Академический Документы

Профессиональный Документы

Культура Документы

Sales Maximization

Загружено:

bsreddy12-10 оценок0% нашли этот документ полезным (0 голосов)

1K просмотров8 страницSales maximization model of oligopoly is another important alternative to profit maximization assumption regarding business behavior. Baumos argues that there is a minimum acceptable profit which must be earned by the management so as to finance future growth of the firm. Oligopolist typically seek to maximize their sales subject to a minimum profit constraint.

Исходное описание:

Оригинальное название

sales maximization.ppt

Авторское право

© © All Rights Reserved

Доступные форматы

PPT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSales maximization model of oligopoly is another important alternative to profit maximization assumption regarding business behavior. Baumos argues that there is a minimum acceptable profit which must be earned by the management so as to finance future growth of the firm. Oligopolist typically seek to maximize their sales subject to a minimum profit constraint.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

1K просмотров8 страницSales Maximization

Загружено:

bsreddy12-1Sales maximization model of oligopoly is another important alternative to profit maximization assumption regarding business behavior. Baumos argues that there is a minimum acceptable profit which must be earned by the management so as to finance future growth of the firm. Oligopolist typically seek to maximize their sales subject to a minimum profit constraint.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PPT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 8

SALES MAXMIZATION - BOUMOLS MODEL

Introduction: sales maximization model of oligopoly

is another important alternative to profit

maximization. W.J Boumol challenges to profit

maximization assumption regarding business behavior

in these days of manager dominated corporate form of

business organization and show sales maximization is

more valid and realistic assumption of business

behavior, further pointed out sales maximization was

quite consistent with rationality assumption about

business behavior.

Baoumol argues that there is a minimum acceptable

profit which must be earned by the management so as

to finance future growth of the firm through retained

profits and also to induce the potential shareholders

for subscribing in the share capital of the company.

Thus according to him, management of oligopolistic

firms seeks maximize sales or in other words total

revenue subject to this minimum profits constraint.

Baumoss Hypothesis:

The oligopolist typically seek to maximize their sales

subject to a minimum profit constraint. The

determination of the minimum just acceptable profit

level is a major analytical problem.

Profit must be high enough to provide the

retained earnings needed to finance current expansion

plans and dividends sufficient to make future issue of

stocks attractive to potential purchasers . In other

words the firm will aim for that stream of profits which

allows for the financing of maximum long-run sales.

The business jargon for this is that management seeks

to retain earnings is sufficient magnitude to take

advantage of all reasonably safe opportunities for

Growth and to provide a fair return to share holders.

He draws out the conclusions reached regarding

these things in the sales maximization model and how

they differ from those profit maximization models. We

explain below all these aspects of Baumoss sales

maximization model of oligopoly.

TR

Profit constraint

R

R1 TC

K

H

E

N A B

C

TP

M

L

G

Y

X

In the above diagram TC and TR are total cost and

total revenue curves respectively.

A firm aims at maximizing profits, it will produce OA

level of output because corresponding to OA output,

the highest of the profit cure TP lies.

If firm wants to maximize sale revenue it will fix

output at OC level which is greater than OA. At output

OC output total revenue is CR2 which is maximum in

the diagram.

At the output level of OC firm's total profit is CG.

If OM is the minimum profit which a firm has to obtain

to satisfy shareholders and for future growth, the ML

is the minimum profit line. This minimum profit line

ML cuts the total profit cure TP at point E, therefore, if

the firm wants total revenue maximization subject to

a profit constraint OM then it will produce and sell

output OB the firm can earn minimum profits OM

even by producing ON output. But the total revenue

at ON is much less than at OB.

Implications of this model:

1. Sales maximization leads to greater output and

lower prices than profit maximization.

2. increase in advertising outlay always raises to total

revenue or sales. i.e. dR>0. as a result will always

___

dA

Pay sales maximiser to increase his advertising

outlay.

3. Increase in overhead costs lower the level of

output and raises prices.

4. Sales maximization makes presumption that the

businessmen will consider non-price competition to

more advantageous alternative to price

competition.

WILLIAMSONSS MANAGERIAL THEORY:

According to Williamson, the managers are

motivated by their self-interest and they maximizing

their own utility function. utility maximization by

the self-interest seeking mangers like sales

maximization model Baumol, is possible only in

corporate form of business organization.

According to Willamson utility function of the self-

seeking managers depends on the following factors.

The sales and other forms of monetary

compensation.

the number of staff under the control of manager.

management slack.( lavishly furnished office,

luxurious company cars, large expenses accounts)

magnitude of the discretionary investment

expenditure by the manager.

Thus utility of a manager in Williamsons model is a

function of the following three variables.

U=f(S,M,Id)

Where U stands for utility function.

M stands for management slack.

Id stands for monetary expenditure on the staff.

Implication of the model:

As compared to profit-maximization firm utility

maximization firm has higher staff expenditure

and more management slack.

if the profit tax-rate is increased there will be

increase in the output and staff expenditure of the

firm.

If a lump-sum tax is imposed on the firm

Williamsons model implies that the firm will

reduce its expenditure, particularly on staff.

This is because with the imposition of lump-sum tax

minimum profit constraint is raised and to earn the

high profits the manager will

Вам также может понравиться

- Solution Manual For Managerial Acct2 2nd Edition by SawyersДокумент20 страницSolution Manual For Managerial Acct2 2nd Edition by SawyersMariahAndersonjerfn100% (49)

- Top 100 Finance Interview Questions With AnswersДокумент37 страницTop 100 Finance Interview Questions With AnswersIbtissame EL HMIDIОценок пока нет

- Problems On Lease and Hire PurchaseДокумент2 страницыProblems On Lease and Hire Purchase29_ramesh17050% (2)

- 5 Rules For Trading Supply and DemandДокумент30 страниц5 Rules For Trading Supply and DemandNaufal Surya100% (1)

- Identification of Business OpportunitiesДокумент4 страницыIdentification of Business OpportunitiesJeyarajasekar Ttr50% (2)

- Business Location WorksheetДокумент3 страницыBusiness Location WorksheetHan Hinata67% (3)

- 08 11 December 2018 Questions and AnswersДокумент26 страниц08 11 December 2018 Questions and AnswersMae TomeldenОценок пока нет

- Williamson's Managerial Discretionary Theory:: I. Expansion of StaffДокумент3 страницыWilliamson's Managerial Discretionary Theory:: I. Expansion of StaffAhim Raj JoshiОценок пока нет

- Introduction To Public IssueДокумент15 страницIntroduction To Public IssuePappu ChoudharyОценок пока нет

- Study Note 4.1, Page 143-168Документ26 страницStudy Note 4.1, Page 143-168s4sahith40% (5)

- Why Wealth Maximization Is Superior To Profit Maximization in TodayДокумент2 страницыWhy Wealth Maximization Is Superior To Profit Maximization in TodaySuman Gill92% (12)

- Functions of SEBIДокумент6 страницFunctions of SEBIKumar Raghav MauryaОценок пока нет

- Insurance and Social SecurityДокумент3 страницыInsurance and Social Securitybeena antuОценок пока нет

- STD 9 CH 7 Joint Stock CompanyДокумент7 страницSTD 9 CH 7 Joint Stock CompanyGhalib HussainОценок пока нет

- Procedure For Formation of Joint Stock CompanyДокумент17 страницProcedure For Formation of Joint Stock CompanyRaj Moyal83% (12)

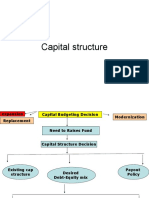

- Capital StructureДокумент23 страницыCapital StructureDrishti BhushanОценок пока нет

- Applications of Marginal Costing and CostДокумент3 страницыApplications of Marginal Costing and CostSahil BishnoiОценок пока нет

- Capital Structure TheoriesДокумент2 страницыCapital Structure TheoriesTHEOPHILUS ATO FLETCHERОценок пока нет

- Financial ManagementДокумент22 страницыFinancial ManagementSapan AnandОценок пока нет

- Weaknesses of Stock Market of IndiaДокумент2 страницыWeaknesses of Stock Market of Indiachronicler92100% (1)

- Debentures ProjectДокумент28 страницDebentures ProjectMT RA100% (1)

- Corporate Tax Planning and Management Module 1.Документ46 страницCorporate Tax Planning and Management Module 1.Viraja GuruОценок пока нет

- Accounting For Managers Question BankДокумент5 страницAccounting For Managers Question BankbhfunОценок пока нет

- Joint Stock CompanyДокумент58 страницJoint Stock CompanyZunaira TauqeerОценок пока нет

- Module-1 International Financial Environment: Rewards & Risk of International FinanceДокумент17 страницModule-1 International Financial Environment: Rewards & Risk of International FinanceAbhishek AbhiОценок пока нет

- TakeoversДокумент9 страницTakeoversiamfromajmer100% (1)

- Salient Features o The Insurance ActДокумент15 страницSalient Features o The Insurance Actchandni babunuОценок пока нет

- Redemption of DebenturesДокумент11 страницRedemption of Debenturesadeeba_kaziiОценок пока нет

- Factoring Advantages and Dis AdvantagesДокумент1 страницаFactoring Advantages and Dis AdvantagesSiva RockОценок пока нет

- Topic: Markowitz Theory (With Assumptions) IntroductionДокумент3 страницыTopic: Markowitz Theory (With Assumptions) Introductiondeepti sharmaОценок пока нет

- New PPT For Euro Issue 1Документ28 страницNew PPT For Euro Issue 1Bravoboy Johny83% (6)

- Capital StructureДокумент41 страницаCapital StructuremobinsaiОценок пока нет

- Narayan Murthy Committee Report, 2003Документ12 страницNarayan Murthy Committee Report, 2003Gaurav Kumar50% (2)

- Leadership Notes-Organizational BehaviorДокумент5 страницLeadership Notes-Organizational BehaviorBashi TaizyaОценок пока нет

- Security Analysis and PortFolio Management Case StudyДокумент4 страницыSecurity Analysis and PortFolio Management Case StudySammir Malhotra0% (1)

- General Insurance PPTДокумент25 страницGeneral Insurance PPTmr_gangsterОценок пока нет

- Tandon Committee Report On Working CapitalДокумент4 страницыTandon Committee Report On Working CapitalMohitAhujaОценок пока нет

- MCQs On Capital StructureДокумент7 страницMCQs On Capital Structuremercy100% (1)

- Cash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelДокумент5 страницCash Management-Models: Baumol Model Miller-Orr Model Orgler's ModelnarayanОценок пока нет

- Fill in The BlanksДокумент5 страницFill in The BlanksSaurabh GuptaОценок пока нет

- Strategic Management CH-1Документ12 страницStrategic Management CH-1padmОценок пока нет

- Regulations of Mutual FundДокумент11 страницRegulations of Mutual FundKishan KavaiyaОценок пока нет

- Chapter 2 - Profit Prior To Incorporation NEW v2Документ15 страницChapter 2 - Profit Prior To Incorporation NEW v2SonamОценок пока нет

- Importance of Deficiency Account in Case of Liquidation of A CompanyДокумент14 страницImportance of Deficiency Account in Case of Liquidation of A CompanyvidhisalianОценок пока нет

- Final Accounts of Banking Company - Lecture 01 - 21-08-2020Документ8 страницFinal Accounts of Banking Company - Lecture 01 - 21-08-2020akash gautamОценок пока нет

- Private and Public CompanyДокумент6 страницPrivate and Public CompanyRAJVEER PARMAR100% (1)

- Ch.1 Profit or Loss Pre and Post Incorporation - OrganizedДокумент14 страницCh.1 Profit or Loss Pre and Post Incorporation - OrganizedMonikaОценок пока нет

- Assessment of Partnership Firm.Документ9 страницAssessment of Partnership Firm.Safa100% (3)

- Cost of CapitalДокумент20 страницCost of CapitalGagan RajpootОценок пока нет

- Winding Up of CompanyДокумент5 страницWinding Up of Companyhrprt_sngh1Оценок пока нет

- Answers of Assignment Questions of Compensation ManagementДокумент16 страницAnswers of Assignment Questions of Compensation ManagementBaqirZarОценок пока нет

- Functions of Secondary MarketДокумент7 страницFunctions of Secondary MarketshugugaurОценок пока нет

- Agencies That Facilitate International FlowsДокумент10 страницAgencies That Facilitate International FlowsKamlesh Choudhary100% (1)

- NPA ManagementДокумент18 страницNPA ManagementVincy LuthraОценок пока нет

- Operations Research Chapter 2Документ23 страницыOperations Research Chapter 2Zerihu100% (3)

- Hire Purchase PPT 1Документ12 страницHire Purchase PPT 1sangeethamadan100% (2)

- Joint Stock Company With Case StudyДокумент27 страницJoint Stock Company With Case Studyvirenshah_984660% (5)

- Week 7 & 8 - Illegality and Public PolicyДокумент58 страницWeek 7 & 8 - Illegality and Public PolicyMaame BaidooОценок пока нет

- Industrial Securities MarketДокумент16 страницIndustrial Securities MarketNaga Mani Merugu100% (3)

- Insurance - Methods of Handling RiskДокумент2 страницыInsurance - Methods of Handling RiskMohit SharmaОценок пока нет

- On Kingfisher AirwaysДокумент22 страницыOn Kingfisher AirwaysPratik Sukhani100% (5)

- Baumols Sales Maximisation ModelДокумент12 страницBaumols Sales Maximisation ModelsukandeОценок пока нет

- FirmДокумент17 страницFirmwigivi4421Оценок пока нет

- Baumol's Sales or Revenue Maximisation Theory: Assumptions, Explanation and CriticismsДокумент9 страницBaumol's Sales or Revenue Maximisation Theory: Assumptions, Explanation and CriticismsndmudhosiОценок пока нет

- Sales MaximizationДокумент8 страницSales Maximizationsteven jobsОценок пока нет

- Chapter One - Part 1Документ21 страницаChapter One - Part 1ephremОценок пока нет

- Research On VN Pangasius IndustryДокумент16 страницResearch On VN Pangasius IndustryDo Minh Gia AnОценок пока нет

- Bushra Nayab Bba Ims, Uop Mba Nust ITBДокумент16 страницBushra Nayab Bba Ims, Uop Mba Nust ITBbushraОценок пока нет

- Flexible Budgets, Standard Costs, and Variance Analysis: Chapter OutlineДокумент33 страницыFlexible Budgets, Standard Costs, and Variance Analysis: Chapter OutlineCeleste VОценок пока нет

- Week 5 - Module in EconomicsДокумент17 страницWeek 5 - Module in EconomicsTommy MonteroОценок пока нет

- Laporan Guest LectureДокумент4 страницыLaporan Guest LecturemaritaputriОценок пока нет

- Term Paper Group 7Документ8 страницTerm Paper Group 7Mahfuzur RahmanОценок пока нет

- Market IntegrationДокумент22 страницыMarket IntegrationCatherine Acutim50% (2)

- Hill Jones CH 7Документ25 страницHill Jones CH 7Tanvir Ahmad ShourovОценок пока нет

- Market-Based Transfer Prices 2. Cost-Based Transfer Prices 3. Negotiated Transfer PricesДокумент10 страницMarket-Based Transfer Prices 2. Cost-Based Transfer Prices 3. Negotiated Transfer PricesvmktptОценок пока нет

- Case Study Question 1Документ4 страницыCase Study Question 1Ichimp GohОценок пока нет

- U.S. Shoe Manufacturing: Knowledge For ActionДокумент8 страницU.S. Shoe Manufacturing: Knowledge For Action曾韋澄Оценок пока нет

- MALAYSIAN RUBBER DEVELOPMENT CORP BHD V GLOVE SEAL SDNДокумент12 страницMALAYSIAN RUBBER DEVELOPMENT CORP BHD V GLOVE SEAL SDNAnis NadhirahОценок пока нет

- S-Meal Cook Application: A Business Plan: Anh Vu Thi NgocДокумент59 страницS-Meal Cook Application: A Business Plan: Anh Vu Thi NgocPrasant GoelОценок пока нет

- R02 Walsh & Seward, 1990Документ39 страницR02 Walsh & Seward, 1990Ritwik KumarОценок пока нет

- Pricing Policy of The Rahimafrooz Renewable Energy Ltd.Документ50 страницPricing Policy of The Rahimafrooz Renewable Energy Ltd.Dipock MondalОценок пока нет

- 2.2 SupplyДокумент18 страниц2.2 SupplyaditiОценок пока нет

- 100% Technology Imitation Proposal On Three Levels Egg Laying Nest BoxДокумент30 страниц100% Technology Imitation Proposal On Three Levels Egg Laying Nest BoxAbel ZegeyeОценок пока нет

- Writing TACS7Документ9 страницWriting TACS7lethiphuong15031999Оценок пока нет

- ACCOUNTING FOR SPECIAL TRANSACTIONS - Construction ContractsДокумент29 страницACCOUNTING FOR SPECIAL TRANSACTIONS - Construction ContractsDewdrop Mae RafananОценок пока нет

- Practice Questions (Not in Prescribed Textbook)Документ7 страницPractice Questions (Not in Prescribed Textbook)ayaОценок пока нет

- Samsung CaseДокумент27 страницSamsung CaseLoving YouОценок пока нет

- The Perfectly Competitive FirmДокумент13 страницThe Perfectly Competitive FirmMaria StancanОценок пока нет

- 11 Practice Problems OligopolyДокумент13 страниц11 Practice Problems Oligopolyphineas12345678910ferbОценок пока нет

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 13 PDFДокумент44 страницыTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 13 PDFFaye Noreen FabilaОценок пока нет