Академический Документы

Профессиональный Документы

Культура Документы

Xiomi and Apple Supply Chain

Загружено:

Aman AnshuАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Xiomi and Apple Supply Chain

Загружено:

Aman AnshuАвторское право:

Доступные форматы

SUBMITTED BY: GROUP 2

AMAN ANSHU(13PGP061)

ARNAB SEN (13PGP069)

DUSHYANT PANDA(13PGP078)

KRITIKA SWAMINATHAN (13PGP087)

PUNEET MANOT (13PGP102)

Smartphones Accounted for 57.6 Percent of Total Sales in Fourth

Quarter of 2013.

The worldwide mobile phone market is anticipated to see a 3%

year-on-year growth in 2014 down from 6 percent in 2013 ,9 percent

in 2012 and 13 percent in 2011.

Smartphone market is forecasted to touch 23.6% growth

Smartphone growth in mature markets such as North America and

some Western European markets are driven by replacement sales.

Smartphone growth is heavily dependent on emerging markets,

notably China which forms 29 percent of global smartphone

shipments.

Worldwide Smartphone Sales to End Users by

Vendor in 2013 (Thousands of Units)

Company 2013

Units

2013

Market

Share (%)

2012

Units

2012

Market

Share (%)

Samsung 299,794.9 31.0 205,767.1 30.3

Apple 150,785.9 15.6 130,133.2 19.1

Huawei 46,609.4 4.8 27,168.7 4.0

LG Electronics 46,431.8 4.8 25,814.1 3.8

Lenovo 43,904.5 4.5 21,698.5 3.2

Others 380,249.3 39.3 269,526.6 39.6

Total 967,775.8 100.0 680,108.2 100.0

Major

Players

Apple Supply Chain

Customer comes first, cost cutting comes second

Since Apple has retail stores, the company can make demand

forecast easily.

Apple is able to increase the inventory turnover by decreasing

average inventory

Apple's product life cycle is longer than seasonal items so that

Apple is not easily affected by seasonal factors

Since demand of products can increase rapidly during this period,

Apple orders products by air instead of sea.

simplifying product process is a good strategy to eliminate

unnecessary product lines.

U.S

China

Europe

Asian Countries

Assembly in

China

Intermediate

warehouses via

FedEx etc.

Online Store

Warehouse

facility

Retail Stores

Warranty Return

Trade in Program

Recycle Program

Direct Sales Force

Wholesalers,

Retailers,

Network Carriers

SOURCING MANUFACTURING WAREHOUSING DISTRIBUTION

RETURN

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

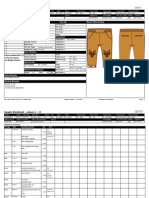

- Lead Time Reduction in Merchandising ProcessesДокумент22 страницыLead Time Reduction in Merchandising ProcessesAman Anshu75% (4)

- The Managerial Decision-Making Process MGT 404 Managerial Decision MakingДокумент33 страницыThe Managerial Decision-Making Process MGT 404 Managerial Decision MakingAman AnshuОценок пока нет

- Crompton Greaves: Channel ConflictsДокумент3 страницыCrompton Greaves: Channel ConflictsAman AnshuОценок пока нет

- The Financial Objective in Widely Held CorporationsДокумент9 страницThe Financial Objective in Widely Held CorporationsAman AnshuОценок пока нет

- Fin 1Документ43 страницыFin 1Aman AnshuОценок пока нет

- Establishing Contouring Incremental Growth Between Varied Bust SizesДокумент33 страницыEstablishing Contouring Incremental Growth Between Varied Bust SizesAman AnshuОценок пока нет

- Group2 ITT CaseДокумент16 страницGroup2 ITT CaseAman Anshu100% (1)

- Equinox Event Calendar - View Mail Bypass-Aman Our Recruitment. Plan Event Document Form PPT Pgpwe Ask Clubs and Committee Ppts - AmanДокумент1 страницаEquinox Event Calendar - View Mail Bypass-Aman Our Recruitment. Plan Event Document Form PPT Pgpwe Ask Clubs and Committee Ppts - AmanAman AnshuОценок пока нет

- Final Reduced Objective Allowable Allowable Cell Name Value Cost Coefficient Increase DecreaseДокумент13 страницFinal Reduced Objective Allowable Allowable Cell Name Value Cost Coefficient Increase DecreaseAman AnshuОценок пока нет

- Theory of CostДокумент49 страницTheory of CostAman Anshu100% (1)

- Final PPT - LeninДокумент34 страницыFinal PPT - LeninAman AnshuОценок пока нет

- Airtel - Sales QuotaДокумент3 страницыAirtel - Sales QuotaAman AnshuОценок пока нет

- The Media Business A Cheaper Times of London Wins ReadersДокумент3 страницыThe Media Business A Cheaper Times of London Wins ReadersAman AnshuОценок пока нет

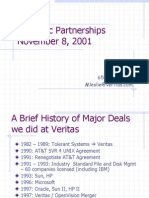

- 0110 Strategic Partnerships1Документ26 страниц0110 Strategic Partnerships1Aman AnshuОценок пока нет

- Sample Worksheet - Colours 1 - 12Документ4 страницыSample Worksheet - Colours 1 - 12Aman AnshuОценок пока нет

- Bergerac Systems Group 10Документ7 страницBergerac Systems Group 10Aman Anshu0% (1)

- UB PioneerДокумент11 страницUB PioneerAman AnshuОценок пока нет

- PVR Annual Report 2012-13Документ110 страницPVR Annual Report 2012-13Aman AnshuОценок пока нет