Академический Документы

Профессиональный Документы

Культура Документы

Financial Management

Загружено:

Kirithiga SrinivasanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Management

Загружено:

Kirithiga SrinivasanАвторское право:

Доступные форматы

FINANCIAL

MANAGEMENT

Presented by:

KIRITHIGA. S

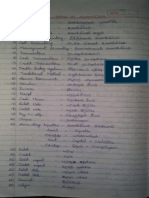

CONTENTS:-

Meaning of financial management

Definition of financial management

Scopes of financial management

Objectives of financial management

MEANING:-

Finance may be defined as the art and science of managing

money.

Financial management means planning, organizing, directing

and controlling the financial activities and utilization of funds.

Financial management means the management of finance of a

business / organisation in order to achieve financial objectives.

Financial management covers both acquisition of funds and

efficient and wise allocation of these funds to various uses.

Experts refers financial management as the science of money

management.

DEFINITION:-

Financial Management is concerned with raising financial

resources and their effective utilisation towards achieving the

organisational goals.

- Dr. S. N. Maheshwari.

Financial Management is concerned with the efficient use of

an important economic resource namely, capital funds.

- Solomon.

Financial Management as an application of general

managerial principles to the area of financial decision

making.

- Howard & Upton.

SCOPES:-

Financial Management and Economics

Financial Management is associated with investment decisions, micro

and macro environmental factors.

It also uses economic equations like money value discount factor,

EOQ, etc.

Financial Management and Accounting

Accounting records includes financial informations.

In olden period both management and accounting are treated same.

Financial Management and Mathematics

Financial Management applies large mathematical and statistical tools

and techniques like EOQ, PV, etc.

This is also known as econometrics.

SCOPES:-

Financial Management and Production Management

Production Management is the operational part of the business.

Financial manager must know the operational process and finance

required for each process.

Financial Management and Marketing Management

Marketing activities needs finance.

Financial Management needs marketing activity to induce sales.

Financial Management and Human Resource Management

Manpower is very essential for any business.

It has to be carefully evaluated and allocate required finance.

OBJECTIVE OF

FINANCIAL

MANAGEMENT

PROFIT

MAXIMIZATION

WEALTH

MAXIMIZATION

PROFIT MAXIMIZATION:-

The primary objective of any business concern is to earn

profit.

Profit maximization is the traditional and narrow approach

which aims at maximizing the profit of the concern.

Its important features:

It is also called as cashing per share maximization.

It is the ultimate aim of the business.

It is the parameter of measuring the efficiency of the business.

It helps to reduce the risk of the business.

Its drawbacks:

Profit is not clearly defined which creates some unnecessary

opinion regarding earnings of the business.

It does not consider the time value of money.

It does not consider the risk of the business.

WEALTH MAXIMIZATION:-

Wealth maximization is one of the modern approaches which

involves latest innovations and improvements.

The wealth here refers to shareholders wealth.

It is also known as value maximization or net present worth

maximization.

This objective is an universally accepted concept.

It considers both time and risk of the business.

It ensures the economic interest of the society.

Its unfavourable arguments;

It creates ownership management controversy.

Its ultimate aim is to maximize the profit.

It can be active only with the profitable position of the business.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- CH 5 - 1Документ25 страницCH 5 - 1api-251535767Оценок пока нет

- Container Loading Supervisor Sample ReportДокумент13 страницContainer Loading Supervisor Sample ReportVivek S SurendranОценок пока нет

- Research Methodology TechniquesДокумент34 страницыResearch Methodology TechniquesKirithiga SrinivasanОценок пока нет

- Organization and Management SyllabusДокумент8 страницOrganization and Management SyllabusArianne100% (6)

- 2003-2004 Chicago Booth MCG CasebookДокумент166 страниц2003-2004 Chicago Booth MCG Casebookr_oko100% (2)

- Maruti Project ReportДокумент85 страницMaruti Project ReportChirag Thakwani93% (14)

- Advertising & Sales PromotionДокумент76 страницAdvertising & Sales PromotionGuruKPO100% (2)

- Acueia: Dacostog CyДокумент3 страницыAcueia: Dacostog CyKirithiga SrinivasanОценок пока нет

- Thinesh Gorden Dividend PolicyДокумент7 страницThinesh Gorden Dividend PolicyKirithiga SrinivasanОценок пока нет

- RenuДокумент11 страницRenuKirithiga SrinivasanОценок пока нет

- 5 C's and Credit Analysis for Evaluating Loan ApplicationsДокумент9 страниц5 C's and Credit Analysis for Evaluating Loan ApplicationsKirithiga SrinivasanОценок пока нет

- Bank ManagementДокумент48 страницBank ManagementKirithiga SrinivasanОценок пока нет

- Bank ManagementДокумент48 страницBank ManagementKirithiga SrinivasanОценок пока нет

- Conjoint AnalysisДокумент34 страницыConjoint AnalysisKirithiga SrinivasanОценок пока нет

- Assignment - 3Документ4 страницыAssignment - 3Kirithiga SrinivasanОценок пока нет

- Ass 4Документ4 страницыAss 4Kirithiga SrinivasanОценок пока нет

- Theodore Levitt's insights on marketing myopia and its causesДокумент17 страницTheodore Levitt's insights on marketing myopia and its causesShreya WagherkarОценок пока нет

- 14) Dec 2004 - AДокумент16 страниц14) Dec 2004 - ANgo Sy VinhОценок пока нет

- II MBA SpecialisationДокумент120 страницII MBA SpecialisationArun KCОценок пока нет

- Flavor ChemistryДокумент1 страницаFlavor ChemistryMVОценок пока нет

- Nissan Motor CorporationДокумент20 страницNissan Motor CorporationYinОценок пока нет

- Case StudyДокумент3 страницыCase StudySaba PervezОценок пока нет

- LIME 6 Case Study Gionee India NewДокумент33 страницыLIME 6 Case Study Gionee India NewTatsat Pandey100% (2)

- FullДокумент53 страницыFullphatpham.31211021082Оценок пока нет

- Transmission Corporation of Telangana LimitedДокумент27 страницTransmission Corporation of Telangana LimitedSrimayi YelluripatiОценок пока нет

- MBA-IB Group 6 PresentationДокумент14 страницMBA-IB Group 6 PresentationBen MponziОценок пока нет

- Branding & Advertising - Fortune FordДокумент77 страницBranding & Advertising - Fortune Fordsainath89Оценок пока нет

- International Marketing (SCDL)Документ575 страницInternational Marketing (SCDL)api-3696347Оценок пока нет

- Qms-thr-Form09 Test Questionnaire. Final ExamДокумент11 страницQms-thr-Form09 Test Questionnaire. Final Examroselle nepomucenoОценок пока нет

- Birla Corporation Limited: An Introduction to Its Cement Business and Manufacturing ProcessДокумент33 страницыBirla Corporation Limited: An Introduction to Its Cement Business and Manufacturing ProcessravisayyesОценок пока нет

- Lesson 6: Marketing Research: Let's Start!Документ14 страницLesson 6: Marketing Research: Let's Start!Jamaica BuenoОценок пока нет

- Hubshout Editable Pricing Guide 11-20-2011Документ13 страницHubshout Editable Pricing Guide 11-20-2011Erin HansonОценок пока нет

- Company Analysis AXE Deodorants: Group A 5Документ16 страницCompany Analysis AXE Deodorants: Group A 5VMОценок пока нет

- Term Paper Proposal (BIM)Документ5 страницTerm Paper Proposal (BIM)Ar milon67% (3)

- Pizza Hut Marketing ProjectДокумент9 страницPizza Hut Marketing ProjectGowsic RoolzОценок пока нет

- Inventory Management: Presented ByДокумент11 страницInventory Management: Presented ByChandan DuttaОценок пока нет

- Venture Center Hot Desks PricingДокумент4 страницыVenture Center Hot Desks PricingAnonymous L77eD5uoОценок пока нет

- AIESEC Balanced ScorecardДокумент29 страницAIESEC Balanced ScorecardCarl ChiangОценок пока нет

- Workflow Process ActivationДокумент20 страницWorkflow Process ActivationSadasiva Reddy KalakataОценок пока нет

- Kellogg's strategy aims to promote balanced lifestyleДокумент4 страницыKellogg's strategy aims to promote balanced lifestyleSeethalakshmy NagarajanОценок пока нет