Академический Документы

Профессиональный Документы

Культура Документы

DuPont Systemppt

Загружено:

Bindal HeenaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DuPont Systemppt

Загружено:

Bindal HeenaАвторское право:

Доступные форматы

DuPont System

For Financial

Analysis

By Kevin Bernhardt, UW-Platteville and UW-

Extension

March 10, 2010

http://cdp.wisc.edu/Management.htm

First,

This Thing

Called Debt

Anatomy of Returns

Total Assets = Total Liabilities + Total Equity

Total amount of stuff

used in the business to

make profits (supplies,

inputs breeding stock,

machinery, etc.)

How much of

that stuff is

financed by the

bank, that is,

debt capital.

How much of

that stuff is

financed by

your own

money, that is,

equity capital.

So, when you make profits, those profits are a return to

all the assets, some of which is a return to your money

invested (equity capital) and some of which is a return

to the banks money (debt capital).

Anatomy of Returns Case 1

$1,000 of Total Assets (all financed by my own

money) generated $500 of total revenue, $400

of total expenses, and thus $100 of profits.

100

1000

=

$10 cents of

income per dollar

of asset

ROROA = 10%

Since it is all my money, then ROROE = 10%

Anatomy of Returns Case 2

$1,000 of Total Assets (financed $700 by my

own money and $300 @8% borrowed from a

bank) generated $500 of total revenue, $400

of expenses before interest for $100 profit,

and $76 profits after interest expenses.

$700

76

700

=

$300

My money

(Equity Capital)

Banks money

(Debt capital)

100

1000

=

$10.9 cents of income

per dollar of your

money

Before interest $.10 cents

of income per dollar of all

assets used.

Total Assets

$1000

ROROA = 10%

ROROE = 10.9%

ROROA>i-rate The extra is payment to equity

10% 8% Thus 2% additional to Equity

I leveraged someone elses money

to increase the return to my money.

Anatomy of Returns Case 2

$1,000 of Total Assets (financed $700 by my

own money and $300 @8% borrowed from a

bank) generated $500 of total revenue, $400

of expenses before interest for $100 profit,

and $76 profits after interest expenses.

ROROA>i-rate Thus ROROE>ROROA (thats good)

Return on equity capital 10% * $700 $70

Return on debt capital (10%-8%) * $300 $6

Total return $76

$76/$700 = 10.9% ROROE

DuPont System

Developed in 1919 by a finance executive at E.I.

du Pont de Nemours and Co

The DuPont system is a way of visualizing the

information so that everyone can see it.

(Stephen Jablonsky, Penn State University)

DuPont analysis is a good tool for getting

people started in understanding how they can

have an impact on results (Doug McCallen,

Caterpillar Inc.)

Number one, its simple (Sam Siegel, CFO)

DuPont System

DuPont Financial Analysis Model is a

rather straightforward method for

assessing the factors that influence a

firms financial performance. (Gunderson,

Detre, and Boehlje, AgriMarketing 2005)

DuPont System What is It?

The system identifies profitability as

being impacted by three different levers:

1. Earnings & efficiency in earnings

2. Ability of your assets to be turned into profits

3. Financial leverage

Earnings

Turnings

Leverage

Operating

Profit Margin

Asset

Turnover

Return On

Assets (less

interest adj.)

Financial

Structure

Return On

Equity

X =

X =

Income

Stream

Investment

Stream

Turnings/Asset Use

Leverage

DuPont System

Earnings/Efficiency

Operating

Profit Margin

Asset

Turnover

Return On

Assets (less

interest adj.)

Financial

Structure

Return On

Equity

X =

X =

Income

Stream

Investment

Stream

Earnings

Turnings

Leverage

DuPont System Ratios

Lets Do The Math

Operating

Profit Margin

Asset

Turnover

Return On

Assets (less

interest adj.)

Financial

Structure

Return On

Equity

X =

X =

Turnings/Asset Use

Leverage

DuPont System

Earnings/Efficiency

NFIFO + interest paid - unpaid labor/mgt

ROROA =

Total Assets

NFIFO + interest pd unpaid labor/mgt

Total Revenue

Total Revenue

Total Assets

Rate Of Return On Assets

Operating Profit Margin Ratio Asset Turnover Ratio

X

Operating

Profit Margin

Asset

Turnover

Return On

Assets (less

interest adj.)

Financial

Structure

Return On

Equity

X =

X =

Turnings/Asset Use

Leverage

DuPont System

Earnings/Efficiency

NFIFO unpaid labor/mgt

ROROE =

Total Equity

NFIFO + interest pd. unpaid labor/mgt

Total Assets

Total Assets

Total Equity

Rate Of Return On Equity

Rate Of Return On Assets

Leverage Ratio

-

interest pd.

Total Assets

i-rate Adj.

=

NFIFO unpaid labor/mgt

Total Assets

X

Net Farm Income From Operations

(NFIFO)

NFIFO = Total Revenue Basic Costs Non Basic Costs

sales, govt. pmts,

custom work +(-)

inventory changes

cash expenses

+(-) accrual expense changes

labor

+ depreciation

+ interest expenses

NFIFO = Total Revenue COGS Operating Expenses Interest

Return On

Assets

Total Assets

Total Equity

Return On

Equity

X =

Leverage

Leverage is the mix of debt

versus equity capital used in

making profits.

- Do we have too much debt?

- Do we have enough debt?

- Is our debt capital generating

profits?

- Can our debt capital be put to

better use?

OK

Too Low

Too Low

NFIFO unpaid labor/mgt + interest

Total Revenue

Total Revenue

Total Assets

Return On

Assets

Total Assets

Total Equity

Return On

Equity

X =

X =

Earnings

Turnings

Leverage

cash income +(-) inventory changes

cash expenses +(-) accrual exp changes + purch lstk Depr

labor + depreciation + interest expenses

OK

Too Low

OPMR

ATO OK

Too Low

Total Revenue =

Basic Costs =

Non Basic Costs =

OK

Too Low

-Too much labor given output

- Not enough labor

-Training and Education

- Better systems and processes

- Weekly/Daily staff meetings

- Performance metrics

NFIFO unpaid labor/mgt + interest

Total Revenue

Total Revenue

Total Assets

Return On

Assets

Total Assets

Total Equity

Return On

Equity

X =

X =

Earnings

Turnings

Leverage

OPMR

ATO

Too Low

OK

Too Low

OK

Too Low

-Unproductive machinery?

- Buildings not being used?

- Breeding livestock not producing?

- Unproductive land?

- Over valued assets?

Also, selling off unproductive assets

and paying off debt could change

your leverage position in a positive

way, and also improve your ROROE!

Financial Diagnostics via DuPont.

Finding the Red Flags!

ROROE

too Low

ROROA

too Low

Revenues too

low for costs

Unused or

Under

Utilized

Assets

Obsolete or

Inefficient

Assets

Leverage

Wrong Kind of

Debt

Not Enough

Debt

OPM too

Low

ATO too

Low

Costs too high

for Revenues

Prices

Production

Quality

Facilities

Processes

Operations

Health

Labor

Repairs

Timeliness

Management

Ability to

Manage

Assets

End

http://cdp.wisc.edu/Management.htm

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

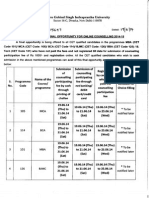

- Guidelines For Internal Marks and Assignments New - PDF (4th Sem)Документ2 страницыGuidelines For Internal Marks and Assignments New - PDF (4th Sem)Bindal HeenaОценок пока нет

- The Nature of Risk ManagementДокумент36 страницThe Nature of Risk ManagementBindal HeenaОценок пока нет

- CustodyДокумент6 страницCustodyBindal HeenaОценок пока нет

- Unit - I Introduction To SHRMДокумент26 страницUnit - I Introduction To SHRMBindal HeenaОценок пока нет

- 2 Decision MakingДокумент16 страниц2 Decision MakingBindal HeenaОценок пока нет

- NTPC Project ReportДокумент88 страницNTPC Project ReportBindal HeenaОценок пока нет

- Abreviations: Difc Dubai International Financial Centre LTDДокумент1 страницаAbreviations: Difc Dubai International Financial Centre LTDBindal HeenaОценок пока нет

- Assignment FMIДокумент2 страницыAssignment FMIBindal HeenaОценок пока нет

- Schedule Opportunity 190614Документ4 страницыSchedule Opportunity 190614Bindal HeenaОценок пока нет

- 3 Money MarketДокумент14 страниц3 Money MarketBindal HeenaОценок пока нет

- 4 Call Money MarketДокумент36 страниц4 Call Money MarketBindal HeenaОценок пока нет

- 10 Capital Adequacy NormsДокумент23 страницы10 Capital Adequacy NormsBindal HeenaОценок пока нет

- Performance EvaluationДокумент8 страницPerformance Evaluationanupam99276Оценок пока нет

- L1 L3Документ21 страницаL1 L3Bindal HeenaОценок пока нет

- 2 Primary MarketДокумент28 страниц2 Primary Marketshrutidas2Оценок пока нет

- Share Price of Hul ExcelДокумент2 страницыShare Price of Hul ExcelBindal HeenaОценок пока нет

- L1 L3Документ21 страницаL1 L3Bindal HeenaОценок пока нет

- Narasimham Committee ReportsДокумент28 страницNarasimham Committee ReportsBindal HeenaОценок пока нет

- Sonali B PlanДокумент6 страницSonali B PlanBindal HeenaОценок пока нет

- Project Monitoring System: in NTPCДокумент38 страницProject Monitoring System: in NTPCBindal HeenaОценок пока нет

- Capital Adequacy 148Документ11 страницCapital Adequacy 148Bindal Heena100% (1)

- 1 Financial MarketДокумент32 страницы1 Financial MarketBindal Heena100% (2)

- Project Management in Ntpc-LibreДокумент25 страницProject Management in Ntpc-LibreBindal Heena100% (1)

- NTPC Faridabad Summer Internship ReportДокумент50 страницNTPC Faridabad Summer Internship ReportBindal HeenaОценок пока нет

- Project Monitoring System: in NTPCДокумент38 страницProject Monitoring System: in NTPCBindal HeenaОценок пока нет

- Moneycontrol NTPC PL Account and Balance SheetДокумент6 страницMoneycontrol NTPC PL Account and Balance SheetBindal HeenaОценок пока нет

- Security ThreatsДокумент49 страницSecurity ThreatsBindal HeenaОценок пока нет

- Training&Academic Calendar 2013-2014Документ152 страницыTraining&Academic Calendar 2013-2014shaktikumarjhaОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- WWF Idh Toolkit FinalДокумент56 страницWWF Idh Toolkit FinalJayverdhan TiwariОценок пока нет

- Coaching Book Jim Rohn OrganizedДокумент10 страницCoaching Book Jim Rohn OrganizedDima FayzullaevОценок пока нет

- RIL's Super Long Bonds: Samir Goyal B17046 BM Section-AДокумент6 страницRIL's Super Long Bonds: Samir Goyal B17046 BM Section-APrathameshОценок пока нет

- Categorical Data Analysis 3rd Edition Agresti Solutions ManualДокумент35 страницCategorical Data Analysis 3rd Edition Agresti Solutions Manualparellacullynftr0100% (20)

- Management Report CLHGДокумент41 страницаManagement Report CLHGSilviu Andrei EneОценок пока нет

- Opportunity Rotary Magazine Vol 2Документ10 страницOpportunity Rotary Magazine Vol 2Wangi FrancisОценок пока нет

- Day 1 S3 RappoportДокумент10 страницDay 1 S3 RappoportDetteDeCastroОценок пока нет

- Promissory Note - SampleДокумент4 страницыPromissory Note - SampleSally SiaotongОценок пока нет

- Maturity+ +P17 1Документ4 страницыMaturity+ +P17 1Cristin Butler KalbОценок пока нет

- Week 3 Individual AssginmentДокумент9 страницWeek 3 Individual AssginmentJames Bradley HuangОценок пока нет

- Chapter 2 Audit of ReceivablesДокумент33 страницыChapter 2 Audit of ReceivablesDominique Anne BenozaОценок пока нет

- Business Opportunity IdentificationДокумент45 страницBusiness Opportunity IdentificationMarkus Bernabe Davira100% (1)

- An Analysis of Retail Banking in Indian Banking SectorДокумент90 страницAn Analysis of Retail Banking in Indian Banking SectorShailendra Soni50% (4)

- Risk Management: Case Study On AIGДокумент8 страницRisk Management: Case Study On AIGPatrick ChauОценок пока нет

- Section 3 Condonation or Remission of The DebtДокумент2 страницыSection 3 Condonation or Remission of The DebtMariaFaithFloresFelisartaОценок пока нет

- International Financial Management 11 Edition: by Jeff MaduraДокумент24 страницыInternational Financial Management 11 Edition: by Jeff MaduraMuhammad BasitОценок пока нет

- HDFC Bank LTD Mumbai Repayment Schedule: Date: 25/07/2020Документ5 страницHDFC Bank LTD Mumbai Repayment Schedule: Date: 25/07/2020Vijay KumarОценок пока нет

- A Study of Capital Structure ManagementДокумент94 страницыA Study of Capital Structure ManagementBijaya DhakalОценок пока нет

- Indigo PaperДокумент75 страницIndigo Papernxoxoxrx xxxОценок пока нет

- Module 3 - DISCOUNT: Most Essential Learning OutcomesДокумент19 страницModule 3 - DISCOUNT: Most Essential Learning Outcomesedwin dumopoyОценок пока нет

- Determinants of Financial Performance of Commercial Banks in EthiopiaДокумент8 страницDeterminants of Financial Performance of Commercial Banks in Ethiopiamesfin DemiseОценок пока нет

- Financial Analysis of EngroДокумент47 страницFinancial Analysis of EngroNauman GilaniОценок пока нет

- Paylater - ToC - Traveloka PaylaterДокумент11 страницPaylater - ToC - Traveloka PaylaterkevincpcepОценок пока нет

- Adam Khoo - Profit From The PanicДокумент202 страницыAdam Khoo - Profit From The PanicJared Leong100% (11)

- China Banking Corp. v. Court of AppealsДокумент6 страницChina Banking Corp. v. Court of AppealsPrincess Loyola TapiaОценок пока нет

- PROBLEMS Page-202Документ2 страницыPROBLEMS Page-202Anonymous YhAvdEdRОценок пока нет

- Rich Dad Summary Mindmap Part 1 PWДокумент1 страницаRich Dad Summary Mindmap Part 1 PWdedfed100% (1)

- CHAPTER 3 Sec. 2 Arts. 1193 1198 With ProblemsДокумент26 страницCHAPTER 3 Sec. 2 Arts. 1193 1198 With ProblemsnicoОценок пока нет

- Financial Statements and Cash Flow: Mcgraw-Hill/IrwinДокумент38 страницFinancial Statements and Cash Flow: Mcgraw-Hill/IrwinBennyKurniawanОценок пока нет

- #6 Alfredo Ching vs. Hon. Court of AppealsДокумент2 страницы#6 Alfredo Ching vs. Hon. Court of AppealsMa. Cielito Carmela Gabrielle G. MateoОценок пока нет