Академический Документы

Профессиональный Документы

Культура Документы

NABARD Presentation Bank

Загружено:

YashkjJawaleАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

NABARD Presentation Bank

Загружено:

YashkjJawaleАвторское право:

Доступные форматы

National Bank for Agriculture &

Rural Development

(NABARD)

1

Genesis

Set up on 12 July 1982 as Apex Institution for

Agriculture and Rural Development carved out of

the Central Bank of the country

To ensure an integrated Development of rural

areas, Single window approach for working capital

and investment credit for both on farm and off

farm investments in rural areas

2

Promote sustainable and equitable

agriculture and rural prosperity through

effective credit support, related

services, institution development and

other innovative initiatives

Mission

3

NABARD- unique features

Facilitating credit flow for agriculture and rural development

Strengthening rural credit delivery system through institutional

development measures

Supervising rural financial institutions (rural co-operative banks

and regional rural banks)

Promoting and supporting policies, practices and innovations

conducive to agriculture and rural development

Raising resources from urban areas to facilitate flow of credit

for rural development

Enabling the poorest of the poor to access financial services

through the largest micro finance movement in the world

4

Laying special emphasis on development of the socially

disadvantaged, particularly the tribal people

Piloting Natural Resource Management through programmes for

soil and water conservation

Facilitating credit planning on assessed developmental potential

and monitoring ground level credit flow PLP

Providing financial support to State Governments for developing

appropriate rural infrastructure- RIDF

Capacity building of RFIS and rural entrepreneurs

Providing consultancy services in project preparation, appraisal,

financial services, evaluation etc. to banks, government and

private enterprise.

NABARD- unique features Contd

5

Credit Planning and monitoring

Credit

Refinance

Co-Finance

Finance

Institutional Development

Supervision

Promotion and Development

Consultancy

Broad Functions

6

Credit Planning and Monitoring

District level Potential Linked Plans prepared for all

districts;

392 District level offices covering 480 districts out of

608;

District level coordination done by District Development

Manager

State Level aggregation of District Plans;

Monitoring the flow of GLC for agriculture & allied

activities;

Issuing policy & operational guidelines to Coop. Banks &

RRBs;

Coordinating with GoI & RBI in policy formulations in

regard to agriculture & allied activities;

7

Credit

Credit is provided as Refinance to

Cooperative Banks and Regional Rural Banks for financing

farmers for meeting their production costs (short term) for

agriculture & allied activities- Short term refinance limits

to Cooperatives and RRBs increased from Rs. 1658 crore in

1982-83 to Rs. 16,352 crore in 2007-08;

Commercial Banks, Cooperative Banks and RRBs for

Investment Purposes (medium & long term) in agriculture

and rural non farm activities. Investment refinance

increased from Rs.703 crore in 1982-83 to Rs.9046 crore

in 2007-08.

Kisan Credit Cards- an innovative product designed by

NABARD to provide timely and hassle free credit to

farmers in meeting farmers credit needs (production,

investment and consumption) 71.5 million cards issued as

on 31 March, 2008

8

Many of the rural credit products have been

evolved and developed by NABARD

Major activities financed

Animal husbandry, Land Development, Farm

Mechanisation, Plantation & Horticulture, Minor

Irrigation, creation of storage capacity, rural non

farm sector; rural housing, SHG financing, forestry

& wasteland development, organic farming, etc.

Credit

Contd

9

Co-financing with Commercial Banks for hi-tech /

export oriented agriculture

Direct Financing to State Governments

Rural Infrastructure Development

Share Capital contribution to Cooperative

Credit Institutions

Revolving Fund Assistance

Credit Contd

10

Institutional Development

Strengthening of Rural Financial Institutions (RFIs) to ensure

credit delivery to the sector

Development Action Plans (DAPs) to enable RFIs to attain

sustainable viability over specified time frame

Memorandum of Understanding with Banks/ State Governments

for implementation of DAPs

NABARD appointed implementing agency for ongoing process of

Revitalisation of Cooperatives - Financial package to be

administered subject to strict conditionalities for reforms and

performance obligations - accordingly NABARD assisting

Cooperative Banks with sufficient training for special audits,

building common accounting & monitoring system, undertake HRD

initiatives, computerisation, etc

11

Institutional Development Contd..

Has constituted a Cooperative Development Fund in NABARD

to support Cooperative Credit Institutions in undertaking

developmental initiatives Financial assistance provided for :-

Infrastructure

Building MIS/Audit Systems

Training

Women Development Cells

Human and Institutional Development through Organisational

Development Initiatives for RRBs and Cooperatives;

Best Performance Awards for Cooperatives

12

Supervision

Supervision of Cooperative Banks and RRBs to assess -

Financial Viability

Operational Soundness

Managerial efficiency

Compliance with Regulations

Individuals

Supervision of banks is sharply focused on core areas of

functioning pertaining to Capital Adequacy, Asset Quality,

Management, Earnings, Liquidity & Systems Compliance

(CAMELSC);

On-site inspection on biennial basis;

Off-site surveillance systems also undertaken;

Board of Supervision Advisory Body to provide directions and

guidance for supervision

13

Various Funds setup in NABARD

(As on 31.3.2008)

Name of Fund Corpus

(Rs. Cr)

Objectives

NRC(LTO) FUND 13615 Refinance operations

NRC (Stabiliation) Fund 1544 Conversion of ST loans into MT

loans in times of natutal

calamities

Cooperative Dev Fund

(CDF)

125 To Support cooperative

institutions in undertaking

development initiatives

WaterShed Dev Fund 614 Supporting Watershed activities

Tribal Development Fund 603 Development of Tribal areas

14

Various Funds setup in NABARD

(As on 31.3.2008) contd

Name of Fund Corpus (Rs.

Cr)

Objectives

Micro Finance

Development & Equity

Fund

127 Supporting micro finance & equity

supoort to mFIs

R & D Fund 50 Supporting R&D in Farm sector

Farm Innovation &

Promotion Fund

4.17 Supporting innovative, risk

friendly & unconventional

experients farm & NFS sector

Rural Innovation Fund 110 Supporting innovations in non

farm sector

Financial Inclusion Fund 15 Support developmental &

promotional activies to secure

greater financial inclusion

15

Name of Fund Corpus (Rs.

Cr)

Objectives

Financial Inclusion

Technology Fund

15 To enhance investment in ICT

aimed at promoting financial

inclusion

Farmers Technology

Transfer Fund

25 Facilitating disseminating &

adoption of appropriate

technologies

Various Funds setup in NABARD

(As on 31.3.2008) contd

16

Promotion and Development

Micro Finance Initiatives (SHG-Bank Linkage)

Now one of worlds largest micro finance initiatives

Pilot started in 1992 with 500 SHGs

3.5 million SHGs linked to the institutional credit structure (31 March,

08), 58 million poor households accessed MF;

Rs. 22000 crore (Approx) given as credit to the SHGs

Capacity building support for Bankers, NGOs, Govt Officers and SHG members

Micro Finance Innovations -

Pilot Project for promotion of micro enterprises by SHGs

Pilot for financing Joint Liability Groups

Pilot for SHG Post Office Linkage

Support to MFIs through RFA, rating support, capital/equity support, etc.

Pilot project for providing social security system for SHG members;

Micro Finance Development & Equity Fund (MFDEF) created in NABARD for

scaling up of the SHG Bank Linkage Programme.

Financial Inclusion Fund and Financial Inclusion Technology Fund set up with

NABARD with a corpus of Rs.500 crore each

17

Promotion and Development Supporting Rural

Entrepreneurship Development

NABARD supports NGOs/ other specialised institutions in

conducting Rural Entrepreneurship Development Programmes

(REDP)

Training of rural unemployed youth for capacity building

Skill and management inputs provided

Supported more than 9400 REDPs and trained over 233

thousand rural youth so far

About 50% of the trained persons have set up their own

self employment ventures

Each successful unit can provide employment to additional

1 to 2 persons

18

Promotion and Development Rural Non farm Sector

Development through Area approach

District Rural Industries Project (DRIP)

Area based programme with District as the unit;

Credit intensification programme for promotion of rural

industries through convergence of all credit and non credit

programmes and synergy among various partner agencies;

Implemented in 106 districts as on 31 March, 2008;

Cluster Approach

Development of select rural clusters through need based

interventions for input supplies, technology upgradation,

market orientation and sustainable income generation;

56 Rural clusters developed as part of National programme

for Rural Industrialisation;

61 clusters developed by NABARD in 56 districts across 22

states as against 50 clusters envisaged

19

Promotion and Development Farm Sector

Initiatives

Natural Resources Management

Watershed Development Programme -initiated in 1992 to

develop micro watersheds in an integrated and comprehensive

manner, for achieving sustainable production systems through

peoples participation with emphasis on soil and water

conservation and rejuvenation of natural resources

A novel initiative for regeneration of natural resources

involving village communities through participatory approach;

Emphasis on self-help, environmental protection and poverty

alleviation

Village Communities in close collaboration with committed

NGOs and NABARD involved in designing, planning,

implementation and monitoring the watershed development

programmes

20

Promotion and Development Farm Sector

Initiatives

Strategies adopted for successful implementation

Peoples commitment that decides selection of a

watershed. A self selection process

People demonstrate willingness to undertake the

watershed project through shared labour and

development of micro-watersheds

Community discipline (self imposed); villagers agree to

bring down the cattle population within the carrying

capacity of the land, ban free grazing and tree felling.

21

Promotion and Development

Farm Sector Initiatives

I mpact of Watershed Development -

Rise in ground water level between 1 to 2 m has been observed

Drinking water scarcity in villages has been overcome

Local employment generation has improved, reducing off season

migration

Increase in agricultural productivity and production -

Dairy activity has received a fillip

Demand for credit has gone up

Women empowerment and reduction in drudgery; large number

of women SHGs formed and credit linked

Secondary impact improved quality of life, housing, health and

education (schools)

Watershed Development Fund created in NABARD to create

replicable watershed development models with participatory

approach.

22

Watershed Treatments:

Ridge to Valley Approach

Continuous Contour Trenches

23

Impact of Watershed Programme

Plantation on Trenches

Ist Year Forestry

Fodder Cultivation

24

Promotion and Development

Natural Resources Management

Wadi a small orchard: Tribal Development Programme

The programme commenced in 1995 for comprehensive development of

tribal families through wadi approach in Gujarat & Maharashtra

benefiting over 20,000 tribal families.

Focus on livelihood support and improvements in quality of life.

A small orchard (WADI) of suitable fruit crops with forestry

plantations on the boundary core intervention.

Soil conservation and water resource development to support the wadis

Other Critical Components dovetailed:

Community Health

Women Development

Development of landless

Processing and Marketing

Implementation through Peoples participation

Tribal Development Fund created in NABARD to support models for

tribal development

25

Wadi Programme

Established Wadi

Blooming Mango Tree

Temporary check dams

for irrigating wadis

Tree platforms:

Soil conservation

26

Promotion and Development

Gender Development

Gender sensitization programmes

Women Development Cells

Assistance to Rural Women in Rural Non Farm Sector

Development (ARWIND)

Assistance for Marketing Non Farm Products of Rural

Women (MAHIMA)

Development of Women through Area Programme

(DEWTA)

27

Major Govt. Programmes being implemented

by/through NABARD

NABARD has overseen the implementation of Farm Package announced

by GOI in 2004

The agricultural advances were doubled in span of two years as

against three years envisaged

PMs package for distressed districts being implemented in 31 districts

spread over 4 states of Maharashtra, Andhra Pradesh, Karnataka &

Kerala

NABARD vested with implementation of Agriculture Debt Waiver and

Debt relief Scheme 2008 in cooperatives and RRBs

NABARD is closlely monitoring the issue of fresh finance to farmers

who were extended the benefit of debt waiver/debt relief in 2008

28

Centrally sponsored schemes of GOI being

implemented by NABARD

NABARD VESTED WITH IMPLEMENTATION OF 24 CENTRALLY

SPONSRED SCHEMES OF GOI

SOME OF THE IMPORTANT SCHEMES BEING IMPLEMENTED

INCLUDE

CAPITAL INVESTMENT SUBSIDY SCHEME FOR COLD STORAGE ,

CISS FOR RURAL GODOWN,

CREDIT LINKED CAPITAL SUBSIDY SCHEME FOR TECHNOLOGY

UPGRADATION OF SSIs,

INTEGRATED WATERSHED DEVELOPMENT PROG RSVY,

DAIRY AND POULTRY VENTRURE CAPITAL FUND

MILLION SHALLOW TUBEWELL PROGRAMME

VIDARBHA PACKAGE

CAPITAL SUBSIGY FOR AGRI MARKETING, INFRASTRUCTURE,

GRADING AND STANDARDISATION

CISS FOR PRODUCTION OF ORGANIC INPUTS

GROUND WATER SCHEME IN ANDHRA PRADESH, GUJARAT,

KARNATAKA, MAHARASHTRA, MADHYA PRADESH, RAJASTHAN AND

TAMIL NADU

29

Consultancy

NABARD has set up a subsidiary company to undertake

consultancy on behalf of NABARD

Clients

Government of India

State Governments

International Bodies

Corporates

Individuals

Areas agriculture, agro-processing and infrastructure projects,

micro finance, watershed Development, Non-Farm Sector,

Institution Development and Training

30

NABARD - Role in

Infrastructure Development

in Rural Areas

31

OBJECTIVE OF RIDF

TO PROVIDE COST EFFECTIVE LOAN SUPPORT TO STATE

GOVERNMENTS TO DEVELOP INFRASTRUCTURE IN

RURAL AREAS.

NABARDs ROLE

NABARD IS THE APPRAISING, SANCTIONING,

FINANCING, MONITORING AND EVALUATING AGENCY

FOR RURAL INFRASTRUCTURE FUNDING FROM RIDF.

RIDF - A STRATEGIC MESHING OF THE

INFRASTRUCTURAL GAP IN RURAL AREAS AND THE

LENDING GAP OF THE COMMERCIAL BANKS.

32

GROWTH OF RIDF

THE RIDF WAS CREATED OUT OF COMMERCIAL BANKS

SHORTFALL IN LENDING TO AGRICULTURE

STARTED WITH RS 2,000 CRORE IN 95-96 (RIDF I)

CORPUS FOR 20114-15 (RIDF XX): RS. 25,000 CRORE +

RS. 5,000 CRORE FOR WAREHOUSING

33

RIDF ACTIVITIES AND TERMS OF LOAN

PROVIDES FINANCIAL ASSISTANCE TO STATE GOVERNMENTS

FOR 31 ACTIVITIES ( RURAL ROADS AND BRIDGES, IRRIGATION,

RURAL DRINKING WATER SCHEMES, MARKETING INFRASTRUCTURE,

HOSPITALS, EDUCATIONAL INSTITUTIONS, etc.)

REPAYMENT PERIOD 7 YEARS INCLUDING 2 YEARS GRACE PERIOD.

RATE OF INTEREST ON LOANS 1.5% LESS THAN BANK RATE

MOBILIZATION ADVANCE 20% / 30% OF THE LOAN AMOUNT

IMMEDIATELY ON SANCTION .

SECURITY TIME PROMISSORY NOTE (TPN), MANDATE WITH

RBI/PRINCIPAL BANKER TO STATE GOVERNMENT.

34

RIDF - THE ADVANTAGES.

THE MOST COST EFFECTIVE FUNDS TO THE STATE.

LOANS WITHOUT ANY MAJOR CONDITIONS.

FIXED INTEREST RATE.

NO HIDDEN COST

NO PROCESSING FEE

NO COMMITMENT CHARGES

NO PRE PAYMENT CHARGES

SUPPLEMENTARY MONITORING CARRIED OUT WITHOUT

ANY COST TO THE PROJECT

35

GoI (Annual Budgetary

announcement)

RBI ( Bank wise allocations &

interest rates)

NABARD

DEVELOP OPERATIONAL GUIDELINES , APPRAISE,

SANCTION, FINANCE, MONITOR AND EVALUATE RURAL

INFRASTRUCTURE PROJECTS OF STATE GOVERNMENTS

State Governments (Finance / Planning Dept)

User Dept

Irrigation

User Dept

Dept of AH

User Dept

Dept of Fisheries

User Dept

Roads & Bridges

RIDF - THE FUNDING MECHANISM

36

RIDF OPERATIONAL MATRIX

NABARD HO

(SPD & PMD)

Sanctioning Committee (SC)

( a sub committee of Board)

REGIONAL OFFICE

Project appraisal, disbursals

Monitoring and evaluation

District Office

monitoring

Consultants

(App. & Mon.)

37

38

Credit Products for Livestock

sector and promotional

activities of NABARD

Foundation Stock

Frozen Semen Banks

Pureline / Grand Parent Poultry Breeding Farms

Multiplication of Progeny

Breeding Farms

AI Units

Calf Rearing

CREDIT PRODUCTS

Contd..

39

Farming

Small Dairy Units (1-2 Animals)

Mini Dairy Units (upto 10 Animals)

Commercial Units (> 10 Animals)

Poultry Layer / Broiler Farming

Central Grower-cum-Satellite Layer Units

Quail / Duck / Turkey / Emu Farming

Sheep / Goat / Pig / Rabbit Farming

CREDIT PRODUCTS

Contd..

40

Feed & Fodder

Production of Fodder Seeds

Setting-up of Feed Plants

Gauchar Land Development

Silvi Pasture Development

Perennial cultivation

Animal Health

Production of Vaccines / Animal Health Products

Disease Diagnostic Laboratories

Veterinary Hospitals / Dispensaries / Clinics

CREDIT PRODUCTS

Contd..

41

Processing Infrastructure

Construction of Milk Houses

Purchase of Milk-o-testers / Automatic Milk

Collection Stations

Bulk Milk Coolers

Purchase of Milk Tankers

Community Milking Machines

Milk Processing Plants

Manufacture of Indigenous Milk Products

Egg Processing Plants

Poultry Dressing and Meat Processing Plants

Slaughter Houses

CREDIT PRODUCTS

Contd..

42

Marketing Infrastructure

Livestock Markets

Poultry Markets

Scheme for Grading, Packing and Exporting of Eggs

Egg and Broiler Centres

Dairy Parlours

Retail Poultry Outlets

CREDIT PRODUCTS

Contd..

43

1. Research and Development(R&D) Fund

2. Farm Innovation & Promotio Fund (FIPF)

3. Rural Innovation Fund (RIF)

4 Farmers Technology Transfer Fund (FTTF)

Promotional Activities

44

45

NABARD - R&D FUND

Objectives

Applied Research and Studies of Technical / Economic

Nature.

Training Related activities in Agriculture, non-

Agriculture, Rural Credit and Financial System, Agri.

Extension etc

Dissemination and Collation of Information

Strengthening the Technical, Monitoring and Evaluation

Cells of Cooperative Banks and RRBs for facilitating

preparation, Appraisal, Monitoring and Evaluation of

projects.

46

Corpus : Rs.50.00 crores

Eligible Agencies

Approved Research Institutions/Organisations/ Agencies

engaged in action oriented and Applied Research,

Individuals or group of individuals sponsored by suitable

organisations.

Implemented since inception of NABARD

contd

NABARD - R&D FUND

47

Farm Innovation and Promotion Fund

(FIPF)

Objectives

To demonstrate the bankability of new concepts in Agri

and Farm sector.

Development of prototypes to make it commercial.

To acquire innovative technology/designs/ products.

Market surveys for potential assessment of new Agri/

Rural products.

To support innovations in Information Technology.

Corpus : Rs.5.00 crores

48

Eligible Institutions/ Individuals

Research Institutions, Universities, Krishi Vigyan Kendras,

Small Farmers Agri Consortium, NGOs, Registered

Community Based Organisations, Registered

producers/Peoples organisations, Individuals/ group of

Individuals, Companies

Implemented since 01 April 2005

Farm Innovation and Promotion Fund

(FIPF)

contd

49

Rural Innovation Fund (RIF)

Objectives

To promote technology-based innovations and

transfer of indigenous technology to increase the

productivity of rural enterprises.

To promote livelihood opportunities and employment in

rural areas and facilitating access to financial and

business promotion services for the poor.

50

Eligible Activities

All innovations and related activities in the Farm,

Rural Non Farm and micro Finance Sectors.

Technology and skill upgradation providers.

Inputs supply and market support leading to promotion

of viable enterprises, sustainable employment,

infrastructure development, improved flow and access

of credit to rural entrepreneurs.

Undertake innovations so as to improve efficiency of

credit delivery and other support services to the rural

resource poor.

Rural Innovation Fund (RIF)

contd

51

Corpus : Rs.139.90 crores

Eligible Institutions/ Individuals

All organizations, institutions and Individuals

Implemented since 01 October 2005

contd

Rural Innovation Fund (RIF)

52

Farmers Technology Transfer Fund

(FTTF)

Objectives

Facilitate adoption of appropriate technologies through

Training-cum-Exposure visits, demonstrative projects or

such other activities.

Dissemination of appropriate technologies and commercial

intelligence through direct contacts, literature, visuals

etc.

Undertake activities such as financial literacy, credit

counselling and other related activities.

Organisation of farmers into informal associations, JLGs,

producer groups, producer companies or other ways for

self- help, collective approach for commercial

transactions, networking with the value chain and financial

inclusion.

53

Contd..

Corpus : Rs. 25 crores

Eligible Institutions/ Individuals

Commercial Banks/RRBs/Cooperative Banks, ATMA, Research

Institutions/SAUs/KVKs,, NGOs/Federation/ Association of

Farmers Clubs or any other registered body such as PACs

etc., Farmers Clubs/Farmers Collectives\Farmers Interest

Groups, Private Companies as part of CSR / Technology

Providers in Rural Areas.

Implemented since 01 April 2008

Farmers Technology Transfer Fund

(FTTF)

54

Other Promotional Funds

Other Promotional Funds of NABARD where,

Animal Husbandry could be one of component

for support are :

Watershed Development Fund

Tribal Development Fund

Financial Inclusion Fund with a corpus of Rs.500 crore

set up by NABARD may also indirectly help in

promoting AH activities apart from others by

supporting capacity building/awareness programmes

55

Activities Supported through Banks

by NABARD

Hatcheries & rearing units :

Inland carps, Ornamental fishes, shrimps and Fresh

water prawn

Integrated inland carp culture with :

Paddy, Horticulture, Dairy, Piggery, Poultry, Duckery,

sewage cum agri. vegetable culture

Inland Farming:

Carps, Air breathing fishes, Running water fishes in

Jhoras & Raceways, Trout, Golden talapia, Fresh water

prawn, mussel culture, etc.

56

Capture fishery:

Boats and nets in inland sector

Traditional boats, MFVs, trawlers, purse seines,

multipurpose fishing vessels in marine sector

Mariculture:

Crab fattening, Lobster, mussel and sea weed

culture

Processing & marketing:

Fish processing units, IQF and surimi units, cold

storages, ice plants, marketing outlets, transport

units, Solar dryers, oven dryers, sun drying, etc

Activities Supported through

Banks by NABARD Contd.

Вам также может понравиться

- ADB Annual Report 2014: Improving Lives Throughout Asia and the PacificОт EverandADB Annual Report 2014: Improving Lives Throughout Asia and the PacificОценок пока нет

- Group7 - Finance (2) - 1Документ27 страницGroup7 - Finance (2) - 1Kartikay MishraОценок пока нет

- A Governance Framework for Climate Relevant Public Investment ManagementОт EverandA Governance Framework for Climate Relevant Public Investment ManagementОценок пока нет

- Presentation On NABARDДокумент27 страницPresentation On NABARDSameer R. KhanОценок пока нет

- ADB Annual Report 2015: Scaling Up to Meet New Development ChallengesОт EverandADB Annual Report 2015: Scaling Up to Meet New Development ChallengesОценок пока нет

- Presentation On NABARDДокумент27 страницPresentation On NABARDSameer R. Khan100% (1)

- The Cook Islands: Stronger Investment Climate for Sustainable GrowthОт EverandThe Cook Islands: Stronger Investment Climate for Sustainable GrowthОценок пока нет

- Nabard Credit To Priority Sector and Neglected SectorДокумент15 страницNabard Credit To Priority Sector and Neglected SectorsharanashutoshОценок пока нет

- Asian Development Bank Trust Funds Report 2020: Includes Global and Special FundsОт EverandAsian Development Bank Trust Funds Report 2020: Includes Global and Special FundsОценок пока нет

- Fin CA2Документ9 страницFin CA2Fizan NaikОценок пока нет

- Access to Finance: Microfinance Innovations in the People's Republic of ChinaОт EverandAccess to Finance: Microfinance Innovations in the People's Republic of ChinaОценок пока нет

- Banking LAWДокумент20 страницBanking LAWRohit DangiОценок пока нет

- Viet Nam: Financial Sector Assessment, Strategy, and Road MapОт EverandViet Nam: Financial Sector Assessment, Strategy, and Road MapОценок пока нет

- NABARD FinalДокумент29 страницNABARD Finalshashank1611100% (1)

- Pacific Private Sector Development Initiative: Progress Report 2013-2014От EverandPacific Private Sector Development Initiative: Progress Report 2013-2014Оценок пока нет

- NABARDДокумент14 страницNABARDChandra Sekhar JujjuvarapuОценок пока нет

- Report On NABARDДокумент15 страницReport On NABARDAnkit TiwariОценок пока нет

- Nabard InterviewДокумент7 страницNabard InterviewAmit GodaraОценок пока нет

- Nabard: HistoryДокумент9 страницNabard: HistoryKumar Prince RajОценок пока нет

- Saman Waseem Saud I Khan Nabila Siddiqui Omar Fahmeed Sana AshrafДокумент12 страницSaman Waseem Saud I Khan Nabila Siddiqui Omar Fahmeed Sana AshrafEr Siraj AzamОценок пока нет

- NabardДокумент13 страницNabardAmit KandekarОценок пока нет

- Reserve Bank of IndiaДокумент10 страницReserve Bank of IndiaKinjal BhanushaliОценок пока нет

- NABARDДокумент46 страницNABARDMahesh Gaddamedi100% (1)

- Rural Marketing Pratyush AssignmentДокумент8 страницRural Marketing Pratyush Assignmentmbamemori22to24Оценок пока нет

- NABARDДокумент25 страницNABARDAmit KumarОценок пока нет

- To The Study On Basic NabardДокумент23 страницыTo The Study On Basic NabardKunal DeoreОценок пока нет

- NabardДокумент36 страницNabardRahul Singh100% (1)

- Major Activities of NabardДокумент13 страницMajor Activities of NabardAbhishek .SОценок пока нет

- Project ReportДокумент57 страницProject ReportRachit DixitОценок пока нет

- On Nabard: Presentation DescriptionДокумент4 страницыOn Nabard: Presentation DescriptionManisha MishraОценок пока нет

- Economics SEM 2 RPДокумент13 страницEconomics SEM 2 RPVansh Batch 2026Оценок пока нет

- A Project Report ON National Bank For Agriculture and Rural DevelopmentДокумент30 страницA Project Report ON National Bank For Agriculture and Rural DevelopmentraviveerakhaniОценок пока нет

- NABARDДокумент14 страницNABARDAnam Kadri100% (1)

- NABARD Organisational Set Up and Functions 556Документ7 страницNABARD Organisational Set Up and Functions 556sauravОценок пока нет

- Financial Institutions: Dfis, Banks and NBFCS: Pradeep Kumar MishraДокумент54 страницыFinancial Institutions: Dfis, Banks and NBFCS: Pradeep Kumar Mishrasunit dasОценок пока нет

- NABARDДокумент10 страницNABARDYogesh SinghalОценок пока нет

- Objectives of NABARDДокумент5 страницObjectives of NABARDAbhinav Ashok ChandelОценок пока нет

- National Seminar OnДокумент12 страницNational Seminar Onniharika_missnehaОценок пока нет

- Development Banks: Submitted To: Submitted byДокумент29 страницDevelopment Banks: Submitted To: Submitted byAnkush ThakurОценок пока нет

- Some of The Milestones in NABARD's Activities Are:: Reserve Bank of IndiaДокумент3 страницыSome of The Milestones in NABARD's Activities Are:: Reserve Bank of IndiaLearner84Оценок пока нет

- Concepts Bike and CarДокумент4 страницыConcepts Bike and CarVinay SheelОценок пока нет

- Nabard Schemes Funding 2012Документ71 страницаNabard Schemes Funding 2012Vikas NagareОценок пока нет

- Reserve Bank of India: Go To TopДокумент10 страницReserve Bank of India: Go To ToppradeepОценок пока нет

- Banking Law NotesДокумент17 страницBanking Law NotesgoluОценок пока нет

- Credit Facilities Offered by NABARDДокумент4 страницыCredit Facilities Offered by NABARDsparsh yadavОценок пока нет

- NABARD - Rural BankДокумент4 страницыNABARD - Rural BankBenedict AbrahamОценок пока нет

- Introduction of NabardДокумент75 страницIntroduction of NabardMayur NayakОценок пока нет

- Reserve Bank of IndiaДокумент4 страницыReserve Bank of IndiaUmesh GuptaОценок пока нет

- Nabard (National Bank For Agriculture and Rural Development)Документ21 страницаNabard (National Bank For Agriculture and Rural Development)ds_frnship4235Оценок пока нет

- Cooperatives and Rural Markets Nabarad: Sub - TopicДокумент25 страницCooperatives and Rural Markets Nabarad: Sub - TopicpoojithaaalamОценок пока нет

- Hiral Eco AssignmentДокумент9 страницHiral Eco Assignmentpradeep jadavОценок пока нет

- NABARD (National Bank For Agriculture and Rural Development) IntroductionДокумент8 страницNABARD (National Bank For Agriculture and Rural Development) Introductionvenkat chalamОценок пока нет

- Nabard Offers CSR Schemes To Corporates in JharkhandДокумент56 страницNabard Offers CSR Schemes To Corporates in JharkhandDatta MoreОценок пока нет

- Development Banks: Mamta Harsita Kuldeep Lovelesh HarikeshДокумент29 страницDevelopment Banks: Mamta Harsita Kuldeep Lovelesh HarikeshRavneet KaurОценок пока нет

- Rural Banking & MicrofinanceДокумент31 страницаRural Banking & MicrofinanceAshish AggarwalОценок пока нет

- Role of NABARD in Rural BankingДокумент20 страницRole of NABARD in Rural BankingParul DhimanОценок пока нет

- Agrifinance Assignment - TMPДокумент14 страницAgrifinance Assignment - TMPMANSHI RAIОценок пока нет

- Nabard 2024Документ6 страницNabard 2024Ttma TtmaОценок пока нет

- Nabard PДокумент16 страницNabard PanjalisssОценок пока нет

- Rural Banking Update June 2022Документ28 страницRural Banking Update June 2022Asif SiddiquiОценок пока нет

- 1 Newton's Ring Mod1 WaterДокумент1 страница1 Newton's Ring Mod1 WaterYashkjJawaleОценок пока нет

- Phosphoric Acid in Cola - Molybdenum Method 1Документ1 страницаPhosphoric Acid in Cola - Molybdenum Method 1YashkjJawaleОценок пока нет

- Newton's RingДокумент1 страницаNewton's RingYashkjJawaleОценок пока нет

- 1 Newton's Ring Mod1 WaterДокумент1 страница1 Newton's Ring Mod1 WaterYashkjJawaleОценок пока нет

- 7 Thermister G1Документ1 страница7 Thermister G1YashkjJawaleОценок пока нет

- Newton's Ring AirДокумент1 страницаNewton's Ring AirYashkjJawaleОценок пока нет

- 4 Malus LawДокумент1 страница4 Malus LawYashkjJawaleОценок пока нет

- 6 Thermal Expansion 2 BrassДокумент1 страница6 Thermal Expansion 2 BrassYashkjJawaleОценок пока нет

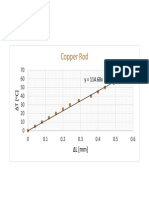

- 6 Thermal Expansion 3 CopperДокумент1 страница6 Thermal Expansion 3 CopperYashkjJawaleОценок пока нет

- Stefan's Law: LN (E) 4.36285 0.163213 LN (T) 30.3693 1.13791 LN (E) 4.3616 LN (T) 30.361Документ1 страницаStefan's Law: LN (E) 4.36285 0.163213 LN (T) 30.3693 1.13791 LN (E) 4.3616 LN (T) 30.361YashkjJawaleОценок пока нет

- Phosphoric Acid in Cola - Molybdenum MethodДокумент1 страницаPhosphoric Acid in Cola - Molybdenum MethodYashkjJawaleОценок пока нет

- How To Open NfoДокумент1 страницаHow To Open NfoYashkjJawaleОценок пока нет

- Newton's RingДокумент1 страницаNewton's RingYashkjJawaleОценок пока нет

- Hole at Bottom of MoonДокумент4 страницыHole at Bottom of MoonYashkjJawaleОценок пока нет

- How To Open NfoДокумент1 страницаHow To Open NfoYashkjJawaleОценок пока нет

- Fibonacci PythonДокумент1 страницаFibonacci PythonYashkjJawaleОценок пока нет

- Project ReportBanty Kumar VermaДокумент126 страницProject ReportBanty Kumar VermagunjanОценок пока нет

- Auditing Theory - Risk AssessmentДокумент10 страницAuditing Theory - Risk AssessmentYenelyn Apistar CambarijanОценок пока нет

- Upcoming Exhibition Schedule - UAEДокумент3 страницыUpcoming Exhibition Schedule - UAEAjay KrishnanОценок пока нет

- CIMA Certificate Paper C4 Fundamentals of Business Economics Practice RevisionДокумент241 страницаCIMA Certificate Paper C4 Fundamentals of Business Economics Practice RevisionNony Um'yioraОценок пока нет

- CR 2015Документ13 страницCR 2015Agr AcabdiaОценок пока нет

- Knipex Gesamtkatalog 2021Документ367 страницKnipex Gesamtkatalog 2021Juan ChoОценок пока нет

- Project Appraisal FinanceДокумент20 страницProject Appraisal Financecpsandeepgowda6828Оценок пока нет

- Product Differentiation and Market Segmentation As Alternative Marketing StrategiesДокумент7 страницProduct Differentiation and Market Segmentation As Alternative Marketing Strategiesshoka1388Оценок пока нет

- Comparative Case Study Between Two AirlineДокумент56 страницComparative Case Study Between Two AirlineGagandeep SinghОценок пока нет

- Not Include Customs Duties, Taxes, Brokerage Fees or Any Other Charges That May Be Incurred. They Are The Responsibility of The Recipient/consigneeДокумент2 страницыNot Include Customs Duties, Taxes, Brokerage Fees or Any Other Charges That May Be Incurred. They Are The Responsibility of The Recipient/consigneeALIZON JAZMIN OROSCO QUISPEОценок пока нет

- OpinionLab v. Iperceptions Et. Al.Документ34 страницыOpinionLab v. Iperceptions Et. Al.PriorSmartОценок пока нет

- Caf 6 PT EsДокумент58 страницCaf 6 PT EsSyeda ItratОценок пока нет

- Accounting Concepts and Principles PDFДокумент9 страницAccounting Concepts and Principles PDFDennis LacsonОценок пока нет

- Training Levies: Rationale and Evidence From EvaluationsДокумент17 страницTraining Levies: Rationale and Evidence From EvaluationsGakuya KamboОценок пока нет

- Design and Implementation of Real Processing in Accounting Information SystemДокумент66 страницDesign and Implementation of Real Processing in Accounting Information Systemenbassey100% (2)

- A Study On Consumer Behavior Regarding Investment On Financial Instruments at Karvy Stock Broking LTDДокумент88 страницA Study On Consumer Behavior Regarding Investment On Financial Instruments at Karvy Stock Broking LTDBimal Kumar Dash100% (1)

- Plan Bee Project To Empower 20 Women in Chitral Proposal - 10!12!2016Документ17 страницPlan Bee Project To Empower 20 Women in Chitral Proposal - 10!12!2016Cristal Montanez100% (1)

- TCI Letter To Safran Chairman 2017-02-14Документ4 страницыTCI Letter To Safran Chairman 2017-02-14marketfolly.comОценок пока нет

- HSC Economics Essay QuestionsДокумент5 страницHSC Economics Essay QuestionsYatharth100% (1)

- Importance of Project Management in ConstructionДокумент10 страницImportance of Project Management in ConstructionNicole SantillanОценок пока нет

- Ashishgupta3554 ResumeДокумент1 страницаAshishgupta3554 ResumeAshish GuptaОценок пока нет

- Soga 37Документ2 страницыSoga 37JohnsonBathОценок пока нет

- Internal Sales Representative As of SAP ERP EhP5 (New)Документ32 страницыInternal Sales Representative As of SAP ERP EhP5 (New)Khalid SayeedОценок пока нет

- Tender Document Heliport ShimlaДокумент128 страницTender Document Heliport ShimlaAdarsh Kumar ManwalОценок пока нет

- Meaning of MarketingДокумент7 страницMeaning of MarketingkritikanemaОценок пока нет

- Products Services FCPO EnglishДокумент16 страницProducts Services FCPO EnglishKhairul AdhaОценок пока нет

- Managerial Economics and Business Strategy, 8E Baye Chap. 3Документ36 страницManagerial Economics and Business Strategy, 8E Baye Chap. 3love75% (4)

- RAD Project PlanДокумент9 страницRAD Project PlannasoonyОценок пока нет

- PAS 96 2008 - Defending Food & DrinkДокумент32 страницыPAS 96 2008 - Defending Food & DrinkMark KwanОценок пока нет