Академический Документы

Профессиональный Документы

Культура Документы

The Securities and Exchange Board of India (SEBI)

Загружено:

kharyarajul0 оценок0% нашли этот документ полезным (0 голосов)

62 просмотров33 страницыThe Securities and Exchange Board of India (SEBI) was established in 1988 as the regulator of the securities market in India. SEBI regulates stock exchanges, registers and regulates intermediaries such as brokers, regulates collective investment schemes including mutual funds, prohibits market manipulation and insider trading. SEBI has regulatory and developmental functions, including protecting investors, ensuring fair practices, promoting research and training. It has powers to regulate stock exchanges and intermediaries, inspect books, and make regulations. SEBI is managed by a board with government and RBI appointments and has various departments that oversee different market functions.

Исходное описание:

sebi

Оригинальное название

sebi-final

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe Securities and Exchange Board of India (SEBI) was established in 1988 as the regulator of the securities market in India. SEBI regulates stock exchanges, registers and regulates intermediaries such as brokers, regulates collective investment schemes including mutual funds, prohibits market manipulation and insider trading. SEBI has regulatory and developmental functions, including protecting investors, ensuring fair practices, promoting research and training. It has powers to regulate stock exchanges and intermediaries, inspect books, and make regulations. SEBI is managed by a board with government and RBI appointments and has various departments that oversee different market functions.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

62 просмотров33 страницыThe Securities and Exchange Board of India (SEBI)

Загружено:

kharyarajulThe Securities and Exchange Board of India (SEBI) was established in 1988 as the regulator of the securities market in India. SEBI regulates stock exchanges, registers and regulates intermediaries such as brokers, regulates collective investment schemes including mutual funds, prohibits market manipulation and insider trading. SEBI has regulatory and developmental functions, including protecting investors, ensuring fair practices, promoting research and training. It has powers to regulate stock exchanges and intermediaries, inspect books, and make regulations. SEBI is managed by a board with government and RBI appointments and has various departments that oversee different market functions.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 33

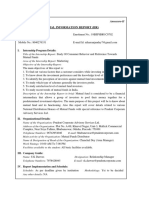

The Securities and Exchange

Board of India (SEBI)

INTRODUCTION

SEBI(Securities and Exchange Board of India) was

constituted on April 12,1988 as a non-statutory body

It is an apex body to develop and regulate the stock

market in India

SEBI is the regulator for the securities market in

India, originally set up by the Government of India in

1988,it acquired statutory form in 1992 with SEBI Act

1992 being passed by the Indian Parliament.

OBJECTIVES

To protect the interest of investors so that there is a

steady flow of savings in to the capital market.

To regulate the securities market

Ensure fair practices by the issuers of securities so

that they can raise resources at minimum cost.

To promote efficient services by brokers, merchant

bankers and other intermediaries so that they become

competitive and professional.

FUNCTIONS

Section 11 of the SEBI Act , there are mainly two types of

functions. They are;

1.Regulatory Functions

2.Developmental Functions

Regulatory Functions

(a). Regulation of stock exchange and self

regulatory organisations.

(b). Registration and regulation of stock

brokers,sub-brokers,registrar to all issue,

merchant bankers, underwriters, portfolio

managers and such other intermediaries who

are associated with securities market.

(c). Registration and regulation of the working of

collective investment schemes including

mutual funds.

(d). Prohibition of fraudulent and unfair trade

practices relating to securities market.

(e). Prohibition of insider trading in securities.

f). Regulating substantial acquisitions of shares

and take over of companies.

(a). Promoting investors education.

(b). Training of intermediaries.

(c). Conducting research and published information useful

to all market participants.

d). Promotion of fair practices. Code of conduct for self-

regulatory organizations.

(e). Promoting self-regulatory organizations.

Developmental Functions

POWERS

SEBI has been vested with the

following powers:

1.Power to call periodical returns from

recognized stock exchange.

2.Power to control and regulate stock

exchange.

3.Power to call any information or

explanation from recognized stock

exchanges or their members.

4. Power to levy fees or other charges for

carrying out the purpose of regulation.

5. Power to grant registration to market

intermediaries.

6.Power to direct enquiries to be made in

relation to affairs of stock exchanges or

members.

7. Power to grant approval to bye-laws of

recognized stock exchanges.

8. Power to make or amend bye-laws of

recognized stock exchanges.

9. Power to compel listing of securities by

public companies.

10. Power to declare applicability of

Section 17 of the Securities Contract

(Regulation) Act is any state or area to

grant licenses to dealers in securities.

ORGANISATION

Chapter 2 of the SEBI Act deals with

establishment, incorporation, administration

and management of the Board of Directors

The SEBI Act provides for the establishment

of a statutory board consisting of six(6)

members.

The chairman and two members are to be

appointed by the Central Government, one

member to be appointed by the Reserve Bank

and two members having experience of

securities market to be appointed by the

Central Govt.

SEBI has divided its activities in to four

operational departments, each headed by an

Executive Director.

1.Primary Market Department: It deals with all

policy matters and regulatory issues relating to

primary market.

2.Issue Management and Intermediaries

Departments: This department is concerned

with inspection of offer documents and other

things like registration, regulation and

monitoring of issue related to intermediaries.

3.Secondary Market Department: It looks after

all the policy and regulatory issues for the

secondary market; administration of the major

stock exchanges and other matters related to

it.

4.Institutional Investment Department: It

concerned with framing policy for foreign

institutional investors.

In addition to this, there are two other

departments: They are; Legal

Department and Investigation

Department, also headed by officials of

the rank of Executive Directors.

SEBI has two Advisory Committees, one

each for primary and secondary markets.

They provide advisory inputs in framing

policies and regulations. These committees

are non-statutory in nature and SEBI is not

bound by the committees.

SEBI and Central

Government

The Central Government has power to

issue directions to SEBI Board,

supersede the Board, if necessary

and to call for returns and reports as

and when necessary.

The Central Government has also

power to give any guideline or to

make regulations and rules for SEBI

and its operations.

The activities of SEBI are financed by

grants from Central Government, in

addition to fees, charges etc.

collected by SEBI.

The fund called SEBI General Fund is

set up, to which, all fees, charges and

grants are credited.

This fund is used to meet the

expenses of the Board and to pay

salary of staff and members of the

body.

SEBI GUIDELINES

SEBI has brought out a number of guidelines separately, from time to

time, for primary market, secondary market, mutual funds,

merchant bankers, foreign institutional investors, investor protection

etc.

1. Guidelines for Primary Market.

(a). New Company: Anew company is one, which has not completed

12 months commercial production and does not have audited

results. And the promoters do not have a track record. These

companies have to issue shares only at par.

(b). New Company set-up by Existing Company: When a new

company is being set-up by existing companies with a five year

track record of consistent profitability and a contribution of at least

50% in the equity of new company,

it can issue its shares at premium.

Conti.

(c). Private and closely held companies: These

having a track record of consistent profitability for at

least three years, shall be permitted to price their

issues freely.

The issue price shall be determined only by the issues in

consultation with lead managers ton the issue.

(d). Existing Listed companies: It will be allowed to raise

fresh capital by freely pricing expanded capital provided

the promoters contribution is 50%on first Rs.100crores of

issue, 40% on next Rs.200 crores, 30% on next Rs 300

crores and 15% on balance issue amount.

2. Guidelines for Secondary Market:

Stock Exchange

(a) Board of Directors of stock exchange has to be

reconstituted

so as to include non-members, public representatives,

government representative to the extent of 50% of total

number of members.

(b)Capital adequacy norms have been laid down for members

of various stock exchanges depending upon their turnover

of trade and other factors.

(c). Working hours for all stock exchanges have been fixed

uniformly.

(d). All the recognized stock exchanges will have to inform

about the transaction within 24 hours.

Brokers

(a). Registration of brokers and sub-brokers is made

compulsory.

(b). Compulsory audit of brokers book and filing of audit report

with SEBI have been made mandatory.

(c). In order to ensure that brokers are professionally qualified

and financially solvent, capital adequacy norms for

registration of brokers have been evolved.

Conti.

(d). To bring about greater transparency and

accountability in the broker-client relationship, SEBI

has made it mandatory for brokers to disclose

transaction price and brokerage separately in the

contract notes issued to client.

(e). No broker is allowed to underwrite more than 5% of

public issue.

3.Foreign Institutional Investors(FII)

(a). Foreign institutional investors have been allowed

to invest in all securities traded in primary and

secondary markets.

(b). There would be no restriction on the volume of

investment for the purpose of entry of FIIs.

Holding of single FII will not ecxeed the ceiling of 5%

of equity capital

Tax rate 10% on large capital gain , 30% on short

term capital gains 20 % on dividend

4.Guidelines to issue of Bonus Shares

(a).Issue of bonus shares after any

public/rights issue is subject to the

condition that no bonus shall be made

which will dilute the value or rights of

holders of debenture, convertible fully or

partly.

(b). There should be a provision in the

Articles of Association of the company for

issue of bonus shares.

c). The bonus is made out of free reserves built out of

the genuine profits or share premiums collected in

cash only.

(d). No bonus issue can be made within 12 months of

any public issue/rights issue.

(e). A company which announces bonus issue after

the approval of the Board of Directors must

implement the proposals within a period of six months

from the date of such proposal and shall not have the

option of changing the decision

5.Guidelines for Rights Issue

Where composite issues are made by

listed companies, they can be issued at

different prices.

Gaps between the clearance dates of

right issues and public issues should not

exceed 30 days.

If right issues of listed companies

exceed Rs.50 lakhs, issue should be

managed by an authorized merchant

banker.

Underwriting of right issues is not

mandatory but as per SEBI Rules

right issues can be underwritten.

No preferential allotment shall be

made along with the right issues.

If the company doesnt receive

minimum subscription (90% of the

issue amount) within 120 days

from the date of opening issue, the

entire subscription should be

refunded within 128 days with

interest @ 15 % p.a. for delay. .

Within 45 days of closure of rights issue,

a report in the prescribed form along

with compliance report duly signed by

the statutory auditor should be

forwarded to SEBI.

(c). Companies making rights issues are

now permitted to dispatch an abridged

letter of offer, containing disclosures as

required in the abridged prospectus.

However, such companies may provide the

detailed letter of offer to any shareholder

upon request.

(d). Again, companies that have filed a

draft offer document with full disclosures

can now come out with further capital

issues even before the shares pertaining to

the document are listed on the brochures.

All listed companies making rights

issue shall issue an advertisement

in at least two All India newspapers

about the dispatch of letters of

offer, opening date, closing date

etc.

6. Guidelines to Debentures

(a).The amount of working capital debenture should

not exceed 20% of the gross current asset.

(b). The debt equity ratio should not exceed 2:1.

(c). The rate of interest can be decided by the

company.

(d). Normally debentures above seven years cannot

be issued.

(e). Debentures issued to public have to be secured

and registered.

(f) credit rating is compulsory for all the debentures

except those issued by public sector companies

7.Guidelines for protection of the Debenture

Holders

(a). Servicing of Debentures

(b). Protection of interest of Debenture Holders

8 Guidelines for underwriters

Hold certificate of registration granted by SEBI

Certificate is valid for 3 yrs from the date of issue

Total underwriting obligations should not exceed 20

times of his networth

Furnish all statements within 6 months from the end

of financial year

Books of account to be maintained for a period of

5yrs

9. Investor protection

New issues

Prohibition of unfair trade practices

Investor education

Grievance cell

Stock invest

10. Book building

Usual methods of fixing share price

doesnt take into consideration the

investors demands

So goes for book building

Steps in book bulding

1. Company approaches merchant banker, intimates

about the no of shares to be issued and other

information on the company

2. MB invites its own investors to bid for the share

3. Investors are asked to indicate the no of shares

4. Allocation is made on the highest bid price

5. If company agrees, shares are allocated

6. Company can cancel if the price is too low

7. Trading commences from the next day

Retail investor

Qualified Institutional buyer

Red herring prospectus

Green shoe option

Floor price

Cap price

Cut off price

11. Buy back of shares

Popular in USA & UK

Company can buy back its own

shares and other securities to the

extent of 25 % of the paid up capital

and free reserves

It is a method of cancellation of the

share capital

It leads to reduction in the share

capital of the company

Advantages

Investors

Investors can sell back the shares

instead of going through secondary

market

Increase EPS

Companies

offers flexibility to the company to

reorganise the capital structure

Helps to eliminate discontended share

holders

SEBI Amendment bill ( 2002)

More powers

Fine of 25 crores for insider trading

Suspend governors of SE

Power to appoint investigating agency

Вам также может понравиться

- Freefincal - Prudent DIY Investing!Документ11 страницFreefincal - Prudent DIY Investing!Ta WexОценок пока нет

- The Little Book of Common Sense Investing: The Only Way To Guarantee Your Fair Share of Stock Market Returns (Little Books. Big Profits) - John C. BogleДокумент6 страницThe Little Book of Common Sense Investing: The Only Way To Guarantee Your Fair Share of Stock Market Returns (Little Books. Big Profits) - John C. Boglecubijawu20% (5)

- Investments NotesДокумент3 страницыInvestments Notesapi-288392911Оценок пока нет

- The Securities and ExchangeДокумент22 страницыThe Securities and ExchangeHappy AnthalОценок пока нет

- Insurance RegulationДокумент186 страницInsurance RegulationVaibhav ChudasamaОценок пока нет

- Security and Exchange Board of IndiaДокумент7 страницSecurity and Exchange Board of IndiaBharath BangОценок пока нет

- Sebi - Securities and Exchange Board of India Learning ObjectivesДокумент13 страницSebi - Securities and Exchange Board of India Learning ObjectivesRituОценок пока нет

- SEBI Role and FunctionsДокумент28 страницSEBI Role and FunctionsAnurag Singh100% (4)

- Sebi - Role and FunctionsДокумент27 страницSebi - Role and Functionsfokat100% (1)

- SEBI - Securities and Exchange Board of IndiaДокумент6 страницSEBI - Securities and Exchange Board of IndiaRAVI RAUSHAN JHAОценок пока нет

- Role of "Sebi" in New Issue MarketДокумент11 страницRole of "Sebi" in New Issue MarketSwati RawatОценок пока нет

- SEBI PPT by SripatiДокумент11 страницSEBI PPT by Sripatimanoranjanpatra100% (3)

- SEBIДокумент6 страницSEBISusan sophia.YОценок пока нет

- Securities & Exchange Board of IndiaДокумент27 страницSecurities & Exchange Board of IndiaApoorva MahajanОценок пока нет

- SEBI Role and Functions PresentationДокумент28 страницSEBI Role and Functions Presentationdustinlark50% (2)

- The Securities and Exchange Board of India (SEBI)Документ23 страницыThe Securities and Exchange Board of India (SEBI)Aditya JainОценок пока нет

- Why Do We Need A Regulatory Body For Investor Protection in India?Документ11 страницWhy Do We Need A Regulatory Body For Investor Protection in India?yangdolОценок пока нет

- Lecture-04 Regulation in Stock MarketДокумент20 страницLecture-04 Regulation in Stock MarketRaman SachdevaОценок пока нет

- Debt Market SEBIДокумент7 страницDebt Market SEBIvidhipatadia3013Оценок пока нет

- Presented By:-Ankit Kumar Ojha Ankit Kamra Gaurav Sarien Roshan Singh Sumit Bhardwaj Yogesh KhandelwalДокумент19 страницPresented By:-Ankit Kumar Ojha Ankit Kamra Gaurav Sarien Roshan Singh Sumit Bhardwaj Yogesh KhandelwalAnkit Kumar OjhaОценок пока нет

- Sebi Capital Market InvestorsДокумент34 страницыSebi Capital Market Investors9887287779Оценок пока нет

- Securiti Es and Exchange Board of of India: Presented by Preetham Naveen Shreesha Nakul Prasad Murugesh Kumar DДокумент19 страницSecuriti Es and Exchange Board of of India: Presented by Preetham Naveen Shreesha Nakul Prasad Murugesh Kumar DMurugesh KumarОценок пока нет

- AFMSДокумент169 страницAFMSJAGRITI SINGH JUОценок пока нет

- 1.7 Business Legal Systems: Mfa 1 SemesterДокумент53 страницы1.7 Business Legal Systems: Mfa 1 SemesterSoumyaparna SinghaОценок пока нет

- Report File On Sebi: Submitted To: Prof. Jaspreet SinghДокумент28 страницReport File On Sebi: Submitted To: Prof. Jaspreet SinghGurinder GuriОценок пока нет

- SEBIДокумент25 страницSEBIsumant singhОценок пока нет

- The Securities AND Exchange BoardДокумент27 страницThe Securities AND Exchange BoardManjrekar RohanОценок пока нет

- Roles Functions OF: & SebiДокумент24 страницыRoles Functions OF: & SebiGourav GuptaОценок пока нет

- SEBI Role & FunctionsДокумент27 страницSEBI Role & FunctionsGayatri MhalsekarОценок пока нет

- Roles Functions OF: & SebiДокумент24 страницыRoles Functions OF: & SebiGourav GuptaОценок пока нет

- Why Do We Need A Regulatory Body For Investor Protection in India?Документ17 страницWhy Do We Need A Regulatory Body For Investor Protection in India?Amrita JhaОценок пока нет

- Capital Market ReformsДокумент5 страницCapital Market ReformsGargi SinhaОценок пока нет

- Regulatory Bodies: Sebi, Rbi, IrdaДокумент29 страницRegulatory Bodies: Sebi, Rbi, IrdaShresth Kotish0% (1)

- About SEBI Establishment of Sebi: Securities and Exchange Board of India ActДокумент17 страницAbout SEBI Establishment of Sebi: Securities and Exchange Board of India ActFaraaz HasnainОценок пока нет

- Project Report - DseДокумент33 страницыProject Report - DseHarsha Vardhan ReddyОценок пока нет

- Project Report - DseДокумент33 страницыProject Report - DseSunita YadavОценок пока нет

- SebiДокумент7 страницSebiAbhijeit BhosaleОценок пока нет

- Working and FunctionsДокумент15 страницWorking and FunctionsaadyaaОценок пока нет

- SEB LawДокумент19 страницSEB LawHimanshu KumarОценок пока нет

- Securities and Exchange Board of IndiaДокумент57 страницSecurities and Exchange Board of IndiaTanay Kumar SinghОценок пока нет

- The Securities and Exchange Board of India (Sebi)Документ26 страницThe Securities and Exchange Board of India (Sebi)chetan_0002Оценок пока нет

- Securities and Exchange Board of IndiaДокумент14 страницSecurities and Exchange Board of Indiakanna2353Оценок пока нет

- Index: S. No. Title No. Remark SДокумент17 страницIndex: S. No. Title No. Remark SSiddhi PatwaОценок пока нет

- Role of SebiДокумент3 страницыRole of SebiAnkush PoojaryОценок пока нет

- Roles Functions OF: & SebiДокумент19 страницRoles Functions OF: & SebiAly SayyadОценок пока нет

- Note On Public IssueДокумент9 страницNote On Public IssueKrish KalraОценок пока нет

- Project Report - Capital MarketДокумент33 страницыProject Report - Capital MarketPragati DixitОценок пока нет

- SEBIДокумент29 страницSEBISanjana Sen100% (1)

- LE Presentation Doc Group-8Документ11 страницLE Presentation Doc Group-8pratiksh1997Оценок пока нет

- SEBI: The Purpose, Objective and Functions of SEBIДокумент10 страницSEBI: The Purpose, Objective and Functions of SEBIShailesh RathodОценок пока нет

- Security Analysis AND Portfolio Management Assignment 2Документ9 страницSecurity Analysis AND Portfolio Management Assignment 2Ankur SharmaОценок пока нет

- SebiДокумент9 страницSebiAnirudh VictorОценок пока нет

- Role of SEBI in Capital MarketsДокумент25 страницRole of SEBI in Capital MarketsVictor LoboОценок пока нет

- How IPO Process IN BangladeshДокумент4 страницыHow IPO Process IN BangladeshSayma Lina0% (1)

- C Law Unit II - Securities Exchange Board of India (SEBI ACT)Документ5 страницC Law Unit II - Securities Exchange Board of India (SEBI ACT)Mr. funОценок пока нет

- Securities and Exchange Board of India PDFДокумент18 страницSecurities and Exchange Board of India PDFShifa RasheedОценок пока нет

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"От Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Оценок пока нет

- Equity Investment for CFA level 1: CFA level 1, #2От EverandEquity Investment for CFA level 1: CFA level 1, #2Рейтинг: 5 из 5 звезд5/5 (1)

- Indian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaОт EverandIndian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- Global Warming: Causes, Effects and Solutions: August 2015Документ8 страницGlobal Warming: Causes, Effects and Solutions: August 2015Oppili yappanОценок пока нет

- Certificate: To Whomsoever It May ConcernДокумент1 страницаCertificate: To Whomsoever It May ConcernkharyarajulОценок пока нет

- Adarsh Credit Co-Operative SocietyДокумент7 страницAdarsh Credit Co-Operative SocietykharyarajulОценок пока нет

- Document 95Документ10 страницDocument 95kharyarajulОценок пока нет

- Corporatesocialresponsibility Nmims PPT 111120210648 Phpapp01Документ53 страницыCorporatesocialresponsibility Nmims PPT 111120210648 Phpapp01kharyarajulОценок пока нет

- Sustainable DevelopmentДокумент35 страницSustainable DevelopmentkharyarajulОценок пока нет

- 02 - Methods of DepreciationДокумент5 страниц02 - Methods of DepreciationkharyarajulОценок пока нет

- Culture Heritage of India Final RajulДокумент9 страницCulture Heritage of India Final RajulkharyarajulОценок пока нет

- Ob Notes 2014Документ23 страницыOb Notes 2014kharyarajulОценок пока нет

- BY: Priya Solanki Richa TharadДокумент13 страницBY: Priya Solanki Richa TharadkharyarajulОценок пока нет

- Culture Heritage of IndiaДокумент10 страницCulture Heritage of IndiakharyarajulОценок пока нет

- Fina CleДокумент2 страницыFina ClekharyarajulОценок пока нет

- New Text DocumentДокумент1 страницаNew Text DocumentkharyarajulОценок пока нет

- Career PlanningДокумент13 страницCareer Planningjuhee4everОценок пока нет

- Project Report On HCL Mileap LaptopsДокумент95 страницProject Report On HCL Mileap LaptopsManish Singh50% (2)

- NISM VA Chapter Wise QuestionsДокумент45 страницNISM VA Chapter Wise QuestionsAvinash JainОценок пока нет

- THE NEW TITANS OF WALL STREET-A THEORETICAL Framework of Passive InvestorsДокумент57 страницTHE NEW TITANS OF WALL STREET-A THEORETICAL Framework of Passive InvestorsGokulОценок пока нет

- Tax On Dividend Distribution, Distribution by Way of BuyBackДокумент3 страницыTax On Dividend Distribution, Distribution by Way of BuyBackABC 123Оценок пока нет

- Investment Pattern of PeoplesДокумент17 страницInvestment Pattern of PeoplesLogaNathanОценок пока нет

- PERFIN Session3 ArticlesДокумент168 страницPERFIN Session3 ArticlesMob Morphling KurustienОценок пока нет

- Investment Behavior and Investment Preference of InvestorsДокумент65 страницInvestment Behavior and Investment Preference of InvestorsmithunОценок пока нет

- Comparative Study of Top 5 Mutual FundsДокумент54 страницыComparative Study of Top 5 Mutual Fundschittu_200980% (10)

- Final Project - AZIZДокумент73 страницыFinal Project - AZIZsmart boyОценок пока нет

- The Mentality of A ChampionДокумент31 страницаThe Mentality of A Championaugustine.arimoro5764100% (4)

- PDF 14 Ici Usfunds RegulationДокумент6 страницPDF 14 Ici Usfunds RegulationANILОценок пока нет

- Initial Information Report (Iir) : I. Internship Program DetailsДокумент2 страницыInitial Information Report (Iir) : I. Internship Program DetailsNihar DeyОценок пока нет

- Monthly Factsheet Working All Funds August21Документ33 страницыMonthly Factsheet Working All Funds August21Sirish N RaoОценок пока нет

- ST4125680 SignedfinalДокумент22 страницыST4125680 SignedfinalSathish KumarОценок пока нет

- HDFC Mutual FundДокумент88 страницHDFC Mutual Fundmiksharma50% (2)

- Compartive Study of Mutual Fund in IndiaДокумент106 страницCompartive Study of Mutual Fund in IndiaRahul GuptaОценок пока нет

- A Study On Selected Equity Mutual FundsДокумент5 страницA Study On Selected Equity Mutual FundsEditor IJTSRDОценок пока нет

- Ch013 International Equity MarketsДокумент11 страницCh013 International Equity MarketslizОценок пока нет

- Performance Evaluation of Mutual Funds in Pakistan For The Period 2004-2008Документ13 страницPerformance Evaluation of Mutual Funds in Pakistan For The Period 2004-2008Mustafa ShabbarОценок пока нет

- Half Yearly Portfolio Disclosure For The Period Ended September 30, 2016 (Company Update)Документ89 страницHalf Yearly Portfolio Disclosure For The Period Ended September 30, 2016 (Company Update)Shyam SunderОценок пока нет

- Study of Mutual Funds at SbiДокумент77 страницStudy of Mutual Funds at SbiNiroop K MurthyОценок пока нет

- VUL Insurance Vs Mutual Fund Vs UITF InvestmentДокумент4 страницыVUL Insurance Vs Mutual Fund Vs UITF InvestmentClint M. MaratasОценок пока нет

- Icici Bank Project ReportДокумент50 страницIcici Bank Project ReportSurendra RatiwalОценок пока нет

- Ch-10 Selecting The Right Investment Products For InvestorsДокумент16 страницCh-10 Selecting The Right Investment Products For InvestorsrishabhОценок пока нет

- Mirae Asset Monthly Full Portfolio January 2021Документ86 страницMirae Asset Monthly Full Portfolio January 2021Ram hereОценок пока нет

- BlackRock OverviewДокумент19 страницBlackRock Overviewinstantshikhar2220% (1)

- Original Prospectus of L&T Financial Holdings IPOДокумент547 страницOriginal Prospectus of L&T Financial Holdings IPO1106531Оценок пока нет

- Chap 7Документ23 страницыChap 7Trinh Bao DinhОценок пока нет