Академический Документы

Профессиональный Документы

Культура Документы

Universidad Tecnológica de Coahuila Production Cost Accounting Class

Загружено:

Edgar Ibarra0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров13 страницUniversidad Tecnologica de Coahuila production cost accounting Class. Objective: to know the basic tools used by cost accounting to generate the information to be used in decisions-making, its function and relationship with financial accounting and management accounting.

Исходное описание:

Оригинальное название

Cost Accounting Class

Авторское право

© © All Rights Reserved

Доступные форматы

PPTX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документUniversidad Tecnologica de Coahuila production cost accounting Class. Objective: to know the basic tools used by cost accounting to generate the information to be used in decisions-making, its function and relationship with financial accounting and management accounting.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров13 страницUniversidad Tecnológica de Coahuila Production Cost Accounting Class

Загружено:

Edgar IbarraUniversidad Tecnologica de Coahuila production cost accounting Class. Objective: to know the basic tools used by cost accounting to generate the information to be used in decisions-making, its function and relationship with financial accounting and management accounting.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPTX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 13

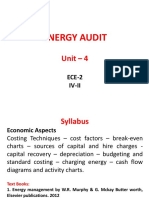

Universidad Tecnolgica de Coahuila

Production Cost Accounting Class

Presented by:

Lic. Celina A. Fernandez Jimenez

December 11, 2013

OBJECTIVES:

General Objective: To know the basic tools used by cost accounting to

generate the information to be used in decisions-making, its function and

relationship with financial accounting and management accounting.

Specific Objective:

The student will be able to:

Make difference between cost accounting and financial accounting

Make difference between cost accounting and management accounting

To understand and define the cost accounting concept and its function

To mention the cost accounting benefits

To distinguish the differences between cost and spend

To understand in a general way the cost accumulation process of a

manufacturing enterprise

To mention and define the different cost classifications

To know the important points to consider when making a product cost.

CONTENT:

FINANCIAL ACCOUNTING CONCEPT

COST ACCOUNTING CONCEPT

MANAGEMENT ACCOUNTING CONCEPT

COST ACCOUNTING BASIC CONCEPTS

FORMULAS FOR COST ACCOUNTING

BASIC CHARTS

PROCESS COST EXAMPLES

ACTIVITIES:

TO READ AND UNDERSTAND THE CONCEPTS FOR FINANCIAL, MANAGEMENT AND

COST ACCOUNTING

TO IDENTI FY THE DIFFERENCES BETWEEN THE FINANCIAL, MANAGEMENT AND COST

ACCOUNTING.

TO REVIEW THE BASIC CHARTS OF A MANUFACTURING PRODUCTION PROCESS

TO LEARN THE BASIC FORMULAS OF COST ACCOUNTING PROCESS

TO REVIEW CHARTS TO UNDERSTAND COST PRODUCTION PROCESS

TO WORK ON EXAMPLES TO PRACTICE COST PRODUCTION PROCESS, ASSETS, SHEET

BALANCES, ETC.

FINANCIAL ACCOUNTING

It is an element series such as registration rules, accounting criteria, presentation forms,

etc. It Expresses in quantitative and monetary terms transactions made by an entity, to

provide useful and secure information to people making-decision.

MANAGEMENT ACCOUNTING

All the tools of the administrative subsystem get together in the management

accounting, this is an information system forwarded to make all functions easier to plan

and control, also for making-decisions. This accounting shows the budget preparation,

production cost and evaluation.

COST ACCOUNTING

This is a system that has techniques and procedures used to quantify the economic

sacrifice incurred by a business to generate incomes of making inventories.

FINANCIAL ACCOUNTING

Assets

* Inventories

Liabilities

Owners Equity

Balance Sheet

Income Statement

Sales

- Sales Cost

* Inventories

= Profit

- Expenses

= Net Income

COST ACCOUNTNG

MANAGEMENT

ACCOUNTING

Supports Financial

Accounting

Cost Accounting allows the inventory value process of materials, product in process

and finish goods to be presented in Balance Sheet.

1. In the Income Statement the cost accounting makes interference in cost

determining for sale costs.

2. It helps in evaluation of business by reviewing the profits generated by areas.

3. Provides bases for tools aplication by administrative accounting, such as

breakeven, etc.

COST PRODUCTION ELEMENTS

Direct Material

+ Direct Labor

+ Indirect Costs

----------------------------

= Production Cost

There are four basic types of cost that accountants need to keep in mind direct,

indirect, fixed, and variable costs. They are defined as follows:

Direct costs: Direct costs can be directly traced to the product. Material and labor costs

are good examples.

Indirect costs: These cant be directly traced to the product; instead, these costs

are allocated, based on some level of activity. For example, overhead costs are

considered indirect costs.

Fixed costs: Fixed costs dont vary with the level of production. A good example is a lease

on a building.

Variable costs: Unlike fixed costs, variable costs change with the level of production. For

example, material used in production is a variable cost.

Every cost can be defined with two of these four costs. For example, the cost to repair

machinery is an indirect variable cost. You decide if the cost is direct or indirect, and if

the cost is fixed or variable.

Checking out cost accounting basics

Just like in any discipline, you use specific cost accounting terms and ideas to communicate

meaning and understand procedures. Understanding basic concepts in crucial, so to start

using cost accounting analysis, you should be familiar with these terms:

Contribution margin: This term is defined as sales minus variable cost. When you subtract

your fixed costs from contribution margin, the amount left over is your profit.

Breakeven point formula: The breakeven point is the level of sales where your profit is

zero. The breakeven formula is sales minus variable cost minus fixed cost. You multiply

your sales per unit by units sold. You also multiply the variable cost per unit by

the same units sold. The sales level that makes the formula equal to zero is the breakeven

point.

Relevant range: Relevant range is a term that relates to machinery, equipment, or vehicles

in your business. Think of relevant range as the maximum level of use for the item you

operate in your business. Say you use a sewing machine. As long as you operate the

machine at or below the relevant range, it should operate normally. The machines cost

should come in at the level you expect. If you operate above the relevant range, the

machine wont operate as you expect. You need to invest in a second machine to operate

above the relevant range.

Digging deeper into cost accounting analysis

As you further your study, you use more complex cost analysis tools. From job costing to variances, the

more involved the job, the more involved your cost accounting tools become. Here are some

important tools youll use:

Job costing: This method of costing assumes that every customer job is different. Plumbers and

carpenters are good examples of businesses that use cost accounting. Because every job is different,

each customer job is assigned material, labor, and overhead costs.

Process costing: Companies use process costing when partially completed units are moved from one

production area to another. Process costing assumes that the products you produce are similar or

even identical.

Variance: A variance is a difference between your planned or budgeted cost and your actual results.

A favorable variance occurs when your actual costs are less than your budgeted or planned cost. An

unfavorable variance is when actual costs are higher than planned.

Inventoriable costs: These are costs that are directly related to the product. Production costs are

inventoriable costs for a manufacturer. If you are a retailer, your cost to purchase inventory is also an

inventoriable. Other costs you incur for goods are included, such as shipping and storage costs.

Must Know Formulas for Cost Accounting

To reduce and eliminate costs in a business, you need to know the formulas that are most often used

in cost accounting. When you understand and use these foundational formulas, youll be able to

analyze a products price and increase profits.

Breakeven Formula

Profit ($0) = sales variable costs fixed costs

Target Net Income

Target net income = sales variable costs fixed costs

Gross Margin

Gross margin = sale price cost of sales (material and labor)

Contribution Margin

Contribution margin = sales variable costs

Pre-Tax Dollars Needed for Purchase

Pre-tax dollars needed for purchase = cost of item (1 - tax rate)

Price Variance

Price variance = (actual price - budgeted price) (actual units sold)

Efficiency Variance

Efficiency variance = (Actual quantity budgeted quantity) (standard price or rate)

Variable Overhead Variance

Variable overhead variance = spending variance + efficiency variance

Ending Inventory

Ending inventory = beginning inventory + purchases cost of sales

Ca X S.A. de C.V.

Income Statement

1 de Enero al 1 Diciembre de 2013

Total Sales $121,164.00

Sales Cost ($ 94, 380.00)

------------------------------------------------------------

Profit $ 26,784.00

Operation Expenses ($ 10,114.00)

------------------------------------------------------------

Operation Profit $ 16,670

---------------------------------------------------------------

Financial Expenses ($ 2,760.00)

--------------------------

Profit befor taxes $ 13,910.00

Taxes ($ 2,782.00)

------------------------

Final Profit $ 11,280.00

EJEMPLO

SUPPORT SUGGESTIONS:

Spanish English Dictionary

English English Dictionary

Internet

EVALUATION CRITERIA: According to FDA-84 Form provided.

REFERENCES:

CONTABILIDAD DE COSTOS / ALSO S. TORRES/ MCGRAW HILL

COSTOS I / CRISTOBAL DEL RIO GONZALEZ/ ECAFSA

INTERNET /CONTABILIDAD FINANCIERA / GERARDO CANTU, NORA E.

ADRADE DE GUAJARDO/ QUINTA EDICION

INTERNET / WWW.ACCOUNTINGCOUCH.COM

Вам также может понравиться

- Solution Manual Chapter 5Документ6 страницSolution Manual Chapter 5sshahar2Оценок пока нет

- Negotiable Instruments Used As Collateral SecurityДокумент5 страницNegotiable Instruments Used As Collateral Securityaweb1100% (1)

- Digital Banking Playbook Final 1Документ21 страницаDigital Banking Playbook Final 1hiteshgoel100% (2)

- USA 1919-41 Notes RemyДокумент33 страницыUSA 1919-41 Notes RemyBryan NgoОценок пока нет

- Statements of Financial Position As at 30 June 20X8 20X7Документ4 страницыStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàОценок пока нет

- Definition of CostingДокумент22 страницыDefinition of CostingmichuttyОценок пока нет

- Cost of AccountingДокумент9 страницCost of Accountingnadeemahad98Оценок пока нет

- Chapter FourДокумент12 страницChapter FourhabatmuОценок пока нет

- Accountancy SectionДокумент124 страницыAccountancy Sections7k1994Оценок пока нет

- Determine Cost of Product and Services With Various Costing: SystemДокумент11 страницDetermine Cost of Product and Services With Various Costing: SystemCherwin bentulanОценок пока нет

- Cost Accounting and Control: (Acctg 107 M-F 5:00-6:10)Документ38 страницCost Accounting and Control: (Acctg 107 M-F 5:00-6:10)Korean Drama Fever PHОценок пока нет

- Cost AccountingДокумент11 страницCost AccountingAfzal AbdullaОценок пока нет

- 11th Sem - Cost ACT 1st NoteДокумент5 страниц11th Sem - Cost ACT 1st NoteRobin420420Оценок пока нет

- Assignment 1 BUSI 3008Документ21 страницаAssignment 1 BUSI 3008Irena MatuteОценок пока нет

- Cost Accounting 1Документ48 страницCost Accounting 1Sherilyn LozanoОценок пока нет

- Acc 3200 MidtermДокумент5 страницAcc 3200 MidtermCici ZhouОценок пока нет

- Chapter 2Документ47 страницChapter 2dawsonОценок пока нет

- Mba Cost and Management Accounting NotesДокумент24 страницыMba Cost and Management Accounting Notesshanu rockОценок пока нет

- Cost ConceptДокумент6 страницCost ConceptDeepti KumariОценок пока нет

- Costing SystemsДокумент4 страницыCosting SystemsNeriza PonceОценок пока нет

- Nature and Scope of Cost & Management Accounting: Unit 1Документ24 страницыNature and Scope of Cost & Management Accounting: Unit 1umang8808Оценок пока нет

- AssignmentДокумент17 страницAssignmentTanzila MahzabinОценок пока нет

- AIOU8408 Assignment 1 0000603169Документ18 страницAIOU8408 Assignment 1 0000603169Farhan ShakilОценок пока нет

- EA Unit 3Документ56 страницEA Unit 3Nikhil TiruvaipatiОценок пока нет

- Kim Possible - Cost of Fucking AccountingДокумент17 страницKim Possible - Cost of Fucking AccountingKim Chong GoОценок пока нет

- Financial Accounting: Section 3Документ54 страницыFinancial Accounting: Section 3LOINI IIPUMBUОценок пока нет

- Learning Unit 2 - Cost Concepts and ClassificationДокумент17 страницLearning Unit 2 - Cost Concepts and ClassificationNashmita SinghОценок пока нет

- MB0041 AccountsДокумент10 страницMB0041 AccountsvermaksatishОценок пока нет

- Product CostДокумент2 страницыProduct Costmba departmentОценок пока нет

- MGT Acctg Cost ConceptДокумент30 страницMGT Acctg Cost ConceptApril Pearl VenezuelaОценок пока нет

- Cost Accounting ProjectДокумент27 страницCost Accounting ProjectKishan KudiaОценок пока нет

- AccountingДокумент14 страницAccountingMayurdhvajsinh JadejaОценок пока нет

- Cost A C NotesДокумент41 страницаCost A C NotesM sai chandra Shiva kumarОценок пока нет

- Cost AccountingДокумент15 страницCost AccountingADОценок пока нет

- Cost Accounting - Meaning and ScopeДокумент27 страницCost Accounting - Meaning and ScopemenakaОценок пока нет

- CMA FullДокумент22 страницыCMA FullHalar KhanОценок пока нет

- CMA FullДокумент22 страницыCMA FullHalar KhanОценок пока нет

- What Is Cost Accounting?: Volume 0%Документ6 страницWhat Is Cost Accounting?: Volume 0%Sheila Mae AramanОценок пока нет

- Management Accounting Costing and BudgetingДокумент20 страницManagement Accounting Costing and BudgetingDigontaArifОценок пока нет

- Glossary: Absorption CostingДокумент11 страницGlossary: Absorption CostingHome UserОценок пока нет

- Q.1 Selected Financial Information About Vijay Merchant CompanyДокумент11 страницQ.1 Selected Financial Information About Vijay Merchant CompanyUttam SinghОценок пока нет

- Cost Volume Profit AnalysisДокумент22 страницыCost Volume Profit AnalysisKirai Kiraikenks100% (1)

- Cost Volume Profit AnalysisДокумент35 страницCost Volume Profit AnalysisChairul AnamОценок пока нет

- 2400-Bcom-18 Cost AccountingДокумент36 страниц2400-Bcom-18 Cost Accountingliza shahОценок пока нет

- Defination of Cost AccountingДокумент5 страницDefination of Cost AccountingYaseen Saleem100% (1)

- UNIT 3 Absorption Variable CostingДокумент19 страницUNIT 3 Absorption Variable Costingannabelle albaoОценок пока нет

- Am Unit - IvДокумент31 страницаAm Unit - IvTamilan Dhinesh Tamilan DhineshОценок пока нет

- East Africa University (Eau) Cost AccountingДокумент27 страницEast Africa University (Eau) Cost AccountingJohn HassanОценок пока нет

- ACCA F5 Study Notes.Документ88 страницACCA F5 Study Notes.Naman. Patel100% (5)

- WWW - Globalcma.in: Cost Accounting Interview QuestionsДокумент12 страницWWW - Globalcma.in: Cost Accounting Interview Questionsjawed ahmerОценок пока нет

- Chapter OneДокумент36 страницChapter Oneyiberta69Оценок пока нет

- Chapter 8 Absorption and Variable Costing and Inventory ManagementДокумент49 страницChapter 8 Absorption and Variable Costing and Inventory ManagementNatanael PakpahanОценок пока нет

- Introduction To Cost AccountingДокумент9 страницIntroduction To Cost AccountingShohidul Islam SaykatОценок пока нет

- Cost AccountingДокумент23 страницыCost AccountingSEEMAОценок пока нет

- Cost AccountingДокумент4 страницыCost AccountingAnunobi JaneОценок пока нет

- Chart of AccountsДокумент9 страницChart of AccountsMarius PaunОценок пока нет

- Ankita Emerging Concepts in Cost & MNGT AcingДокумент21 страницаAnkita Emerging Concepts in Cost & MNGT AcingAnkita NirolaОценок пока нет

- ACC 304 Oral First TermДокумент3 страницыACC 304 Oral First TermMahmudul HasanОценок пока нет

- Management Accounting Notes: Nature of Management Accounting Characteristics of Management AccountingДокумент7 страницManagement Accounting Notes: Nature of Management Accounting Characteristics of Management AccountingRobin FernandoОценок пока нет

- Assignment DataДокумент284 страницыAssignment DataDerickMwansaОценок пока нет

- A. Detailed Organizational Structure of Finance DepartmentДокумент22 страницыA. Detailed Organizational Structure of Finance Departmentk_harlalkaОценок пока нет

- Cost AccountingДокумент13 страницCost Accountingsaswatimishra62Оценок пока нет

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОт EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОценок пока нет

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageОт EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageРейтинг: 5 из 5 звезд5/5 (1)

- Module 3 ComputationДокумент16 страницModule 3 ComputationGhillian Mae GuiangОценок пока нет

- Chapter 5Документ17 страницChapter 5Sarah AzoreОценок пока нет

- Topic 3 SolutionДокумент10 страницTopic 3 Solutiontijopaulose00Оценок пока нет

- Quiz 1 Answer Key-2Документ3 страницыQuiz 1 Answer Key-2Allison LeОценок пока нет

- AFC 1000 Exam 2012 S2Документ9 страницAFC 1000 Exam 2012 S2tusharОценок пока нет

- Passive IncomeДокумент31 страницаPassive IncomeE.D.J100% (1)

- General Insurance UwДокумент90 страницGeneral Insurance UwsushantducatiОценок пока нет

- China Daily Hong Kong - April 9 2018Документ24 страницыChina Daily Hong Kong - April 9 2018Boki VaskeОценок пока нет

- Quiz 3Документ15 страницQuiz 3help215Оценок пока нет

- MACDДокумент2 страницыMACDJEAN MARCO CAJA ALVAREZОценок пока нет

- 2003 White PaperДокумент26 страниц2003 White PaperShreeОценок пока нет

- Supply Chain ManagementДокумент15 страницSupply Chain Managementgabriel jimenezОценок пока нет

- Dec 2006 - AnsДокумент13 страницDec 2006 - AnsHubbak Khan75% (4)

- Balance IncomeДокумент71 страницаBalance IncomepengeavОценок пока нет

- Problem - Trader For A Day - Restrictions - Tora Internship Test - April 2019 - INGIniousДокумент7 страницProblem - Trader For A Day - Restrictions - Tora Internship Test - April 2019 - INGIniousPaul GabrielОценок пока нет

- MFM Project Guidelines From Christ University FFFFFДокумент6 страницMFM Project Guidelines From Christ University FFFFFakash08agarwal_18589Оценок пока нет

- 4 IKEA Branches Out in RussiaДокумент2 страницы4 IKEA Branches Out in RussiaSaniSah50% (2)

- A Summer Training Project Report OnДокумент85 страницA Summer Training Project Report Onrajancomes33% (3)

- Seven Secrets To Real Estate WealthДокумент11 страницSeven Secrets To Real Estate WealthBlvsr100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rahul kumarОценок пока нет

- Lecture - 014 - RBR DBD Rally Base Rally - Drop Base Drop-1Документ17 страницLecture - 014 - RBR DBD Rally Base Rally - Drop Base Drop-1d.alencarpiresОценок пока нет

- Questions For ESP2Документ35 страницQuestions For ESP2Wabi SabiОценок пока нет

- A Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Документ34 страницыA Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Trang HuỳnhОценок пока нет

- Job Satisfaction ProjectДокумент36 страницJob Satisfaction ProjectGulam Hussain79% (24)

- M5 Financial Modelling For Mining Companies PDFДокумент3 страницыM5 Financial Modelling For Mining Companies PDFPradita Astarina100% (1)