security BankДокумент8 страницFirst Security BankFarhat987Оценок пока нет

- First Security BankДокумент5 страницFirst Security BankFarhat987Оценок пока нет

- EXIMДокумент7 страницEXIMFarhat987Оценок пока нет

- Southeast University: Internship ReportДокумент1 страницаSoutheast University: Internship ReportFarhat987Оценок пока нет

- First Security BankДокумент11 страницFirst Security BankFarhat987Оценок пока нет

- Principles of Health and Social Care PracticeДокумент12 страницPrinciples of Health and Social Care PracticeFarhat987100% (5)

- DBBLДокумент110 страницDBBLFarhat987Оценок пока нет

- A Report On "Pulses": Business CommunicationДокумент21 страницаA Report On "Pulses": Business CommunicationFarhat987Оценок пока нет

- Oxfam Strategic Plan, 2013-2019Документ32 страницыOxfam Strategic Plan, 2013-2019Farhat987Оценок пока нет

- TRT - mgt351 Chapter 1Документ20 страницTRT - mgt351 Chapter 1Farhat987Оценок пока нет

- Oxfam GB PolicyДокумент5 страницOxfam GB PolicyFarhat987Оценок пока нет

- Sample Chart of Accounts: Account Name Code Financial Statement Group NormallyДокумент2 страницыSample Chart of Accounts: Account Name Code Financial Statement Group NormallyQamar ShahzadОценок пока нет

- Indzara Personal Finance Manager 2010 v2Документ8 страницIndzara Personal Finance Manager 2010 v2AlexandruDanielОценок пока нет

- The Civilisation of The Renaissance in Italy by Burckhardt, Jacob, 1818-1897Документ239 страницThe Civilisation of The Renaissance in Italy by Burckhardt, Jacob, 1818-1897Gutenberg.org100% (1)

- Financial Analysis and Reporting ModuleДокумент163 страницыFinancial Analysis and Reporting ModuleMarc JeromeОценок пока нет

- Quality Rice MillДокумент65 страницQuality Rice MillBaseerou Yousouf Al-zomoweeОценок пока нет

- Success Center Accounting Tips and Practice Sheet Building Blocks To A General Journal Entry and T-AccountДокумент2 страницыSuccess Center Accounting Tips and Practice Sheet Building Blocks To A General Journal Entry and T-AccountThe PsychoОценок пока нет

- Current Liabilities and Payroll AccountingДокумент17 страницCurrent Liabilities and Payroll AccountingEla PelariОценок пока нет

- Government of Philippine Islands vs. El Hogar FilipinoДокумент3 страницыGovernment of Philippine Islands vs. El Hogar FilipinoCharmila SiplonОценок пока нет

- Instructions For Form 990-T: Internal Revenue ServiceДокумент15 страницInstructions For Form 990-T: Internal Revenue ServiceIRSОценок пока нет

- 2016 SALN Form - JudithdocДокумент2 страницы2016 SALN Form - JudithdocNDAP DavaoОценок пока нет

- Business Economics - Question BankДокумент4 страницыBusiness Economics - Question BankKinnari SinghОценок пока нет

- CORPORATE TAX PLANNING AND MANAGEMENT CiaДокумент4 страницыCORPORATE TAX PLANNING AND MANAGEMENT CiaAaronОценок пока нет

- What - If Using ExcelДокумент17 страницWhat - If Using ExcelcathycharmedxОценок пока нет

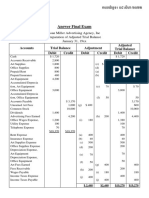

- Answer Final Exam (POA)Документ2 страницыAnswer Final Exam (POA)Phâk Tèr ÑgОценок пока нет

- TFA - Chapter 40 - DepreciationДокумент6 страницTFA - Chapter 40 - DepreciationAsi Cas JavОценок пока нет

- Documents - MX - Logical and Analytical ReasoningДокумент29 страницDocuments - MX - Logical and Analytical ReasoningzeekumОценок пока нет

- ACCT 3001 Chapter 5 Assigned Homework SolutionsДокумент18 страницACCT 3001 Chapter 5 Assigned Homework SolutionsPeter ParkОценок пока нет

- CH 14 SimulationДокумент85 страницCH 14 SimulationaluiscgОценок пока нет

- Inventory CostiДокумент8 страницInventory CostiChowsky123Оценок пока нет

- Name: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCAДокумент3 страницыName: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCASuy YanghearОценок пока нет

- Global Research: Arab Potash CompanyДокумент38 страницGlobal Research: Arab Potash Companynahool1990Оценок пока нет

- Mind Map Chapter 3 and 4 OutlineДокумент2 страницыMind Map Chapter 3 and 4 OutlinePatricia SantosОценок пока нет

- UBL Internship FinlllДокумент102 страницыUBL Internship FinlllAbdul JabbarОценок пока нет

- Housing Loan DetailsДокумент9 страницHousing Loan DetailsPandurangbaligaОценок пока нет

- Appendix eДокумент2 страницыAppendix eapi-283357075Оценок пока нет

- Materials For Soap MakingДокумент31 страницаMaterials For Soap Making123satОценок пока нет

- A Project Report On "Exhibit & Presentation Linking" An Event Study ATДокумент41 страницаA Project Report On "Exhibit & Presentation Linking" An Event Study ATNaresh ReddyОценок пока нет

- TS Grewal Solutions For Class 11 Accountancy Chapter 13 - Depreciation - CBSE TutsДокумент44 страницыTS Grewal Solutions For Class 11 Accountancy Chapter 13 - Depreciation - CBSE TutsRahul Kashiramka72% (18)

- BCGДокумент138 страницBCGANKUSHSINGH2690Оценок пока нет

- Quiz 2 AnswersДокумент7 страницQuiz 2 AnswersAlyssa CasimiroОценок пока нет