Академический Документы

Профессиональный Документы

Культура Документы

CGTMSE Presentation

Загружено:

sandippatil030 оценок0% нашли этот документ полезным (0 голосов)

73 просмотров20 страницCGTMSE - IMC / ICSI-08.03.2013. SKS and Associates. CGT guarantees covers for loans sanctioned to a maximum amount of Rs. 100lacs including fund and non fund based finances given by MLI.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCGTMSE - IMC / ICSI-08.03.2013. SKS and Associates. CGT guarantees covers for loans sanctioned to a maximum amount of Rs. 100lacs including fund and non fund based finances given by MLI.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

73 просмотров20 страницCGTMSE Presentation

Загружено:

sandippatil03CGTMSE - IMC / ICSI-08.03.2013. SKS and Associates. CGT guarantees covers for loans sanctioned to a maximum amount of Rs. 100lacs including fund and non fund based finances given by MLI.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 20

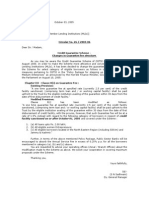

Presented by.

C.A Suresh Kumar Subrahmanyan & Associates

Office: 14 A/11. Manish Nagar

J.P.Road, Andheri (West)

Mumbai 53.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 1 28/02/2013

CGT-CREDIT GUARANTEE FUND TRUST

CGTMSE

Introduction

Challenges faced by SMEs

Objective

Credit guarantee scheme

Eligible Lending Institutions

Risk coverage

Rehabilitation assistance

Eligible borrowers

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 2

CGT-CREDIT GUARANTEE FUND TRUST

CGTMSE

Non eligibility

Guarantee fees structure

Annual Service Fees

Cost & Interest to the Borrower

Amendment in October 2012

Composite all - in guarantee fee

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 3 28/02/2013

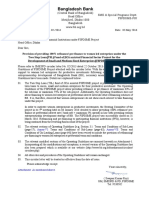

Introduction - CGTMSE

Launched by Ministry of Micro, Small & Medium Enterprises

Guarantee given to Member Lending Institutions (MLI)

For loans sanctioned with out collateral security and/or third

party guarantee.

Considering the financial requirements of SMEs & practical

hurdles faced by them in raising finance.

CGT guarantees covers for loans sanctioned to a maximum

amount of Rs. 100lacs including fund and non fund based

finances given by MLI.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 4 28/02/2013

Challenges faced by SMEs

Limited available Capital for SMEs

Sustaining through initial years

Difficulties in obtaining Finance from Banks and

other lending institutions

Requirement of collateral securities

Requirement of third party guarantee

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 5 28/02/2013

OBJECTIVES OF CREDIT GUARANTEE FUND TRUST

Make available Collateral free Credit facility to SMEs

To strengthen Credit delivery system

To facilitate flow of Credit to SMEs

MLI to give importance for project viability

Secure credit facility purely on primary security of

assets financed

MLI should endeavor to give composite credit to the

borrowers

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 6 28/02/2013

Credit guarantee scheme

Available to eligible MLI

For any collateral / third party guarantee free loans

extended to new as well as existing Micro & small

enterprises

Maximum guarantee cover up to 100lacs.

Extent of guarantee cover up to 75/80/85% of Credit

sanctioned

Time limit to apply for covering eligible credit facility

sanctioned in one calendar quarter is before end of

subsequent calendar quarter

CGTMSE - IMC/ICSI-08.03.2013. SSK & Associates. 7 28/02/2013

Eligible Lending Institutions

All scheduled commercial Banks

Specified Regional Rural Banks

NSIC, NEDFI, SIDBI which have entered into an

agreement with the trust for the purpose

Eligible lending institutions to enter in to agreement &

become eligible Member Lending Institutions (MLI)

CGTMSE - IMC/ICSI-08.03.2013. SSK & Associates. 8 28/02/2013

Maximum Risk coverage

Up to 75 % (85% for select category of borrowers) of the

defaulted principal amount in respect of term loans

including interest for one quarter

Outstanding working capital advance including interest

Time limit - As on the date of becoming NPA or as on

date of filing suit which ever is lower.

Non qualifying amounts Penal interest, Service

charge, commitment charge or any other levies/

charges.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 9 28/02/2013

Rehabilitation Assistance

For the unit covered under CGTMSE and becoming sick

due to factors beyond the control of management,

assistance for rehabilitation extended by the lender

could also be covered under the scheme provided the

overall assistance is within the credit cap of Rs.100

lakhs.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 10 28/02/2013

Eligible borrowers

New and existing Micro and Small Enterprises engaged

in manufacturing or service activity excluding 'Retail

Trade'.

Loans sanctioned to all activities that come under

service sector as per RBI's guidelines on 'Lending to

Priority Sector' and MSMED Act 2006, except retail

trade are eligible for coverage under the scheme.

Loans given to small road & water transporters

Mandatory to have Income tax Permanent Account

Number (PAN)

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 11 28/02/2013

Eligible borrowers(contd)

Additional Credit facilities sanctioned to existing units

can be covered provided no collateral/ third party

guarantee is obtained

Where part of credit is covered with collateral and part

of facility without collateral security is not eligible if it

is of composite in nature.

Credit facilities allowed to eligible borrower can be

from various institutions subject to ceiling of 100lakhs

per borrower and subject to maximum eligible amount

of the MLI.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 12 28/02/2013

Eligible borrowers(contd)

Co-financing to a MSE unit by Financial Institution

with a Commercial Bank is also covered under the

Scheme

Presently credit facility extended to self-help group is

not covered under the scheme

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 13 28/02/2013

Non eligibile borrowers

Any facility given on the basis of collateral security or

third party guarantee is disqualified for coverage under

the scheme

The Trust also reserves the right to reject any

application for the guarantee cover, if it deems

necessary

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 14 28/02/2013

Guarantee fees structure

Payable by MLI to the Trust up front

Guarantee fee to be payable within 30 days from the

date of first disbursement of the facility

Credits sanctioned up to Rs5lacs - 1%

Credits sanctioned above Rs 5lacs to Rs 100lacs 1.5%

Credits sanctioned above Rs 5lacs to Rs 50lacs in

North Eastern region 0.75%

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 15 28/02/2013

Annual Service fees structure

Payable by MLI to the Trust

Credits sanctioned up to Rs5lacs - 0.5%

Credits sanctioned above Rs 5lacs to Rs 100lakhs 0.75%

ASF payable before 31

st

. May of the year.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 16 28/02/2013

Cost & Interest to the Borrower

Left to the discretion of MLI either to charge to the

borrower or bear these fees by themselves

Interest rate payable by borrower: MLI shall follow the

guideline issued by the RBI

Interest rate shall not exceed 3% over and above Prime

lending rate excluding annual service fees

Primary security should be in the form of Business

Assets. Minimum requirement of Net Assets (Assets-

Liabilities) is 1.33 times the loan amount.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 17 28/02/2013

Composite all - in guarantee fee

Sr.

No

Credit facility Annual Guarantee fee(AGF) {%}

Women, Micro

Enterprises and

units in North East

Region (incl.

Sikkim)

Others

1 Upto Rs.5 lakh 0.75 1.00

2 Above Rs.5 lakhs and upto Rs.100

lakh

0.85 1.00

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 18 28/02/2013

Amendment in October 2012

Exceptions to Third party guarantee obtained by MLI

from:

Proprietor in case of sole proprietary concern

Partners in the case of partnership firm/LLP

Trustees in the case of Trusts

Karta & coparceners in the case of HUF

Promoters/Directors in the case of Public/private

limited Companies.

CGTMSE - IMC/ICSI-08.03.2013. SKS & Associates. 19 28/02/2013

28/02/2013

CGTMSE - IMC/ICSI-08.03.2013. SSK &

Associates. 20

Вам также может понравиться

- WWW - Cgtmse.In: Tolani Institute of Management StudiesДокумент16 страницWWW - Cgtmse.In: Tolani Institute of Management StudiesFenil ThakkarОценок пока нет

- CGTMSE Presentation FinalДокумент30 страницCGTMSE Presentation FinalVishal Chaudhari100% (1)

- Collateral SecurityДокумент2 страницыCollateral SecurityThanga pandiyanОценок пока нет

- CGTMSEДокумент4 страницыCGTMSEPrasath KumarОценок пока нет

- Cgtmse MДокумент82 страницыCgtmse MAnonymous EtnhrRvz0% (1)

- CGTMSEДокумент43 страницыCGTMSEAnkur Datta100% (1)

- Cgtsme FaqДокумент12 страницCgtsme FaqMatilda LoiselОценок пока нет

- Circ 36Документ8 страницCirc 36Harsh MehtaОценок пока нет

- CGTMSE FAQsДокумент19 страницCGTMSE FAQsVarun DeshpandeОценок пока нет

- Introduction To Credit GuaranteeДокумент1 страницаIntroduction To Credit Guaranteessr68Оценок пока нет

- Ede 6 PRДокумент6 страницEde 6 PRsingaporeid006Оценок пока нет

- By CA Amit BansalДокумент22 страницыBy CA Amit BansalSindhuja BhaskaraОценок пока нет

- What Is Microcredit?Документ10 страницWhat Is Microcredit?hiteshОценок пока нет

- Tanvi Goel - Professional Practices - Government Scheme (CGFTMSE)Документ6 страницTanvi Goel - Professional Practices - Government Scheme (CGFTMSE)Tanvi GoelОценок пока нет

- CGTMSE Information Booklet 2015Документ56 страницCGTMSE Information Booklet 2015Puneet AgarwalОценок пока нет

- Credit Guarantee Fund Trust For MicroДокумент1 страницаCredit Guarantee Fund Trust For MicrojadejachanduОценок пока нет

- FAQs-ECLGS - Updated As On 31.03.2022Документ32 страницыFAQs-ECLGS - Updated As On 31.03.2022vedaОценок пока нет

- CGTMSE MMS Final Summer ProjectДокумент36 страницCGTMSE MMS Final Summer ProjectSuresh Kadam50% (4)

- Sbi Smart Products For SmeДокумент30 страницSbi Smart Products For SmeRAJEEV THAKURОценок пока нет

- Credit Guarantee Trust For Micro - Small Enterprises (CGTMSE)Документ12 страницCredit Guarantee Trust For Micro - Small Enterprises (CGTMSE)Manoj Kumar MannepalliОценок пока нет

- Circular Risk Capital Assistance For Msme UnitsДокумент7 страницCircular Risk Capital Assistance For Msme Unitss.k.pandeyОценок пока нет

- CGTMSE SchemesДокумент20 страницCGTMSE SchemesarulbankofindiaОценок пока нет

- Benefits For MSME RegistrationДокумент3 страницыBenefits For MSME RegistrationAnkita SinghОценок пока нет

- Credit Guarantee Fund Trust For Micro & Small Enterprises (CgtmseДокумент1 страницаCredit Guarantee Fund Trust For Micro & Small Enterprises (CgtmseMubarakОценок пока нет

- Cgtmse LoansДокумент3 страницыCgtmse LoansNarayanan VenkatachalamОценок пока нет

- Aatmanirbhar Bharat: Policy HighlightsДокумент3 страницыAatmanirbhar Bharat: Policy HighlightsVidya KoliОценок пока нет

- Credit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESДокумент2 страницыCredit Guarantee Fund Scheme For MICRO AND SMALL ENTERPRISESsachinoilОценок пока нет

- Credit Guarantee Fund Trust For Small Industries: Circular No.14/2003-04Документ1 страницаCredit Guarantee Fund Trust For Small Industries: Circular No.14/2003-04Harsh MehtaОценок пока нет

- Faqs Eclgs Updated As On 06.10.2022Документ41 страницаFaqs Eclgs Updated As On 06.10.2022A BcОценок пока нет

- PM Rozgar Yojana - GuidelinesДокумент5 страницPM Rozgar Yojana - GuidelinesNisarg ShahОценок пока нет

- Basic Details About CGTMSEДокумент3 страницыBasic Details About CGTMSEhemalОценок пока нет

- Introduction of Rushikulya Gramya BankДокумент7 страницIntroduction of Rushikulya Gramya BankYaadrahulkumar MoharanaОценок пока нет

- Credit Guarantee Fund Trust For Small Industries: All Member Lending Institutions of CGTSIДокумент2 страницыCredit Guarantee Fund Trust For Small Industries: All Member Lending Institutions of CGTSIHarsh MehtaОценок пока нет

- 4 24 20145 07 53PM PDFДокумент2 страницы4 24 20145 07 53PM PDFpawarkamal5Оценок пока нет

- May 032016 Smespdl 02 eДокумент5 страницMay 032016 Smespdl 02 eSuman kunduОценок пока нет

- FAQs-ECLGS - Updated As On 26.11.2020Документ20 страницFAQs-ECLGS - Updated As On 26.11.2020Avnish KhuranaОценок пока нет

- SIDBI PresentationДокумент34 страницыSIDBI PresentationNarendra KumarОценок пока нет

- Inc42 Media: Skip To ContentДокумент39 страницInc42 Media: Skip To Contentshashi shekhar dixitОценок пока нет

- Credit Guarantee Fund Trust For Small Industries: All Member Lending InstitutionsДокумент4 страницыCredit Guarantee Fund Trust For Small Industries: All Member Lending InstitutionsHarsh MehtaОценок пока нет

- FAQs-ECLGS - Updated As On 07.01.2021Документ21 страницаFAQs-ECLGS - Updated As On 07.01.2021Pawan GuptaОценок пока нет

- State Bank of Travancore: Small and Medium Enterprises - Overview and Schemes AwardsДокумент31 страницаState Bank of Travancore: Small and Medium Enterprises - Overview and Schemes Awardslock_jaw30Оценок пока нет

- MSMEДокумент7 страницMSMERitika SharmaОценок пока нет

- Ede 4.1Документ17 страницEde 4.1Aditee PatilОценок пока нет

- Cgtmse 123Документ19 страницCgtmse 123nchantiОценок пока нет

- 1 Oriental Sme Development Scheme EligibilityДокумент4 страницы1 Oriental Sme Development Scheme EligibilitydocsanshmОценок пока нет

- IPR RegistrationsДокумент21 страницаIPR RegistrationsSSОценок пока нет

- 3 Credit Guarantee Scheme of Cgtmse and How It Is Implemented by Bank of BarodaДокумент19 страниц3 Credit Guarantee Scheme of Cgtmse and How It Is Implemented by Bank of BarodaAkshayОценок пока нет

- These Faqs Are Subject To Changes From Time To TimeДокумент6 страницThese Faqs Are Subject To Changes From Time To TimeEntomic ChemicalsОценок пока нет

- Can Startups Get Bank Loan Without Any Collateral Security?: Working Capital Loan From BanksДокумент3 страницыCan Startups Get Bank Loan Without Any Collateral Security?: Working Capital Loan From BanksrajОценок пока нет

- Circ 25Документ1 страницаCirc 25Harsh MehtaОценок пока нет

- Tata AigДокумент4 страницыTata AigHarpal Singh MassanОценок пока нет

- Assignment No 6Документ4 страницыAssignment No 61346 EE Omkar PrasadОценок пока нет

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeДокумент2 страницыIffco-Tokio General Insurance Co - LTD: Servicing Officesumit.raj.iiit5613Оценок пока нет

- Project Final AshwaniДокумент17 страницProject Final AshwaniGupta AshwaniОценок пока нет

- Circ 26Документ2 страницыCirc 26Harsh MehtaОценок пока нет

- T 4 CQKV 4 D2 TSDH I3 MK8 KQ FSN YPw 6 RTBBSMH 7 P 449 DДокумент4 страницыT 4 CQKV 4 D2 TSDH I3 MK8 KQ FSN YPw 6 RTBBSMH 7 P 449 DAnish PuthusseryОценок пока нет

- RMA Against Bank Guarantee: 1A) Benefits Extended To Mses Having Valid RegistrationДокумент8 страницRMA Against Bank Guarantee: 1A) Benefits Extended To Mses Having Valid RegistrationVijaysinh ChavanОценок пока нет

- To Print VaibhavДокумент59 страницTo Print VaibhavtechcaresystemОценок пока нет

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5От EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Оценок пока нет

- Rs 55,000 Crore Air India ScamДокумент19 страницRs 55,000 Crore Air India Scamhindu.nationОценок пока нет

- Fidelity Bond FormsДокумент28 страницFidelity Bond FormsJerry SelimОценок пока нет

- Adjusting ProcessДокумент66 страницAdjusting ProcessAnonymous mnAAXLkYQC100% (1)

- Citi Bank in BangladeshДокумент2 страницыCiti Bank in BangladeshSSN073068Оценок пока нет

- Financial Statments Analysis of PPLДокумент25 страницFinancial Statments Analysis of PPLIfzal Ahmad100% (2)

- Go Vs UCPBДокумент9 страницGo Vs UCPBES AR ViОценок пока нет

- History of Agrarian ReformДокумент22 страницыHistory of Agrarian ReformGail Voir100% (1)

- Slide CH 5Документ39 страницSlide CH 5KaranОценок пока нет

- Income Tax NitДокумент6 страницIncome Tax NitrensisamОценок пока нет

- Little Paris Expansion PresentationДокумент12 страницLittle Paris Expansion PresentationKeith KhooОценок пока нет

- CPA Board Exam Quizzer Vol. 2Документ13 страницCPA Board Exam Quizzer Vol. 2John Mahatma AgripaОценок пока нет

- WT Form 19Документ2 страницыWT Form 19sukanyaОценок пока нет

- VipuДокумент3 страницыVipuGeetanshu SinghОценок пока нет

- Bank of AmericaДокумент7 страницBank of Americakirtan patelОценок пока нет

- CPE Paper - Md. Syful Islam - Fraud & Money Laundering in Banking Sector-BD Perspective - 30nov08Документ50 страницCPE Paper - Md. Syful Islam - Fraud & Money Laundering in Banking Sector-BD Perspective - 30nov08Kamrul HassanОценок пока нет

- Risk Analysis, Real Options, and Capital BudgetingДокумент40 страницRisk Analysis, Real Options, and Capital BudgetingANKIT AGARWALОценок пока нет

- Banking LawДокумент19 страницBanking LawAmado Vallejo IIIОценок пока нет

- Paculdo V Regalado (2000)Документ3 страницыPaculdo V Regalado (2000)Migen SandicoОценок пока нет

- OpenTuition - BPP ACCA Order Books FormДокумент2 страницыOpenTuition - BPP ACCA Order Books FormraveenaОценок пока нет

- Fixed Deposit Rate ChartДокумент3 страницыFixed Deposit Rate ChartmoregauravОценок пока нет

- Republic Vs Security CreditДокумент8 страницRepublic Vs Security CreditSyElfredGОценок пока нет

- Par X Factor (Single Payment) XXX + Present Value of Annual Interest at Par X Interest Rate X Factor (Installment) XXX Market ValueДокумент5 страницPar X Factor (Single Payment) XXX + Present Value of Annual Interest at Par X Interest Rate X Factor (Installment) XXX Market ValueRachel Mae FajardoОценок пока нет

- Ashok Commercial Enterprises vs. Parekh Aluminex LTDДокумент3 страницыAshok Commercial Enterprises vs. Parekh Aluminex LTDChitra ChakrapaniОценок пока нет

- Rating Criteria For Manufacturing CompaniesДокумент8 страницRating Criteria For Manufacturing CompaniesAnonymous 9PCGIRKОценок пока нет

- Deed of Acknowledgment of Debt Know All Men by These PresentsДокумент3 страницыDeed of Acknowledgment of Debt Know All Men by These PresentsJohn Rey Bantay RodriguezОценок пока нет

- CAARTSДокумент290 страницCAARTSJonef Dulawan100% (1)

- Chapter 21 Financial InstrumentsДокумент21 страницаChapter 21 Financial InstrumentsHammad Ahmad67% (3)

- East RayaДокумент1 страницаEast RayaeendaiОценок пока нет

- Case Study of Sunlight Industries LTD: SolutionДокумент3 страницыCase Study of Sunlight Industries LTD: Solutionparv guptaОценок пока нет

- Demonetisation PresentationДокумент21 страницаDemonetisation PresentationNawazish KhanОценок пока нет