Академический Документы

Профессиональный Документы

Культура Документы

Marine For Banking Company-2012.

Загружено:

Uzair SupariwalaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Marine For Banking Company-2012.

Загружено:

Uzair SupariwalaАвторское право:

Доступные форматы

1

MARINE INSURANCE

FOR BANKERS

R . GANATRA

M.A.,M.COM., LL.M., F.I.I.I., D.M.M.T.

MARIRAJ ASSOCIATES

098211 40676

grajkal@yahoo.co.in

`

2

MARINE INSURANCE

1. Introduction

2. Scope of Cover & Exclusions

3. Warehouse to Warehouse Clause

4. Claim Procedure/Documents

5. UCPDC 600 & Marine Insurance

3

MEANING

INSURANCE OF

GOODS IN TRANSIT BY VARIOUS MODES OF

TRANSPORT [Cargo Insurance]

SHIPS CARRYING CARGO/GOODS [Hull

Insurance]

SHIPS DURING CONSTRUCTION (HULL Insurance)

SHIPS DURING BREAKAGE [Hull Insurance]

FREIGHT INSURANCE [Hull Insurance]

CERTAIN LIABILITIES E.G. COLLISION LIABILITY

[Cargo/Hull Insurance

4

INTERNATIONAL

THE TERMS AND CONDITIONS CALLED

CLAUSES ARE INTERNATIONAL IN

CHARACTER- DRAFTED BY INSTITUTE

OF LONDON UNDERWRITERS AND VERY

WIDELY FOLLOWED.

OTHER CLAUSES BY AMERICAN AND

DUETCH UNDERWRITERS.

5

AGREED VALUE

AGAINST MARKET VALUE & RE-

INSTATEMENT / REPLACEMENT

VALUEFOLLOWED IN OTHER

BRANCHES, MARINE POLICY IS

AGREED VALUE POLICY.

VALUE ONCE AGREED FINAL.

CIF + 10% INTERNATIONAL NORMS.

6

INSURABLE INTEREST -1

INSURABLE INTEREST IS DIRECT

RELATIONSHIP WITH PROPERTY /

PERSON OF SUCH A NATURE THAT

IF THAT PROPERTY OR PERSON

SUFFERS LOSS THE HOLDER OF I.I.

SUFFERS FINANCIAL LOSS.

7

INSURABLE INTEREST- 2

I.I. DEPENDS UPON TERMS OF SALE

INCOTERMS 2010 AND SALES OF

GOODS ACT.

UNDER INCOTERMS PASSING OF

RISK IS IMPORTANT, INSURABLE

INTEREST PASSES WITH THE RISK

8

INSURABLE INTEREST - 3

EX- W BUYERS INSURABLE INTEREST

FOB/FCA- BUYER + SELLER.

CIF- BUYER OR SELLER, WHETHER

MONEY PAID OR NOT. UPTO CIF PLACE

ONLY.

ASSIGNMENT- CARGO POLICIES

GENERALLY FREELY ASSIGNABLE.

9

ASSIGNMENT

POLICY CAN BE ASSIGNED EVEN AFTER

LOSS IF THERE IS PRIOR AGREEMENT.

ASSIGNMENT VS. NEGOTIATION.

ASSIGNEE DOES NOT GET BETTER

RIGHTS, BREACH OF WARRANTY

EFFECTIVE AGAINST BUYER ALSO.

10

EXCESS

THE AMOUNT WHICH IS TO BE

DEDUCTED FROM EACH AND EVERY

LOSS.

IF L/C SPECIFIES IRRESPECTIVE OF

PERCENTAGE THEN EXCESS NOT TO

BE ACCEPTED, OTHERWISE AS PER

UCPDC 600 EXCESS MAY BE ACCEPTED.

EXCESS GIVES DEDUCTION IN PREMIUM.

11

ECGC VS. MARINE POLICIES

MARINE POLICIES COVER LOSS OR

DAMAGE TO THE CARGO.

MERE NON PAYMENT BY BUYER NOT

COVERED.

ECGC POLICIES COVER NON PAYMENT

DUE TO ECONOMIC AND POLITICAL

REASONS.

BOTH ARE COMPELMENTARY.

12

INSTITUTE CARGO CLAUSES

SEA TRANSIT

I.C.C. (C)

I.C.C. ( B)

I.C.C.( A)

AIR TRANSIT

= xxx

= xxx

I.C.C.(A.C.)

13

LOSS/ DAMAGE TO CARGO ;

1) FIRE/ EXPLOSION

2) STRANDING,GROUNDING,SINKING,CAPSIZING OF THE

VESSEL/CRAFT

3) OVERTURNING/ DERAILMENT OF LAND CONVEYANCE

4) COLLISION/ CONTACT WITH EXTERNAL OBJECTOTHER

THAN WATER

5) DISCHARGE OF CARGO AT PORT OF DISTRESS

6) GENERAL AVERAGE SACRIFICE

7) JETTISON

II G.A. CONTRIBUTION SALAVAGE CHARGES

III LIABILITY UNDER BOTH TO BLAME COLLISION

CLAUSE

I.C.C.( C) COVERAGE

14

ICC(B) COVERAGE

1 TO 7 O I.C.C.(C)

8 EARTHQUAKE, VOLCANIC ERUOPTION OR

LIGHTNING

9. ENTRY OF SEA, LAKE OR RIVER WATER INTO

VESSEL CRAFT HOLD CONVEYANCE

CONTAINER LIFTVAN OR PLACE OF

STORAGE

10. TOTAL LOSS OF ANY PACKAGE LOST

OVERBOARD OR DROPPED WHILST LOADING

ON TO OR UNLOADING FROM VESSEL OR

CRAFT

11. WASHING OVERBOARD

15

Institute Cargo Clauses

Extraneous perils

TPND

Fresh water / rainwater damage.

Hook/ oil damage.

Heating & sweating.

Mud, acid and other damages.

Breakage.

Leakage.

Country damage.

Bursting/ tearing of bags.

Contamination.

Etc.,

16

I.C.C.(A) COVERAGE

1 TO 7 OF I.C.C.(C)

8 TO 11 OF I.C.C.(B)

+ ALL OTHER RISKS WHICH GIVE RISE

TO PHYSICAL LOSS/ DAMAGE TO

CARGO &

ARE NOT SPECIFICALLY EXCLUDED

17

GENERAL EXCLUSIONS-1

Willful misconduct.

Ordinary losses.

Insufficient packing.

Inherent vice

Delay

Financial default of shipping co / airlines.

Nuclear losses.

18

GENERAL EXCLUSIONS -2

War perils

Strikes, terrorism perils.

Malicious / deliberate damage (only under

ICC ( C ) & ICC ( B ).

Un seaworthiness/ unfitness of the

carrying vessel with privy/ knowledge of

the exporter.

19

20

21

INLAND TRANSIT CLAUSES(ITC)

RISKS COVERED

PHYSICAL LOSS OR DAMAGE TO GOODS.

CLAUSES( C)

I. FIRE

II. LIGHTNING

CLASUES (B)

III. BREAKAGE OF BRIDGES

IV. COLLISSION WITH/BY CARRYING VEHICLE

V. OVERTURNING OF CARRYING VEHICLE

VI. DERAILMENT OR ACCIDENT OF LIKE NATURE TO

CARRYING WAGON/VEHICLE

CLAUSES(A)

VII. ALL OTHER RISKS WHICH ARE NOT EXCLUDED.

22

EXCLUSIONS

WILFUL MISCONDUCT OF THE ASSURED

ORDINARY LOSSES

INSUFFICIENCY OF PACKING /PREPARATION

INHERENT VICE

DELAY, EVEN IF CAUSED BY INSURED PERIL

NUCLEAR LOSSES

WAR AND ALLIED PERILS

STRIKES AND ALLIED PERILS

ADDITIONAL EXCLUSIONS:

MALICIOUS DAMAGE

EXTENSIONS AVAILABLE

MALICIOUS DAMAGE(ITCB,C)

S.R.C.C.(ALL)

23

Inland transit Clauses- duration

Ware house to ware house

After reaching final destination town/ city

7 days maximum

If earlier policy is over earlier.

24

MARINE UNDERWRITING

PAYMENT OF PREMIUM

Premium on exports/ import to be paid in foreign

currency- exceptions for Indian Residents:

Exports: insurance as per sales contract,

undertaking to recover full price.

Imports: insurance as per sales contract,

undertaking to get licence endorsed.

Between two foreign countries: If Indian acting as

mercantile agent.

25

CLAIMS

MANAGEMENT

R.GANATRA

26

LAWS APPLICABLE IN INDIA

1. THE INDIAN CONTRACT ACT 1869

2. THE MARINE INSURANCE ACT 1963

3. THE INSURANCE ACT 1938

4. INSURANCE RULES 1939

5. THE CARRIAGE BY ROAD ACT 2007

6. RAILWAYS ACT 1989

7. CARRAIGE OF GOODS BY SEA ACT 1925

8. MULTIMODAL TRANSPORT OF GOODS ACT 1993

9. CARRAIGE BY AIR ACT 2007

10. AIRCRAFT ACT 1934

11. THE INDIAN PORTS ACT 1906- & BYE LAWS

12. MAJOR PORT TRUSTS ACT 1963

13. MERCHANT SHIPPING ACT 1958

14. CUSTOMS ACT 1962

15. INDIAN POST OFFICE ACT 1838 & GUIDE

16. THE INDIAN STAMPS ACT 1899

17. GIM OF RBI

27

CLAIM PROCEDURE

Intimation of loss - Carriers/ Bailees

- Insurance Company

Survey - Ship Survey

- Insurance Survey

Loss Minimisation

Claim on Carriers/ Bailees

Time Limits

Claim Documents

28

CLAIM DOCUMENTS

Proof of insurance

Shipping documents

Documents to prove loss/ damage

Proof of loss minimising expenses

Forwarding/ clearance documents

Claim on carriers/bailees

Other documents as required

Claim bill

29

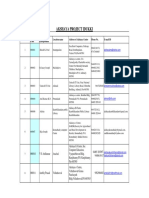

TABLE OF TIME LIMITS(1)

AGENCY NOTICE OF CLAIM LODGEMENT OF

CLAIM

SUIT BAR

STEAMER 3 DAYS IMMDLY 1 YEAR

M.T.O. IMMDLY 6 DAYS 9 MONTHS

PORTS 7 DAYS 6 MONTHS 6 MONTHS

AIRLINES

DOMESTIC

DAMAGE IMMDLY 7 DAYS 2 YEARS

NON.DEL IMMDLY 14 DAYS 2 YEARS

NOTE: TIME LIMITS FROM DATE OF DELIVERY

30

TABLE OF TIME LIMITS (2)

AGENCY NOTICE OF CLAIM LODGEMENT OF

CLAIM

SUIT BAR

AIRLINES

INTERNATIONAL

DAMAGE IMMDLY 14 DAYS 2 YEARS

NON DEL IMMDLY 21 DAYS 2 YEARS

ROAD WAYS IMMDLY 180 DAYS FROM

DATE OF L.R.

3 YEARS FROM

DATE OF L.R.

RAIL WAYS IMMDLY 6 MONTHS FROM

DATE OF R/R)

3 YEARS FROM

DATE OF R.R.

NOTE: TIME LIMITS FROM DATE OF DELIVERY

31

UCP600 ARTICLE 28-a

a. An insurance document, such as an

insurance policy, an insurance

certificate or a declaration under an

open cover, must appear to be issued

and signed by an insurance company,

an underwriter or their agents or their

proxies. (issued by proper person)

32

UCP 600 28 a, b

Any signature by an agent or proxy

must indicate whether the agent or

proxy has signed for or on behalf of the

insurance company or underwriter.

(signatory to write capacity)

b. When the insurance document

indicates that it has been issued in

more than one original, all originals

must be presented. (no of originals)

33

UCP 600 28 c ,d, e

c. Cover notes will not be accepted. (no C/N)

d. An insurance policy is acceptable in lieu of an

insurance certificate or a declaration under an

open cover ( Policy acceptable)

e. The date of the insurance document must be

no later than the date of shipment, unless it

appears from the insurance document that the

cover is effective from a date not later than the

date of shipment. (date of cover prior to

shipment)

34

UCP 600 28 f i ,ii

f. i. The insurance document must

indicate the amount of insurance

coverage and be in the same currency as

the credit. (insurance currency &

amount)

ii. A requirement in the credit for

insurance coverage to be for a

percentage of the value of the goods, of

the invoice value or similar is deemed to

be the minimum amount of coverage

required.(Minimum sum insured)

35

UCP 600 28 f ii (cont)

If there is no indication in the credit of

the insurance coverage required, the

amount of insurance coverage must be

at least 110% of the CIF or CIP value of

the goods ( CIF/CIP + 10%)

36

UCP 600 28 f ii (cont)

When the CIF or CIP value

cannot be determined from the

documents, the amount of

insurance coverage must be

calculated on the basis of the

amount for which honour or

negotiation is requested or the

gross value of the goods as shown

on the invoice, whichever is

greater. (OR Invoice Value)

37

UCP 600 28 f iii

iii. The insurance document must

indicate that risks are covered at least

between the place of taking in charge or

shipment and the place of discharge or

final destination as stated in the credit. (

Min Cover between shipment place and

port of discharge)

38

UCP 600 28 g

g. A credit should state the type of

insurance required and, if any, the

additional risks to be covered. An

insurance document will be accepted

without regard to any risks that are not

covered if the credit uses imprecise

terms such as "usual risks" or

"customary risks". (precise cover)

39

UCP 600 28 h

h. When a credit requires insurance

against "all risks" and an insurance

document is presented containing any

"all risks" notation or clause, whether or

not bearing the heading "all risks", the

insurance document will be accepted

without regard to any risks stated to be

excluded. ( All Risks a misnomer)

40

UCP 600 28 i, j

i. An insurance document may contain

reference to any exclusion clause.

(Exclusions allowed)

j. An insurance document may indicate

that the cover is subject to a franchise

or excess (deductible allowed ).

41

SUMMARY OF ARTICLE 28

Insurance document issued by proper person.

Signatory to write capacity.

All originals to be presented .

Cover note not to be accepted.

Policy can be accepted under open cover.

Date of cover prior to shipment.

Insurance currency and amount as per L/C.

Minimum sum insured.

CIF/CIP+10% Or Invoice value +10%.

Places of cover.

Precise description of cover.

All Risks misnomer.

Exclusions/ deductibles allowed.

42

Thank you

Вам также может понравиться

- BengalДокумент13 страницBengalharshОценок пока нет

- Ignou Regional and Study CentersДокумент5 страницIgnou Regional and Study Centersbtech_dksОценок пока нет

- A Rum and Steel IndustriesДокумент6 страницA Rum and Steel IndustriesArumand Steel IndustriesОценок пока нет

- Contact of AVLДокумент4 страницыContact of AVLbingoinwebОценок пока нет

- Department of Animal HusbandryДокумент54 страницыDepartment of Animal Husbandrymohammed anazОценок пока нет

- Supervisor MechanicalДокумент35 страницSupervisor MechanicalPreethi RanganathanОценок пока нет

- B in Contact With Kumar - PBVДокумент33 страницыB in Contact With Kumar - PBVvenkatesh_1829Оценок пока нет

- Ss PDFДокумент4 страницыSs PDFtummmereОценок пока нет

- Diesel EngineДокумент8 страницDiesel EngineAmritОценок пока нет

- HR Director VP Manufacturing in Dallas Fort Worth TX Resume Nancy GenglerДокумент2 страницыHR Director VP Manufacturing in Dallas Fort Worth TX Resume Nancy GenglerNancy Gengler1Оценок пока нет

- Idukki List of Akshaya CentresДокумент9 страницIdukki List of Akshaya Centreshari prakashОценок пока нет

- CompaniesДокумент5 страницCompaniesratul02Оценок пока нет

- Adrem Solutions: Roorkee - Computer HardwareДокумент2 страницыAdrem Solutions: Roorkee - Computer Hardwarersrakesh97Оценок пока нет

- CP List 15032018Документ47 страницCP List 15032018Pradeep PandianОценок пока нет

- Magna Construction & Engineering CoДокумент47 страницMagna Construction & Engineering CoMaiwand KhanОценок пока нет

- E.C. Job - CompanyДокумент14 страницE.C. Job - CompanyDipak PatelОценок пока нет

- Registered MSOs ListДокумент112 страницRegistered MSOs ListchaitanyaОценок пока нет

- PARTH Directory Industry4Документ48 страницPARTH Directory Industry4Parth PatelОценок пока нет

- Nse Yahoo SymbolsДокумент99 страницNse Yahoo SymbolshannryssОценок пока нет

- List of Poly-Technique CollegesДокумент12 страницList of Poly-Technique CollegesMamon GhoshОценок пока нет

- FAQs On SBOДокумент52 страницыFAQs On SBOAbhinay KumarОценок пока нет

- Classified 2015 02 04 000000Документ5 страницClassified 2015 02 04 000000sasikalaОценок пока нет

- SN HDU Name Registration No. Organisation Address Phone / Fax Number Email Fees Paid Joining Date Expiry Date DivisionДокумент25 страницSN HDU Name Registration No. Organisation Address Phone / Fax Number Email Fees Paid Joining Date Expiry Date DivisionVidya Adsule100% (1)

- Document of DataДокумент2 страницыDocument of Datalokmatgroup3660Оценок пока нет

- Pages PGDM - FinanceДокумент6 страницPages PGDM - Financebela_joshiОценок пока нет

- Companies in NCRДокумент7 страницCompanies in NCRDeepak KОценок пока нет

- Sheela Foam Limited - RHP - November 18, 2016Документ478 страницSheela Foam Limited - RHP - November 18, 2016bijuprasadОценок пока нет

- Brief Curriculum VitaeДокумент15 страницBrief Curriculum VitaeRupendra ChourasiyaОценок пока нет

- Panoli IndДокумент9 страницPanoli Indanon_981731217Оценок пока нет

- Tamil Nadu EnggДокумент83 страницыTamil Nadu EnggRena SahiОценок пока нет

- Alu CansДокумент26 страницAlu CansindusexposiumОценок пока нет

- NWДокумент38 страницNWvishiwizardОценок пока нет

- Core Vendor PDFДокумент215 страницCore Vendor PDFSakar EngitechОценок пока нет

- Mobile Phone Dealers in Ahmedabad - 91mobilesДокумент2 страницыMobile Phone Dealers in Ahmedabad - 91mobileskismatluckОценок пока нет

- SecuritasДокумент4 страницыSecuritasVikas SainiОценок пока нет

- Industries in Govindpura Industrial Area, Bhopal (M.P) : Baijnath TyresДокумент1 страницаIndustries in Govindpura Industrial Area, Bhopal (M.P) : Baijnath TyresAmit SinghОценок пока нет

- List A: UCN Name of The Auditor / Firm AddressДокумент9 страницList A: UCN Name of The Auditor / Firm AddressJitender BhadauriaОценок пока нет

- .Welcome To College of Engineering, ShegaonДокумент3 страницы.Welcome To College of Engineering, ShegaonSrinivas KaratlapelliОценок пока нет

- India Lawyers TranslatorsДокумент35 страницIndia Lawyers TranslatorsSaandip DasguuptaОценок пока нет

- It AscДокумент348 страницIt AscUpender BhatiОценок пока нет

- Waste OilДокумент45 страницWaste Oilprasad336Оценок пока нет

- Energy Audit CosДокумент2 страницыEnergy Audit CosAbul Lais NalbandОценок пока нет

- List of Exploration Agencies Available With IbmДокумент8 страницList of Exploration Agencies Available With IbmtusharparmaraОценок пока нет

- Calibration Directory 2 DTD 22.04.2020 1 1 PDFДокумент174 страницыCalibration Directory 2 DTD 22.04.2020 1 1 PDFthe creationОценок пока нет

- List of Companies.Документ9 страницList of Companies.Rashmi K SasidharanОценок пока нет

- 03 MumbaiДокумент30 страниц03 MumbaiAbhilashSatapathyОценок пока нет

- Recent VendorsДокумент4 страницыRecent VendorsVaishali JaiswalОценок пока нет

- Mrs. DEEPA SANJAY Deepa - Pen@yahoo - Co.in Mobile # - 07875436967 O BJECTIVEДокумент4 страницыMrs. DEEPA SANJAY Deepa - Pen@yahoo - Co.in Mobile # - 07875436967 O BJECTIVEdeepa_penОценок пока нет

- Industry List ValuableДокумент3 страницыIndustry List Valuablewestern120Оценок пока нет

- Biotech Companies in IndiaДокумент9 страницBiotech Companies in Indiaapi-3779164100% (5)

- Noida JVRS Projects & Engineers, Noida: To, Ami Cooling SystemДокумент15 страницNoida JVRS Projects & Engineers, Noida: To, Ami Cooling SystemPuneet ParasharОценок пока нет

- Rating Profile: Sov A1+ P1+ Call/repoДокумент22 страницыRating Profile: Sov A1+ P1+ Call/repoprashant.mehtaОценок пока нет

- Fmai 5 PDFДокумент53 страницыFmai 5 PDFvenkatesh_1829Оценок пока нет

- Ra ListДокумент218 страницRa ListPiratesОценок пока нет

- List of Empanelled Hospitals For CIL and Its Subsidiaries Updated On 06.08.2017 09082017-1 PDFДокумент26 страницList of Empanelled Hospitals For CIL and Its Subsidiaries Updated On 06.08.2017 09082017-1 PDFTapan MazumdarОценок пока нет

- Portrait of an Industrial City: 'Clanging Belfast' 1750-1914От EverandPortrait of an Industrial City: 'Clanging Belfast' 1750-1914Оценок пока нет

- KVIC EDPTrainingДокумент35 страницKVIC EDPTrainingPrabhudas ChoudaryОценок пока нет

- HENRYДокумент7 страницHENRYJuan M González CОценок пока нет

- Industrial Waxes, Inc., A Corporation v. Gerald Few Brown, 258 F.2d 800, 2d Cir. (1958)Документ7 страницIndustrial Waxes, Inc., A Corporation v. Gerald Few Brown, 258 F.2d 800, 2d Cir. (1958)Scribd Government DocsОценок пока нет

- PSL, S.A - MT CalakmulДокумент10 страницPSL, S.A - MT CalakmulJuan M González CОценок пока нет

- 2009 Annual Report PDFДокумент370 страниц2009 Annual Report PDFMd Kaleem100% (1)

- Noise EASA TCDS A.120 - (IM) - Boeing - 737 10 09042013Документ507 страницNoise EASA TCDS A.120 - (IM) - Boeing - 737 10 09042013İ. Çağlar YILDIRIMОценок пока нет

- ConfigДокумент4 страницыConfigRafan SyahrezaОценок пока нет

- As 7658 (2012) - Railway Infrastructure - Railway Level CrossingsДокумент8 страницAs 7658 (2012) - Railway Infrastructure - Railway Level Crossingsbriankimbj0% (1)

- Chapter 11-12 - Marketing StrategyДокумент70 страницChapter 11-12 - Marketing StrategyHaryadi WidodoОценок пока нет

- Iloilo City Regulation Ordinance 2014-260Документ6 страницIloilo City Regulation Ordinance 2014-260Iloilo City Council100% (1)

- Toto Driver PDFДокумент24 страницыToto Driver PDFsuranjanacОценок пока нет

- Citroen Berlin Go Brochure 1Документ24 страницыCitroen Berlin Go Brochure 1rramadanОценок пока нет

- BlackboxДокумент18 страницBlackboxArpit BhardwajОценок пока нет

- Midwest Express 105 DTWДокумент106 страницMidwest Express 105 DTWGFОценок пока нет

- Hotel CAR - Limousine ChecklistДокумент1 страницаHotel CAR - Limousine ChecklistHồ VyОценок пока нет

- Ejercicio #1 de Llenado de Bill of LadingДокумент4 страницыEjercicio #1 de Llenado de Bill of LadingKatherine VallejosОценок пока нет

- FHWA-SA-21-014 - CPFM - 051821 Enhancing Safety Through Continuous Pavement Friction MeasurementДокумент2 страницыFHWA-SA-21-014 - CPFM - 051821 Enhancing Safety Through Continuous Pavement Friction MeasurementPhilip KyungОценок пока нет

- D Value CalcДокумент5 страницD Value CalcAstri NgentОценок пока нет

- Booking Confirmation: ....... DJ1012......... ........ 15 Dec 2022..................Документ2 страницыBooking Confirmation: ....... DJ1012......... ........ 15 Dec 2022..................Hạnh SumiОценок пока нет

- Marina Systems CompleteДокумент317 страницMarina Systems CompleteYew LimОценок пока нет

- SimBrief Flight Dispatch Highlight 6Документ32 страницыSimBrief Flight Dispatch Highlight 6Abang FayyadОценок пока нет

- SM 661Документ1 006 страницSM 661hydromaq S.AОценок пока нет

- Fasilitas Pelabuhan Dan FungsinyaДокумент98 страницFasilitas Pelabuhan Dan FungsinyaDiego Maradona MahardutaОценок пока нет

- Chapter 1 Low Bed TrailerДокумент14 страницChapter 1 Low Bed TrailerOdlnayer Allebram100% (1)

- FightersДокумент132 страницыFighterszainiОценок пока нет

- Railway's ElectrificationДокумент14 страницRailway's ElectrificationAnmolОценок пока нет

- Highlight ORION Rev 12Документ7 страницHighlight ORION Rev 12RissaОценок пока нет

- Agt Tractor Broshure English enДокумент6 страницAgt Tractor Broshure English enLuciusОценок пока нет

- Study Area Delineation & Planning Surveys: CE697 Urban Transport System PlanningДокумент26 страницStudy Area Delineation & Planning Surveys: CE697 Urban Transport System PlanningDhrubajyoti DattaОценок пока нет

- Corporate Strategy PDFДокумент27 страницCorporate Strategy PDFaryan singhОценок пока нет

- CV PT. Gori Global Indonesia-Gunung SindurДокумент3 страницыCV PT. Gori Global Indonesia-Gunung SindurIkhsanul ArifОценок пока нет

- Cars For Sale Mar. 13 2023 1 PDFДокумент3 страницыCars For Sale Mar. 13 2023 1 PDFvictor privadoОценок пока нет

- 65646-Item-Brochure Dynapac DRS120DДокумент5 страниц65646-Item-Brochure Dynapac DRS120DUri RocabadoОценок пока нет

- 25S15 Ch. Cab. WДокумент10 страниц25S15 Ch. Cab. Wsambudello0% (1)