Академический Документы

Профессиональный Документы

Культура Документы

Analytics For Retail Banking - Marketelligent

Загружено:

Marketelligent100%(1)100% нашли этот документ полезным (1 голос)

469 просмотров2 страницыAnalytics for Retail Banking - Marketelligent

Оригинальное название

Analytics for Retail Banking - Marketelligent

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAnalytics for Retail Banking - Marketelligent

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

469 просмотров2 страницыAnalytics For Retail Banking - Marketelligent

Загружено:

MarketelligentAnalytics for Retail Banking - Marketelligent

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Profit-based Customer Acquisition Strategy

Revenue Scorecards; eg Total 180 days

revenue

Campaign Management

Cross-sell Scorecards

Retention and Activation

Loan Prepayments

Loyalty and Winback

Pricing Analytics

Credit Delinquency Scorecards

Customer Approval and Conversion

Scorecards

Optimal Loan Amount, Pricing and loan

duration

Portfolio Loss Forecasting

Collections Analytics

Fraud Analytics

Basel II Analytics

Credit Risk Analytics Marketing Analytics

Analytics that impact all items of the portfolio P&L

Example: Credit Cards

RETAIL BANKING ANALYTICS

Marketelligent is in the business of providing

analytic services that help you make smarter

business decisions. With deep expertise in

Credit Risk and Marketing across asset- and

liability-based Products, we offer an

affordable global delivery model leveraging

the best of domain expertise and analytic

capabilities.

New Accounts Acquired

Accounts Closed

Account Activation rate

Payment Rate

Total Ending Receivables

Interest

Cost of Funds

Net Interest Margin

Risk-based Fees

Interchange

Affinity Rebates

Cross-Sell

Annual Fees

Net Credit Losses

Net Credit Margin

Operating Expenses

Loan Loss reserve

Net Income

R

E

V

E

N

U

E

S

E

X

P

E

N

S

E

S

Bank P&L

Reduce Customer Attrition

- Voluntary / Involuntary

- Retention Strategies

- Winback

Improve profitability of Assets

- Credit Line Strategies

- Pricing

- Balance Transfer

Maximize Fee Revenue

- Over Credit limit

- Delinquency

- Bad Check

Reduce Net Credit Losses

- Credit Line strategies

- Pricing strategies

- Collections

Acquire Profitable Customers

- Whom to approve/decline?

- What Pricing?

- What Credit Line ?

Increase activation rates

- Deepening Engagement

- Inactive Customer Treatment

Maximize Interest Revenue

- Product Pricing

- Customer Behavior Revolvers,

transactors, etc

Increase Cross-sell Revenues

- Revenue Enhancing Products

- Breadth of relationships

CONTACT

www.marketelligent.com

MARKETELLIGENT, INC.

80 Broad Street, 5th Floor, New York, NY 10004

1.212.837.7827 (o) 1.208.439.5551 (fax) info@marketelligent.com

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0 1 2 3 4 5 6 7 8 9 10

Random

New Model

Existing Model

C

u

m

u

l

a

t

i

v

e

D

e

f

a

u

l

t

R

a

t

e

Scorecard Deciles

PREDICT USING SCORECARDS

Design, develop and implement predictive scorecards across

functions: response, approvals, delinquencies, collections,

cross-sell, etc

Acquisition Usage & Loyalty

V

a

l

u

e

Time

Retention

Activation

RETAIN & ACTIVATE

Identify Customers at Risk of Disengagement via predictive

scorecards. Take appropriate action to lower attrition.

Segment Inactive Customers across various dimensions.

Implement targeted activation campaigns.

MAXIMIZE COLLECTIONS

Collectability

Scorecard

Placement Balance

(Amount the account

entered Collections with)

Required Effort

(Efforts required to

collect past dues)

Develop & implement holistic strategies to collect efficiently;

thereby reducing cost/dollar collected

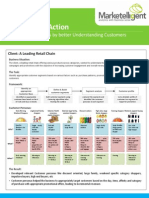

SEGMENT YOUR CUSTOMERS

Segment Customers to better understand their needs and

wants; their sensitivities to various factors, etc.

RETAIL BANKING -

CREDIT RISK & MARKETING ANALYTICS

Lower defaults by upto

15% using approval

scorecards

Segment based on a

specific objective; or

natural clustering

Increase activation by

upto 20% by optimal

targeting and right offers

Increase Collections by

upto 20% using Collection

Scorecards

Вам также может понравиться

- JP MORGAN Pakistan AnalysisДокумент64 страницыJP MORGAN Pakistan AnalysisSara NoorОценок пока нет

- Northwestern Mutual v2Документ9 страницNorthwestern Mutual v2Shekhar PawarОценок пока нет

- Sevice Manual BOBCAT S630 PDFДокумент890 страницSevice Manual BOBCAT S630 PDFArtemio Garcia Barrientos100% (11)

- Asset Liability ManagementДокумент8 страницAsset Liability ManagementAvinash Veerendra TakОценок пока нет

- Commercial Banks Credit Scoring Model for Corporate BorrowersДокумент26 страницCommercial Banks Credit Scoring Model for Corporate BorrowersHumayun SabirОценок пока нет

- Metrics That Matter For A Successful Treasury Transformation Session 22Документ5 страницMetrics That Matter For A Successful Treasury Transformation Session 22vino06cse57Оценок пока нет

- BSA3A Group1 AUD02 FinalAnalyticsДокумент9 страницBSA3A Group1 AUD02 FinalAnalyticsKyra BantogОценок пока нет

- Transportation System, Analysis and Modelling (CE-632) : Carried Out by Group-3Документ15 страницTransportation System, Analysis and Modelling (CE-632) : Carried Out by Group-3Naman Kumar100% (2)

- Credit Risk AssessmentДокумент8 страницCredit Risk Assessmentmahita_m4a3081Оценок пока нет

- Fs Data and AnalyticsДокумент5 страницFs Data and Analyticsvcpc2008Оценок пока нет

- SME Credit Rating Methodology ASEANДокумент155 страницSME Credit Rating Methodology ASEANNinjee BoОценок пока нет

- Fintech and The Future of Finance GlossaryДокумент14 страницFintech and The Future of Finance GlossaryAKINBONI MICHEALОценок пока нет

- Wallstreet Suite Risk Management For GovernmentsДокумент8 страницWallstreet Suite Risk Management For GovernmentsghaeekОценок пока нет

- Data Lake InfographicДокумент1 страницаData Lake Infographicarhasan75Оценок пока нет

- SM F4GE-IVECO-Telehandler EN PDFДокумент117 страницSM F4GE-IVECO-Telehandler EN PDFjulianmata71% (7)

- Analytics in Action - How Marketelligent Helped A B2B Retailer Increase Its Lead VelocityДокумент2 страницыAnalytics in Action - How Marketelligent Helped A B2B Retailer Increase Its Lead VelocityMarketelligentОценок пока нет

- Parts Catalog TT75, TT55 NEW HOLLANDДокумент360 страницParts Catalog TT75, TT55 NEW HOLLANDrogerio97% (35)

- Investment TemplateДокумент86 страницInvestment TemplateLeonard KendrickОценок пока нет

- Wharton - Business Analytics - Week 6 - SummaryДокумент40 страницWharton - Business Analytics - Week 6 - SummaryGgarivОценок пока нет

- Analytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sMarketelligentОценок пока нет

- Accenture Banking 2016Документ16 страницAccenture Banking 2016Rahul TripathiОценок пока нет

- SDLC Phases Feasibility Analysis RequirementsДокумент4 страницыSDLC Phases Feasibility Analysis RequirementsBrandon Mitchell0% (1)

- Complete Checklist for Manual Upgrades to Oracle Database 12c R1Документ27 страницComplete Checklist for Manual Upgrades to Oracle Database 12c R1Augustine OderoОценок пока нет

- Air Car SeminarДокумент24 страницыAir Car SeminarSatyajit MenonОценок пока нет

- UNIT-IV-Financing of ProjectsДокумент13 страницUNIT-IV-Financing of ProjectsDivya ChilakapatiОценок пока нет

- 633676496954865000Документ23 страницы633676496954865000shaheencmОценок пока нет

- Tecumseh Service Repair Manual VH80 VH100 HH80 HH100 HH120 Oh120 Oh140 Oh160 Oh180 8HP Thru 18HP Cast Iron Engines 691462a PDFДокумент78 страницTecumseh Service Repair Manual VH80 VH100 HH80 HH100 HH120 Oh120 Oh140 Oh160 Oh180 8HP Thru 18HP Cast Iron Engines 691462a PDFDan Clarke75% (4)

- A Kids Guide To Chicago - FullДокумент37 страницA Kids Guide To Chicago - FullDiana ZipetoОценок пока нет

- SME RouteДокумент56 страницSME RouteChandura PriyankОценок пока нет

- Harnessing The Potential of Data in InsuranceДокумент13 страницHarnessing The Potential of Data in InsuranceSRINIVAS RAOОценок пока нет

- Analytics P&C Insurance v1Документ1 страницаAnalytics P&C Insurance v1Kunal DeshmukhОценок пока нет

- Bank FocusДокумент11 страницBank FocustempesoyОценок пока нет

- CreditMetrics (Technical Document) PDFДокумент212 страницCreditMetrics (Technical Document) PDFAngel Gutiérrez ChambiОценок пока нет

- Human ResourcesДокумент12 страницHuman ResourcesulluОценок пока нет

- Commercial Loan OriginationДокумент11 страницCommercial Loan Originationsathyanarayana rao ranyaОценок пока нет

- OliverWyman ModularFS FinalДокумент16 страницOliverWyman ModularFS FinalTuan TranОценок пока нет

- QUICK GUIDE To Installing Oracle Database 11gR2 - PART1Документ7 страницQUICK GUIDE To Installing Oracle Database 11gR2 - PART1Peter AsanОценок пока нет

- Data Monetization: 6 Categories and Use CasesДокумент3 страницыData Monetization: 6 Categories and Use CasesmohnishОценок пока нет

- Cisco CCNA SecurityДокумент85 страницCisco CCNA SecurityPaoPound HomnualОценок пока нет

- Analytics in Action - How Marketelligent Helped A Quick Service Restaurant Chain Identify Customer Pain PointsДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Quick Service Restaurant Chain Identify Customer Pain PointsMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped Increase Customer Engagement Via Targeted Cross-SellДокумент2 страницыAnalytics in Action - How Marketelligent Helped Increase Customer Engagement Via Targeted Cross-SellMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped An Online Remittance Firm Identify Risky TransactionsДокумент2 страницыAnalytics in Action - How Marketelligent Helped An Online Remittance Firm Identify Risky TransactionsMarketelligentОценок пока нет

- Retail Banking Presentation GrowthДокумент45 страницRetail Banking Presentation GrowthNiyati BagweОценок пока нет

- Optimally Leveraging Predictive Analytics in Wholesale Banking: The Why and HowДокумент12 страницOptimally Leveraging Predictive Analytics in Wholesale Banking: The Why and HowHemant DujariОценок пока нет

- Bankbi Financial Performance & Banking PerformanceДокумент16 страницBankbi Financial Performance & Banking PerformanceAbdelmadjid Bouamama50% (2)

- List of Analytics Consulting Companies in IndiaДокумент3 страницыList of Analytics Consulting Companies in IndiaAmardeep KaushalОценок пока нет

- Data Analytics in The Cloud SOA WorldДокумент26 страницData Analytics in The Cloud SOA Worldtomplunkett100% (2)

- Report on Credit Scoring's Effects on Availability and AffordabilityДокумент304 страницыReport on Credit Scoring's Effects on Availability and AffordabilityhbsqnОценок пока нет

- Kotak Mobile Banking App Product StrategyДокумент19 страницKotak Mobile Banking App Product StrategyRachitaRattanОценок пока нет

- Analytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueДокумент2 страницыAnalytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueMarketelligentОценок пока нет

- Data Mining and Credit ScoringДокумент8 страницData Mining and Credit ScoringHaniyaAngelОценок пока нет

- Analytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningMarketelligentОценок пока нет

- Company ProfileДокумент26 страницCompany ProfileTechknomaticОценок пока нет

- Fractal Analytics - Corporate ReportДокумент2 страницыFractal Analytics - Corporate ReportShashi BhagnariОценок пока нет

- Financial Analytics DerivativesДокумент2 страницыFinancial Analytics DerivativesgauravroongtaОценок пока нет

- Clustering Approaches For Financial Data Analysis PDFДокумент7 страницClustering Approaches For Financial Data Analysis PDFNewton LinchenОценок пока нет

- SAS Banking - Basel II SolutionsДокумент12 страницSAS Banking - Basel II Solutionsashfaqultanim007Оценок пока нет

- Propensity Score Methods Using SASДокумент37 страницPropensity Score Methods Using SASravigupta82Оценок пока нет

- Critical Capabilities For Analytics and Business Intelligence PlatformsДокумент73 страницыCritical Capabilities For Analytics and Business Intelligence PlatformsDanilo100% (1)

- Capstone Project NBFC Loan Foreclosure PredictionДокумент48 страницCapstone Project NBFC Loan Foreclosure PredictionAbhay PoddarОценок пока нет

- What Makes A Good LoaNДокумент25 страницWhat Makes A Good LoaNrajin_rammsteinОценок пока нет

- 1) Explain The Various Stages of NPD: New Product Development StagesДокумент33 страницы1) Explain The Various Stages of NPD: New Product Development StagesROHITОценок пока нет

- Siddhant Jena: Qualifications College/Institution Grade/Marks (%) /C.G.P.A Year of PassingДокумент2 страницыSiddhant Jena: Qualifications College/Institution Grade/Marks (%) /C.G.P.A Year of Passingsiddhant jenaОценок пока нет

- A Review On Credit Card Default Modelling Using Data ScienceДокумент7 страницA Review On Credit Card Default Modelling Using Data ScienceEditor IJTSRDОценок пока нет

- Business Analytics For Banking: Three Ways To WinДокумент8 страницBusiness Analytics For Banking: Three Ways To Winkaushik.grОценок пока нет

- Accounts Receivable and Credit Collection ReportДокумент27 страницAccounts Receivable and Credit Collection Reportbob2nkongОценок пока нет

- Sou Team 2Документ30 страницSou Team 2api-508942309Оценок пока нет

- India Life Insurance Sector: Incentive Structures To Deliver Optimal ResultsДокумент8 страницIndia Life Insurance Sector: Incentive Structures To Deliver Optimal ResultssolukoyaОценок пока нет

- PiperJaffrayCompanies OverviewOfTheEvolvingFinTechLandscape Aug 23 2015Документ186 страницPiperJaffrayCompanies OverviewOfTheEvolvingFinTechLandscape Aug 23 2015nihir_nemani100% (1)

- Assignment 2: (Wikipedia - )Документ3 страницыAssignment 2: (Wikipedia - )richardanelson000Оценок пока нет

- Application of Decision Sciences To Solve Business Problems - MarketelligentДокумент17 страницApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Petroleum Retailer Identify 'At Risk' CustomersДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Petroleum Retailer Identify 'At Risk' CustomersMarketelligentОценок пока нет

- Order of Magnitude Forecast - How Marketelligent Helped A Leading OTC Company Launch New Products in Emerging MarketsДокумент2 страницыOrder of Magnitude Forecast - How Marketelligent Helped A Leading OTC Company Launch New Products in Emerging MarketsMarketelligent100% (1)

- Application of Decision Sciences To Solve Business Problems - MarketelligentДокумент14 страницApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A CPG Company Optimize Its Media PlanningДокумент2 страницыAnalytics in Action - How Marketelligent Helped A CPG Company Optimize Its Media PlanningMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A US Manufacturer Improve Demand ForecastsДокумент2 страницыAnalytics in Action - How Marketelligent Helped A US Manufacturer Improve Demand ForecastsMarketelligentОценок пока нет

- Application of Business Sciences To Solve Business Problems - MarketelligentДокумент17 страницApplication of Business Sciences To Solve Business Problems - MarketelligentMarketelligentОценок пока нет

- Application of Decision Sciences To Solve Business Problems - MarketelligentДокумент25 страницApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentОценок пока нет

- Marketelligent Capabilities & Offerings For Sales AnalyticsДокумент10 страницMarketelligent Capabilities & Offerings For Sales AnalyticsMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueДокумент2 страницыAnalytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueMarketelligentОценок пока нет

- Automotive Capabilities - MarketelligentДокумент17 страницAutomotive Capabilities - MarketelligentMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Retailer Increase RevenuesДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Retailer Increase RevenuesMarketelligentОценок пока нет

- Application of Decision Sciences To Solve Business Problems in The Consumer Packaged Goods (CPG) IndustryДокумент24 страницыApplication of Decision Sciences To Solve Business Problems in The Consumer Packaged Goods (CPG) IndustryMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Publishing House Identify Its Social InfluencersДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Publishing House Identify Its Social InfluencersMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Technology Firm Prioritize Business PartnershipsДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Technology Firm Prioritize Business PartnershipsMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Hair Care Manufacturer Re-Design Its Product Communication StrategiesДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Hair Care Manufacturer Re-Design Its Product Communication StrategiesMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Bank Validate A Predictive ModelДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Bank Validate A Predictive ModelMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A B2B Retailer Minimize Bad DebtsДокумент2 страницыAnalytics in Action - How Marketelligent Helped A B2B Retailer Minimize Bad DebtsMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped An Insurance Provider Optimize Acquisition InvestmentsДокумент2 страницыAnalytics in Action - How Marketelligent Helped An Insurance Provider Optimize Acquisition InvestmentsMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sMarketelligent100% (1)

- Analytics in Action - How Marketelligent Helped A Manufacturer Optimize Trade Promotion SpendsДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Manufacturer Optimize Trade Promotion SpendsMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Leading OTC Manufacturer Track Market DevelopmentДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Leading OTC Manufacturer Track Market DevelopmentMarketelligent100% (1)

- Trade Promotion Optimization - MarketelligentДокумент12 страницTrade Promotion Optimization - MarketelligentMarketelligentОценок пока нет

- Analytics in Action - How Marketelligent Helped A Leading Alcobev Manufacturer Forecast SalesДокумент2 страницыAnalytics in Action - How Marketelligent Helped A Leading Alcobev Manufacturer Forecast SalesMarketelligentОценок пока нет

- Instruction and Maintenance Manual: Silenced Screw Rotary Compressor UnitsДокумент34 страницыInstruction and Maintenance Manual: Silenced Screw Rotary Compressor UnitsJohnny Diaz VargasОценок пока нет

- Tugas Dinamika Struktur Shape Function - Kelompok 6Документ8 страницTugas Dinamika Struktur Shape Function - Kelompok 6Mochammad Choirul RizkyОценок пока нет

- By Himanshu Panwar Asst. Prof. Civil Engineering Department AkgecДокумент34 страницыBy Himanshu Panwar Asst. Prof. Civil Engineering Department AkgecAlok0% (1)

- Easi-Pay Guide via e-ConnectДокумент29 страницEasi-Pay Guide via e-ConnectKok WaiОценок пока нет

- Engineering Data (Design Manual) - EDTRAU342315-D - RXYQ-BYMДокумент104 страницыEngineering Data (Design Manual) - EDTRAU342315-D - RXYQ-BYMignatiusglenОценок пока нет

- Service Accessories: CatalogДокумент32 страницыService Accessories: CatalogdummaОценок пока нет

- 300G IM SettingsSheets 20160122Документ27 страниц300G IM SettingsSheets 20160122zeljkoradaОценок пока нет

- 29 KprogДокумент582 страницы29 KprogMike MorrowОценок пока нет

- Strategic Human Resource Management and The HR ScorecardДокумент20 страницStrategic Human Resource Management and The HR ScorecardRajat JainОценок пока нет

- Sabri Toyyab Resume Spring 2019Документ2 страницыSabri Toyyab Resume Spring 2019api-457400663Оценок пока нет

- B2BДокумент31 страницаB2BAjay MaheskaОценок пока нет

- To Civil Engineering: RoadsДокумент30 страницTo Civil Engineering: Roadshemant kumarОценок пока нет

- Solar Powered Automatic Toilet LightДокумент10 страницSolar Powered Automatic Toilet LightarwinОценок пока нет

- Fuzzy Set Theory: UNIT-2Документ45 страницFuzzy Set Theory: UNIT-2Sharma SudhirОценок пока нет

- Gta Namaste America Cheat CodesДокумент4 страницыGta Namaste America Cheat CodesGaurav PathakОценок пока нет

- Certification Authorities Software Team (CAST) Cast 10Документ8 страницCertification Authorities Software Team (CAST) Cast 10Anastasia SuckallahОценок пока нет

- MELHORES SITES DE INFOPRODUTOS PLR E SUAS RANKS NO ALEXAДокумент8 страницMELHORES SITES DE INFOPRODUTOS PLR E SUAS RANKS NO ALEXAAlexandre Silva100% (2)

- C Programming: Charudatt KadolkarДокумент34 страницыC Programming: Charudatt KadolkarDhiliban SwaminathanОценок пока нет

- 1100cc Engine Parts CatalogueДокумент39 страниц1100cc Engine Parts CatalogueSimon placenciaОценок пока нет

- TARPfinal PDFДокумент28 страницTARPfinal PDFRakesh ReddyОценок пока нет