Академический Документы

Профессиональный Документы

Культура Документы

Morning View 21jan2010

Загружено:

AndysTechnicalsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Morning View 21jan2010

Загружено:

AndysTechnicalsАвторское право:

Доступные форматы

High Yield Debt ETF (HYG)

87.25

We have written several times in the last few months about the following

concept: There will be no appreciable decline in the stock market until

corporate debt falls. So far, the HYG remains above key support at 87.25.

However, we must take note of the rather sharp RSI Divergence into the recent

peak. Such a signal is not necessarily a sign of an impending crash, but it’s

something that should get the attention of HYG bulls. A break below 87.25

would look very bearish…

Andy’s Technical Commentary__________________________________________________________________________________________________

5

3 1150

S&P 500 (180 min.)

1

1130

1129 4?

“a”

1113

2

“b”

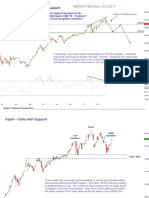

That was the third try in the last few weeks to break below 1130 with yesterday’s low of 1129.25.

The price action on this proposed wave-4 looks like a “mini” version of the “b” wave price action in

that sense that we’re getting volatile snapbacks within a well defined range. The math is pretty easy

for the bears: If the recent drop from 11501129 was only the beginning of bigger decline, then the

1143 (62% retrace) should not be bettered. It still looks there is a little ways to go higher in stocks,

but just in case I’m wrong, I have a “sell stop” for my own mother at 1,112, to initiate a short position

that would eliminate her long exposure to this market.

(X)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 (90 minute) 5

3

Reprinted from 1/20/2010

1

1130

4?

“a”

1113

2

“b”

This market could not take out key support at 1,130. Instead it ricocheted higher from key support.

Until this market can decisively take out 1,130, we’ll have to assume higher prices. This is getting

very difficult because we continue to deal with very “odd shapes.” The waves 1&3 are “corrective”

patterns, thus the continued belief in some sort of “terminal/diagonal” conclusion. The issue for the

bears is that waves 1&3 were very similar in size, so an extended wave-5 is a distinct possibility. I’ll

readily admit, though, that all of the price action is puzzling. If you’ve been a bear, the best strategy

has clearly been to “wait” for a true reversal pattern, something we haven’t seen in several months.

How can you be bearish when we can’t even take out a previous low?

(X)

Andy’s Technical Commentary__________________________________________________________________________________________________

Dollar Index (120 minute) (5)?

(3)

Very impressive move in the DXY. The x (or b) wave clearly [5]?

ended in the 76.5077.00 zone. It’s hard for me to see a

a or w “micro” fourth wave on this chart, which makes me think we

-c- probably have some sideways/lower congestion coming soon.

(5) However, higher levels look a highly probability in the near term.

[3]

78.45

(4)

[4]

78.19

[1]

[2]

(1) This looks like an important

level of support now.

-a-

(2)

-b-

x or b

Andy’s Technical Commentary__________________________________________________________________________________________________

a or w Dollar Index (60 minute)

-c-

(5)

78.45

Yesterday it was suggested that 78.14 was a more likely target given the pace of the bounce. The DXY

is already “knocking on that door.” I can see a case where the Dollar gets some short term resistance

today into this zone.

-b- (c)

-d-

[5]?

[3]?

[4]

[1]

(a)

[2]

-a-

-c-

(b)

Reprinted from 1/20/2010

76.67

-e-

x

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any kind. This report is technical

commentary only. The author is NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s interpretation of technical analysis. The

author may or may not trade in the markets discussed. The author may hold positions opposite of

what may by inferred by this report. The information contained in this commentary is taken from

sources the author believes to be reliable, but it is not guaranteed by the author as to the accuracy

or completeness thereof and is sent to you for information purposes only. Commodity trading

involves risk and is not for everyone.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading:

Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or options contracts, you should

consider your financial experience, goals and financial resources, and know how much you can

afford to lose above and beyond your initial payment to a broker. You should understand commodity

futures and options contracts and your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk

disclosure documents your broker is required to give you.

Вам также может понравиться

- National Auto Lock Service, NC: ChevroletДокумент36 страницNational Auto Lock Service, NC: ChevroletAlejandro Ponton TrabajosОценок пока нет

- (Roland Berger) Chart LibraryДокумент159 страниц(Roland Berger) Chart Librarymarcelo moОценок пока нет

- Dokumen - Pub - Bobs Refunding Ebook v3 PDFДокумент65 страницDokumen - Pub - Bobs Refunding Ebook v3 PDFJohn the First100% (3)

- SPB 1 Floor PivotsДокумент29 страницSPB 1 Floor PivotsMuthukumar KОценок пока нет

- Market Commentary 5aug12Документ7 страницMarket Commentary 5aug12AndysTechnicalsОценок пока нет

- Product CatalogsДокумент12 страницProduct Catalogscab666Оценок пока нет

- Okuma Manuals 361Документ119 страницOkuma Manuals 361AminОценок пока нет

- Functional DesignДокумент17 страницFunctional DesignRajivSharmaОценок пока нет

- Excon2019 ShowPreview02122019 PDFДокумент492 страницыExcon2019 ShowPreview02122019 PDFSanjay KherОценок пока нет

- Investment Analysis and Portfolio Management Reilly 10th Edition Solutions ManualДокумент11 страницInvestment Analysis and Portfolio Management Reilly 10th Edition Solutions ManualMonicaAcostagzqkx100% (72)

- Leak Detection ReportДокумент29 страницLeak Detection ReportAnnMarie KathleenОценок пока нет

- Please List Team Members BelowДокумент35 страницPlease List Team Members BelowHarshit Verma17% (6)

- Mark Garside Resume May 2014Документ3 страницыMark Garside Resume May 2014api-199955558Оценок пока нет

- SimovertДокумент41 страницаSimovertRamez YassaОценок пока нет

- Morning View 20jan2010Документ8 страницMorning View 20jan2010AndysTechnicalsОценок пока нет

- Morning View 29jan2010Документ5 страницMorning View 29jan2010AndysTechnicalsОценок пока нет

- Morning Update 3 Mar 10Документ5 страницMorning Update 3 Mar 10AndysTechnicalsОценок пока нет

- Morning View 26jan2010Документ8 страницMorning View 26jan2010AndysTechnicalsОценок пока нет

- S&P Futures 3 March 10 EveningДокумент2 страницыS&P Futures 3 March 10 EveningAndysTechnicalsОценок пока нет

- Morning View 28jan2010Документ7 страницMorning View 28jan2010AndysTechnicalsОценок пока нет

- Market Discussion 5 Dec 10Документ9 страницMarket Discussion 5 Dec 10AndysTechnicalsОценок пока нет

- Market Commentary 27NOV11Документ5 страницMarket Commentary 27NOV11AndysTechnicalsОценок пока нет

- Morning View 5mar2010Документ7 страницMorning View 5mar2010AndysTechnicalsОценок пока нет

- Market Commentary 20NOV11Документ7 страницMarket Commentary 20NOV11AndysTechnicalsОценок пока нет

- Market Discussion 23 Jan 11Документ10 страницMarket Discussion 23 Jan 11AndysTechnicalsОценок пока нет

- Market Commentary 21feb11Документ10 страницMarket Commentary 21feb11AndysTechnicalsОценок пока нет

- Market Discussion 12 Dec 10Документ9 страницMarket Discussion 12 Dec 10AndysTechnicalsОценок пока нет

- Market Update 21 Nov 10Документ10 страницMarket Update 21 Nov 10AndysTechnicalsОценок пока нет

- S&P 500 Update 30 Nov 09Документ8 страницS&P 500 Update 30 Nov 09AndysTechnicalsОценок пока нет

- Morning View 25jan2010Документ5 страницMorning View 25jan2010AndysTechnicalsОценок пока нет

- SP500 Update 13 June 10Документ9 страницSP500 Update 13 June 10AndysTechnicalsОценок пока нет

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartДокумент8 страницREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsОценок пока нет

- S&P 500 Update 20 Dec 09Документ10 страницS&P 500 Update 20 Dec 09AndysTechnicalsОценок пока нет

- Market Commentary 27mar11Документ10 страницMarket Commentary 27mar11AndysTechnicalsОценок пока нет

- Market Commentary 25SEP11Документ8 страницMarket Commentary 25SEP11AndysTechnicalsОценок пока нет

- S&P 500 Update 4 Apr 10Документ10 страницS&P 500 Update 4 Apr 10AndysTechnicalsОценок пока нет

- Gold Report 20 Dec 2009Документ9 страницGold Report 20 Dec 2009AndysTechnicalsОценок пока нет

- S& P 500 Update 2 May 10Документ9 страницS& P 500 Update 2 May 10AndysTechnicalsОценок пока нет

- General Growth Properties 7 Jan 09Документ4 страницыGeneral Growth Properties 7 Jan 09AndysTechnicalsОценок пока нет

- S&P 500 Update 2 Jan 10Документ8 страницS&P 500 Update 2 Jan 10AndysTechnicalsОценок пока нет

- Soa All Apm Exams for Qfic Fall 2014 副本Документ147 страницSoa All Apm Exams for Qfic Fall 2014 副本cnmouldplasticОценок пока нет

- Smart2Go Training - Golden Ratio Method Simplify W D Gann's Squaring Techniques For Trading StocksДокумент29 страницSmart2Go Training - Golden Ratio Method Simplify W D Gann's Squaring Techniques For Trading Stocksdivyapurusadas icloudОценок пока нет

- Market Commentary 19DEC11Документ9 страницMarket Commentary 19DEC11AndysTechnicals100% (1)

- Chapter 01Документ12 страницChapter 01seanwu95Оценок пока нет

- 3 Financial ManagementДокумент17 страниц3 Financial ManagementVishakha AgarwalОценок пока нет

- Market Update 18 July 10Документ10 страницMarket Update 18 July 10AndysTechnicalsОценок пока нет

- One Picture Doesnt Tell The Whole StoryДокумент4 страницыOne Picture Doesnt Tell The Whole StoryMichael MarioОценок пока нет

- Morning View 12feb2010Документ8 страницMorning View 12feb2010AndysTechnicalsОценок пока нет

- Unit 3 FinanceДокумент17 страницUnit 3 FinanceSuhani BansalОценок пока нет

- 6 Week 3. Fama-French and The Cross Section of Stock Returns - Detailed NotesДокумент37 страниц6 Week 3. Fama-French and The Cross Section of Stock Returns - Detailed NotesdmavodoОценок пока нет

- Task 1 Practice 2 PDFДокумент7 страницTask 1 Practice 2 PDFNgọc NgânОценок пока нет

- Corporate Finance European Edition 2nd Edition Hillier Solutions ManualДокумент30 страницCorporate Finance European Edition 2nd Edition Hillier Solutions Manualthuyhai3a656100% (31)

- Dollar Index (180 Minute) "Unorthodox Model"Документ6 страницDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsОценок пока нет

- Copper Report 31 Jan 2010Документ8 страницCopper Report 31 Jan 2010AndysTechnicalsОценок пока нет

- Futures Junctures: PerspectiveДокумент6 страницFutures Junctures: PerspectiveBudi MuljonoОценок пока нет

- Trellix Helix Demo GuideДокумент49 страницTrellix Helix Demo GuideLyu SeyОценок пока нет

- Dollar Index (DXY) Daily ContinuationДокумент6 страницDollar Index (DXY) Daily ContinuationAndysTechnicalsОценок пока нет

- BO2 Glossary 15-16 U6 2Документ4 страницыBO2 Glossary 15-16 U6 2Артём БочкарёвОценок пока нет

- MCX Technicals - 19th Mar 08Документ1 страницаMCX Technicals - 19th Mar 08Rangarajan HОценок пока нет

- Market Commentary 22JUL12Документ6 страницMarket Commentary 22JUL12AndysTechnicalsОценок пока нет

- Gains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainДокумент4 страницыGains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainGaro OhanogluОценок пока нет

- TH BL K TH BL KSHL MDL SHL MDL The Black The Black - Scholes Model Scholes ModelДокумент7 страницTH BL K TH BL KSHL MDL SHL MDL The Black The Black - Scholes Model Scholes ModelPrashantKumarОценок пока нет

- Taxation For Decision Makers 2017 1st Edition Escoffier Solutions ManualДокумент5 страницTaxation For Decision Makers 2017 1st Edition Escoffier Solutions Manualamandabinh1j6100% (22)

- Memo For TEST 2. QP - CBEN 012 - 22 Sept 2023)Документ9 страницMemo For TEST 2. QP - CBEN 012 - 22 Sept 2023)Blessing 14mulaloОценок пока нет

- Jlhi (: Ill) LJДокумент1 страницаJlhi (: Ill) LJNguyễn PhongОценок пока нет

- Practice1 Mathematics Analysis and Approaches Paper 1 HLДокумент13 страницPractice1 Mathematics Analysis and Approaches Paper 1 HLTayseeraОценок пока нет

- Delta Surface Methodology - Implied Volatility Surface by DeltaДокумент9 страницDelta Surface Methodology - Implied Volatility Surface by DeltaShirley XinОценок пока нет

- Market Commentary 1JUL12Документ8 страницMarket Commentary 1JUL12AndysTechnicalsОценок пока нет

- Market Commentary 22JUL12Документ6 страницMarket Commentary 22JUL12AndysTechnicalsОценок пока нет

- Market Commentary 29apr12Документ6 страницMarket Commentary 29apr12AndysTechnicalsОценок пока нет

- Market Commentary 1apr12Документ8 страницMarket Commentary 1apr12AndysTechnicalsОценок пока нет

- Market Commentary 10JUN12Документ7 страницMarket Commentary 10JUN12AndysTechnicalsОценок пока нет

- Market Commentary 17JUN12Документ7 страницMarket Commentary 17JUN12AndysTechnicalsОценок пока нет

- Dollar Index (DXY) Daily ContinuationДокумент6 страницDollar Index (DXY) Daily ContinuationAndysTechnicalsОценок пока нет

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportДокумент6 страницS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 11mar12Документ7 страницMarket Commentary 11mar12AndysTechnicalsОценок пока нет

- Market Commentary 16jan12Документ7 страницMarket Commentary 16jan12AndysTechnicalsОценок пока нет

- Market Commentary 18mar12Документ8 страницMarket Commentary 18mar12AndysTechnicalsОценок пока нет

- Market Commentary 25mar12Документ8 страницMarket Commentary 25mar12AndysTechnicalsОценок пока нет

- Market Commentary 19DEC11Документ9 страницMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 6NOVT11Документ4 страницыMarket Commentary 6NOVT11AndysTechnicalsОценок пока нет

- Market Commentary 20NOV11Документ7 страницMarket Commentary 20NOV11AndysTechnicalsОценок пока нет

- Market Commentary 27NOV11Документ5 страницMarket Commentary 27NOV11AndysTechnicalsОценок пока нет

- Copper Commentary 11dec11Документ6 страницCopper Commentary 11dec11AndysTechnicalsОценок пока нет

- Market Commentary 25SEP11Документ8 страницMarket Commentary 25SEP11AndysTechnicalsОценок пока нет

- Sp500 Update 23oct11Документ7 страницSp500 Update 23oct11AndysTechnicalsОценок пока нет

- Sp500 Update 11sep11Документ6 страницSp500 Update 11sep11AndysTechnicalsОценок пока нет

- Market Commentary 30OCT11Документ6 страницMarket Commentary 30OCT11AndysTechnicalsОценок пока нет

- Sp500 Update 5sep11Документ7 страницSp500 Update 5sep11AndysTechnicalsОценок пока нет

- Copper Commentary 2OCT11Документ8 страницCopper Commentary 2OCT11AndysTechnicalsОценок пока нет

- Study 107 - The Doctrine of Salvation - Part 8Документ2 страницыStudy 107 - The Doctrine of Salvation - Part 8Jason MyersОценок пока нет

- Turning PointsДокумент2 страницыTurning Pointsapi-223780825Оценок пока нет

- Business Analytics Emphasis Course GuideДокумент3 страницыBusiness Analytics Emphasis Course Guidea30000496Оценок пока нет

- LTE Networks Engineering Track Syllabus Overview - 23 - 24Документ4 страницыLTE Networks Engineering Track Syllabus Overview - 23 - 24Mohamed SamiОценок пока нет

- Electro Fashion Sewable LED Kits WebДокумент10 страницElectro Fashion Sewable LED Kits WebAndrei VasileОценок пока нет

- Quick Help For EDI SEZ IntegrationДокумент2 страницыQuick Help For EDI SEZ IntegrationsrinivasОценок пока нет

- g6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERДокумент23 страницыg6 - AFA - Q1 - Module 6 - Week 6 FOR TEACHERPrincess Nicole LugtuОценок пока нет

- CAT 320D2: Hydraulic ExcavatorДокумент5 страницCAT 320D2: Hydraulic Excavatorhydeer 13Оценок пока нет

- Mastertop 1230 Plus PDFДокумент3 страницыMastertop 1230 Plus PDFFrancois-Оценок пока нет

- Financial Accounting 2 SummaryДокумент10 страницFinancial Accounting 2 SummaryChoong Xin WeiОценок пока нет

- Aleksandrov I Dis 1-50.ru - enДокумент50 страницAleksandrov I Dis 1-50.ru - enNabeel AdilОценок пока нет

- SMC 2D CADLibrary English 1Документ590 страницSMC 2D CADLibrary English 1Design IPGEОценок пока нет

- Ob NotesДокумент8 страницOb NotesRahul RajputОценок пока нет

- Dialogue Au Restaurant, Clients Et ServeurДокумент9 страницDialogue Au Restaurant, Clients Et ServeurbanuОценок пока нет

- The Magic DrumДокумент185 страницThe Magic Drumtanishgiri2012Оценок пока нет

- Proceeding of Rasce 2015Документ245 страницProceeding of Rasce 2015Alex ChristopherОценок пока нет

- Lec 33 - Householder MethodДокумент11 страницLec 33 - Householder MethodMudit SinhaОценок пока нет

- Rule 113 114Документ7 страницRule 113 114Shaila GonzalesОценок пока нет

- Read While Being Blind.. Braille's Alphabet: Be Aware and Active !Документ3 страницыRead While Being Blind.. Braille's Alphabet: Be Aware and Active !bitermanОценок пока нет

- V737 OverheadДокумент50 страницV737 OverheadnewahОценок пока нет

- Lesson PlanДокумент2 страницыLesson Plannicole rigonОценок пока нет

- HirePro Video Proctored Online-Instruction Sheet - Bain IndiaДокумент1 страницаHirePro Video Proctored Online-Instruction Sheet - Bain Indiaapoorv sharmaОценок пока нет

- Acute Coronary SyndromeДокумент30 страницAcute Coronary SyndromeEndar EszterОценок пока нет