Академический Документы

Профессиональный Документы

Культура Документы

Presentation On Zakah

Загружено:

helperforeu50%(2)50% нашли этот документ полезным (2 голоса)

1K просмотров15 страницAfter Salah, Zakah is the main act of worship which has to be performed monetarily. Whoever evades Zakah has been warned of the consequences in this world and hereafter. Zakah functions as a social security for all. Those who have enough money today pay for what they have. If they need money tomorrow they will get what is necessary to help them live decently.

Исходное описание:

Оригинальное название

Presentation on Zakah

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAfter Salah, Zakah is the main act of worship which has to be performed monetarily. Whoever evades Zakah has been warned of the consequences in this world and hereafter. Zakah functions as a social security for all. Those who have enough money today pay for what they have. If they need money tomorrow they will get what is necessary to help them live decently.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

50%(2)50% нашли этот документ полезным (2 голоса)

1K просмотров15 страницPresentation On Zakah

Загружено:

helperforeuAfter Salah, Zakah is the main act of worship which has to be performed monetarily. Whoever evades Zakah has been warned of the consequences in this world and hereafter. Zakah functions as a social security for all. Those who have enough money today pay for what they have. If they need money tomorrow they will get what is necessary to help them live decently.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 15

Importance of Zakah

• Zakah is one of the five pillars of Islam.

• It has been mentioned, along with daily Prayers (Salah/

Namaz), over thirty two times in the Quran.

• Allah's word commanding ".....and establish regular Salah

and give regular Zakah....." are referred to in many parts of

the Quran.

From this we can conclude that after Salah, Zakah is the

most important act in Islam.

• Just as Salah is the most important act of worship which has

to be performed bodily, so is Zakah the main act of worship

which has to be performed monetarily.

• Those who fulfill this duty have been promised abundant

reward in this world and hereafter. Whoever evades Zakah

has been sternly warned in the Qur'an and Hadith of the

consequences.

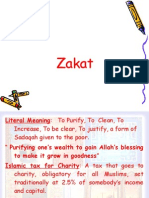

Meanings

• Linguistically, Zakah has two

meanings: purification and growth.

• Technically, it means to purify

one's possession of wealth by

distributing a prescribed amount to

the poor, the indigent, the slaves

or captives, and the wayfarer.

Benefits of Giving Zakah

There are many major benefits of giving Zakah:

• It reminds Muslims of the fact that whatever wealth they may

possess is due to the blessings of Allah and as such it is to be

spent according to the His commands.

• Zakah functions as a social security for all. Those who have

enough money today pay for what they have. If they need

money tomorrow they will get what is necessary to help them

live decently.

• Zakah payer pays his dues to Allah as an act of worship, a

token of submission and an acknowledgment of gratitude. The

receiver of Zakah receives it as a grant from Allah out of His

bounty, a favor for which he is thankful to Allah.

• Economically, Zakah is the best check against hoarding. Those

who do not invest their wealth but prefer to save or hoard it

would see their wealth dwindling year after year at the rate of

the payable Zakah. This helps increase production and

stimulates supply because it is a redistribution of income that

enhances the demand by putting more real purchasing power in

the hands of poor.

Obligation of Zakah

• Zakah is obligatory upon a person if :

• He or she is an adult, sane, free and Muslim.

• He/she must possess wealth in excess of

specified minimum (Nisaab) excluding his or

her personal needs (clothing, household

furniture, utensils, cars etc. are termed article

of personal needs).

• It should be possessed for a complete lunar

year.

• It should be of productive nature from which

one can derive profit or benefit such as

merchandise for business, gold, silver, livestock

etc.

Amount of Wealth/Nisaab

• The amount of wealth which makes one liable for

Zakah is called Nisaab. The Nisaab as fixed by

Prophet Muhammad (P.B.U.H) is as follows:

• Nisaab of cash, stock or bonds, other cash assets is the

equivalent amount of Gold or Silver. Nisaab is calculated by

adding up the cash value of all the assets such as gold, silver,

currency etc. and if it is equal to or in excess of the minimum

Nisaab as specified in the above table, the Zakah is due at the

rate of 2.5%.

• The payment of Zakah is compulsory on the excess wealth or

effects which is equal to or exceeds the value of Nisaab, and

which is possessed for a full Islamic year. If such wealth

decreases during the course of the year and increases again to

the value of Nisaab before the end of the year, the Zakat then

must be calculated on the full amount that is possessed at the

end of the year.

TYPES OF WEALTH ON WHICH

ZAKAT IS IMPOSED

• 1. Gold and silver, in any form.

• 2. Cash, bank notes, stocks,

bonds etc.

• 3. Merchandise for business,

equal to the value of Nisaab.

• 4. Live stock.

• On income derived from rental

business.

CALCULATION OF ZAKAT

• 1. To calculate Zakah on jewelry etc. one must first

determine the gold or silver content and then calculate

the Zakah according to current market price.

• 2. If the Gold possessed is less than 87.48 grams or if

silver possessed is less then 612.36 grams, but the

value of both combined is equal to or exceeds the

Nisaab of either Gold or Silver, the Zakah will be due.

• 3. In the event of an article not being of pure gold or

pure silver, but containing a mixture of other metals

and the gold or silver content is more than the other

metal, it will be regarded as gold or silver and Zakat will

be due. But in the case where other metal/s is of

greater quantity than either gold or silver, Zakat will

not be due on this article.

CALCULATION OF ZAKAT

• 4. For stocks (shares held in a company), Zakat is

calculated based upon the current market value. As

machinery, land, fixtures and fittings, furniture,

buildings etc. are exempt from Zakat, one is allowed

to subtract these from the total asset. This could be

obtained from annual reports. For example, if one has

shares worth $1000 and machinery, land etc., are

worth 5% of the total asset, then deduct $50 for

these assets, afterwards deduct the liabilities of the

company proportionately to the percentage of shares

held. Zakat must be calculated on the balance.

DISTRIBUTION OF ZAKAT

• 1. Zakah should be given as soon as possible after it

becomes due.

• 2. All of the Zakah can be given to one person or to several

persons.

• 3. A poor man cannot be paid for his work from Zakah nor

can Zakah be given in payment of services, except to the

people appointed by the Islamic government to collect

Zakah.

• 4. Zakah will only be valid if the recipient is made the

owner of that amount. If, for example, a few needy persons

are fed a meal from Zakah money, then Zakah will not be

fulfilled as they were not made owners of the food.

• 5. Zakah cannot be given for the construction of Masjid,

Madrasah, Hospital, a well, a bridge or any other public

amenity.

• 6. Zakah can be paid in kind from the same merchandise on

which it is due, or alternatively, it could be paid in cash.

TYPES OF WEALTH ON WHICH ZAKAT IS

NOT IMPOSED

• 1. On any metals other than gold or silver.

• 2. Fixtures and fittings of a shop, car, trucks or any

delivery vehicle etc., which is used in running

business.

• 3. Diamonds, pearls, other precious or semi

precious stones which are for personal use.

• 4. There is no Zakah on personal residence,

household furniture, pots and pan, personal clothing,

whether they are in use or not.

• 5. There is no Zakah on a person whose liabilities

exceed or equal his assets. (Home Mortgage in this

country is not to be counted as personal liability for

the Zakah purpose).

RECIPIENTS OF ZAKAT

• The recipients of Zakah, according to Quran are as follows:

• "Alms are for the poor and the needy, and those employed to

administer (the funds); for those whose hearts have been

(recently) reconciled (to truth); for those in bondage and in debt;

and for the wayfarer: (Thus is it) ordained by Allah, and Allah is

full of Knowledge and Wisdom." (Quran 9:60)

• 1. FUQARA: people who are poor and who possess more than

their basic needs but do not possess wealth equal to Nisaab.

• 2. MASAKEEN: people who are destitute and extremely needy

to the extent they are forced to beg for their daily food rations.

• 3. AL-AMILEEN: people appointed by an Islamic Government to

collect Zakah.

• 4. MU-ALLAFATUL-QULUB: persons who have recently

accepted Islam and are in need of basic necessities who would

benefit from encouragement by Muslims which would help

strengthen their faith.

RECIPIENTS OF ZAKAT

• 5. AR-RIQAAB: slaves who are permitted to work for

remuneration and have an agreement from their masters to

purchase their freedom on payment of fixed amounts.

• 6. AL-GHAARIMEEN: persons who have a debt and do not

possess any other wealth or goods with which they could repay

that which they owe. It is conditional that this debt was not

created for any un-Islamic purpose.

• 7. FI-SABILILLAH: persons who have to carry out an

obligatory deed which has become obligatory on them and

subsequently (due to loss of wealth) are unable to complete

that obligation.

• 8. IBN-US-SABEEL: persons who are travelers and during

the course of their journey do not possess basic necessities,

though they are well to do at home. They could be given Zakat

in order to fulfill travel needs to return home.

PERSONS WHO CANNOT BE GIVEN

ZAKAT

• 1. Zakah cannot be given to the descendants of

Muhammad (P.B.U.H);

• 2. Zakah cannot be given to parents and

grandparents. In the same manner one's children

and grandchildren cannot be given Zakah. A

husband and wife cannot give Zakat to each

other.

• 3. Zakah contributions cannot be given to such

institutions or organizations who do not give the

rightful recipients possession of Zakah, but

instead use Zakah funds for constructions,

investment or salaries.

VIRTUES OF ZAKAT:

• Allah says in the Quran:

• "The parable of those who spend their wealth in the way of

Allah is that of a grain of corn. It grows seven ears and

each ear has hundred grains. Allah increases manifold to

whom He pleases." (Quran 2:261)

• It is stated in the Hadith that by giving Zakat the following

benefits are derived:

• 1. Gain the pleasure of Allah.

• 2. Increase in wealth and protection from losses.

• 3. Allah's forgiveness and blessings.

• 4. Protection from the wrath of Allah and from a bad

death.

• 5. A shelter on the Day of Judgment;

• 6. Security from seventy misfortunes.

THE PUNISHMENT FOR NOT

GIVING ZAKAH

• Allah says in the Quran:

• "And there are those who hoard gold and silver

and do not spend it in the way of Allah,

announce to them a most grievous penalty

(when) on the Day of Judgment heat will be

produced out of that wealth in the fire of Hell.

Then with it they will be branded on their

forehead and their flanks and backs. (It will be

said to them) This is the treasure which you

hoarded for yourselves, taste then the treasure

that you have been hoarding." (Al-Quran 9:34-

35)

Вам также может понравиться

- Quick N Easy Pasta Dishes: Prep Time Is 15 Minutes Or LessОт EverandQuick N Easy Pasta Dishes: Prep Time Is 15 Minutes Or LessОценок пока нет

- Beta Thalassemia: DefinitionДокумент9 страницBeta Thalassemia: Definitioncelestina dawn peterОценок пока нет

- Coronavirus Disease 2019 (COVID-19) : Because Learning Changes EverythingДокумент29 страницCoronavirus Disease 2019 (COVID-19) : Because Learning Changes EverythingDennis MuthusiОценок пока нет

- E.how To A Build A Good FriendshipДокумент1 страницаE.how To A Build A Good FriendshipThuỳ Vy NguyễnОценок пока нет

- High Risk Newborn - Study GuideДокумент10 страницHigh Risk Newborn - Study GuideMalou Yap Buot100% (1)

- A Middle-Range Theory of Self-Care ofДокумент24 страницыA Middle-Range Theory of Self-Care ofARIKAОценок пока нет

- Pedia Concepts 2:: From Respiratory Problems To HematologicДокумент119 страницPedia Concepts 2:: From Respiratory Problems To HematologicarudarbmeeОценок пока нет

- Management of Wilms Tumor: Literature Review (NAMA)Документ15 страницManagement of Wilms Tumor: Literature Review (NAMA)DeaNataliaОценок пока нет

- Biofuels WorksheetДокумент3 страницыBiofuels WorksheetMan Iam StrongОценок пока нет

- Clinician'S Guide: Asthma Management GuidelinesДокумент16 страницClinician'S Guide: Asthma Management GuidelinesNata1511Оценок пока нет

- New Lab ManualДокумент81 страницаNew Lab ManualHusam AbbasОценок пока нет

- What Is Covid-19Документ5 страницWhat Is Covid-19Aunia Putri HemasОценок пока нет

- Presentation On Zakat - Dr. Mohammed Najeeb Qasmi (English)Документ30 страницPresentation On Zakat - Dr. Mohammed Najeeb Qasmi (English)The Clear Evidence100% (1)

- Or Technique Scrubbing, Gowning and Arranging Instruments: 1. Define The Following Terms: Peri - Operative NursingДокумент35 страницOr Technique Scrubbing, Gowning and Arranging Instruments: 1. Define The Following Terms: Peri - Operative NursingHoney MacabuhayОценок пока нет

- Genetics: (Percentage Breakdown of Overall Hemophilia Population by Severity)Документ2 страницыGenetics: (Percentage Breakdown of Overall Hemophilia Population by Severity)uikgykОценок пока нет

- Hemophilia AДокумент29 страницHemophilia ASari RakhmawatiОценок пока нет

- RESPIRATORY DISORDERS (Abdurahman S)Документ19 страницRESPIRATORY DISORDERS (Abdurahman S)Rahmat MuliaОценок пока нет

- NCP CaseДокумент34 страницыNCP CaseIsobel Mae JacelaОценок пока нет

- OBLICON 2nd Exam CasesДокумент241 страницаOBLICON 2nd Exam CasesAmanda ButtkissОценок пока нет

- Thalassemia 20-05-2020Документ164 страницыThalassemia 20-05-2020Mohd Anas SheikhОценок пока нет

- Apnea 2019Документ10 страницApnea 2019aiswarya sreekumarОценок пока нет

- VII. Drug StudyДокумент11 страницVII. Drug StudyJeffrey Dela CruzОценок пока нет

- Advantages and Disadvantages of Various Assessment MethodsДокумент7 страницAdvantages and Disadvantages of Various Assessment MethodsYenTranОценок пока нет

- ThalassemiaДокумент16 страницThalassemiaAry AffandiОценок пока нет

- Care of Clients With Alterations in Oxygen Carrying Capacity (Hematologic Disorder)Документ30 страницCare of Clients With Alterations in Oxygen Carrying Capacity (Hematologic Disorder)Michael John CanlasОценок пока нет

- Important Resources For Older AdultsДокумент4 страницыImportant Resources For Older AdultsState Senator Liz KruegerОценок пока нет

- Postpartum DisordersДокумент68 страницPostpartum DisordersPrecious SorianoОценок пока нет

- CD Sample Meeting ScriptДокумент10 страницCD Sample Meeting ScriptChristine BОценок пока нет

- Commonly Used Drugs in HDДокумент2 страницыCommonly Used Drugs in HDanon_140774008Оценок пока нет

- Dua Before Starting ClassesДокумент1 страницаDua Before Starting ClassesAun Hasan AliОценок пока нет

- Stool ExaminationДокумент5 страницStool ExaminationOlib OlieОценок пока нет

- Three Types of BiodiversityДокумент3 страницыThree Types of BiodiversityMaruthi Nayaka J PОценок пока нет

- The Role of School Principals As Human Resource Managers in Secondary Schools in Nandi County KenyaДокумент10 страницThe Role of School Principals As Human Resource Managers in Secondary Schools in Nandi County KenyaladiОценок пока нет

- ThalassemiaДокумент24 страницыThalassemiaapi-459076195Оценок пока нет

- Deetz - Theory As A Way of Seeing and ThinkingДокумент22 страницыDeetz - Theory As A Way of Seeing and Thinkingmercy silahisОценок пока нет

- 3M CVP Monitoring - Assisting in BMA ECG Interpretation - Final Draft - 3CДокумент65 страниц3M CVP Monitoring - Assisting in BMA ECG Interpretation - Final Draft - 3CAlexa GoteraОценок пока нет

- Zakat and EconomyДокумент16 страницZakat and Economyzzgohar100% (1)

- ZakatДокумент16 страницZakatSADIA SOHAILОценок пока нет

- Zakaat: Verses From The Holy Qur'anДокумент5 страницZakaat: Verses From The Holy Qur'anmurtazasahtoОценок пока нет

- ZakaatДокумент6 страницZakaatSyed MuneebОценок пока нет

- Zakat in IslamДокумент36 страницZakat in IslamSajjad AliОценок пока нет

- Understanding & Calculating Zaka H: Upda TED VER SionДокумент16 страницUnderstanding & Calculating Zaka H: Upda TED VER SionkhalidJMОценок пока нет

- Rules of Zakat PDFДокумент10 страницRules of Zakat PDFWan AbqariОценок пока нет

- Rules of Zakat PDFДокумент10 страницRules of Zakat PDFWan AbqariОценок пока нет

- Objectives Guidelines: by Faizan Quddoos and M.Fahd-Un-Nabi Khan X-O Usman Public SchoolДокумент40 страницObjectives Guidelines: by Faizan Quddoos and M.Fahd-Un-Nabi Khan X-O Usman Public SchoolFtaufiaОценок пока нет

- ZakatДокумент39 страницZakatAmeer HamzaОценок пока нет

- Zakat AlmsgivingДокумент13 страницZakat AlmsgivingMunazza AdnanОценок пока нет

- Understanding & Calculating Zakah: 1stethical Charitable Trust'SguidetoДокумент9 страницUnderstanding & Calculating Zakah: 1stethical Charitable Trust'SguidetoidamielОценок пока нет

- ZakatДокумент38 страницZakatAbdul WaseyОценок пока нет

- Objectives Guidelines: by Faizan Quddoos and M.Fahd-Un-Nabi Khan X-O Usman Public SchoolДокумент40 страницObjectives Guidelines: by Faizan Quddoos and M.Fahd-Un-Nabi Khan X-O Usman Public SchoolYami BlumutОценок пока нет

- Ashu ZakatДокумент3 страницыAshu ZakatMuhammad NABEEGHОценок пока нет

- Definition:: ZakatДокумент5 страницDefinition:: ZakatMuhammad NABEEGHОценок пока нет

- Zakat Calculater ML Ilyas GhumanДокумент6 страницZakat Calculater ML Ilyas GhumanAung Zin OoОценок пока нет

- A Practical Guide For Calculating ZakatДокумент12 страницA Practical Guide For Calculating ZakatAbdurrahman WijayaОценок пока нет

- HF PracticalGuideforCalculatingZakatДокумент12 страницHF PracticalGuideforCalculatingZakatWaqas AtharОценок пока нет

- Zakat: Hijri), Allah Made ItДокумент4 страницыZakat: Hijri), Allah Made ItTuba AbrarОценок пока нет

- Lecture ZakatДокумент19 страницLecture ZakatSaad Ur RehmanОценок пока нет

- Welfare InstituteДокумент24 страницыWelfare InstituteSANIYAAH INAMОценок пока нет

- Apzqr 1Документ41 страницаApzqr 1Arshad BashirОценок пока нет

- Understanding & Calculating Zakah: 1stethical Charitable Trust'SguidetoДокумент9 страницUnderstanding & Calculating Zakah: 1stethical Charitable Trust'SguidetoImran SaeedОценок пока нет

- Man, PhysicalДокумент8 страницMan, PhysicalhelperforeuОценок пока нет

- Progress Report Entrepren Gas BirnerДокумент3 страницыProgress Report Entrepren Gas BirnerhelperforeuОценок пока нет

- Pakistan Tobacco Limited AFSReportДокумент33 страницыPakistan Tobacco Limited AFSReporthelperforeuОценок пока нет

- Final Report EntrepreneurshipДокумент23 страницыFinal Report EntrepreneurshiphelperforeuОценок пока нет

- Report On Lakson Tobacco and Paksitan TobaccoДокумент67 страницReport On Lakson Tobacco and Paksitan TobaccoZaka Ul HassanОценок пока нет

- Lec.1 Introduction of MEДокумент44 страницыLec.1 Introduction of MEhelperforeuОценок пока нет

- Food & Water by VinodДокумент19 страницFood & Water by VinodhelperforeuОценок пока нет

- 8 You'Re Getting The Behaviour You DesignedДокумент3 страницы8 You'Re Getting The Behaviour You DesignedhelperforeuОценок пока нет

- 3 High Performance Organization Structures and CharacteristicsДокумент2 страницы3 High Performance Organization Structures and CharacteristicshelperforeuОценок пока нет

- 1 Organizational Structure and Its ClassificationsДокумент3 страницы1 Organizational Structure and Its ClassificationshelperforeuОценок пока нет

- 6 Getting It TogetherДокумент5 страниц6 Getting It TogetherhelperforeuОценок пока нет

- 2 Matrix OrganizationsДокумент3 страницы2 Matrix OrganizationshelperforeuОценок пока нет

- 7 Decentralized Organization Structures Empower and EnergizeДокумент2 страницы7 Decentralized Organization Structures Empower and EnergizehelperforeuОценок пока нет

- A Process That Account For An Individual's Intensity, Direction, PersistenceДокумент37 страницA Process That Account For An Individual's Intensity, Direction, Persistencemaknojiayasir100% (1)

- Organizational BehaviorДокумент63 страницыOrganizational BehaviorhelperforeuОценок пока нет

- Organizational Structure and DesignДокумент33 страницыOrganizational Structure and Designhelperforeu100% (1)

- EmotionsДокумент26 страницEmotionshelperforeu100% (1)

- Basic Approaches To LeadershipДокумент26 страницBasic Approaches To LeadershiphelperforeuОценок пока нет

- Mon & Bank - Final Islamic BankingДокумент32 страницыMon & Bank - Final Islamic BankinghelperforeuОценок пока нет

- Foundations of Group BehaviorДокумент30 страницFoundations of Group Behaviorhelperforeu0% (1)

- PersonalityДокумент15 страницPersonalityhelperforeuОценок пока нет

- 1 ATTITUDES and J-SatisfactionДокумент17 страниц1 ATTITUDES and J-Satisfactionhelperforeu0% (1)

- PerceptionДокумент15 страницPerceptionhelperforeuОценок пока нет

- Managerial AccountingДокумент19 страницManagerial AccountinghelperforeuОценок пока нет

- Selected Q's in Money and Banking.Документ27 страницSelected Q's in Money and Banking.helperforeuОценок пока нет

- Managing InventoryДокумент12 страницManaging InventoryhelperforeuОценок пока нет

- Report Money and BankingДокумент51 страницаReport Money and BankinghelperforeuОценок пока нет

- Mon & Bank KSCДокумент24 страницыMon & Bank KSChelperforeuОценок пока нет

- What Is AccountingДокумент33 страницыWhat Is AccountinghelperforeuОценок пока нет

- Introduction To Managerial Acct Lecture 1Документ29 страницIntroduction To Managerial Acct Lecture 1helperforeuОценок пока нет

- How To Perform Salah CorrectlyДокумент12 страницHow To Perform Salah Correctlymam3006Оценок пока нет

- IMAAM Azam - Hanifah PDFДокумент145 страницIMAAM Azam - Hanifah PDFbornflax100% (1)

- Dua'a For Sufficient SustenanceДокумент3 страницыDua'a For Sufficient Sustenancectpq72q999Оценок пока нет

- Anis Al ArwaДокумент66 страницAnis Al ArwaMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaОценок пока нет

- The Authority of The HadithДокумент28 страницThe Authority of The Hadithapi-107509421Оценок пока нет

- The Harms of Casting Lustful GlancesДокумент68 страницThe Harms of Casting Lustful GlancesIrfan YasinОценок пока нет

- Islam Has Given So Much Importance To Cleanliness As It Is Considered To Be A Part of FaithДокумент2 страницыIslam Has Given So Much Importance To Cleanliness As It Is Considered To Be A Part of FaithTariqueAnwerОценок пока нет

- P.2 IreДокумент6 страницP.2 Iresecretary chosenОценок пока нет

- Rafa Al-Yadain Reference of HadithsДокумент3 страницыRafa Al-Yadain Reference of HadithsOsama WasifОценок пока нет

- Wazaif Ush-Shaaqir RasulДокумент113 страницWazaif Ush-Shaaqir Rasuldr nuzhatОценок пока нет

- Rise and Spread of IslamДокумент18 страницRise and Spread of IslamamudhaОценок пока нет

- FiqhДокумент104 страницыFiqhLukman HakimОценок пока нет

- Muhammad, Legacy of A ProphetДокумент71 страницаMuhammad, Legacy of A ProphetBooks for IslamОценок пока нет

- Differences in Salah Between Men and WomenДокумент31 страницаDifferences in Salah Between Men and WomenMUSALMAN BHAIОценок пока нет

- Blessings of Salat Upon The ProphetДокумент25 страницBlessings of Salat Upon The ProphetB Aris Wahyu MunandarОценок пока нет

- 1 PBДокумент14 страниц1 PBIpit QueenОценок пока нет

- Islamic LawsДокумент645 страницIslamic LawsTariqul IslamОценок пока нет

- Ramadan TabooДокумент3 страницыRamadan Taboocetin.ozanahmetОценок пока нет

- Lec 5 PillarsДокумент40 страницLec 5 PillarshassanОценок пока нет

- Understanding The Four Madhhabs (With Footnotes)Документ35 страницUnderstanding The Four Madhhabs (With Footnotes)othmanedОценок пока нет

- Importance of Jummah Prayer-Nouman Ali Khan Proof ReadДокумент5 страницImportance of Jummah Prayer-Nouman Ali Khan Proof ReadAmmar Ali KhanОценок пока нет

- Purification Prayer: Book of and For ChildrenДокумент26 страницPurification Prayer: Book of and For Childrenimti13Оценок пока нет

- Ramadan: Fajr Zuhr ASR Maghrib IshāДокумент1 страницаRamadan: Fajr Zuhr ASR Maghrib IshāFarid HaibatanОценок пока нет

- The Etiquette of ConversationДокумент185 страницThe Etiquette of ConversationafeeraОценок пока нет

- Quranic Spiritual SolutionsДокумент30 страницQuranic Spiritual SolutionsFaraz KhanОценок пока нет

- Summary of SalatДокумент6 страницSummary of Salatafsharali100% (2)

- Qunoot - e - Naazilah Dua For Protection Against NaturalДокумент5 страницQunoot - e - Naazilah Dua For Protection Against NaturalhafiznoshadОценок пока нет

- Enigma of IslamДокумент90 страницEnigma of IslamArun VasanОценок пока нет

- Eid Al-FitrQUR'AN and HADITH PDFДокумент6 страницEid Al-FitrQUR'AN and HADITH PDFikramulhaqueОценок пока нет

- Miracle OF Ziyarat AshuraДокумент64 страницыMiracle OF Ziyarat AshuraShaikh Ahsan AliОценок пока нет