Академический Документы

Профессиональный Документы

Культура Документы

Enron Final

Загружено:

Kirti Kiran0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров20 страницcorporate scams- enron

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документcorporate scams- enron

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров20 страницEnron Final

Загружено:

Kirti Kirancorporate scams- enron

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 20

Corporate scams

It turns out that creative accounting is a

creative term for WHITE COLLAR

CRIMES!!!

ENRON CORPORATION..

Background

Enron is a US based company formed in 1985

by Kenneth Lay from a merger of Houston

Natural Gas Company and Inter North Inc.

It was the first nationwide natural gas pipeline

network in Houston, Texas.

It was ranked 7

th

on the Fortune 500 list of

companies.

Although its core business was transmission and

distribution of power, it branched into non-energy

fields like risk management, weather derivatives

and internet bandwidth.

Enron was one of the leading

electricity, natural gas, pulp, paper and

communication companies, with

claimed revenues of nearly $101 billion

in 2000.

Enron was also called Americas most innovative

company for 6 consecutive years from 1996 to

2001.

The Structure

ENRON

CORPORATION

ENRON

WHOLESALE

SERVICES

ENRON

ENERGY

SERVICES

ENRON

GLOBAL

ASSETS

What went wrong???

Who were the people

involved???

THE TRUTH

MEASURES TAKEN

Creative Accounting

In just 15 years, Enron grew into

one of Americas largest companies.

Enron used accounting limitations

to its advantage in managing both

its earnings and balance sheet to

portray a favorable depiction of its

performance.

Was it really making profits?

1.Use of mark to market accounting.

MARK TO MARKETING HISTORIC COST

Introduced by President Jeffrey

Skilling in Enron.

An accounting conception

generally used.

Accounting for the fair value of

the asset/ liability based on the

current market price.

Accounting based on the past

transactions.

This method allowed Enron to

count projected earnings from

long term energy contracts as

current income.

Shows correct profits as it shows

current income. Does not inflate

profit.

2. Creating Special Purpose Entities

(Vehicles)..

Enrons rapid growth in 1990s-Use

the diversification strategy.

Units not expected to generate

significant cash flow in short term.

Enron thought of

a temporary

solution to solve

the cash

problems - SPE

MISUSE of Special Purpose

Entities.

SPEs are legal entities created to fulfill

narrow, specific or temporary objectives. It

is used by companies to isolate the firm

from financial risk.

They would back the SPEs borrowings by

loaning shares in Enron as security.

Enron used hundreds of these off- balance

sheet transactions as a way to hide debt

and improve its liquidity.

Main People Involved

The CEO, Mr. Kenneth Lay took no

action despite being aware of the

malpractices.

The Chief Financial

Officer Mr. Andrew Fastow also played a major role

in the scandal.

Arthur Andersen, was a major support for the

scandal as it was the internal and external auditor

of Enron.

The Enron Scandal - Timeline

Whistle blowing!!( 2001)

February CEO Ken Lay retires (Jeffrey takes

over as the CEO)

14

th

August Jeffrey resigns stating personal

reasons.

Mid-August Vice-President Sherron Watkins

writes an anonymous letter to the

CEO Mr. Kenneth Lay.

16

th

October

Announces 1

st

quarterly loss worth

$618 million from Raptors (SPE).

October SEC announces investigation

1

st

Nov Stock price falls to less than $1.(was

US $90.75/share at one time)

8

th

Nov Told investors that they were

restating earnings for the past 4 and

years.

2

nd

Dec Filed for bankruptcy ( was the

biggest bankruptcy till then with

Enrons assets worth $63.4 billion)

Since 1997,

TOTAL LOSS= $591 million

TOTAL DEBT= $628 million

THE TRUTH

1. Investigation revealed that there had been a

total loss of $586million.

2. $30million of self dealings by the CFO.

3. $700million of net earnings disappeared.

4. $1.2billion of shareholders equity disappeared.

5. $4billion was in hidden liabilities.

6. Over $2billion loss on retirement and pension

funds.

7. 25000 employees losing their jobs and medical

insurance.

Measures taken

The Sarbanes Oxley Act was passed by President

George W Bush on July 30

th

, 2002.

The disclosure requirements as per this new Act are-

1. All material including off balance sheet

transactions.

2. The Special Purpose Entities must be disclosed in

annual and quarterly financial reports.

3. Auditor independence.

4. White Collar Crime Penalty Enhancement.

Duty without devotion ,

Education without character,

Politics without principles and

Commerce without ethics

are not only useless but also dangerous.

- BHAGWAN SRI SATHYA SAI BABA

PRESENTATION BY

SREE KUMARI. S . RAJU

II B.Com (Hons.)

Register no.: 132308

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

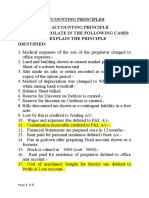

- Accounting Principles and ConceptsДокумент5 страницAccounting Principles and ConceptsKirti KiranОценок пока нет

- Marketing CommunicatonsДокумент24 страницыMarketing CommunicatonsKirti KiranОценок пока нет

- Consumer BehaviourДокумент31 страницаConsumer BehaviourKirti KiranОценок пока нет

- Capital BudgetingДокумент48 страницCapital BudgetingKirti KiranОценок пока нет

- Cost Sheet Questions.72124749Документ7 страницCost Sheet Questions.72124749Gayathri SankarОценок пока нет

- Accounting Standard 29Документ40 страницAccounting Standard 29Kirti KiranОценок пока нет

- Module: Competing in The Network EconomyДокумент32 страницыModule: Competing in The Network EconomyKirti KiranОценок пока нет

- Seven Standard Parts in Business LettersДокумент1 страницаSeven Standard Parts in Business LettersKirti KiranОценок пока нет

- TheGreat Indian Retail StoryДокумент28 страницTheGreat Indian Retail StoryBishwajeet Pratap SinghОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Hni Bangalore 81 MaviyaДокумент4 страницыHni Bangalore 81 MaviyaSanchayita SarwanОценок пока нет

- Cash Flow + Projects Cover PageДокумент7 страницCash Flow + Projects Cover PagekoftaОценок пока нет

- 0 200 Ac MotorsДокумент177 страниц0 200 Ac MotorsBrion Bara Indonesia0% (1)

- Corporation Code of The Philippines ReviewerДокумент2 страницыCorporation Code of The Philippines ReviewerMyra QuidatoОценок пока нет

- List of Preference Shares 03.04.19Документ249 страницList of Preference Shares 03.04.19VikasОценок пока нет

- Slides of Chapter 4Документ27 страницSlides of Chapter 4Uzzaam HaiderОценок пока нет

- Vbook - Pub Business Combination QuizДокумент3 страницыVbook - Pub Business Combination QuizRialeeОценок пока нет

- Seminar 1A - Group Reporting: (A) Power Over The InvesteeДокумент44 страницыSeminar 1A - Group Reporting: (A) Power Over The InvesteeJasmine TayОценок пока нет

- Micro SecДокумент373 страницыMicro SecАмарджит Сингх БхартхОценок пока нет

- Companies Act Cap 388Документ388 страницCompanies Act Cap 388JK S1Оценок пока нет

- Corporate Governance: Decades of Dialogue and Data: Introduction To Special Topic ForumДокумент13 страницCorporate Governance: Decades of Dialogue and Data: Introduction To Special Topic ForumVictor sanchez RuizОценок пока нет

- Susan Mary Watson - The Corporate Legal PersonДокумент33 страницыSusan Mary Watson - The Corporate Legal PersonPeroshnah T. DevОценок пока нет

- UntitledДокумент14 страницUntitledKimОценок пока нет

- Refer To The Information Provided in p10 2a p10 2a Donnie Hilfiger Has TwoДокумент1 страницаRefer To The Information Provided in p10 2a p10 2a Donnie Hilfiger Has TwoBube KachevskaОценок пока нет

- Chapter 7 Special Purpose Vehicle: 7.1 ConceptДокумент13 страницChapter 7 Special Purpose Vehicle: 7.1 Conceptsimple_aniОценок пока нет

- TUGAS DOSEN Chapter 5Документ15 страницTUGAS DOSEN Chapter 5novita sariОценок пока нет

- HLA-Policy Change Application FormДокумент4 страницыHLA-Policy Change Application FormJinieОценок пока нет

- DCB Bank: Corporate Governance ReportДокумент11 страницDCB Bank: Corporate Governance Reportb1_mit297Оценок пока нет

- 2020 Tutorial 4Документ2 страницы2020 Tutorial 4chikaОценок пока нет

- 2016 Business Quarter03Документ180 страниц2016 Business Quarter03Ch ChristianОценок пока нет

- Chapter 7 CorprationДокумент15 страницChapter 7 CorprationBiru EsheteОценок пока нет

- Prvih10Vlasnika 06112022Документ204 страницыPrvih10Vlasnika 06112022Amil DzankovićОценок пока нет

- Accounting QuizДокумент5 страницAccounting QuizLloyd Lameon0% (1)

- Pre Pack IBCДокумент9 страницPre Pack IBCNARENRSHARMAОценок пока нет

- Samsung FirmwaresДокумент200 страницSamsung FirmwaresEdis Aganović100% (1)

- Fundamental Equity Analysis - FTSE 100 Index Members (UKX Index)Документ205 страницFundamental Equity Analysis - FTSE 100 Index Members (UKX Index)Q.M.S Advisors LLCОценок пока нет

- Final Ipo of NitinДокумент153 страницыFinal Ipo of Nitinjainnitinkumar83% (6)

- Basic Concepts of Stocks and BondsДокумент10 страницBasic Concepts of Stocks and BondsDaniel De Guzman100% (1)

- Website - Unpaid Dividends - 2014 To 2020Документ24 страницыWebsite - Unpaid Dividends - 2014 To 2020Sohan SoNuОценок пока нет

- GAILGas ExistingCNGStationsДокумент4 страницыGAILGas ExistingCNGStationsclass xОценок пока нет