Академический Документы

Профессиональный Документы

Культура Документы

PPT. Ratios

Загружено:

Nino Siniuk0 оценок0% нашли этот документ полезным (0 голосов)

40 просмотров19 страницPepsi was first introduced as "Brad's Drink" in new Bern, north Carolina, united states, in 1893 by Caleb Bradham. ABILITY TO PAY CURRENT LIABILITIES Current ratio is mainly used to give an idea of the company's ability to pay back its short-term liabilities. ABLE to pay LONG-TERM debt debt ratio - a financial ratio that measures the extent of a company's or consumer's

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPepsi was first introduced as "Brad's Drink" in new Bern, north Carolina, united states, in 1893 by Caleb Bradham. ABILITY TO PAY CURRENT LIABILITIES Current ratio is mainly used to give an idea of the company's ability to pay back its short-term liabilities. ABLE to pay LONG-TERM debt debt ratio - a financial ratio that measures the extent of a company's or consumer's

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

40 просмотров19 страницPPT. Ratios

Загружено:

Nino SiniukPepsi was first introduced as "Brad's Drink" in new Bern, north Carolina, united states, in 1893 by Caleb Bradham. ABILITY TO PAY CURRENT LIABILITIES Current ratio is mainly used to give an idea of the company's ability to pay back its short-term liabilities. ABLE to pay LONG-TERM debt debt ratio - a financial ratio that measures the extent of a company's or consumer's

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 19

Comparative Analysis of Pepsi &

Coca-Cola for 2013 (Financial

Ratios Analysis)

2014

Overview

Pepsi was first

introduced as

"Brad's Drink

in New Bern, North

Carolina, United

States, in 1893

by Caleb Bradham,

who made it at his

drugstore where

the drink was sold.

Coca Cola was

invented by a

pharmacist (John

Pemberton) in the

year 1886 when he

was experimenting for

a recipe for headache

and an energizer.

Nowadays Coke

serves as one of the

number one

recognized brands of

the world.

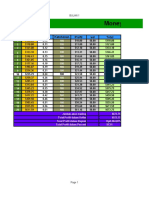

ABILITY TO PAY CURRENT

LIABILITIES

Current ratio is mainly used to give an idea

of the company's ability to pay back its short-

term liabilities (debt and payables) with its

short-term assets (cash, inventory,

receivables).

Acid-test ratio

A indicator that determines whether a firm

has enough short-term assets to cover its

immediate liabilities without selling

inventory.

ABILITY TO SELL INVENTORY AND COLLECT

RECEIVABLES

Inventory Turnover - A ratio showing how many

times a company's inventory is sold and replaced

over a period.

Accounts receivable turnover

The ratio tells how many times during

the year average receivables were

turned into cash. Accounts receivable

turnover measures the ability to collect

cash from customers.

Days Sales in Receivables

Days Sales In Receivables tells you how many

days on average it takes to turn your accounts

receivable balance into cash. Therefore it

measures the efficiency of your collections policy

and department.

ABILITY TO PAY LONG-TERM

DEBT

Debt Ratio - a

financial ratio that

measures the

extent of a

companys or

consumers

leverage.

Times-Interest-Earned Ratio

Ensuring interest

payments to debt

holders and

preventing

bankruptcy

depends mainly on

a company's ability

to sustain earnings.

PROFITABILITY

Rate of Return on Sales - This measure is helpful to

management, providing insight into how much profit is

being produced per dollar of sales. A ratio widely used to

evaluate a company's operational efficiency. ROS is also

known as a firm's "operating profit margin"

Rate of Return on Total

Assets

Measures a

companys success

in using assets to

earn a profit.

Net Income + Interest

Expense/Average Total Assets

Rate of Return on Common

Stockholders Equity

The amount of net income returned as a percentage of

shareholders equity. Return on equity measures a

corporation's profitability by revealing how much profit

a company generates with the money shareholders

have invested.

Earnings per Share of Common

Stock (EPS)

The portion of a

company's profit

allocated to each

outstanding share

of common stock.

Earnings per share

serves as an

indicator of a

company's

profitability.

ANALYZE STOCK AS AN

INVESTMENT

Price/Earnings ratio - It's

usually more useful to

compare the P/E ratios of

one company to other

companies in the same

industry, to the market in

general or against the

company's own historical

P/E.

Dividend Yield

A financial ratio

that shows how

much a company

pays out in

dividends each

year relative to its

share price. In the

absence of any

capital gains, the

dividend yield is

the return on

investment for a

stock.

Book Value per Share of

Common Stock

It would be the amount of money that a holder

of a common share would get if a company

were to liquidate

CONCLUSIONS &

RECOMMENDATIONS

CONCLUSIONS &

RECOMMENDATIONS

!

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- NHD capital budgeting process risksДокумент2 страницыNHD capital budgeting process risksrath3477100% (4)

- Time Value of Money ProblemsДокумент24 страницыTime Value of Money ProblemsMahidhara Davangere100% (1)

- Semi Annual Report 2020Документ113 страницSemi Annual Report 2020J. BangjakОценок пока нет

- Lecture Slides Forwards 2Документ26 страницLecture Slides Forwards 2Praveen Kumar DusiОценок пока нет

- Chapter 8Документ60 страницChapter 8rana ahmedОценок пока нет

- Special Economic Zones - Ram Krishna RanjanДокумент45 страницSpecial Economic Zones - Ram Krishna RanjanVibhas KumarОценок пока нет

- Uts Manajemen KeuanganДокумент8 страницUts Manajemen KeuangantntAgstОценок пока нет

- WST PrattCapitalДокумент7 страницWST PrattCapital4thfloorvalueОценок пока нет

- CFA Institute: Actual Exam QuestionsДокумент8 страницCFA Institute: Actual Exam QuestionsFarin KaziОценок пока нет

- ResumeДокумент2 страницыResumeapi-337242608Оценок пока нет

- National Highways Infra Trust: and Thus To Raise Further Debt." On Page 36Документ1 837 страницNational Highways Infra Trust: and Thus To Raise Further Debt." On Page 36Someshwar Rao ThakkallapallyОценок пока нет

- Catalogue V 17Документ11 страницCatalogue V 17percysearchОценок пока нет

- Pemi Additional FormДокумент1 страницаPemi Additional FormJun GomezОценок пока нет

- Money Management Trading Forex: Hari Modal Lot Ketahanan Profit WD TotalДокумент26 страницMoney Management Trading Forex: Hari Modal Lot Ketahanan Profit WD TotallezanofanОценок пока нет

- Trade PolicyДокумент11 страницTrade PolicyRayhanDenОценок пока нет

- Sample Letter of Intent LOIДокумент2 страницыSample Letter of Intent LOIsappz3545448100% (1)

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsДокумент27 страницSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunОценок пока нет

- Chicago's largest public companies in 2007Документ8 страницChicago's largest public companies in 2007mayankpdОценок пока нет

- Updates On Open Offer (Company Update)Документ80 страницUpdates On Open Offer (Company Update)Shyam SunderОценок пока нет

- CH 01 - Inter Corporate Acquisitions and Investments in Other EntitiesДокумент37 страницCH 01 - Inter Corporate Acquisitions and Investments in Other EntitiesMerriam Leirose Daganta Cabidog100% (3)

- Ubaf1053 Accounting in PraticeДокумент18 страницUbaf1053 Accounting in PraticeTeoh Rou PeiОценок пока нет

- Individual Assign - Ibf301 - Ib17b01 - Su23Документ3 страницыIndividual Assign - Ibf301 - Ib17b01 - Su23Quỳnh Lê DiễmОценок пока нет

- Compound Interest: Compounded Mo Re Than Once A Yea RДокумент24 страницыCompound Interest: Compounded Mo Re Than Once A Yea RCristine CañeteОценок пока нет

- FIN 4604 Sample Questions IIДокумент25 страницFIN 4604 Sample Questions IIEvelyn-Jiewei LiОценок пока нет

- Impact of Working Capital Management On The Profitability of The Food and Personal Care Products Companies Listed in Karachi Stock Exchange (Finance)Документ41 страницаImpact of Working Capital Management On The Profitability of The Food and Personal Care Products Companies Listed in Karachi Stock Exchange (Finance)Muhammad Nawaz Khan Abbasi100% (1)

- BUSINESS TRANSACTIONS AND ACCOUNT TITLESДокумент4 страницыBUSINESS TRANSACTIONS AND ACCOUNT TITLESPAIN SAMAОценок пока нет

- Types and Forms of Dividends ExplainedДокумент9 страницTypes and Forms of Dividends ExplainedKram Olegna AnagergОценок пока нет

- 9 Ways to Become a Crorepati in 15 YearsДокумент13 страниц9 Ways to Become a Crorepati in 15 Yearsmmiimc@gmail.comОценок пока нет

- Tiffany Faces Exchange Rate RisksДокумент4 страницыTiffany Faces Exchange Rate RiskssadecespamОценок пока нет

- Tybms - Sem 5 - S&D - ObjectivesДокумент3 страницыTybms - Sem 5 - S&D - ObjectivesGautam TupeОценок пока нет