Академический Документы

Профессиональный Документы

Культура Документы

Chapter 22

Загружено:

Frederick Xavier Lim0 оценок0% нашли этот документ полезным (0 голосов)

19 просмотров44 страницы"Strategy formulation" develops strategies to attain an organization's goals. Management control process assures that the strategies are implemented. Four facets of the management control environment: Nature of organizations, rules, guidelines and procedures that govern the actions of the organization's members.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ"Strategy formulation" develops strategies to attain an organization's goals. Management control process assures that the strategies are implemented. Four facets of the management control environment: Nature of organizations, rules, guidelines and procedures that govern the actions of the organization's members.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

19 просмотров44 страницыChapter 22

Загружено:

Frederick Xavier Lim"Strategy formulation" develops strategies to attain an organization's goals. Management control process assures that the strategies are implemented. Four facets of the management control environment: Nature of organizations, rules, guidelines and procedures that govern the actions of the organization's members.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 44

Chapter 22

Control: The Management

Control Environment

Alex Co

Betina Jareno

Management Control

This chapter addresses the control process and

the use of accounting information in that

process.

strategy formulation develops strategies to attain an

organizations goals.

Where do you want to go?

How do you want to get there?

Strategies change whenever a new opportunity or a new

threat is perceived.

Management Control Process

Seeks to assure that the strategies are implemented.

Process by which managers influence members of the

organization to implement the organizations strategies

efficiently and effectively.

Includes planning.

Two Parts of Planning

A statement of objectives.

Resources required to achieve those objectives.

Goals and Objectives

GOALS OBJECTIVES

Broad, usually non-

quantitative, long run

plans relating to the

organization as a

whole.

More specific, often

quantitative, shorter

run plans for individual

responsibility centers.

The Environment

Four facets of the management control environment:

Nature of organizations.

Rules, guidelines and procedures that govern the actions of the

organizations members.

The organizations culture.

External environment.

The Nature of Organizations

Organization: a group of human beings who work together

for one or more purposes.

Managers or the management: Leaders who perform

important tasks.

Tasks of Management

Determining goals.

Determining objectives to achieve the goals.

Communicating goals and objectives.

Determining tasks to be performed to achieve objectives.

Coordination.

Matching individuals to tasks.

Motivating.

Observing/monitoring employee performance.

Taking corrective action as needed.

Organization Hierarchy

Layers of management with authority running from top to

bottom.

Organization chart.

Categorized concept subordination of entities that work

together to contribute to serve one aim.

Provides leadership, direction, and division of labor.

Organization Chart

Rules, Guidelines, and

Procedures

Influence the way members behave.

Written, or verbal; formal, or informal.

Culture

Norms of behavior determined by:

Tradition.

External influences.

Attitudes of senior management and the board of

directors (BOD).

External Environment

Everything outside of the organization itself.

E.g., customers, suppliers, competitors, regulatory

agencies.

Responsibility Centers and

Responsibility Accounts

Responsibility Centers

Responsibility Accounting

The Management Accounting Construct that deals with

both planned and actual accounting information about

the inputs and outputs of a responsibility center.

Responsibility Accounting

Lame Mans term: It shows if you hit your work quota for the

year.

This definition is not limited to sales.

You usually know whether youre doing your job when your

boss recognizes you.

Sales Department

250,000 worth of goods 20,000 selling expenses 600,000 sales target for the year

(500,000 units)

Production Department

150,000 worth of raw materials 50,000 processing cost 250,000 cost of production

(500,000 units)

Responsibility Centers

Commonly perform work related to several products.

Inputs to a responsibility center are called cost elements or line items (on a

department cost report).

Costs have three different dimensions:

Dimensions of Costs

Responsibility center. Where was cost incurred?

Product dimension. For what output was the cost incurred?

Cost element dimension. What type of resource was used?

Limitations of Actual Costs

Compared to Standard

Not an accurate measure of efficiency for at least 2 reasons:

Recorded costs are not precisely accurate measures of resources

consumed.

Standard are at best only approximate measures of what resource

consumption ideally should have been in the circumstances prevailing.

Terms in Responsibility

Accounting

Line Items

Effectiveness

Efficiency

Effectiveness and Efficiency

Effectiveness Efficiency

How well the

responsibility center

does its job.

The amount of output

per unit of input.

Lower cost is more efficient

More output (e.g. sales) is more effective.

Types of Responsibility

Centers

Revenue Center

Expense Center

Profit Center

Investment Center

Revenue Center

Responsible for outputs of center as measured in monetary terms

(revenues).

Not responsible for the costs of goods or services that the center sells.

E.g., sales organization.

Also responsible for selling expenses (e.g., travel, advertising, point-of-

purchase displays, sales office salaries, rent).

Expense Centers

Responsible for expenses (i.e., the costs) incurred but

does not measure its outputs in terms of revenues.

E.g., production departments, staff units such as

accounting.

Standard or Engineered Cost

Center

Expense center for which many of its cost elements have

standard costs established.

Differences between standard costs and actual costs are

variances.

E.g., production cost centers, fast food restaurants, and

blood testing laboratories.

Discretionary Expense Center

Also called managed cost center.

Difficult to measure output in monetary terms.

Production support and corporate staff.

E.g., human resources, accounting, R&D.

Profit Center

If a performance is measured by the revenue it earns and the

expenses it incurs, this is the classification of that

responsibility center.

Resembles a business on its own it has its own income

statement.

Profit Center (Criteria)

If the center involves extra record keeping

If the manager of the center has no deciding authority on quantity

and quality in relation to costs.

If senior management requires the center to use the services of

another responsibility center

If outputs are homogeneous

If the center puts managers in business for themselves, which

promotes freedom and competition

Terms to Remember

Transfer-price

Market-based transfer price

Cost-based transfer price

Transfer Prices

Price at which goods or services are sold between responsibility centers

within a company.

Revenue for selling center and cost for the receiving center.

2 general types of transfer prices:

Market based price.

Cost based price.

Market-based Transfer Prices

Based on price for same product between independent parties, i.e.,

a market price or, equivalently, an arms length price.

Adjusted for quantifiable differences such as credit costs.

Where available is widely used.

Frequently not available.

Cost-Based Transfer Prices

When no reliable market price is available.

Cost plus a mark-up.

If based on actual cost, little incentive to reduce costs.

Transfer Pricing Issues

Negotiated by responsibility centers or set/arbitrated by top management.

Should manager have freedom to use alternative source?

Sub-optimization: maximize profits for a responsibility center may not

maximize profit for the consolidated company.

Investment Center

Managers are held responsible for the use of assets as well

as for profit.

Performance is measured by RESIDUAL INCOME

Measures of Performance

Return on investment = Profit/Investment

Return on assets = (net income) / (total assets).

Split between ROS and Asset Turnover

Residual income = Pre-interest profit (Capital charge *

investment)

Residual Income

A.K.A. Economic Profit, Economic Value Added

Residual Income = (How much you want to earn + Interest

expense) (Cost of capital + Money that you put in)

Residual Income

Residual income = Income before taxes less a capital

charge.

Capital charge is calculated by applying a rate to the

investment centers assets or net assets.

Advantage of Residual

Income over ROI

Advantage of ROI Over

Residual Income:

Encourages managers

to make all

investments whose

return is greater than

the capital cost rate.

ROI measures are ratios

that can be used to

compare investment

centers of different sizes.

Residual income is an

internal number that is not

reported to shareholders

and other outsiders.

Investment Center Issues

Asset allocation between

centers.

How to value assets (e.g.,

historical cost or

replacement cost).

Managers focus their day-

to-day efforts on

managing current assets,

particularly inventories

and receivables.

Most companies

control investments

in fixed assets using

capital investment

(i.e., capital

budgeting)

procedures

addressed in Chapter

27.

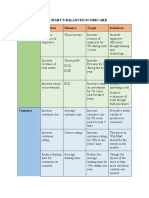

Non-monetary Measures

Non-monetary as well as monetary objectives.

E.g., Quality of goods or services, customer satisfaction.

Management by objectives (MBO) and Balanced Scorecards in

Chapter 24.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Word Business Case TemplateДокумент5 страницWord Business Case TemplateSanthosh Kumar Setty100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- People V CaparasДокумент3 страницыPeople V CaparasFrederick Xavier LimОценок пока нет

- CAT UniversityДокумент31 страницаCAT Universityaskvishnu7112Оценок пока нет

- DOLE v. Maritime Company of The PhilsДокумент2 страницыDOLE v. Maritime Company of The PhilsFrederick Xavier LimОценок пока нет

- CIR V CTA Manila GolfДокумент2 страницыCIR V CTA Manila GolfFrederick Xavier LimОценок пока нет

- CIR V CTA Manila GolfДокумент2 страницыCIR V CTA Manila GolfFrederick Xavier LimОценок пока нет

- A Guide To Calculating Return On Investment (ROI) - InvestopediaДокумент9 страницA Guide To Calculating Return On Investment (ROI) - InvestopediaBob KaneОценок пока нет

- Espinoza V UOBДокумент1 страницаEspinoza V UOBFrederick Xavier LimОценок пока нет

- Retail Math'Sppt1Документ40 страницRetail Math'Sppt1nataraj105100% (8)

- People v. Almazan DigestДокумент1 страницаPeople v. Almazan DigestFrederick Xavier LimОценок пока нет

- Assignment 11 Managerial AccountingДокумент9 страницAssignment 11 Managerial AccountingFaisal AlsharifiОценок пока нет

- Macaslang V ZamoraДокумент3 страницыMacaslang V ZamoraFrederick Xavier LimОценок пока нет

- B ST XI Subhash Dey All Chapters PPTs Teaching Made EasierДокумент1 627 страницB ST XI Subhash Dey All Chapters PPTs Teaching Made EasierAarush GuptaОценок пока нет

- Stott Pilates (PDFDrive) PDFДокумент99 страницStott Pilates (PDFDrive) PDFpaperhurtsОценок пока нет

- Automation ROIДокумент10 страницAutomation ROIskodliОценок пока нет

- Rabuco V VillegasДокумент2 страницыRabuco V VillegasFrederick Xavier LimОценок пока нет

- Pasag V ParochaДокумент3 страницыPasag V ParochaFrederick Xavier LimОценок пока нет

- Wal-Mart's Balanced ScorecardДокумент3 страницыWal-Mart's Balanced ScorecardCấn Thu HuyềnОценок пока нет

- Margarejo v. Escoses DigestДокумент1 страницаMargarejo v. Escoses DigestFrederick Xavier LimОценок пока нет

- D'Armoured v. OrpiaДокумент2 страницыD'Armoured v. OrpiaFrederick Xavier LimОценок пока нет

- Internship Report On Shakarganj Sugar Mill by SYED AHMAD MUSTAFAДокумент21 страницаInternship Report On Shakarganj Sugar Mill by SYED AHMAD MUSTAFAAhmad Mustafa100% (2)

- Cafe BoxДокумент21 страницаCafe BoxJhoanna Mary PescasioОценок пока нет

- PP V Candido DigestДокумент1 страницаPP V Candido DigestFrederick Xavier LimОценок пока нет

- Asset Management - Whole-Life Management of Physical AssetsДокумент285 страницAsset Management - Whole-Life Management of Physical AssetsAbhishek Goud Byrey100% (1)

- Marimperio v. CAДокумент5 страницMarimperio v. CAFrederick Xavier LimОценок пока нет

- Dela Vega V BallilosДокумент2 страницыDela Vega V BallilosFrederick Xavier LimОценок пока нет

- CIR V Gonzales 2010Документ4 страницыCIR V Gonzales 2010Frederick Xavier LimОценок пока нет

- Alitalia V IacДокумент3 страницыAlitalia V IacFrederick Xavier LimОценок пока нет

- Required Document ChecklistДокумент3 страницыRequired Document ChecklistFrederick Xavier LimОценок пока нет

- Peak Ventures V Villareal DigestДокумент1 страницаPeak Ventures V Villareal DigestFrederick Xavier LimОценок пока нет

- CMDI V CAДокумент3 страницыCMDI V CAFrederick Xavier LimОценок пока нет

- DBP Pool V Radio MindanaoДокумент3 страницыDBP Pool V Radio MindanaoFrederick Xavier LimОценок пока нет

- Estates Reyes V CIR (CTA)Документ2 страницыEstates Reyes V CIR (CTA)Frederick Xavier LimОценок пока нет

- Raz V IACДокумент2 страницыRaz V IACFrederick Xavier Lim100% (1)

- Chua Yek Hong V IACДокумент2 страницыChua Yek Hong V IACFrederick Xavier LimОценок пока нет

- HomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Документ5 страницHomeWork MCS-Nurul Sari (1101002048) - Case 5.1 5.4Nurul SariОценок пока нет

- Bowling Green Sports FacilityДокумент10 страницBowling Green Sports Facilityapi-377831528Оценок пока нет

- KMBN 301 Strategic Management Unit 5Документ20 страницKMBN 301 Strategic Management Unit 5kumar sahityaОценок пока нет

- FA Poject Nestle Vs EngroДокумент27 страницFA Poject Nestle Vs EngroNaveed Alei Shah67% (3)

- Saffer 2010 Chapter3 PDFДокумент26 страницSaffer 2010 Chapter3 PDFFabiano RamosОценок пока нет

- Case StudyДокумент32 страницыCase StudyAdee ButtОценок пока нет

- The Capital Adequacy Ratio in Pension FundsДокумент7 страницThe Capital Adequacy Ratio in Pension FundsInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Responsibility Accounting QuizДокумент4 страницыResponsibility Accounting QuizSetty HakeemaОценок пока нет

- Carrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)Документ23 страницыCarrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)WerchampiomsОценок пока нет

- ROI ChecklistДокумент2 страницыROI ChecklistTarig TahaОценок пока нет

- What Is The Anderson Model of Learning Evaluation?Документ9 страницWhat Is The Anderson Model of Learning Evaluation?துர்காதேவி சௌந்தரராஜன்100% (1)

- UNIT 1 - Planning & Evaluating OperationsДокумент22 страницыUNIT 1 - Planning & Evaluating OperationsGurneet Singh7113Оценок пока нет

- Responsibility Accounting AssignmentДокумент5 страницResponsibility Accounting AssignmentMikah LabacoОценок пока нет

- SaaS Acronyms Defined and Explained 6 PDFДокумент1 страницаSaaS Acronyms Defined and Explained 6 PDFRitin mahajanОценок пока нет

- ENTREP Lesson 5-7Документ10 страницENTREP Lesson 5-7FruitySaladОценок пока нет

- 123Документ1 страница123kristineОценок пока нет

- Test Maf651Документ4 страницыTest Maf651Zoe McKenzieОценок пока нет

- Performance 6.10Документ2 страницыPerformance 6.10George BulikiОценок пока нет