Академический Документы

Профессиональный Документы

Культура Документы

Final Presentation On Housing Loan

Загружено:

nwzashrafОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Final Presentation On Housing Loan

Загружено:

nwzashrafАвторское право:

Доступные форматы

Presentation topic :-

Home Financing

Group Members

Muhammad Nawaz

100645-002

Atif Razzaq

100645-006

Hafiz Muhammad Irfan

100645-020

Saqlain Munir

100645-027

Waseem Ahmad

Home financing by

With this facility you no longer to just dream about the home

We will provide you required financing up to 70%of the value

of the property

Payment period ranges from 3 to 25 years.

You own a plot but need financing to construct a home

We shall provide up to 100% construction cost say to good

bye rent forever

Even you dont have plot we will provide up to 60% of the

value of the plot you selected to purchase.

Payment period ranges from 3 to 25 years.

You already own a home, but need extra space for a growing

family or want to see some rooms to get a new look.

Simply apply for financing up to Rs. 3.50 million or 40% of

the surveyed value of your home and get for yourself the extra

space!

The crown jewel of our Home Finance scheme, the

opportunity for someone to buy already constructed home

early in life.

We offer up to principal payment in 3 years, for financing up

to 25 years.

Home start is especially designed for young professionals.

Does your existing instalment on a home finance leave

you with nothing to spend?

Genuinely attractive rates and flexible payment options

that could leave more funds with you each month.

With our Home BTF, repaying your home finance will

not make you break into a sweat! Transfer up to 100 %

of the existing finance.

Stretch your repayment period for up to 25 years

once again!

Pakistani nationals.

Age between 23 years to 50 years at the time of application, subject to

maximum age of 60 at maturity of finance.

Minimum income of Rs. 50,000- (per month) from all sources, including

estimated rental income of the property financed duly verified by the

valuator.

Permanent employees - Currently employed with total employment

experience of at least 2 year.

Professional contractual employees (with experience i.e. bankers,

engineers, doctors, architect etc) - currently employed with total

employment experience of at least 3 years.

Self employed professionals must be practicing and conducting business for

at least 3 years with satisfactory track record.

For other self employed persons where stream of income is generated from

property rent /return on fixed deposit /DSC/SSC must have the source of

income for at least last 6 months.

Business individuals must be practicing and conducting business for at least

five years with satisfactory track record either individually owned or a family

business.

High Net worth Individuals with acceptable level of net wealth

commensurate with the size of loan applied

FINANCING ELIGIBILITY

PRODUCT MAXIMUM ELIGIBILITY

All Products

Main Borrower - 40 times of

GMI

plus

Spouse - 40 times of GMI

Or

other relation - 20 times of

GMI

Financing amounts based on Gross Monthly Incomes (GMI) are given below.

2 recent passport size colour photographs.

Copy of Computerized NIC (original to be shown at our office). **

Bank Statement for the last 6 months (original or attested). **

Copies of complete chain of title documents of the property being offered

(if identified).

Processing fee cheque / pay order favoring Bank Alfalah Ltd.

Life Insurance (MPP) and property insurance (PI) forms.*

Letter of understanding.*

Salary Certificate (original) from the employer, showing the

gross salary, deductions and length of service.

Latest Salary Slip / Pay Slips duly attested by the HR

department

Employment Verification Form signed by the employer. *

Salaried Director - Copy of Form 29 / Form A.

Additional documents for salaried resident Pakistanis

Additional documents for salaried Non-

Resident Pakistanis (NRPs)

Copy of Pakistani Passport valid for at least next 1 year.** or NICOP

Copy of Contract / Work Permit / Iqama / Residence Permit / etc.**

Copies of last 3 years Income Tax Returns (Not Applicable for Middle

Eastern Countries) **

Personal Guarantee of a relative based in Pakistan and acceptable to Bank.

Copy of current professional association membership / trade body membership

certificate (if applicable).

Deed of Partnership + Undertaking & NOC as per Bank format.*

Sole Proprietorship Letter / Certificate from customers Bank.*

Copy of latest Form 29 duly attested by the Company Secretary.

Letter from company secretary confirming either the status and share-holding or

remuneration (where applicant is a Director / paid Director of company).

Copies of last 3 years Income Tax Returns.

Rates & charges as per schedule of charges

In case the delay occurs on part of the customer in availing the approved loan

beyond 45 days time, the following reports may again be obtained at customers

cost:

1. ECIB Report

2. Valuation Report (if required)

3. Data Check Report

4. Income Estimation Report (if applicable)

All related charges like Duplicate Statement, Cheque Return Fee etc, as applicable

in general banking are payable.

1. We provide you with all the information you need about Bank Alfalah Home

Finance. This can be through a face-to-face meeting with our Relationship Officer,

or over the telephone, or through the mail / email.

2. You complete an application form and pass it on to us, together with the required

documents give us basic information about your income source & quantum and the

amount you need, we may give you an agreement in principle.

3. Once you have decided on the amount you want and finalized the property, you

provide us the property documents.

4. We make some inquiries about your financial circumstances.

5. We carry out a valuation of the property and verification of your income.

6. Once we have carried out all the initial processing, we send you our offer

through a Facility Advice Letter.

7. You sign the Facility Advice Letter and return it to us.

8. Our Documentation Control Centre will get in touch with you to complete

Finance & Security documentation including legal opinion on the title

documents of the property and also the life (Mortgage Protection Plan) &

property insurances.

9. You sign the Finance Agreement and Charge documents.

10. Our legal advisor will accompany you to the Registrars office on the

appointed date with our cheque against the financing for conveyance of the

property and your home finance begins

Basic Eligibility Criteria (pre-requisites) is as follows.

A Pakistani National; ( holder of either a Pakistani passport, or NICOP)

Your age should be between 23-50 years when you apply.

Verifiable continuous inflow of minimum gross annual income of US$

60,000 & AED/SAR 180,000 or equivalent respectively in tax paying &

non-tax paying countries.

No un-explained delays/defaults towards repayment of current/ past

consumer financings from any Bank both in Pakistan and abroad.

Affordability of financing within Banks acceptable limits.

Salaried Person - Minimum continuous service of 02 years (not necessarily

with the same employer)

Self Employed Professional - Must be practicing and conducting business

for at least 03 years.

Business Person - In business for a minimum of 05 continuous years

(Bank reserves the right to refuse financing for any reason)

Tentative amount of financing that we would be able to finance can be

deduced using following formula. GMI = Gross Monthly Incomes.

PRODUCT MAXIMUM ELIGIBILITY

All Products

Main Borrower - 40 times of

GMI

plus

Spouse - 40 times of GMI

Or

other relation - 20 times of GMI

Being the first to accommodate our overseas nationals, we

offer the same facilities to them with one addition to above

basic eligibility criteria i.e. either a valid Pakistani Nationality

is held OR a valid CNIC/NICOP/Origin card is held.

The financing eligibility can be deduced by first converting

your income into Rupees terms at prevailing exchange rate

(discounted by 10%) and then applying the above multiplier

factor formula.

Non-Resident Pakistanis

Please note that the Mark up rate varies every month with the

changes in 01 year KIBOR - a benchmark affected by markets

credit liquidity. Mark-up pricing is re-visited on the

anniversary date of finance every year till its maturity keeping

in view the then prevailing KIBOR.

Вам также может понравиться

- Home Loan From State Bank of IndiaДокумент2 страницыHome Loan From State Bank of IndiaSandra HoneyОценок пока нет

- HBL Islamic Homefinance: Key FeaturesДокумент6 страницHBL Islamic Homefinance: Key FeaturesaftabОценок пока нет

- LIC Housing FinanceДокумент25 страницLIC Housing Financepatelnayan22Оценок пока нет

- What Is A.odtДокумент4 страницыWhat Is A.odtAnonymous nZJiWLdC6Оценок пока нет

- Customer Satisfaction of Housing Loans from SBIДокумент43 страницыCustomer Satisfaction of Housing Loans from SBIDebjyoti RakshitОценок пока нет

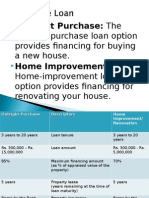

- Outright Purchase: TheДокумент14 страницOutright Purchase: TheMuhammad Umair KhalidОценок пока нет

- Saibaan Comprehensive PresentationДокумент61 страницаSaibaan Comprehensive PresentationTalha SiddiquiОценок пока нет

- Meezan Easy Home Eligibility and RatesДокумент6 страницMeezan Easy Home Eligibility and Ratesnoname1Оценок пока нет

- Theoretical Framework of Home LoanДокумент8 страницTheoretical Framework of Home LoanTulika GuhaОценок пока нет

- Axis Bank Term Deposit ProductsДокумент35 страницAxis Bank Term Deposit ProductsSaroj Kumar PandaОценок пока нет

- HL Sourcing by Gold Loan BranchesДокумент11 страницHL Sourcing by Gold Loan Brancheskumargaurav786Оценок пока нет

- BDO Biñan BranchДокумент4 страницыBDO Biñan BranchRosel Aubrey RemigioОценок пока нет

- HDFC Ltd. Home Loan FeaturesДокумент8 страницHDFC Ltd. Home Loan FeaturesVishv SharmaОценок пока нет

- ICICI Personal LoanДокумент11 страницICICI Personal LoanAjit SamalОценок пока нет

- PROJECT REPORT On Housing Loans at State Bank of IndiaДокумент23 страницыPROJECT REPORT On Housing Loans at State Bank of IndiaDebjyoti Rakshit100% (2)

- Government Startup Loans in India: Schemes and ProvidersДокумент10 страницGovernment Startup Loans in India: Schemes and ProvidersSriniketh SridharОценок пока нет

- LoansДокумент17 страницLoansPia Samantha DasecoОценок пока нет

- Procedures Undertaken Before Granting Bank Finance & Banking ServicesДокумент24 страницыProcedures Undertaken Before Granting Bank Finance & Banking ServicesNikhil RanjanОценок пока нет

- Sagar & AnandДокумент9 страницSagar & AnandAnand ChavanОценок пока нет

- Comparative Analysis of The Home Loan of Sbi in Bharuch: Prepared byДокумент14 страницComparative Analysis of The Home Loan of Sbi in Bharuch: Prepared byBhavini UnadkatОценок пока нет

- CP ASSOCIATES BULLET POINTSДокумент13 страницCP ASSOCIATES BULLET POINTSvikashvacОценок пока нет

- Banking Financial InstitutionДокумент8 страницBanking Financial InstitutionMaDnEssRushОценок пока нет

- Consumer Finance at Bank AlfalahДокумент29 страницConsumer Finance at Bank AlfalahSana Khan100% (2)

- f014 - Home Loan of HDFC BankДокумент38 страницf014 - Home Loan of HDFC BankMahesh SatapathyОценок пока нет

- Employment Offer Letter for Portfolio Manager PositionДокумент2 страницыEmployment Offer Letter for Portfolio Manager PositionMukul GuptaОценок пока нет

- PNB Doctor - S DelightДокумент18 страницPNB Doctor - S DelightNishesh KumarОценок пока нет

- Gen-Next Junior (Saving Account) : Product NatureДокумент6 страницGen-Next Junior (Saving Account) : Product NaturedinkaramОценок пока нет

- Financing Residential PropertiesДокумент27 страницFinancing Residential PropertiesShuYunОценок пока нет

- HOME IMPROVEMENT LOANS UNDER 20% OF HOUSING LOANДокумент3 страницыHOME IMPROVEMENT LOANS UNDER 20% OF HOUSING LOANSantosh KumarОценок пока нет

- Nri Home LoanДокумент3 страницыNri Home LoanPeddinti Vamsi KrishnaОценок пока нет

- Brac BankДокумент18 страницBrac BankMahbub TusharОценок пока нет

- Small Biz LoanДокумент4 страницыSmall Biz LoanJulian AlbaОценок пока нет

- Commercial Banking-Hdfc Housing FinanceДокумент24 страницыCommercial Banking-Hdfc Housing FinancePankul KohliОценок пока нет

- PNB Savings Smart Salary LoansДокумент11 страницPNB Savings Smart Salary LoanstinОценок пока нет

- MCB Bank ReportДокумент30 страницMCB Bank ReportdadagfazalОценок пока нет

- Non-Marketable Financial Assets: Bank DepositsДокумент8 страницNon-Marketable Financial Assets: Bank DepositsDhruv MishraОценок пока нет

- Axis Bank - Hoam LoanДокумент21 страницаAxis Bank - Hoam LoansonamОценок пока нет

- Group project consumer runing finance Presented by BankДокумент27 страницGroup project consumer runing finance Presented by BankDanish HassanОценок пока нет

- Pag Ibig Housing LoanДокумент5 страницPag Ibig Housing LoanHeber BacolodОценок пока нет

- Business For Self Mortgage Insurance ProgramДокумент2 страницыBusiness For Self Mortgage Insurance ProgramArlyne Tiam-CoronelОценок пока нет

- Colina William B. Peta 2 Business FinanceДокумент5 страницColina William B. Peta 2 Business FinanceMarshMellowОценок пока нет

- Personal loan details letterДокумент4 страницыPersonal loan details letterchelladuraik25% (4)

- Bcsbi & Msme CodeДокумент31 страницаBcsbi & Msme CodeStellaОценок пока нет

- Loan SBPPДокумент46 страницLoan SBPPDrasti DesaiОценок пока нет

- Coop Policies: 1. MembershipДокумент9 страницCoop Policies: 1. Membershippapotchi patototОценок пока нет

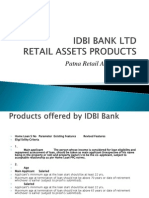

- Patna Retail Assets CentreДокумент31 страницаPatna Retail Assets CentreSatyajit BanerjeeОценок пока нет

- Sbi ProjectДокумент7 страницSbi ProjectSumeet KambleОценок пока нет

- FD_Terms-and-Conditions_0Документ10 страницFD_Terms-and-Conditions_0iamtom101516Оценок пока нет

- MudraДокумент16 страницMudrabkarthikindiaОценок пока нет

- Step 1: Check Your Qualifications: Bdo BankДокумент4 страницыStep 1: Check Your Qualifications: Bdo BankCristy JavinarОценок пока нет

- IDBI Bank Home LoanДокумент11 страницIDBI Bank Home Loansahil7827Оценок пока нет

- Intership ReportДокумент27 страницIntership Reportzindani123456Оценок пока нет

- Loan Management PolicyДокумент11 страницLoan Management Policyvinayak_cОценок пока нет

- PNB Personal Loan Scheme-Pnb Sahyog Covid 19Документ17 страницPNB Personal Loan Scheme-Pnb Sahyog Covid 19Nishesh KumarОценок пока нет

- Provisional Tax Saving Fixed Deposit Confirmation AdviceДокумент3 страницыProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshОценок пока нет

- Askari Bank provides corporate, retail and Islamic banking servicesДокумент7 страницAskari Bank provides corporate, retail and Islamic banking servicesSabih TariqОценок пока нет

- Alinma BankДокумент4 страницыAlinma BankAnonymous bwQj7OgОценок пока нет

- Payment of Bonus Act:: Kamgar Sangh Vs Government of India, ItДокумент16 страницPayment of Bonus Act:: Kamgar Sangh Vs Government of India, ItArun ShettarОценок пока нет

- History and Islamic banking services of Allied Bank LimitedДокумент21 страницаHistory and Islamic banking services of Allied Bank LimitedRiaz MirzaОценок пока нет

- APM Assignment On Imposed & Participative BudgetingДокумент4 страницыAPM Assignment On Imposed & Participative BudgetingnwzashrafОценок пока нет

- Assignment of Advanceperformance ManagmentДокумент6 страницAssignment of Advanceperformance ManagmentnwzashrafОценок пока нет

- APM Assignment On Imposed & Participative BudgetingДокумент4 страницыAPM Assignment On Imposed & Participative BudgetingnwzashrafОценок пока нет

- Assignment 3Документ3 страницыAssignment 3nwzashrafОценок пока нет

- Qaza Namaz Ka TareeqaДокумент27 страницQaza Namaz Ka Tareeqasatti89Оценок пока нет

- Sme ProjectДокумент36 страницSme ProjectnwzashrafОценок пока нет

- Sme Final Project ReportДокумент14 страницSme Final Project ReportnwzashrafОценок пока нет

- Presentation On Sme Bank LTDДокумент21 страницаPresentation On Sme Bank LTDnwzashrafОценок пока нет

- Sme ProjectДокумент36 страницSme ProjectnwzashrafОценок пока нет

- Week 01 Is Basic - Topic: Information Systems in World/global Business TodayДокумент18 страницWeek 01 Is Basic - Topic: Information Systems in World/global Business TodaynwzashrafОценок пока нет

- CV For Students & Inexperienced PersonsДокумент3 страницыCV For Students & Inexperienced PersonsnwzashrafОценок пока нет

- User Interface Design, Data Flow Chart and DFD All in 1 For B.I.SДокумент23 страницыUser Interface Design, Data Flow Chart and DFD All in 1 For B.I.SnwzashrafОценок пока нет

- Data Flow Chart For Store OpertionsДокумент3 страницыData Flow Chart For Store OpertionsnwzashrafОценок пока нет

- Break Even Analysis. Presentation by MOhammad NawazДокумент5 страницBreak Even Analysis. Presentation by MOhammad NawaznwzashrafОценок пока нет

- How business processes, transaction systems, and enterprise applications improve organizational performanceДокумент7 страницHow business processes, transaction systems, and enterprise applications improve organizational performanceahmedsalem2012Оценок пока нет

- Learning Outline: Who Are Managers?Документ12 страницLearning Outline: Who Are Managers?nwzashrafОценок пока нет

- CommunicationДокумент13 страницCommunicationnwzashrafОценок пока нет

- CHRO 3.0 Lead Future HR Function India PDFДокумент40 страницCHRO 3.0 Lead Future HR Function India PDFpriteshpatel103100% (1)

- 20% DEVELOPMENT UTILIZATION FOR FY 2021Документ2 страницы20% DEVELOPMENT UTILIZATION FOR FY 2021edvince mickael bagunas sinonОценок пока нет

- Jonathan R Madi Koe HLP 14 Juni 17Документ3 страницыJonathan R Madi Koe HLP 14 Juni 17agustinОценок пока нет

- Plan Green Spaces Exam GuideДокумент8 страницPlan Green Spaces Exam GuideJully ReyesОценок пока нет

- MP Newsletter 6Документ24 страницыMP Newsletter 6acmcОценок пока нет

- CV Hasan Abdul WafiДокумент2 страницыCV Hasan Abdul WafiWafi AdenОценок пока нет

- Notice WritingДокумент2 страницыNotice WritingMeghana ChaudhariОценок пока нет

- Acts and Statutory Instruments: The Volume of UK Legislation 1850 To 2019Документ24 страницыActs and Statutory Instruments: The Volume of UK Legislation 1850 To 2019Adam GreenОценок пока нет

- Title:Football: Player:Cristiano Ronaldo Dos Santos AveroДокумент60 страницTitle:Football: Player:Cristiano Ronaldo Dos Santos AveroranvenderОценок пока нет

- EXL ServiceДокумент2 страницыEXL ServiceMohit MishraОценок пока нет

- 721-1002-000 Ad 0Документ124 страницы721-1002-000 Ad 0rashmi mОценок пока нет

- Producer Organisations: Chris Penrose-BuckleyДокумент201 страницаProducer Organisations: Chris Penrose-BuckleyOxfamОценок пока нет

- Al Fara'aДокумент56 страницAl Fara'azoinasОценок пока нет

- Employee Separation Types and ReasonsДокумент39 страницEmployee Separation Types and ReasonsHarsh GargОценок пока нет

- Cartagena PresentationДокумент20 страницCartagena PresentationPaula SimóОценок пока нет

- Spouses Ismael and Teresita Macasaet Vs Spouses Vicente and Rosario MacasaetДокумент20 страницSpouses Ismael and Teresita Macasaet Vs Spouses Vicente and Rosario MacasaetGladys Laureta GarciaОценок пока нет

- Trivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFДокумент12 страницTrivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFABINОценок пока нет

- Interview - Duga, Rennabelle PДокумент4 страницыInterview - Duga, Rennabelle PDuga Rennabelle84% (19)

- Agent of The ShroudДокумент25 страницAgent of The ShroudKoen Van OostОценок пока нет

- Galvanize Action donation instructionsДокумент1 страницаGalvanize Action donation instructionsRasaq LakajeОценок пока нет

- Environmental PolicyLegislationRules & RegulationsДокумент14 страницEnvironmental PolicyLegislationRules & RegulationsNikin KannolliОценок пока нет

- Unique and Interactive EffectsДокумент14 страницUnique and Interactive EffectsbinepaОценок пока нет

- MKT201 Term PaperДокумент8 страницMKT201 Term PaperSumaiyaNoorОценок пока нет

- Understanding the Causes and Misconceptions of PrejudiceДокумент22 страницыUnderstanding the Causes and Misconceptions of PrejudiceმარიამიОценок пока нет

- BCG Matrix Relative Market ShareДокумент2 страницыBCG Matrix Relative Market ShareJan Gelera100% (1)

- Chapter 1 Capstone Case: New Century Wellness GroupДокумент4 страницыChapter 1 Capstone Case: New Century Wellness GroupJC100% (7)

- Types of Electronic CommerceДокумент2 страницыTypes of Electronic CommerceVivek RajОценок пока нет

- FinTech BoguraДокумент22 страницыFinTech BoguraMeraj TalukderОценок пока нет

- Aircraft Accident/Incident Summary Report: WASHINGTON, D.C. 20594Документ14 страницAircraft Accident/Incident Summary Report: WASHINGTON, D.C. 20594Harry NuryantoОценок пока нет

- Aero T RopolisДокумент9 страницAero T RopolisZeynep çetinelОценок пока нет