Академический Документы

Профессиональный Документы

Культура Документы

Ansoff S Matrix

Загружено:

Lauren ObrienОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ansoff S Matrix

Загружено:

Lauren ObrienАвторское право:

Доступные форматы

ANSOFF MATRIX,

BCG MATRIX,

LIFE CYCLE ANALYSIS

CUEVAS, Rieland

REBADOMIA, Chumescene

TAN, Nerick Jason

TAVEROS, Maxine Ann

VENTURA, Cleo Ariana

VILLAHERMOSA, Giah

UY, John

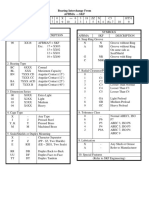

ANSOFFS MATRIX

Product and Growth Matrix

Ansoffs Matrix

Developed by Igor Ansoff

Explains different growth strategies for a company via

existing products and new products, and in existing

markets and new markets

Used after having the SWOT Analysis

Suggests for possible strategies: Market Penetration,

Market Development, Product Development and

Diversification

Different Growth Strategies

Market

Penetration

Product

Development

Market

Development

Diversification

Existing Products New Products

E

s

t

a

b

l

i

s

h

e

d

M

a

r

k

e

t

N

e

w

M

a

r

k

e

t

Market Penetration

Aims

Focus on selling your existing products or services to

existing markets to achieve growth in market share

Risk Low

Profits Low

Approaches

Maintain or increase the market share of current

products

Secure dominance of growth markets

Restructure a mature market by driving out competitors

Increase usage by existing customers

Requires

Detailed market

Competitor intelligence

Market Development

Aims

Focus on selling your existing products or services to

new markets

Risk Moderate

Profits Medium

Approaches

New Geographical Markets

New product dimensions or packaging

New distribution channels

Requires

Detailed market and competitor intelligence

Well-researched market, financial and operational data

Product Development

Aims

Focus on developing new products or services to

existing markets

Risk Moderate

Profits Moderate

Approaches

New product is closely associated with current product

Matches current customers purchasing habits

Reinvents or refreshing existing products

Requires

Research and Development

Assessment of customer needs

Clear path for brand extension

Diversification

Aims

Focus on selling new products or services to new

markets

Risk High

Profits High

Approaches

Honest assessment of risks

Access to capital and willingness to invest

Clear expectation of potential gains

Right balance of risks versus rewards

Types

Forward

Full

Backward

Advantages and Disadvantages

- Useful tool in analyzing the

strategic position of the firm

and set objectives for the way

forward

- sub-divides the options into

four specific strategies that

management could consider for

long term growth

- indicates the level of risk

associated with each strategy

thus encouraging management

to focus carefully on the impact

of any decision made

- Simplistic

- Its main focus tends to be

market potential rather then

the resources required by the

firm to support its chosen

strategy

- usefulness will be very limited

to a firm whose objective is

survival

- No guarantee of success

- Based on forecasts

BCG Matrix

INTRODUCTION

BOSTON COUNSULTING GROUP(BCG)

MATRIX is developed by Bruce

Henderson of the Boston Consulting group

in the early 1970s

Businesses are classified as low or high

performers depending on their relative

market share and their market growth rate

MARKET SHARE

It is the percentage of the total market

thats being serviced by your company,

measured either in revenue terms or unit

volume terms.

RMS= Business unit sales this year

Leading rival sales this year

The higher your market share, the higher

proportion of the market you control

MARKET GROWTH RATE

Used as a measure of a markets

attractiveness

MGR= Individual sales this year- Individual sales last year

Individual Sales Last year

Those with high growth rate are those where the

total market share available is expanding, and

there is plenty of opportunity for everyone to

make money

BCG MATRIX

A portfolio planning model which is based

on the observation that a companys

business units can be classified in to four

categories:

>Stars

>Question marks

>Cash cows

>Dogs

STARS

High growth, high market share

Needs large amounts of cash and are

leaders in the business so they could also

generate large amounts of cash.

CASH COWS

Low growth, High market share

Foundation of the company, usually the

stars of yesterday

Generate more cash than required

Extract profits by investing as little cash as

possible

Located in an industry that is mature

Dogs

Low growth, Low market share

Avoid or minimize the number of dogs in a

company

Do not have potential to bring much cash

Business is situated at a declining stage

Question Marks

High growth, Low market share

Most businesses start of as this

Absorb great amounts of cash if market

share remains low

Have potential to become stars, cash

cows, or dogs

Investments should be high

WHY BCG MATRIX?

To assess:

Profiles of products/businesses

The cash demands of products

The development cycles of products

Resource allocation and divestment

decisions

BENEFITS

Simple and easy to understand

Used to identify corporate cash resources

that can be used to maximize a companys

future growth and profitability

Limitations

Uses only two dimensions

Problems on getting data on market share

and market growth

High market share doesnt mean high

profits all the time

Businesses/products with low market

share can be profitable too

CONCLUSION

Though the BCG matrix has its limitations,

it is one of the most famous and simple

portfolio-planning matrix, used by large

companies having multi-products.

Life Cycle

Analysis

What is LCA?

Looking at a products complete life cycle

From Raw Materials to Final Disposal of the

product.

Examines the environmental impact of a

product by considering the major stages

of a products life.

What is LCA? (Contd)

Major Stages include:

A. Raw Material Acquisition

B. Processing

C. Manufacturing

D. Product Life

E. Waste Management/ End of Life

Historical Perspective

1960s: Coca Cola explores alternative

containers besides the glass bottle.

1970s: Oil embargos in the US create

concerns about energy supplies.

Resources & Environmental Profile Analysis

(REPA)

1974: A new beverage container

comparison and compare different

plastics.

Historical Perspective (Contd)

1980s: Green Movement in Europe

brings focus on emissions and need to

recycle.

1990s: Battle between cloth and

disposable diapers

1992: Energy, Water, and Solid waste

Purpose

1. Calculate products environmental

impact.

2. Identify positive and negative

environmental impact.

3. Opportunities for process or product

improvement.

4. Compare several processes.

5. Quantitatively justify a change in a

process or product.

Life Cycle

Inventory

(LCI)

Life Cycle

Impact

Assessment

(LCIA)

Final Report

LIFE CYCLE ANALYSIS

Life Cycle Inventory (LCI)

process which quantifies all inputs and

outputs of a process or product.

Inputs = Energy and Raw Materials

Outputs = Material Emissions to the

Environment, such as water, air, & solid

waste.

Sample Life Cycle Stages

Inputs

Life Cycle

of Process

or Product

Output

Trees and

Crops

Water

Gas &

Crude Oil

Chemicals

Energy

Capital

Equipment

Raw Material

Processing

Manufacturing

Production

Transportation

Product Life

Maintenance

Airborne

Emissions

Recyclable

Waste

Co-products

Waterborne

Emissions

Landfill Waste

Dumping and

Littering

Life Cycle Impact Assessment (LCIA)

Way to interpret how the processes and

products impact human health and

environment.

Gives a more meaningful basis for comparison.

Step 1: Create a definition and

scope

Consider the following topics when

developing definition and scope:

a. Goal of LCA

b. Audience

c. Production and Process

Information

d. Data Accuracy

e. Result Interpretation and Display

f. Ground Rules

Step 2: Life Cycle Inventory

(LCI)

Consider the following when completing

the LCI:

a. Process Flow

b. Data Gathering

c. Data Inventory

d. Result

Step 3: Life Cycle Impact

Assessment (LCIA)

Consider the following when completing

an LCIA:

a. Impact Categories

b. Result Categorization

c. Impact Comparisons

d. Important Potential Impacts

e. Results

Step 4: Interpret the results and

make recommendations

Consider the following when interpreting

results:

a. Final Results

b. Conclusions

c. Limitations

d. Recommendations

e. Report Information

Вам также может понравиться

- Assignment of Strategic Operational IssuesДокумент22 страницыAssignment of Strategic Operational IssuesGhadoor Mmsk50% (2)

- Growth Matrix - Ansoff Growth MatrixДокумент5 страницGrowth Matrix - Ansoff Growth MatrixOng SooShin100% (1)

- Growth Strategy Process Flow A Complete Guide - 2020 EditionОт EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionОценок пока нет

- Bottom of The PyramidДокумент6 страницBottom of The PyramidKiranmySeven KiranmySevenОценок пока нет

- Vertical IntegrationДокумент36 страницVertical IntegrationYvan Cham0% (1)

- Abd 702 Creating and Managing Competitive Advantage: Submitted by Student ID Submitted ToДокумент21 страницаAbd 702 Creating and Managing Competitive Advantage: Submitted by Student ID Submitted ToPoonam KatariaОценок пока нет

- Case Analysis 1Документ6 страницCase Analysis 1Fu Maria JoseОценок пока нет

- Internalization Theory For The Digital EconomyДокумент8 страницInternalization Theory For The Digital Economyefe westОценок пока нет

- Competencies and CapabilitiesДокумент10 страницCompetencies and CapabilitiesMarwan BecharaОценок пока нет

- Porter's Diamond Model (Analysis of Competitiveness) ...Документ2 страницыPorter's Diamond Model (Analysis of Competitiveness) ...BobbyNicholsОценок пока нет

- Chapter 07 SMДокумент25 страницChapter 07 SMTehniat HamzaОценок пока нет

- Schneider Electric Case Study:: Accelerating Global Digital Platform Deployment Using The CloudДокумент8 страницSchneider Electric Case Study:: Accelerating Global Digital Platform Deployment Using The CloudAjaySon678100% (1)

- PESTLE Analysis For TescoДокумент3 страницыPESTLE Analysis For TescoGerly-Dennis Balansag0% (2)

- Strategic Operations IssuesДокумент20 страницStrategic Operations IssuesMichael YuleОценок пока нет

- Sustainability B 5Документ19 страницSustainability B 5black MirrorОценок пока нет

- ALDI Financial PerspectiveДокумент10 страницALDI Financial PerspectiveJessica JessОценок пока нет

- Strategy FormulationДокумент9 страницStrategy Formulationapi-3774614100% (1)

- Industry AnalysisДокумент7 страницIndustry AnalysisRachel TangОценок пока нет

- Strategic Analysis & ChoicesДокумент44 страницыStrategic Analysis & ChoicesHritesh RulesОценок пока нет

- Accenture Ltd.Документ3 страницыAccenture Ltd.sravan06991a1239Оценок пока нет

- EOQ - P.AgroДокумент72 страницыEOQ - P.AgrokartikОценок пока нет

- The Secret of Multi-Branding: The Brand As The Ultimate Business DriverДокумент13 страницThe Secret of Multi-Branding: The Brand As The Ultimate Business DriverJamaica LayuganОценок пока нет

- Management Control System: DR Rashmi SoniДокумент35 страницManagement Control System: DR Rashmi SoniPriyanka ReddyОценок пока нет

- PGBM16 Global Corporate Strategy Aug 2011Документ5 страницPGBM16 Global Corporate Strategy Aug 2011cnu_neveb4Оценок пока нет

- Inside Unilever - The Evolving Transnational CompanyДокумент22 страницыInside Unilever - The Evolving Transnational CompanybenjameОценок пока нет

- The Porter Five-WPS OfficeДокумент3 страницыThe Porter Five-WPS Officehammad khatri0% (1)

- Cafe de CoralДокумент10 страницCafe de CoralMattPunОценок пока нет

- Business Level or Generic StrategiesДокумент50 страницBusiness Level or Generic StrategiesSirsanath BanerjeeОценок пока нет

- Global Strategy Context Chapter 10Документ17 страницGlobal Strategy Context Chapter 10Lloyd M. StallingsОценок пока нет

- Marketing StrategiesДокумент3 страницыMarketing StrategiesJoshua TobiОценок пока нет

- Chapter 8 Final Presentation-4Документ31 страницаChapter 8 Final Presentation-4api-269676361Оценок пока нет

- Value Chain ModelДокумент21 страницаValue Chain ModelDanish AhsanОценок пока нет

- Emotional IntelligenceДокумент26 страницEmotional IntelligenceNisha MalhotraОценок пока нет

- P3 - Business Analysis Chapter 1. Business StrategyДокумент10 страницP3 - Business Analysis Chapter 1. Business StrategyAnnisa PramestiОценок пока нет

- WBS Graphical TemplateДокумент1 страницаWBS Graphical TemplateJaveed A. KhanОценок пока нет

- Introduction To Strategic ManagementДокумент13 страницIntroduction To Strategic ManagementcellouОценок пока нет

- Woolworth Analysis by Saurav GautamДокумент15 страницWoolworth Analysis by Saurav Gautamsaurav gautamОценок пока нет

- Value Chain Analysis of LICДокумент7 страницValue Chain Analysis of LICROHIT KUMAR SINGHОценок пока нет

- Marketing Plan-Oxfam AustraliaДокумент11 страницMarketing Plan-Oxfam Australiahandyjohn123Оценок пока нет

- Ebay IncДокумент41 страницаEbay IncbusinessdatabasesОценок пока нет

- Effective Strategy Action - From Formulation To Implementation PDFДокумент5 страницEffective Strategy Action - From Formulation To Implementation PDFgagansrikankaОценок пока нет

- SWOT Analysis PDFДокумент8 страницSWOT Analysis PDFDinesh Rawal0% (1)

- Abdullahi Hassan (PBS20101067) HRM7101Документ28 страницAbdullahi Hassan (PBS20101067) HRM7101Abdalla HassanОценок пока нет

- Balanced Scorecard FoundationДокумент15 страницBalanced Scorecard Foundationitumeleng1Оценок пока нет

- Strategy in PracticeДокумент26 страницStrategy in PracticeVivek KotakОценок пока нет

- Ansoff MatrixДокумент6 страницAnsoff MatrixRameshwari Mudaliar100% (1)

- CHAPTER 5. Types of StrategiesДокумент23 страницыCHAPTER 5. Types of StrategiesAiralyn RosОценок пока нет

- Order-Winning and Order-Qualifying CriteriaДокумент3 страницыOrder-Winning and Order-Qualifying CriteriaJesica MaryОценок пока нет

- MAlith RatioДокумент32 страницыMAlith RatioMaithri Vidana KariyakaranageОценок пока нет

- 1993EvaluatingBusiness RumeltДокумент11 страниц1993EvaluatingBusiness RumeltAhsan MujeebОценок пока нет

- Dương Thị Tường Vy - 2199137 - Group 3: Why is the niche market occupied by Nespresso attractive to generic rivals?Документ1 страницаDương Thị Tường Vy - 2199137 - Group 3: Why is the niche market occupied by Nespresso attractive to generic rivals?Dương Thị Tường VyОценок пока нет

- Ansoff Matrix PresentationДокумент25 страницAnsoff Matrix PresentationNickie Boy ManaloОценок пока нет

- Challenges in Research & Academic WritingДокумент56 страницChallenges in Research & Academic WritingGuru PrasadОценок пока нет

- 1410ict - Draft eДокумент10 страниц1410ict - Draft eDhyllan Rhys McEnroeОценок пока нет

- International Marketing MixДокумент12 страницInternational Marketing Mixlifeis1enjoyОценок пока нет

- Intra Industry AnalysisДокумент9 страницIntra Industry AnalysisManzzieОценок пока нет

- Zurich Edition 17 FullДокумент4 страницыZurich Edition 17 FullsyedmanОценок пока нет

- Final Examination (21355)Документ13 страницFinal Examination (21355)Omifare Foluke Ayo100% (1)

- General Recommendations: Manufacturing ProcessДокумент1 страницаGeneral Recommendations: Manufacturing ProcessLauren ObrienОценок пока нет

- Pure and Conditional Obligation.Документ2 страницыPure and Conditional Obligation.Lauren Obrien83% (12)

- Narrative: Production ProcessДокумент4 страницыNarrative: Production ProcessLauren ObrienОценок пока нет

- OE/S Process Sales Order Notification: Context Diagram: Production ProcessДокумент11 страницOE/S Process Sales Order Notification: Context Diagram: Production ProcessLauren ObrienОценок пока нет

- JIT Writeup.Документ1 страницаJIT Writeup.Lauren ObrienОценок пока нет

- IAS I Summary.Документ1 страницаIAS I Summary.Lauren ObrienОценок пока нет

- Final Out Put DraftДокумент11 страницFinal Out Put DraftLauren ObrienОценок пока нет

- Ias 12Документ42 страницыIas 12Lauren ObrienОценок пока нет

- Baby Bloomers.Документ1 страницаBaby Bloomers.Lauren ObrienОценок пока нет

- Chapter 4 (Salosagcol)Документ4 страницыChapter 4 (Salosagcol)Lauren Obrien100% (1)

- KPMGДокумент29 страницKPMGLauren ObrienОценок пока нет

- Capital Expenditure DecisionsДокумент48 страницCapital Expenditure DecisionsLauren ObrienОценок пока нет

- Jollibee CSR ActivitiesДокумент12 страницJollibee CSR ActivitiesLauren ObrienОценок пока нет

- Schedule of Forced LeavesДокумент194 страницыSchedule of Forced LeavesLauren ObrienОценок пока нет

- Ac521 Practical FinalsДокумент2 страницыAc521 Practical FinalsLauren ObrienОценок пока нет

- Dream. AC522Документ676 страницDream. AC522Lauren ObrienОценок пока нет

- Dream. AC522Документ676 страницDream. AC522Lauren ObrienОценок пока нет

- Avon CSFДокумент3 страницыAvon CSFLauren ObrienОценок пока нет

- Competitive Strategy Management - AvonДокумент44 страницыCompetitive Strategy Management - AvonLauren Obrien100% (3)

- 69397attacment To 1701Документ3 страницы69397attacment To 1701Lauren ObrienОценок пока нет

- AC521 Technical Writing (Business Correspondence)Документ2 страницыAC521 Technical Writing (Business Correspondence)Lauren ObrienОценок пока нет

- Important! (Budget)Документ1 страницаImportant! (Budget)Lauren ObrienОценок пока нет

- Finding 2 Final Report. (AC521)Документ3 страницыFinding 2 Final Report. (AC521)Lauren ObrienОценок пока нет

- Mas Quizbowl QuestionsДокумент18 страницMas Quizbowl QuestionsLauren ObrienОценок пока нет

- Negotiable InstrumentsДокумент1 страницаNegotiable InstrumentsLauren ObrienОценок пока нет

- ReadmeДокумент3 страницыReadmeLauren ObrienОценок пока нет

- History Essay Answers.Документ2 страницыHistory Essay Answers.Lauren ObrienОценок пока нет

- Job Description.Документ1 страницаJob Description.Lauren ObrienОценок пока нет

- Cel 1 Prac 1 Answer KeyДокумент12 страницCel 1 Prac 1 Answer KeyLauren ObrienОценок пока нет

- Theoretical CyclesДокумент49 страницTheoretical CyclesMariaEzzaSyUyОценок пока нет

- FebvreДокумент449 страницFebvreIan Pereira AlvesОценок пока нет

- Indoor Air Quality Standard Procedures - 2014 RevДокумент12 страницIndoor Air Quality Standard Procedures - 2014 RevFioriAmeliaHathawayОценок пока нет

- Carrefour-SA Shopping Center TurkeyДокумент2 страницыCarrefour-SA Shopping Center TurkeyVineet JogalekarОценок пока нет

- CS402 Mcqs MidTerm by Vu Topper RMДокумент50 страницCS402 Mcqs MidTerm by Vu Topper RMM. KhizarОценок пока нет

- 12-Week Off-Season Training Programme Junior Rugby (U18 - U21)Документ5 страниц12-Week Off-Season Training Programme Junior Rugby (U18 - U21)LeBron JamesОценок пока нет

- RD Sharma Class8 SolutionsДокумент2 страницыRD Sharma Class8 Solutionsncertsoluitons100% (2)

- VavДокумент8 страницVavkprasad_56900Оценок пока нет

- Pitot/Static Systems: Flight InstrumentsДокумент11 страницPitot/Static Systems: Flight InstrumentsRoel MendozaОценок пока нет

- Compiled LecsДокумент24 страницыCompiled LecsNur SetsuОценок пока нет

- 500 TransДокумент5 страниц500 TransRodney WellsОценок пока нет

- SAT Practice Test 10 - College BoardДокумент34 страницыSAT Practice Test 10 - College BoardAdissaya BEAM S.Оценок пока нет

- PH & TemperatureДокумент8 страницPH & TemperatureNanaОценок пока нет

- Esterification Oil of WintergreenДокумент8 страницEsterification Oil of WintergreenMaria MahusayОценок пока нет

- Asaali - Project Estimation - Ce155p-2 - A73Документ7 страницAsaali - Project Estimation - Ce155p-2 - A73Kandhalvi AsaaliОценок пока нет

- Clocks (New) PDFДокумент5 страницClocks (New) PDFAbhay DabhadeОценок пока нет

- Synthesis Essay Coming To Grips With GenesisДокумент11 страницSynthesis Essay Coming To Grips With Genesisapi-259381516Оценок пока нет

- c270 KW NTA855G2 60 HZДокумент31 страницаc270 KW NTA855G2 60 HZAhmad El KhatibОценок пока нет

- Paper-Czechowski-Slow-strain-rate Stress Corrosion Testing of Welded Joints of Al-Mg AlloysДокумент4 страницыPaper-Czechowski-Slow-strain-rate Stress Corrosion Testing of Welded Joints of Al-Mg Alloysjavo0128Оценок пока нет

- Science Magazine February 2020Документ133 страницыScience Magazine February 2020Elena González GonzálezОценок пока нет

- RepaHeel Beeswax-Based Gel For Treating Heel Spurs Has Been Produced in EUДокумент2 страницыRepaHeel Beeswax-Based Gel For Treating Heel Spurs Has Been Produced in EUPR.comОценок пока нет

- Nomenclatura SKFДокумент1 страницаNomenclatura SKFJuan José MeroОценок пока нет

- 988611457NK448908 Vehicle Scan ReportДокумент5 страниц988611457NK448908 Vehicle Scan ReportVictor Daniel Piñeros ZubietaОценок пока нет

- ACR39U-U1: (USB Type A) Smart Card ReaderДокумент8 страницACR39U-U1: (USB Type A) Smart Card Readersuraj18in4uОценок пока нет

- Terminals of Ecm: E3 E4 E5 E6Документ2 страницыTerminals of Ecm: E3 E4 E5 E6jeremih alhegn100% (1)

- SMC VM Eu PDFДокумент66 страницSMC VM Eu PDFjoguvОценок пока нет

- Flusser-The FactoryДокумент2 страницыFlusser-The FactoryAlberto SerranoОценок пока нет

- Surface Finish Measurement NotesДокумент32 страницыSurface Finish Measurement NotesAneez ShresthaОценок пока нет

- Orbitol Motor TMTHWДокумент20 страницOrbitol Motor TMTHWRodolfo ErenoОценок пока нет

- Assessment of Diabetic FootДокумент7 страницAssessment of Diabetic FootChathiya Banu KrishenanОценок пока нет