Академический Документы

Профессиональный Документы

Культура Документы

Sales & Distribution Management - Prof. J. N. Godinho

Загружено:

Gunjan SinghИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sales & Distribution Management - Prof. J. N. Godinho

Загружено:

Gunjan SinghАвторское право:

Доступные форматы

SALES & DISTRIBUTION MANAGEMENT PROF. J. N.

GODINHO

CUMBERLAND METAL INDUSTRIES

GROUP 4

13P001 AANSHU CHADHA

13P021 GUNJAN RAI MADAN

13P022 DARSHAN GANDHI

13P027 KUSHAGRA GROVER

13P029 NISHANT MADAN

13P054 VASUNDHARA TIKOO

CONTEXT

Cumberland metal industries is one of the

largest manufacturers of curled metal

products.

It faced a declining market share in Slip

Seal (exhaust gas recirculation valves), its

main source of revenue.

It had 80% of the market share. Not

optimistic of maintaining the market share, the

company planned to diversify away from a total

reliance on the product & industry.

Curled Metal Cushion Pads pads that

prevented shock of the hammer from damaging

while pile driving

Background

Competitor

Analysis

ABOUT CUMBERLAND

COMPETITOR ANALYSIS

33% faster

Lasted for the entire job

Performance increase of

20%

Downtime eliminated

Asbestos pads were

hazardous

CMI pads never went above

250 F, so change overs

COLERICK TEST

80 Asbestos = 1 CMI

FIAZO TEST

120 Asbestos = 1 CMI

ADVANTAGES of CMI

Background

Competitor

Analysis

ASBESTOS vs CMI

PROBLEM STATEMENT

Determine a method for pricing the new pads

Decide which channels to market the pads based on the

pricing strategy

Background

Competitor

Analysis

Issues Pricing

QUESTIONS POSED TO THE COMPANY

PRICING

100 Asbestos

= 1 CMI

Taking mean of

Colerick and Faizo

Tests

1 Asbestos =

3 $

Price of one 11.5

inch Asbestos pad =

3 USD

1 CMI Pad =

300 $

Therefore Price of 1

CMI pad = 3x 100

USD

Background

Competitor

Analysis

Issues Pricing

Channels

PRICING STRATEGY

STAKEHOLDER ANALYSIS

STAKEHOLDER TYPE IMPORTANCE ATTITUDE

Pile Hammer Manufactures Neutral

Architectural/Consulting Engineers Positive

Pile Hammer Distributing/Renting

Companies

Negative

Large Engineering/Construction

Contractors

Positive

Soil Consultants Positive

Independent Pile-Driving

Contractors

Positive

Background

Competitor

Analysis

Issues Stakeholders

Channels

MAPPING OF STAKEHOLDES WITH IMPORTANCE & ATTITUDE

CMI

Large pile driving

contractors (75%) Own/

manufacture equipment

Small independent pile

driving contractors

rented equipment (25%)

larger firms ,companies with

deeper pockets

tend to buy in bulk

less risk averse

more willing to agree on long-

term contracts

sophisticated

Pile hammer

manufacturers

Pile hammer renting/

distributing companies

Provide first pads to

contractors

Conflict of interest

Will keep what could be

sold most easily

Dont want efficiency

Small Customer

But major Influencer

Focused on making money

Not very sophisticated

But knowledgeable

Entities participating in purchases / Customers

Influencer Reseller

Consumer

Architectural/

Consulting engineers

1

2

1

2

3

CHANNEL SELECTION

Background

Competitor

Analysis

Issues

Channels

2. MARKET DEMOGRAPHICS

Concentrated markets

3. BUYING BEHAVIOUR (LARGE PILE

DRIVING CONTRACTORS)

larger firms ,companies with

deeper pockets

tend to buy in bulk

less risk averse

more willing to agree on long-

term contracts

1. NATURE OF PRODUCT

Innovation, technically complex

CMI cushion pads 100 times expensive, life 10 times more than asbestos,

performance increase of 20%

little attention paid to cushion pads

no promotion

Mostly unbranded, cut by anonymous job shops

Risk that the industry will not try the CMI

pads due to the lack of clear distribution

channels and existing attitudes towards

pads

FACTORS AFFECTING CHANNEL SELECTION

Pricing

Background

Competitor

Analysis

Issues

UNDERSTANDING CHANNEL SUITABILITY - ALTERNATIVES

Channels Nature of

Product

Market

demographics

Transaction Amount Buyer behavior

Direct Sales Technically

Complex, New,

Expensive

High concentration

of buyers

Large dollar amount of

individual purchase

transactions

Buyers needs for

technical info /

customization/

persuasion

Independent

distributors

Simple, well

known products

Widely dispersed &

fragmented

markets

Low transaction

amounts

Bundled purchasing

behavior, small buyers

Captive

distribution

Simple, well

known products

May come at some cost in enlisting the full support of other

intermediaries + More control

Manufacturers

reps

Technically

Complex, New,

Expensive

Concentrated

markets

Large individual

transactions

Buyers needs for

technical info /

customization/

persuasion

CHANNEL SELECTION

Channels

Pricing

Background

Competitor

Analysis

Issues Pricing

RECOMMENDATIONS

Short Term

Currently we need manufacturer reps

with the knowledge of construction

industry to promote the product directly

and also try to educate

influencers/distributors about the

product benefits

Channels Pros Cons

Direct Sales Direct control

Help to educate the

distributors and other

channel intermediaries

Fixed cost required

No contacts in the market

Lack of industry

knowledge

Manufacturers reps Deep roots in the

construction market

Better understanding of

the industry

Less control

Long Term

Concentrate to have more independent

distributors to increase the reach and

availability of the product

CHANNEL SELECTION

Channels

Вам также может понравиться

- Curled Metal Inc - Group 10Документ18 страницCurled Metal Inc - Group 10Richa Pandey75% (8)

- TATAДокумент27 страницTATASrideb SahaОценок пока нет

- I Tata SteelДокумент36 страницI Tata Steelshranil-k-shah-7086100% (1)

- b2b Case 9Документ5 страницb2b Case 9SIDDHANT MOHAPATRAОценок пока нет

- Case Study Analysis-1Документ14 страницCase Study Analysis-1Shanti SureshОценок пока нет

- Group4 CMIДокумент5 страницGroup4 CMIMonika_22Оценок пока нет

- Price Objectives: Maximize Quantity and Profit Margin. Price MethodsДокумент2 страницыPrice Objectives: Maximize Quantity and Profit Margin. Price MethodsvelusnОценок пока нет

- 2 Channel MKTG SOD Channel Flows IFIMДокумент29 страниц2 Channel MKTG SOD Channel Flows IFIMSharon Elin SunnyОценок пока нет

- Saurabh Rustagi 10P049 Vedanta Present A IonДокумент13 страницSaurabh Rustagi 10P049 Vedanta Present A Ionsaurabh6688Оценок пока нет

- Market Structure: Industrial Market Vs Consumer MarketДокумент37 страницMarket Structure: Industrial Market Vs Consumer Marketftricot6904Оценок пока нет

- Institute of Management Studies: Outsourcing and ProcurementДокумент20 страницInstitute of Management Studies: Outsourcing and ProcurementMahath MohanОценок пока нет

- Signode Industries IncДокумент8 страницSignode Industries IncArun AhlawatОценок пока нет

- Crown Cork & Seal 1989Документ5 страницCrown Cork & Seal 1989Vijay Yadav33% (3)

- CRM Section2 Group12 XiameterДокумент10 страницCRM Section2 Group12 XiameterSaswat Kumar DeyОценок пока нет

- Industrial Markeing MMS - Sem - IДокумент37 страницIndustrial Markeing MMS - Sem - INitesh NagdevОценок пока нет

- Channel StrategyДокумент95 страницChannel StrategyEllur Anand0% (1)

- Topic 3Документ36 страницTopic 3Patrick John LumutanОценок пока нет

- Curled Metal Inc. Case StudyДокумент18 страницCurled Metal Inc. Case StudybilalОценок пока нет

- Marketing Plastics Resins: GE & BWДокумент17 страницMarketing Plastics Resins: GE & BWGaurav Kumar0% (1)

- Porters Five Forces Model For Industry CompetitionДокумент15 страницPorters Five Forces Model For Industry CompetitionShahid ChuhdryОценок пока нет

- Master of Business Administration 2020-22: Group Assignment 2 XiameterДокумент3 страницыMaster of Business Administration 2020-22: Group Assignment 2 Xiameterkusumit1011Оценок пока нет

- B2B Marketing Strategy GuideДокумент48 страницB2B Marketing Strategy Guidevishal_000Оценок пока нет

- Curled Metal Inc.: By: Sheetal Gwoala Jisun Hong Jacquiline Njiraine Gabriela Silva Betel SolomonДокумент12 страницCurled Metal Inc.: By: Sheetal Gwoala Jisun Hong Jacquiline Njiraine Gabriela Silva Betel SolomonRahul GandhiОценок пока нет

- Summer Internship Report: "Market Research On Consumer Buying Behaviour Towards CeramicproductsДокумент25 страницSummer Internship Report: "Market Research On Consumer Buying Behaviour Towards CeramicproductsMithil Gadhvi666Оценок пока нет

- CMI's Strategic Launch of New Cushion PadsДокумент20 страницCMI's Strategic Launch of New Cushion PadsNivedita SharmaОценок пока нет

- Marktng Management RAMASASTRYДокумент512 страницMarktng Management RAMASASTRYapi-19958143Оценок пока нет

- IsmДокумент43 страницыIsmKalpana GoelОценок пока нет

- Crown Cork & Seal's Strategic Options in 1989Документ12 страницCrown Cork & Seal's Strategic Options in 1989Noha MoustafaОценок пока нет

- Bus MKTДокумент15 страницBus MKTjagadish hudagiОценок пока нет

- Crown, Cork and Seal in 1989Документ21 страницаCrown, Cork and Seal in 1989Shweta GuptaОценок пока нет

- Strategy Towards Buyers and Suppliers 17.9.19Документ22 страницыStrategy Towards Buyers and Suppliers 17.9.19AARTI PAREWAОценок пока нет

- 1st Lec b2bДокумент39 страниц1st Lec b2b123sexОценок пока нет

- Types and Role of Channel Intermediaries in India For Consumer and Industrial ProductsДокумент22 страницыTypes and Role of Channel Intermediaries in India For Consumer and Industrial ProductsRishab Jain 2027203Оценок пока нет

- Marketing Strategy For VoltasДокумент37 страницMarketing Strategy For Voltasswatithorat50% (2)

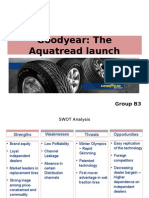

- GoodyearДокумент10 страницGoodyearMiteshwar SinghОценок пока нет

- Project Distribution ChannelsДокумент72 страницыProject Distribution ChannelsMohtashim Javed0% (1)

- CIIE Project: Group 1Документ15 страницCIIE Project: Group 1Abhishek SarafОценок пока нет

- Unit Iii Introduction To SourcingДокумент17 страницUnit Iii Introduction To SourcingVignesh VickyОценок пока нет

- How Can A Seamless Tube Industry Tackle The Threats of New EntrantsДокумент3 страницыHow Can A Seamless Tube Industry Tackle The Threats of New EntrantsAkash_C1992Оценок пока нет

- Blue StarДокумент48 страницBlue StarRuchir Shukla0% (1)

- Final Presentation - Poters Five ForcesДокумент41 страницаFinal Presentation - Poters Five ForcesgawadesxОценок пока нет

- B2B Marketing Strategy GuideДокумент48 страницB2B Marketing Strategy GuideSatish Biradar80% (5)

- Useful Articles: What To Consider When Buying CastingsДокумент5 страницUseful Articles: What To Consider When Buying Castingssujay13780Оценок пока нет

- CH 3 Industry Analysis Porter 2021 10 22 20 06 02Документ20 страницCH 3 Industry Analysis Porter 2021 10 22 20 06 02SOFIA TERESA MURUA BENITEZОценок пока нет

- MGSC01 Lec 1 NotesДокумент6 страницMGSC01 Lec 1 Notesalex.c.mark66scribd2Оценок пока нет

- Cumber Land Group 3Документ17 страницCumber Land Group 3uhdam_bmsceОценок пока нет

- Industrial MarketingДокумент39 страницIndustrial MarketingMohite Rao GokhaleОценок пока нет

- Session IX, X Supply Chain ProcurementДокумент33 страницыSession IX, X Supply Chain ProcurementAbhik DattaОценок пока нет

- WESCO Distribution Inc Group Project ReportДокумент14 страницWESCO Distribution Inc Group Project ReportKeshav BajajОценок пока нет

- Nucor CorporationДокумент17 страницNucor Corporationnobodyknows123Оценок пока нет

- 5672 - 1187 - 27 - 1070 - 48 - Forces at Work&SCPДокумент20 страниц5672 - 1187 - 27 - 1070 - 48 - Forces at Work&SCPsaurabh_mishra523100% (1)

- Marketing ChannelsДокумент22 страницыMarketing ChannelsSwapnil Panpatil0% (1)

- Coatings Word June 2016Документ52 страницыCoatings Word June 2016sami_sakr100% (1)

- Zuari Cements AnjiДокумент67 страницZuari Cements AnjiRamesh AnkathiОценок пока нет

- Summary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisОт EverandSummary of The Innovator's Dilemma: by Clayton M. Christensen | Includes AnalysisОценок пока нет

- Beating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsОт EverandBeating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsОценок пока нет

- Residential Asphalt Roofing Manual Design and Application Methods 2014 EditionОт EverandResidential Asphalt Roofing Manual Design and Application Methods 2014 EditionОценок пока нет

- Game Book: WELCOME - Introduction To The GameДокумент8 страницGame Book: WELCOME - Introduction To The GameGunjan SinghОценок пока нет

- Why Are The Rural Markets So Attractive?: Rural Marketing 01, March Week 1 Making Sense of The Bottom of The PyramidДокумент2 страницыWhy Are The Rural Markets So Attractive?: Rural Marketing 01, March Week 1 Making Sense of The Bottom of The PyramidGunjan SinghОценок пока нет

- Emami acquires She Comfort; L'Oreal buys Cheryl Cosmeceuticals; ITC purchases B Natural fruit juice brandДокумент4 страницыEmami acquires She Comfort; L'Oreal buys Cheryl Cosmeceuticals; ITC purchases B Natural fruit juice brandGunjan SinghОценок пока нет

- Sales ManagementДокумент262 страницыSales ManagementRocky DeyОценок пока нет

- ODC - Group 2 - Change Capable OrganisationsДокумент10 страницODC - Group 2 - Change Capable OrganisationsGunjan SinghОценок пока нет

- Central Problems in The Management of InnovationДокумент19 страницCentral Problems in The Management of InnovationGunjan Singh100% (1)

- Pharma and Currency 1 AugДокумент7 страницPharma and Currency 1 AugGunjan SinghОценок пока нет

- We Indians Are Very Strong and Tolerant PeopleДокумент2 страницыWe Indians Are Very Strong and Tolerant PeopleGunjan SinghОценок пока нет

- Garnier MenДокумент5 страницGarnier MenGunjan SinghОценок пока нет

- Essential candidate and watch detailsДокумент2 страницыEssential candidate and watch detailsSurya King MakerОценок пока нет

- NPV Irr Mirr XirrДокумент6 страницNPV Irr Mirr XirrRaju PandaОценок пока нет

- Peeters Consulting Completed These Transactions During June 2014 A Trevor PeetersДокумент1 страницаPeeters Consulting Completed These Transactions During June 2014 A Trevor PeetersTaimour HassanОценок пока нет

- ED Operations Management and Patient Flow Playbook and ToolkitДокумент66 страницED Operations Management and Patient Flow Playbook and ToolkitjyothiОценок пока нет

- Contoh Soal SKL Bahasa Inggris: Dear Wulan, Read The Following Text To Answer Questions Number 1Документ6 страницContoh Soal SKL Bahasa Inggris: Dear Wulan, Read The Following Text To Answer Questions Number 1Yolanda VitriОценок пока нет

- Chapter Six Strategic Control and EvaluationДокумент68 страницChapter Six Strategic Control and EvaluationbutwalserviceОценок пока нет

- Change Management Status Report TemplateДокумент3 страницыChange Management Status Report TemplateHanumantha Rao MallelaОценок пока нет

- Mergers Workbook II-Electronic WorksheetsДокумент11 страницMergers Workbook II-Electronic WorksheetsBathina Srinivasa RaoОценок пока нет

- Act121 - 1S 2Q - Set AДокумент4 страницыAct121 - 1S 2Q - Set AElena Salvatierra ButiuОценок пока нет

- Human Resource Planning & DevelopmentДокумент145 страницHuman Resource Planning & Developmentsunru24Оценок пока нет

- IBM TemplateДокумент9 страницIBM Templategfgdfg7579Оценок пока нет

- Pre-Feasibility Study, Feasibility Study & Business PlanДокумент16 страницPre-Feasibility Study, Feasibility Study & Business PlanNyle Joy DalunazaОценок пока нет

- Dwnload Full Financial Accounting Ifrs 3rd Edition Weygandt Test Bank PDFДокумент35 страницDwnload Full Financial Accounting Ifrs 3rd Edition Weygandt Test Bank PDFasselinferdie100% (12)

- Emergency Management Disaster Preparedness Manager in Phoenix AZ Resume Don BrazieДокумент2 страницыEmergency Management Disaster Preparedness Manager in Phoenix AZ Resume Don BrazieDonBrazieОценок пока нет

- PFRS 3 Business Combinations SummaryДокумент4 страницыPFRS 3 Business Combinations SummaryKryzzel Anne JonОценок пока нет

- Mohamed Bakouche Rezkia - LinkedInДокумент3 страницыMohamed Bakouche Rezkia - LinkedInBoufrina ToufikОценок пока нет

- Apple IncДокумент5 страницApple IncCalvin SongОценок пока нет

- Iso 9001 2015Документ32 страницыIso 9001 2015ksmohsin100% (3)

- SAP Implementation Project: Business Blueprint Key Data Structure Material Management ModuleДокумент12 страницSAP Implementation Project: Business Blueprint Key Data Structure Material Management ModuleAasif Ahmed Jalaludeen75% (4)

- HRMSДокумент68 страницHRMSDishan ShiranthaОценок пока нет

- Rounding ProfileДокумент11 страницRounding ProfileSukanta Brahma100% (2)

- NetFlix’s VOD offer analysis and strategy recommendationsДокумент22 страницыNetFlix’s VOD offer analysis and strategy recommendationsJon Ones100% (2)

- Cloud Computing and Business Intelligence by Alexandru TOLEДокумент10 страницCloud Computing and Business Intelligence by Alexandru TOLERafaelОценок пока нет

- Mess Bill Hostel Students ICT BhubaneswarДокумент2 страницыMess Bill Hostel Students ICT BhubaneswarAnkita PriyadarsiniОценок пока нет

- Quality Assurance in SurveysДокумент32 страницыQuality Assurance in SurveysDurga Prasad PahariОценок пока нет

- Management Agreement BreakdownДокумент7 страницManagement Agreement Breakdownjoseph dОценок пока нет

- AF201 Lecture SlideДокумент50 страницAF201 Lecture Slidemusuota100% (1)

- Bwts Newsletter 657 771Документ24 страницыBwts Newsletter 657 771Humayun NawazОценок пока нет

- Celebrity Endorsements ReportДокумент88 страницCelebrity Endorsements Reporthandsomepayu100% (8)

- Hero FinCorp Ltd. 24th AGM NoticeДокумент88 страницHero FinCorp Ltd. 24th AGM Noticesuraj ManОценок пока нет