Академический Документы

Профессиональный Документы

Культура Документы

Financial Literacy

Загружено:

Melchior Salvatore0 оценок0% нашли этот документ полезным (0 голосов)

51 просмотров22 страницыThis document summarizes a presentation on financial literacy for managing risk in financing agriculture. The presentation covers the definition of financial literacy, why it is important, common risks in agricultural financing, how financial literacy can be applied along the agricultural value chain, and different methodologies and approaches for financial literacy. The presentation provides examples of financial literacy programs and strategies at the individual, institutional, country, and global levels.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document summarizes a presentation on financial literacy for managing risk in financing agriculture. The presentation covers the definition of financial literacy, why it is important, common risks in agricultural financing, how financial literacy can be applied along the agricultural value chain, and different methodologies and approaches for financial literacy. The presentation provides examples of financial literacy programs and strategies at the individual, institutional, country, and global levels.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

51 просмотров22 страницыFinancial Literacy

Загружено:

Melchior SalvatoreThis document summarizes a presentation on financial literacy for managing risk in financing agriculture. The presentation covers the definition of financial literacy, why it is important, common risks in agricultural financing, how financial literacy can be applied along the agricultural value chain, and different methodologies and approaches for financial literacy. The presentation provides examples of financial literacy programs and strategies at the individual, institutional, country, and global levels.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 22

Financial Literacy

For Risk Management

In Financing Agriculture

Expert Meeting

Managing Risk in Financing

Agriculture

April 1 3, 2009

Johannesburg, South Africa

Mr. Charles Mutua

www.sccportal.org

The Swedish Cooperative Centre (SCC)

was founded in 1958 by the Swedish

cooperative movement.

The overall goal of SCC is poverty

alleviation, which is expressed in the

organisations vision of

a world free from poverty and injustice.

SCC

SCCs priority sectors and cross-cutting thematic

areas

Rural

Finance

Housing

Finance

Micro-

insuranc

e

Financial

Educatio

n

Where we are:

Presentation Outline

What is Financial Literacy?

What is Financial Literacy is not

Why Financial Literacy?

Justification

Importance

What Risks?

Financial Literacy along the Value Chain (VC)

FL Methodologies & Approaches

WHAT IS?

Financial literacy is the ability to process financial information and

make informed decisions about personal finance

(Asian Development Bank)

Financial Literacy is a situation which empowers consumers to

make informed decisions (skills, attitudes, knowledge and

understanding) enabling the consumer to act accordingly

Financial literacy/education seeks to strengthen and change

behaviors that lead to increased incomes, better management and

protection of scarce assets, and effective use of financial services

(Microfinance Opportunities)

It uses Adult learning principles and practices

Brings learners own experience to a learning event

What is not!

It is not Marketing (publicity, sales or

advertising)

Financial Literacy is not just raising of

awareness and providing information

Why Financial Literacy?

Justification:

Kenya for example: 38% of the

population is excluded from financial

services (unbanked). Only 19% uses

financial services from formal

institutions like banks, 8% uses semi-

formal institutions (SACCOs) while

35% uses informal systems (ROSCAs,

ASCAs etc)

(Financial Access in Kenya 2007, FinAccess)

South Africa: Only 34% of survey

respondents knew the correct word to

describe annual price increases. (ECI

Africa 2004, FinScope)

Formal

19%

Formal Other

8%

Informal

35%

Excluded

39%

WhyContd

Importance:

At the individual level - the lack of financial literacy makes people

more susceptible to the devastation caused by emergencies, over-

indebtedness, over-zealous retailers or fraudulent schemes

At the institutional level - the lack of financial literacy generates

misinformation and mistrust of formal financial service providers

Misinformed consumers make poor clients, who in turn represent

increased risk for financial institutions and contribute to a weaker

bottom line.

At the market level - uninformed consumers cannot play a

developmental and monitoring role in the market to weed out bad

practices and providers.

Financial literacy is a win-win proposition for clients and institutions

An informed customer is a good customer

What Risks?

Production Risks

Credit risks

Payment/Sales Contract Risks

Price Risks

Currency Risks

Diversion Risks

Buyers Risks

Non Compliance/Client Integrity

Customer Performance Risks

Transactional Risks

/ Payment Risks

Country / Political Risks

Warehouse Merchandise

Risks on value, quality..

Inherent Risks in

Financing Agriculture

Associated Risks

F

i

n

a

n

c

i

a

l

L

i

t

e

r

a

c

y

Financial Literacy Along the VC Flow

Medium and Large

Exporters and

Wholesalers

Processors

Collector/Traders

Farmers & Producer Groups

Input Suppliers

F

i

n

a

n

c

e

a

n

d

S

u

p

p

o

r

t

i

n

g

S

e

r

v

i

c

e

s

Savings

Investments

Credit

Banking Services

Risk Management

(i.e. Insurance)

Planning

Etc.

FL Methodologies

Speeches and discussion forums

Radio and TV programs

Articles and advertising campaigns

Print material (posters, leaflets)

Competitions

Expositions

School events

Road shows

Study Circles

Organized visits to financial institutions

Involvement of multipliers

(e.g. priests, trade unions, teachers)

Training of trainers

Mentoring, use of corporate volunteers

E-platforms

Awareness and Information Learner-Centered

Learner Centered Methodology: Key Principles

that must be taken into account

Relevance

Dialogue

Engagement

Learning must involve

learners through discussion,

small groups and

learning from peers

Immediacy

Learners must be

able to apply the new

learning immediately

20/40/80

Rule

We remember

20 percent of what we hear,

40 percent of what we hear and see,

80 percent of what

we hear, see and do

Cognitive, Affective,

and Psychomotor Interaction

Learning should involve

thinking and emotions

as well as doing

Respect

Learners need

to feel respected

and like equals

Affirmation

Learners need to

receive praise, even

for small efforts

Safety

Learners need to feel

that others value their ideas and

contributions, that others

will not belittle or

ridicule them

Learners learn

best when

drawing on their own

knowledge and

experience

Learning must be two-way

Adapted from: Adult Learning Principles and Curriculum Design

for Financial Education, MFO, FH, Citigroup

Approaches:

At the Individual &

institutional level

Choose a sustainable

methodology (one-on-

one, TOTs, study guides

etc)

Develop/adapt a relevant

curriculum e.g. Swedish

Cooperative Centre, Financial

Literacy Study Circle Guide

Learning together practically!

You reap what you sow!

Basic Record Keeping!

Contd

At the country level

Craft national strategies for financial literacy

Create partnerships

Integrate financial education and insurance in

curricula of public education system

Code of Ethics, e.g. Uganda Microfinance

Financial literacy emphasis days/months using a

combination of instruments

Target group specific activities (children, youth,

women, entrepreneurs)

Indirect learning as part of other campaigns (health,

finance in general

Approaches: Kenyas Example (Adapted from: Financial

Education in Kenya, FSD Kenya, MFO, 2008)

Actors

oGovernment (Ministries)

oRegulators and supervisors

oPublic learning institutions

oParastatals

Roles and Responsiblities

oPolicy development

oPolicy enforcement

oFacilitate entry (to schools)

oDisseminate information

oAssess impact

oStaff time and funding

Actors

oIndustry players and their

onetworks

oCivic institutions (NGOs,

churches, consumer

oprotection associations)

Roles and Responsiblities

oLeveraging client base

oIncorporate FE activitites

into service delivery

oHost FE Programs

oStaff time and funding (CSR)

oFinance FE campaigns

Vision

Champion FE initiative;

maintain singular focus;

maintain neutrality &

credibility;

quality control on content;

market FE to stakeholders;

policy advocacy;

identify and co-ordinate

working groups,

facilitate research and

monitoring and evaluation

activities

Financial Education Partnership

(Public/Private Partnership)

Contd

At the global level

International Network on Financial Education

www.financial-education.org

Yearly conference: www.FinancialEducationSummit.org

Global Training Program: www.GlobalFinancialEd.org

Financial Education Fund (FEF) - FEF is a new fund

which will support innovative projects in Africa that

improve financial capability: www.genesis-analytics.com

Working group Insurance education

www.microinsurancenetwork.org

Merci! Gracias! Ke a

Leboha!

Ngiyabonga! Ndoliboa!

Nakhensa!

Thank You!

Mr. Charles Mutua

Senior Programme Officer Financial Services

Swedish Cooperative Centre & Vi Agroforestry

Regional Office for Eastern Africa

P.O. Box 45767 00100, Nairobi, Kenya

Tel: +254 20 4180201/37

Fax: +254 20 4180277

Web: www.sccportal.org

Email: charles.mutua@sccroea.org

Вам также может понравиться

- Growth Strategy Process Flow A Complete Guide - 2020 EditionОт EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionОценок пока нет

- Financial LiteracyДокумент47 страницFinancial Literacydrsazali8577Оценок пока нет

- Ebook Financial Reality Coping GuideДокумент56 страницEbook Financial Reality Coping GuideShel MarieОценок пока нет

- What Is Creative Leadership?: Creative Problem-Solving MovementДокумент7 страницWhat Is Creative Leadership?: Creative Problem-Solving MovementamitsinghbdnОценок пока нет

- Rule of 72 Lesson PlanДокумент5 страницRule of 72 Lesson PlanJimmy SmithsonОценок пока нет

- A Cost of Production Report Is AДокумент15 страницA Cost of Production Report Is AMubasharОценок пока нет

- Mastering The Rockefeller Habits: Executive SummaryДокумент5 страницMastering The Rockefeller Habits: Executive SummaryCiprian PinteaОценок пока нет

- Business ModelsДокумент88 страницBusiness ModelsvamospudiendoОценок пока нет

- Innovation Model CanvasДокумент1 страницаInnovation Model Canvasapi-534391196Оценок пока нет

- Social Networking and The WorkplaceДокумент39 страницSocial Networking and The Workplacejohnrooksby100% (1)

- Zokaityte2017 Book FinancialLiteracyEducationДокумент309 страницZokaityte2017 Book FinancialLiteracyEducationPriya Ranjan25% (4)

- C.collins True ProfessionalismДокумент12 страницC.collins True ProfessionalismThien Phan DucОценок пока нет

- Good Strategy, Bad Strategy: Richard P. RumeltДокумент1 страницаGood Strategy, Bad Strategy: Richard P. RumeltJUAN PABLO CLOSE MENDIAОценок пока нет

- Category Design Drives Markets by Mark DonniganДокумент15 страницCategory Design Drives Markets by Mark DonniganMark DonniganОценок пока нет

- Why Should Nonprofits Invest in Brand?: And, Where To BeginДокумент11 страницWhy Should Nonprofits Invest in Brand?: And, Where To BeginmakniazikhanОценок пока нет

- Goal Setting and Life Management: Publishing As Pearson (Imprint) Lydia E. Anderson - Sandra B. BoltДокумент24 страницыGoal Setting and Life Management: Publishing As Pearson (Imprint) Lydia E. Anderson - Sandra B. BoltMarinel June PalerОценок пока нет

- Zappos ComДокумент6 страницZappos ComDebashish BaggОценок пока нет

- How To Build A Winning PipelineДокумент15 страницHow To Build A Winning PipelineShailendra SinghОценок пока нет

- 06-Wrong Ways To Source DealsДокумент6 страниц06-Wrong Ways To Source DealsYash SОценок пока нет

- How To Create Customers For Life BJ Bueno PDFДокумент47 страницHow To Create Customers For Life BJ Bueno PDFFerri FatraОценок пока нет

- Musings On ManagementДокумент9 страницMusings On ManagementTarannum Aurora 20DM226Оценок пока нет

- Creative Brief-LegoДокумент3 страницыCreative Brief-Legoapi-555099259Оценок пока нет

- How To Measure and Manage Your Life Based On Your Personal InnovationfДокумент12 страницHow To Measure and Manage Your Life Based On Your Personal InnovationfDerlis Calderon100% (1)

- MXP Campaign 2021 (Aies - Ec-Mxp-Joinaiesec)Документ17 страницMXP Campaign 2021 (Aies - Ec-Mxp-Joinaiesec)Ahsan KamranОценок пока нет

- Value DisciplinesДокумент6 страницValue Disciplinesyouth_kid029Оценок пока нет

- Understanding and Designing Business ModelsДокумент25 страницUnderstanding and Designing Business ModelsN. BhaskarОценок пока нет

- LESSON Building A Content Cretion Framework SCRIPT PDFДокумент8 страницLESSON Building A Content Cretion Framework SCRIPT PDFJohn WilkinsОценок пока нет

- JOB TO BE DONEjklДокумент8 страницJOB TO BE DONEjklDiego Alejandro Alvarez VillaОценок пока нет

- 1909 CMO Secrets Revealed Book 1Документ11 страниц1909 CMO Secrets Revealed Book 1Veken BakradОценок пока нет

- MIT15 390S13 Lec21Документ60 страницMIT15 390S13 Lec21Claudia Silvia AndreiОценок пока нет

- Advertising Design Theoretical Frameworks and Types of AppealsДокумент57 страницAdvertising Design Theoretical Frameworks and Types of AppealsBernardy LОценок пока нет

- 13 Models of ConsumerДокумент21 страница13 Models of Consumerrahuljha11088100% (2)

- Customer Winback: How to Recapture Lost Customers--And Keep Them LoyalОт EverandCustomer Winback: How to Recapture Lost Customers--And Keep Them LoyalРейтинг: 4 из 5 звезд4/5 (3)

- "Why Some Firms Outperform Others" Resource Possession & Exploitation Resources & CapabilitiesДокумент1 страница"Why Some Firms Outperform Others" Resource Possession & Exploitation Resources & CapabilitiesJordan ChizickОценок пока нет

- BBC News Style Guide Searchable VersionДокумент194 страницыBBC News Style Guide Searchable VersionAna NaletilićОценок пока нет

- Stfu—Start the F Up: For Present and Future Leaders of Startups, Small and Medium-Sized CompaniesОт EverandStfu—Start the F Up: For Present and Future Leaders of Startups, Small and Medium-Sized CompaniesОценок пока нет

- MBFW Pitch DeckДокумент53 страницыMBFW Pitch DeckTom SchrankОценок пока нет

- Practitioner's Worksheet For The Circle of Conflict-1Документ5 страницPractitioner's Worksheet For The Circle of Conflict-1zaineb_sehgalОценок пока нет

- Bus 5113 Unit 2 - Writing AssignmentДокумент4 страницыBus 5113 Unit 2 - Writing Assignmentwonnetta nicholsonОценок пока нет

- Branding and Special Focus On Toon Branding 97-2003Документ87 страницBranding and Special Focus On Toon Branding 97-2003Manasi Ghag100% (1)

- No Excuses Remote Team ManagementДокумент103 страницыNo Excuses Remote Team Managementunreal2Оценок пока нет

- The Microsoft Way (Review and Analysis of Stross' Book)От EverandThe Microsoft Way (Review and Analysis of Stross' Book)Оценок пока нет

- True Religion Apparel, Inc. (TRLG) - Financial and Strategic SWOT Analysis ReviewДокумент33 страницыTrue Religion Apparel, Inc. (TRLG) - Financial and Strategic SWOT Analysis ReviewSteven GeeОценок пока нет

- A 60815 Course Syl Lab UsДокумент14 страницA 60815 Course Syl Lab Usjenezus82Оценок пока нет

- The Goal of This Worksheet Is To Identify The Reason Why Your Tax Business ExistsДокумент3 страницыThe Goal of This Worksheet Is To Identify The Reason Why Your Tax Business ExistsAdeel100% (1)

- Kjaer Global Trends 2020Документ11 страницKjaer Global Trends 2020João JönkОценок пока нет

- The Strategic Pyramid: Steal This IdeaДокумент6 страницThe Strategic Pyramid: Steal This IdeaporqОценок пока нет

- Lean Acres: A Tale of Strategic Innovation and Improvement in a Farm-iliar SettingОт EverandLean Acres: A Tale of Strategic Innovation and Improvement in a Farm-iliar SettingОценок пока нет

- For Love and Money: How to profit with purpose and grow a business with loveОт EverandFor Love and Money: How to profit with purpose and grow a business with loveОценок пока нет

- Symbiosis OnePage BusinessPlan PDFДокумент1 страницаSymbiosis OnePage BusinessPlan PDFBayu Adhika PrasetyaОценок пока нет

- Dr. Chuang, Yuh-ShyДокумент11 страницDr. Chuang, Yuh-ShyYsumaryan DoniОценок пока нет

- Production Book Template 2Документ28 страницProduction Book Template 2So AZ Cop WatchОценок пока нет

- BT Group PLC Marketing Strategy and Marketing ActivitiesДокумент19 страницBT Group PLC Marketing Strategy and Marketing ActivitiesNazifa TaslimaОценок пока нет

- B690 S15 4 SyllabusДокумент15 страницB690 S15 4 SyllabusEverson-Jocelyn PerezОценок пока нет

- Great Storytelling Connects Employees To Their WorkДокумент5 страницGreat Storytelling Connects Employees To Their WorkKev Gianfranco MazaОценок пока нет

- Thomas Green: Power, Office Politics, and A Career in CrisisДокумент7 страницThomas Green: Power, Office Politics, and A Career in CrisispeppeОценок пока нет

- The Smart Entrepreneur: Part III: Proof of ConceptОт EverandThe Smart Entrepreneur: Part III: Proof of ConceptРейтинг: 4 из 5 звезд4/5 (1)

- F4 - Exam Paper 2Документ32 страницыF4 - Exam Paper 2IVAN TIONG WEI JUN MoeОценок пока нет

- RCMCH 2Документ22 страницыRCMCH 2Mahmoud GamalОценок пока нет

- Order 111-3369545-5506652Документ1 страницаOrder 111-3369545-5506652can kayarОценок пока нет

- ID Analisis Strategi - Pemasaran Dalam - Mening PDFДокумент7 страницID Analisis Strategi - Pemasaran Dalam - Mening PDFAry Handoko STОценок пока нет

- Loadstar Shipping vs. Pioneer AsiaДокумент7 страницLoadstar Shipping vs. Pioneer AsiaKrisleen AbrenicaОценок пока нет

- CPM PertДокумент17 страницCPM Pert39SEAShashi KhatriОценок пока нет

- Oracle Workforce Scheduling User Guide For Corporate ProfileДокумент29 страницOracle Workforce Scheduling User Guide For Corporate ProfilejayОценок пока нет

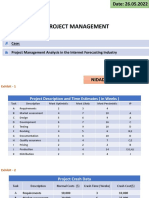

- Project Management Analysis in The Internet Forecasting IndustryДокумент14 страницProject Management Analysis in The Internet Forecasting IndustryNiranjan NidadavoluОценок пока нет

- PSALM Vs CIRДокумент2 страницыPSALM Vs CIRIshОценок пока нет

- Cryptography and Network Security: UNIT-1Документ5 страницCryptography and Network Security: UNIT-1atmadeep09Оценок пока нет

- Mini Project-2Документ44 страницыMini Project-2ÇHäÎťÂñŸà MùŚïČÂłŚОценок пока нет

- Le 1 Answer KeyДокумент8 страницLe 1 Answer KeyApril NaidaОценок пока нет

- Lenovo Mobiles Consumer Satisfaction Full ProjectДокумент47 страницLenovo Mobiles Consumer Satisfaction Full ProjectAnn Amitha AntonyОценок пока нет

- Disbursement Voucher: Quezon City GovernmentДокумент1 страницаDisbursement Voucher: Quezon City GovernmentAnnamaAnnamaОценок пока нет

- Business Finance Lecture 1Документ19 страницBusiness Finance Lecture 1arabella joy gabitoОценок пока нет

- SBC For Dummies PreviewДокумент10 страницSBC For Dummies PreviewEGX Consultores100% (1)

- Business PlanДокумент11 страницBusiness PlanSamir BhandariОценок пока нет

- New Dodge Chrysler Jeep Airbag Squib Spiral Cable Clock Spring 56046533ae 3 Plug EbayДокумент1 страницаNew Dodge Chrysler Jeep Airbag Squib Spiral Cable Clock Spring 56046533ae 3 Plug EbayJohan LorenzoОценок пока нет

- Philippine Nurses Licensure Examination Results Released in Ten (10) Working DaysДокумент5 страницPhilippine Nurses Licensure Examination Results Released in Ten (10) Working DaysRapplerОценок пока нет

- 12-21 Target Prices, Target Costs, Activity-Based Costing.: Total For 250,000 Tiles (1) Per Unit (2) (1) ÷ 250,000Документ2 страницы12-21 Target Prices, Target Costs, Activity-Based Costing.: Total For 250,000 Tiles (1) Per Unit (2) (1) ÷ 250,000viviokОценок пока нет

- County/Parish Company Notice Date Received Date Effective DateДокумент48 страницCounty/Parish Company Notice Date Received Date Effective DateSiebel MaterialsОценок пока нет

- 4 - Organizational Diagnosis and Strategic CapabilityДокумент8 страниц4 - Organizational Diagnosis and Strategic CapabilityMarta RibeiroОценок пока нет

- Industry and Company ProfileДокумент19 страницIndustry and Company ProfileSukruth SОценок пока нет

- HRM-Internal Sources of RecruitmentДокумент2 страницыHRM-Internal Sources of RecruitmentclaudiaОценок пока нет

- Permormance Unit - 2Документ14 страницPermormance Unit - 2Alexander Gilang Samudra RajasaОценок пока нет

- In Your Daily LifeДокумент2 страницыIn Your Daily Lifeostz albanОценок пока нет

- AFAR 2 DiscussionДокумент3 страницыAFAR 2 DiscussionAngela Miles DizonОценок пока нет

- Lesson Plan Grade 11: Department of EducationДокумент3 страницыLesson Plan Grade 11: Department of EducationMary Grace Pagalan LadaranОценок пока нет

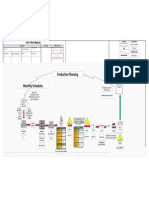

- Production Planning Monthly Schedules: Value Stream MappingДокумент1 страницаProduction Planning Monthly Schedules: Value Stream MappingpranayОценок пока нет

- How To Make Life Changing Money With OnlyFansДокумент79 страницHow To Make Life Changing Money With OnlyFansamit shukla100% (1)