Академический Документы

Профессиональный Документы

Культура Документы

State Bank of India: Transforming A State Owned Giant

Загружено:

Sahil NagpalИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

State Bank of India: Transforming A State Owned Giant

Загружено:

Sahil NagpalАвторское право:

Доступные форматы

State Bank of India: Transforming a state Owned Giant

History of SBI

Lineage to bank of Calcutta Estd 1806

rechristened as Bank of Bengal

Presidency bank

Imperial bank of India by merging the three presidency banks

RBI Estd 1935 cease IBI

Post Independence

Govt wanted to focus rural India

Govt takeover IBI and integrated with state own banks

1955 SBI Born

500 branch in 1960

18000 branch in 2011

A bank with 60% Govt stake

Was India `s largest banks

43

rd

largest bank world wide

Market capitalization of over $36.5 billion in 2011

More than 267000 employees

Pan India network over 18000 branch

25000 ATMs

Profit $2.6 billion

5 associate banks and 22 subsidiaries constituted State Bank group

Role played by SBI

Developed India rural regions

Finance for modernizing the countries agriculture industry

Infrastructure development credit and assistance in village

Merchant banking

Housing finance

Institutional investor services

from an old,

hierarchical,

transaction

oriented,

government

bank

Transformation

Phases

Transformation

Phases

Transformation

Phases

to modern,

customer

focused,

technologically

advanced

Universal Bank.

2006 : SBI losing market share of

two decades to Private & foreign

banks.

2010: SBI had more than double

its profits, deposits and advances

and won Asian Banker

Achievement award for strongest

bank in the Asia Pacific Region.

Bank Issues

Lost sight in early 1990s

Aftermath of bank nationalization

Profit of bank

Focus on Physical expansion

75% area at branch reserved for employee

Less focus on customer

Multiple people involved in transaction process

Manual work time

Transformation begin

In 1990s transitioned from manual ledger system to computerized back office operation

2003 implemented centralized online real time banking solution

Organization structure

Officers

Clerical

Subordinated staff

Organisation Structure

The Changing Banking Environment

Indian Govt. nationalized 14 commercial banks ---1969

91% of banking in govt. ctrl

Issue for pvt bank of license and entry restriction

RBI decided whom they could lend, how much, what rate

Result

1) Nationalized bank network overburdened with NPA(social obligation)

2) Directed lending practice

3) Outdated risk management technique

4) Customer issues

5) A/C deficit

New Entry

Private bank(ICICI Bank, HDFC Bank)

Foreign Bank ( Standard chartered Bank,Citibank,HSBC)

Strategy used by new entrant

1) Large investment in Technology

2) Customer services

3) Concept of remote banking

4) ATM

5) Centralized process

6) Anywhere any time banking

7) Noval branch experience

8) Best talent hired

9) Salary package

10) new age population

11) Income level

2006 :- O.P. Bhatt becomes the SBI Chairman

In a departure from traditional practice govt. select chairman of eligibility criteria.

Challenges face by him

1) Market share of bank fall from 35% to 15%

2) Largest bank in terms of assets but lost its voice significantly

3) In race to retain numbers, quality has compromised

4) Losing customer

5) Bank for senior citizen

6) No sale focus

7) No integration from top to bottom level

8) Communication was one way

9) No recognisation for hard work

10) Lost pride

11) HR policy were outdated

12) No goal, no vision,no commitment

13) Attitude issue

14) technical platform missing

15) Complex structure

Vision

1) innovative,hardworking,team person

2) Encourage reverse feed back

3) Want bank as customer oriented

4) Most tech savvy

5) Global bank

6) Focus on market share in every quarter .25%

Establishing Leadership

1) Prepare SBI status and charting out strategy

2) Input from consultant,professors,within bank and retired persons

3) Created 4 new strategic business group headed by DMD

4) CREATED CORPORATE COMMUNICATION & CHANGE DEPT.

5) CUSTOMER,BUSINESS,STAFF IS PRIME FOCUS

The Cascading conclaves

Aamby Vally

Top Management(2 MD,22DMD)

1) First day reference point

2) Banks Status

3) Analyzed the previous day progress and design next step

4) 14 point transformation agenda foe bank along 3 parameters

i) Business Initiative

ii) Enabling initiatives for facilitating business

iii) People initiative

The next Wave of conclave

For GM and CGM

1) Group exercise

2) Issue discussion

3) Feedback

4) Series of 5 conclave

For AGM

1) Feedback

Union Conclave

2006 in jodhpur

Union Conclave

2006 in jodhpur

Movie to motivate(Bagger Vance)

Winning IT Platform

2008 all of SBIs branch were on CBS rollout.

Completed the reengineering process

Centralized branch

Focus on sale and services

Redesign branch

Focus on core business

Develop Customer Services

Redefine Banks Vision

Service desk for customer

SMS unhappy service

Others

Integrated risk mgmt

New sys for measure business performance

Improve capital adequacy ratio

Motivation for Employee

1) The Power of One (presentation)

2) Parivartan (Internal communication prog)

3) Training for entire branch at a same time

4) Serving to country

5) Changing individual performance mgmt system

6) More responsibility to work

7) Reward and recognition

8) ESOPs scheme

9) Employee suggestion scheme

Business Initiative

win back the Indian middle class customer

Focus on strategic location

Rebuild profitable wholesale bank

In 4 yrs fee income increased from .15$ billion to .90$ billion.

Sanction 12000 cr to Tata Corus deal.

SBI Advertisement Campaign

2007: Pure Banking Nothing Else

2008: Banker To Every Indian

2009: Banker to This Indian

2010: Banker to These Indians

2011: Proud to be Indian

Smart global expansion

Capture international mkt

Capture great share of India linked business

Issued foreign currency bonds

March and Beyond

2008 most valuable bank

2010Rank 68 from 107 in 2006

Indian market share increase 25%

Awards for bank

most preferred bank, bank of the year

A CEO of a well established bank waiting for Mr. Bhatt to retire.

Вам также может понравиться

- Stata Bank of India - Transforming A Public Sector GiantДокумент7 страницStata Bank of India - Transforming A Public Sector GiantAbhishek Minz100% (1)

- Presentation 1Документ18 страницPresentation 1kartikithoraveОценок пока нет

- How TITAN Watches Changed Consumers Perception About Wrist WatchesДокумент16 страницHow TITAN Watches Changed Consumers Perception About Wrist WatchessiddiquiajazОценок пока нет

- SBI Case Group 3Документ21 страницаSBI Case Group 3manujsriОценок пока нет

- Case Study - Project ScorpioДокумент18 страницCase Study - Project ScorpioKarthick SrinivasanОценок пока нет

- Riverfront Development Challenges in Indian CitiesДокумент6 страницRiverfront Development Challenges in Indian CitiesAshwin KumarОценок пока нет

- Coffee Wars in India: How CCD Can Retain Market Leadership Against StarbucksДокумент3 страницыCoffee Wars in India: How CCD Can Retain Market Leadership Against StarbucksPulkit AggarwalОценок пока нет

- ICICI Global Expansion StrategyДокумент15 страницICICI Global Expansion StrategyAmit DeyОценок пока нет

- Jakson Evolution of A Brand - Section A - Group 10Документ4 страницыJakson Evolution of A Brand - Section A - Group 10RAVI RAJОценок пока нет

- Group09 CaseДокумент7 страницGroup09 CaseJuhi Gahlot SarkarОценок пока нет

- ITC Case Study - Group 10Документ15 страницITC Case Study - Group 10shardulОценок пока нет

- Park Hotel Knowlege ManagementДокумент23 страницыPark Hotel Knowlege ManagementChirag Vora100% (1)

- Case Questions - The Indian Sugar IndustryДокумент2 страницыCase Questions - The Indian Sugar IndustrySMRITI MEGHASHILAОценок пока нет

- Privatization of Banking in IndiaДокумент14 страницPrivatization of Banking in IndiaProf. R V SinghОценок пока нет

- Levendary Cafe The China ChallengeДокумент13 страницLevendary Cafe The China Challengeyogendra choukikerОценок пока нет

- Case Amara RajaДокумент2 страницыCase Amara RajaAnand JohnОценок пока нет

- Bbva CaseДокумент2 страницыBbva CasePankaj AgarwalОценок пока нет

- Goli Vada Pav Is A VadaДокумент7 страницGoli Vada Pav Is A Vadaabramasw86Оценок пока нет

- "Think Fresh, Deliver More": A PresentationДокумент63 страницы"Think Fresh, Deliver More": A PresentationKapil Kumar JhaОценок пока нет

- Wrightline Inc. Case Study: Group-6Документ6 страницWrightline Inc. Case Study: Group-6sili coreОценок пока нет

- ITC Ltd Strategy AnalysisДокумент6 страницITC Ltd Strategy AnalysisMukul GargОценок пока нет

- Dabur RepositioningДокумент11 страницDabur RepositioningsaurabhОценок пока нет

- Comparative Study of BSNL and AritelДокумент15 страницComparative Study of BSNL and AriteldiviprabhuОценок пока нет

- MDCM (B)Документ13 страницMDCM (B)VinayKumarОценок пока нет

- Icici BankДокумент59 страницIcici BankChetan JanardhanaОценок пока нет

- Group 4 - Aakash Book StoreДокумент4 страницыGroup 4 - Aakash Book StoreAnkit Sutariya0% (1)

- IBS Case Study QuestionsДокумент6 страницIBS Case Study QuestionsJessica Luu100% (1)

- Magnet Beauty Products Leasing Decision ImpactДокумент11 страницMagnet Beauty Products Leasing Decision ImpactFiqri100% (1)

- AakashBookStore ClassДокумент16 страницAakashBookStore Classharshit100% (1)

- Fiitjee JD National Head Academic Delivery Strategic Result AssuranceДокумент2 страницыFiitjee JD National Head Academic Delivery Strategic Result AssuranceVaishnaviRaviОценок пока нет

- PaulVinod MondelezДокумент4 страницыPaulVinod MondelezPaul VinodОценок пока нет

- Shiva Tourist DhabaДокумент7 страницShiva Tourist DhabaChaitanya JethaniОценок пока нет

- Group Assignment - Case Analysis: Flipkart: Transitioning To A Marketplace ModelДокумент4 страницыGroup Assignment - Case Analysis: Flipkart: Transitioning To A Marketplace ModelBhavishaОценок пока нет

- Group 9 - GirishДокумент23 страницыGroup 9 - GirishKostub GoyalОценок пока нет

- InfoTech CorporationДокумент11 страницInfoTech CorporationSomdipta MaityОценок пока нет

- Tata Daewoo Deal1Документ5 страницTata Daewoo Deal1Ashwinikumar KulkarniОценок пока нет

- Group A1 A WAC II 2 - ProposalДокумент9 страницGroup A1 A WAC II 2 - ProposalKuntalDekaBaruahОценок пока нет

- HCL Technologies: Pushing The Billion-Dollar WebsiteДокумент4 страницыHCL Technologies: Pushing The Billion-Dollar WebsiteShubham Parihar100% (1)

- Ques 1. How Hard Do You Think Installing Otisline Was in 1990?Документ1 страницаQues 1. How Hard Do You Think Installing Otisline Was in 1990?Rashmi RanjanОценок пока нет

- Indian Suv Scorpio' Takes On Global Players in Us Market: Presented To - Dr. Gautam DuttaДокумент14 страницIndian Suv Scorpio' Takes On Global Players in Us Market: Presented To - Dr. Gautam DuttaAmrit PatnaikОценок пока нет

- SWOT Analysis of The Making SMaL Big SMaL Camera Technologies HBR Case SolutionДокумент8 страницSWOT Analysis of The Making SMaL Big SMaL Camera Technologies HBR Case Solutionprerna004Оценок пока нет

- Cottle Taylor Case AnalysisДокумент22 страницыCottle Taylor Case AnalysisRALLAPALLI VISHAL VIJAYОценок пока нет

- Assignment QuestionsДокумент3 страницыAssignment QuestionsApoorva Mathur-DM 20DM039100% (1)

- Hul Rural Marketing StrategyДокумент14 страницHul Rural Marketing StrategyPramesh AnuragiОценок пока нет

- India Cement Industry Economic OverviewДокумент9 страницIndia Cement Industry Economic Overviewnitinahir20105726Оценок пока нет

- OTISLINE PresentationДокумент5 страницOTISLINE PresentationAseem SharmaОценок пока нет

- How Room Key Can Help or Hurt Accor's Distribution StrategyДокумент3 страницыHow Room Key Can Help or Hurt Accor's Distribution StrategyDahagam Saumith0% (2)

- Changing Mindsets in Consumption Pattern of SOFT DRINK in Rural MarketДокумент36 страницChanging Mindsets in Consumption Pattern of SOFT DRINK in Rural MarketgouravawanishraviОценок пока нет

- The Park Hotels Designing Experience Case SolutionДокумент60 страницThe Park Hotels Designing Experience Case Solutionvivek singhОценок пока нет

- Diversey in IndiaДокумент4 страницыDiversey in IndiaahbninОценок пока нет

- Overcoming Problems at Whitbread PLCДокумент2 страницыOvercoming Problems at Whitbread PLCUttam100% (1)

- Marketing Research On Positioning of Hero Honda Bikes in India - Updated - 2011Документ54 страницыMarketing Research On Positioning of Hero Honda Bikes in India - Updated - 2011Piyush SoniОценок пока нет

- ICICI Bank: India's Leading Private Sector BankДокумент36 страницICICI Bank: India's Leading Private Sector BankYusra InclusiveОценок пока нет

- SBIДокумент12 страницSBIHemlata Kale50% (2)

- Commercial Bank ManagementДокумент38 страницCommercial Bank ManagementAikya Gandhi100% (1)

- DiruДокумент84 страницыDirudhiru_hadiaОценок пока нет

- Latest Trends in BankingДокумент98 страницLatest Trends in BankingViji Ranga0% (1)

- Annual Report On SBI Habib - 65Документ20 страницAnnual Report On SBI Habib - 65Shashikala RajwadeОценок пока нет

- Presentation On "Internet Banking With Reference To State Bank of India"Документ14 страницPresentation On "Internet Banking With Reference To State Bank of India"Prince PurshiОценок пока нет

- NAL - Top 30Документ2 страницыNAL - Top 30Sahil NagpalОценок пока нет

- Account DetailsДокумент2 страницыAccount DetailsSahil NagpalОценок пока нет

- Account DetailsДокумент2 страницыAccount DetailsSahil NagpalОценок пока нет

- Enterprise Risk ManagementДокумент16 страницEnterprise Risk ManagementSahil Nagpal100% (1)

- Advertising Law in IndiaДокумент3 страницыAdvertising Law in IndiaSahil NagpalОценок пока нет

- Account DetailsДокумент2 страницыAccount DetailsSahil NagpalОценок пока нет

- Formulas and concepts for profit, loss, time, distance, speed, partnership and moreДокумент9 страницFormulas and concepts for profit, loss, time, distance, speed, partnership and morePrashanth MohanОценок пока нет

- Risk Management ProcessДокумент2 страницыRisk Management ProcessSahil NagpalОценок пока нет

- Railways Project (Final)Документ40 страницRailways Project (Final)Arka Nandy100% (1)

- Customer QuestionaireДокумент3 страницыCustomer QuestionaireSahil NagpalОценок пока нет

- Banking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduДокумент27 страницBanking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduilusonaОценок пока нет

- Sparsh Nephrocare - IMC Interim ReportДокумент11 страницSparsh Nephrocare - IMC Interim ReportSamyak RajОценок пока нет

- Cluster Analysis Using SASДокумент7 страницCluster Analysis Using SASSahil NagpalОценок пока нет

- IB2 CH 5 PEST AnalysisДокумент6 страницIB2 CH 5 PEST AnalysisSahil NagpalОценок пока нет

- Handover Notes-Finance and Admin - 31 August 2021Документ5 страницHandover Notes-Finance and Admin - 31 August 2021Liberty RuzvidzoОценок пока нет

- ENCE 422 Homework #1Документ2 страницыENCE 422 Homework #1MariaОценок пока нет

- Avon Make A Payment Information July 2021 PDFДокумент1 страницаAvon Make A Payment Information July 2021 PDFHeggies StaeraОценок пока нет

- ROI, RI, and EVA AnalysisДокумент7 страницROI, RI, and EVA AnalysisAna Leah DelfinОценок пока нет

- Financial Management PPT PresentationДокумент52 страницыFinancial Management PPT PresentationJadez Dela CruzОценок пока нет

- Understanding Equidam Business Valuation-2Документ11 страницUnderstanding Equidam Business Valuation-2Djamaludin Akmal IqbalОценок пока нет

- Solving partnership problems involving sale of non-current assets and insolvency of partnersДокумент5 страницSolving partnership problems involving sale of non-current assets and insolvency of partnersshudayeОценок пока нет

- Bad Bank Is Actually A Good Idea: S. Prasanth, Dr. S.SudhamathiДокумент4 страницыBad Bank Is Actually A Good Idea: S. Prasanth, Dr. S.SudhamathiSARVESH RОценок пока нет

- Admission of A New PartnerДокумент36 страницAdmission of A New PartnerSreekanth DogiparthiОценок пока нет

- Tutorial Week 3 QuestionsДокумент9 страницTutorial Week 3 QuestionsShermaine WanОценок пока нет

- Value Beat 121013Документ3 страницыValue Beat 121013zarr pacificadorОценок пока нет

- 2021 Annual Financial Report For The National Government Volume IДокумент506 страниц2021 Annual Financial Report For The National Government Volume IAliah MagumparaОценок пока нет

- 13 Capital Structure (Slides) by Zubair Arshad PDFДокумент34 страницы13 Capital Structure (Slides) by Zubair Arshad PDFZubair ArshadОценок пока нет

- Service Marketing Mix or 7p'sДокумент5 страницService Marketing Mix or 7p'srasel_ustcОценок пока нет

- HSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementДокумент13 страницHSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementStephen BgoyaОценок пока нет

- Koperasi Anak Sains Mara Berhad Asmara Profit Margin ReportДокумент13 страницKoperasi Anak Sains Mara Berhad Asmara Profit Margin ReportMuhamad Arif Abdul LatifОценок пока нет

- Review Sheet Midterm PDFДокумент12 страницReview Sheet Midterm PDFeleОценок пока нет

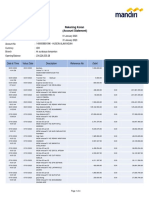

- Rek Koran Mandiri PT HAI Jan-April 2023Документ14 страницRek Koran Mandiri PT HAI Jan-April 2023wahyu suhartonoОценок пока нет

- KIA InvoiceДокумент1 страницаKIA InvoiceScribdTranslationsОценок пока нет

- OverviewДокумент18 страницOverviewGaurav SinghОценок пока нет

- Syllabus For BankingДокумент15 страницSyllabus For BankingAnil NamosheОценок пока нет

- Control of The Money SupplyДокумент2 страницыControl of The Money SupplyMario SarayarОценок пока нет

- 04 The Full Syllabus - Management Level Continued: Paper F2 Assessment StrategyДокумент3 страницы04 The Full Syllabus - Management Level Continued: Paper F2 Assessment StrategyRehman MuzaffarОценок пока нет

- Overseas Fund and Share Account ApplicationДокумент2 страницыOverseas Fund and Share Account ApplicationMaria Evans MayorОценок пока нет

- Your Combined Statement: Aisiatou Barry 10740 Guy R Brewer BLVD JAMAICA, NY 11433-2380Документ10 страницYour Combined Statement: Aisiatou Barry 10740 Guy R Brewer BLVD JAMAICA, NY 11433-2380Ayesha ShaikhОценок пока нет

- Credit Risk Analysis - Control - GC - 2Документ176 страницCredit Risk Analysis - Control - GC - 2Keith Tanaka MagakaОценок пока нет

- Notes MBAДокумент46 страницNotes MBAAghora Siva100% (3)

- E Math Exam PracticeCh5 8Документ4 страницыE Math Exam PracticeCh5 8chitminthu560345Оценок пока нет

- Accounting 202 Strategic Business AnalysisДокумент6 страницAccounting 202 Strategic Business AnalysisJona Francisco0% (1)

- PNB AN 30.9.2020 Eng 1st PageДокумент1 страницаPNB AN 30.9.2020 Eng 1st PagecanilreddyОценок пока нет