Академический Документы

Профессиональный Документы

Культура Документы

Pinto Ch03 Ppts

Загружено:

Arthur HoИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pinto Ch03 Ppts

Загружено:

Arthur HoАвторское право:

Доступные форматы

Chapter 3

Discounted Dividend Valuation

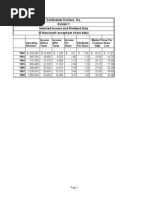

Exhibit 3-1: COKE and HRL: The Earnings and Dividends

Record

COKE

HRL

Payout Ratio

(%)

COKE

Payout

Ratio

EPS ($) DPS ($) (%)

HRL

Payout

Ratio (%)

27

Year

1998

EPS

($) DPS ($)

1.75

1.00

0.52

29

1997

1.79

1.00

56

0.72

0.39

54

1.65

0.45

27

1996

1.73

1.00

58

0.52

0.30

58

29

1.33

0.42

32

1995

1.67

1.00

60

0.79

0.29

37

1.00

39

1.35

0.39

29

1994

1.52

1.00

66

0.77

0.25

32

1.00

93

1.30

0.37

28

1993

1.60

0.88

55

0.66

0.22

33

0.71

1.00

141

1.20

0.35

29

1992 (0.23)

0.88

NM*

0.62

0.18

29

0.37

1.00

270

1.11

0.33

30

Year

EPS ($)

DPS ($)

2006

2.55

1.00

39

2.05

0.56

2005

2.53

1.00

40

1.82

2004

2.41

1.00

41

2003

3.40

1.00

2002

2.56

2001

1.07

2000

1999

*NM = Not meaningful

Source: Standard & Poors Stock Reports, www.sec.edgar-online.com.

57

EPS

Payout

($) DPS ($) Ratio (%)

0.93

0.32

34

Exhibit 3-2: Average Annual Real GDP Growth Rates:

19802006 (in percent)

Time Period

Country

19801989

19901999

20002006

Australia

3.4%

3.3%

3.1%

Canada

3.0

2.4

3.0

Denmark

2.2

2.3

2.0

France

2.1

1.8

2.0

Germany

1.9

1.3

1.3

Italy

2.4

1.5

1.3

Japan

3.9

1.7

1.6

Netherlands

2.0

3.0

1.9

Sweden

2.4

1.8

2.9

Switzerland

1.8

1.1

1.9

United Kingdom

2.4

2.1

2.7

United States

3.1

3.1

2.6

Source: OECD, Datastream, Bloomberg.

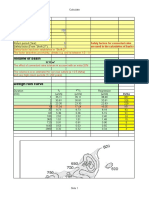

Exhibit 3-3: Estimated Price Given Uncertain Inputs

g = 5.75%

g = 6.00%

g = 6.25%

r = 9.00%

$22.13

$24.03

$26.27

r = 9.25%

$20.55

$22.18

$24.08

r = 9.50%

$19.18

$20.59

$22.23

Exhibit 3-4: Estimated PVGO as a Percentage of Price

Company

r*

E1

Price

E1/r

PVGO

PVGO/Price

Google, Inc.

2.09

13.7%

$15.88

$332.0

115.91

216.09

65.1%

McDonalds

Corp.

1.04

9.0

3.45

53.35

38.33

15.02

28.2

Macys Inc.

1.28

10.1

1.30

10.50

12.87

2.37

22.6

*The required rate of return is estimated using the CAPM with the following inputs: the beta

from the Standard & Poors Stock Reports, 4.3 percent (30-year U.S. T-bond rate) for the

risk-free rate of return, and 4.5 percent for the equity risk premium.

Source: Standard & Poors Stock Reports for beta, earnings estimate, and price of each.

Exhibit 3-5: Carl Zeiss Meditec AG

Time

Value

Calculation

Dt or Vt

Present Values

Dt/(1.097)t or

Vt/(1.097)t

D1

0.14(1.15)

0.1610

0.1468

D2

0.14(1.15)2

0.1852

0.1539

D3

0.14(1.15)3

0.2129

0.1613

D4

0.14(1.15)4

0.2449

0.1691

D5

0.14(1.15)5

0.2816

0.1772

D6

0.14(1.15)6

0.3238

0.1858

D7

0.14(1.15)7

0.3724

0.1948

D8

0.14(1.15)8

0.4283

0.2042

D9

0.14(1.15)9

0.4925

0.2141

10

D10

0.14(1.15)10

0.5664

0.2244

10

V10

0.14(1.15)10(1.08)/(0.097

0.08)

35.9817

14.2566

Total

16.0882

Exhibit 3-6: Value of DuPont Common Stock

Time

Value

Calculation

Dt or Vt

Present Values

Dt/(1.105)t or

Vt/(1.105)t

D1

$1.48(1.10)1

$1.6280

$1.4733

D2

1.48(1.10)2

1.7908

1.4666

D3

1.48(1.10)3

1.9699

1.4600

D4

1.48(1.10)4

2.1669

1.4534

V4

14 [1.48(1.10)4/0.40]

= 14 [2.1669/0.40]

= 14 5.4172

75.8404

50.8688

Total

$56.72

Exhibit 3-7: Estimated Value of IBM

Time

Value

Calculation

Dt or Vt

Present

Values

Dt/(1.12)t or

Vt/(1.12)t

D1

1.60(1.14)

$1.8240

$1.6286

D2

1.60(1.14)2

2.0794

1.6577

D3

1.60(1.14)2(1.12)

2.3289

1.6577

D4

1.60(1.14)2(1.12)2

2.6083

1.6577

D5

1.60(1.14)2(1.12)3

2.9214

1.6577

D6

1.60(1.14)2(1.12)4

3.2719

1.6577

D7

1.60(1.14)2(1.12)5

3.6645

1.6577

V7

1.60(1.14)2(1.12)5(1.102)/(0.12 0.102)

$224.3515

101.4852

Total

$113.0600

Exhibit 3-8: Energen

Time

Dt or Vt

Explanation of Dt or Value of Dt or

Vt

Vt

PV at 10%

D1

0.46(1.12)1

$0.5152

$0.4684

D2

0.46(1.12)2

0.5770

0.4769

D3

0.46(1.12)3

0.6463

0.4855

D4

0.46(1.12)4

0.7238

0.4944

D5

0.46(1.12)5

0.8107

0.5034

V5

H-model explained

above

$42.1564

26.1758

Total

$28.6044

Exhibit 3-9: Energen with No Growth in Year 2

Time

Dt or Vt

Explanation of Dt or Vt Value of Dt or Vt PV at

10%

D1

0.46(1.12)1

D2

$0.5152

$0.4684

No growth in Year 2

0.5152

0.4258

D3

0.46(1.12)2

0.5770

0.4335

D4

0.46(1.12)3

0.6463

0.4414

D5

0.46(1.12)4

0.7238

0.4494

V5

H-model explained above

$37.6376

23.3700

Total

$25.5885

Exhibit 3-10: Value of Yang Co. Stock

Year

Dt or Vt

Value of Dt or Vt

Present Value at 12%

Explanation of Dt or Vt

D1

$21.00

$18.75

Dividend set at $21

D2

18.90

15.07

Previous dividend 0.90

D3

17.01

12.11

Previous dividend 0.90

D4

15.31

9.73

Previous dividend 0.90

D5

60.00

34.05

Set at $60

D6

40.00

20.27

Set at $40

D7

40.00

18.09

Set at $40

V7

600.00

271.41

V7 = D8/(r g)

V7 = (40.00 1.05)/(0.12 0.05)

Total

$399.48

Exhibit 3-11: Johnson & Johnson

Present Value of Dt Present Value of Dt

and V6

and

at r = 9.68%

V6 at r = 10%

Time

Dt

$1.8094

$1.6497

$1.6449

1.9722

1.6394

1.6300

2.1497

1.6293

1.6151

2.3432

1.6192

1.6005

2.5541

1.6092

1.5859

2.7840

1.5992

1.5715

2.9789

Subtotal 1

(t = 1 to 6)

$9.75

$9.65

Subtotal 2

(t = 7 to `)

$63.85

$56.05

Total

$73.60

$65.70

Market Price

$66.19

$66.19

Exhibit 3-12: IBM Corporation

Year

ROE (%)

Profit Margin (%) Asset

Turnover

Financial

Leverage

2006

30.6 =

10.30

0.821

3.62

2005

24.7 =

8.77

0.880

3.20

2004

29.3 =

8.77

0.910

3.67

2003

30.1 =

8.54

0.940

3.75

Exhibit 3-13: Hoshino Distributors Pro Forma Financial

Statements (in millions)

Year 1

Year 2

Year 3

Year 4

Year 5

Income statement

Sales

$100.00

$120.00

$138.00

EBIT

20.00

24.00

24.84

24.29

26.72

4.00

4.83

5.35

5.64

6.18

16.00

19.17

19.49

18.65

20.54

Taxes

6.40

7.67

7.80

7.46

8.22

Net income

9.60

11.50

11.69

11.19

12.32

Dividends

1.92

2.30

3.51

4.48

6.16

Total assets

$80.00

$96.00

$110.40

$121.44 $133.58

Total debt

$40.00

$48.32

$53.52

$56.38 $61.81

Equity

$40.00

$47.68

$56.88

$65.06 $71.77

Interest

EBT

$151.80 $166.98

Balance sheet

Вам также может понравиться

- SodaPDF-merged-Merging ResultДокумент15 страницSodaPDF-merged-Merging ResultzhuzhОценок пока нет

- Debit Aliran Metode RationalДокумент3 страницыDebit Aliran Metode RationalAnggun Vita MutiaraОценок пока нет

- Budget Presentation 15.09.2011Документ12 страницBudget Presentation 15.09.2011Raja RamОценок пока нет

- Corporate Finance - Exercises Session 1 - SolutionsДокумент5 страницCorporate Finance - Exercises Session 1 - SolutionsLouisRemОценок пока нет

- Rancob Hitung ManualДокумент8 страницRancob Hitung ManualAsnurОценок пока нет

- Oferta PDFДокумент67 страницOferta PDFAlexandru GhineaОценок пока нет

- Floodable Ni AlcaydeДокумент149 страницFloodable Ni AlcaydeAndronicoll Mayuga NovalОценок пока нет

- Polaroid CorporationДокумент14 страницPolaroid CorporationMandley SourabhОценок пока нет

- Ujian SOPДокумент136 страницUjian SOPsugendengalОценок пока нет

- Revised Xcel From AvniДокумент5 страницRevised Xcel From AvniHannah BlackОценок пока нет

- Investment Ass#6 - Daniyal Ali 18u00265Документ3 страницыInvestment Ass#6 - Daniyal Ali 18u00265Daniyal Ali100% (1)

- Lab4 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissaДокумент7 страницLab4 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissaFahmi GilangОценок пока нет

- Asignación A Cargo Del DecenteДокумент9 страницAsignación A Cargo Del DecenteGaby C.Оценок пока нет

- All in RatesДокумент17 страницAll in Ratesrkacquaye100% (1)

- Solution To Campbell Lo Mackinlay PDFДокумент71 страницаSolution To Campbell Lo Mackinlay PDFstaimouk0% (1)

- Waste ManagementДокумент18 страницWaste ManagementsmikaramОценок пока нет

- RSI CalculationsДокумент36 страницRSI CalculationsG. S. YadavОценок пока нет

- Math 101 Business and Consumer LoansДокумент31 страницаMath 101 Business and Consumer LoansAdi Garcia ArcenasОценок пока нет

- Home Work Excel SolutionДокумент16 страницHome Work Excel SolutionSunil KumarОценок пока нет

- NPV CalculationДокумент19 страницNPV CalculationmschotoОценок пока нет

- Continental CarriersДокумент3 страницыContinental CarriersCharleneОценок пока нет

- Chapter 10 Discounted DividendДокумент5 страницChapter 10 Discounted Dividendmahnoor javaidОценок пока нет

- Solution To 4.13Документ5 страницSolution To 4.13Niyati ShahОценок пока нет

- Table 8 Demographic Structure and MacroeconomyДокумент3 страницыTable 8 Demographic Structure and MacroeconomyzhuzhОценок пока нет

- Coca Cola Financial AnalysisДокумент4 страницыCoca Cola Financial AnalysisMohammad AliОценок пока нет

- Progres CL Nova Agt 16Документ37 страницProgres CL Nova Agt 16Aziz PediansyahОценок пока нет

- Pertemuan 4 - Contoh Perhitungan Tanpa NgelinkДокумент13 страницPertemuan 4 - Contoh Perhitungan Tanpa NgelinkNabila HusniatiОценок пока нет

- Rights IssueДокумент18 страницRights Issuemuthum44499335Оценок пока нет

- SolutionsДокумент3 страницыSolutionsSwathi JayaprakashОценок пока нет

- Tugas Klompok JerryДокумент9 страницTugas Klompok Jerryfajar sulaimanОценок пока нет

- Modelo WilsonДокумент14 страницModelo WilsonB. Lizet NuñezОценок пока нет

- Word Debit Aliran Metode RationalДокумент9 страницWord Debit Aliran Metode RationalAnggun Vita MutiaraОценок пока нет

- 2.4 Unsteady-State Pressure Distribution Calculations in Directional WellДокумент10 страниц2.4 Unsteady-State Pressure Distribution Calculations in Directional Wellسحر سلامتیانОценок пока нет

- Stanley BetДокумент113 страницStanley Betpetrica20Оценок пока нет

- Assignment 2 Question 1: 1A) Statement of Comprehensive IncomeДокумент17 страницAssignment 2 Question 1: 1A) Statement of Comprehensive IncomesmaОценок пока нет

- Development Sales Lacking: Wheelock Properties (S)Документ7 страницDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerОценок пока нет

- Risk and Portfolio Management Spring 2011: Statistical ArbitrageДокумент66 страницRisk and Portfolio Management Spring 2011: Statistical ArbitrageSwapan ChakrabortyОценок пока нет

- Sample ValuationДокумент18 страницSample Valuationprasha99Оценок пока нет

- Detail P&L Jan Feb Mar Apr May: To ControlДокумент33 страницыDetail P&L Jan Feb Mar Apr May: To ControlmadhujayarajОценок пока нет

- Rain Water Basin DesignДокумент11 страницRain Water Basin DesignSturza AnastasiaОценок пока нет

- CANSLIM - PlantationДокумент17 страницCANSLIM - Plantationtok janggutОценок пока нет

- Ie8b05277 Si 001Документ20 страницIe8b05277 Si 001Nipun ChopraОценок пока нет

- Fixed Income Nmims BLR s6Документ22 страницыFixed Income Nmims BLR s6harshit.dwivedi320Оценок пока нет

- 6 CHP 13 14 15 SolutionДокумент21 страница6 CHP 13 14 15 SolutionBijay AgrawalОценок пока нет

- Coca-Cola Co: FinancialsДокумент6 страницCoca-Cola Co: FinancialsSibghaОценок пока нет

- Table 1a Two-Sided Critical Z-Values (: FunctionsДокумент5 страницTable 1a Two-Sided Critical Z-Values (: FunctionsJeffОценок пока нет

- LAPORAN UJI INDERAWI - Sri Sabili Rohmah - 173020109 - KEL.D - SCORINGДокумент4 страницыLAPORAN UJI INDERAWI - Sri Sabili Rohmah - 173020109 - KEL.D - SCORINGbudi rahmatОценок пока нет

- Ifa Completed Full AnswerДокумент25 страницIfa Completed Full AnswerEileen Wong100% (2)

- Ejercicio de Tirante Normal Con Flujo UniformeДокумент6 страницEjercicio de Tirante Normal Con Flujo UniformeMaira IbarguenОценок пока нет

- Baûng Tính Theùp Cho Phaàn Töû CoätДокумент3 страницыBaûng Tính Theùp Cho Phaàn Töû CoätNguyen Quoc LamОценок пока нет

- Tabel 3.1 Perhitungan Gumbel: Bab Iii Debit Banjir Rancangan Q50 THДокумент3 страницыTabel 3.1 Perhitungan Gumbel: Bab Iii Debit Banjir Rancangan Q50 THSari RahmawatiОценок пока нет

- Microsoft ValuationДокумент4 страницыMicrosoft ValuationcorvettejrwОценок пока нет

- Earth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RДокумент4 страницыEarth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RCamarada RojoОценок пока нет

- Acceleration of a geared system experiment: ω (j) / ω (i) = t (i) / t (j)Документ11 страницAcceleration of a geared system experiment: ω (j) / ω (i) = t (i) / t (j)jihad hasanОценок пока нет

- Descargas Rios LambayequeДокумент36 страницDescargas Rios LambayequeAngel AcuñaОценок пока нет

- EXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Документ16 страницEXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Ana MarkovićОценок пока нет

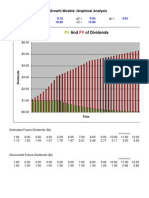

- And of Dividends: Divgraph: The Dividend Growth Models: Graphical AnalysisДокумент10 страницAnd of Dividends: Divgraph: The Dividend Growth Models: Graphical AnalysisSara LeeОценок пока нет

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsОт EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsОценок пока нет

- KFC DeliveryДокумент1 страницаKFC DeliveryArthur HoОценок пока нет

- Black Litterman ModelДокумент20 страницBlack Litterman ModelpaufabraОценок пока нет

- Mother Rice Cooker WarrantyДокумент1 страницаMother Rice Cooker WarrantyArthur HoОценок пока нет

- Cointegration Portfolios of European Equities For Index Tracking and Market Neutral StrategiesДокумент21 страницаCointegration Portfolios of European Equities For Index Tracking and Market Neutral StrategiesHenry ChowОценок пока нет

- Merrill Lynch - How To Read A Financial ReportДокумент53 страницыMerrill Lynch - How To Read A Financial Reportstephenspw92% (12)

- Price Indices For Hong Kong Property Market (1999 100)Документ1 страницаPrice Indices For Hong Kong Property Market (1999 100)Arthur HoОценок пока нет

- Cointegration Portfolios of European Equities For Index Tracking and Market Neutral StrategiesДокумент21 страницаCointegration Portfolios of European Equities For Index Tracking and Market Neutral StrategiesHenry ChowОценок пока нет

- March 2009 Home Builder PDFДокумент0 страницMarch 2009 Home Builder PDFArthur HoОценок пока нет

- East America Special and Orlan Do: HighlightsДокумент2 страницыEast America Special and Orlan Do: HighlightsArthur HoОценок пока нет

- Financial Statement AnalysisДокумент2 страницыFinancial Statement AnalysisArthur HoОценок пока нет

- Bond School 2013Документ20 страницBond School 2013Arthur HoОценок пока нет

- PFE PfizerДокумент12 страницPFE PfizerArthur HoОценок пока нет

- Position Sizing 123Документ4 страницыPosition Sizing 123Arthur HoОценок пока нет

- FT 101Документ1 страницаFT 101Arthur HoОценок пока нет

- Nestle 2012 Financial StatementsДокумент118 страницNestle 2012 Financial StatementshemantbaidОценок пока нет

- Risk Management in Future ContractsДокумент4 страницыRisk Management in Future Contractsareesakhtar100% (1)

- GEOGRAPHICAL IDENTIFICATION TO Jamaican Blue Mountain CoffeeДокумент1 страницаGEOGRAPHICAL IDENTIFICATION TO Jamaican Blue Mountain Coffee052 Sachchidanand Singh100% (1)

- ASCC #2 Location of WWF in Conc SlabsДокумент1 страницаASCC #2 Location of WWF in Conc SlabsKen SuОценок пока нет

- Astm E1757 01Документ2 страницыAstm E1757 01Ankit MaharshiОценок пока нет

- All Alerts For 17 Jan - ChartinkДокумент17 страницAll Alerts For 17 Jan - Chartinkkashinath09Оценок пока нет

- Icma.: PakistanДокумент3 страницыIcma.: Pakistangfxexpert36Оценок пока нет

- Accountancy Review: Assignment Lpu Review For Submission After April 30, 2020Документ5 страницAccountancy Review: Assignment Lpu Review For Submission After April 30, 2020jackie delos santosОценок пока нет

- All Sister Concern ProfileДокумент15 страницAll Sister Concern Profileanowar hossainОценок пока нет

- Foreign Currency Derivatives Group 7Документ53 страницыForeign Currency Derivatives Group 7Shean BucayОценок пока нет

- ComparitiveДокумент6 страницComparitivesanath vsОценок пока нет

- World BankДокумент47 страницWorld Bankhung TranОценок пока нет

- Tma Members List South Circle 2022-2023Документ15 страницTma Members List South Circle 2022-2023acube.printerОценок пока нет

- Global Alternating Pressure Mattress Industry 2015 Market Research Report 9dimen PDFДокумент4 страницыGlobal Alternating Pressure Mattress Industry 2015 Market Research Report 9dimen PDFRemi DesouzaОценок пока нет

- Determinants of Interest Rate Spreads Among Licensed Commercial Banks in KenyaДокумент8 страницDeterminants of Interest Rate Spreads Among Licensed Commercial Banks in KenyaViverОценок пока нет

- Benefits and Costs of FDIДокумент4 страницыBenefits and Costs of FDImarriette joy abadОценок пока нет

- List of CasesДокумент17 страницList of CasesANANYAОценок пока нет

- Guest Reservation Form and Details (Bamba)Документ13 страницGuest Reservation Form and Details (Bamba)Angel BambaОценок пока нет

- Tourism in RomaniaДокумент8 страницTourism in RomaniaEdit SpitaОценок пока нет

- Tourism Statistics2019Документ10 страницTourism Statistics2019Atish KissoonОценок пока нет

- Sara Semar - 043647655 - Tugas 3 Bahasa Inggris Niaga ADBI4201Документ3 страницыSara Semar - 043647655 - Tugas 3 Bahasa Inggris Niaga ADBI4201Francesc Richard WengerОценок пока нет

- 61365annualreport Icai 2019 20 EnglishДокумент124 страницы61365annualreport Icai 2019 20 EnglishSãñ DëëpОценок пока нет

- Bank Market PowerДокумент18 страницBank Market PowerWahyutri IndonesiaОценок пока нет

- CACS1 Updates Version 2.3Документ2 страницыCACS1 Updates Version 2.3trishitalalaОценок пока нет

- Analysis of The Economic Survey 2022-23Документ39 страницAnalysis of The Economic Survey 2022-23Umair NeoronОценок пока нет

- 4 5915484905189411272Документ1 страница4 5915484905189411272Henok Fikadu100% (1)

- DoubleBTCGuide23 PDFДокумент92 страницыDoubleBTCGuide23 PDFAbdull KajoОценок пока нет

- The Great Depression NotesДокумент3 страницыThe Great Depression NotesAthena GuzmanОценок пока нет

- MCQS InvestmentДокумент3 страницыMCQS Investmentaashir chОценок пока нет

- The Theory of The Firm: An Overview of The Economic Mainstream, Revised EditionДокумент331 страницаThe Theory of The Firm: An Overview of The Economic Mainstream, Revised EditionPaul WalkerОценок пока нет

- M21 HL Paper 3 IB1 Mark SchemeДокумент8 страницM21 HL Paper 3 IB1 Mark SchemeJane ChangОценок пока нет